Nitheesh NH

Introduction

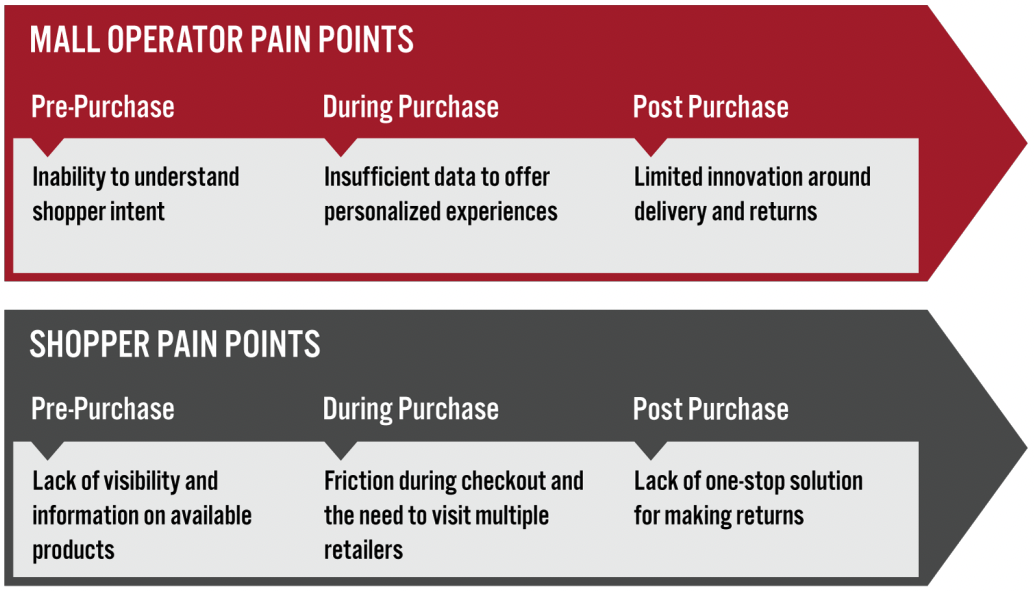

What’s the Story? Today’s shopper is becoming increasingly multichannel, and providing a consistent and unified experience across these channels is more important than ever. This follows pandemic-induced acceleration in online retail and challenges to brick-and-mortar retail: Based on US Census Bureau data, Coresight Research estimates that US e-commerce sales rose 45.3% year over year in 2020 and increased by 16.9% in 2021 against strong comparatives. We expect growth momentum to continue, reaching a benchmark figure of over $1 trillion by the end of 2023, with e-commerce accounting for just under one-quarter (22.4%) of total US retail sales in that year. We believe that a truly blended omnichannel experience is imperative for retailers to successfully deliver memorable and convenient shopping experiences and retain customers. This must extend to malls and shopping centers, which are grappling with receding occupancy rates in the US. In this report, we present the best path forward for mall operators, discuss the current state of US malls and shopping centers, and explore key shopper trends in the US. This report is sponsored by Adeptmind, an AI (artificial intelligence)-based product-discovery solution for malls and shopping centers. Why It Matters Increasing e-commerce adoption has translated to shoppers expecting more connected and unified experiences across all shopping channels, including malls. E-commerce has substantially eroded friction points in the shopping journey, allowing consumers to check out from the comfort of their homes, receive personalized recommendations, and make returns and receive refunds more easily. We believe this to be a contributing factor in reduced traffic and low occupancy rates in many malls and shopping centers. Reduced traffic can also be a result of connected consumers making more targeted shopping trips (i.e., they browse and research products online before visiting a physical store and make fewer, targeted trips), which we see as a long-term trend. We believe that both shoppers and mall operators face challenges across all stages of the shopper journey, as shown in Figure 1.Figure 1. Pain Points Associated with Shopping at Malls and Shopping Centers [caption id="attachment_150270" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

These challenges can be overcome by focusing on introducing newer technologies and innovative experiences to the benefit of all stakeholders—mall-based retailers, mall operators and shoppers.

