Nitheesh NH

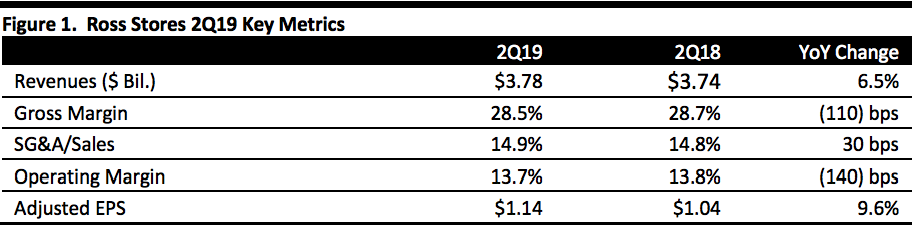

[caption id="attachment_95204" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Ross Stores 2Q19 revenues were $3.78 billion, lower than the consensus estimate of $3.96 billion and up 6.5% year over year. The company reported 2Q19 adjusted EPS of $1.14, higher than the consensus estimate of $1.11 and up from $1.04 last year.

Comparable sales were up 3%, especially impressive given last year’s strong quarterly comparison of 5%. The company attributed this to slightly higher traffic and an increase in average basket size.

The company delivered respectable gains in both sales and earnings for 2Q19. The strongest merchandise categories at Ross continue to be the men's segment followed by children’s, while the women’s segment continues to trail. Management reported it is working on merchandising initiatives in women’s and the entire store better deliver the right products and brands.

The midwest and southeast were the best performing geographic regions.

Average in-store inventories were up 4% to support back-to-school shopping.

The company’s 2019 expansion program is on schedule: Ross Stores added 22 new Ross and six dd’s DISCOUNTS locations in the second quarter. The company is on track to open a total of approximately 100 locations in 2019, including 75 Ross and 25 dd’s DISCOUNTS. The numbers do not reflect plans to close or relocate 10 stores. The company plans to open 42 new stores during the third quarter, including 30 Ross and 12 dd DISCOUNT locations.

Outlook

The company tightened 2019 full year earnings per share guidance to $4.41-4.50, up from prior guidance of $4.38-$4.52, compared to the consensus estimate of $4.52. The updated guidance reflects the recent announcement of 10% additional tariffs of goods sourced from China to start September 1, including apparel and footwear. Management added that historically, disruptions have benefitted off-price.

The company expects third-quarter earnings per share to be $0.92-0.96, compared to the consensus estimate of $1.00. The company expects same store sales for the year to be up 1-2%.

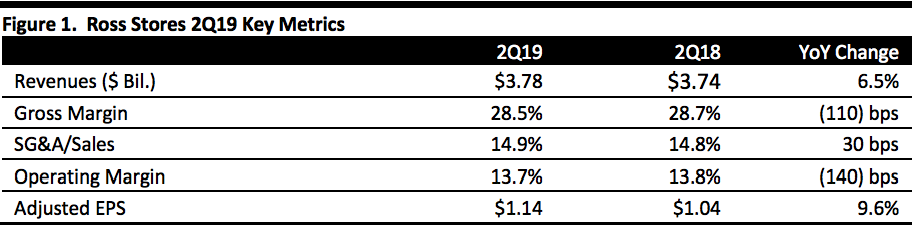

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Ross Stores 2Q19 revenues were $3.78 billion, lower than the consensus estimate of $3.96 billion and up 6.5% year over year. The company reported 2Q19 adjusted EPS of $1.14, higher than the consensus estimate of $1.11 and up from $1.04 last year.

Comparable sales were up 3%, especially impressive given last year’s strong quarterly comparison of 5%. The company attributed this to slightly higher traffic and an increase in average basket size.

The company delivered respectable gains in both sales and earnings for 2Q19. The strongest merchandise categories at Ross continue to be the men's segment followed by children’s, while the women’s segment continues to trail. Management reported it is working on merchandising initiatives in women’s and the entire store better deliver the right products and brands.

The midwest and southeast were the best performing geographic regions.

Average in-store inventories were up 4% to support back-to-school shopping.

