Ross Stores, Inc.

Sector: Off-price

Countries of operation: Guam and the US

Key product categories: Accessories, apparel, footwear and home

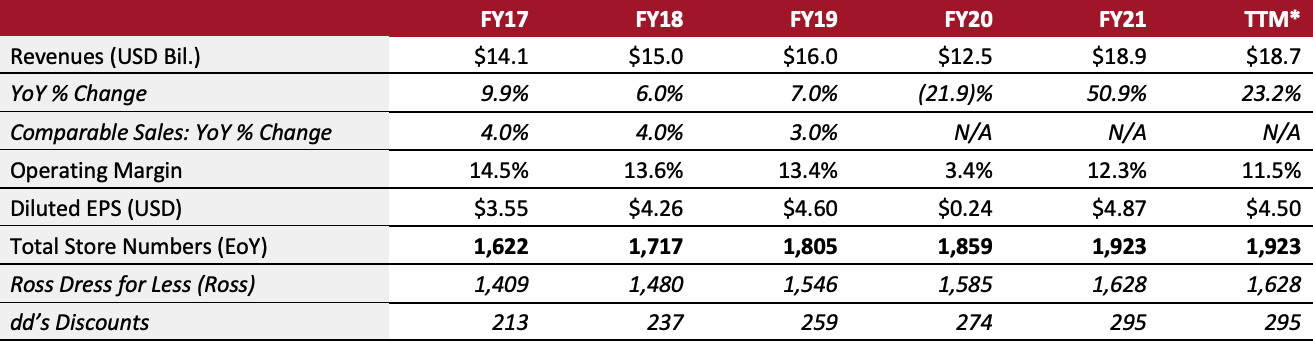

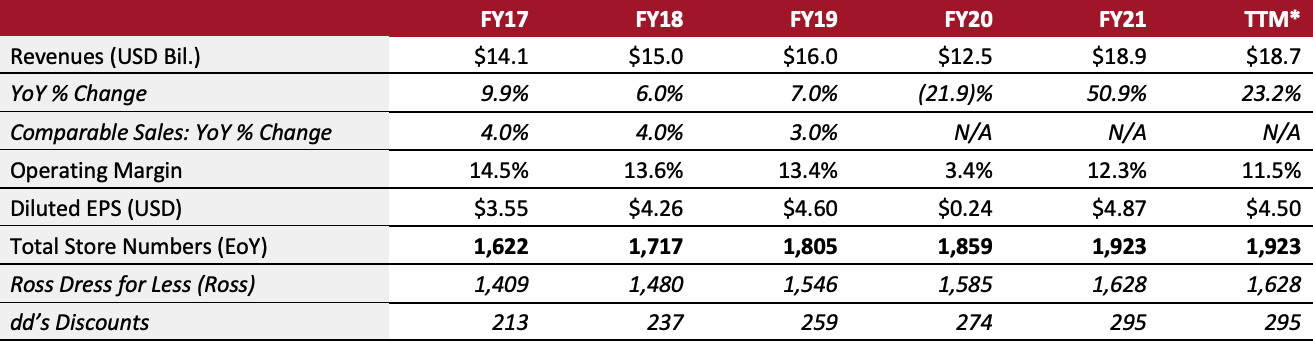

Annual Metrics

[caption id="attachment_152232" align="aligncenter" width="700"]

Fiscal year ends on January 30 of the following calendar year

Fiscal year ends on January 30 of the following calendar year

*TTM for the 12-month period ended April 30, 2022[/caption]

Summary

Ross Stores is an off-price specialty retailer that operates two off-price retail apparel and home brands: Ross Dress for Less (Ross) and dd’s Discounts. The company’s product categories include apparel, accessories, footwear and home. Ross Stores was founded in 1982 and is headquartered in Dublin, California. As of January 29, 2022, the company has approximately 100,000 employees and operates 1,923 stores, comprising 1,628 Ross Stores and 295 dd’s Discount stores.

According to the company’s investor presentation in August 2021, more than half of the company’s stores across Ross and dd’s Discounts (54%) are located in California, Florida, Illinois and Texas. The company has a large network of merchandise vendors and manufacturers for both Ross and dd’s Discounts.

According to its fiscal 2021 10-K report, Ross offers high-quality, in-season, name-brand and designer items priced 20%–60% lower than department and specialty store regular prices. Its target customers are primarily from middle-income households. Comparatively, dd’s Discounts meanwhile features more moderately priced, quality, in-season, name-brand items priced 20%–70% lower than moderate department and discount stores. The typical dd’s Discounts store is located in an established shopping center in a densely populated urban or suburban neighborhood, and its target customers typically come from households with more moderate incomes than Ross customers.