However, creating a new digital channel to enable shoppers to browse and purchase at their local malls and shopping centers can be highly complicated for mall operators. Large malls and shopping centers have hundreds of tenants and connecting the inventory to databases requires advanced technologies and ability to sync online and offline data. As a result, most malls and shopping centers today still lack this type of comprehensive e-commerce channel.

Source: Coresight Research[/caption]

These challenges can be overcome by focusing on introducing newer technologies and innovative experiences to the benefit of all stakeholders—mall-based retailers, mall operators and shoppers.

However, creating a new digital channel to enable shoppers to browse and purchase at their local malls and shopping centers can be highly complicated for mall operators. Large malls and shopping centers have hundreds of tenants and connecting the inventory to databases requires advanced technologies and ability to sync online and offline data. As a result, most malls and shopping centers today still lack this type of comprehensive e-commerce channel.

Reviving US Shopping Malls Amid Retail’s Digital Wave: Coresight Research x Adeptmind Analysis

The Future of the Mall as an Omnichannel Platform: Three Recommendations We believe that the future of the mall lies in omnichannel retail. Below, we present three recommendations for mall operators seeking to pave a successful path toward omnichannel. 1. Extend Services to Digital To Simplify Challenges Facing Mall Operators- Extending services to digital—such as via an app or website, alternative fulfillment options such as curbside pickup for online orders, and seamless online returns—will substantially benefit mall/shopping center retail tenants as it increases convenience for shoppers and so drives conversion and loyalty.

- By launching a dedicated online shopping destination, malls and shopping centers can take advantage of valuable online shopper data to better understand visitors’ purchasing habits and select tenants accordingly.

- Leveraging solutions such as Adeptmind’s “Complete the Look” tool provides a medium for cross-selling to digital shoppers who can then make seamless purchases and choose to either have their order delivered or collect it from a store.

- Following a pandemic-driven shift to e-commerce from brick-and-mortar retail as shoppers stayed away from busy locations, consumers are now returning to physical stores. Avoidance rates of malls and shopping centers have receded substantially, according to our US Consumer Tracker (a weekly survey of US consumers): In our survey conducted on May 2, 2022, only 23% of US shoppers reported that they are avoiding malls and shopping centers, down from over 50% in the survey conducted on May 10, 2021.

- Communicating shopper activity to mall-based retailers and sharing data—such as browsing/search history and products added to a cart or wish list—can help mall-based retailers capture important data on consumers’ product interests, price propensity and sizing preferences (in apparel and footwear) to provide a more personalized in-store experience.

- Digital technologies encompassing product search, delivery and returns must be seamless to deliver optimal experiences to shoppers. Leveraging third-party technology providers with deep expertise can help alleviate implementation challenges for mall operators.

- Retailers can work with a technology partner to oversee inventory at the store level; mall owners, in partnership with technology providers, can seek buy-in from retail tenants to manage the inventory on a per SKU basis. In addition, managing fulfillment efficiently and ensuring hassle-free returns can alleviate most of the challenges associated with the “mall-as-a-platform” concept.

