Nitheesh NH

Introduction: The Inflection Point for the Modern Retailer

The US retail industry is in an era of unprecedented disruption and transformation. The landscape is seeing heightened competition and consumers are rapidly switching between brands, retailers and channels. Many traditional – and iconic – retailers are filing for bankruptcy protection and closing sizable numbers of stores. And based on store closure patterns, we can see major retailers are coming under renewed pressure in 2019: So far this year, US retailers have announced 5,480 store closures – compared to 5,727 closures in all of 2018.

In the past two years, more than the 50 retailers have filed for bankruptcy protection, including household names such as Sears Holdings and Toys “R” Us. So far in 2019, the situation has remained severe as some retailers continue to face declining store traffic, a liquidity crunch, management challenges, weakened competitive positions and ailing credit ratings. At present, retailers account for about one-fifth of total distressed borrowers in the US, according to Bloomberg.

In the following sections, we will discuss how bankruptcies plagued US retailers in 2017 and 2018. We will also get into the details of some of the major bankruptcy victims (those having liabilities of over $50 million) and discuss the reasons for their downfall.

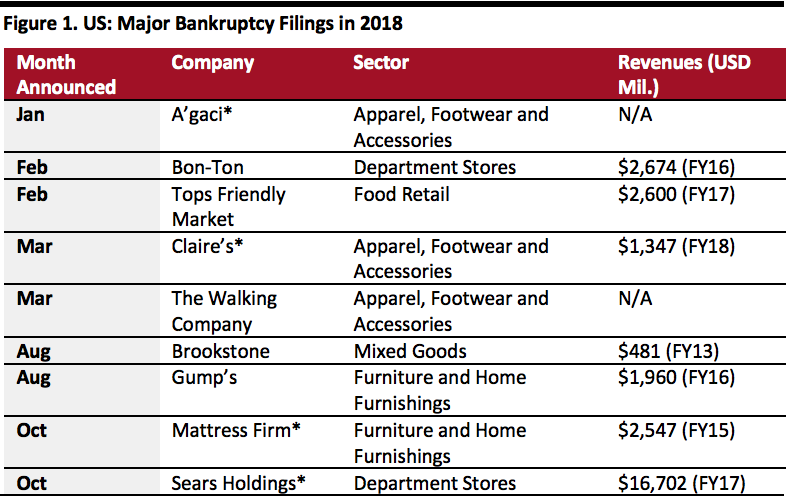

2018 Saw a Large Number of Retail Bankruptcies, Including the Liquidation of Toy “R” Us

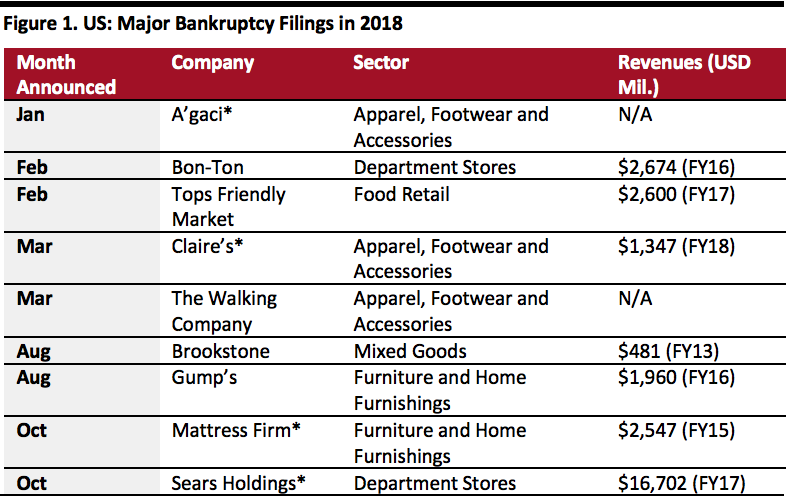

In 2018, US GDP grew 2.9%, its highest growth rate since 2015. Total US retail sales (ex automobiles and gasoline) grew 4.3% year over year to $3.6 trillion in 2018, while the unemployment rate came down to 3.9% in December 2018 versus 4.1% in December 2017. Despite the positive conditions, for many retailers, 2018 was a year of significant challenges. Over a dozen major retail companies, including some well-known department-store chains, food retailers, footwear companies, mattress sellers and home improvement stores, filed for bankruptcy protection in 2018.

The biggest was Sears Holdings, formed in 2005 after the merger of Sears (founded in 1893) and Kmart (founded in 1899). Well-known names such as Bon-Ton and Mattress Firm also went under. While a few retailers, such as Sears, managed to emerge from bankruptcy proceedings, some retail companies closed their doors for good.

