DIpil Das

US Store Closures: Apparel Specialist Stores Lead Closures

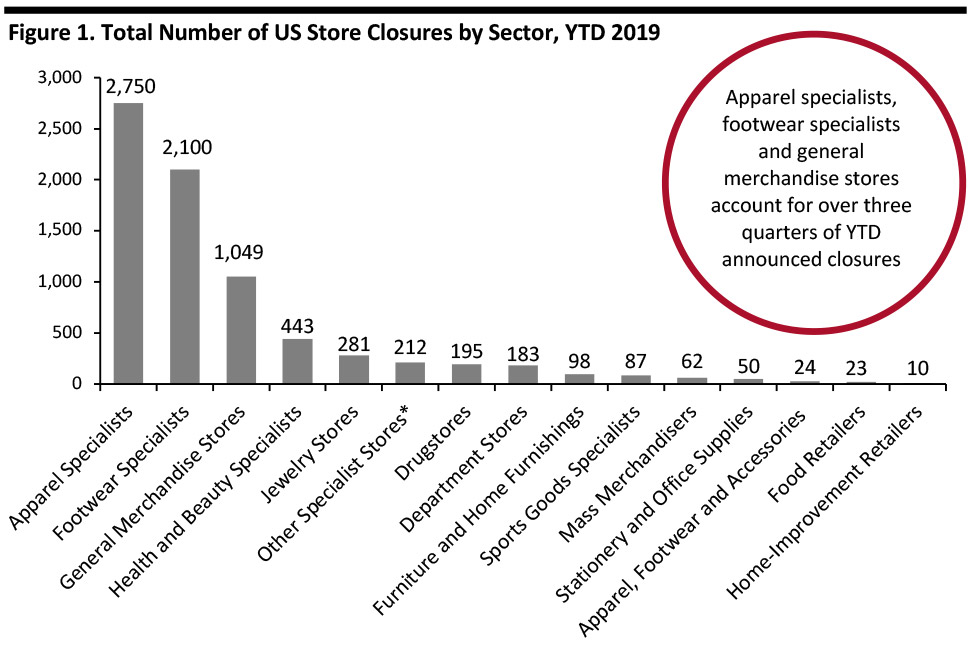

In the US, we have seen 7,567 store closure announcements by major retailers in 2019, as of July 31, 2019. This is up from 5,524 closures in the full year 2018. Among the sectors, apparel specialist stores lead the casualty list with 2,750 closures announced so far this year.

Of the year-to-date announced closures for the year so far, the apparel specialists comprise the sector that has been most impacted, accounting for 36% of total closures (14% in 2018), followed by footwear specialists at 28% (8% in 2018) and general merchandise stores at 14% (just 2% in 2018).

[caption id="attachment_94632" align="aligncenter" width="700"] All YTD 2019 data in this report are as of July 31, 2019.

All YTD 2019 data in this report are as of July 31, 2019. *Includes retailers such as rent to own company Rent-A-Center and party supplies retailer Party City.

Source: Company reports/Coresight Research [/caption]

Payless, which shut 2,100 stores this year, has been the single-biggest contributor to store closures. The company filed for bankruptcy for the second time in February after previously entering and subsequently emerging from bankruptcy in 2017.

