albert Chan

EXECUTIVE SUMMARY

RFID is a 70-year-old technology that involves bouncing radio waves off antennas in order to locate and identify objects. Retailers are showing a renewed interest in the technology. A few early attempts at deployment were not successful, as the technology, viewed by many as too expensive, was often imposed on suppliers against their will. Why has RFID picked back up in recent years? We think three trends have been driving adoption: accelerated shipping, omni-channel operations and the IoT.

It has become imperative that retailers know precisely where their inventory is, as many are now following Amazon’s lead and offering two-day (and up to one-hour) shipping. It is no longer sufficient to take inventory once a week or once a month; retailers now need to know where their inventory is in real time, and in which hub, in order to be able to guarantee delivery within a specified time period.

Omni-channel operations can benefit from RFID for similar reasons. To successfully fulfill an online order or allow in-store pickup of it, a retailer must be confident that the product ordered is close to the customer, or that it can reach him or her within the promised amount of time. For brick-and-mortar stores to take on the function of shipping hubs, retailers need to know precisely what inventory is on the shelves at all times.

Finally, there has been an explosion in the number of things that are connected to the Internet as part of the IoT trend—and the identity and location of each of these things must be tracked. The IoT has spurred the development of new applications and services, such as grocery tracking and medication adherence tracking, and RFID is one technology that can enable such functionality.

With RFID tags now costing only pennies apiece, cost no longer seems to be as big a concern for retailers as it once was. Installation of an RFID system could still cost a couple of hundred thousand dollars or more, most of it in software and services, but since e-commerce companies are continually setting the standard in terms of convenience, shipping times and certainty that goods will arrive, retailers cannot afford to wait any longer to adopt RFID.

RFID technology does have its limitations: humans must still be involved in the process, which means that data is sometimes entered incorrectly, and systems are sometimes unable to read tags due to interference from other signals. There are some concerns about privacy, too, but overall, the technology continues to improve. During the last five years, we have seen several major brands and retailers move forward with RFID installations, suggesting that the technology has finally hit its sweet spot in retail.

WHY RFID NOW?

Although RFID dates back to discoveries during World War II and saw its first patent filings in 1973, its use in the US has been sporadic. It has promised much for retail: an accurate view of inventory and the ability to track what is in the storeroom and what is on the shelves in real time. However, until recently, retailers have generally shunned the technology due to fears that it is too costly to install and too difficult to manage. Moreover, many retailers that have dabbled with RFID, such as Walmart, have ended up deploying it in a more limited way than originally planned. So, what is different today that could drive retailers to part with their precious dollars and adopt a new technology? We think a key driver is the shortening of shipping times, led by Amazon. The need to offer faster shipping has led many other retailers to implement omni-channel operations as quickly as possible, and RFID is one technology that enables this.

Accelerated Shipping

Amazon launched its Prime service in 2005—with free two-day shipping on selected items—and it has set the standard for all other e-commerce companies and operations. Since then, Amazon has introduced one-day shipping (for an extra fee) and accelerated shipping times of one or two hours through its Prime Now service. Many brick-and-mortar retailers have had to offer faster shipping in order to compete, and some have partnered with local delivery startups to offer same-day delivery.

[caption id="attachment_101021" align="aligncenter" width="500"] Source: chicagotribune.com[/caption]

Source: chicagotribune.com[/caption]

Omni-Channel

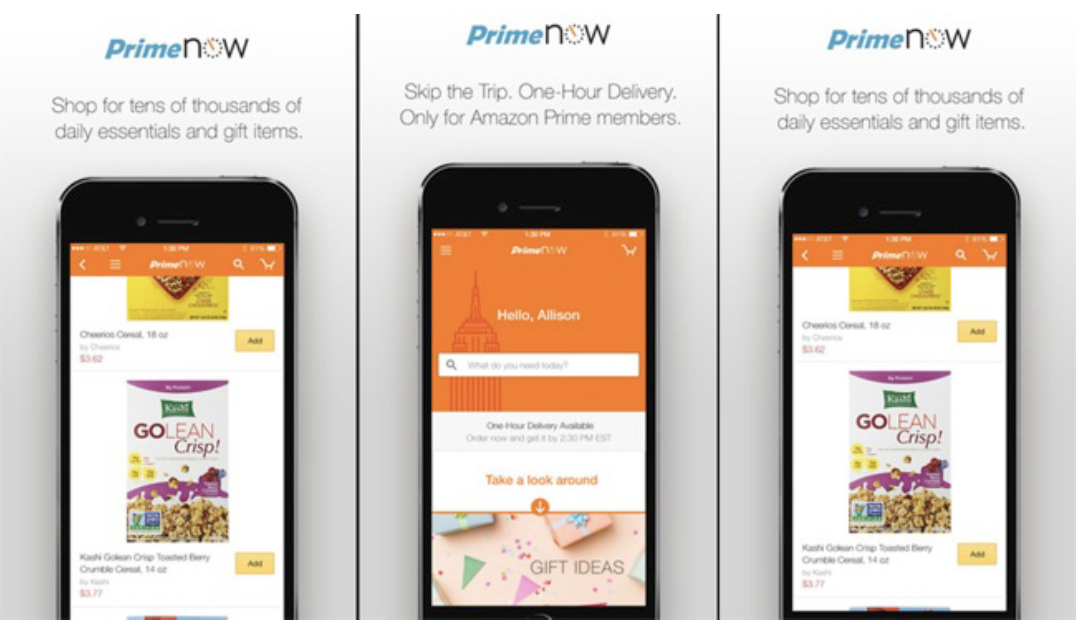

Although more and more companies have moved into omni-channel retailing over the past several years, the reality is that, even today, most retailers operate their brick-and-mortar and e-commerce businesses separately, each with its own inventory. But the traditional method of operating a central distribution center is insufficient: it does not allow retailers to get goods to customers fast enough in an environment where those customers all expect accelerated shipping. Retailers must bring goods closer to customers in order to be able to deliver them faster.

To do so, some retailers have turned their brick-and-mortar stores into distribution centers. In order to guarantee two-day (or one-hour) shipping, a retailer must be certain that the goods are in close proximity to the customer and can indeed be delivered within the specified amount of time. Retailers risk customers’ ire if they accept orders that they cannot deliver within the promised amount of time. This requires an accurate view of the inventory on the shelves and in the storeroom. If the closest distribution center, whether that is a warehouse or a brick-and-mortar store, does not have a particular item in inventory, then the retailer needs to be able to locate it in the next-closest center. This requires an accurate view of inventory across the distribution network.