One such example is the iconic Toys “R” Us, which was liquidated in 2018 after filing for bankruptcy in September 2017. The company was saddled with billions of dollars in debt that prevented it from making needed investment in store upgrades and technology. A leveraged buyout by a private equity firm for over $5 billion added a huge amount of debt to the balance sheet. Toys “R” Us was also slow to fully embrace e-commerce, leaving it vulnerable to Amazon and other online platforms.

[caption id="attachment_82514" align="aligncenter" width="640"] *Subsequently emerged from bankruptcy

*Subsequently emerged from bankruptcy

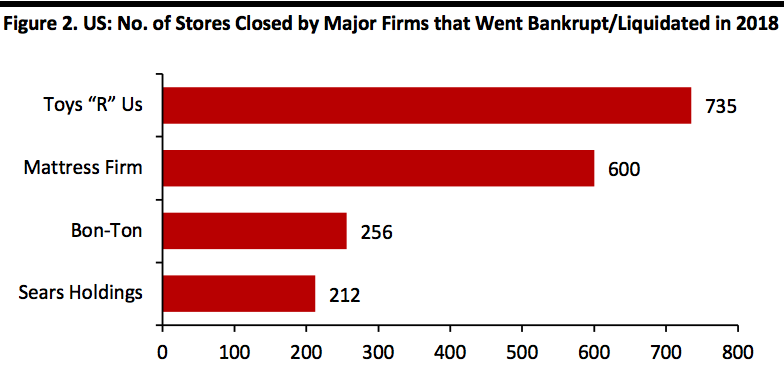

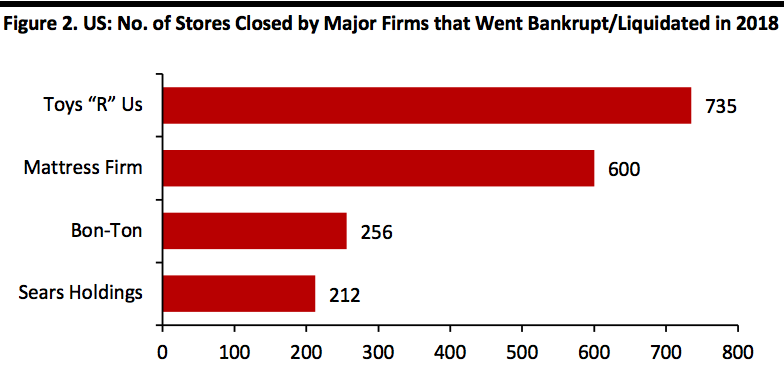

Source: Company reports/Coresight Research[/caption] These bankruptcies contributed to the substantial number of store closures in 2018. In total, Coresight Research recorded 5,726 store closures in the year. We show major closures in 2018 by selected bankrupt retailers below. [caption id="attachment_82515" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