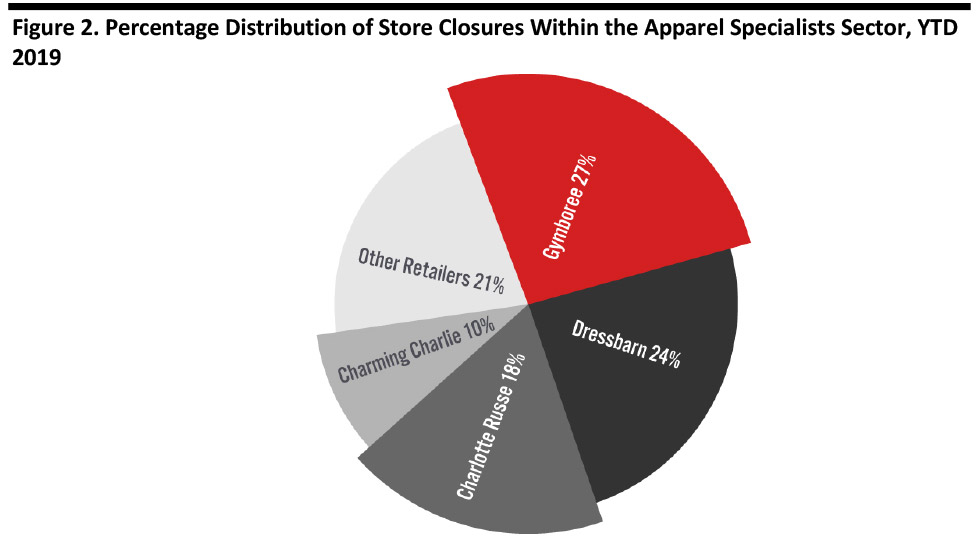

Among apparel specialist stores, Gymboree declared bankruptcy in January and shut 749 US stores. Ascena Retail Group announced in May that it would wind up its Dressbarn business and shut down all its 661 stores, while Charlotte Russe declared bankruptcy in February and announced it would shut down its store estate of at least 500 stores. Charming Charlie filed for bankruptcy in July and announced it would shut all its 261 stores. These four retailers accounted for 79% of total announced closures recorded so far this year, as depicted in the figure below.

[caption id="attachment_94633" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Among general merchandise stores, Shopko filed for bankruptcy in January and shut down all its 371 stores by June. Dollar Tree-owned Family Dollar plans to close 359 stores and Fred’s has announced it will close 313 stores.

Among health and beauty specialists, GNC plans to close an estimated 332 stores in 2019. GNC announced in July 2019 that it will close between 700 to 900 stores by the end of 2020; our 2019 figure is a calendarized estimate.

In the jewelry stores category, Signet Jewelers announced 159 closures while Samuels Jewelers announced 122 closures.

Other non-apparel retailers that reported major closures included Walgreens, with 195 estimated closures as of July 31, and Rent-A-Center, with 125 closures

Sears led closures in the department store sector, with 72 announced closures as of July 31 (it announced an additional 21 Sears department store closures in early August).