[caption id="attachment_101022" align="aligncenter" width="500"] Source: Wilson, Perumal & Company[/caption]

Source: Wilson, Perumal & Company[/caption]

The IoT

While there is much hype surrounding the IoT, it is a fact that an increasing number of intelligent electronic devices in our lives are being connected to the Internet. It is not just PCs, smartphones and wearable technology devices that are connected; our houses and automobiles have started to become connected, too. And Cisco Systems forecasts that 50 billion devices will be connected to the Internet by 2020. All of these things will need to be tracked and accounted for. Specifically, things belonging to the IoT need to be tagged somehow with an automatic identification technology, and RFID can serve this purpose. For example, RFID chips can be used to tag grocery items in order to help grocers monitor consumption and expiration. And RFID tags on prescription bottles can help companies ensure prescription adherence and monitor expiration dates.

MARKET SIZE

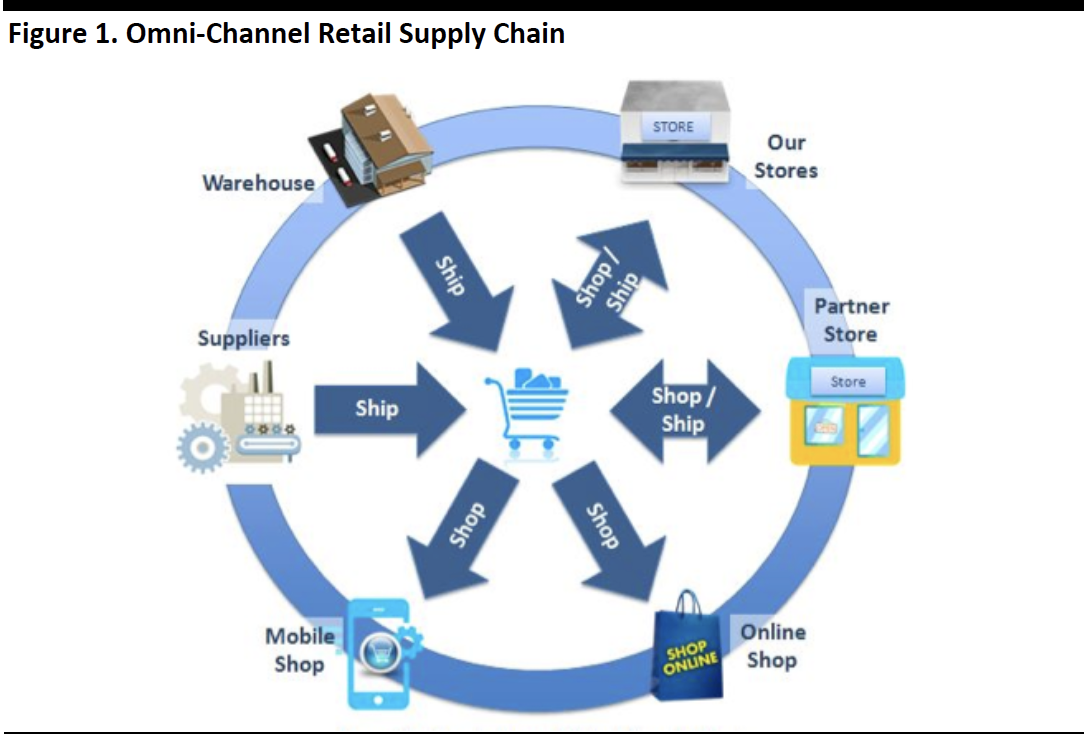

According to market research firm IDTechEx, the global RFID market—for tags, interrogators, systems, services, networking and software—will reach approximately $13.9 billion this year and grow at a 17.0% CAGR through 2018.

[caption id="attachment_101023" align="aligncenter" width="500"] Source: IDTechEx[/caption]

Source: IDTechEx[/caption]

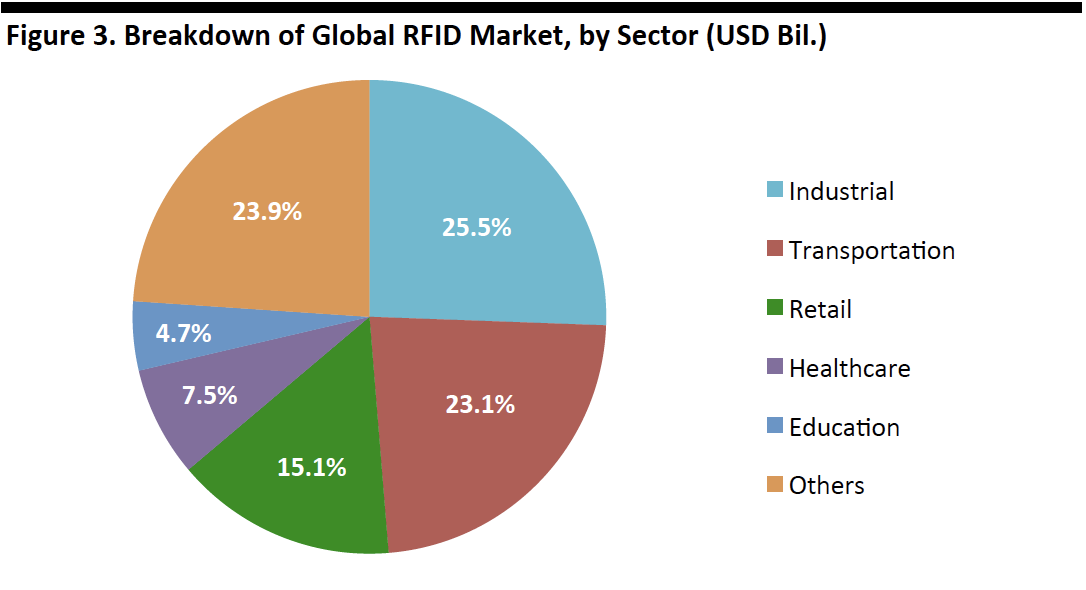

In the graph below, we see that the industrial sector is currently the largest global RFID market, followed by transportation, retail, healthcare and education.

[caption id="attachment_101024" align="aligncenter" width="500"] Source: Frost & Sullivan[/caption]

Source: Frost & Sullivan[/caption]

Within the above categories, RFID technology is used most extensively for the following applications:

- Industrial—Asset tracking, such as of equipment, tools and inventory

- Transportation—Ticketing

- Retail—Apparel item marking

- Healthcare—Asset tracking of medical equipment and instruments

- Others—Government mandates for the tracking of livestock

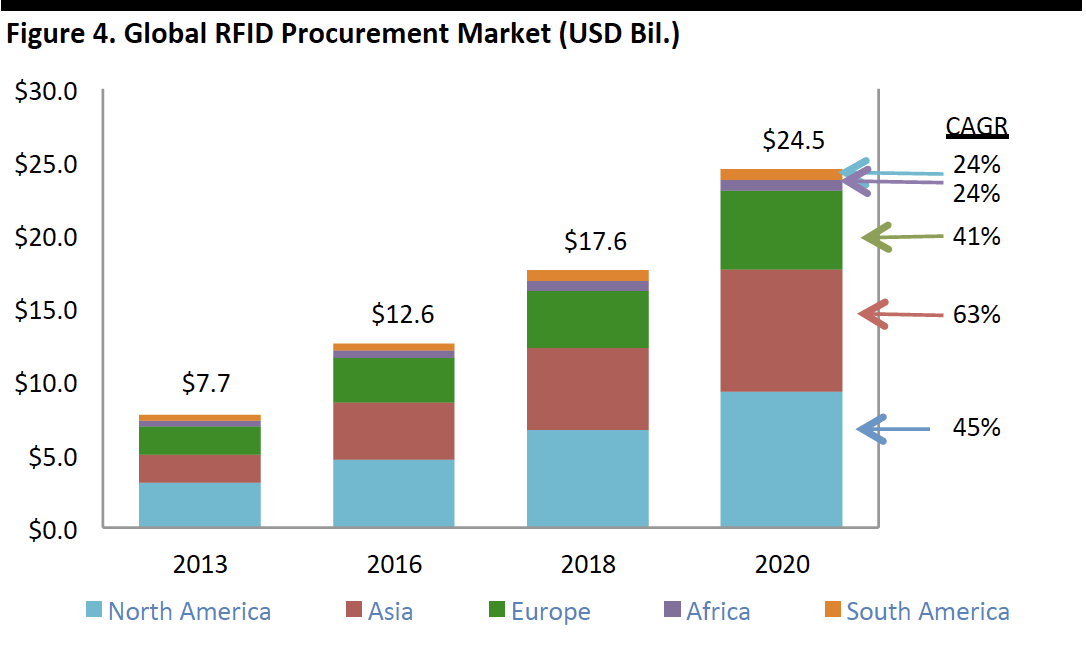

The graph below shows the global RFID procurement market by geography. Market Info Group predicts that the fastest-growing regions will be Asia (predicted to grow at a 63% CAGR), followed by North America (at 45%), Europe (at 41%), and then Africa and South America (both at 24%), for a total CAGR of 47% during 2013–2020.

[caption id="attachment_101025" align="aligncenter" width="500"] Source: Market Info Group[/caption]

Source: Market Info Group[/caption]

Chinese Market

China has been an enthusiastic user of RFID tags in smart cards and transit cards. Lux Research estimates that the Chinese RFID market will be worth about $719 million, comprising nearly 1.8 billion units, this year. The firm forecasts that the Chinese market will grow at a 12% CAGR in dollar terms and at a 19% CAGR in unit terms during 2012–2017.

[caption id="attachment_101026" align="aligncenter" width="450"] Source: globalsources.com[/caption]

Source: globalsources.com[/caption]

RFID’S BENEFITS

Below, we list some of the revenue enhancements and cost savings that retailers can expect to achieve by implementing RFID.

Revenue Enhancements

- Eliminating Out-of-Stock Situations. A Harvard Business School study found that 8% of all retail items are out of stock at any given time, which costs the industry more than $69 billion per year. Consulting firm Kurt Salmon estimates this figure at 8%–15%. Using RFID reduces the likelihood of an item being out of stock by 60%–80%, according to ABI Research.

- Sales Lift from Inventory Management. Kurt Salmon cites an example of a retailer that saw a 4% sales lift from using RFID, which amounted to a $2.5 billion revenue increase across the company’s entire store fleet.

- Inventory in the Right Place. Inventory also gets “lost” at retailers. In one pilot study, only 30% of merchandise was located in sufficient time to transfer it to the clearance rack. Kurt Salmon estimates that finding inventory in time can result in a 3%–5% increase in net sales.

- Reduce Theft. According to the University of Florida, retailers lose more than $37 billion per year due to shrinkage, or theft. RFID can also serve as an electronic surveillance tool to prevent theft. American Apparel’s 120 stores using RFID run at 99.8% inventory accuracy and shrinkage has been cut by 55%, on average.

- Omni-Channel Opportunities. Having an accurate view of inventory enables retailers to offer services such as ship-from-store and click-and-collect, which also allows them to save money on shipping costs. Nordstrom claimed that the integration of its online and in-store inventories resulted in a 39% sales increase.

- Better Customer Experience. RFID, along with intelligent displays and smartphone apps, can be used to offer customers additional information on the products they are viewing, to enable magic mirrors, and to offer individual promotions and discounts.

Cost Savings

- Better Planning. Companies that have an accurate view of their inventory can better manage inventory replenishment and increase inventory turns. These result in better cash management and reduce the need for markdowns. Kurt Salmon cites one retailer that estimates using RFID can reduce inventory by 1% while boosting sales by 4%–5%.

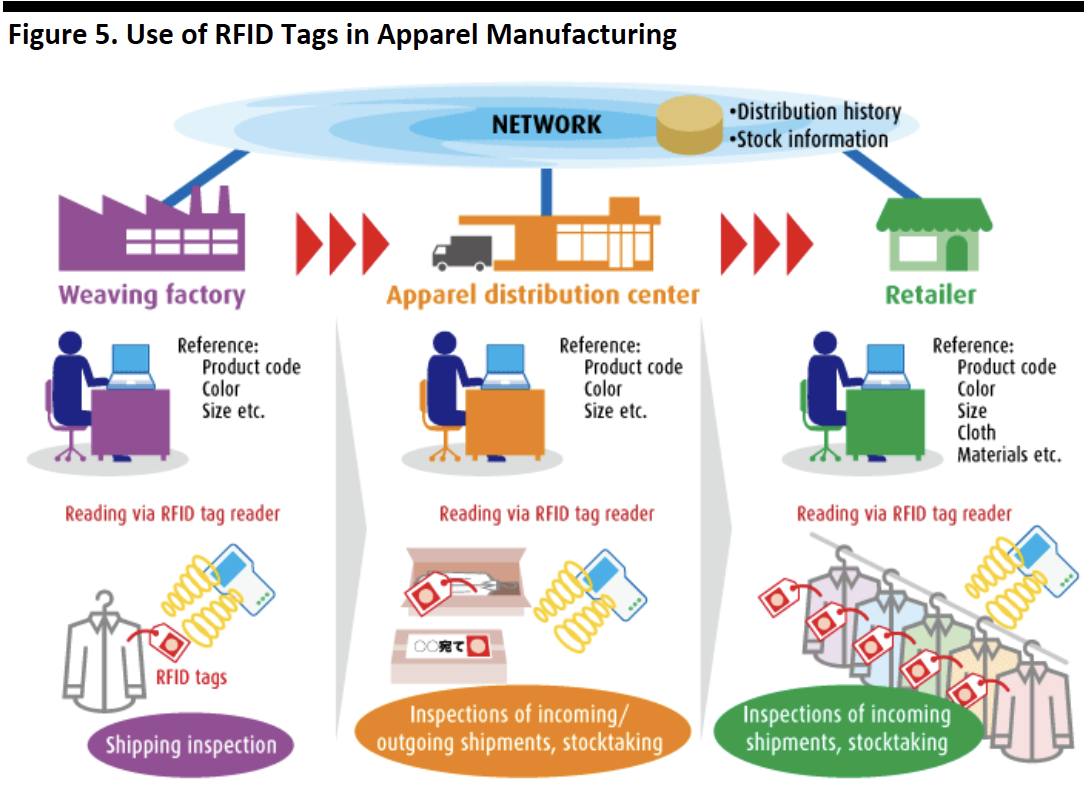

Applications in Apparel Manufacturing

Using RFID tags can provide additional value to apparel manufacturers, enabling them to track garments throughout the entire manufacturing process, from the factory to the distribution center to the retailer, as depicted in the figure below. RFID tags can also be used to verify the custody chain of luxury garments, enabling retailers to vouch for their authenticity.

