albert Chan

In this report, we discuss recent developments in robotics, from startup funding to new applications. As technology continues to evolve and consumer demands change, retailers are increasingly turning to robotics and automated solutions to reduce costs, increase efficiency, and deliver a better customer experience online and in-store.

1. Robotics in Retail: An Overview

Macro trends such as rising labor costs have been driving the adoption of automation in retail. Furthermore, the Covid-19 pandemic amplified the need for retailers to automate key business processes both online and in-store—grocery retailers, for example, struggled to meet a surge in demand, leading to delayed deliveries and long wait times. The deployment of robotics can help to address such challenges by providing the following key advantages:

- Cost reduction—Robots can reduce labor costs by replacing existing human workers or by allowing retailers to expand capacity without increasing headcount.

- Efficiency gains—Whether it is warehouse automation or picking and sorting, robots are more efficient than human workers. Potential health implications, such as those related to Covid-19, are also eliminated in fully-automated centers. Robots can be deployed in warehouses to do repetitive or potentially dangerous work, but they can also work alongside humans—startups such as Locus Robotics, for instance, develop robots that reduce workers’ non-efficient indoor walking time (which we discuss later in this report).

- Improvement of the customer experience—Companies are developing consumer-facing robots that aim to provide a seamless shopping experience.

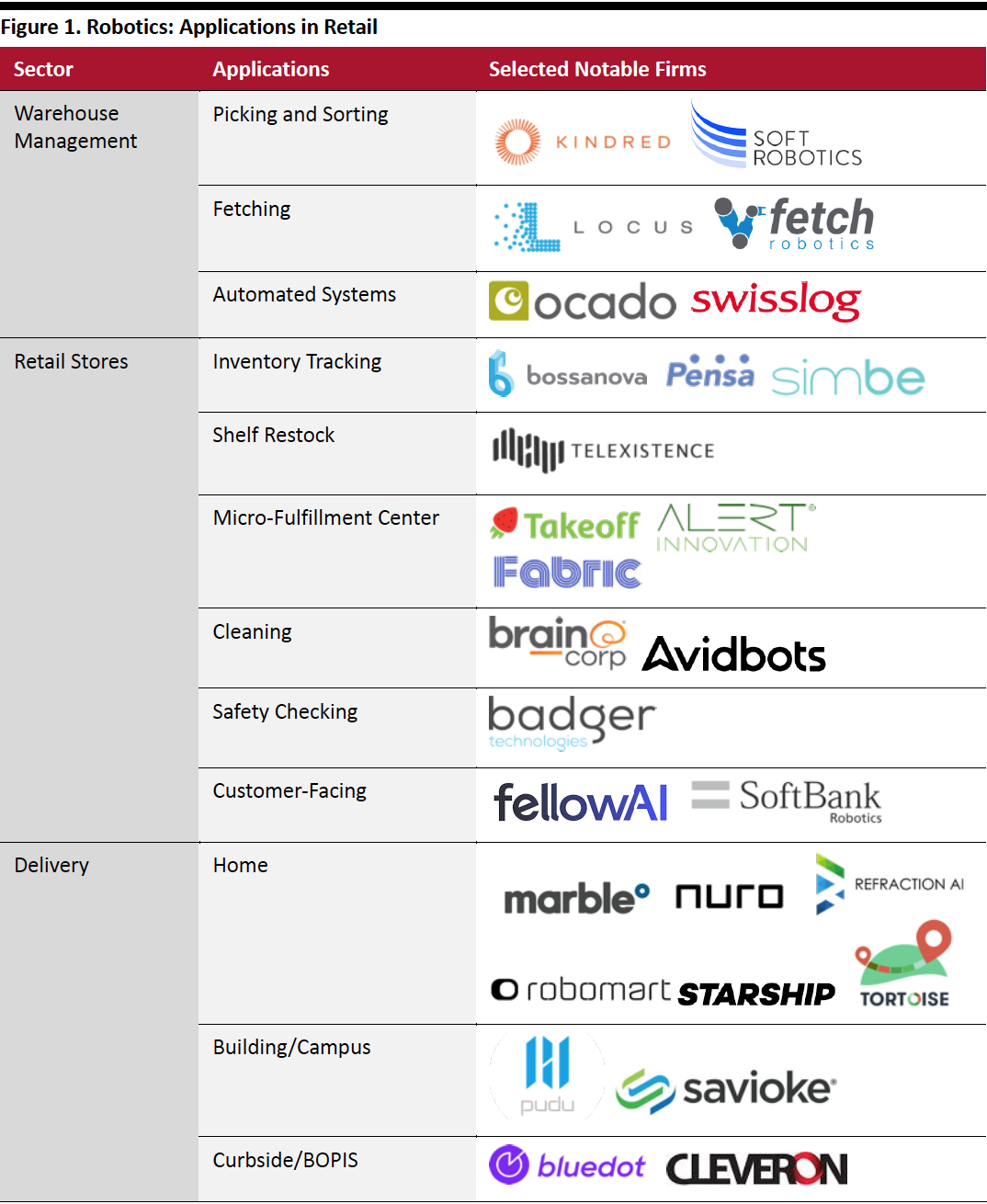

Retailers are therefore deploying robots across their businesses, from warehouse management to in-store execution to delivery services. In Figure 1, we present selected leading players across the key areas that retailers are leveraging robotics solutions.

[caption id="attachment_115690" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Funding Activities in Robotics

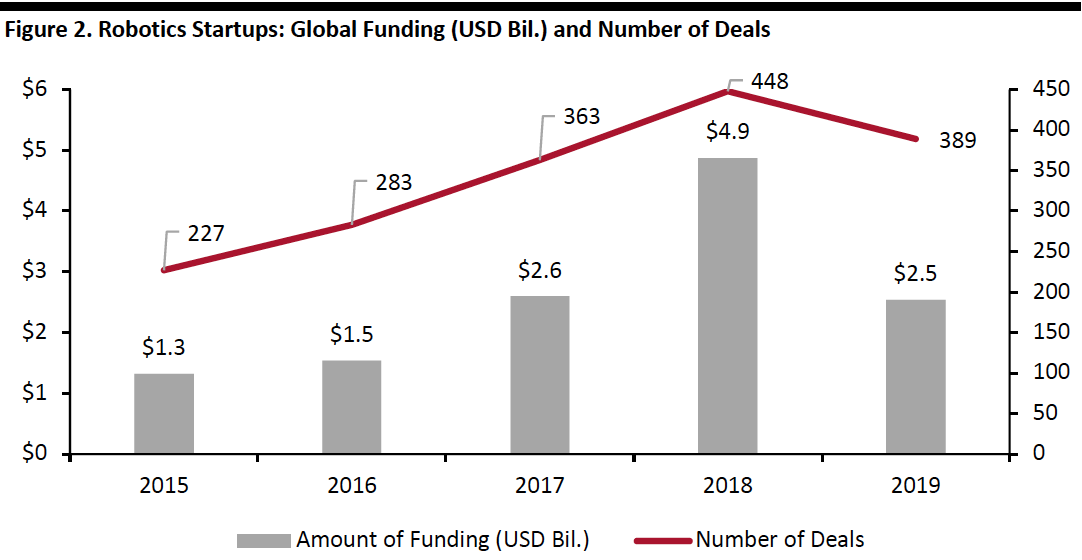

Robotics startups raised a total of $2.5 billion in 2019, down from almost $4.9 billion in 2018, according to CB Insights. After a few years of growth in robotics funding, the decrease seen last year could reflect industry consolidation as venture capitalists invest in more mature companies rather than betting on younger ones. In addition, because of the small market size, total funding can be easily influenced by a few mega deals—or lack thereof. However, due to increased demand, we expect to see positive momentum in robotics funding over the next few years.

