albert Chan

Deborah Weinswig, CEO and Founder of Coresight Research, spoke at the California Grocers Association Strategic Conference on September 29, 2020. We present key insights from the event in this report, including the challenges that grocers face in today’s retail world and the future of the omnichannel grocery shopping experience and supply chain.

1. Grocers Will Continue To Rely on the Online ChannelIn terms of recent developments in retail, Weinswig stated that we have seen years of innovation and learning condensed into a matter of months due to the Covid-19 crisis. She highlighted that perhaps the most impressive aspect of retail innovation during the course of the crisis has been the ability of retailers to not just think of new ways to optimize their operations but to implement these strategies rapidly and effectively. Weinswig believes that the pandemic has seen 10 years worth of strategies implemented in just six months.

[caption id="attachment_117896" align="aligncenter" width="550"] Deborah Weinswig discusses recent retail innovation

Deborah Weinswig discusses recent retail innovationSource: Coresight Research[/caption]

Much of the innovation in grocery has come in the form of an emphasis on online grocery offerings. Coresight Research estimates that online grocery will grow by 75% in the full-year 2020—down slightly from the more-than-doubling in online orders during the height of the pandemic but still vastly greater than any previous year.

2. Grocers Face Unique Challenges When Fulfilling Online OrdersWhile many grocers have seen stellar growth in their online sales, they must wrestle with increased competition in the e-commerce space to remain successful. In addition, they also need to adjust to the preferences of the increasingly demanding online grocery shopper: According to a 2020 survey conducted by micro-fulfillment company Fabric, 33% of US consumers prefer their grocery orders to be fulfilled within two hours, while 59% of respondents stated that their preferred grocery order fulfillment speed is same-day delivery. Speed is demanded across the board in the e-commerce channel, but with just 8% of consumers stating that they prefer next-day delivery or longer for their grocery orders, it seems that grocery retailers in particular need to invest heavily in the ability to fulfill online orders quickly. Weinswig said that looking forward, grocers should aim to be able to fulfill orders within two hours to stay competitive.

Grocery retailers have an advantage in their ability to rely on in-store and curbside pickup rather than more costly delivery services. A Coresight Research survey conducted in September 2020 found that fully three-quarters of US consumers who had bought grocery/nongrocery products online this year reported that they collected 50–100% of their online grocery orders, while just 47% of consumers collected the majority of their nongrocery online orders.

During the pandemic, grocers have employed in-store pickers to shop for delivery and BOPIS (buy online, pick up in store) orders. Although Weinswig lauded grocery retailers’ ability to pivot quickly to facilitate greater volumes of online orders, she argued that the current picker model may need further adaptation to be a viable model going forward. Today, many consumers continue to avoid visting brick-and-mortar grocery stores, or at least reduce the time they spend browsing, due to concerns around Covid-19. However, Weinswig believes that in a post-crisis world, people will again to begin to enjoy the in-store grocery shopping experience, and she thus cautions that an overabundance of pickers (more than 15% of shoppers in a store) will reduce the quality of the browsing experience for customers.

Shoppers also get frustrated with certain aspects of the current online grocery experience, Weinswig said, especially when it comes to retailers making substitutions for products that are unavailable. Instead of the current substitution system, Weinswig recommended that grocers get more creative with how the substitution process works to minimize shopper frustration. For example, grocery retailers could gamify the substitution process to make it more engaging and fun, perhaps enabling consumers to compete in games for the chance to win a higher-priced substitute for unavailable products.

