albert Chan

Introduction

In grocery retail, technology is redefining the customer shopping experience, automating supply chain processes, enabling analytics-driven business decisions and cutting cost. At the forefront of such innovations in the US are Walmart and Kroger, the country’s two biggest grocery retailers. In this report, we examine the major technological innovations by Walmart and Kroger, their major areas of focus as well as collaborations with technology companies. For Walmart, we focus on its grocery business and we include the company’s Sam’s Club chain in our discussion.

Technology is Changing the Grocery Retail Landscape

Retailers have lagged in adopting technology compared to other sectors, in part because of lower margins in retail, the substantial investment required and the risks involved. Grocery retailers have particularly slim margins compared to nonfood sectors such as apparel, furniture and home-improvement, which makes it even more challenging for them to invest in technology. However, the grocery retail landscape is rapidly changing as technological advancements have paved the way for more cost-effective innovations in grocery.

Amazon has emerged as a leader in the US e-commerce industry, controlling just over half of the market. Amazon enjoyed an estimated 52.5% share of the US e-commerce market in 2018, according to Euromonitor International. But food and groceries are one market in which Amazon has not yet gained a meaningful share. Amazon’s attempts to crack the grocery market have prompted it to venture offline — where the bulk of groceries are sold — by opening Amazon Go stores and acquiring Whole Foods Market. The threat of Amazon has been one spur for Walmart and Kroger to invest in technology, expand in e-commerce and remodel their physical stores.

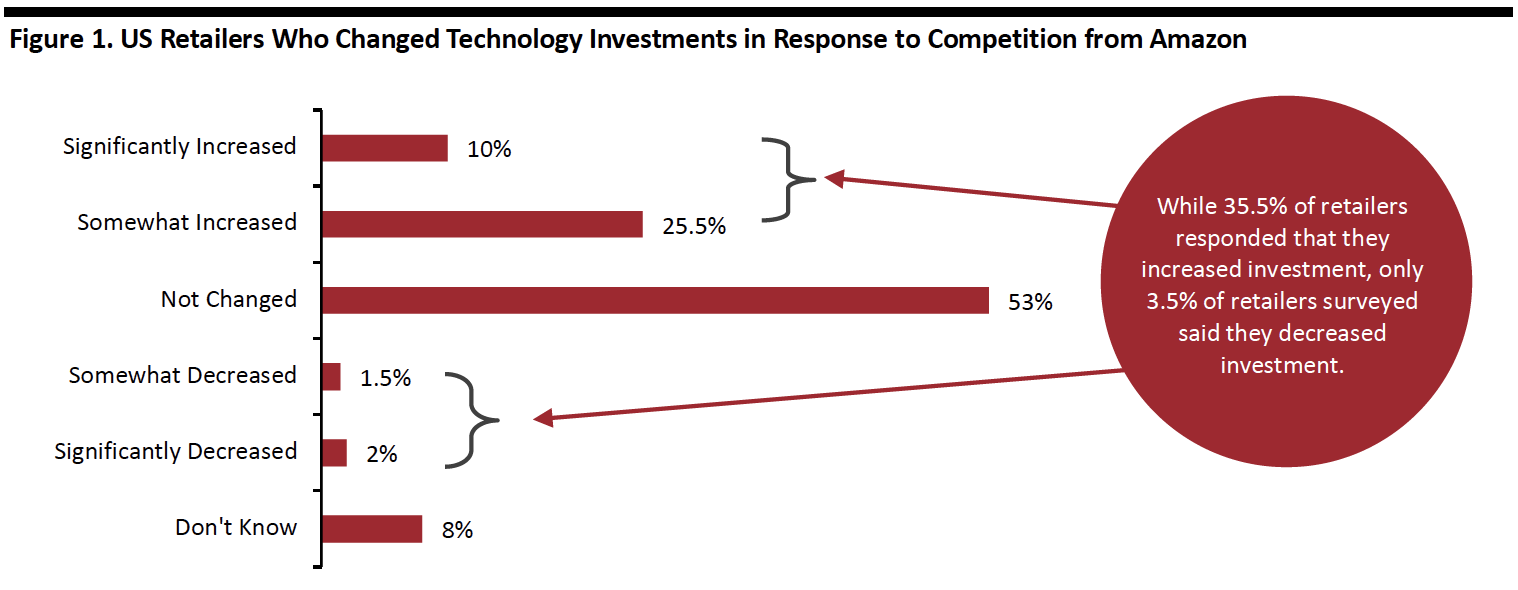

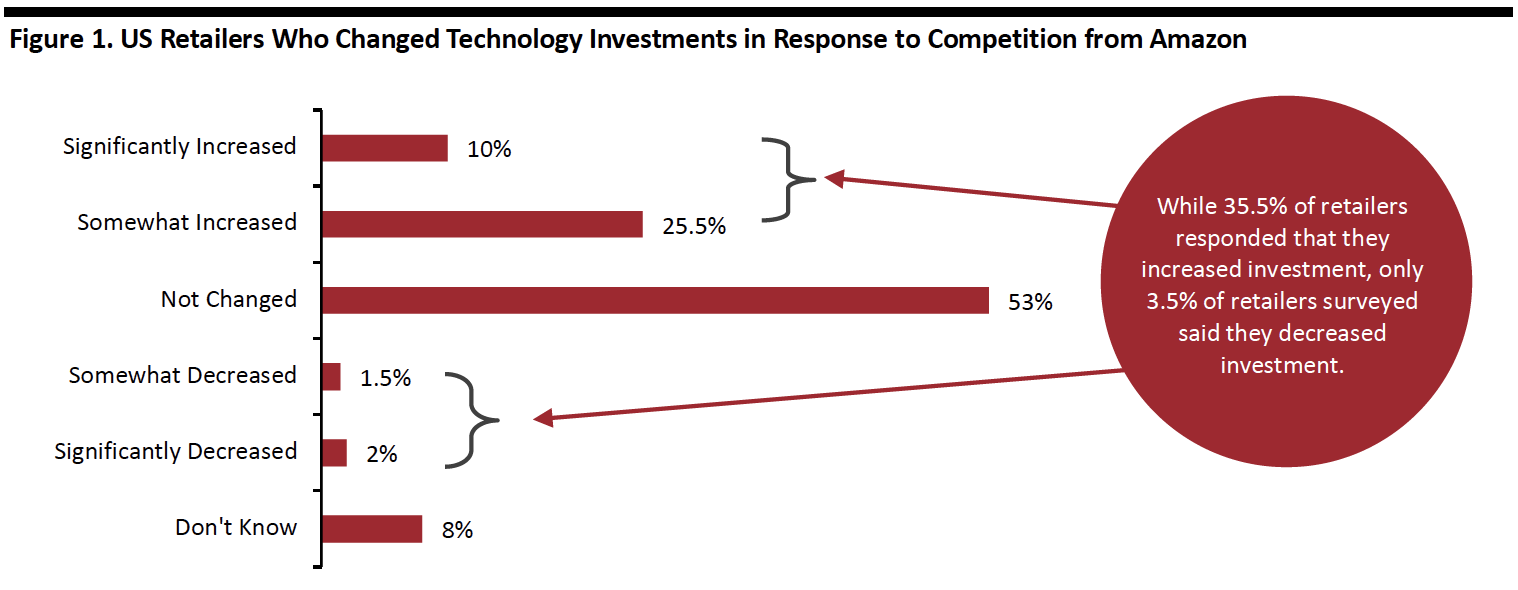

According to a survey conducted in 2017 by NAPCO research, a media research firm, representatives of about 36% of US retailers surveyed said they increased technology investment in response to competition from Amazon.

[caption id="attachment_91580" align="aligncenter" width="700"] Base: US Retailers, surveyed in August 2017

Base: US Retailers, surveyed in August 2017

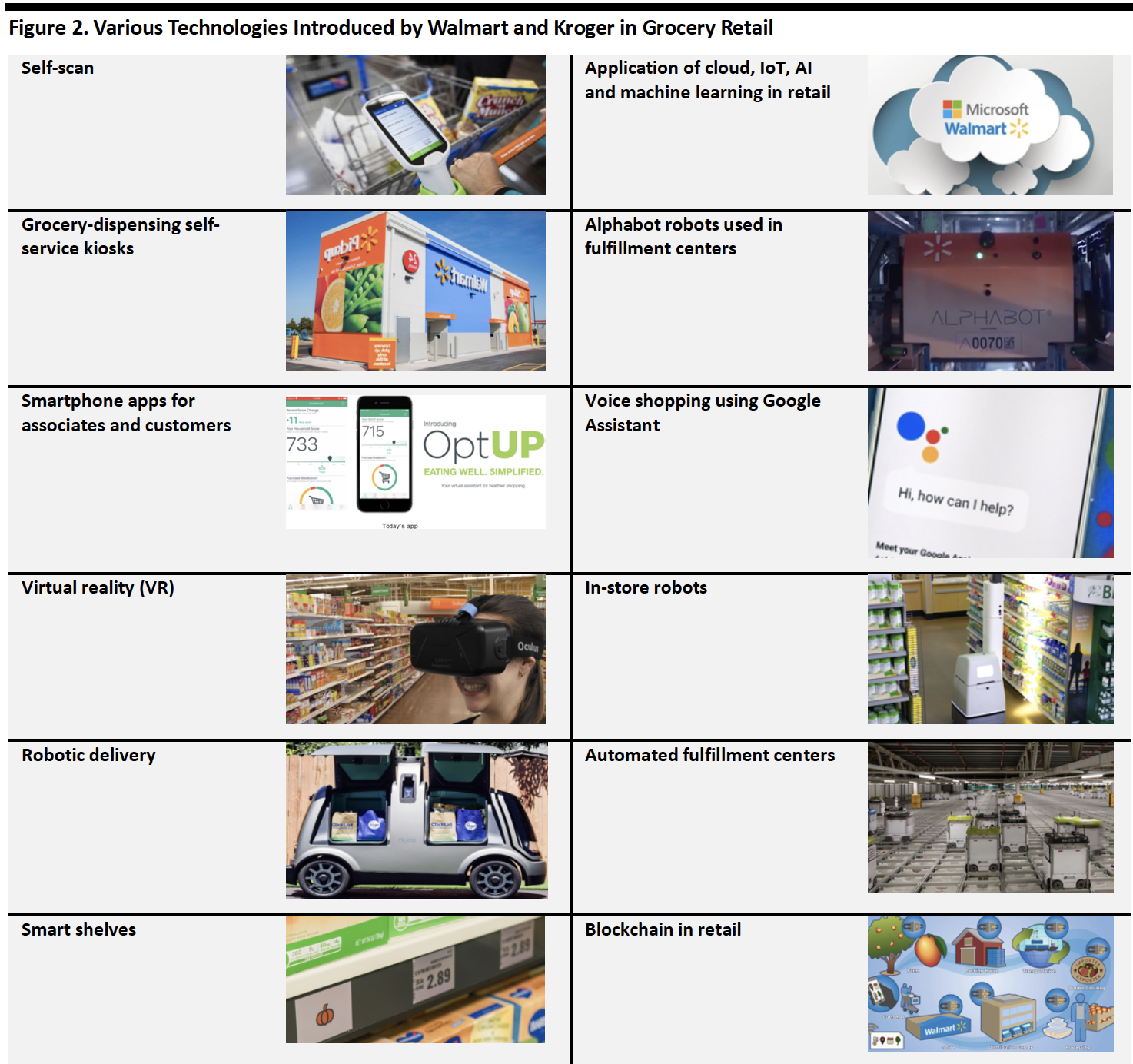

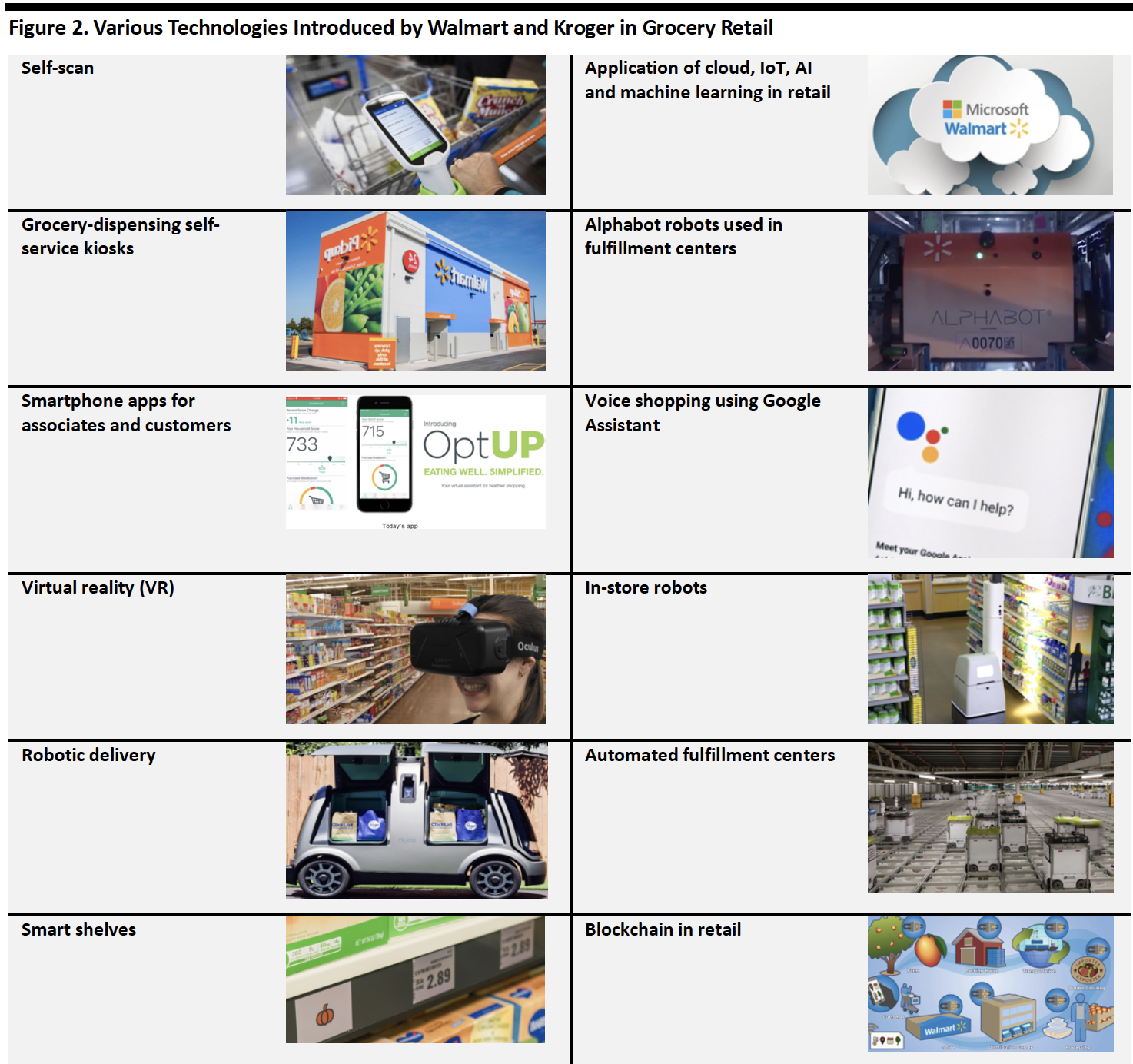

Source: NAPCO Research[/caption] As discussed in our report US Millennials and Grocery, millennials have a strong influence on the US grocery retail industry due to sheer numbers and their resulting spending power. Millennials are digital natives and so are likely to expect seamless digital experiences when buying groceries. As a result, retailers have been improving their digital and omnichannel platforms, embracing new innovations to speed the supply chain, delivery and check-out, and help them cut out cost in distribution and stores, including by improving employee productivity. Technological Innovations By Walmart and Kroger Walmart and Kroger are leading innovation in the retail grocery landscape. In the following sections, we dive into their major innovations. The technologies we discuss in this report include the following: [caption id="attachment_91581" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Seamless Shopping Experience

Increasingly, customers expect to shop, check out, pay and get orders fulfilled in a variety of ways. Particularly in the frequently purchased, nondiscretionary grocery category, we expect consumers to increasingly look for services and channels that eliminate friction from the shopping process. To meet such consumer demands, grocery retailers have started adopting advanced technology, driven by machine learning, computer vision and IoT, which can transform the consumer shopping experience.