[caption id="attachment_115691" align="aligncenter" width="700"] Source: CB Insights[/caption]

Source: CB Insights[/caption]

Logistics Robotics: Market Size

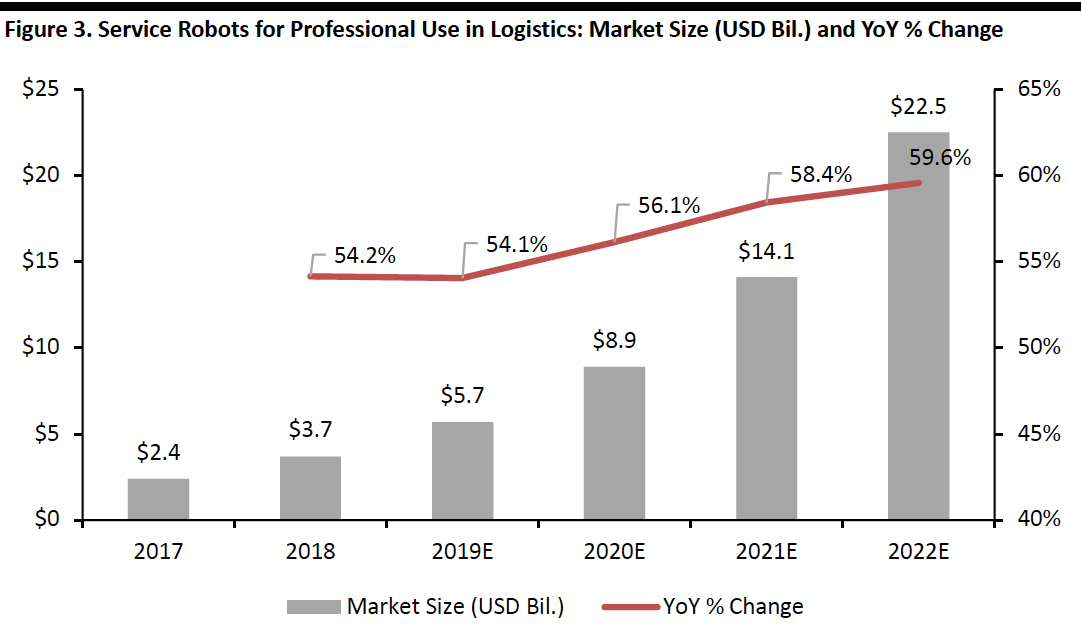

Logistics is a key area for the implementation of robotics solutions. The market for professional service robots in logistics is estimated to reach a value of $8.9 billion in 2020, up 56.1% from 2019, according to The International Federation of Robotics. The market is likely to continue to grow significantly over the next few years, reaching $22.5 billion in 2022 (see Figure 3).

[caption id="attachment_115692" align="aligncenter" width="700"] Source: International Federation of Robotics[/caption]

Source: International Federation of Robotics[/caption]

The State of Play: Q&A with Silicon Valley Robotics

Exploring the current state of the robotics market, we present selected thoughts from our recent discussion with Andra Keay, Managing Director of Silicon Valley Robotics, a nonprofit organization that supports the innovation and commercialization of robotics technologies. Members come from both the academic world, such as Northwestern University Retail Analytics Council, and startups like Fetch Robotics—many are early-stage, pre-funding startups or funded firms without significant revenues.

- How does robotics interact with artificial intelligence (AI)?

Keay believes that “robotics and AI are two sides of a coin.” Robotics can take AI into new arenas and incorporating robots is one of the fastest ways to digitalize business processes.

- Why do you think the implementation of robotics in retail is low?

Although Keay believes that retail is a viable market for robotics, she said that the rollout of robotics has been slow for two primary reasons: Production challenges mean that it can take up to two years for robotics firms to expand the supply chain and increase production; and robotics startups face talent competition from large companies such as Google, as there are only a small number of roboticists available.

- What is going on in robotics as a sector?

In Keay’s experience, a small number of more mature companies are starting to dominate several subsectors in robotics. Initially, startups want to focus on applications that add the most value for retailers—but as companies grow, they start to add new features to address various pain points for retail clients.