The company’s 2019 expansion program is on schedule: Ross Stores added 22 new Ross and six dd’s DISCOUNTS locations in the second quarter. The company is on track to open a total of approximately 100 locations in 2019, including 75 Ross and 25 dd’s DISCOUNTS. The numbers do not reflect plans to close or relocate 10 stores. The company plans to open 42 new stores during the third quarter, including 30 Ross and 12 dd DISCOUNT locations.

Outlook

The company tightened 2019 full year earnings per share guidance to $4.41-4.50, up from prior guidance of $4.38-$4.52, compared to the consensus estimate of $4.52. The updated guidance reflects the recent announcement of 10% additional tariffs of goods sourced from China to start September 1, including apparel and footwear. Management added that historically, disruptions have benefitted off-price.

The company expects third-quarter earnings per share to be $0.92-0.96, compared to the consensus estimate of $1.00. The company expects same store sales for the year to be up 1-2%.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Ross Stores 2Q19 revenues were $3.78 billion, lower than the consensus estimate of $3.96 billion and up 6.5% year over year. The company reported 2Q19 adjusted EPS of $1.14, higher than the consensus estimate of $1.11 and up from $1.04 last year.

Comparable sales were up 3%, especially impressive given last year’s strong quarterly comparison of 5%. The company attributed this to slightly higher traffic and an increase in average basket size.

The company delivered respectable gains in both sales and earnings for 2Q19. The strongest merchandise categories at Ross continue to be the men's segment followed by children’s, while the women’s segment continues to trail. Management reported it is working on merchandising initiatives in women’s and the entire store better deliver the right products and brands.

The midwest and southeast were the best performing geographic regions.

Average in-store inventories were up 4% to support back-to-school shopping.

The company’s 2019 expansion program is on schedule: Ross Stores added 22 new Ross and six dd’s DISCOUNTS locations in the second quarter. The company is on track to open a total of approximately 100 locations in 2019, including 75 Ross and 25 dd’s DISCOUNTS. The numbers do not reflect plans to close or relocate 10 stores. The company plans to open 42 new stores during the third quarter, including 30 Ross and 12 dd DISCOUNT locations.

Outlook

The company tightened 2019 full year earnings per share guidance to $4.41-4.50, up from prior guidance of $4.38-$4.52, compared to the consensus estimate of $4.52. The updated guidance reflects the recent announcement of 10% additional tariffs of goods sourced from China to start September 1, including apparel and footwear. Management added that historically, disruptions have benefitted off-price.

The company expects third-quarter earnings per share to be $0.92-0.96, compared to the consensus estimate of $1.00. The company expects same store sales for the year to be up 1-2%.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Ross Stores 2Q19 revenues were $3.78 billion, lower than the consensus estimate of $3.96 billion and up 6.5% year over year. The company reported 2Q19 adjusted EPS of $1.14, higher than the consensus estimate of $1.11 and up from $1.04 last year.

Comparable sales were up 3%, especially impressive given last year’s strong quarterly comparison of 5%. The company attributed this to slightly higher traffic and an increase in average basket size.

The company delivered respectable gains in both sales and earnings for 2Q19. The strongest merchandise categories at Ross continue to be the men's segment followed by children’s, while the women’s segment continues to trail. Management reported it is working on merchandising initiatives in women’s and the entire store better deliver the right products and brands.

The midwest and southeast were the best performing geographic regions.

Average in-store inventories were up 4% to support back-to-school shopping.

The company’s 2019 expansion program is on schedule: Ross Stores added 22 new Ross and six dd’s DISCOUNTS locations in the second quarter. The company is on track to open a total of approximately 100 locations in 2019, including 75 Ross and 25 dd’s DISCOUNTS. The numbers do not reflect plans to close or relocate 10 stores. The company plans to open 42 new stores during the third quarter, including 30 Ross and 12 dd DISCOUNT locations.

Outlook

The company tightened 2019 full year earnings per share guidance to $4.41-4.50, up from prior guidance of $4.38-$4.52, compared to the consensus estimate of $4.52. The updated guidance reflects the recent announcement of 10% additional tariffs of goods sourced from China to start September 1, including apparel and footwear. Management added that historically, disruptions have benefitted off-price.

The company expects third-quarter earnings per share to be $0.92-0.96, compared to the consensus estimate of $1.00. The company expects same store sales for the year to be up 1-2%.