DIpil Das

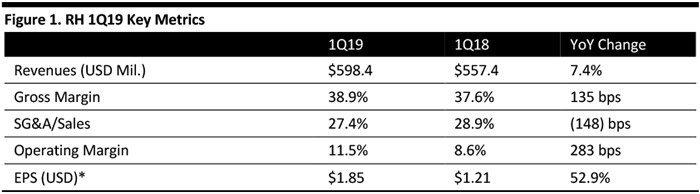

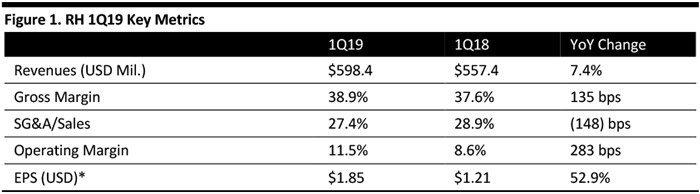

[caption id="attachment_90584" align="aligncenter" width="700"] *EPS is adjusted primarily for amortization of debt discount and asset impairments

*EPS is adjusted primarily for amortization of debt discount and asset impairments

Source: Company reports/Coresight Research[/caption] 1Q19 Results RH reported 1Q19 revenues of $598.4 million, up 7.4% year over year and beating the $583.7 million consensus estimate. Adjusted EPS was $1.85, comfortably beating the $1.53 consensus estimate and up 52.9% from $1.21 in the year-ago quarter. GAAP EPS was $1.43, up 41.6% from $1.01 in the year-ago quarter. Details from the Quarter

*EPS is adjusted primarily for amortization of debt discount and asset impairments

*EPS is adjusted primarily for amortization of debt discount and asset impairments Source: Company reports/Coresight Research[/caption] 1Q19 Results RH reported 1Q19 revenues of $598.4 million, up 7.4% year over year and beating the $583.7 million consensus estimate. Adjusted EPS was $1.85, comfortably beating the $1.53 consensus estimate and up 52.9% from $1.21 in the year-ago quarter. GAAP EPS was $1.43, up 41.6% from $1.01 in the year-ago quarter. Details from the Quarter

- Despite negative macro trends and increased tariffs, RH expressed cautious optimism for continued business momentum, supported by:

- Recent introduction of RH Beach House, RH’s new spinoff brand.

- Continued elevation and expansion of its product range.

- Investments in RH Interior Design.

- Launch of RH Ski House and new galleries scheduled to open by fall.

- RH New York, located in Manhattan’s Meatpacking District, is trending at an annualized revenue run rate of over $100 million.

- RH San Francisco and RH Charlotte, which were both scheduled to open late in the fourth quarter, have experienced delays, and will instead open in the first quarter of fiscal 2020.

- The company claims to have renegotiated product costs and also raised prices selectively to compensate for the impact of higher tariffs on goods from China. Additionally, the company confirmed it is moving certain production and new product development operations out of China, scouting for new partnership opportunities and expanding manufacturing facilities in the US.

- Management stated that it is on schedule to achieve its target asset sales of $50-60 million in fiscal 2019.

- RH plans to continue the acceleration of its real estate transformation, opening five to seven new galleries in fiscal 2020 and at least seven new galleries in fiscal 2021.

- Adjusted net revenues of $2.64-2.66 billion, an increase of 5-6% and above the $2.60 billion consensus estimate.

- Adjusted EPS of $8.76-9.27, an increase of 4-10% and above the $8.31 consensus estimate.

- Annual net revenue growth of 8-12%.

- Adjusted operating margins in the mid to high teens.

- Adjusted annual earnings growth of 15-20%.

- Return on invested capital (ROIC) above 50%.