- What is your opinion on funding activities in robotics startups?

Keay explained that valuations for robotics startups are low compared to software-as-a-service and other enterprise markets, partly because venture capital firms do not have much prior experience in the space and information on key success factors is limited.

2. Robotics in Warehouse Management

Covid-19 induced tremendous pressure on retailers’ supply chains, prompting companies to turn to robotics to reduce the need for human labor and improve efficiency. Below, we discuss how Kroger and Gap Inc are actively expanding their robotics capabilities, as well as developments in collaborative technology from Locus Robotics.

Kroger Announces Three Additional Automated Fulfillment Centers

Kroger has announced that it is expanding its partnership with British grocer Ocado through plans to build three automated fulfillment centers in the Great Lakes, Pacific Northwest and West regions of the US. The three new centers vary in size, but all will serve as delivery hubs for online orders. Kroger’s goal is to build a flexible fulfillment network, combining larger and smaller formats, to speed up order processing and better meet consumer demand for online grocery shopping.

The two companies first partnered in 2018 with plans to build 20 “Ocado-powered” fulfillment centers across the country, using Ocado’s proprietary automated warehousing technology.

Gap Inc. Adds More Robots to Its Warehouses

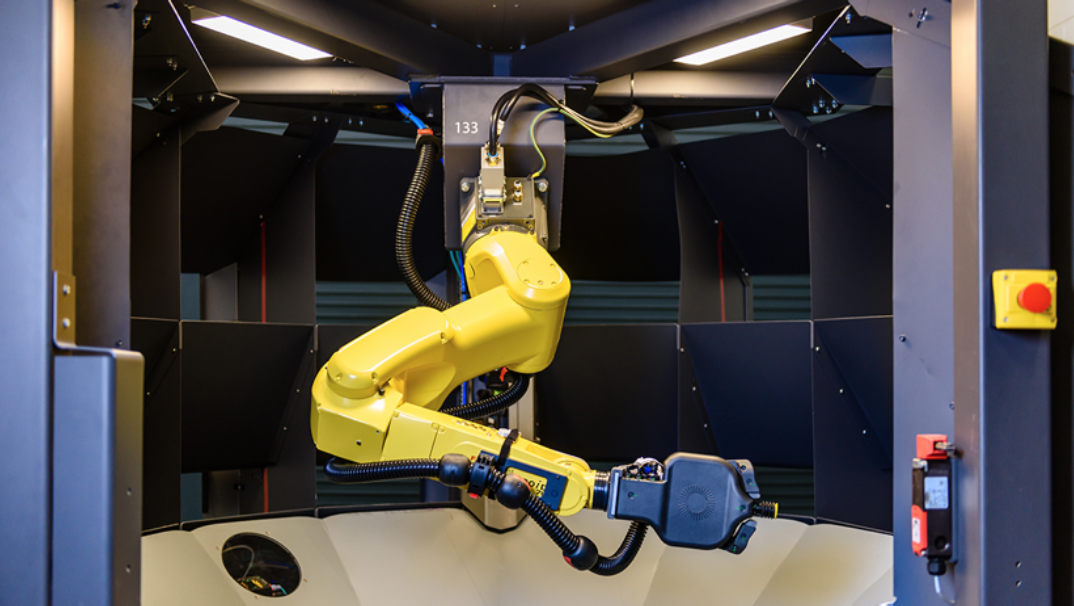

Apparel retailer Gap Inc is accelerating its implementation of warehouse robots for assembling online orders. The company is using Kindred’s SORT solution, which uses industrial robotic arms to pick merchandise.

Gap first installed Kindred’s robotic picking technology in 2017. The company then purchased 73 SORT robots for US distribution centers earlier this year, bringing the size of the total fleet to 106. Through the first four months of 2020, the system picked more than 13 million units of Gap merchandise, with an average sorting speed of 335 units per hour while maintaining 99.8% uptime, as reported by Kindred. Each machine is able to handle a typical four-person workload and separate multi-SKU batches into individual customer orders.

