Source: Company reports

4Q15 RESULTS

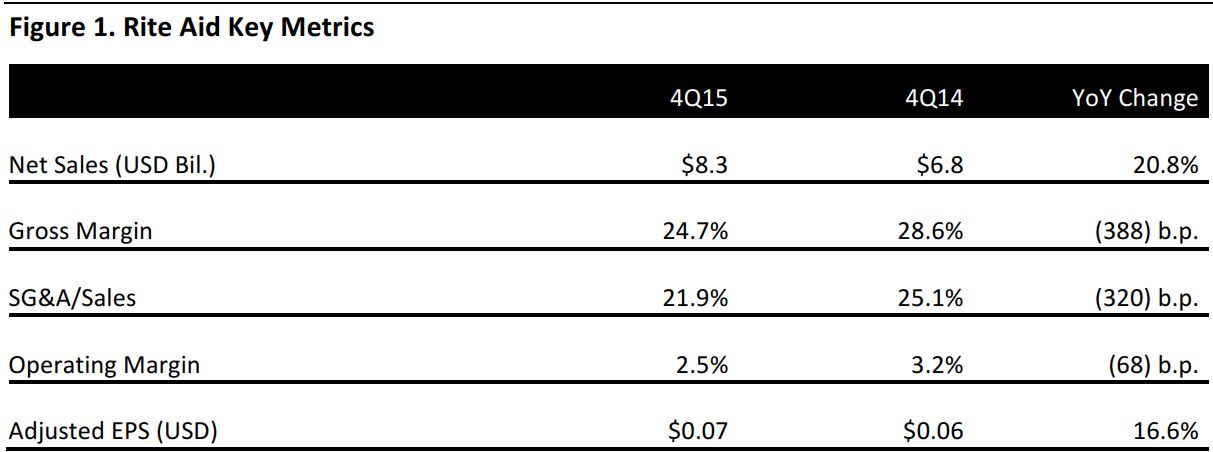

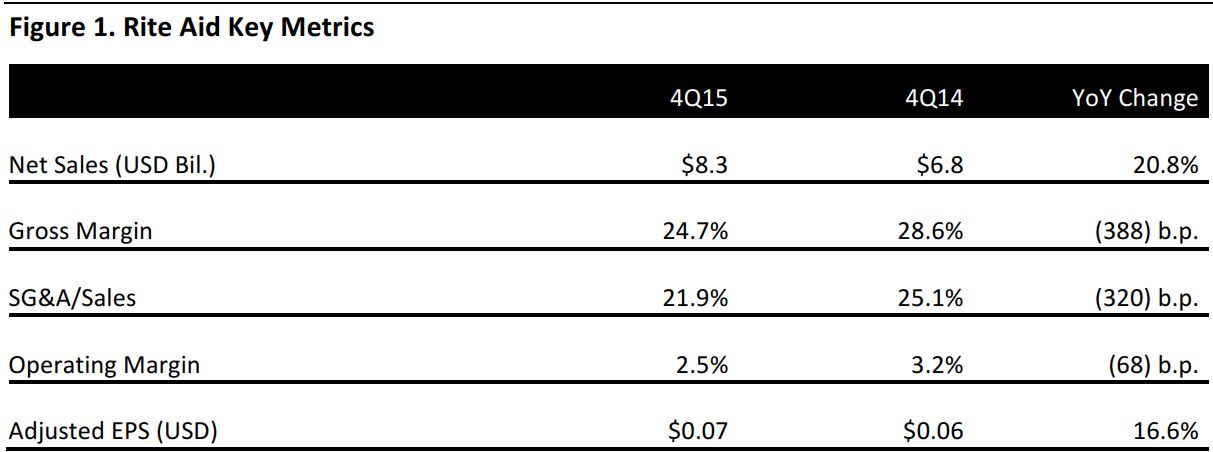

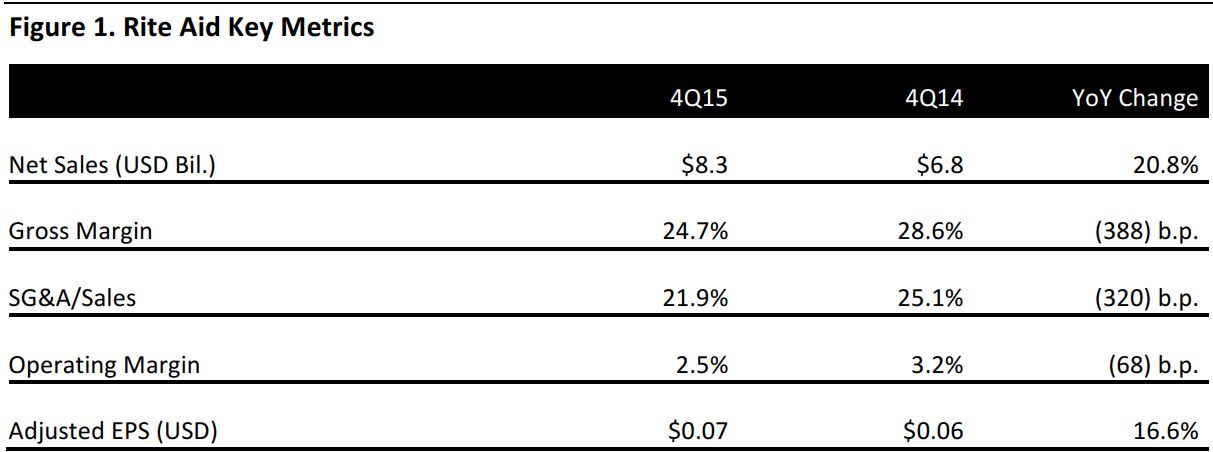

Rite Aid, the third-largest drugstore chain in the US, reported 4Q15 net sales of $8.3 billion, up 20.8% year over year but slightly below the consensus estimate. Retail Pharmacy sales were $6.8 billion, down 0.3% compared to the year-ago quarter. The new pharmacy services segment recorded sales of $1.5 billion. In February 2015, Rite Aid acquired pharmacy-benefit manager Envision Pharmaceutical Services from investment firm TPG for about $2 billion. Revenue from the new segment accounted for 18% of total revenue, driving the year-over-year sales increase.

Same-store sales decreased by 0.6% as a result of lower retail sales and new generic drug introductions. Pharmacy sales decreased by 0.8%, their first decline in three years, and retail sales decreased by 0.4%, their first decline in two years.

The number of same-store prescriptions filled increased by 0.1% from the year-ago quarter.

Adjusted EPS was $0.07, compared to $0.06 in the year-ago quarter.

Rite Aid has worked to expand its RediClinics and remodeled 89 wellness stores, which offer organic food and natural personal-care options. It added three new clinics during the quarter, bringing the total to 78.

2015 RESULTS

Net sales in 2015 increased by 15.9%, to $30.7 billion, slightly below the consensus estimate of $30.9 billion. Retail Pharmacy sales were $26.9 billion, up 1.3%, owing to an increase in same-store sales. Pharmacy services sales were $4.1 billion, driven by the acquisition of Envision.

Retail comps for the year increased by 1.3%, consisting of a 1.8% increase in pharmacy sales and a 0.2% increase in retail sales. Same-store prescriptions filled increased by 0.5% over the prior year period. Prescription sales accounted for 69.1% of total drugstore sales, and third-party prescription revenue was 97.8% of pharmacy sales.

Adjusted EPS was $0.23 compared to $0.27 in the prior year. A decline in adjusted net income resulted primarily from increased interest expense from the company’s acquisition of Envision and higher depreciation expense related to an increase in capital spending.

GUIDANCE

Rite Aid did not provide guidance for the year.

Last October, Rite Aid agreed to be acquired by Walgreens Boots Alliance in a transaction valued at $17.2 billion. The deal is pending regulatory approval, and the companies expect the transaction to close in the second half of 2016.