1) Sam's Club’s Scan & Go versus Kroger’s Scan, Bag, Go versus Amazon Go

Self-scan and autonomous checkouts are set to help eliminate pain points in grocery retail, by allowing customers to skip the checkout lines. The difference between self-scan and autonomous checkouts is that with self-scan, such as Sam's Club’s Scan & Go and Kroger’s Scan, Bag, Go, customers must scan the items before checking out, but they still skip the checkout lines. With autonomous checkout such as that deployed by Amazon Go, consumers don’t even have to scan items, as the task is handled by technology.

Amazon launched autonomous checkout in its 1,800-square-foot Amazon Go store in Seattle, opened in January 2018. Customers check in through turnstiles by scanning the Amazon Go smartphone app. Cameras and sensors detect each product that customers take from the shelf and update the shopper’s cart. When customers finish shopping and walk through a checkout gate, the system automatically charges the customer’s account using stored payment information. Similar stores have been opened by other retailers, particularly in China, which we discussed in an earlier report.

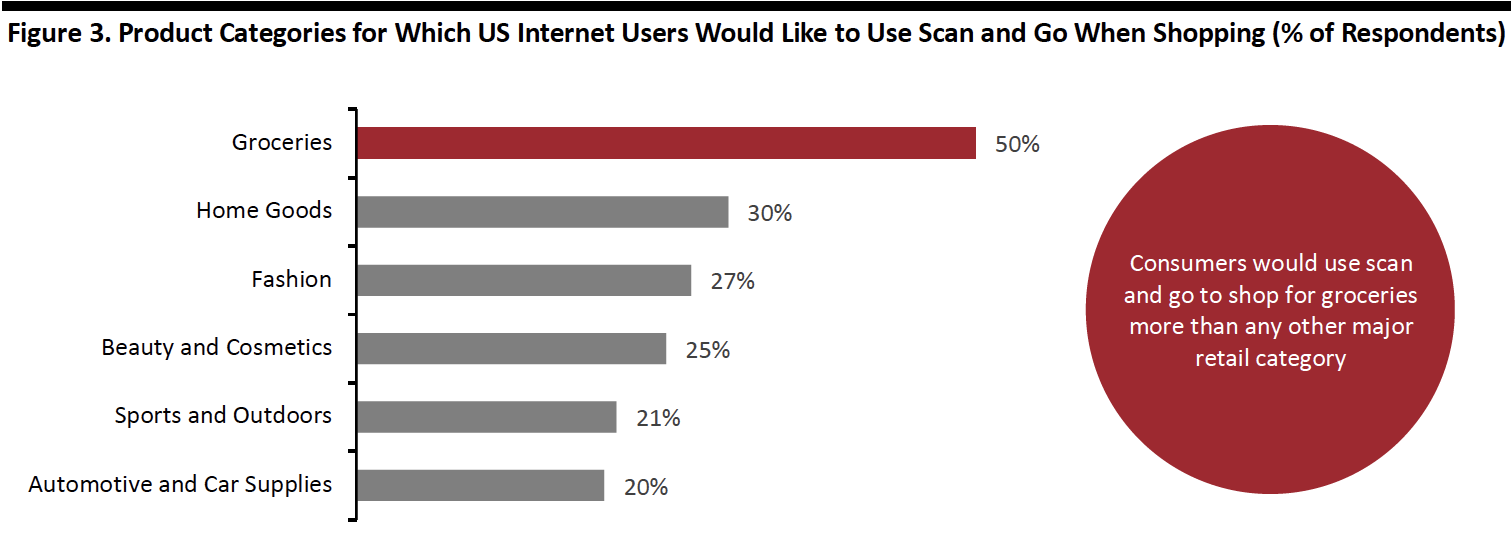

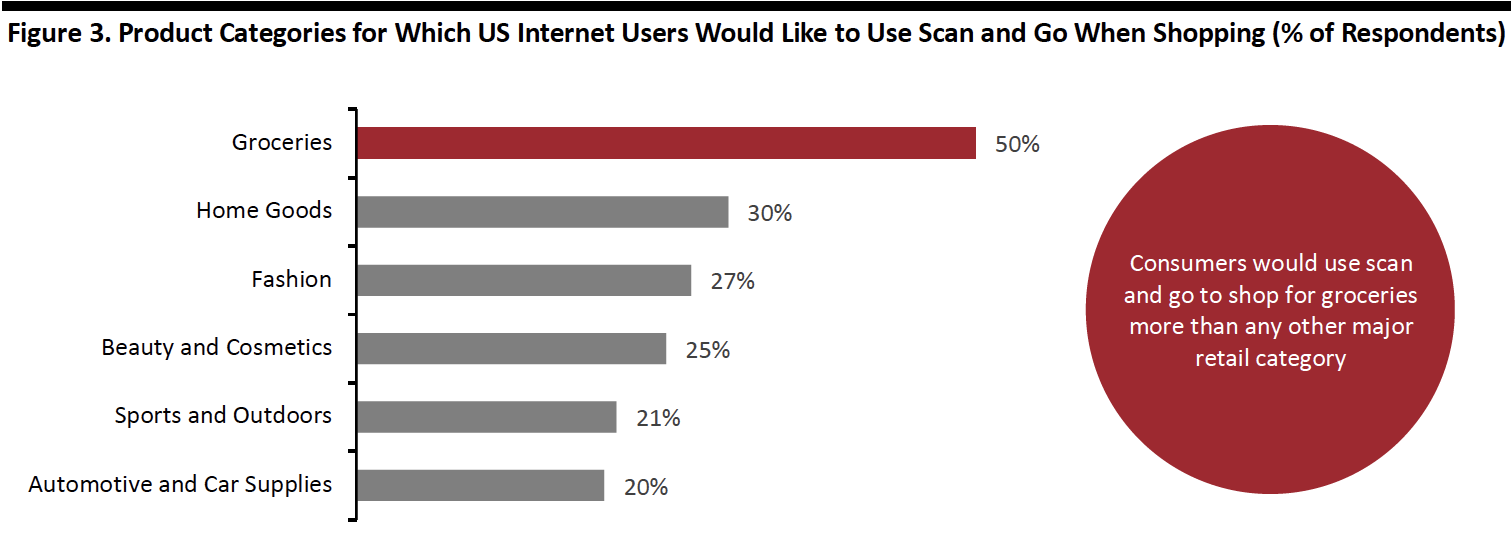

According to a March 2018 survey conducted by YouGov, a market research firm, 50% of US respondents said they would like to use scan and go technology to buy groceries, compared to 25% of respondents who said they would like to use scan and go technology to buy beauty/cosmetic items. Of the major retail categories suggested to respondents, groceries was by far the most popular option — underlining how shoppers want to drive friction out of shopping for this category.

[caption id="attachment_91582" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Seamless Shopping Experience

Increasingly, customers expect to shop, check out, pay and get orders fulfilled in a variety of ways. Particularly in the frequently purchased, nondiscretionary grocery category, we expect consumers to increasingly look for services and channels that eliminate friction from the shopping process. To meet such consumer demands, grocery retailers have started adopting advanced technology, driven by machine learning, computer vision and IoT, which can transform the consumer shopping experience.

1) Sam's Club’s Scan & Go versus Kroger’s Scan, Bag, Go versus Amazon Go

Self-scan and autonomous checkouts are set to help eliminate pain points in grocery retail, by allowing customers to skip the checkout lines. The difference between self-scan and autonomous checkouts is that with self-scan, such as Sam's Club’s Scan & Go and Kroger’s Scan, Bag, Go, customers must scan the items before checking out, but they still skip the checkout lines. With autonomous checkout such as that deployed by Amazon Go, consumers don’t even have to scan items, as the task is handled by technology.

Amazon launched autonomous checkout in its 1,800-square-foot Amazon Go store in Seattle, opened in January 2018. Customers check in through turnstiles by scanning the Amazon Go smartphone app. Cameras and sensors detect each product that customers take from the shelf and update the shopper’s cart. When customers finish shopping and walk through a checkout gate, the system automatically charges the customer’s account using stored payment information. Similar stores have been opened by other retailers, particularly in China, which we discussed in an earlier report.

According to a March 2018 survey conducted by YouGov, a market research firm, 50% of US respondents said they would like to use scan and go technology to buy groceries, compared to 25% of respondents who said they would like to use scan and go technology to buy beauty/cosmetic items. Of the major retail categories suggested to respondents, groceries was by far the most popular option — underlining how shoppers want to drive friction out of shopping for this category.

[caption id="attachment_91582" align="aligncenter" width="700"] Base: US Internet users aged 18+, surveyed in March 2018