Company Analysis

Coresight Research insight: Ross Stores’ strategy is reliant on physical stores—the company does not offer online shopping. Nevertheless, it has sufficient room to grow in terms of exposure in the US, as currently over 50% of the stores in its portfolio are situated in just four states. The company may also be able to obtain attractive real estate deals due to the pandemic in order to expand. However, in the long term, we believe that a physical-only channel strategy for value products is a risk and may have an upper limit on growth potential—especially as consumer behavior is shifting online and the market landscape for value products is increasingly competitive.

| Tailwinds |

Headwinds |

- Opportunities for expansion in the US, as the company has a market hold in a just small number of key states

- Opportunities to gain market share or market presence due to retailers that may be going out of business

- Well-positioned for value pricing, as more consumers are seeking values due to the pandemic

- Due to supply chain bottlenecks, the off-price sector may be well-positioned for access to inventory overflow and are able to store for packaway

|

- Increasing competition in trending apparel

- Underexposure to high-growth e-commerce and the company’s near-100% reliance on physical consumer shopping/stores for revenue

|

Strategy

Ross Stores identified the following four strategic objectives to offer competitive value to its target customers in its fiscal year 2021 10K report for the year ended January 29, 2022:

- Maintain an appropriate level of recognizable brands, labels and fashions at strong discounts throughout the stores

- Meet customer needs on a local basis

- Deliver an in-store experience that reflects the expectations of the off-price customer

- Manage real estate growth to compete effectively across all markets

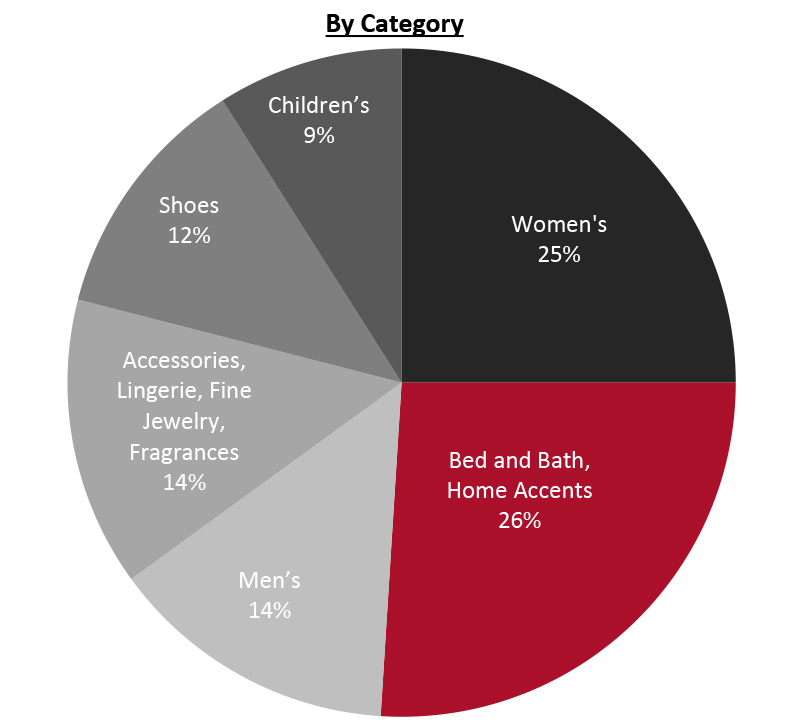

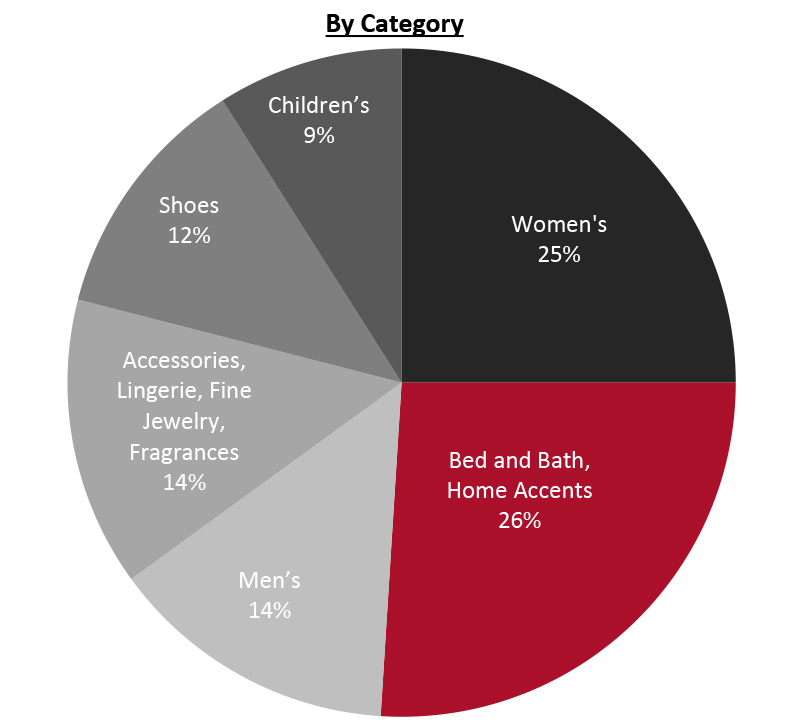

Revenue Breakdown (FY21)

