Nitheesh NH

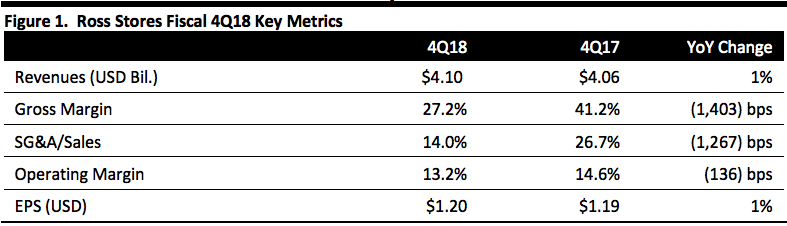

[caption id="attachment_79424" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

In fiscal 4Q18, Ross Stores’ revenues and EPS grew 1% and 1%, year over year, respectively. The company’s comparable sales increased 4% year over year in 4Q18. For the fourth quarter, men’s was the best-performing merchandise category. Ladies apparel business continued to face weakness during the holiday season. The Southeast and the Midwest were the strongest-performing regions.

dd’s Discounts posted better-than-expected gains in both sales and operating profit in 4Q18. At the end of the quarter, total consolidated inventories were up 7% year over year, while average in-store inventories were slightly down year over year. Packaway (which consists of closeouts, order cancellations, and manufacturer overruns which are packed away in warehouses and resold to consumers later) accounted for 46% of total inventories, compared with 49% in the year-ago period.

Ross Stores’ gross margin declined 1,403 basis points year over year to 27.2% in 4Q18, due to higher freight costs, rising distribution expenses and increased buying and occupancy costs. Operating margin dropped 136 basis points year over year to 13.2% in 4Q18, mainly due to higher costs for freight and wages.

FY18 Results

For the fiscal year 2018, Ross Stores’ revenues and EPS grew 6% and 20%, year over year, respectively. The company’s comparable sales were up 4% year over year in FY18, in line with the growth in each of the three prior years. Ross Stores’ operating margin declined from 14.5% in FY17 to 13.6% in FY18.

Outlook

For fiscal 1Q19, Ross Stores forecasts revenue growth of 3-6% year over year. The company projects EPS will be $1.05–1.11 in 1Q19, lower than the consensus estimate of $1.18, and lower than the $1.11 earnings per share in 1Q18.

In 1Q19, Ross Stores forecasts comparable sales growth of flat to up 2%, compared to the consensus estimate of 2.4%. The company plans to open 22 new Ross and 6 dd’s DISCOUNTS locations during the first quarter.

For FY19, Ross Stores expects revenues and EPS to grow 5-6% and 1–6% year over year, respectively. The company forecasts comparable sales growth of 1–2% in FY2019. Ross Stores projects operating margin will be 13.2–13.4% in FY20. The company plans to open about 100 new stores in 2019, consisting of approximately 75 Ross and 25 dd’s Discounts locations. In FY19, consensus estimate calls for revenues and EPS growth of 6% and 6%, year over year, respectively.

Source: Company reports/Coresight Research[/caption]

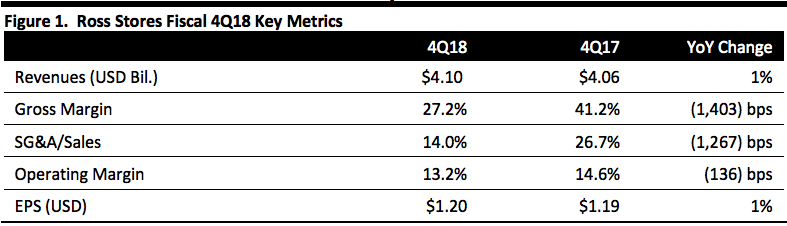

4Q18 Results

In fiscal 4Q18, Ross Stores’ revenues and EPS grew 1% and 1%, year over year, respectively. The company’s comparable sales increased 4% year over year in 4Q18. For the fourth quarter, men’s was the best-performing merchandise category. Ladies apparel business continued to face weakness during the holiday season. The Southeast and the Midwest were the strongest-performing regions.

dd’s Discounts posted better-than-expected gains in both sales and operating profit in 4Q18. At the end of the quarter, total consolidated inventories were up 7% year over year, while average in-store inventories were slightly down year over year. Packaway (which consists of closeouts, order cancellations, and manufacturer overruns which are packed away in warehouses and resold to consumers later) accounted for 46% of total inventories, compared with 49% in the year-ago period.

Ross Stores’ gross margin declined 1,403 basis points year over year to 27.2% in 4Q18, due to higher freight costs, rising distribution expenses and increased buying and occupancy costs. Operating margin dropped 136 basis points year over year to 13.2% in 4Q18, mainly due to higher costs for freight and wages.

FY18 Results

For the fiscal year 2018, Ross Stores’ revenues and EPS grew 6% and 20%, year over year, respectively. The company’s comparable sales were up 4% year over year in FY18, in line with the growth in each of the three prior years. Ross Stores’ operating margin declined from 14.5% in FY17 to 13.6% in FY18.

Outlook

For fiscal 1Q19, Ross Stores forecasts revenue growth of 3-6% year over year. The company projects EPS will be $1.05–1.11 in 1Q19, lower than the consensus estimate of $1.18, and lower than the $1.11 earnings per share in 1Q18.

