Nitheesh NH

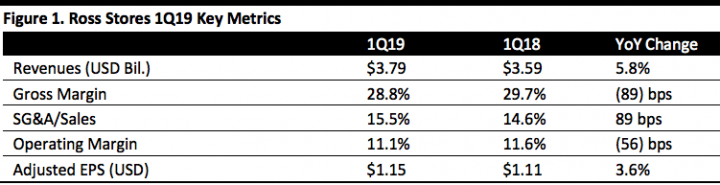

[caption id="attachment_89382" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Ross Stores 1Q19 revenues were $3.79 billion, even with the consensus estimate and up 5.8% year over year. The company reported 1Q19 adjusted EPS of $1.15, higher than the consensus estimate of $1.12 and up from the year ago period.

Management stated that the company delivered better than expected earnings per share growth over the quarter despite continued underperformance in ladies’ apparel. The company commented it is working to improve its merchandise assortments in ladies. The strongest merchandise category at Ross was the men's segment while the Midwest was the best performing geographic region.

Comparable sales were up 2%, also at the high end of company guidance of flat to 2%. This was attributed to an increase in the average basket size.

The 2019 expansion program is on schedule. Ross Stores added 22 new Ross and six dd’s Discounts locations in the first quarter. The company is on track to open a total of approximately 100 locations in 2019 comprised of 75 Ross and 25 dd’s Discounts. The numbers do not reflect plans to close or relocate 10 stores.

Outlook

The company raised its 2019 full year EPS guidance to $4.38-4.52, up from prior guidance of $4.30-$4.50 and compared to the consensus estimate of $4.52. Management projects same-store sales will be up 1-2%, in line with the consensus estimate.

The company expects second quarter earnings per share to be $1.06-1.11, up from $1.04 in the prior year and compared to the consensus estimate of $1.14. The company plans to open 28 new stores during the second quarter including 22 Ross and six dd’s Discounts locations.

Source: Company reports/Coresight Research[/caption]

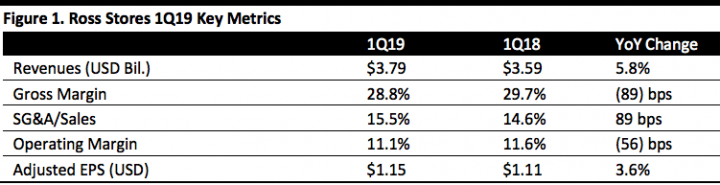

1Q19 Results

Ross Stores 1Q19 revenues were $3.79 billion, even with the consensus estimate and up 5.8% year over year. The company reported 1Q19 adjusted EPS of $1.15, higher than the consensus estimate of $1.12 and up from the year ago period.

Management stated that the company delivered better than expected earnings per share growth over the quarter despite continued underperformance in ladies’ apparel. The company commented it is working to improve its merchandise assortments in ladies. The strongest merchandise category at Ross was the men's segment while the Midwest was the best performing geographic region.

Comparable sales were up 2%, also at the high end of company guidance of flat to 2%. This was attributed to an increase in the average basket size.

The 2019 expansion program is on schedule. Ross Stores added 22 new Ross and six dd’s Discounts locations in the first quarter. The company is on track to open a total of approximately 100 locations in 2019 comprised of 75 Ross and 25 dd’s Discounts. The numbers do not reflect plans to close or relocate 10 stores.

Outlook

The company raised its 2019 full year EPS guidance to $4.38-4.52, up from prior guidance of $4.30-$4.50 and compared to the consensus estimate of $4.52. Management projects same-store sales will be up 1-2%, in line with the consensus estimate.

The company expects second quarter earnings per share to be $1.06-1.11, up from $1.04 in the prior year and compared to the consensus estimate of $1.14. The company plans to open 28 new stores during the second quarter including 22 Ross and six dd’s Discounts locations.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Ross Stores 1Q19 revenues were $3.79 billion, even with the consensus estimate and up 5.8% year over year. The company reported 1Q19 adjusted EPS of $1.15, higher than the consensus estimate of $1.12 and up from the year ago period.

Management stated that the company delivered better than expected earnings per share growth over the quarter despite continued underperformance in ladies’ apparel. The company commented it is working to improve its merchandise assortments in ladies. The strongest merchandise category at Ross was the men's segment while the Midwest was the best performing geographic region.

Comparable sales were up 2%, also at the high end of company guidance of flat to 2%. This was attributed to an increase in the average basket size.

The 2019 expansion program is on schedule. Ross Stores added 22 new Ross and six dd’s Discounts locations in the first quarter. The company is on track to open a total of approximately 100 locations in 2019 comprised of 75 Ross and 25 dd’s Discounts. The numbers do not reflect plans to close or relocate 10 stores.

Outlook

The company raised its 2019 full year EPS guidance to $4.38-4.52, up from prior guidance of $4.30-$4.50 and compared to the consensus estimate of $4.52. Management projects same-store sales will be up 1-2%, in line with the consensus estimate.

The company expects second quarter earnings per share to be $1.06-1.11, up from $1.04 in the prior year and compared to the consensus estimate of $1.14. The company plans to open 28 new stores during the second quarter including 22 Ross and six dd’s Discounts locations.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Ross Stores 1Q19 revenues were $3.79 billion, even with the consensus estimate and up 5.8% year over year. The company reported 1Q19 adjusted EPS of $1.15, higher than the consensus estimate of $1.12 and up from the year ago period.

Management stated that the company delivered better than expected earnings per share growth over the quarter despite continued underperformance in ladies’ apparel. The company commented it is working to improve its merchandise assortments in ladies. The strongest merchandise category at Ross was the men's segment while the Midwest was the best performing geographic region.

Comparable sales were up 2%, also at the high end of company guidance of flat to 2%. This was attributed to an increase in the average basket size.

The 2019 expansion program is on schedule. Ross Stores added 22 new Ross and six dd’s Discounts locations in the first quarter. The company is on track to open a total of approximately 100 locations in 2019 comprised of 75 Ross and 25 dd’s Discounts. The numbers do not reflect plans to close or relocate 10 stores.

Outlook

The company raised its 2019 full year EPS guidance to $4.38-4.52, up from prior guidance of $4.30-$4.50 and compared to the consensus estimate of $4.52. Management projects same-store sales will be up 1-2%, in line with the consensus estimate.

The company expects second quarter earnings per share to be $1.06-1.11, up from $1.04 in the prior year and compared to the consensus estimate of $1.14. The company plans to open 28 new stores during the second quarter including 22 Ross and six dd’s Discounts locations.