Base: US Internet users aged 18+, surveyed in March 2018

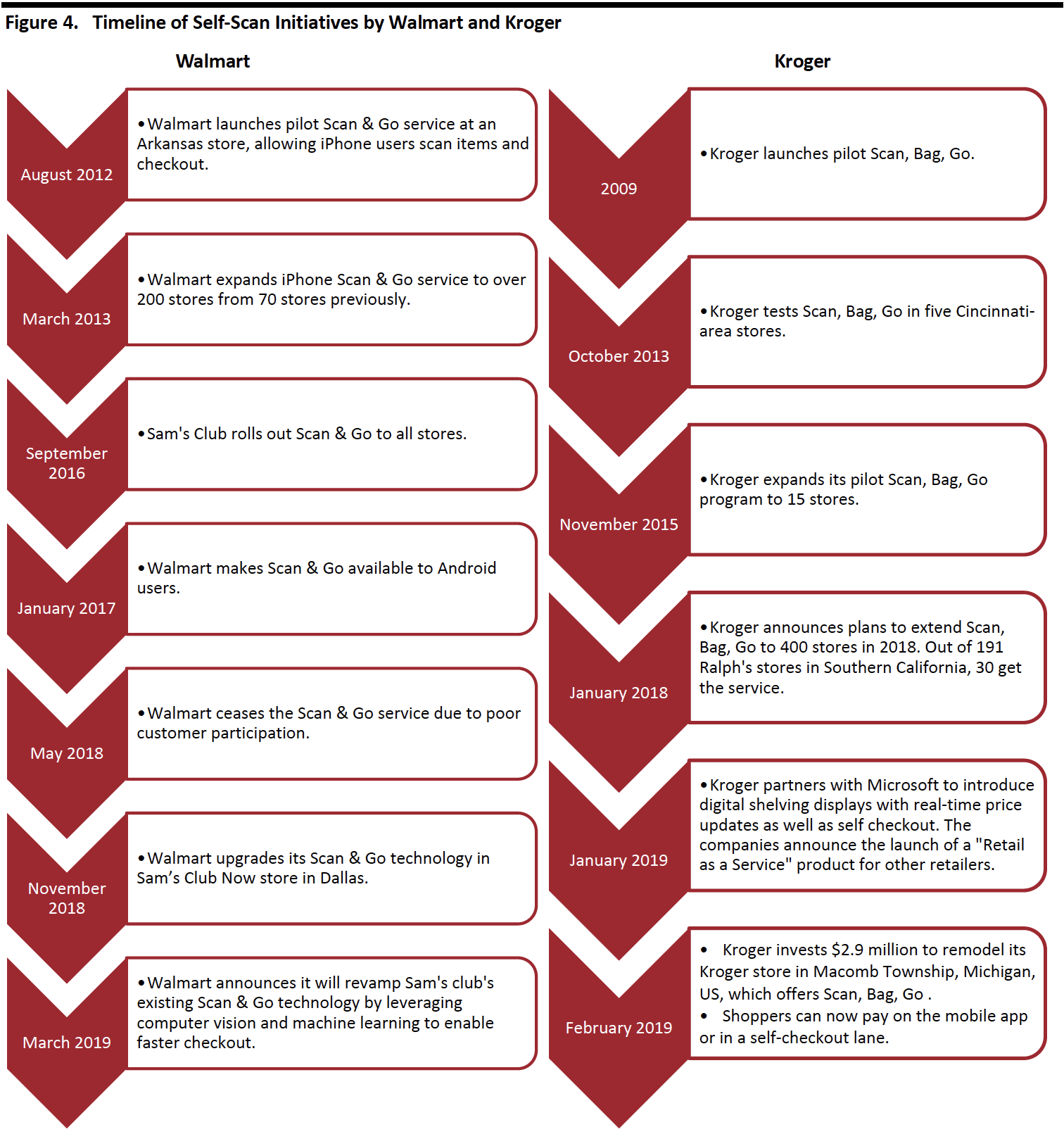

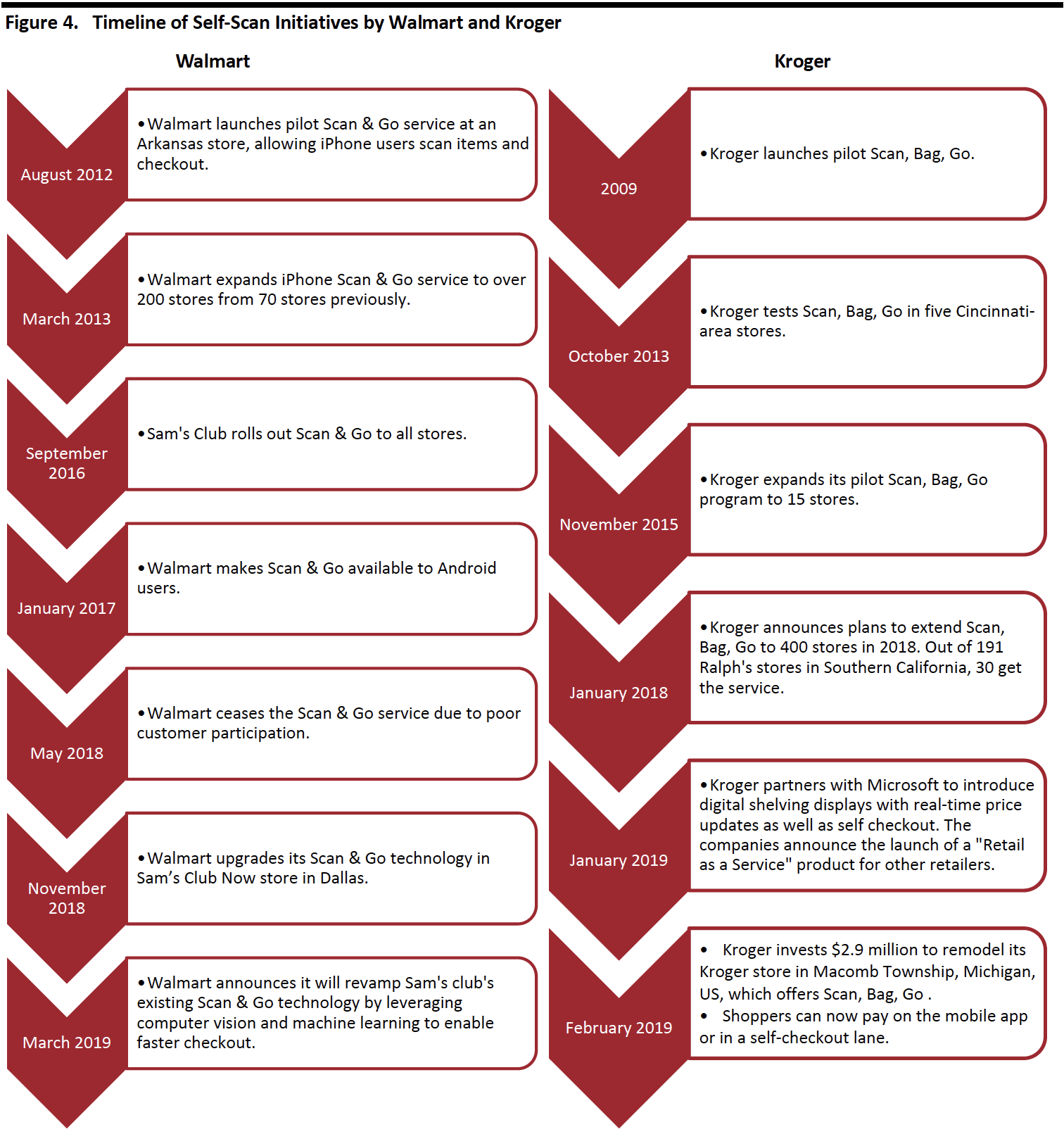

Source: YouGov[/caption] Following the launch of Amazon Go, in October 2018 Walmart launched an upgraded self-scan service at its Sam’s Club Now store in Dallas. Sam’s Club’s Scan & Go works in a similar way to Walmart’s previous Scan & Go service — which the company ended in April 2018 and which we discuss in the next section. With the Scan & Go smartphone app, Sam’s Club customers scan product barcodes, then use the app to pay and the receipt is manually verified by associates at the exit. (Walmart and Sam’s Club stores have associates at the door to check customer receipts.) Before launching the Scan & Go app in Sam’s Club stores, Walmart introduced the technology in its own stores: Back in August 2012, it launched a pilot service at Arkansas stores for iPhone users. By March 2013, the service was expanded to 200 stores from 70. In January 2017, the service was made available to Android users. But Walmart suspended the service in April 2018. Even though customers were able to skip the checkout line, Scan & Go posed challenges which prompted Walmart to end the service. The reasons were: Source: Company reports[/caption]

Amazon Go has a clear edge over Sam’s Club’s Scan & Go and Kroger’s Scan, Bag, Go, since Walmart and Kroger customers still need to scan products. However, as Kroger and Walmart ramp up their technology, aided by technology partners, we expect these companies to adopt AI, machine learning and IoT and make their checkout processes more autonomous.

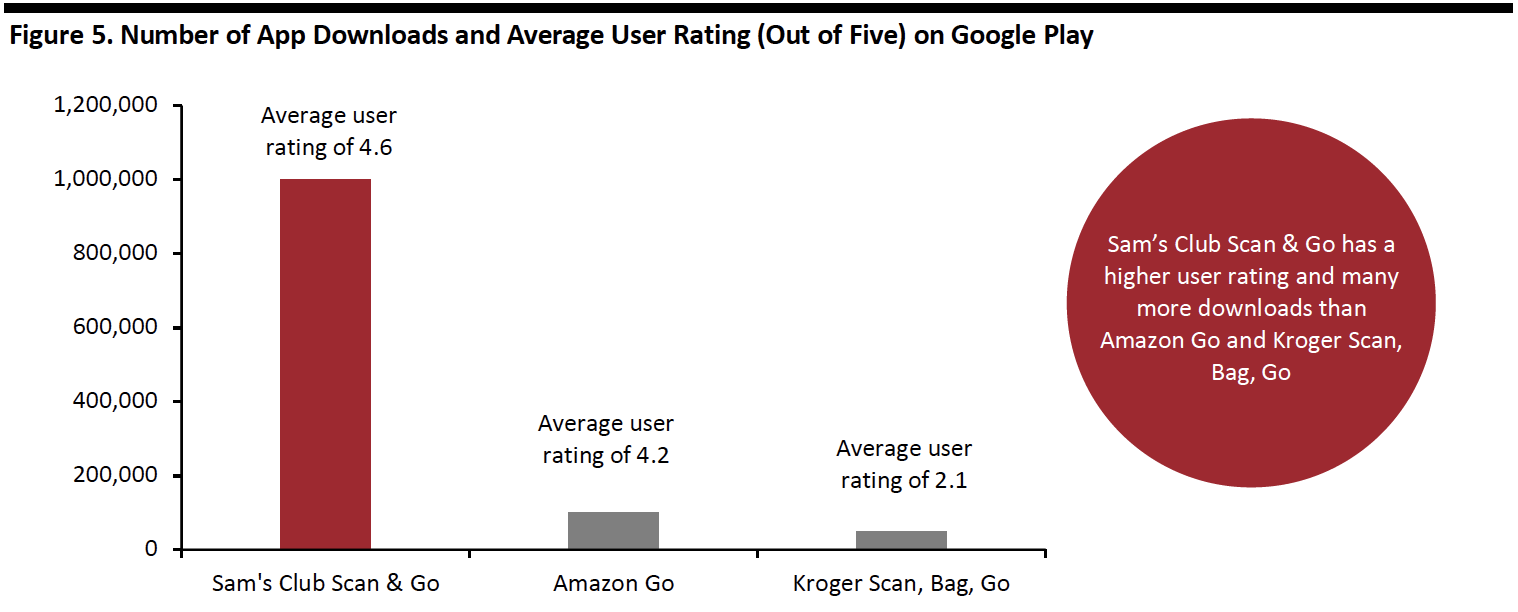

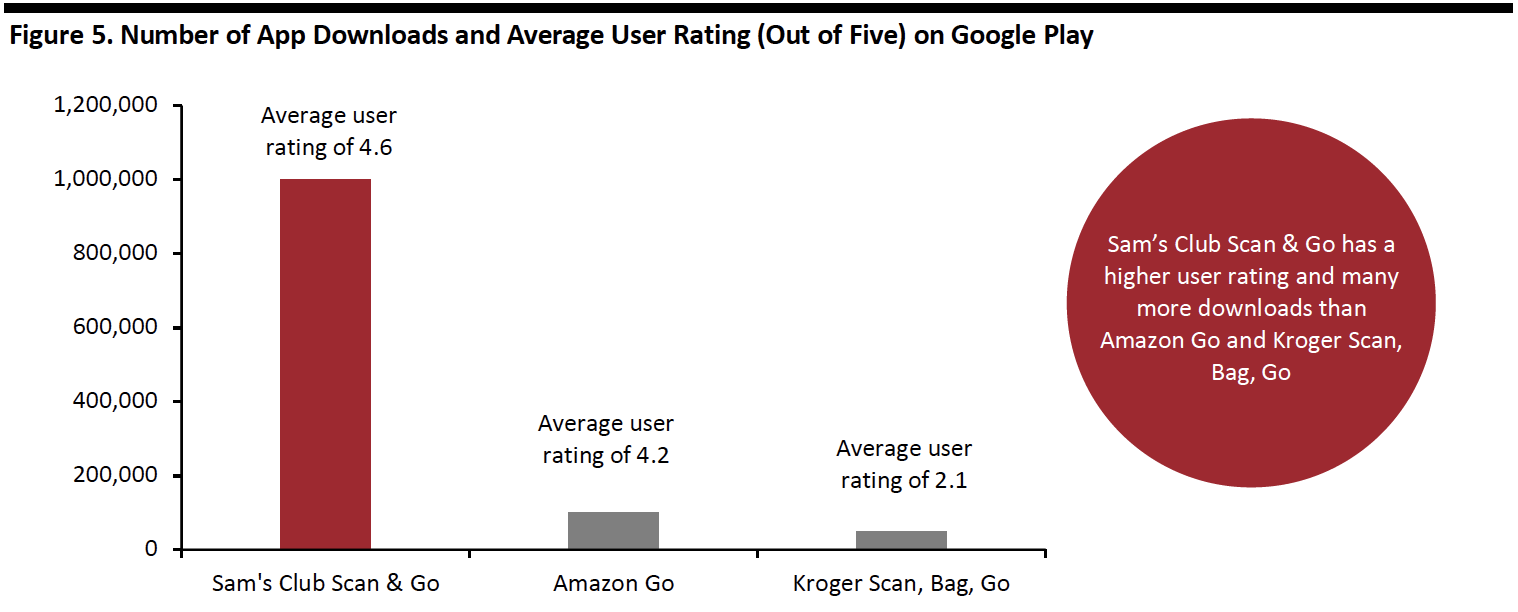

Based on data from the Google Play Store, Sam’s Club’s Scan & Go remains the clear winner in terms of number of app downloads and average user rating. The data reflect downloads and ratings by users of Android smartphones.

[caption id="attachment_91584" align="aligncenter" width="700"]

Source: Company reports[/caption]

Amazon Go has a clear edge over Sam’s Club’s Scan & Go and Kroger’s Scan, Bag, Go, since Walmart and Kroger customers still need to scan products. However, as Kroger and Walmart ramp up their technology, aided by technology partners, we expect these companies to adopt AI, machine learning and IoT and make their checkout processes more autonomous.

Based on data from the Google Play Store, Sam’s Club’s Scan & Go remains the clear winner in terms of number of app downloads and average user rating. The data reflect downloads and ratings by users of Android smartphones.

[caption id="attachment_91584" align="aligncenter" width="700"] Download numbers are rounded; Sam’s Club Scan & Go downloads as of May 17, 2019, Amazon Go downloads as of June 11, 2019, and Kroger's Scan, Bag, Go downloads as of May 21, 2019

Download numbers are rounded; Sam’s Club Scan & Go downloads as of May 17, 2019, Amazon Go downloads as of June 11, 2019, and Kroger's Scan, Bag, Go downloads as of May 21, 2019

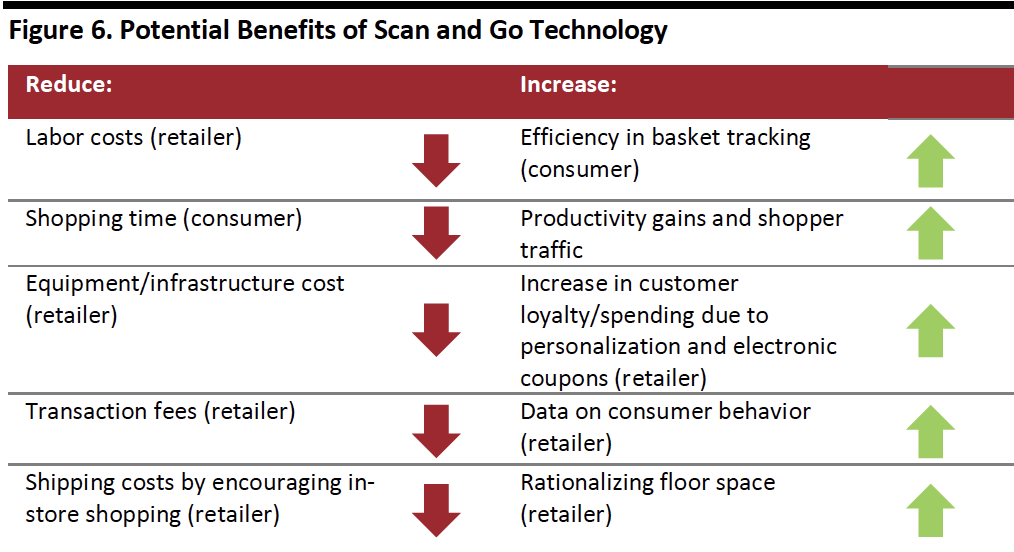

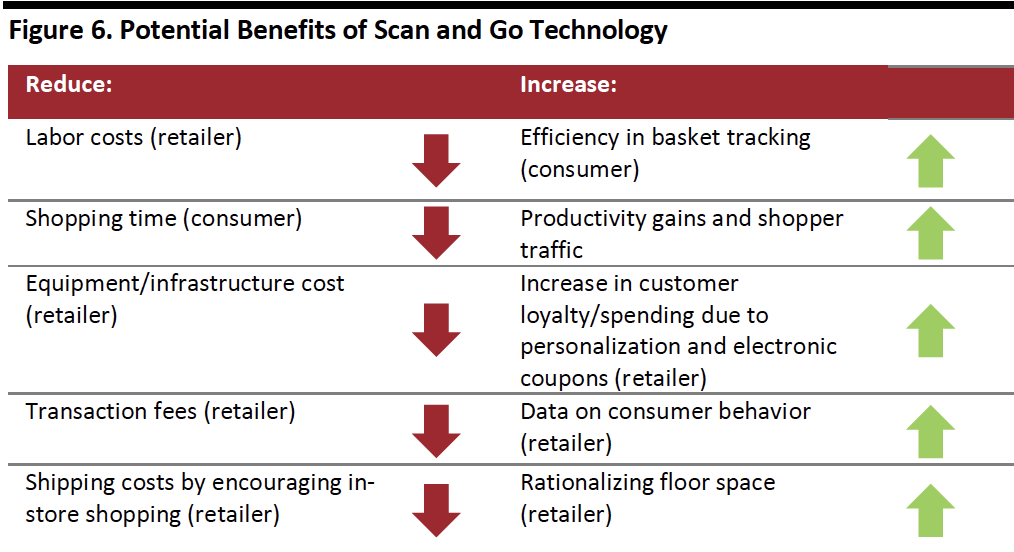

Source: Google Play Store[/caption] What are the Benefits of Scan and Go Technology? Scan and go can be a “win-win” situation for retailers and consumers. Scan and go integrates the shopping process with smartphones; so, apart from tracking their basket and saving time by avoiding the checkout line, customers can also get digital coupons and personalized shopping recommendations on their phones. Retailers can cut labor costs and employ associates in other productive roles, reduce equipment costs (such as self-checkout kiosks) and rationalize floor space. In-app coupons, loyalty points and discounts can prompt consumers to shop more, which can be difficult to execute in traditional shopping set up. When retailers distribute proprietary payment cards integrated into scan and go systems and promote those cards through fee waivers and offers, they also save on third-party fees and commission. For the retailers, the cost incurred on private-label payment cards is typically lower than that on cards issued by third parties. [caption id="attachment_91585" align="aligncenter" width="700"] Source: Coresight Research[/caption]

2) Kiosks

Walmart Self-Service Kiosks

Walmart launched self-serve kiosks for grocery pick-up in the parking lot of one of its Oklahoma superstores on June 2017. After customers purchase groceries online, associates pack the grocery items and store them in the giant kiosks placed in the parking area of the store. Customers pick up orders with a code. In October 2018, Walmart opened its second refrigerated automated grocery kiosk in Sherman, about 60 miles north of Dallas, also in the parking lot.

