Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

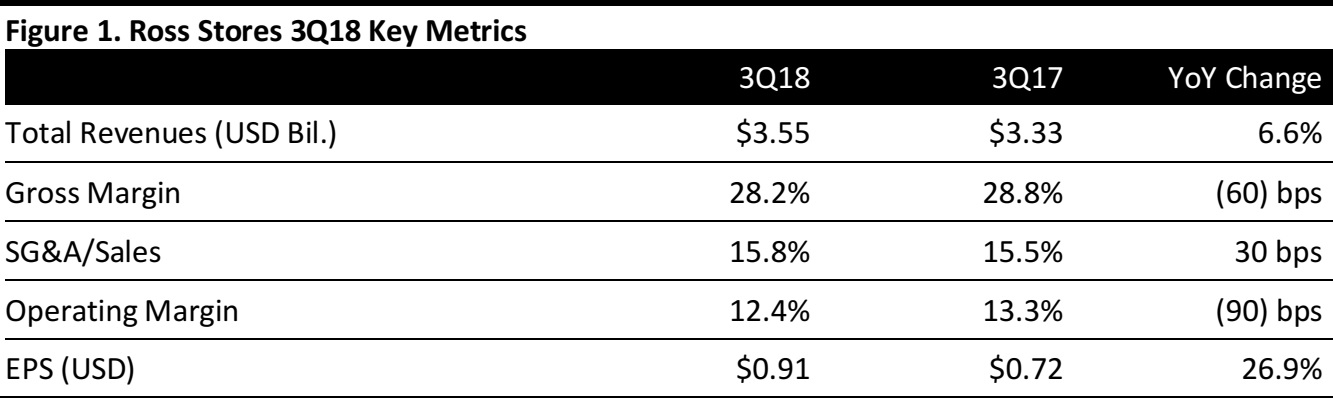

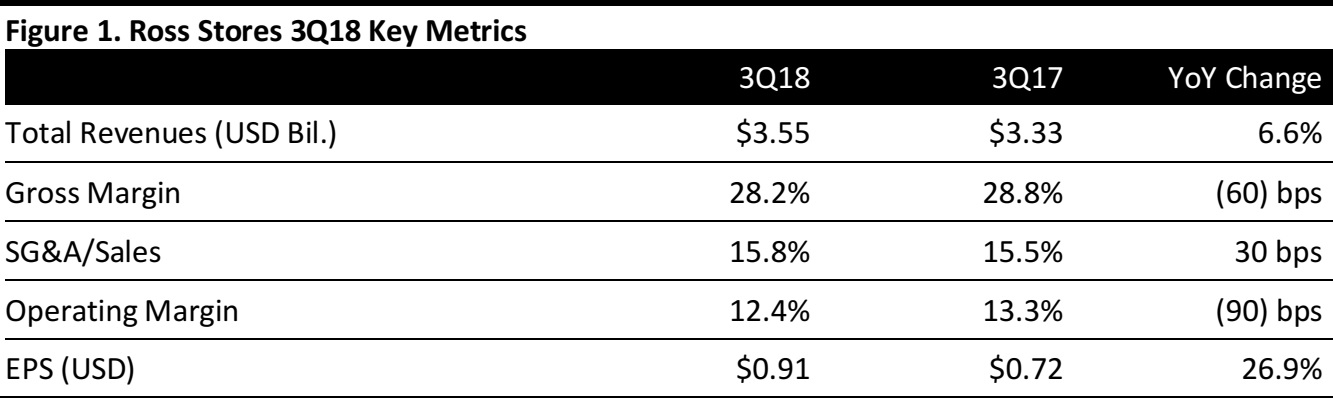

3Q18 Results

Ross Stores reported 3Q18 revenues of $3.55 billion, up 6.6% year over year and in line with the consensus estimate. Diluted EPS was $0.91, just above the consensus estimate of $0.90.

Comparable sales increased by 3.0% year over year in the quarter, beating the consensus estimate of 2.8%. Ross reported that the comparable sales increase was driven by increased traffic and bigger average baskets.

The Midwest and Florida were the strongest regions, while men's was the top-performing merchandise category.

Ross reported gross margins were down nearly 60 basis points compared to the year-ago period, due to higher merchandise margins driven by freight cost inflation. Management also reported that the company raised its minimum wage to $11, which will impact second-half performance.

dd’s Discounts, a slightly smaller, deep-discount chain store owned by Ross Stores selling clothing, shoes, and home goods, posted better sales and operating profits for the period.

The company opened 30 Ross stores and 10 dd’s Discounts locations in 3Q18. The company expects to end the year with 1,477 Ross and 235 dd’s Discounts stores, totaling 1,712 stores.

Management commented that as the company enters the holiday season, it faces tough sales comparisons from 2017, and the company is expecting another fiercely competitive retail environment, projecting fourth quarter comparable store sales gains of 1% to 2% versus a strong 5% increase last year.

Outlook

Ross Stores expects 4Q18 sales to decrease 1%-2% and provided 4Q18 guidance for EPS in the range of $1.09–$1.14, just above the consensus estimate of $1.08, which includes a one-time, non-cash benefit of approximately $0.97 per share related to the favorable resolution of a tax matter. The company raised its full-year earnings per share guidance to $4.15–$4.20, from $4.01–$4.10.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research