albert Chan

On June 30, 2021, Switzerland-based luxury holding goods company Compagnie Financière Richemont SA (known as Richemont) announced that it has acquired Belgian luxury leather goods maker Delvaux.

Delvaux was established in 1829 and is one of the oldest luxury leather goods houses in the world. It was also the first to file an official patent for a leather handbag, in 1908, and is described by Richemont as “the inventor of the modern luxury handbag.”

Delvaux’s range includes handbags, small leather goods and accessories, such as scarves and bag straps, for women and men. The products are made in Belgium and France and sold online and through 50 boutiques worldwide.

Delvaux’s acquisition by Richemont will allow it access to an expanded online and offline retail network as well as the conglomerate’s supply network and professional expertise.

Richemont acquired Delvaux from Hong Kong-based business magnates Victor and William Fung and Singaporean investment firm Temasek Holdings. The luxury conglomerate stated that the transaction “has no material impact” on its assets and results for the current fiscal year.

Delvaux—Richemont’s Route into the Fashion and Soft Luxury Segment

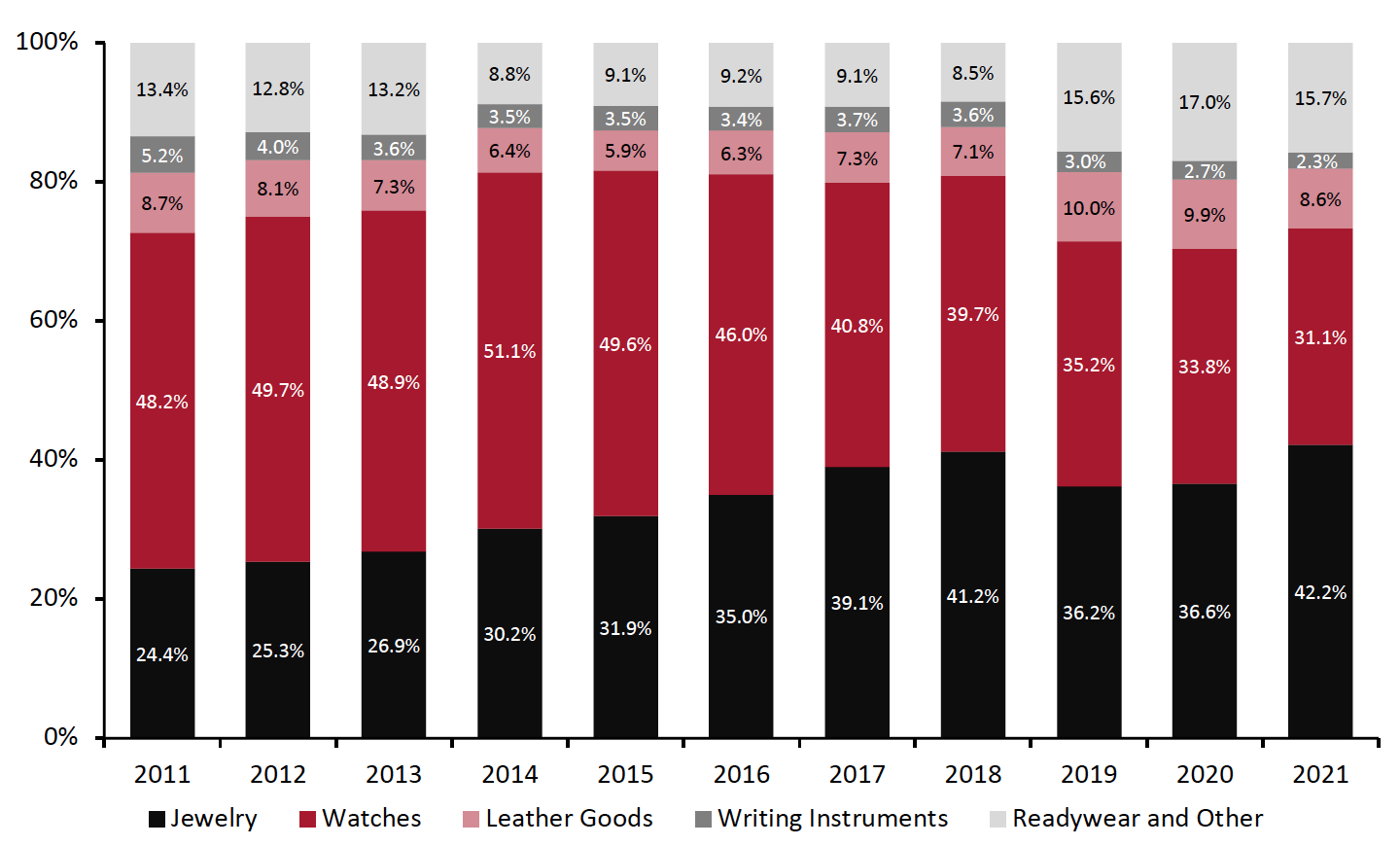

Richemont’s presence in the hard luxury segment is significantly stronger than in the soft luxury segment. On average over the last 10 years, over 75% of Richemont’s revenues have been from the jewelry and watches categories.