Comparison of US Retail Bankruptcies: 2018 vs. 2017

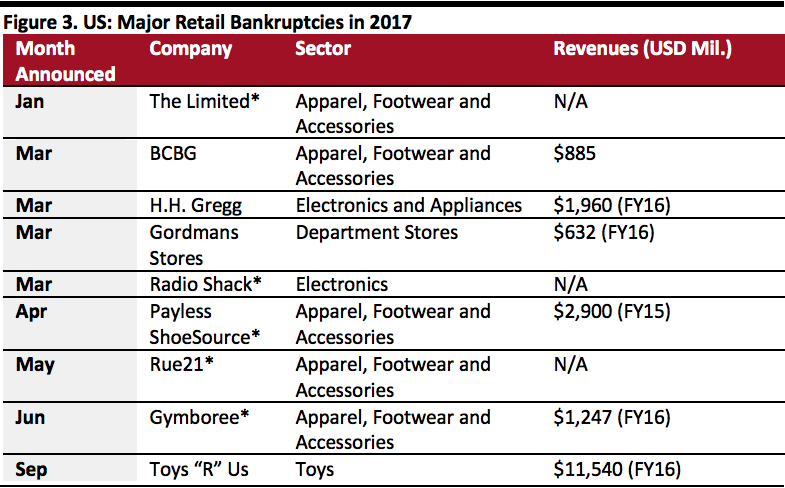

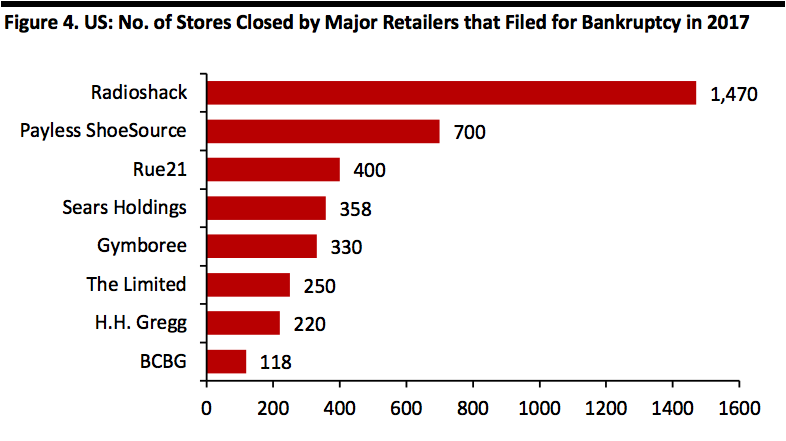

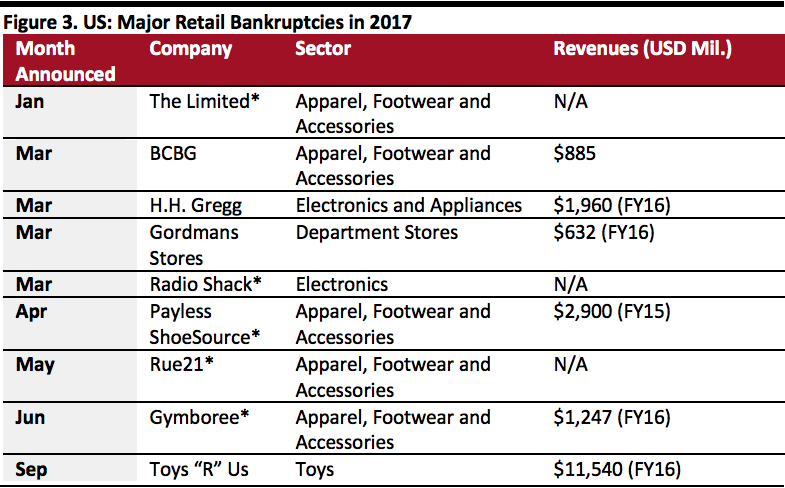

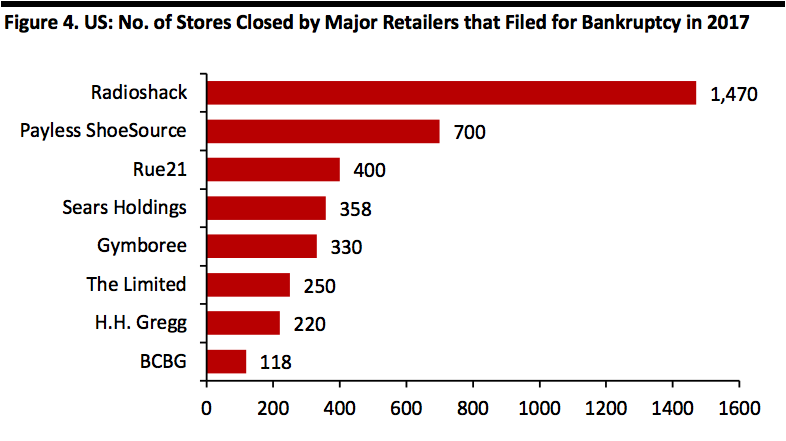

In 2017, bankruptcies among US retailers hit a six-year high after more than 50 retailers sought Chapter 11 protection. Below, we note some of the key similarities and differences between 2017 and 2018 retail bankruptcies.

Source: Company reports/Coresight Research[/caption]

Comparison of US Retail Bankruptcies: 2018 vs. 2017

In 2017, bankruptcies among US retailers hit a six-year high after more than 50 retailers sought Chapter 11 protection. Below, we note some of the key similarities and differences between 2017 and 2018 retail bankruptcies.

*Subsequently merged from bankruptcy

*Subsequently merged from bankruptcy

Source: Company reports/Coresight Research[/caption] Store closures slowed in 2018: After 8,139 store closure announcements in 2017, there were only 5,726 in 2018, a large number of which were due to bankruptcy. [caption id="attachment_82517" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

In summary, 2018 witnessed approximately 16 US retail bankruptcy filings, far fewer than the nearly 50 bankruptcies in 2017. Yet, measured by scale, 2018’s failures proved more painful as we saw filings by some of biggest retailers such as Sears and Mattress Firm, and the liquidation of Toys “R” Us and Bon-Ton Stores.

Retail bankruptcies in 2017 and 2018 occurred due to various reasons. We present some below.

Major Factors That Led to US Retail Bankruptcies in 2017 and 2018

Bankruptcies are being driven by a number of factors: Saturation of brick-and-mortar locations, a shrinking middle-class, competition from online platforms and rising debt, among others.