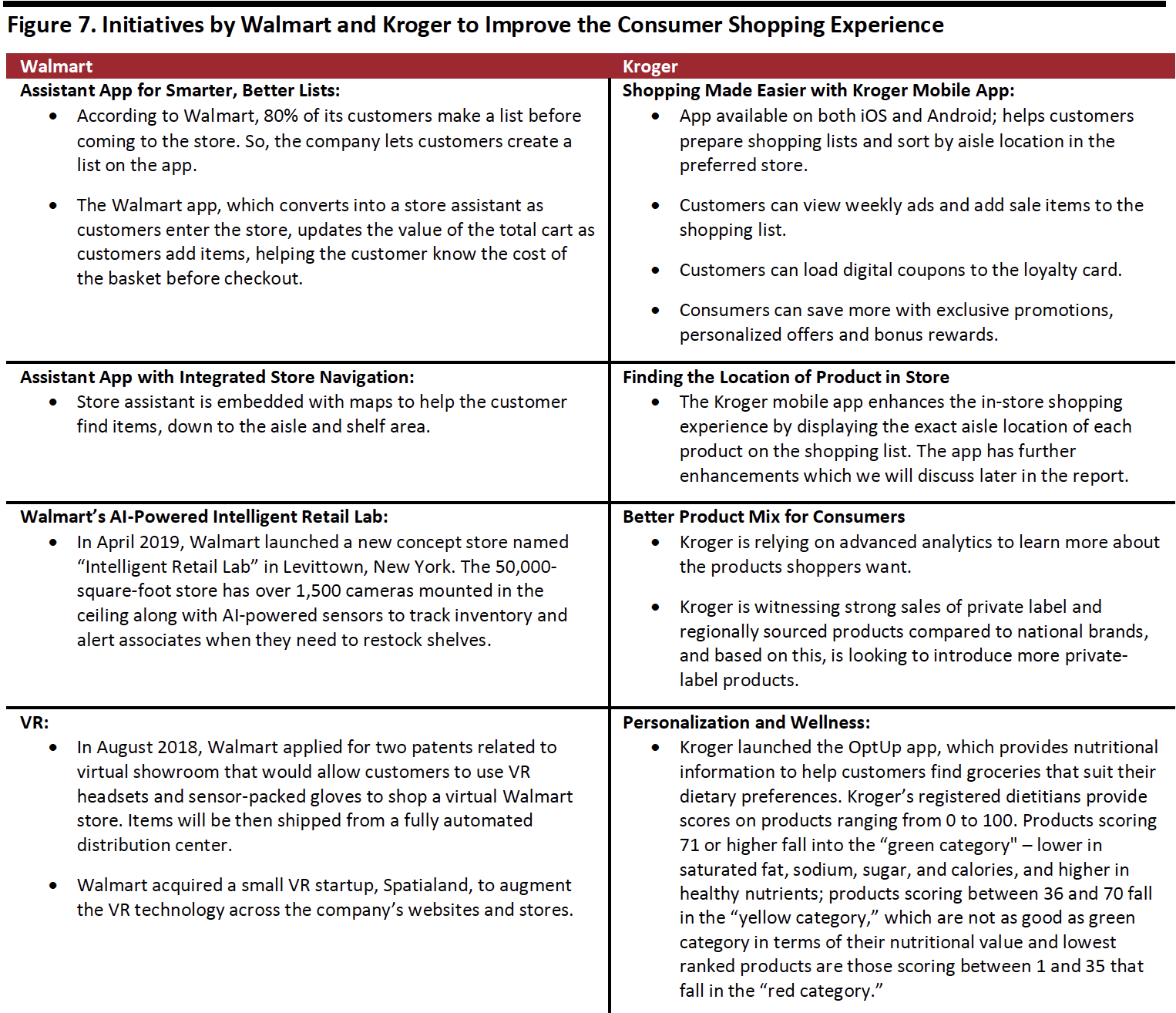

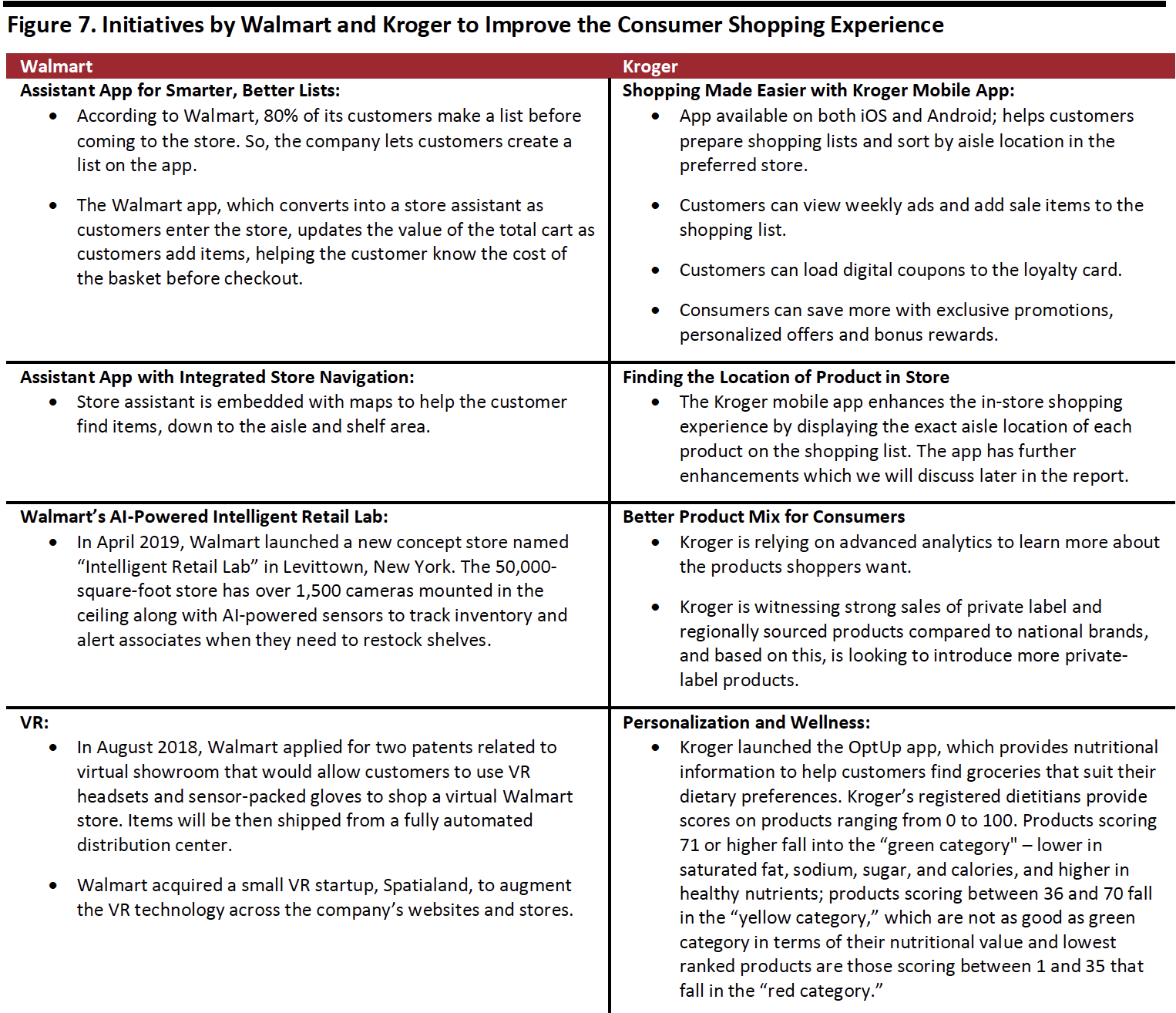

3) Experiential Shopping

Walmart introduced the Walmart app, which not only has Walmart Pay, but other features such as a product search bar, reviews and pricing information for products available in store. Walmart is also leveraging VR to allow customers to shop from the comfort of their home.

[caption id="attachment_91586" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

2) Kiosks

Walmart Self-Service Kiosks

Walmart launched self-serve kiosks for grocery pick-up in the parking lot of one of its Oklahoma superstores on June 2017. After customers purchase groceries online, associates pack the grocery items and store them in the giant kiosks placed in the parking area of the store. Customers pick up orders with a code. In October 2018, Walmart opened its second refrigerated automated grocery kiosk in Sherman, about 60 miles north of Dallas, also in the parking lot.

3) Experiential Shopping

Walmart introduced the Walmart app, which not only has Walmart Pay, but other features such as a product search bar, reviews and pricing information for products available in store. Walmart is also leveraging VR to allow customers to shop from the comfort of their home.

[caption id="attachment_91586" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Use of Autonomous Vehicles in Grocery Delivery

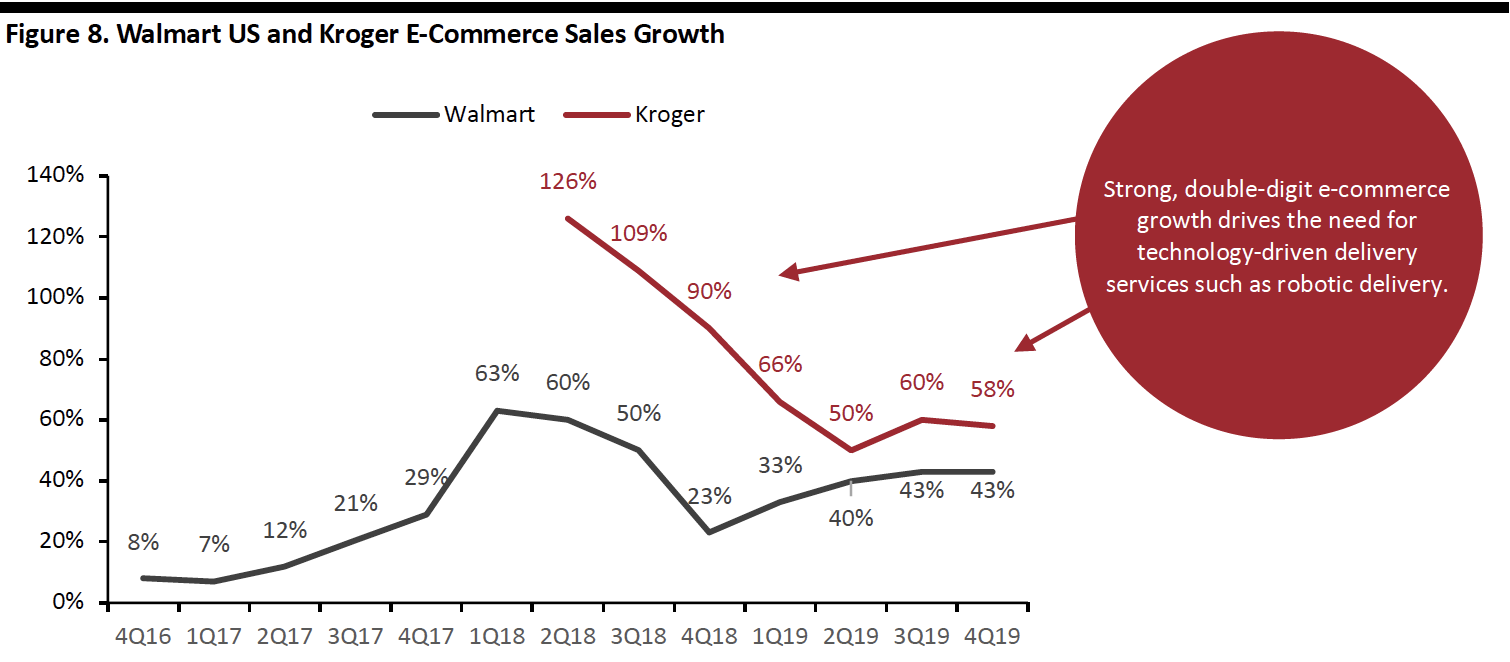

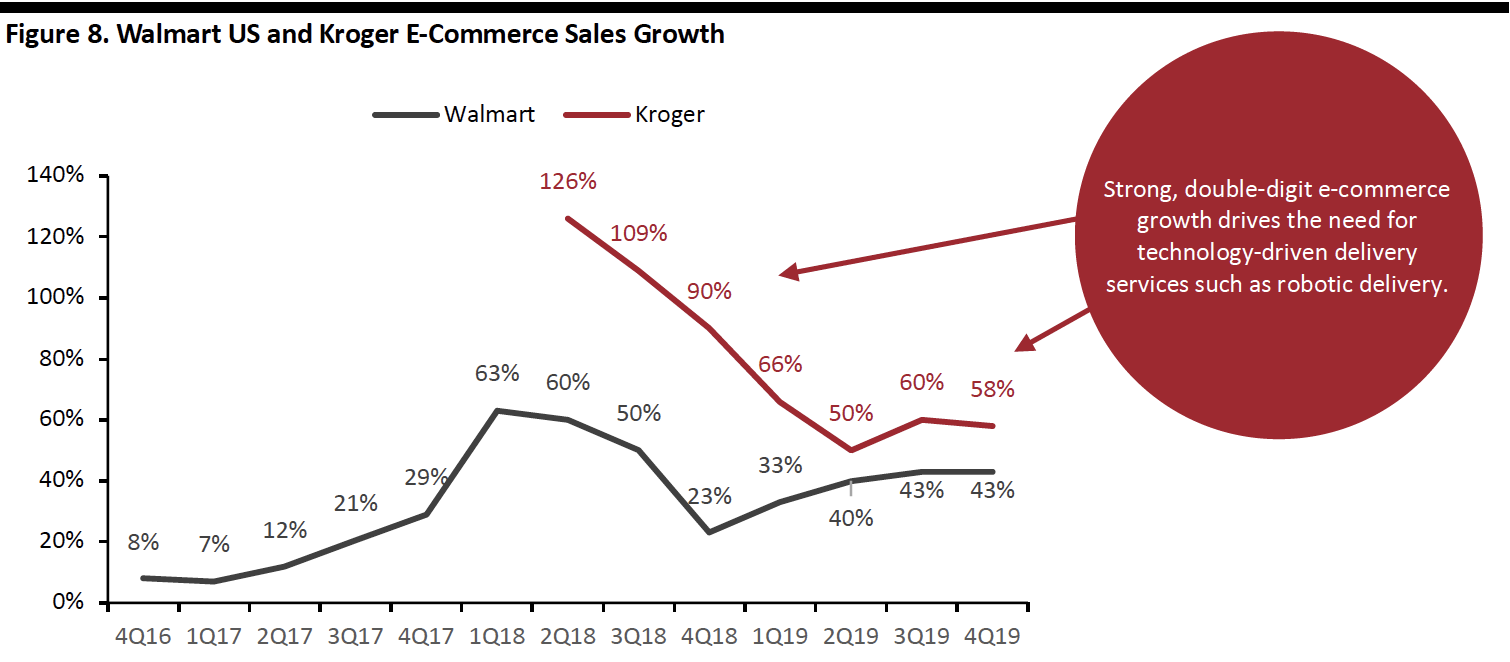

As e-commerce continues to grow quickly, so too do customer expectations of rapid delivery. We estimate that online retail sales of food and drink totaled a little under $22 billion in 2018, having climbed around 26% year over year and by a total of almost 200% in five years. Walmart and Kroger have seen very strong growth in e-commerce, as we show below.