In 1Q19, Ross Stores forecasts comparable sales growth of flat to up 2%, compared to the consensus estimate of 2.4%. The company plans to open 22 new Ross and 6 dd’s DISCOUNTS locations during the first quarter.

For FY19, Ross Stores expects revenues and EPS to grow 5-6% and 1–6% year over year, respectively. The company forecasts comparable sales growth of 1–2% in FY2019. Ross Stores projects operating margin will be 13.2–13.4% in FY20. The company plans to open about 100 new stores in 2019, consisting of approximately 75 Ross and 25 dd’s Discounts locations. In FY19, consensus estimate calls for revenues and EPS growth of 6% and 6%, year over year, respectively.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

In fiscal 4Q18, Ross Stores’ revenues and EPS grew 1% and 1%, year over year, respectively. The company’s comparable sales increased 4% year over year in 4Q18. For the fourth quarter, men’s was the best-performing merchandise category. Ladies apparel business continued to face weakness during the holiday season. The Southeast and the Midwest were the strongest-performing regions.

dd’s Discounts posted better-than-expected gains in both sales and operating profit in 4Q18. At the end of the quarter, total consolidated inventories were up 7% year over year, while average in-store inventories were slightly down year over year. Packaway (which consists of closeouts, order cancellations, and manufacturer overruns which are packed away in warehouses and resold to consumers later) accounted for 46% of total inventories, compared with 49% in the year-ago period.

Ross Stores’ gross margin declined 1,403 basis points year over year to 27.2% in 4Q18, due to higher freight costs, rising distribution expenses and increased buying and occupancy costs. Operating margin dropped 136 basis points year over year to 13.2% in 4Q18, mainly due to higher costs for freight and wages.

FY18 Results

For the fiscal year 2018, Ross Stores’ revenues and EPS grew 6% and 20%, year over year, respectively. The company’s comparable sales were up 4% year over year in FY18, in line with the growth in each of the three prior years. Ross Stores’ operating margin declined from 14.5% in FY17 to 13.6% in FY18.

Outlook

For fiscal 1Q19, Ross Stores forecasts revenue growth of 3-6% year over year. The company projects EPS will be $1.05–1.11 in 1Q19, lower than the consensus estimate of $1.18, and lower than the $1.11 earnings per share in 1Q18.

In 1Q19, Ross Stores forecasts comparable sales growth of flat to up 2%, compared to the consensus estimate of 2.4%. The company plans to open 22 new Ross and 6 dd’s DISCOUNTS locations during the first quarter.

For FY19, Ross Stores expects revenues and EPS to grow 5-6% and 1–6% year over year, respectively. The company forecasts comparable sales growth of 1–2% in FY2019. Ross Stores projects operating margin will be 13.2–13.4% in FY20. The company plans to open about 100 new stores in 2019, consisting of approximately 75 Ross and 25 dd’s Discounts locations. In FY19, consensus estimate calls for revenues and EPS growth of 6% and 6%, year over year, respectively.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

In fiscal 4Q18, Ross Stores’ revenues and EPS grew 1% and 1%, year over year, respectively. The company’s comparable sales increased 4% year over year in 4Q18. For the fourth quarter, men’s was the best-performing merchandise category. Ladies apparel business continued to face weakness during the holiday season. The Southeast and the Midwest were the strongest-performing regions.

dd’s Discounts posted better-than-expected gains in both sales and operating profit in 4Q18. At the end of the quarter, total consolidated inventories were up 7% year over year, while average in-store inventories were slightly down year over year. Packaway (which consists of closeouts, order cancellations, and manufacturer overruns which are packed away in warehouses and resold to consumers later) accounted for 46% of total inventories, compared with 49% in the year-ago period.

Ross Stores’ gross margin declined 1,403 basis points year over year to 27.2% in 4Q18, due to higher freight costs, rising distribution expenses and increased buying and occupancy costs. Operating margin dropped 136 basis points year over year to 13.2% in 4Q18, mainly due to higher costs for freight and wages.

FY18 Results

For the fiscal year 2018, Ross Stores’ revenues and EPS grew 6% and 20%, year over year, respectively. The company’s comparable sales were up 4% year over year in FY18, in line with the growth in each of the three prior years. Ross Stores’ operating margin declined from 14.5% in FY17 to 13.6% in FY18.

Outlook

For fiscal 1Q19, Ross Stores forecasts revenue growth of 3-6% year over year. The company projects EPS will be $1.05–1.11 in 1Q19, lower than the consensus estimate of $1.18, and lower than the $1.11 earnings per share in 1Q18.

In 1Q19, Ross Stores forecasts comparable sales growth of flat to up 2%, compared to the consensus estimate of 2.4%. The company plans to open 22 new Ross and 6 dd’s DISCOUNTS locations during the first quarter.

For FY19, Ross Stores expects revenues and EPS to grow 5-6% and 1–6% year over year, respectively. The company forecasts comparable sales growth of 1–2% in FY2019. Ross Stores projects operating margin will be 13.2–13.4% in FY20. The company plans to open about 100 new stores in 2019, consisting of approximately 75 Ross and 25 dd’s Discounts locations. In FY19, consensus estimate calls for revenues and EPS growth of 6% and 6%, year over year, respectively.