Source: Company reports/Coresight Research[/caption]

In summary, 2018 witnessed approximately 16 US retail bankruptcy filings, far fewer than the nearly 50 bankruptcies in 2017. Yet, measured by scale, 2018’s failures proved more painful as we saw filings by some of biggest retailers such as Sears and Mattress Firm, and the liquidation of Toys “R” Us and Bon-Ton Stores.

Retail bankruptcies in 2017 and 2018 occurred due to various reasons. We present some below.

Major Factors That Led to US Retail Bankruptcies in 2017 and 2018

Bankruptcies are being driven by a number of factors: Saturation of brick-and-mortar locations, a shrinking middle-class, competition from online platforms and rising debt, among others.

Note: Figures in fixed 2018 dollars

Note: Figures in fixed 2018 dollars

Source: Euromonitor International/Coresight Research[/caption] Source: Debtwire/Bankruptcydata.com/Coresight Research[/caption]

While companies such as Sears Holding and Mattress Firm managed to survive bankruptcy, Toys “R” Us and Bon-Ton did not. In the following segment, we highlight retailers’ struggles after they emerged from the bankruptcy process and how amendments to the bankruptcy laws in 2005 favor liquidation over restructuring.

Despite Emerging from Bankruptcy, Many Retailers Continue to Struggle

Historically, US retailers have used the bankruptcy process to reorganize by reducing the debt significantly and closing most of their stores. Before the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) 2005 law, retailers often spent years in bankruptcy while deciding which leases to keep and which to abandon and which business models to follow. However, the BAPCPA 2005 law gives bankrupt retailers just 210 days to act on store leases. Since it can take up to 90 days to hold a going-out-of-business (GOB) sale, retailers often have just 120 days to propose a reorganization plan and provide disclosure statements to creditors, who then evaluate the plan and decide whether to approve or reject it. Owing to this reduced time frame, bankrupt firms are finding it more difficult to restructure debt and emerge from bankruptcies.

While some retailers manage to emerge strong from bankruptcies, many end up back in bankruptcy or in liquidation, such as The Walking Company and Brookstone, both of which filed for bankruptcies in 2018, the second time in recent years. The main problems are a weak business model, declining topline growth and increasing debt. Also, the bankruptcy process can prove distracting, impacting management’s ability to focus on running the business.

Gymboree and Payless ShoeSource both exited, then subsequently re-entered, bankruptcy. During its first bankruptcy reorganization, Gymboree eliminated $900 million in debt and closed 300 stores, but the company continued to lose market share, from about 27.4% to 15.8%, according to data compiled by Earnest Research and cited by Retail Dive.

In its first bankruptcy, Payless ShoeSource closed 900 stores, leaving it with a substantial footprint of 3,000 outlets, most of which were located in Class-B malls. Payless eliminated $435 million in debt, but continued to carry a substantial burden. In its second bankruptcy, the company said it would close all its remaining 2,100 stores in the US and Puerto Rico.

Both Gymboree and Payless are again on the brink due to their high debt loads and the increasingly competitive retail environment.

Sears Holdings emerged from bankruptcy in February, with 425 fewer stores. The company plans to downsize its full line operation and open smaller stores, each of which will be about one-third the size of its previous stores. Sear’s business restructuring plan relies on deep cuts to overheads, which means the company will have virtually no marketing budget.

Distressed retailers may survive bankruptcy, but we believe many may be short-term revivals that merely delay the inevitable – unless they create a sound long-term restructuring plan.