[caption id="attachment_146240" align="aligncenter" width="400"]

Source: Company reports

Source: Company reports[/caption]

Company Developments

| Date |

Development |

| March 2022 |

Ross Stores announces 22 stores opened and 8 |

| October 2021 |

Ross Stores announces the opening of 18 Ross stores and 10 dd’s Discounts stores across 15 different states in September and October. |

| September 2021 |

Ross Stores announces that Adam Orvos, currently Group Senior Vice President, Supply Chain Administration, is being promoted to Executive Vice President and Chief Financial Officer, effective October 1, 2021. |

| July 2021 |

Ross Stores opens 22 Ross stores and eight dd’s Discounts stores across 11 different states in June and July. |

| July 2021 |

Ross Stores announces the departure of Travis Marquette, Executive Vice President and Chief Financial Officer |

| March 2021 |

Ross Stores announces that Doniel Sutton has been elected to its Board of Directors, effective March 11, 2021. |

| October 2020 |

Ross Stores opens a total of 39 new locations: 30 Ross stores and nine dd’s Discounts stores across 17 US states. These locations complete the company’s store growth plans of 66 new stores for fiscal 2020. |

| October 2020 |

Ross Stores announces the closing of $1.0 billion notes offering and early settlement of tender offers. |

| May 2020 |

Ross Stores begins a phased reopening of its stores on May 14, 2020. As of May 21, 2020, 700 stores have been reopened with the remaining stores expected to be reopened over the coming weeks. |

| April 2020 |

Ross Stores announces that the Ross Stores Foundation and the company have jointly pledged $1.5 billion of donations to organizations providing essential Covid-19 relief services, as well as additional support to associates. |

| April 2020 |

Ross Stores announces its stores will remain closed due to Covid-19 and temporarily furloughs the majority of its store and distribution center associates, as well as some other associates across the business, starting on April 5, 2020, until operations resume. |

| March 2020 |

Ross Stores closes all of its stores through April 3, 2020, due to Covid-19. |

| March 2020 |

Ross Stores announces that Patricia H. Mueller and Larree M. Renda have joined its Board of Directors. Mueller most recently served as Chief Marketing Officer and Senior Vice President, Advertising and Marketing for Home Depot from 2011 to 2016. Renda spent over 40 years at Safeway, where she most recently served as an Executive Vice President from 1999 to 2015. |

| March 2020 |

Ross Stores adds 19 Ross stores and seven dd’s Discounts in its first quarter. These new locations are part of the company’s plans to add approximately 100 new stores—75 Ross and 25 dd’s Discounts locations—during fiscal 2020. |

| January 2020 |

Ross Stores announces the departure of Bernie Brautigan, President of Merchandising at Ross Dress for Less since 2016. |

| October 2019 |

Ross Stores announces the opening of 30 Ross stores and 12 dd’s Discounts stores across 19 US states in September and October. These new locations complete the company’s store growth plans of 98 new stores for fiscal 2019. |

| August 2019 |

Ross Stores announces leadership changes: Michael Hartshorn is named Group President and Chief Operating Officer; Michael Kobayashi is promoted to President, Operations and Technology; Gary Cribb is promoted to Senior Group Executive Vice President, Stores and Loss Prevention; Travis Marquette is promoted to Group Senior Vice President and Chief Financial Officer. |

| July 2019 |

Ross Stores announces the opening of 22 Ross stores and six dd’s Discounts stores across 10 states in June and July. |

| April 2019 |

Ross Stores announces that Michael O’Sullivan, the company’s President and Chief Operating Officer since 2009, resigned from the company and its Board of Directors, effective immediately, to accept a position with another company. |

| March 2019 |

Ross Stores opens 22 Ross Dress for Less and six dd’s Discounts stores across 12 US states in February and March. |

| October 2018 |

Ross Stores announces that the Ross Stores Foundation has made a $300,000 cash donation to the American Red Cross to support relief efforts for those impacted by the ongoing wildfires in Northern and Southern California. |

Source: Company reports

Management Team

- Barbara Rentler—CEO and Director

- Michael J. Hartshorn—Group President and Chief Operating Officer

- Adam Orvos—Group Senior VP and CFO

- Connie Kao—Vice President of Investor Relations

Source: Company reports

Fiscal year ends on January 30 of the following calendar year

Fiscal year ends on January 30 of the following calendar year Source: Company reports[/caption]

Company Developments

Source: Company reports[/caption]

Company Developments