[caption id="attachment_115693" align="aligncenter" width="550"] The Kindred SORT System

The Kindred SORT SystemSource: Kindred[/caption]

Retailers Leverage Cobots To Support Their Employees

The use of “cobots” (collaborative robots) is gaining momentum. Many retailers are using cobots to support their employees and improve operational efficiency. For example, British retailer Boots UK deployed 135 cobots from Locus Robotics, an autonomous mobile robotics provider, in its warehouse in late 2019, to help staff keep up with holiday demand. Boots UK noted that these cobots are two to three times faster than manually pushing trolleys over long distances, thus reducing human workers’ non-efficient walking time in the warehouse.

Locus Robotics focuses on warehouse automation, designing robots that collaborate with workers. The startup announced a $40 million Series D fundraising round led by Zebra Ventures in June 2020. The company previously raised $26 million in 2019, $25 million in 2017 and $8 million in 2016. Locus Robotics plans to enter Australia and New Zealand markets in the near future.

[caption id="attachment_115694" align="aligncenter" width="550"] Locus Robotics’ autonomous robots at work with a picking associate

Locus Robotics’ autonomous robots at work with a picking associateSource: Locus Robotics[/caption]

3. Robotics in Retail Stores

As the cost of human labor increases, retailers are investing in robotics to reduce costs and improve the in-store customer experience (for example, by reducing out-of-stocks). Robots can work longer hours without extra cost and can maintain high efficiency. Below, we discuss two notable examples of the use of store-based robotics, by Albertsons and FamilyMart.

Albertsons Expands Automation Partnership with Takeoff Technologies

Takeoff Technologies develops automated micro-fulfillment centers for grocers. The company expanded its partnership with Albertsons, the second-largest traditional grocery chain in the US, in late 2019, to open more micro-fulfillment centers for online grocery orders. Unlike the warehouse solutions discussed above, micro-fulfillment centers are typically built inside existing stores, taking around 10,000 square feet of space and holding over 15,000 different products.

Robots in these centers can assemble online grocery orders of up to 60 items in less than five minutes, almost 10 times faster than manual in-store picking. Overall, for each location, the system can process around 3,500 online orders per week on a two-hour service policy, according to Takeoff Technologies.

[caption id="attachment_115695" align="aligncenter" width="550"] Takeoff Technologies’ Micro-Fulfillment Center

Takeoff Technologies’ Micro-Fulfillment CenterSource: Takeoff Technologies[/caption]

FamilyMart To Use Robots To Stock Shelves

Japanese convenience store chain FamilyMart recently partnered with Telexistence, a Tokyo-based robotics development company, to use robots to stock shelves. The partnership carried out a feasibility test in July in select FamilyMart stores to evaluate the extent to which the robots could reduce labor costs. FamilyMart plans to roll out these robots into 20 stores across Japan by 2022, depending on the success of the test. A human operator will control the robots remotely through a virtual reality terminal (see image below). These robots can move like humans and handle 30 items at a time. According to Telexistence, the robots currently take eight seconds to stock one item—three seconds longer than humans—but Telexistence intends to improve the robots’ efficiency and their capacity to carry items.

Convenience stores in Japan tend to stay open 24 hours a day and suffer from labor shortages, resulting in higher labor costs. In 2017, Japan’s Ministry of Economy, Trade and Industry launched a project to encourage retailers to use electronic tags on all merchandise. The goal is to eventually transform stores to be entirely unstaffed as well as to reduce food waste.

[caption id="attachment_115696" align="aligncenter" width="550"] Telexistence Model H Robot Demonstration

Telexistence Model H Robot DemonstrationSource: Telexistence[/caption]

4. Two New Commercial Applications of Robots

In response to Covid-19, robotics companies are re-engineering robots to add additional skills. In this section, we discuss two new applications in security and health and safety.