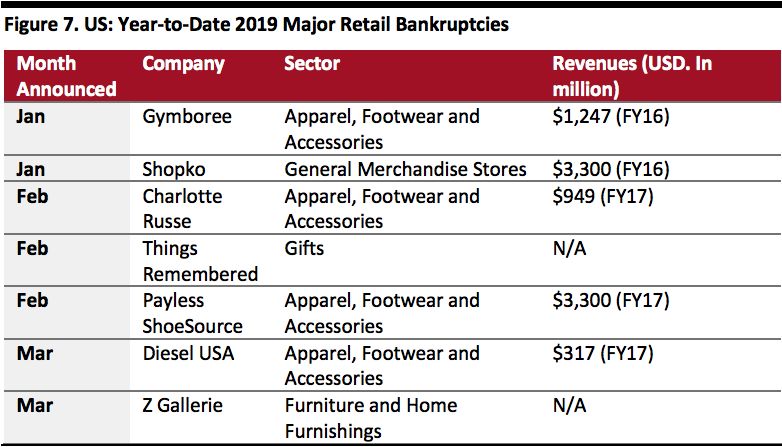

Continuation of Bankruptcies in 2019

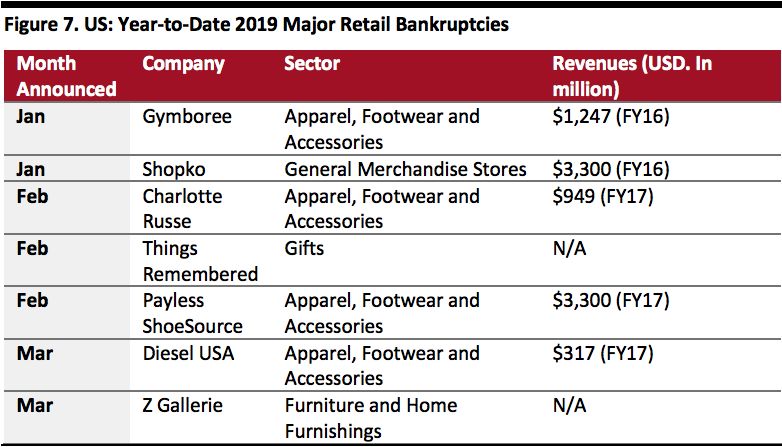

In 2019, bankruptcies are continuing at a rapid pace. Twelve weeks into 2019, seven major retailers have already filed for bankruptcy in the US. Discount store Shopko announced it will liquidate its assets and close all its stores by June 2019, as the company failed to find a buyer for its business.

[caption id="attachment_82524" align="aligncenter" width="640"]

Source: Debtwire/Bankruptcydata.com/Coresight Research[/caption]

While companies such as Sears Holding and Mattress Firm managed to survive bankruptcy, Toys “R” Us and Bon-Ton did not. In the following segment, we highlight retailers’ struggles after they emerged from the bankruptcy process and how amendments to the bankruptcy laws in 2005 favor liquidation over restructuring.

Despite Emerging from Bankruptcy, Many Retailers Continue to Struggle

Historically, US retailers have used the bankruptcy process to reorganize by reducing the debt significantly and closing most of their stores. Before the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) 2005 law, retailers often spent years in bankruptcy while deciding which leases to keep and which to abandon and which business models to follow. However, the BAPCPA 2005 law gives bankrupt retailers just 210 days to act on store leases. Since it can take up to 90 days to hold a going-out-of-business (GOB) sale, retailers often have just 120 days to propose a reorganization plan and provide disclosure statements to creditors, who then evaluate the plan and decide whether to approve or reject it. Owing to this reduced time frame, bankrupt firms are finding it more difficult to restructure debt and emerge from bankruptcies.

While some retailers manage to emerge strong from bankruptcies, many end up back in bankruptcy or in liquidation, such as The Walking Company and Brookstone, both of which filed for bankruptcies in 2018, the second time in recent years. The main problems are a weak business model, declining topline growth and increasing debt. Also, the bankruptcy process can prove distracting, impacting management’s ability to focus on running the business.

Gymboree and Payless ShoeSource both exited, then subsequently re-entered, bankruptcy. During its first bankruptcy reorganization, Gymboree eliminated $900 million in debt and closed 300 stores, but the company continued to lose market share, from about 27.4% to 15.8%, according to data compiled by Earnest Research and cited by Retail Dive.

In its first bankruptcy, Payless ShoeSource closed 900 stores, leaving it with a substantial footprint of 3,000 outlets, most of which were located in Class-B malls. Payless eliminated $435 million in debt, but continued to carry a substantial burden. In its second bankruptcy, the company said it would close all its remaining 2,100 stores in the US and Puerto Rico.

Both Gymboree and Payless are again on the brink due to their high debt loads and the increasingly competitive retail environment.

Sears Holdings emerged from bankruptcy in February, with 425 fewer stores. The company plans to downsize its full line operation and open smaller stores, each of which will be about one-third the size of its previous stores. Sear’s business restructuring plan relies on deep cuts to overheads, which means the company will have virtually no marketing budget.

Distressed retailers may survive bankruptcy, but we believe many may be short-term revivals that merely delay the inevitable – unless they create a sound long-term restructuring plan.

Continuation of Bankruptcies in 2019

In 2019, bankruptcies are continuing at a rapid pace. Twelve weeks into 2019, seven major retailers have already filed for bankruptcy in the US. Discount store Shopko announced it will liquidate its assets and close all its stores by June 2019, as the company failed to find a buyer for its business.