[caption id="attachment_101027" align="aligncenter" width="500"] Source: Japanese Ministry of Internal Affairs and Communications[/caption]

Source: Japanese Ministry of Internal Affairs and Communications[/caption]

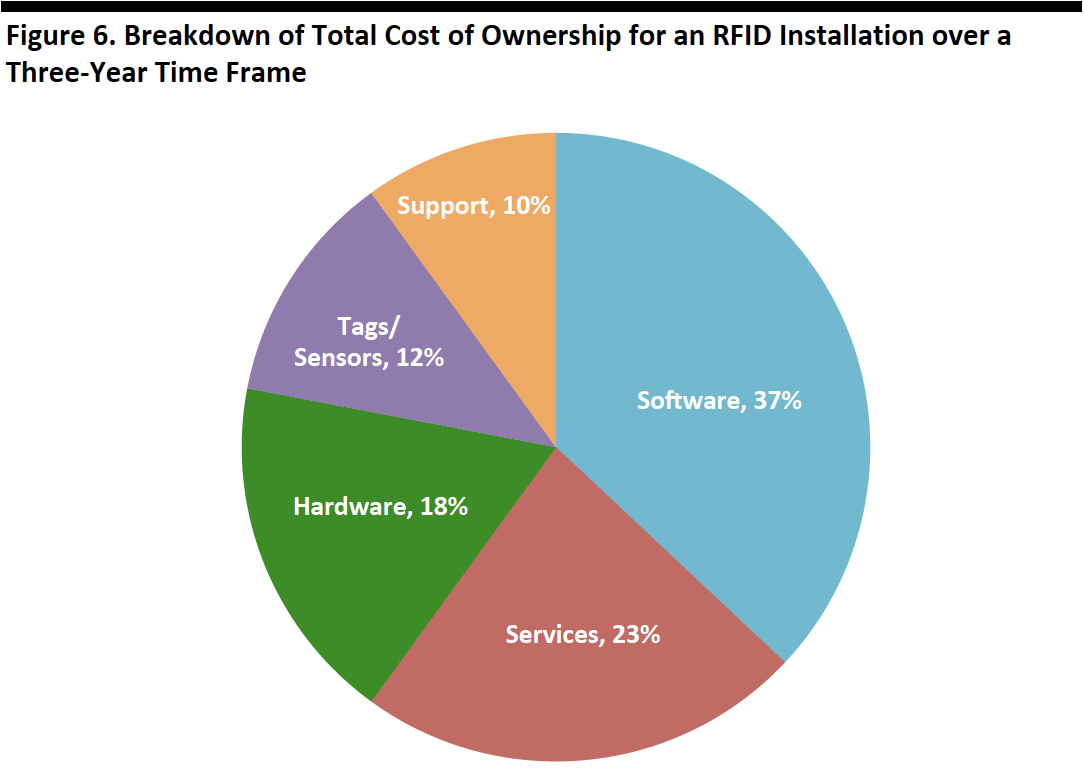

THE COST OF RFID

When Walmart piloted a program in the early 2000s that required its top 100 suppliers to implement RFID systems, prices ranged between $500,000 and $1 million—and a $500,000 figure has thus stuck in the minds of CFOs ever since. However, that figure is largely inaccurate, and higher than what some companies would pay to implement an RFID system. According to Joseph Leone, a consultant with RFID Global Solution who worked on Walmart’s implementation, RFID implementations can run from $15,000 for small vendors to $400,000 for larger vendors. Most companies that spend conservatively can implement RFID for less than $250,000 per facility, Leone says. Steve Halliday, President of High Tech Aid, a consulting firm, said, “Quotes of $200,000 to $300,000 are more common.”

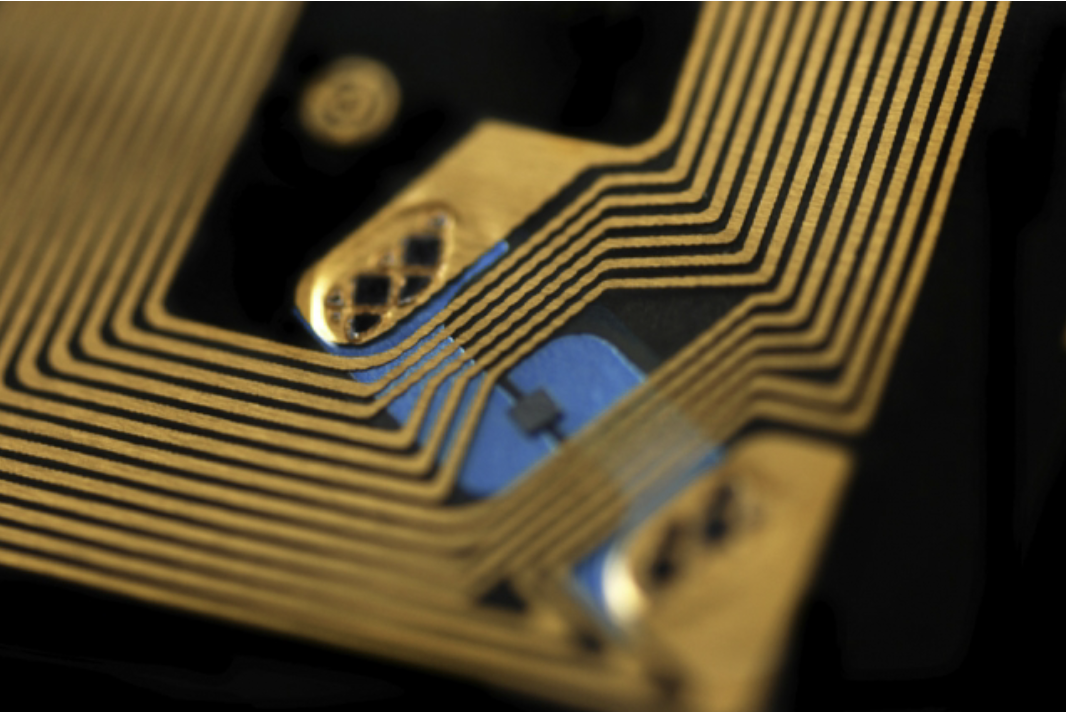

[caption id="attachment_101028" align="aligncenter" width="450"] Source: news.mit.edu[/caption]

Source: news.mit.edu[/caption]

In the figure below, we see that the relevant hardware comprises less than half the cost of an RFID installation; the majority is made up of expense for integration, changes to supply chain applications, and data storage and analysis.