US Store Openings: General Merchandise Stores Lead in Openings

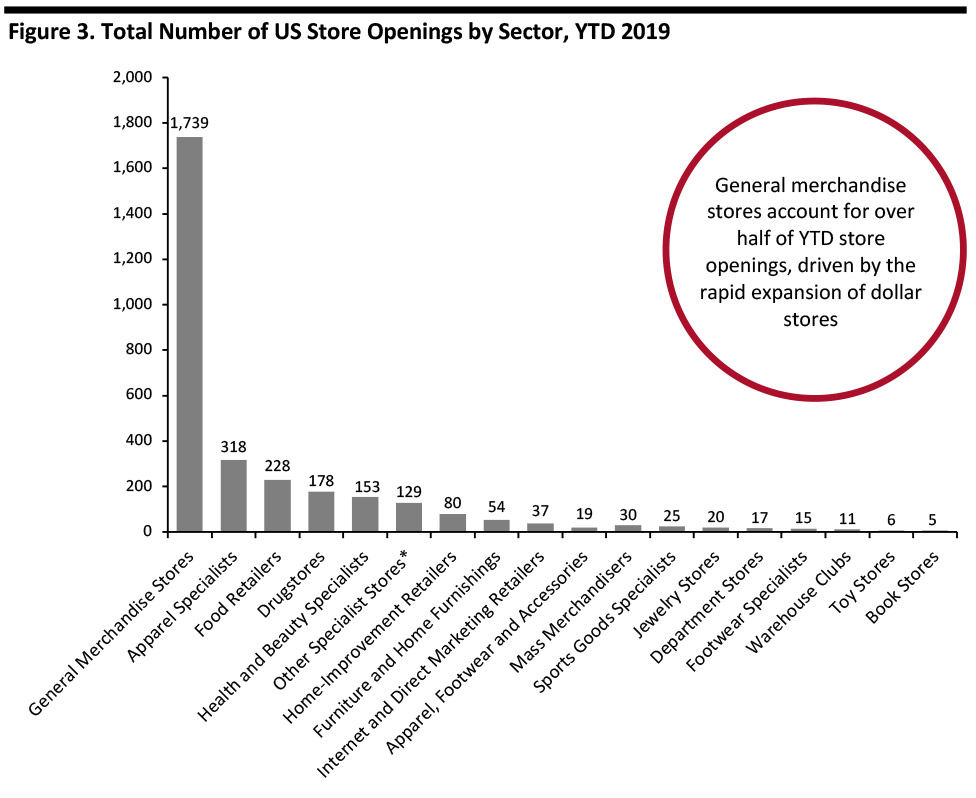

Major US retailers announced 3,064 store openings in 2019 as of July 31, 2019, compared to the 3,258 stores opened in 2018. In 2019 so far, general merchandise stores (which includes the growing dollar-store segment), constituted almost 57% of total announced store openings in the US. Apparel specialist stores and food retailers also announced significant number of store openings.

The 1,739 store openings by general merchandise retailers outnumbered the 1,049 closures in the sector, and the 228 store openings by food retailers outnumbered the 23 closures in that sector. Apparel specialists announced 318 openings, significantly fewer than the 2,750 closed.

[caption id="attachment_94634" align="aligncenter" width="700"] *Other specialist stores include niche retailers such as crafts retailer Hobby Lobby.

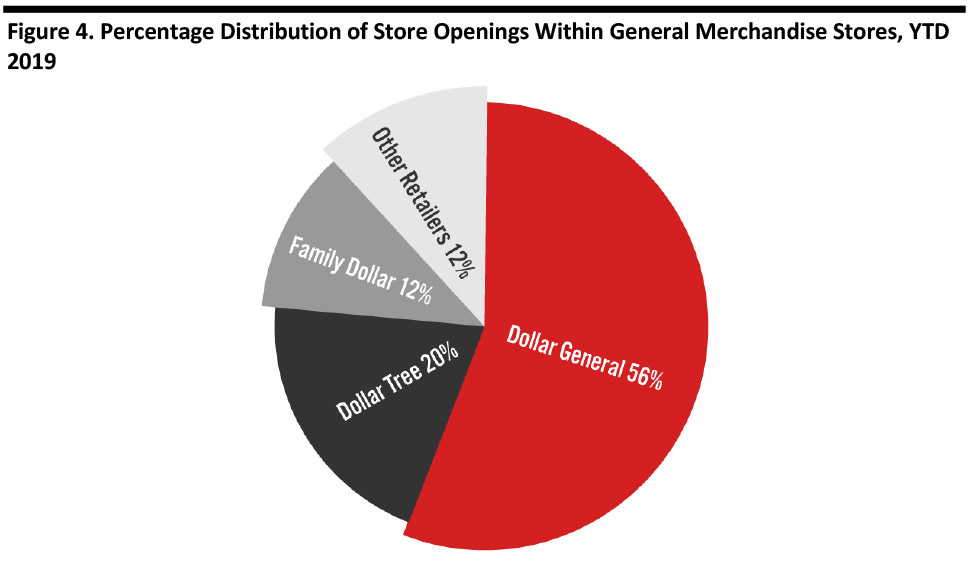

*Other specialist stores include niche retailers such as crafts retailer Hobby Lobby. Source: Company reports/Coresight Research [/caption] Dollar stores had a significant impact on the total number of openings in the general merchandise sector with Dollar General, Dollar Tree and Family Dollar announcing they will open 975, 348 and 202 stores, respectively. These three retailers accounted for 88% of sector openings announced this year, reflecting the proliferation of discount stores in the US retail landscape. [caption id="attachment_94635" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Among apparel specialist stores, off-pricers Ross Stores and Burlington are leading the pack, having announced plans to open 100 and 50 stores, respectively.

Food retail was significantly boosted by German discount grocery chain Aldi, which will open an estimated 159 stores this year. Aldi announced in June 2017 that it will open around 2,500 stores by the end of 2022; our 2019 figure is a calendarized estimate.

Overall, with the number of announced closures in 2019 already surpassing the total number of closures in 2018, and standing at more than double the number of year-to-date announced openings, this year continues to represent testing times for brick-and-mortar retail and we expect this theme to continue in the second half of the year.

Note on Methodology

Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. For some retailers, store opening and closure numbers are estimated, including from part-year data or global figures. Figures for openings and closures are gross.