[caption id="attachment_82524" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

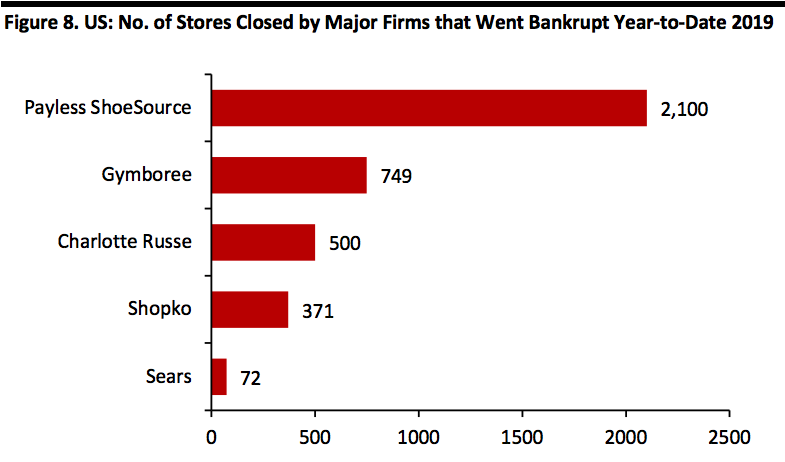

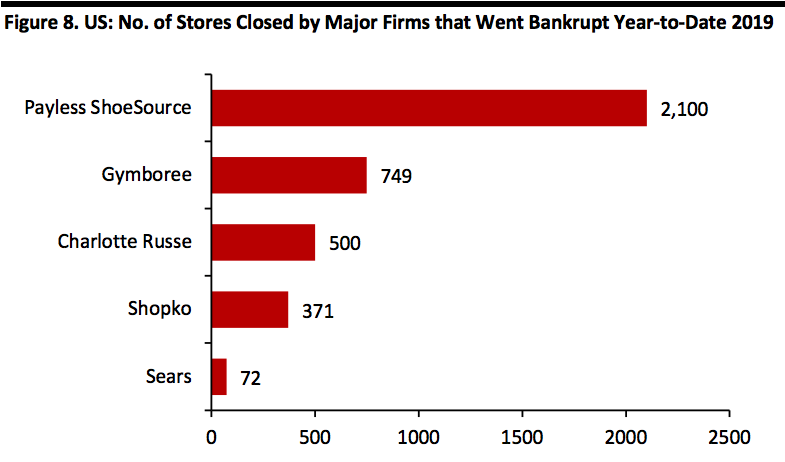

In terms of store closures, year-to-date 2019, retailers have announced 5,399 store closings, up 71% year over year; some 2,100 of these closures were announced by Payless ShoeSource alone. If we annualize 2019 store closures from the latest part-year data, it would be more than double the store closures reported in 2018.

[caption id="attachment_82526" align="aligncenter" width="640"]

Source: Company reports/Coresight Research[/caption]

In terms of store closures, year-to-date 2019, retailers have announced 5,399 store closings, up 71% year over year; some 2,100 of these closures were announced by Payless ShoeSource alone. If we annualize 2019 store closures from the latest part-year data, it would be more than double the store closures reported in 2018.

[caption id="attachment_82526" align="aligncenter" width="640"] Refers to the period from January 1, 2019 to March 22, 2019