[caption id="attachment_101029" align="aligncenter" width="500"] Source: Entigral Systems[/caption]

Source: Entigral Systems[/caption]

Below, we list the cost of the components of an RFID system, according to Atlas RFID Store, a US-based seller of enterprise RFID equipment.

- Tags

- Low Frequency: $0.50–$5.00

- High Frequency: $0.23–$0.10

- Ultra-High Frequency

- Active: $25–$100+

- Passive: $0.13–$0.25

- Antennas: $100–$1,000+

- Readers: $450–$4,000

There are also integrated RFID readers available, which contain both a reader and an antenna. Other kinds of equipment, such as RFID printers, RFID portals (which read the tags that pass through a doorway), and a variety of cables and adapters are available, too.

TECHNOLOGY

How RFID Works

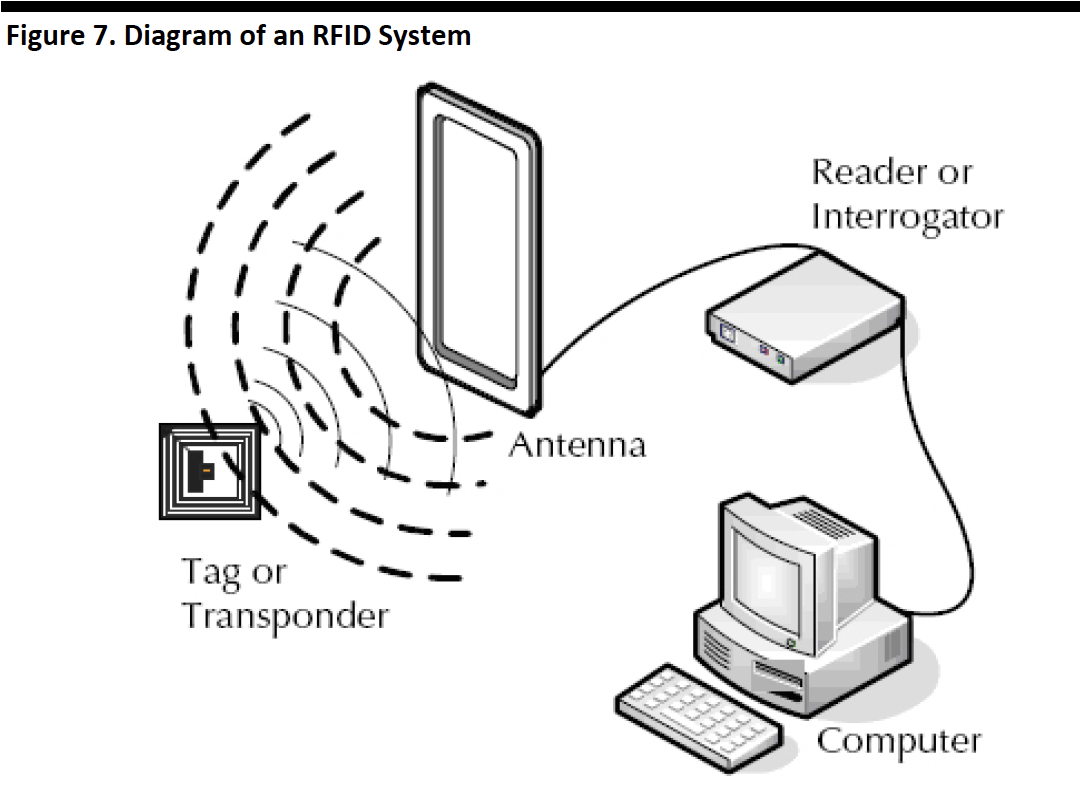

An RFID system consists of two main parts:

- A tag

- An antenna, which is connected to a reader (or interrogator), which is then connected to a computer or a network.

Each tag consists of two parts: an integrated circuit (i.e., a chip) and an antenna. The chip holds data such as the serial number and the electronic product code that the host uses to determine information about the product that was tagged. The antenna is used to collect the energy needed to turn on the chip and transmit information back to the reader.

Tags can be either active or passive. An active tag supplies its own energy, while a passive tag captures and briefly stores small amounts of energy from the reader. The energy is used to produce a response by the tag in the form of information that is transmitted over a radio frequency. That information is then captured by the reader and interpreted by the host.

The diagram below illustrates the operation of an RFID system.

[caption id="attachment_101030" align="aligncenter" width="500"] Source: AtlasRFIDstore.com[/caption]

Source: AtlasRFIDstore.com[/caption]

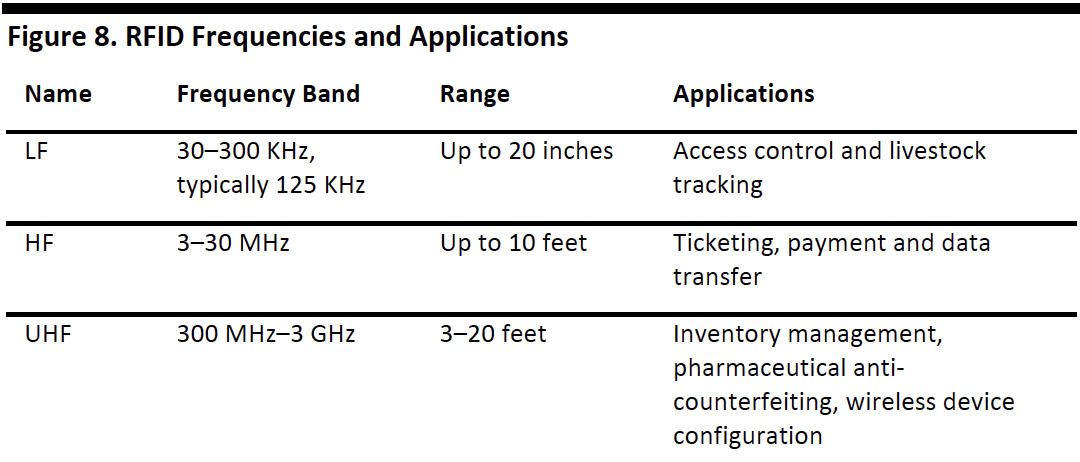

Different tags operate using different frequencies, so readers must be able to pick up specific frequencies (although some readers can read multiple frequencies). The three most common frequencies in use are low frequency (LF), high frequency (HF) and ultra-high frequency (UHF). UHF is the most common frequency used for retail applications.