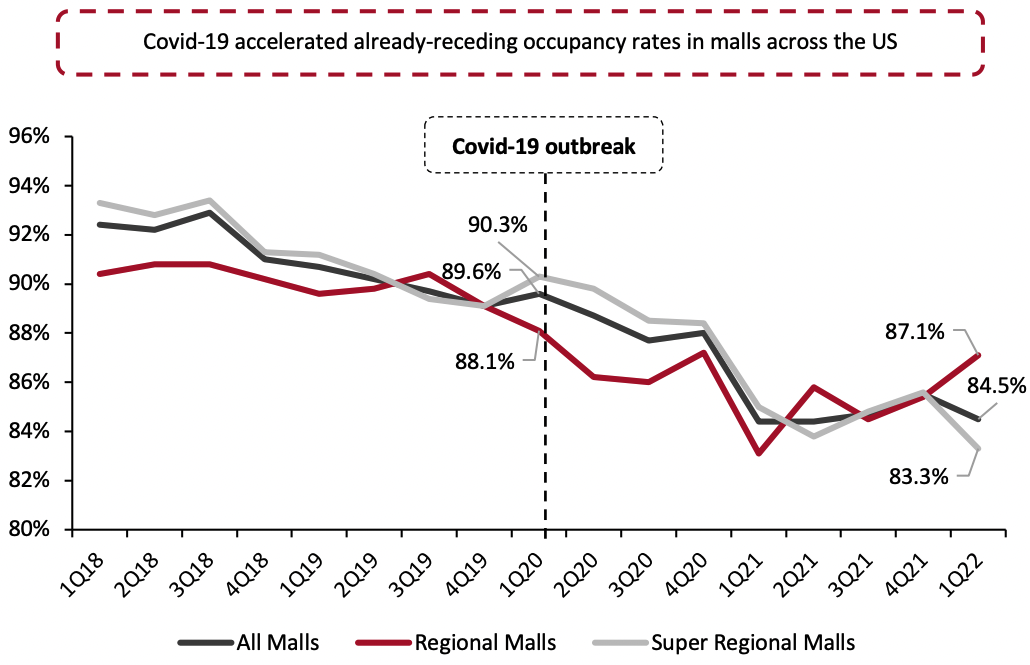

- Overall mall occupancy in the US fell from 89.6% during the first quarter of 2020 to 84.5% during the first quarter of 2022.

- Regional malls and shopping centers have shown some resistance. Mall occupancy declines were softer than at the national level, dropping from 88.1% during the first quarter of 2020 to 87.1% during the first quarter of 2022.

Figure 2. US Mall Occupancy Rates, by Mall Type (%) [caption id="attachment_150271" align="aligncenter" width="700"]

Regional malls have a gross leasable area of 400,000–800,000 square feet and have at least two anchor stores; super regional malls have a gross leasable area of over 800,000 square feet and have at least three anchor stores, per ICSC classification

Regional malls have a gross leasable area of 400,000–800,000 square feet and have at least two anchor stores; super regional malls have a gross leasable area of over 800,000 square feet and have at least three anchor stores, per ICSC classificationSource: ICSC/NCREIF[/caption] We believe that the overgrown retail space and surge in e-commerce has created a need for mall owners to provide distinct, attractive and value-add services to their tenants. Facilities such as single-cart checkout, BOPIS (buy online, pick up in-store) and same-day delivery can help mall owners position themselves strongly in this tough and demanding environment, where innovation is the only form of survival. Mall-Based Retailers Struggle with Ship-from-Store Shipping from store is an efficient multichannel delivery method to meet consumer expectations for fast order delivery. Shipping from store increases product availability for shoppers as it enables retailers to ship products from either distribution centers or stores in high-density areas close to shoppers. However, mall-based retailers in the US are struggling to take advantage of ship-from-store:

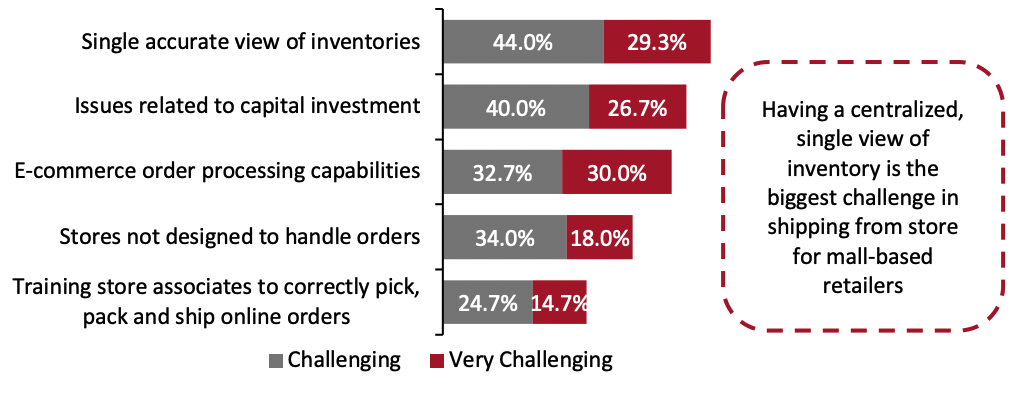

- Inventory management is a challenging business operation, particularly for retailers operating across multiple channels. Inventory aggregation is the top challenge for mall-based retailers, Coresight Research survey data indicates.

- Issues related to capital investment emerged as the second major challenge in store-based fulfillment, cited as either “challenging” or “very challenging” by two-thirds of respondents.

Figure 3. Top Perceived Challenges in Operating Store-Based Fulfillment (% of Respondents) [caption id="attachment_150272" align="aligncenter" width="700"]

Base: 150 mall-based retail executives, surveyed in June 2021

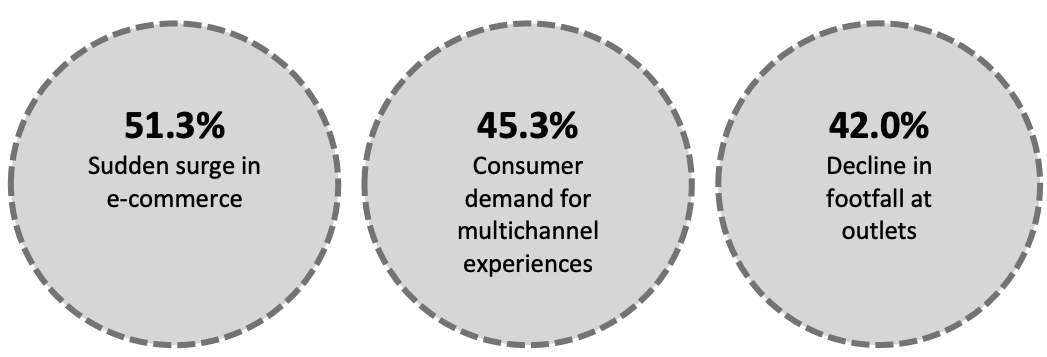

Base: 150 mall-based retail executives, surveyed in June 2021Source: Coresight Research[/caption] We believe that mall operators can help retailers to address such challenges as they introduce digital capabilities. For fulfillment, mall owners can allow for in-store staff or dedicated representatives to pick and pack product from each store and keep them ready for same-day delivery at a pickup station or using lockers. In addition, they can partner with established delivery partners to ship directly to customers. The Online Surge Has Led Mall-Based Retailers into Untested Waters Covid-19 challenged most retailers, primarily due to the surge in online sales. Our June 2021 survey of mall-based retail executives reveals the top three challenges that mall-based retailers are facing, either directly or indirectly, due the pandemic: Over half (51.3%) of all respondents cited a surge in e-commerce, making it the topmost challenge, followed by shopper demand for multichannel experiences (45.3%) and a decline in footfall at outlets (42.0%). We are seeing these challenges persist in 2022 due to the following underlying reasons:

- A lack of innovative solutions, such as online shopping from mall stores, flexible fulfilment, return options and access to a digital search directory

- An inability of mall operators and mall-based retailers to collect shopper data effectively, which can improve the overall shopping experience by providing insights on what shoppers expect from a convenient and personalized experience

Figure 4. Top Three Pandemic-Induced Challenges Faced by US Mall-Based Retailers (% of Respondents) [caption id="attachment_150273" align="aligncenter" width="700"]