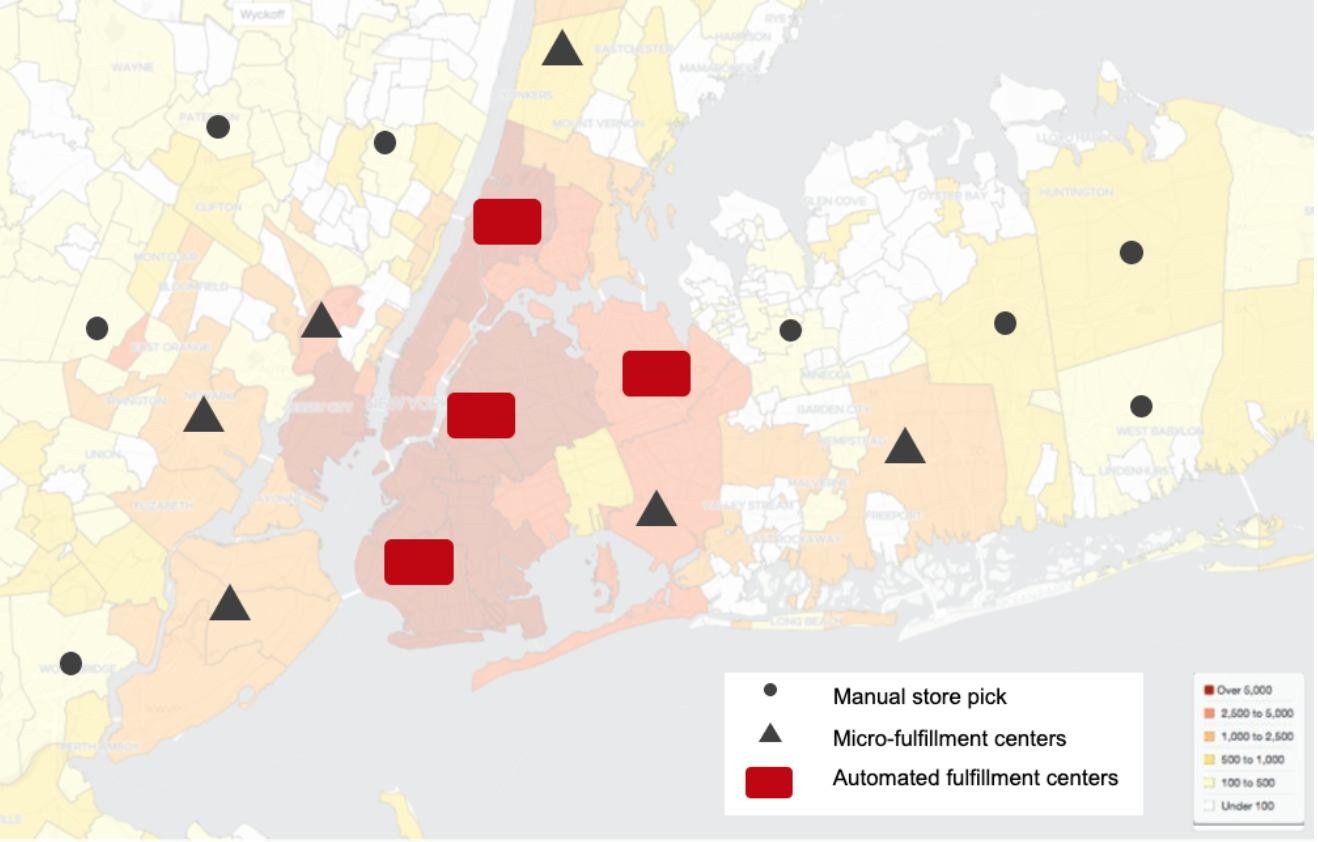

3. Optimizing the Supply Chain for the Long-Term Has Become a NecessityWeinswig advised grocery retailers to begin developing an efficient, long-term online fulfillment infrastructure. Pickers are not an economically viable, scalable solution to fulfillment, and this method can negatively impact the in-store shopping experience for customers, as outlined previously. Weinswig believes that micro-fulfillment strategies can help grocers to more efficiently scale their online capabilities, but she emphasized that there is no one-size-fits-all solution to delivery and BOPIS fulfillment. Instead, she recommends that retailers adopt a diversified fulfillment strategy, using different techniques based on the locations of their stores.

In areas of high population density, automated fulfillment centers can take the fulfillment burden away from stores. However, in less densely populated areas, the lower volumes of sales may not justify the operating costs of an automated fulfillment center; dark stores and micro-fulfillment centers may therefore be the most suitable options. In more sparsely populated areas, Weinswig believes that manual store picking will still play a prominent role.

The network map below illustrates a theoretical example of how grocery retailers could tailor their fulfillment model to the market, using different methods according to population density.

[caption id="attachment_117897" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Optimization earlier in the supply chain is also becoming more important. Weinswig emphasized that as demand remains volatile and consumer preferences change rapidly, demand forecasting has become an increasingly important tool for grocers to use. She pointed to demand forecasting powered by machine learning as having the potential to make a major difference to the bottom lines of grocery retailers. Such technology enables grocers to use a vast array of variables to inform their decisions, and make strategy adjustments in real time.