As more consumers shop online, retailers have started offering same-day to one-hour delivery services. To accomplish this at scale, retailers may need to look to innovative delivery options driven by technology.

[caption id="attachment_91587" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Use of Autonomous Vehicles in Grocery Delivery

As e-commerce continues to grow quickly, so too do customer expectations of rapid delivery. We estimate that online retail sales of food and drink totaled a little under $22 billion in 2018, having climbed around 26% year over year and by a total of almost 200% in five years. Walmart and Kroger have seen very strong growth in e-commerce, as we show below.

As more consumers shop online, retailers have started offering same-day to one-hour delivery services. To accomplish this at scale, retailers may need to look to innovative delivery options driven by technology.

[caption id="attachment_91587" align="aligncenter" width="700"] For Walmart, prior to 4Q17, the growth rates are global e-commerce growth rates. Kroger 4Q figures are for the respective full fiscal years; 4Q e-commerce growth was not broken out.

For Walmart, prior to 4Q17, the growth rates are global e-commerce growth rates. Kroger 4Q figures are for the respective full fiscal years; 4Q e-commerce growth was not broken out.

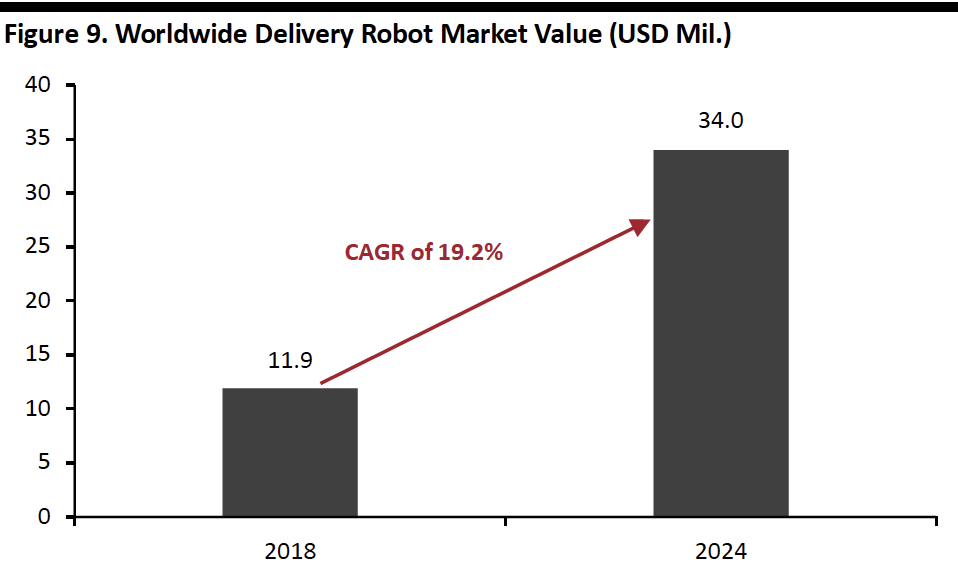

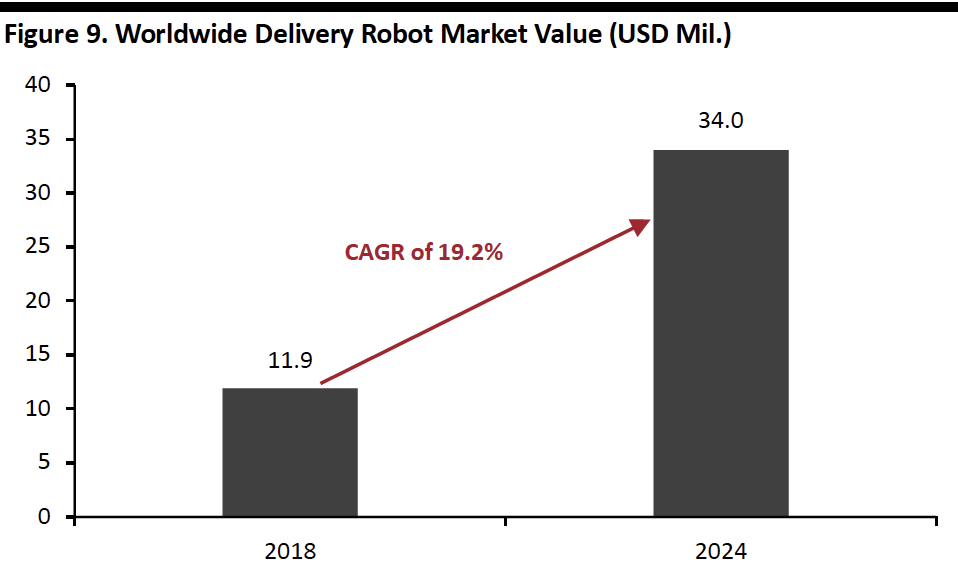

Source: Company reports[/caption] Retailers have launched pilot programs to use self-driving vehicles and robots to deliver groceries. According to consulting and research firm MarketsandMarkets, the global delivery robots market is expected to grow at a CAGR of 19.2% to $34.0 million by 2024. [caption id="attachment_91588" align="aligncenter" width="700"] Source: MarketsandMarkets[/caption]

Walmart: The company has tied up with Waymo, a self-driving platform developer and subsidiary of Alphabet Inc., to provide pick up and drop service for online shoppers: A self-driving vehicle is dispatched to pick up the customer, drive him or her to the store to pick up the online order, then drive the customer back home. It started pilot service in Phoenix, Arizona, in July 2018.

Walmart has also partnered with Ford and PostMates to test grocery delivery using self-driving vehicles. The pilot project began in Miami-Dade County in November 2018.

Kroger: Kroger launched a self-drive delivery pilot service in Scottsdale, Arizona, in August 2018, in collaboration with Nuro, a startup that designs and develops autonomous delivery vehicles. The Kroger-owned Fry’s store was the only one to participate in the pilot under which online grocery orders are loaded into self-drive vehicles and delivered to customers. In April 2019, the service was extended to Houston. Nuro will initially use regular cars outfitted with its auto pilot platform, but will later use its custom-built self-driving robots.

Retail-Tech Collaborations

Retail-tech collaboration can pave the way for new innovations in the retail sector.

Leading tech companies such as Microsoft, Google and Alert Innovation have been involved in many recent retail tie-ups. In 2017, Kroger launched its “Restock Kroger” plan to redefine the customer experience by emphasizing digitalization and collaborating with technology companies to gain access to emerging technologies driven by IoT, machine learning and AI.

Kroger is working with Microsoft, Ocado and the University of Cincinnati to revamp its stores and distribution centers.

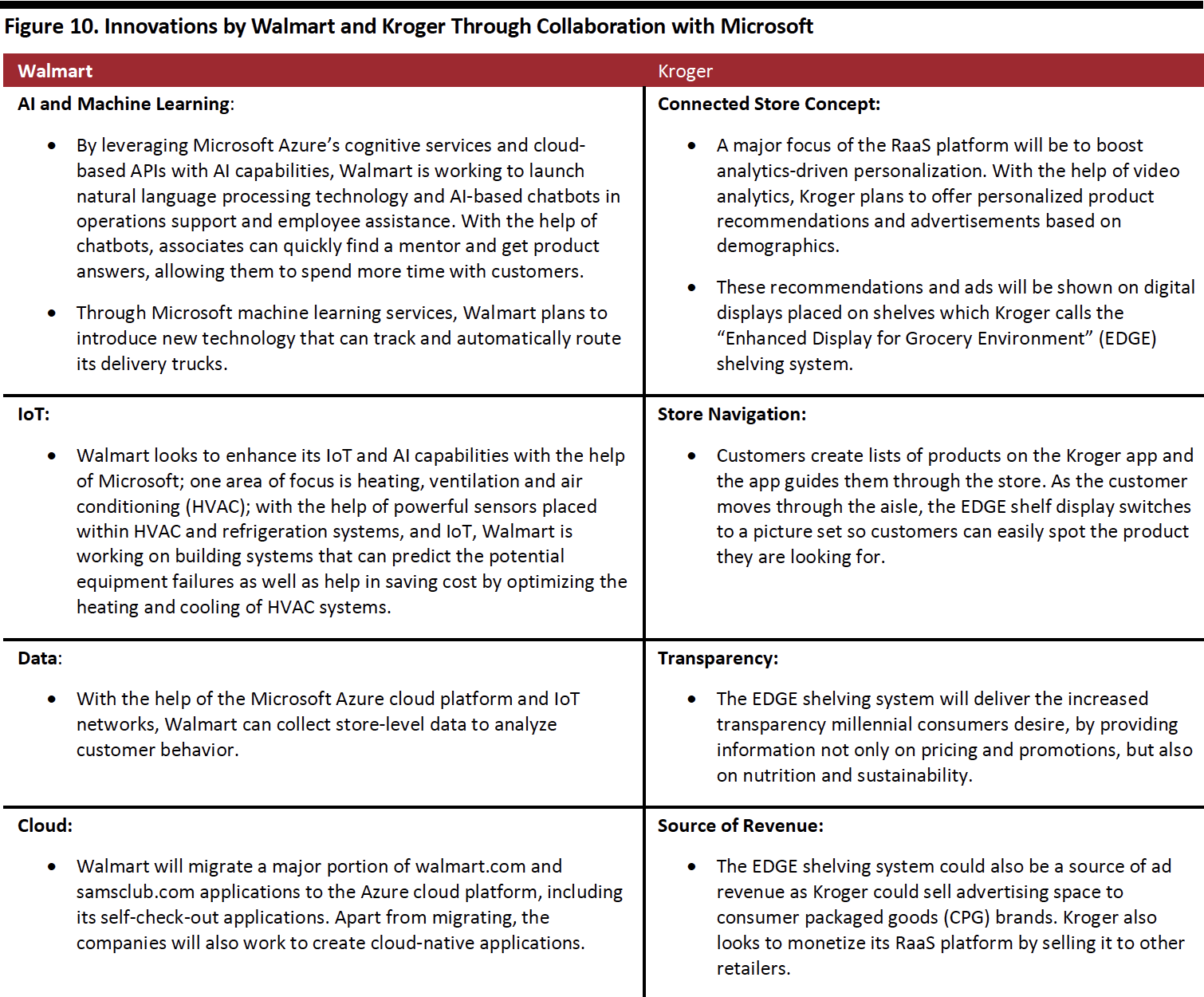

Walmart and Kroger Partner with Microsoft

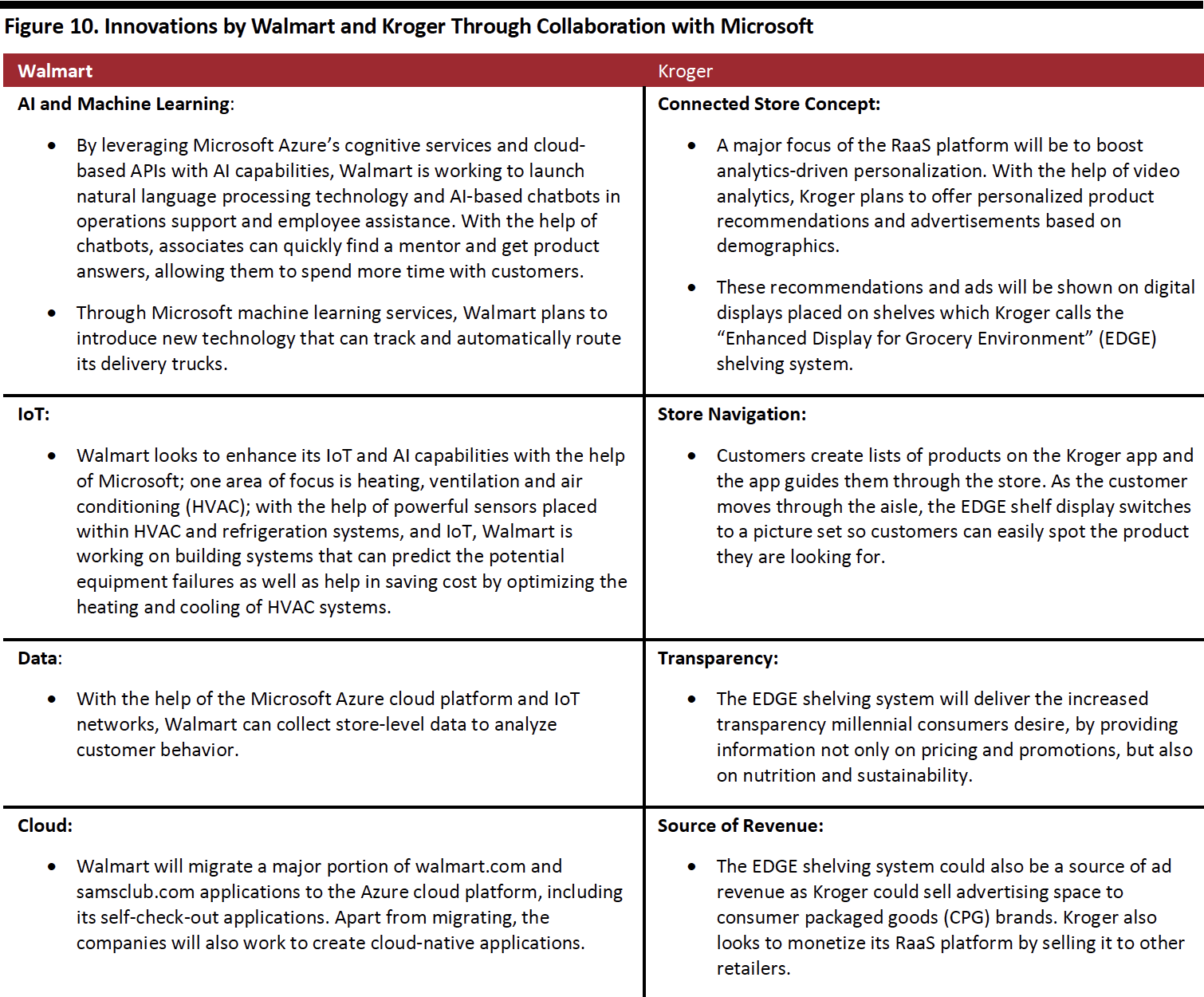

In July 2018, Walmart and Microsoft announced a five-year cloud partnership to drive digital transformation, supported by AI, cloud and IoT technology. Similarly, in January 2019, Kroger announced a collaboration with Microsoft to leverage the latter’s Azure cloud technology to develop and market a retail as a service (RaaS) platform, which will include a wide array of front- and back-end solutions for retailers. Collaborating with Microsoft, Kroger announced it will transform two pilot stores in Monroe, Ohio, and Redmond, Washington.