Base: 150 mall-based retail executives, surveyed in June 2021

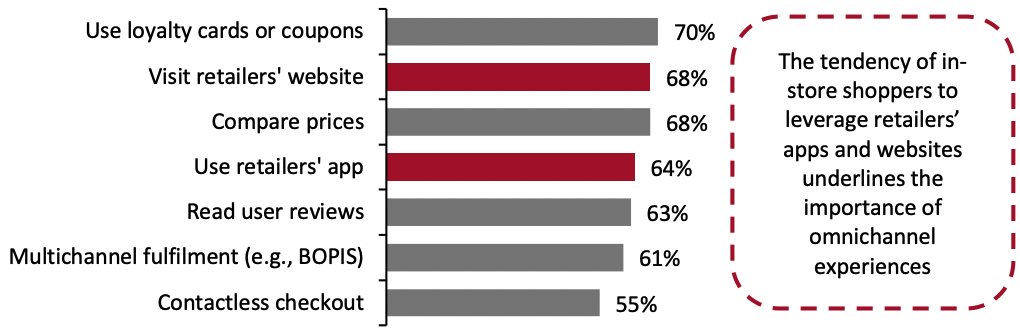

Base: 150 mall-based retail executives, surveyed in June 2021Source: Coresight Research[/caption] Evaluating Key Shopper Trends in the US Although Shoppers Are Increasingly Online, Stores Remain Important Shoppers are better informed, more technically affluent and more present online than ever before. Coresight Research’s March 2022 social commerce survey indicated that 65% of US shoppers use social media as a part of their shopping process, indicating a major overlap between physical and digital commerce. Moreover, around two-thirds of US consumers visit a retailers’ website or app while shopping in-store, according to a September 2021 survey conducted by mobile app experience company Airship.

Figure 5. Selected Activities for Which Shoppers Use Their Smartphone In-Store (% of Respondents) [caption id="attachment_150274" align="aligncenter" width="700"]

Base: 1,200 US consumers, surveyed in September 2021

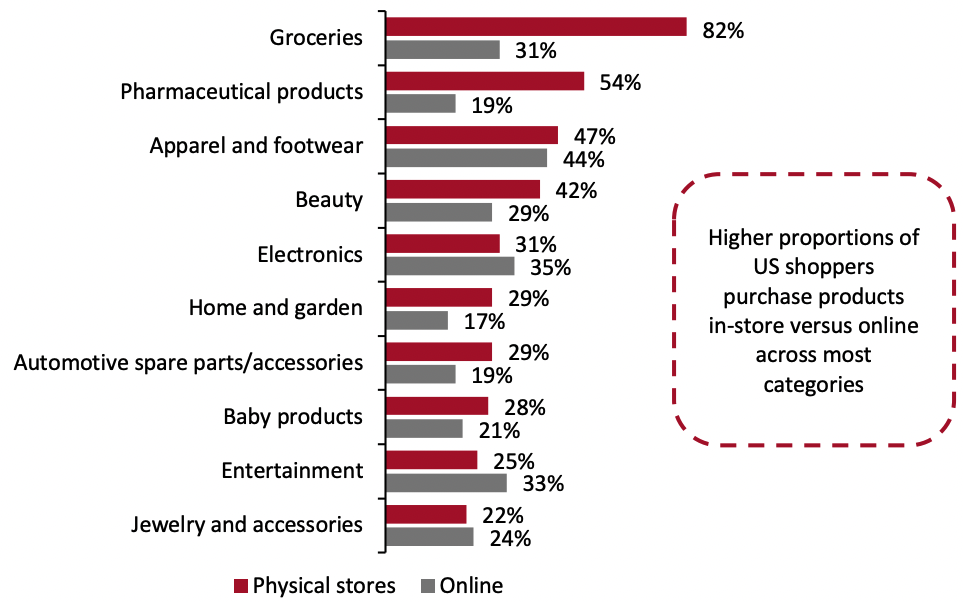

Base: 1,200 US consumers, surveyed in September 2021Source: Airship[/caption] We believe that an increase in e-commerce does not undermine the importance of brick-and-mortar retail. For example, shoppers still prefer to purchase fragrances, home furnishings and furniture, and selected apparel categories in a physical store. In fact, a higher proportion of respondents made purchases in-store versus online across most categories during the first quarter of 2022 in the US, according to Klarna’s shopping pulse survey of US consumers, as shown in Figure 6.

