Source: Company reports/Fung Global Retail & Technology

2Q17 RESULTS

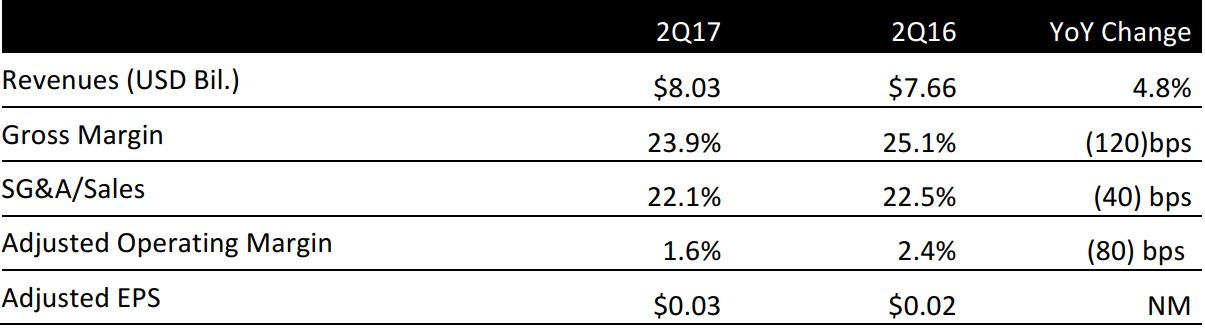

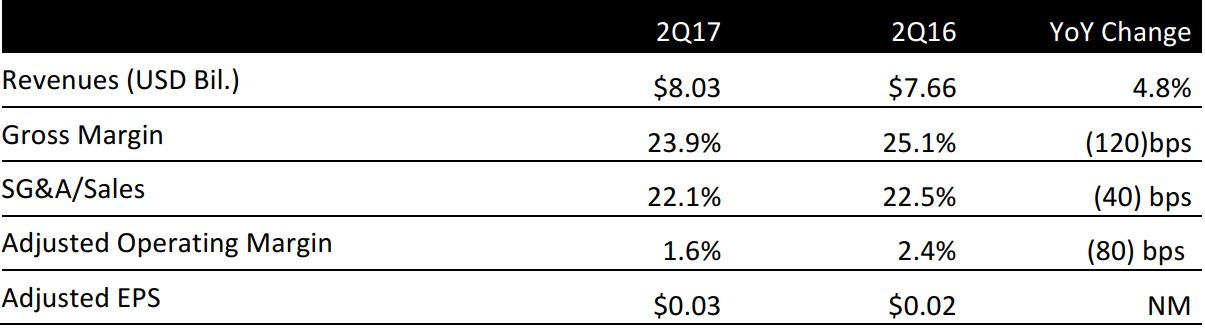

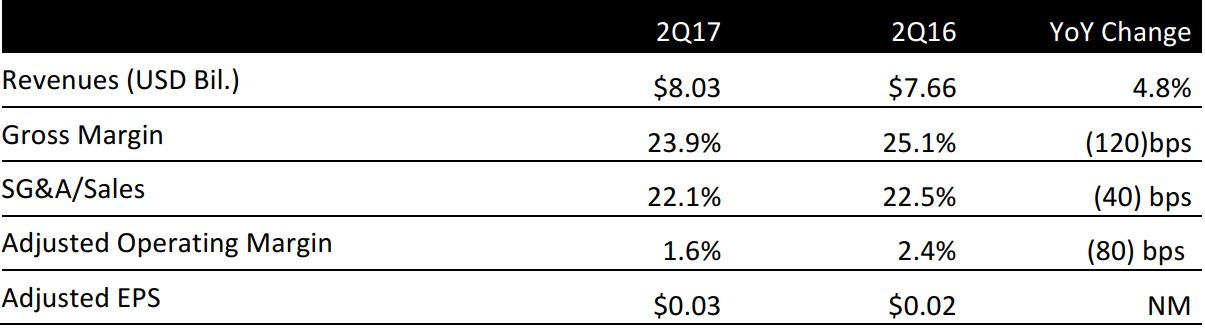

Adjusted EPS for 2Q17 was $0.03, ahead of the $0.02 consensus estimate and up from last year’s $0.02.

Rite Aid reported 2Q17 revenues of $8.03 billion, up 4.8% year over year from last year’s $7.66 billion and below the consensus estimate of $8.17 billion.

Adjusted EBITDA was $312.7 million, or 3.9% of reported revenues for the quarter versus 4.5% for the same period last year, beating the consensus estimate of $311.3 million. The decrease in adjusted EBITDA reflected lower margins at its pharmacy due to a lower reimbursement rate and script count. This was partially offset by margin improvement in its front-end business.

Total comps sales decreased 2.5%, with a 3.6% decline in pharmacy sales, which was offset by the 0.1% increase in front-end sales. The pharmacy sales comps result reflected a negative impact of 101 basis points from new generic introductions and a 1.8% decline in the number of prescriptions filled.

Businesses that contributed to the positive results included its EnvisionRX PBM, and its strong front-end segment. There was some improvement in prescription drug costs, which was offset by challenging reimbursement rates.

OUTLOOK

The company continues to believe that the announced acquisition of Rite Aid by Walgreens will close in the second half of 2016. This expectation is consistent with an earlier update by Walgreens on the status of the transaction. Both companies have been in talks with the Federal Trade Commission (FTC) regarding the review of the pending acquisition.

Management is optimistic about the outlook of the business. The company remained dedicated to improving operating metrics and converting more stores to the wellness format. The wellness stores continue to outperform the chain average in comps results. The format currently accounts for almost half of its stores.