[caption id="attachment_91589" align="aligncenter" width="700"]

Source: MarketsandMarkets[/caption]

Walmart: The company has tied up with Waymo, a self-driving platform developer and subsidiary of Alphabet Inc., to provide pick up and drop service for online shoppers: A self-driving vehicle is dispatched to pick up the customer, drive him or her to the store to pick up the online order, then drive the customer back home. It started pilot service in Phoenix, Arizona, in July 2018.

Walmart has also partnered with Ford and PostMates to test grocery delivery using self-driving vehicles. The pilot project began in Miami-Dade County in November 2018.

Kroger: Kroger launched a self-drive delivery pilot service in Scottsdale, Arizona, in August 2018, in collaboration with Nuro, a startup that designs and develops autonomous delivery vehicles. The Kroger-owned Fry’s store was the only one to participate in the pilot under which online grocery orders are loaded into self-drive vehicles and delivered to customers. In April 2019, the service was extended to Houston. Nuro will initially use regular cars outfitted with its auto pilot platform, but will later use its custom-built self-driving robots.

Retail-Tech Collaborations

Retail-tech collaboration can pave the way for new innovations in the retail sector.

Leading tech companies such as Microsoft, Google and Alert Innovation have been involved in many recent retail tie-ups. In 2017, Kroger launched its “Restock Kroger” plan to redefine the customer experience by emphasizing digitalization and collaborating with technology companies to gain access to emerging technologies driven by IoT, machine learning and AI.

Kroger is working with Microsoft, Ocado and the University of Cincinnati to revamp its stores and distribution centers.

Walmart and Kroger Partner with Microsoft

In July 2018, Walmart and Microsoft announced a five-year cloud partnership to drive digital transformation, supported by AI, cloud and IoT technology. Similarly, in January 2019, Kroger announced a collaboration with Microsoft to leverage the latter’s Azure cloud technology to develop and market a retail as a service (RaaS) platform, which will include a wide array of front- and back-end solutions for retailers. Collaborating with Microsoft, Kroger announced it will transform two pilot stores in Monroe, Ohio, and Redmond, Washington.

[caption id="attachment_91589" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Walmart Collaborates with Alert Innovation

In August 2018, Walmart partnered with Alert Innovation, a robotics automation company, to deploy Alphabot in its Salem, New Hampshire store. The robotics system was installed to speed online order fulfillment. Alphabots pick the items from storage and deliver them to store staff, who pack the orders.

Walmart and Google Collaboration

Walmart collaborated with Google in August 2017 to launch voice shopping via Google Assistant. With the help of Google Home Mini, customers can shop more than two million Walmart items using voice commands with the help of Google Assistant. Customers also get personalized recommendations based on previous purchases. Easy Reorder reminds shoppers of other items they have bought online or instore as they shop.

Kroger Partnership with Ocado

In May 2018, Kroger announced a collaboration with Ocado to strengthen its e-commerce capabilities. The agreement will see the companies build 20 robot-equipped customer fulfillment centers (CFCs). Robots in Ocado’s automated warehouse model move in a grid network controlled by an air traffic system, picking crates of products and delivering them to packing stations. Founded as an online-only supermarket in April 2000, Ocado has emerged as a technology company with expertise in warehouse automation.

The companies announced the first automated CFC will be in Monroe, Ohio. In March 2019, Kroger announced Groveland, Florida as the location of its second CFC.

Kroger Partners with the University of Cincinnati

In August 2018, Kroger collaborated with the University of Cincinnati to operate an innovation lab within the school's 1819 Innovation Hub. Through the collaboration, Kroger will focus on developing innovative solutions to better serve its consumers. The innovation lab will be staffed with R&D engineers, software developers, university faculty and interns. Kroger hosted five interns this spring per its internship program at the 1819 Innovation Hub.

Technology-Driven Employee Productivity Initiatives

Walmart

Walmart has been investing in increasing employee productivity: It introduced mobile apps and in-store robots to assist associates in their routine tasks and help improve efficiency.

1) Mobile Applications

Walmart introduced the My Productivity App back in 2016, which integrated access to sales, replenishment, warehouse and other data, letting associates access any department without physically disappearing from the store. Walmart estimates associates spend thousands of hours in back rooms away from the sales floor annually and the My Productivity App has enabled the associates to spend most of their working hours with customers.

Walmart also introduced a suite of apps in September 2018. These apps give associates visibility that helps them spend less time on routine tasks and more time on the floor with customers.

Source: Company reports/Coresight Research[/caption]

Walmart Collaborates with Alert Innovation

In August 2018, Walmart partnered with Alert Innovation, a robotics automation company, to deploy Alphabot in its Salem, New Hampshire store. The robotics system was installed to speed online order fulfillment. Alphabots pick the items from storage and deliver them to store staff, who pack the orders.

Walmart and Google Collaboration

Walmart collaborated with Google in August 2017 to launch voice shopping via Google Assistant. With the help of Google Home Mini, customers can shop more than two million Walmart items using voice commands with the help of Google Assistant. Customers also get personalized recommendations based on previous purchases. Easy Reorder reminds shoppers of other items they have bought online or instore as they shop.

Kroger Partnership with Ocado

In May 2018, Kroger announced a collaboration with Ocado to strengthen its e-commerce capabilities. The agreement will see the companies build 20 robot-equipped customer fulfillment centers (CFCs). Robots in Ocado’s automated warehouse model move in a grid network controlled by an air traffic system, picking crates of products and delivering them to packing stations. Founded as an online-only supermarket in April 2000, Ocado has emerged as a technology company with expertise in warehouse automation.

The companies announced the first automated CFC will be in Monroe, Ohio. In March 2019, Kroger announced Groveland, Florida as the location of its second CFC.

Kroger Partners with the University of Cincinnati

In August 2018, Kroger collaborated with the University of Cincinnati to operate an innovation lab within the school's 1819 Innovation Hub. Through the collaboration, Kroger will focus on developing innovative solutions to better serve its consumers. The innovation lab will be staffed with R&D engineers, software developers, university faculty and interns. Kroger hosted five interns this spring per its internship program at the 1819 Innovation Hub.

Technology-Driven Employee Productivity Initiatives

Walmart

Walmart has been investing in increasing employee productivity: It introduced mobile apps and in-store robots to assist associates in their routine tasks and help improve efficiency.

1) Mobile Applications

Walmart introduced the My Productivity App back in 2016, which integrated access to sales, replenishment, warehouse and other data, letting associates access any department without physically disappearing from the store. Walmart estimates associates spend thousands of hours in back rooms away from the sales floor annually and the My Productivity App has enabled the associates to spend most of their working hours with customers.

Walmart also introduced a suite of apps in September 2018. These apps give associates visibility that helps them spend less time on routine tasks and more time on the floor with customers.

Source: Center for Biological Diversity and Ugly Fruit and Veg Campaign[/caption]

Blockchain Technology in Grocery

With the growing popularity of cryptocurrencies, blockchain has emerged as a technology for storing transaction data in ledgers known as “blocks” which are interlinked using the cryptography. Blockchain technology was extensively used in Bitcoin trading and soon became popular because of its decentralized model, which makes it more difficult to hack. Now, it’s catching on in retail. In our report Blockchain in Retail, we discuss how blockchain can disrupt retail operations. By decentralizing processes through which retailers interact with partners, industry players and consumers, blockchain technology has the potential to make operations more efficient and secure.

In 2016, IBM and Walmart teamed up to start a blockchain project. The initial project was to trace shipments of fresh mangos. IBM extended its collaboration to Kroger, Wegmans Food Markets, McLane, and suppliers such as Dole, Driscoll’s, Golden State Foods, McCormick and Co, Nestle, Tyson Foods and Unilever. The collaboration, called “The Food Trust Blockchain,” stores data on over one million items sourced by the retailers.

Blockchain can trace items back to the source in the event of problems but also just to increase transparency and help retailers improve the quality of their offerings. Faced with an outbreak of e. coli in early 2018, Walmart was able to trace the leafy greens that were the source within a few seconds using blockchain – which otherwise would have taken a week. Walmart plans to extend its blockchain initiative to other vegetable and fruit suppliers in 2019.

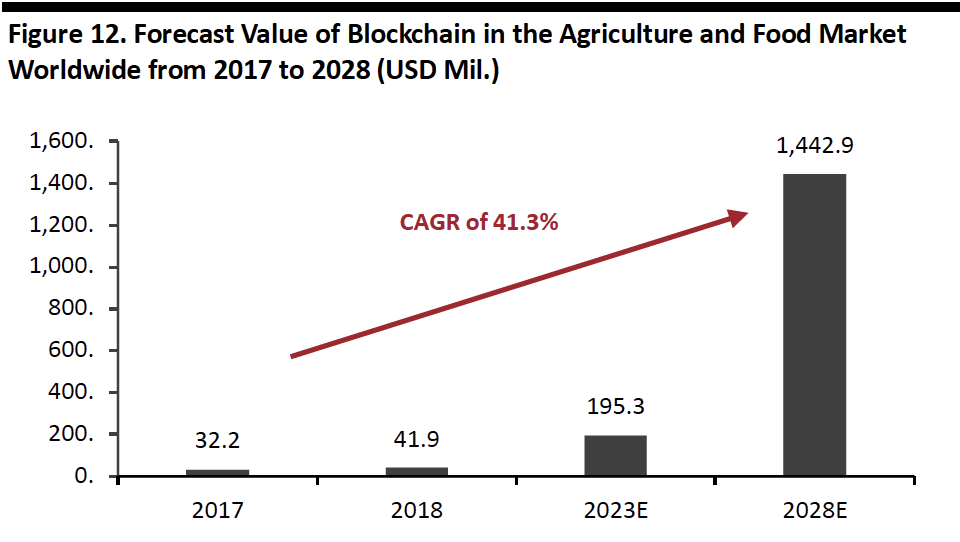

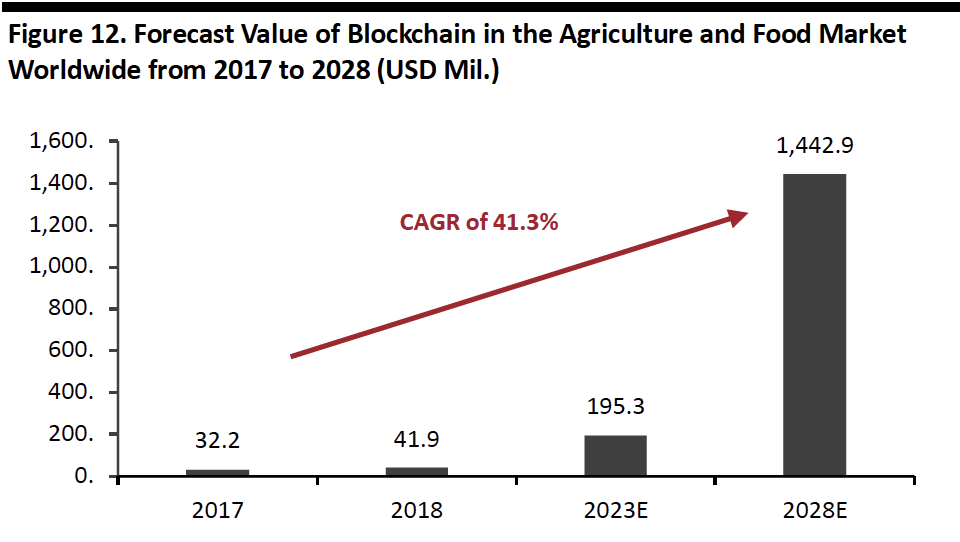

Adoption of blockchain technology in grocery is likely to increase rapidly. According to BIS Research, the global market value of blockchain in the agriculture and food market was estimated at $41.9 million in 2018 and is projected to reach $1.4 billion by 2028.

[caption id="attachment_91591" align="aligncenter" width="700"]

Source: Center for Biological Diversity and Ugly Fruit and Veg Campaign[/caption]

Blockchain Technology in Grocery

With the growing popularity of cryptocurrencies, blockchain has emerged as a technology for storing transaction data in ledgers known as “blocks” which are interlinked using the cryptography. Blockchain technology was extensively used in Bitcoin trading and soon became popular because of its decentralized model, which makes it more difficult to hack. Now, it’s catching on in retail. In our report Blockchain in Retail, we discuss how blockchain can disrupt retail operations. By decentralizing processes through which retailers interact with partners, industry players and consumers, blockchain technology has the potential to make operations more efficient and secure.

In 2016, IBM and Walmart teamed up to start a blockchain project. The initial project was to trace shipments of fresh mangos. IBM extended its collaboration to Kroger, Wegmans Food Markets, McLane, and suppliers such as Dole, Driscoll’s, Golden State Foods, McCormick and Co, Nestle, Tyson Foods and Unilever. The collaboration, called “The Food Trust Blockchain,” stores data on over one million items sourced by the retailers.

Blockchain can trace items back to the source in the event of problems but also just to increase transparency and help retailers improve the quality of their offerings. Faced with an outbreak of e. coli in early 2018, Walmart was able to trace the leafy greens that were the source within a few seconds using blockchain – which otherwise would have taken a week. Walmart plans to extend its blockchain initiative to other vegetable and fruit suppliers in 2019.

Adoption of blockchain technology in grocery is likely to increase rapidly. According to BIS Research, the global market value of blockchain in the agriculture and food market was estimated at $41.9 million in 2018 and is projected to reach $1.4 billion by 2028.

[caption id="attachment_91591" align="aligncenter" width="700"] Source: BIS Research/Statista[/caption]

Key Insights

The digitalization of grocery retailing is about much more than e-commerce. Walmart and Kroger are leading the charge in digital adoption across the grocery supply chain and in stores. In the coming years, we expect adoption of customer-facing technologies to strip ever more friction out of the grocery shopping process. In the frequently purchased, nondiscretionary grocery category, we expect consumers to increasingly look for tools, services and channels that eliminate pain points from the shopping journey.

Grocery retailers will respond by adopting technology to better serve customers through faster delivery and seamless in-store shopping experiences. Retailers will embrace new technologies driven by IoT, AI and machine learning to transform the physical store into a connected store. And we expect to see retailers expand robotic delivery and increase their use of robots in stores and distribution centers.

Source: BIS Research/Statista[/caption]

Key Insights

The digitalization of grocery retailing is about much more than e-commerce. Walmart and Kroger are leading the charge in digital adoption across the grocery supply chain and in stores. In the coming years, we expect adoption of customer-facing technologies to strip ever more friction out of the grocery shopping process. In the frequently purchased, nondiscretionary grocery category, we expect consumers to increasingly look for tools, services and channels that eliminate pain points from the shopping journey.

Grocery retailers will respond by adopting technology to better serve customers through faster delivery and seamless in-store shopping experiences. Retailers will embrace new technologies driven by IoT, AI and machine learning to transform the physical store into a connected store. And we expect to see retailers expand robotic delivery and increase their use of robots in stores and distribution centers.