MIT-Designed Robots To Disinfect Space

The Massachusetts Institute of Technology’s (MIT’s) Computer Science and Artificial Intelligence Laboratory has worked with Ava Robotics and the Greater Boston Food Bank to develop a robot that can disinfect a 4,000-square-foot warehouse in approximately 30 minutes. The robot uses a custom UV-C light to disinfect surfaces and neutralize the coronavirus. While UV-C light is effective in killing bacteria and viruses on surfaces, it can be harmful to humans. The robot is therefore designed to be autonomous, without the need for direct human supervision.

Currently, the team is exploring how to use the robot’s sensors to adapt to changes in the surrounding environment. In the future, this type of autonomous UV disinfection could be deployed in supermarkets, factories and restaurants.

[caption id="attachment_115697" align="aligncenter" width="550"] MIT’s robot

MIT’s robotSource: Alyssa Pierson/CSAIL[/caption]

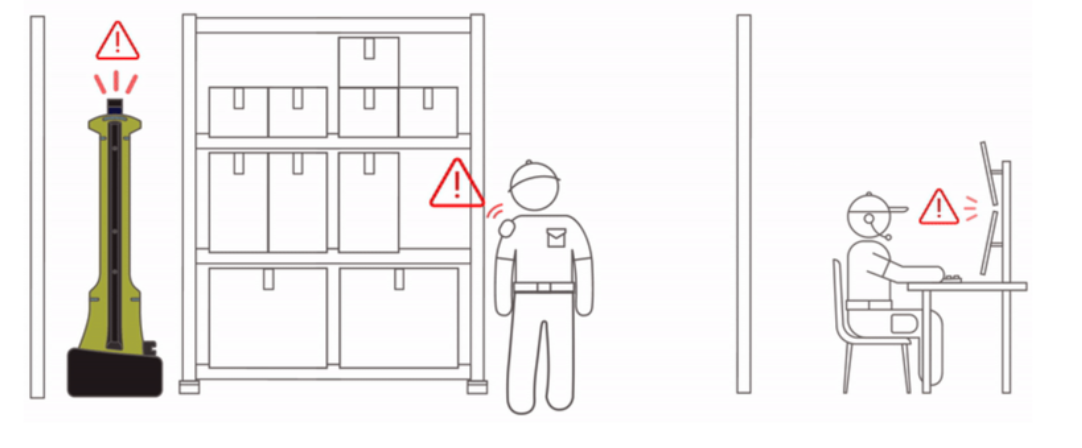

Badger Technologies Introduces Robots for the Security Sector

Badger Technologies, a product division of manufacturing services company Jabil, introduced the Badger PatrolBot autonomous robot in June 2020, which is tailored for the security sector. PatrolBots can check automatically whether windows and doors are secured, fire extinguishers and defibrillators are properly stored, and floors are free of debris and potential hazards. The robots can also be used for surveillance of areas that are not supported by cameras and investigating alarms.

PatrolBots can streamline security-guard tour scheduling, log real-time checkpoint and report incidents. In addition, they can fulfill social-distancing requirements without reducing the level of security. Previously, some retailers have been using Badger’s robots to detect potential hazard situations such as spills on the floor.

[caption id="attachment_115698" align="aligncenter" width="550"] Badger PatrolBot autonomous robot demonstration

Badger PatrolBot autonomous robot demonstrationSource: Badger Technologies[/caption]

Key Insights

The pandemic has put pressure on logistics and amplified companies’ need to evaluate and deploy new technologies.

- Robotics applications have infiltrated almost every aspect of business operations. By accelerating their adoption of robotics, retailers can realize the benefits of cost reductions and efficiency, helping them to improve customer service and remain competitive in challenging times.

- Increased e-commerce order volumes make efficiency even more critical in operations. Robotics in warehouse and logistics can help retailers to improve operational efficiency.

- Employers need to keep staff safe and implement social-distancing against the backdrop of Covid-19. Startups should add new capabilities to robots to address these new demands.

- In the future, we expect to see more in-store robotics assisting customers and reducing labor costs.