[caption id="attachment_101031" align="aligncenter" width="500"] Source: Impinj[/caption]

Source: Impinj[/caption]

RFID COMPONENT AND SYSTEM VENDORS

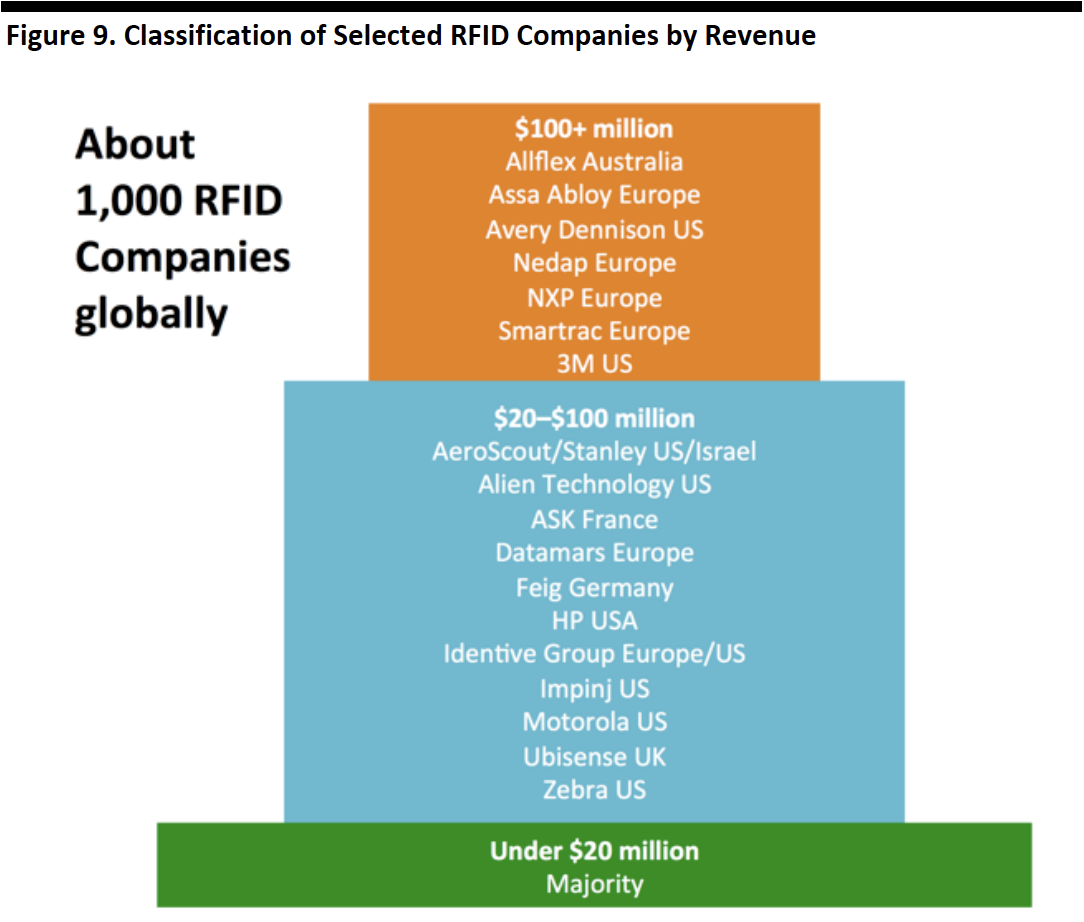

Market researcher IDTechEx tracks more than 1,000 RFID companies globally and classifies them by RFID revenues, as shown in the figure below.

[caption id="attachment_101032" align="aligncenter" width="500"] Source: IDTechEx[/caption]

Source: IDTechEx[/caption]

Selected RFID Suppliers

Zebra Technologies is a global leader in enterprise asset intelligence, designing and marketing specialty printers, mobile computing, data capture, RFID products and real-time location systems. The company claims to be number one in RFID, and its product portfolio includes RFID handheld readers, fixed readers, antennas and printers. Its RFID readers use passive UHF to provide high-speed, non-line-of-sight data capture, reading data from RFID tags in near real time using the electronic product code standard. Zebra also offers mobile computers that support HF near-field communications (NFC) and LF radio technologies.

[caption id="attachment_101033" align="aligncenter" width="500"] Source: zebra.com[/caption]

Source: zebra.com[/caption]

Taiwanese conglomerate Yuen Foong Yu (YFY) has a subsidiary in its Technology Group called Arizon RFID Technology. The company manufactures antennas, chip packaging and inlay bonding, and designs and manufactures HF and UHF transponders and tags, plus complete RFID solutions. Arizon claims to be the largest manufacturer of RFID technologies in China and Taiwan and the second largest in the world.

Catalyst, a Li & Fung company, offers an end-to-end RFID solution for retailers; the company provides solutions for tagging, inventory, improving the customer experience and security. The company offers a range of customer experience products, including the Catalyst Smart Screen, which allows customers to interact and engage with a simple touch screen. When a customer takes a garment to the screen, the system automatically displays a completed look and other product information. The Catalyst Smart Fitting Room triggers content on a screen when a garment is taken into a fitting room. When a customer product is placed on the Catalyst Smart Tray, it reads the RFID tag and automatically displays additional product information, features and benefits via images, video and audio; the tray has been used for both cosmetics and footwear. Finally, Catalyst ePay integrates with point-of-sale systems to enable the simultaneous scanning of multiple items.

[caption id="attachment_101034" align="aligncenter" width="500"] Source: catalyst-direct.com[/caption]

Source: catalyst-direct.com[/caption]

Other RFID product vendors:

- AiRISTA offers identification and track-and-trace solutions using passive, active and semi-active RFID, real-time location systems, GPS and other technologies.

- Alien Technology offers UHF passive RFID transceiver chips, tags, inlays, labels, fixed and mobile readers, and related services.

- CenTrak offers healthcare facilities real-time location systems that use infrared and RFID technology.

- Ekahau offers Wi-Fi-enabled RFID tags, badges and sensors.

- Impinj offers RAIN (derived from Radio-frequency IdentificatioN—a standardized version of RFID) solutions.

- Mojix offers fixed-infrastructure sensor networks that collect, store, analyze and interconnect data from RFID and other sensor devices.

- PLUS Location Systems offers real-time location system hardware and software components.

- Smartrac offers products that enable businesses to identify, authenticate, track and complement product offerings with digitally based services and that link objects to customers’ IT systems.

- TeleTracking offers RFID tracking solutions for hospitals.

- ThingMagic, a division of Trimble, offers RFID reader modules.

- Ubisense offers a real-time location systems.

- Versus Technology offers an RFID-based real-time location system for use in healthcare.