Base: US Retailers, surveyed in August 2017

Base: US Retailers, surveyed in August 2017Source: NAPCO Research[/caption] As discussed in our report US Millennials and Grocery, millennials have a strong influence on the US grocery retail industry due to sheer numbers and their resulting spending power. Millennials are digital natives and so are likely to expect seamless digital experiences when buying groceries. As a result, retailers have been improving their digital and omnichannel platforms, embracing new innovations to speed the supply chain, delivery and check-out, and help them cut out cost in distribution and stores, including by improving employee productivity. Technological Innovations By Walmart and Kroger Walmart and Kroger are leading innovation in the retail grocery landscape. In the following sections, we dive into their major innovations. The technologies we discuss in this report include the following: [caption id="attachment_91581" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Seamless Shopping Experience

Increasingly, customers expect to shop, check out, pay and get orders fulfilled in a variety of ways. Particularly in the frequently purchased, nondiscretionary grocery category, we expect consumers to increasingly look for services and channels that eliminate friction from the shopping process. To meet such consumer demands, grocery retailers have started adopting advanced technology, driven by machine learning, computer vision and IoT, which can transform the consumer shopping experience.

1) Sam's Club’s Scan & Go versus Kroger’s Scan, Bag, Go versus Amazon Go

Self-scan and autonomous checkouts are set to help eliminate pain points in grocery retail, by allowing customers to skip the checkout lines. The difference between self-scan and autonomous checkouts is that with self-scan, such as Sam's Club’s Scan & Go and Kroger’s Scan, Bag, Go, customers must scan the items before checking out, but they still skip the checkout lines. With autonomous checkout such as that deployed by Amazon Go, consumers don’t even have to scan items, as the task is handled by technology.

Amazon launched autonomous checkout in its 1,800-square-foot Amazon Go store in Seattle, opened in January 2018. Customers check in through turnstiles by scanning the Amazon Go smartphone app. Cameras and sensors detect each product that customers take from the shelf and update the shopper’s cart. When customers finish shopping and walk through a checkout gate, the system automatically charges the customer’s account using stored payment information. Similar stores have been opened by other retailers, particularly in China, which we discussed in an earlier report.

According to a March 2018 survey conducted by YouGov, a market research firm, 50% of US respondents said they would like to use scan and go technology to buy groceries, compared to 25% of respondents who said they would like to use scan and go technology to buy beauty/cosmetic items. Of the major retail categories suggested to respondents, groceries was by far the most popular option — underlining how shoppers want to drive friction out of shopping for this category.

[caption id="attachment_91582" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Seamless Shopping Experience

Increasingly, customers expect to shop, check out, pay and get orders fulfilled in a variety of ways. Particularly in the frequently purchased, nondiscretionary grocery category, we expect consumers to increasingly look for services and channels that eliminate friction from the shopping process. To meet such consumer demands, grocery retailers have started adopting advanced technology, driven by machine learning, computer vision and IoT, which can transform the consumer shopping experience.

1) Sam's Club’s Scan & Go versus Kroger’s Scan, Bag, Go versus Amazon Go

Self-scan and autonomous checkouts are set to help eliminate pain points in grocery retail, by allowing customers to skip the checkout lines. The difference between self-scan and autonomous checkouts is that with self-scan, such as Sam's Club’s Scan & Go and Kroger’s Scan, Bag, Go, customers must scan the items before checking out, but they still skip the checkout lines. With autonomous checkout such as that deployed by Amazon Go, consumers don’t even have to scan items, as the task is handled by technology.

Amazon launched autonomous checkout in its 1,800-square-foot Amazon Go store in Seattle, opened in January 2018. Customers check in through turnstiles by scanning the Amazon Go smartphone app. Cameras and sensors detect each product that customers take from the shelf and update the shopper’s cart. When customers finish shopping and walk through a checkout gate, the system automatically charges the customer’s account using stored payment information. Similar stores have been opened by other retailers, particularly in China, which we discussed in an earlier report.

According to a March 2018 survey conducted by YouGov, a market research firm, 50% of US respondents said they would like to use scan and go technology to buy groceries, compared to 25% of respondents who said they would like to use scan and go technology to buy beauty/cosmetic items. Of the major retail categories suggested to respondents, groceries was by far the most popular option — underlining how shoppers want to drive friction out of shopping for this category.

[caption id="attachment_91582" align="aligncenter" width="700"] Base: US Internet users aged 18+, surveyed in March 2018

Base: US Internet users aged 18+, surveyed in March 2018Source: YouGov[/caption] Following the launch of Amazon Go, in October 2018 Walmart launched an upgraded self-scan service at its Sam’s Club Now store in Dallas. Sam’s Club’s Scan & Go works in a similar way to Walmart’s previous Scan & Go service — which the company ended in April 2018 and which we discuss in the next section. With the Scan & Go smartphone app, Sam’s Club customers scan product barcodes, then use the app to pay and the receipt is manually verified by associates at the exit. (Walmart and Sam’s Club stores have associates at the door to check customer receipts.) Before launching the Scan & Go app in Sam’s Club stores, Walmart introduced the technology in its own stores: Back in August 2012, it launched a pilot service at Arkansas stores for iPhone users. By March 2013, the service was expanded to 200 stores from 70. In January 2017, the service was made available to Android users. But Walmart suspended the service in April 2018. Even though customers were able to skip the checkout line, Scan & Go posed challenges which prompted Walmart to end the service. The reasons were:

- Low consumer participation, as customers found scanning and bagging big items difficult.

- The technology transferred the manual work from store associates to the consumers.

- Walmart also cited “difficult-to-scale and error-prone systems” as reasons for discontinuing the service.

- Owing to low participation, Walmart found the infrastructure investment uneconomical.

Source: Company reports[/caption]

Amazon Go has a clear edge over Sam’s Club’s Scan & Go and Kroger’s Scan, Bag, Go, since Walmart and Kroger customers still need to scan products. However, as Kroger and Walmart ramp up their technology, aided by technology partners, we expect these companies to adopt AI, machine learning and IoT and make their checkout processes more autonomous.

Based on data from the Google Play Store, Sam’s Club’s Scan & Go remains the clear winner in terms of number of app downloads and average user rating. The data reflect downloads and ratings by users of Android smartphones.

[caption id="attachment_91584" align="aligncenter" width="700"]

Source: Company reports[/caption]

Amazon Go has a clear edge over Sam’s Club’s Scan & Go and Kroger’s Scan, Bag, Go, since Walmart and Kroger customers still need to scan products. However, as Kroger and Walmart ramp up their technology, aided by technology partners, we expect these companies to adopt AI, machine learning and IoT and make their checkout processes more autonomous.

Based on data from the Google Play Store, Sam’s Club’s Scan & Go remains the clear winner in terms of number of app downloads and average user rating. The data reflect downloads and ratings by users of Android smartphones.

[caption id="attachment_91584" align="aligncenter" width="700"] Download numbers are rounded; Sam’s Club Scan & Go downloads as of May 17, 2019, Amazon Go downloads as of June 11, 2019, and Kroger's Scan, Bag, Go downloads as of May 21, 2019

Download numbers are rounded; Sam’s Club Scan & Go downloads as of May 17, 2019, Amazon Go downloads as of June 11, 2019, and Kroger's Scan, Bag, Go downloads as of May 21, 2019Source: Google Play Store[/caption] What are the Benefits of Scan and Go Technology? Scan and go can be a “win-win” situation for retailers and consumers. Scan and go integrates the shopping process with smartphones; so, apart from tracking their basket and saving time by avoiding the checkout line, customers can also get digital coupons and personalized shopping recommendations on their phones. Retailers can cut labor costs and employ associates in other productive roles, reduce equipment costs (such as self-checkout kiosks) and rationalize floor space. In-app coupons, loyalty points and discounts can prompt consumers to shop more, which can be difficult to execute in traditional shopping set up. When retailers distribute proprietary payment cards integrated into scan and go systems and promote those cards through fee waivers and offers, they also save on third-party fees and commission. For the retailers, the cost incurred on private-label payment cards is typically lower than that on cards issued by third parties. [caption id="attachment_91585" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

2) Kiosks

Walmart Self-Service Kiosks

Walmart launched self-serve kiosks for grocery pick-up in the parking lot of one of its Oklahoma superstores on June 2017. After customers purchase groceries online, associates pack the grocery items and store them in the giant kiosks placed in the parking area of the store. Customers pick up orders with a code. In October 2018, Walmart opened its second refrigerated automated grocery kiosk in Sherman, about 60 miles north of Dallas, also in the parking lot.

3) Experiential Shopping

Walmart introduced the Walmart app, which not only has Walmart Pay, but other features such as a product search bar, reviews and pricing information for products available in store. Walmart is also leveraging VR to allow customers to shop from the comfort of their home.

[caption id="attachment_91586" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

2) Kiosks

Walmart Self-Service Kiosks

Walmart launched self-serve kiosks for grocery pick-up in the parking lot of one of its Oklahoma superstores on June 2017. After customers purchase groceries online, associates pack the grocery items and store them in the giant kiosks placed in the parking area of the store. Customers pick up orders with a code. In October 2018, Walmart opened its second refrigerated automated grocery kiosk in Sherman, about 60 miles north of Dallas, also in the parking lot.

3) Experiential Shopping

Walmart introduced the Walmart app, which not only has Walmart Pay, but other features such as a product search bar, reviews and pricing information for products available in store. Walmart is also leveraging VR to allow customers to shop from the comfort of their home.

[caption id="attachment_91586" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Use of Autonomous Vehicles in Grocery Delivery

As e-commerce continues to grow quickly, so too do customer expectations of rapid delivery. We estimate that online retail sales of food and drink totaled a little under $22 billion in 2018, having climbed around 26% year over year and by a total of almost 200% in five years. Walmart and Kroger have seen very strong growth in e-commerce, as we show below.

As more consumers shop online, retailers have started offering same-day to one-hour delivery services. To accomplish this at scale, retailers may need to look to innovative delivery options driven by technology.

[caption id="attachment_91587" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Use of Autonomous Vehicles in Grocery Delivery

As e-commerce continues to grow quickly, so too do customer expectations of rapid delivery. We estimate that online retail sales of food and drink totaled a little under $22 billion in 2018, having climbed around 26% year over year and by a total of almost 200% in five years. Walmart and Kroger have seen very strong growth in e-commerce, as we show below.

As more consumers shop online, retailers have started offering same-day to one-hour delivery services. To accomplish this at scale, retailers may need to look to innovative delivery options driven by technology.

[caption id="attachment_91587" align="aligncenter" width="700"] For Walmart, prior to 4Q17, the growth rates are global e-commerce growth rates. Kroger 4Q figures are for the respective full fiscal years; 4Q e-commerce growth was not broken out.

For Walmart, prior to 4Q17, the growth rates are global e-commerce growth rates. Kroger 4Q figures are for the respective full fiscal years; 4Q e-commerce growth was not broken out.Source: Company reports[/caption] Retailers have launched pilot programs to use self-driving vehicles and robots to deliver groceries. According to consulting and research firm MarketsandMarkets, the global delivery robots market is expected to grow at a CAGR of 19.2% to $34.0 million by 2024. [caption id="attachment_91588" align="aligncenter" width="700"]

Source: MarketsandMarkets[/caption]

Walmart: The company has tied up with Waymo, a self-driving platform developer and subsidiary of Alphabet Inc., to provide pick up and drop service for online shoppers: A self-driving vehicle is dispatched to pick up the customer, drive him or her to the store to pick up the online order, then drive the customer back home. It started pilot service in Phoenix, Arizona, in July 2018.

Walmart has also partnered with Ford and PostMates to test grocery delivery using self-driving vehicles. The pilot project began in Miami-Dade County in November 2018.

Kroger: Kroger launched a self-drive delivery pilot service in Scottsdale, Arizona, in August 2018, in collaboration with Nuro, a startup that designs and develops autonomous delivery vehicles. The Kroger-owned Fry’s store was the only one to participate in the pilot under which online grocery orders are loaded into self-drive vehicles and delivered to customers. In April 2019, the service was extended to Houston. Nuro will initially use regular cars outfitted with its auto pilot platform, but will later use its custom-built self-driving robots.

Retail-Tech Collaborations

Retail-tech collaboration can pave the way for new innovations in the retail sector.

Leading tech companies such as Microsoft, Google and Alert Innovation have been involved in many recent retail tie-ups. In 2017, Kroger launched its “Restock Kroger” plan to redefine the customer experience by emphasizing digitalization and collaborating with technology companies to gain access to emerging technologies driven by IoT, machine learning and AI.

Kroger is working with Microsoft, Ocado and the University of Cincinnati to revamp its stores and distribution centers.

Walmart and Kroger Partner with Microsoft

In July 2018, Walmart and Microsoft announced a five-year cloud partnership to drive digital transformation, supported by AI, cloud and IoT technology. Similarly, in January 2019, Kroger announced a collaboration with Microsoft to leverage the latter’s Azure cloud technology to develop and market a retail as a service (RaaS) platform, which will include a wide array of front- and back-end solutions for retailers. Collaborating with Microsoft, Kroger announced it will transform two pilot stores in Monroe, Ohio, and Redmond, Washington.

[caption id="attachment_91589" align="aligncenter" width="700"]

Source: MarketsandMarkets[/caption]

Walmart: The company has tied up with Waymo, a self-driving platform developer and subsidiary of Alphabet Inc., to provide pick up and drop service for online shoppers: A self-driving vehicle is dispatched to pick up the customer, drive him or her to the store to pick up the online order, then drive the customer back home. It started pilot service in Phoenix, Arizona, in July 2018.

Walmart has also partnered with Ford and PostMates to test grocery delivery using self-driving vehicles. The pilot project began in Miami-Dade County in November 2018.

Kroger: Kroger launched a self-drive delivery pilot service in Scottsdale, Arizona, in August 2018, in collaboration with Nuro, a startup that designs and develops autonomous delivery vehicles. The Kroger-owned Fry’s store was the only one to participate in the pilot under which online grocery orders are loaded into self-drive vehicles and delivered to customers. In April 2019, the service was extended to Houston. Nuro will initially use regular cars outfitted with its auto pilot platform, but will later use its custom-built self-driving robots.

Retail-Tech Collaborations

Retail-tech collaboration can pave the way for new innovations in the retail sector.

Leading tech companies such as Microsoft, Google and Alert Innovation have been involved in many recent retail tie-ups. In 2017, Kroger launched its “Restock Kroger” plan to redefine the customer experience by emphasizing digitalization and collaborating with technology companies to gain access to emerging technologies driven by IoT, machine learning and AI.

Kroger is working with Microsoft, Ocado and the University of Cincinnati to revamp its stores and distribution centers.

Walmart and Kroger Partner with Microsoft

In July 2018, Walmart and Microsoft announced a five-year cloud partnership to drive digital transformation, supported by AI, cloud and IoT technology. Similarly, in January 2019, Kroger announced a collaboration with Microsoft to leverage the latter’s Azure cloud technology to develop and market a retail as a service (RaaS) platform, which will include a wide array of front- and back-end solutions for retailers. Collaborating with Microsoft, Kroger announced it will transform two pilot stores in Monroe, Ohio, and Redmond, Washington.

