DIpil Das

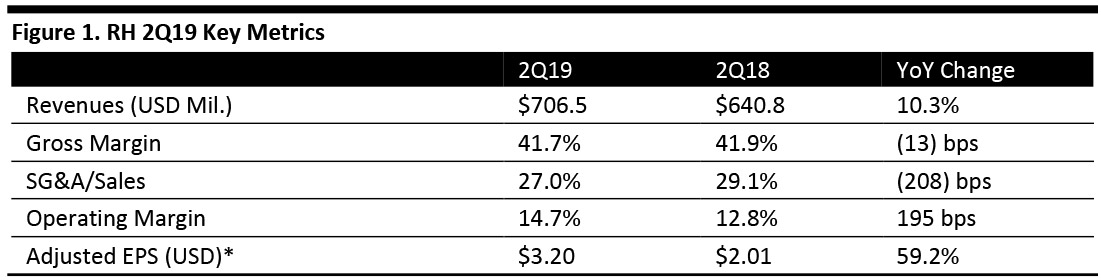

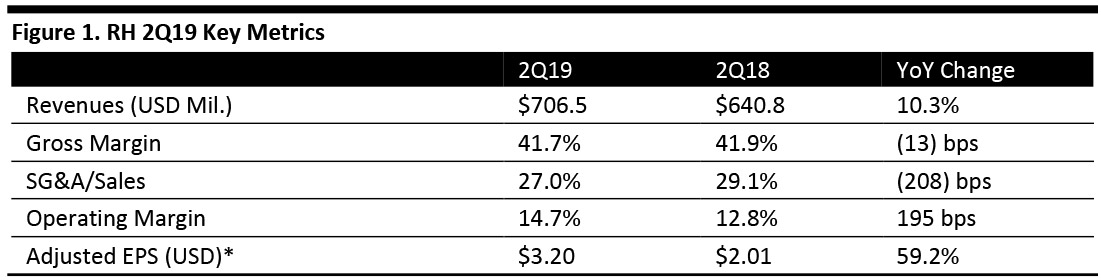

[caption id="attachment_96189" align="aligncenter" width="700"] *EPS is adjusted primarily for amortization of debt discount and asset impairments

*EPS is adjusted primarily for amortization of debt discount and asset impairments

Source: Company reports/Coresight Research[/caption] 2Q19 Results RH reported 2Q19 revenues of $706.5 million, up 10.3% year over year and beating the $669.3 million consensus estimate. Adjusted EPS was $3.20, comfortably beating the $2.69 consensus estimate and up 59.2% from $2.01 in the same quarter of the previous year. GAAP EPS was $2.86, up 24.9% from $2.29 in 2Q18. Details from the Quarter

*EPS is adjusted primarily for amortization of debt discount and asset impairments

*EPS is adjusted primarily for amortization of debt discount and asset impairments Source: Company reports/Coresight Research[/caption] 2Q19 Results RH reported 2Q19 revenues of $706.5 million, up 10.3% year over year and beating the $669.3 million consensus estimate. Adjusted EPS was $3.20, comfortably beating the $2.69 consensus estimate and up 59.2% from $2.01 in the same quarter of the previous year. GAAP EPS was $2.86, up 24.9% from $2.29 in 2Q18. Details from the Quarter

- The company attributed its robust revenue growth in 2Q to the strength of its core RH business, strong performance from new galleries led by RH New York, expansion of RH Hospitality and planned accelerated outlet sales arising from the closure of a distribution facility in 4Q18. Moreover, delivered sales in the final weeks of the quarter were better than expected owing to shipping efficiencies, and there were lower returns thanks to a redesign of the company’s home delivery network.

- RH New York, which the company considers as its most important new gallery, is trending at an annualized revenue run rate of over $100 million. RH expects this gallery to generate over $30 million in cash contribution in FY19, which is its first full fiscal year.

- Despite negative macro trends and increased tariffs, RH expressed optimism for continued business momentum, supported by:

- Recent mailing of the Fall Interiors and soon to be in-home Modern Source Books.

- Growing contribution from RH Beach House, RH’s new spinoff brand.

- Launch of RH Ski House and new galleries scheduled to open by fall.

- Management stated that the impact of higher tariffs on goods from China has been accounted for in its guidance for the year and believes that the tariffs will not deter it from achieving its stated financial goals.

- The company claims to have renegotiated product costs and also raised prices selectively to compensate for the impact of higher tariffs.

- Management expects to achieve its target asset sales of $50-60 million in FY19.

- RH plans to continue the acceleration of its real estate transformation, opening five to seven new galleries in FY20 and at least seven new galleries in FY21.

- Adjusted net revenues of $2.68-2.69 billion, an increase of 7-8% and above the $2.67 billion consensus estimate. Previous guidance for adjusted net revenues was $2.66-$2.67 billion.

- Adjusted EPS of $10.53-10.76, an increase of 25-28% and above the $9.80 consensus estimate. Previous guidance for adjusted EPS was $9.08-$9.52.

- Annual net revenue growth of 8-12%.

- Adjusted operating margin percentages in the mid to high teens.

- Adjusted annual earnings growth of 15-20%.

- Return on invested capital (ROIC) above 50%.