Nitheesh NH

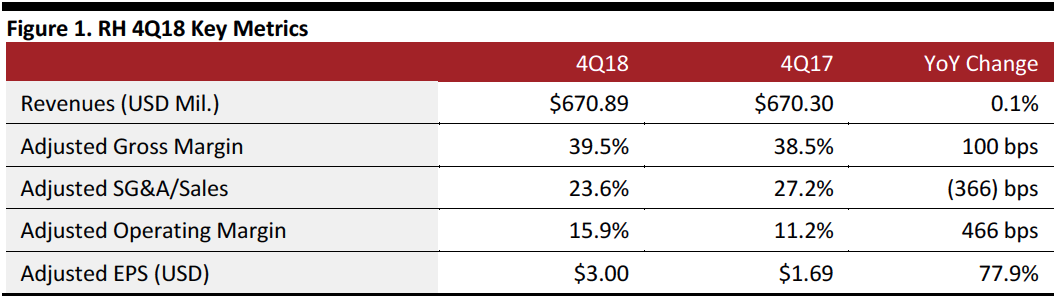

[caption id="attachment_82060" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

RH reported 4Q18 revenues of $670.89 million, flat year over year and missing the $686.4 million consensus estimate.

Comparable-brand revenue growth was 5%, beating the 4.8% estimate and the 2% rate reported in the year-ago quarter.

Adjusted EPS was $3.00, beating the $2.86 consensus estimate and up 77.9% from $1.69 in the year-ago quarter. GAAP EPS was $1.41, up from $0.01 in the year-ago quarter.

FY18 Results

FY18 revenues were $2.5 billion, up 2.7%. On a comparable 52-week basis, adjusted net revenues increased 5%.

Comparable-brand revenue growth was 4%, down from 6% in the prior year.

Adjusted EPS was $5.68, beating the $2.86 consensus estimate. GAAP EPS was $5.68, up from $0.07 in the prior year.

Merchandise inventories increased to $532 million from $527 million a year ago.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

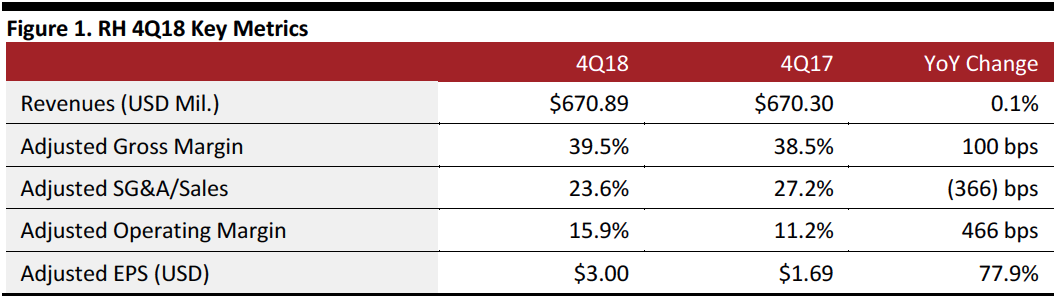

4Q18 Results

RH reported 4Q18 revenues of $670.89 million, flat year over year and missing the $686.4 million consensus estimate.

Comparable-brand revenue growth was 5%, beating the 4.8% estimate and the 2% rate reported in the year-ago quarter.

Adjusted EPS was $3.00, beating the $2.86 consensus estimate and up 77.9% from $1.69 in the year-ago quarter. GAAP EPS was $1.41, up from $0.01 in the year-ago quarter.

FY18 Results

FY18 revenues were $2.5 billion, up 2.7%. On a comparable 52-week basis, adjusted net revenues increased 5%.

Comparable-brand revenue growth was 4%, down from 6% in the prior year.

Adjusted EPS was $5.68, beating the $2.86 consensus estimate. GAAP EPS was $5.68, up from $0.07 in the prior year.

Merchandise inventories increased to $532 million from $527 million a year ago.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

4Q18 Results

RH reported 4Q18 revenues of $670.89 million, flat year over year and missing the $686.4 million consensus estimate.

Comparable-brand revenue growth was 5%, beating the 4.8% estimate and the 2% rate reported in the year-ago quarter.

Adjusted EPS was $3.00, beating the $2.86 consensus estimate and up 77.9% from $1.69 in the year-ago quarter. GAAP EPS was $1.41, up from $0.01 in the year-ago quarter.

FY18 Results

FY18 revenues were $2.5 billion, up 2.7%. On a comparable 52-week basis, adjusted net revenues increased 5%.

Comparable-brand revenue growth was 4%, down from 6% in the prior year.

Adjusted EPS was $5.68, beating the $2.86 consensus estimate. GAAP EPS was $5.68, up from $0.07 in the prior year.

Merchandise inventories increased to $532 million from $527 million a year ago.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

4Q18 Results

RH reported 4Q18 revenues of $670.89 million, flat year over year and missing the $686.4 million consensus estimate.

Comparable-brand revenue growth was 5%, beating the 4.8% estimate and the 2% rate reported in the year-ago quarter.

Adjusted EPS was $3.00, beating the $2.86 consensus estimate and up 77.9% from $1.69 in the year-ago quarter. GAAP EPS was $1.41, up from $0.01 in the year-ago quarter.

FY18 Results

FY18 revenues were $2.5 billion, up 2.7%. On a comparable 52-week basis, adjusted net revenues increased 5%.

Comparable-brand revenue growth was 4%, down from 6% in the prior year.

Adjusted EPS was $5.68, beating the $2.86 consensus estimate. GAAP EPS was $5.68, up from $0.07 in the prior year.

Merchandise inventories increased to $532 million from $527 million a year ago.

Details from the Quarter

- The core RH business experienced a sales decline of approximately 10 percentage points beginning the third week of December, which persisted through the remainder of the fourth quarter, leading to a $13 million shortfall versus the midpoint of RH’s revised revenue guidance.

- RH New York, located in Manhattan’s Meatpacking District, is now trending at an annualized revenue run rate of more than $100 million. Management expects sales to accelerate throughout the year as street construction is completed and new tenants begin to fill empty storefronts.

- The company continues to create new operating platforms, including a distribution center network redesign, the redesign of its reverse logistics and outlet business, and the improvement of its home delivery and customer experience. This new platform is driving lower costs and lowering inventory levels, as well as boosting earnings and inventory turns. Management expects this multi-year effort to dramatically improve the customer experience, raise margins and generate significant cost savings over the next several years.

- RH has several new brand extension plans in the development pipeline:

- RH Beach House with a dedicated Source Book to launch this spring.

- RH Ski House with a dedicated Source Book to launch this fall.

- RH Color to delay its launch until next year, to present the two second home concepts in a more logical progression.

- The company also plans to increase its investment in RH Interior Design as it continues building the interior design firm in North America.

- RH will accelerate its real estate transformation, opening five to seven new Galleries per year, up from three to five per year. In the second half 2019, RH plans to open five new Galleries, including in Edina, Minnesota; Charlotte, North Carolina; Corte Madera, California; San Francisco; and, Columbus, Ohio. Each will have an integrated hospitality offering. Due to continued construction on Gansevoort Street, the company will delay opening the New York Guesthouse until spring 2020.

- Adjusted net revenues of $2.58-2.635 billion, an increase of 3-5%, below the $2.75 billion consensus estimate.

- Adjusted EPS of $8.41-9.08, an increase of 11-19% and below the $10.11 consensus estimate.

- Annual net revenue growth of 8-12%.

- Adjusted operating margins in the mid- to high teens.

- Adjusted annual earnings growth of 15-20%.

- Return on invested capital (ROIC) more than 50%.