[caption id="attachment_91589" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Walmart Collaborates with Alert Innovation

In August 2018, Walmart partnered with Alert Innovation, a robotics automation company, to deploy Alphabot in its Salem, New Hampshire store. The robotics system was installed to speed online order fulfillment. Alphabots pick the items from storage and deliver them to store staff, who pack the orders.

Walmart and Google Collaboration

Walmart collaborated with Google in August 2017 to launch voice shopping via Google Assistant. With the help of Google Home Mini, customers can shop more than two million Walmart items using voice commands with the help of Google Assistant. Customers also get personalized recommendations based on previous purchases. Easy Reorder reminds shoppers of other items they have bought online or instore as they shop.

Kroger Partnership with Ocado

In May 2018, Kroger announced a collaboration with Ocado to strengthen its e-commerce capabilities. The agreement will see the companies build 20 robot-equipped customer fulfillment centers (CFCs). Robots in Ocado’s automated warehouse model move in a grid network controlled by an air traffic system, picking crates of products and delivering them to packing stations. Founded as an online-only supermarket in April 2000, Ocado has emerged as a technology company with expertise in warehouse automation.

The companies announced the first automated CFC will be in Monroe, Ohio. In March 2019, Kroger announced Groveland, Florida as the location of its second CFC.

Kroger Partners with the University of Cincinnati

In August 2018, Kroger collaborated with the University of Cincinnati to operate an innovation lab within the school's 1819 Innovation Hub. Through the collaboration, Kroger will focus on developing innovative solutions to better serve its consumers. The innovation lab will be staffed with R&D engineers, software developers, university faculty and interns. Kroger hosted five interns this spring per its internship program at the 1819 Innovation Hub.

Technology-Driven Employee Productivity Initiatives

Walmart

Walmart has been investing in increasing employee productivity: It introduced mobile apps and in-store robots to assist associates in their routine tasks and help improve efficiency.

1) Mobile Applications

Walmart introduced the My Productivity App back in 2016, which integrated access to sales, replenishment, warehouse and other data, letting associates access any department without physically disappearing from the store. Walmart estimates associates spend thousands of hours in back rooms away from the sales floor annually and the My Productivity App has enabled the associates to spend most of their working hours with customers.

Walmart also introduced a suite of apps in September 2018. These apps give associates visibility that helps them spend less time on routine tasks and more time on the floor with customers.

Source: Company reports/Coresight Research[/caption]

Walmart Collaborates with Alert Innovation

In August 2018, Walmart partnered with Alert Innovation, a robotics automation company, to deploy Alphabot in its Salem, New Hampshire store. The robotics system was installed to speed online order fulfillment. Alphabots pick the items from storage and deliver them to store staff, who pack the orders.

Walmart and Google Collaboration

Walmart collaborated with Google in August 2017 to launch voice shopping via Google Assistant. With the help of Google Home Mini, customers can shop more than two million Walmart items using voice commands with the help of Google Assistant. Customers also get personalized recommendations based on previous purchases. Easy Reorder reminds shoppers of other items they have bought online or instore as they shop.

Kroger Partnership with Ocado

In May 2018, Kroger announced a collaboration with Ocado to strengthen its e-commerce capabilities. The agreement will see the companies build 20 robot-equipped customer fulfillment centers (CFCs). Robots in Ocado’s automated warehouse model move in a grid network controlled by an air traffic system, picking crates of products and delivering them to packing stations. Founded as an online-only supermarket in April 2000, Ocado has emerged as a technology company with expertise in warehouse automation.

The companies announced the first automated CFC will be in Monroe, Ohio. In March 2019, Kroger announced Groveland, Florida as the location of its second CFC.

Kroger Partners with the University of Cincinnati

In August 2018, Kroger collaborated with the University of Cincinnati to operate an innovation lab within the school's 1819 Innovation Hub. Through the collaboration, Kroger will focus on developing innovative solutions to better serve its consumers. The innovation lab will be staffed with R&D engineers, software developers, university faculty and interns. Kroger hosted five interns this spring per its internship program at the 1819 Innovation Hub.

Technology-Driven Employee Productivity Initiatives

Walmart

Walmart has been investing in increasing employee productivity: It introduced mobile apps and in-store robots to assist associates in their routine tasks and help improve efficiency.

1) Mobile Applications

Walmart introduced the My Productivity App back in 2016, which integrated access to sales, replenishment, warehouse and other data, letting associates access any department without physically disappearing from the store. Walmart estimates associates spend thousands of hours in back rooms away from the sales floor annually and the My Productivity App has enabled the associates to spend most of their working hours with customers.

Walmart also introduced a suite of apps in September 2018. These apps give associates visibility that helps them spend less time on routine tasks and more time on the floor with customers.

- PlanIT: The app is an information center that helps associates stay up to date on company and store announcements. It also facilitates communication between store managers, department managers and associates.

- The receiving app: The biggest challenge associates face is having the merchandise on the shelf when the customers need it. Through the receiving app, back-room associates can scan the truck ID and know what products have arrived at the store. The app saves associate time as they don’t have to manually review inventory.

- The Downstock App: The Boss Nova in-store robot scans the aisles to identify out-of-stock items and alerts associates through the Downstock app.

- The Claims App: The Claims app helps find the best option for a return: selling at off-price, donation or simply disposing of it, sorted in the order in which they should be considered.

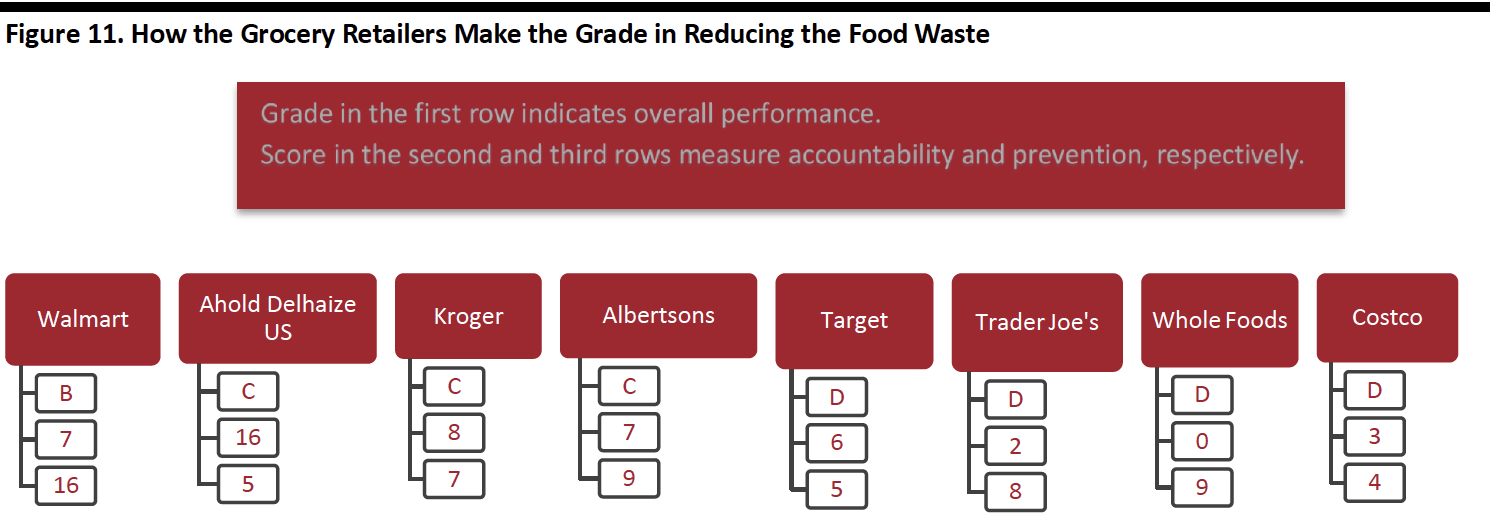

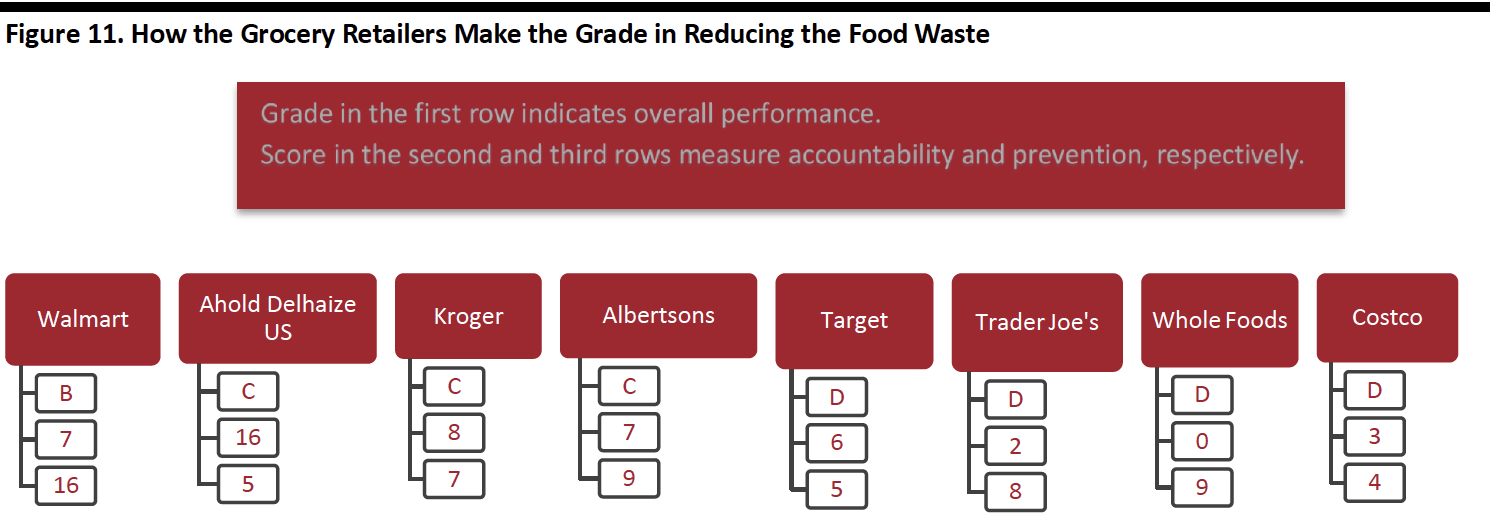

- Accountability: How much data a retailer shares with the public and whether the retailer has a waste reduction goal. Maximum points: 19 (the more points, the better).

- Prevention: Based on initiatives taken to reduce supply chain and produce waste. Maximum points: 20 (the more points, the better).

Source: Center for Biological Diversity and Ugly Fruit and Veg Campaign[/caption]

Blockchain Technology in Grocery

With the growing popularity of cryptocurrencies, blockchain has emerged as a technology for storing transaction data in ledgers known as “blocks” which are interlinked using the cryptography. Blockchain technology was extensively used in Bitcoin trading and soon became popular because of its decentralized model, which makes it more difficult to hack. Now, it’s catching on in retail. In our report Blockchain in Retail, we discuss how blockchain can disrupt retail operations. By decentralizing processes through which retailers interact with partners, industry players and consumers, blockchain technology has the potential to make operations more efficient and secure.

In 2016, IBM and Walmart teamed up to start a blockchain project. The initial project was to trace shipments of fresh mangos. IBM extended its collaboration to Kroger, Wegmans Food Markets, McLane, and suppliers such as Dole, Driscoll’s, Golden State Foods, McCormick and Co, Nestle, Tyson Foods and Unilever. The collaboration, called “The Food Trust Blockchain,” stores data on over one million items sourced by the retailers.

Blockchain can trace items back to the source in the event of problems but also just to increase transparency and help retailers improve the quality of their offerings. Faced with an outbreak of e. coli in early 2018, Walmart was able to trace the leafy greens that were the source within a few seconds using blockchain – which otherwise would have taken a week. Walmart plans to extend its blockchain initiative to other vegetable and fruit suppliers in 2019.

Adoption of blockchain technology in grocery is likely to increase rapidly. According to BIS Research, the global market value of blockchain in the agriculture and food market was estimated at $41.9 million in 2018 and is projected to reach $1.4 billion by 2028.

[caption id="attachment_91591" align="aligncenter" width="700"]

Source: Center for Biological Diversity and Ugly Fruit and Veg Campaign[/caption]

Blockchain Technology in Grocery

With the growing popularity of cryptocurrencies, blockchain has emerged as a technology for storing transaction data in ledgers known as “blocks” which are interlinked using the cryptography. Blockchain technology was extensively used in Bitcoin trading and soon became popular because of its decentralized model, which makes it more difficult to hack. Now, it’s catching on in retail. In our report Blockchain in Retail, we discuss how blockchain can disrupt retail operations. By decentralizing processes through which retailers interact with partners, industry players and consumers, blockchain technology has the potential to make operations more efficient and secure.

In 2016, IBM and Walmart teamed up to start a blockchain project. The initial project was to trace shipments of fresh mangos. IBM extended its collaboration to Kroger, Wegmans Food Markets, McLane, and suppliers such as Dole, Driscoll’s, Golden State Foods, McCormick and Co, Nestle, Tyson Foods and Unilever. The collaboration, called “The Food Trust Blockchain,” stores data on over one million items sourced by the retailers.

Blockchain can trace items back to the source in the event of problems but also just to increase transparency and help retailers improve the quality of their offerings. Faced with an outbreak of e. coli in early 2018, Walmart was able to trace the leafy greens that were the source within a few seconds using blockchain – which otherwise would have taken a week. Walmart plans to extend its blockchain initiative to other vegetable and fruit suppliers in 2019.

Adoption of blockchain technology in grocery is likely to increase rapidly. According to BIS Research, the global market value of blockchain in the agriculture and food market was estimated at $41.9 million in 2018 and is projected to reach $1.4 billion by 2028.

[caption id="attachment_91591" align="aligncenter" width="700"] Source: BIS Research/Statista[/caption]

Key Insights

The digitalization of grocery retailing is about much more than e-commerce. Walmart and Kroger are leading the charge in digital adoption across the grocery supply chain and in stores. In the coming years, we expect adoption of customer-facing technologies to strip ever more friction out of the grocery shopping process. In the frequently purchased, nondiscretionary grocery category, we expect consumers to increasingly look for tools, services and channels that eliminate pain points from the shopping journey.

Grocery retailers will respond by adopting technology to better serve customers through faster delivery and seamless in-store shopping experiences. Retailers will embrace new technologies driven by IoT, AI and machine learning to transform the physical store into a connected store. And we expect to see retailers expand robotic delivery and increase their use of robots in stores and distribution centers.

Source: BIS Research/Statista[/caption]

Key Insights

The digitalization of grocery retailing is about much more than e-commerce. Walmart and Kroger are leading the charge in digital adoption across the grocery supply chain and in stores. In the coming years, we expect adoption of customer-facing technologies to strip ever more friction out of the grocery shopping process. In the frequently purchased, nondiscretionary grocery category, we expect consumers to increasingly look for tools, services and channels that eliminate pain points from the shopping journey.

Grocery retailers will respond by adopting technology to better serve customers through faster delivery and seamless in-store shopping experiences. Retailers will embrace new technologies driven by IoT, AI and machine learning to transform the physical store into a connected store. And we expect to see retailers expand robotic delivery and increase their use of robots in stores and distribution centers.