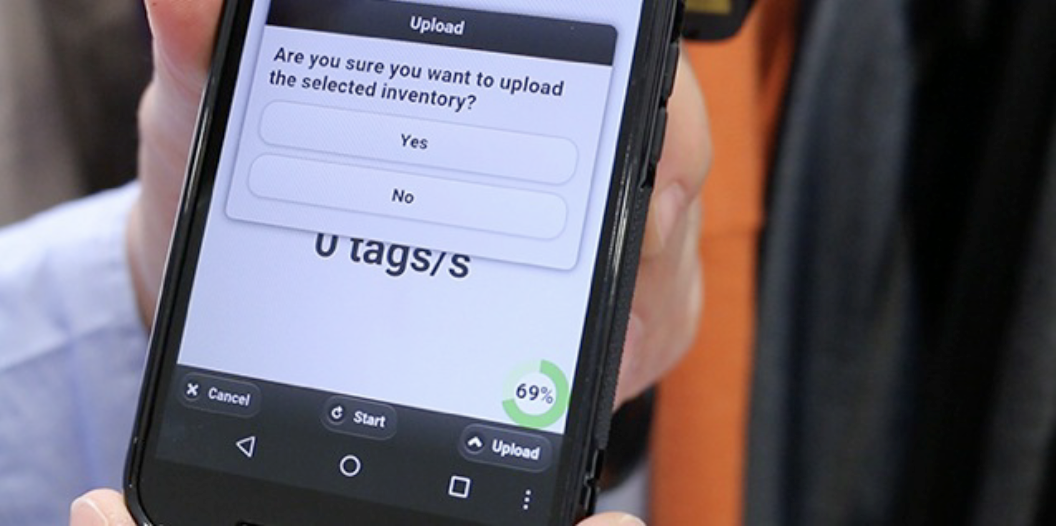

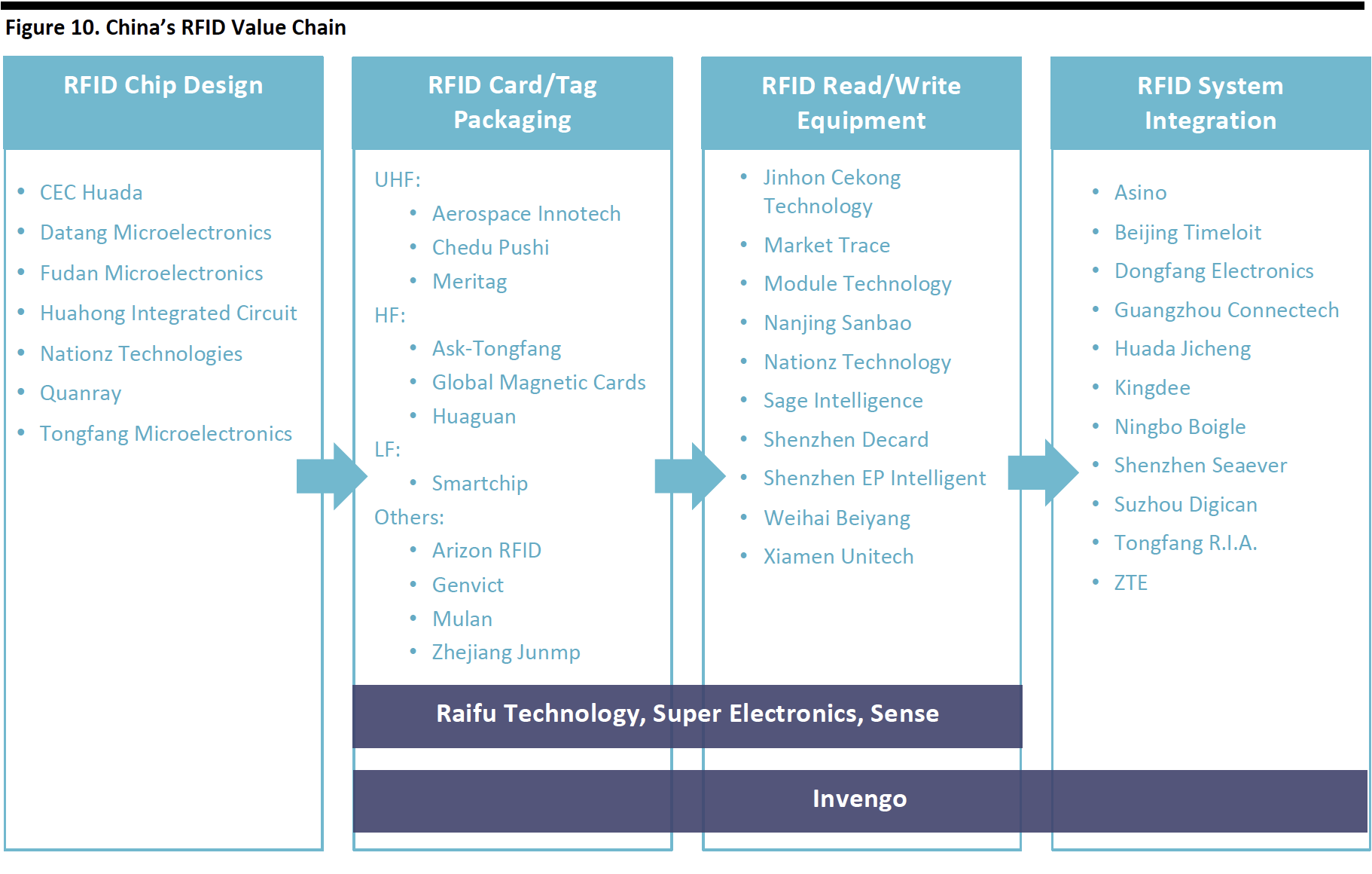

There is also a wide spectrum of companies in China supplying various RFID components and systems. The figure below classifies several of them.

[caption id="attachment_101035" align="aligncenter" width="700"] Source: Lux Research[/caption]

Source: Lux Research[/caption]

RFID IMPLEMENTATION CASE STUDIES

Many retailers have experimented at one time or another with various RFID implementations. In the last five years, we have seen many major retailers implement the technology.

Walmart’s early experience with RFID is well documented, and it likely resulted in the rest of the retailing industry resisting the technology for a number of years. In 2003, the company began requiring that its top 100 suppliers attach RFID tags to pallets and cases of goods sent to Walmart distribution centers. Many suppliers resisted, believing the technology had high costs and few benefits. In the face of this resistance, Walmart reconfigured its strategy in 2007.

Since then, a number of retailers have returned to the technology, and companies that have recently deployed RFID include:

G-Star Raw, which took part in a “magic mirror” demonstration with Impinj at the National Retail Federation’s Retail’s Big Show in 2016. The mirror offers product information on a large screen when a shopper approaches the screen with a tagged item in hand. Kenneth Cole, L.L.Bean and New Balance are also reportedly testing versions of this technology. Impinj claims to have shipped 3 billion RFID chips in 2015.

Inditex plans to use RFID technology for inventory management, which will be in place in more than 2,000 Zara stores by the end of the year.