Up until 2018, leather goods comprised an average of 7.0% of Richemont’s total revenues. The company has been attempting to grow further in the category and introduced new collections in its Chloé and Dunhill brands in 2018.

The conglomerate stated in its 2019 annual report that its “Fashion & Accessories Maisons’ focus is now on… improving sell-through and cash flow, developing capabilities in leather goods and increasing digital reach.” To achieve this goal, Richemont introduced further leather goods lines in its Dunhill and Montblanc brands in 2019, leading to increased share and sales of leather goods.

In 2021, the leather goods category saw a fall in its share of revenues, to 8.6% from 9.9% in 2020, while jewelry gained share significantly (see Figure 1 below). Delvaux’s acquisition is a small but serious move, denoting Richemont’s desire to expand in soft luxury.

Figure 1. Share of Richemont Revenues by Product Line (%)

[caption id="attachment_129437" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

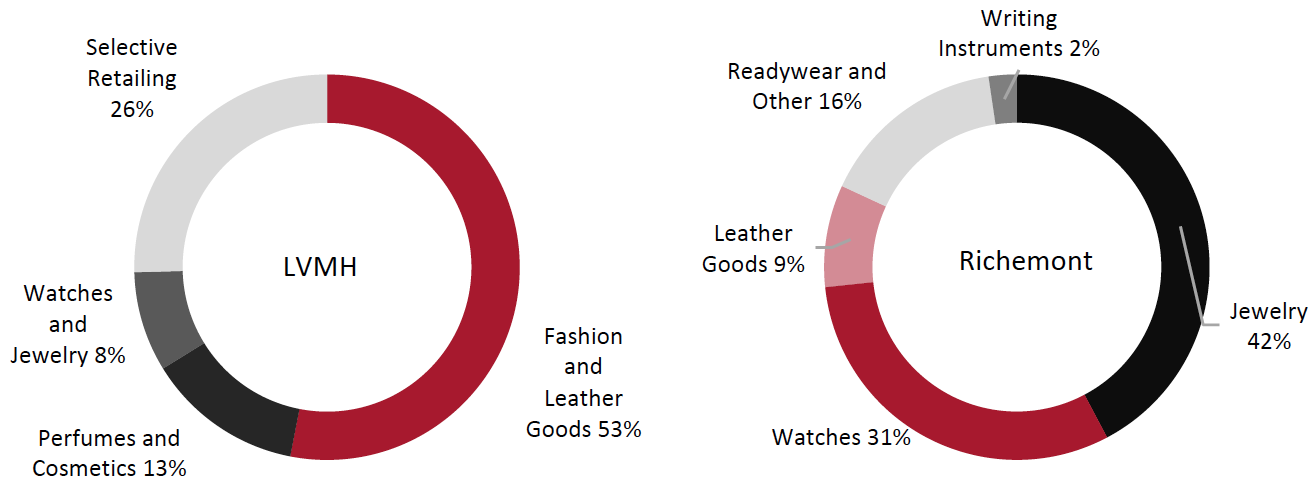

Moreover, Richemont’s fashion and leather goods revenues pale in comparison to those of LVMH. In 2020, LVMH’s revenues from Fashion and Leather Goods were €21.2 billion ($25.1 billion) and accounted for about 53.1% of its total revenues, up from 46% in 2019. Richemont’s revenues from its leather goods and clothing segments totaled €3.2 billion ($3.8 billion). Of course, LVMH is an industry leader in luxury, with total revenues of nearly €40.0 billion in 2020 (excluding revenues from Wines & Spirits and hospitality segments) while Richemont’s was €13.1 billion ($15.6 billion) in the fiscal year ended March 31, 2021.

Figure 2. LVMH and Richemont: Share of Revenues by Product Line (%), Latest Fiscal Year [caption id="attachment_129438" align="aligncenter" width="700"]

LVMH’s fiscal years end December 31 and Richemont’s fiscal years end March 31.

LVMH’s fiscal years end December 31 and Richemont’s fiscal years end March 31.Source: Company reports[/caption]

On the other hand, Richemont’s revenues from its watches and jewelry segments far outstrip those of LVMH. Richemont’s watches and jewelry revenues amounted to an aggregate of €9.6 billion ($11.4 billion) in its latest fiscal year. LVMH’s Watches and Jewelry segment, at a third of Richemont’s, amounted to €3.4 billion ($4.0 billion) in its latest fiscal year.

By acquiring Delvaux, Richemont would be able to build its strengths further in a luxury segment where its presence is less strong and diversify its business activities and risks further, making it more resilient to industry shocks.

Coresight Research’s View: A Calculated Move To Diversify Further Into Soft Luxury

Richemont is an established leader in hard luxury but lags in soft luxury, where LVMH has proven itself with its namesake LV brand. The Delvaux acquisition adds a greater array of soft luxury products to Richemont’s portfolio, and will allow the company to diversify its consumer base further.

Furthermore, Richemont owns online luxury site Net-A-Porter and has invested in online luxury retailer Farfetch in partnership with Alibaba, which runs luxury e-commerce platforms Tmall Luxury Pavilion and Luxury Soho. Platforms such as Farfetch are popular among digital-first younger luxury consumers and open up further avenues for Richemont to sell Delvaux’s products and expand.