Figure 6. Categories Shopped Online and In-Store (% of Respondents) [caption id="attachment_150275" align="aligncenter" width="700"]

Base: Over 1,000 US consumers, surveyed during the first quarter of 2022

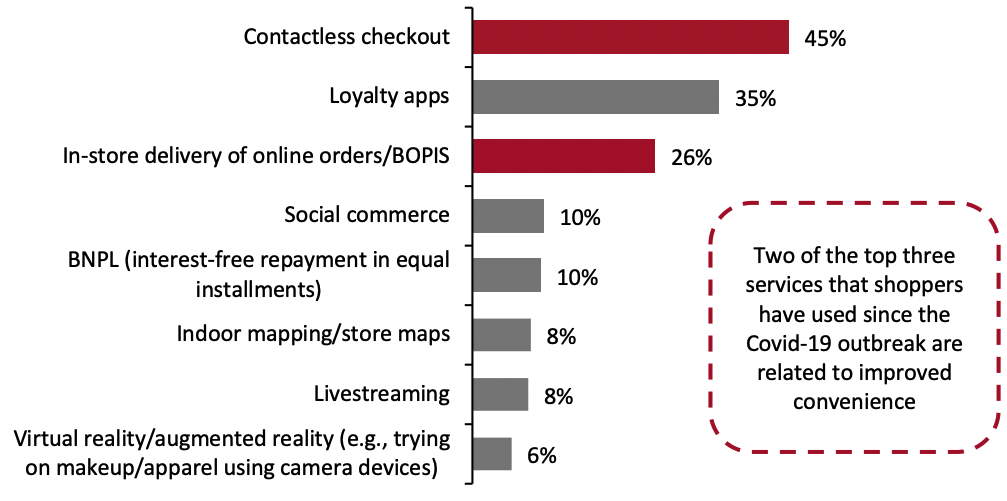

Base: Over 1,000 US consumers, surveyed during the first quarter of 2022Source: Klarna[/caption] Shoppers Signal a Strong Preference for Omnichannel Experiences Convenience is paramount to shoppers. The Covid-19 pandemic led to many first-time digital shoppers ordering products from the comfort of their home, which exposed them to the convenience of one-click checkout—but many consumers still opted to visit stores for convenience in the last mile: A Coresight Research survey of US consumers in March 2022 reveals that one-quarter of respondents had picked up online orders of discretionary products in-store since the Covid-19 outbreak (see Figure 7). Shoppers are increasingly expecting in-store checkout processes to mirror the ease of online ordering by integrating technology: 45% of consumers have used contactless checkout when shopping for discretionary products and services since the Covid-19 outbreak, our survey shows—although this is no doubt bolstered by heightened consumer awareness of safety and demand for contact-light experiences throughout the shopping journey.

Figure 7. Selected Services That Shoppers Have Used for Purchasing Discretionary Products Since the Covid-19 Outbreak (% of Respondents) [caption id="attachment_150276" align="aligncenter" width="700"]