Kohl’s, in partnership with Checkpoint Systems, launched a pilot program testing RFID in 2012 and has since expanded the program to cover strategic apparel items that include footwear, denim and men’s basics, such as underwear and T-shirts.

Levi’s was an early adopter of RFID and uses the technology to help both customers and associates locate specific sizes of jeans, which can look similar when stacked on a store shelf.

Lucky Brand opened two stores in the summer of 2015 outfitted with an RFID system from Catalyst that enables customers to view how a garment looks on a model, learn more about the garment and find out which sizes are available in the store or online.

Macy’s began pilot-testing RFID technology in its SoHo Bloomingdale’s location. Following initial testing on fashion apparel, the company began putting RFID tags on items such as social occasion dresses and men’s jackets in late 2014. Most recently, Macy’s launched an RFID system from Tyco called Pick to the Last Unit (P2LU) for omni-channel fulfillment.

Marks & Spencer tagged about 80% of its items last year and aims to tag 100% of its items by 2017. Currently, 100% of the clothing the retailer sells is RFID tagged, as are half of homeware items, such as bedding, bathroom products and soft furnishings. The company uses tags from Avery Dennison.

Ralph Lauren launched eight RFID-enabled interactive fitting rooms in late 2015 at its Polo Ralph Lauren flagship store in New York City. In partnership with Oak Labs, the technology offers a smart mirror with a touch screen and a built-in RFID reader that identifies the RFID tags on garments brought into the fitting room. Following pilot testing, the company plans to install these types of fitting rooms in additional stores.

Rebecca Minkoff’s store in the SoHo district of New York City uses RFID tags from Avery Dennison, along with technology from eBay and other vendors, to identify garments brought into the changing room, where they activate a magic mirror.

Salvatore Ferragamo is embedding microchips in its bags and shoes in an effort to combat counterfeiting. The company initially inserted RFID chips in the left soles of women’s shoes starting in 2014 and has subsequently expanded its tagging program to include men’s shoes, women’s leather goods and luggage.

In 2015, Target announced the launch of an RFID-tagging program. The company planned to start with a dozen stores and expand the use of the technology to all 1,795 of its stores in the US in 2016.

ALTERNATIVE TECHNOLOGIES: RFID, NFC, BLE OR QR?

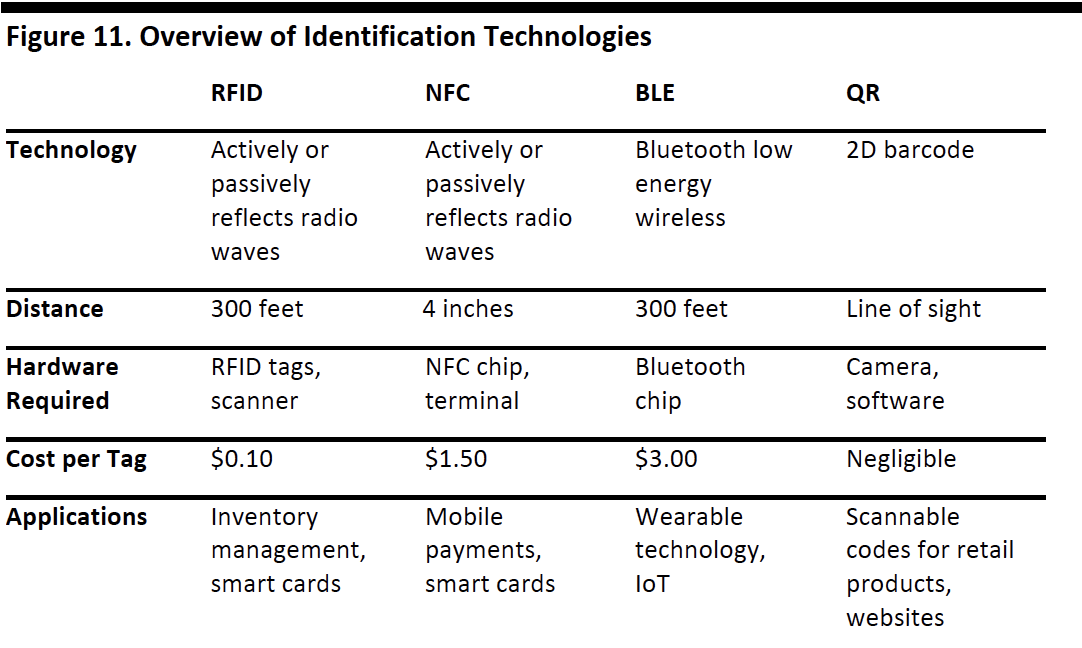

There is much discussion and confusion as to which identification technology is the best. We believe the appropriate technology depends on an individual retailer’s budget, range and application. Companies seem to be adopting technologies as follows: RFID appears to be the most appropriate for inventory management (as compared to NFC) due to its greater range (a whole shelf of garments can be scanned by a reader). NFC is being deployed in smartphones and payment terminals to facilitate electronic and mobile payments. Bluetooth low energy (BLE) is a variation of the Bluetooth technology present in most smartphones and tablets: it is enabling wearable technology and the IoT. Finally, quick response (QR) codes are 2D barcodes that are best used to guide visitors to product, news or other websites.

[caption id="attachment_101036" align="aligncenter" width="500"] Source: AtlasRFIDstore.com/Unitag.io/Fung Global Research & Technology[/caption]

Source: AtlasRFIDstore.com/Unitag.io/Fung Global Research & Technology[/caption]

NEGATIVE VIEWS OF RFID

In addition to concerns about the cost of implementing RFID, there are two other key areas of concern that make many retailers hesitant to embrace the technology: privacy and accuracy.

Privacy is a natural concern with any technology that can be used for identification purposes, and many fear that RFID technology could be used for tracking individuals. However, these fears may be overblown. RFID tags have a limited range, so individuals can be tracked only when they are in the range of a reader. Also, the vast majority of applications are for tracking objects—the tags are readable only by a corresponding type of reader. We are not currently aware of any initiatives to use RFID technology for tracking people.

Another concern about RFID tags is their accuracy. For example, even if a tag is scanned and read by the reader correctly, the information may not be accurate. That is because the code is tied to information that was probably input by a human and is therefore subject to human error. Also, readers are not able to read every tag every single time, so some tags are missed. Moreover, interference from other electromagnetic signals, such as Wi-Fi, microwaves and Bluetooth, can also impede accuracy. Companies are dealing with interference by using special signal-blocking paints, and evolving RFID standards are steadily improving readers’ ability to receive the correct signals from tags.

CONCLUSION

RFID is an old technology that finally seems to have found its sweet spot. Many retailers have begun to overcome their fears about the cost of implementing the technology. During the past five years, the need to offer accelerated shipping and seamless omni-channel operations has driven many companies to begin deploying RFID. And as the number of devices that are part of the IoT grows over the next several years, we are likely to see even further adoption of the technology in retail.