Refers to the period from January 1, 2019 to March 22, 2019

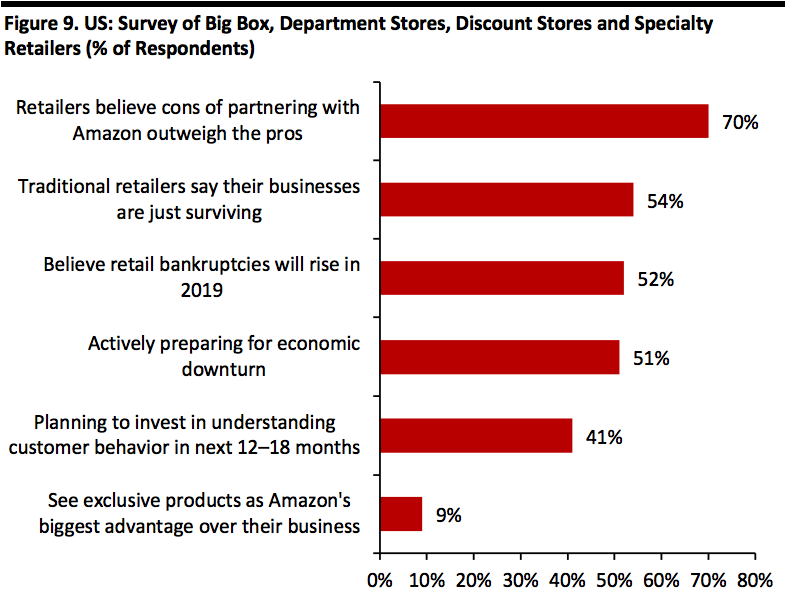

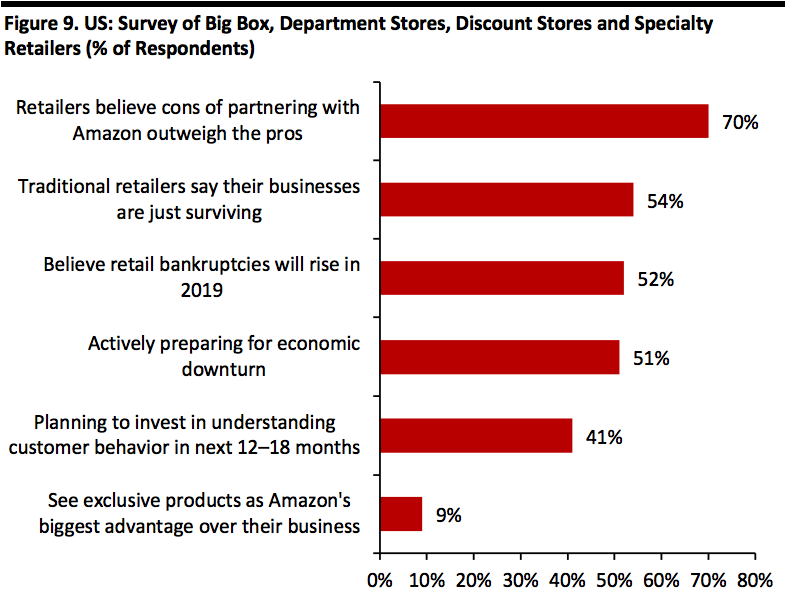

Source: Company reports/Coresight Research[/caption] Over the next 12 to 18 months, the US retail sector seems positioned for further, significant transition – on top of concerns over the ongoing trade war with China and the looming possibility of recession. Retail Industry Outlook According to our analysis of data from the US Census Bureau, retail sales excluding automobiles and gasoline grew 4.3% year over year in 2018. For 2019, the NRF expects US retail sales to grow at 3.8-4.4%, at the midpoint slower than 2018, due to the ongoing US-China trade war and possible economic slowdown. According to a recent survey from the National Association of Business Economics (NABE), about 75% of business economists expect a recession to hit the US by 2021, though only 10% expect a recession in 2019. In retail, some big mall owners have cautioned more bankruptcies are on the way. David Simon, CEO of Simon Property Group, the largest mall owner in the US in terms of total measured area in square feet, said during the 4Q18 earnings conference call that his company is nervous about a few store chains and expects more bankruptcies for retailers with high debt levels. Retail Executives’ Expectations for 2019 According to a 2019 BDO survey of 300 US retail executives, 52% believe retail bankruptcies will rise in 2019 and nearly 51% of are actively preparing for an economic downturn. [caption id="attachment_82527" align="aligncenter" width="640"] Source: BDO/Coresight Research[/caption]

Reviewing Selected Retail Bankruptcies

In the following sections, we review the details of selected major retailers that entered bankruptcy or liquidated in 2018.

Bon-Ton

Established: 1898

Retail sector: Department stores

Bankruptcy filing date: February 4, 2018

Liquidation date: April 17, 2018

Number of stores closed: 256

Bon-Ton was burdened with debt, which it took to finance expansion, including acquisitions of other regional department stores. In 2005, the company made the boldest move in its 107-year history, when it acquired Saks’ Northern Department Store Group for $1.1 billion. The deal exposed Bon-Ton to heavy amounts of debt and stopped Bon-Ton from quickly adapting to changing digital trends that reduced footfall in malls and department stores. At the time of bankruptcy filing, the company carried hundreds of millions of dollars in debt.