Base: 500 US consumers surveyed in March 2022

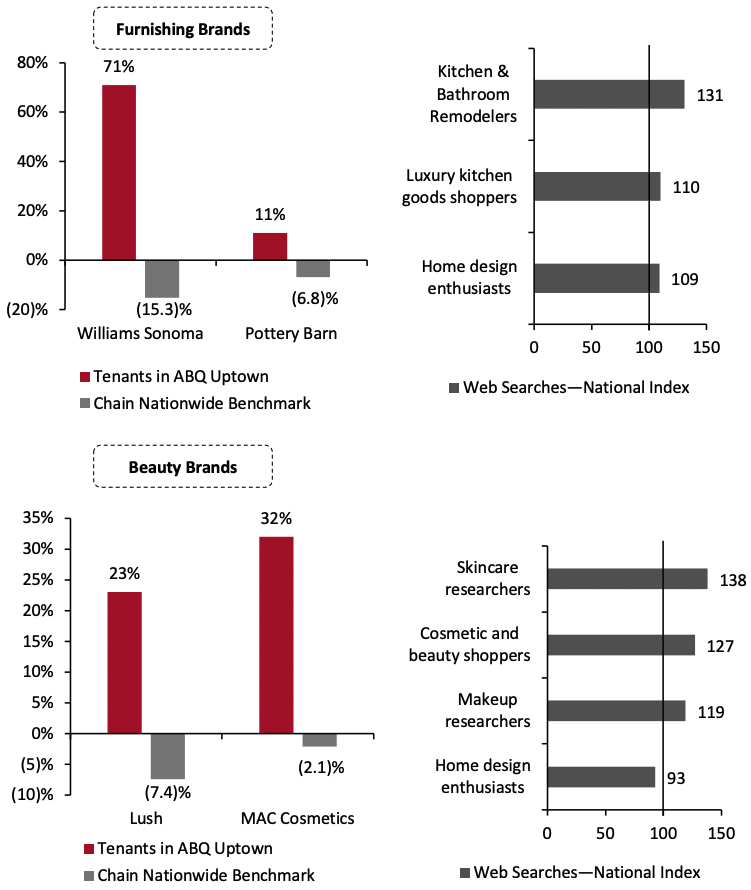

Base: 500 US consumers surveyed in March 2022Source: Coresight Research[/caption] Shoppers are increasingly looking for ways to simplify their “search to purchase” process, which spans multiple channels. Brands and retailers must eliminate friction across product search, as well as checkout and delivery. There Is an Increasing Need for a Holistic View of Shopper Demand With inflationary pressure tightening its grip, shoppers are tending to make fewer and targeted trips to malls and shopping centers. Furthermore, shoppers typically make web searches around selected product categories before they visit malls and shopping centers physically. In fact, there emerged a “significant correlation” between foot traffic to malls and visitor search data, according to a late-2021 study of visitors at the ABQ Uptown shopping center in Albuquerque, New Mexico, conducted by location analytics provider Placer.ai and customer segmentation company Spatial.ai. Spatial.ai groups users into behavioral segments based on their social and website visitation information. The web search index represents the search activity of these user segments, with 100 being average. The study unveils strong year-over-two-year growth in foot traffic at furniture brands Williams Sonoma (71%) and Pottery Barn (11%) in the ABQ Uptown mall, which is alongside strong web search index results of shopper categories such as “Kitchen and bathroom remodelers” and “Home design enthusiasts.” Foot traffic was substantially higher for both brands at ABQ Uptown compared to the nationwide benchmarks during this period, which were negative figures for both Williams Sonoma and Pottery Barn (see Figure 8). The study unveils similar trends for beauty brands.

Figure 8. ABQ Uptown Shopping Mall and Nationwide Benchmark: Yo2Y Change in Volume of Visits (%) at Furnishing and Beauty Brands (Left); Web Searches Index of ABQ Uptown Visitors, by Category (Right) [caption id="attachment_150277" align="aligncenter" width="700"]

Source: Placer.ai[/caption]

Geolocating shopper search can help establish shopper intent to purchase certain products. Mall owners can leverage these insights to identify the optimal tenant mix at their locations. Malls and shopping centers should use shoppers’ search data to understand localized trends, provide mall visitors with a personalized experience and help create synergies among retail tenants.

Source: Placer.ai[/caption]

Geolocating shopper search can help establish shopper intent to purchase certain products. Mall owners can leverage these insights to identify the optimal tenant mix at their locations. Malls and shopping centers should use shoppers’ search data to understand localized trends, provide mall visitors with a personalized experience and help create synergies among retail tenants.