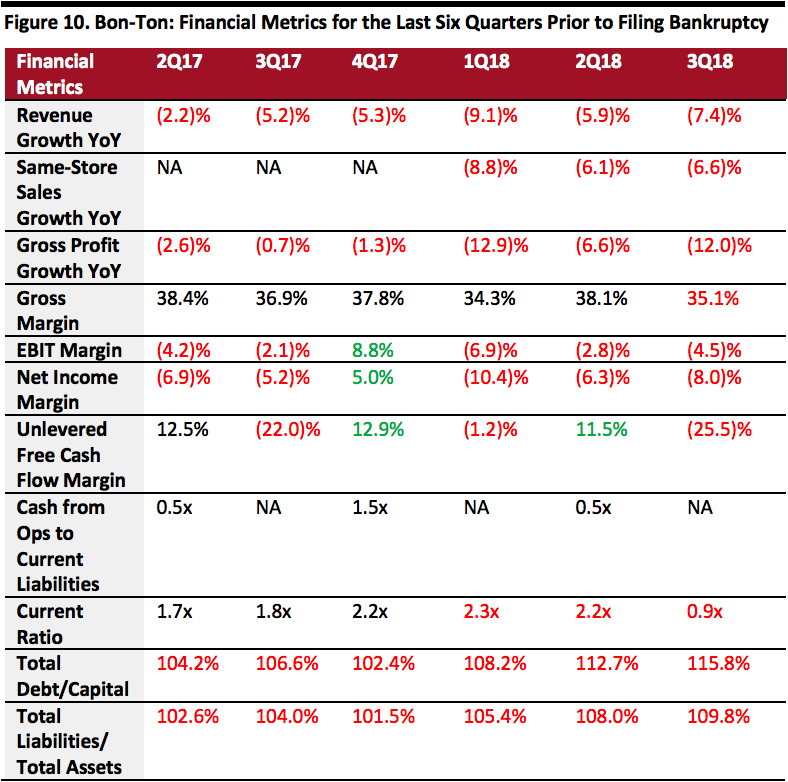

Bon-Ton’s financial performance deteriorated in the couple of years prior to its bankruptcy: The company had struggled to generate cash flow from its retail business and even had to borrow funds to meet day-to-day obligations. Bon-Ton reported negative same-store sales growth for 13 of its last 16 quarters.

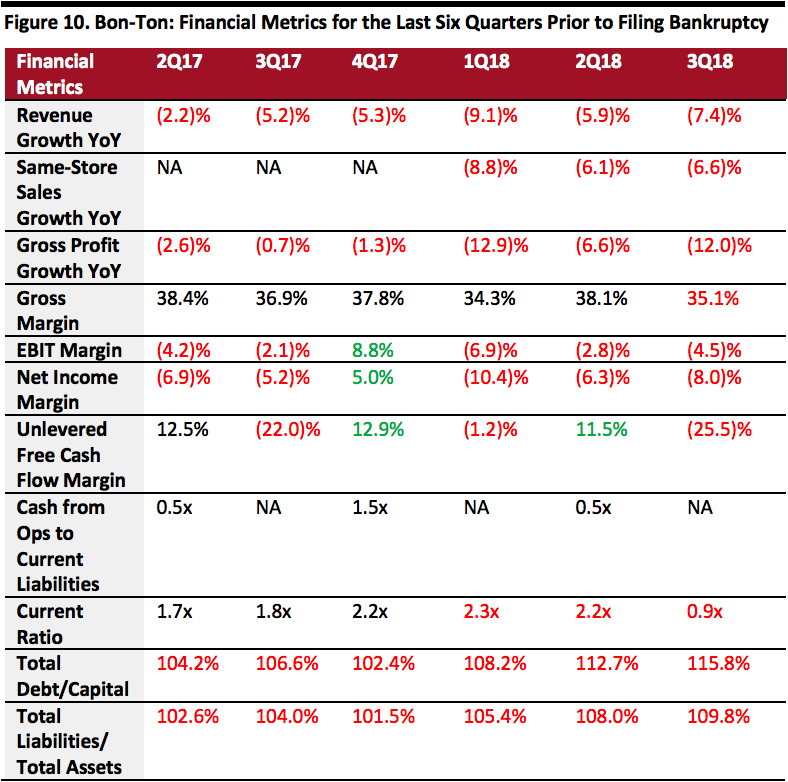

When we review Bon-Ton’s last six quarters prior to filing bankruptcy, we see the following:

Source: BDO/Coresight Research[/caption]

Reviewing Selected Retail Bankruptcies

In the following sections, we review the details of selected major retailers that entered bankruptcy or liquidated in 2018.

Bon-Ton

Established: 1898

Retail sector: Department stores

Bankruptcy filing date: February 4, 2018

Liquidation date: April 17, 2018

Number of stores closed: 256

Bon-Ton was burdened with debt, which it took to finance expansion, including acquisitions of other regional department stores. In 2005, the company made the boldest move in its 107-year history, when it acquired Saks’ Northern Department Store Group for $1.1 billion. The deal exposed Bon-Ton to heavy amounts of debt and stopped Bon-Ton from quickly adapting to changing digital trends that reduced footfall in malls and department stores. At the time of bankruptcy filing, the company carried hundreds of millions of dollars in debt.

Bon-Ton’s financial performance deteriorated in the couple of years prior to its bankruptcy: The company had struggled to generate cash flow from its retail business and even had to borrow funds to meet day-to-day obligations. Bon-Ton reported negative same-store sales growth for 13 of its last 16 quarters.

When we review Bon-Ton’s last six quarters prior to filing bankruptcy, we see the following:

Source: S&P Capital IQ/Coresight Research[/caption]

Mattress Firm

Established: 1986

Retail sector: Furniture and Home Furnishings

Bankruptcy filing date: October 5, 2018

Emerged date: November 11, 2018

Number of stores closed: 600

Mattress Firm emerged from bankruptcy less than two months after filing for Chapter 11 protection, albeit having closed about 600 stores. The company blamed over-expansion and above-market rents for its bankruptcy. Since 2005, Mattress Firm had acquired more than 25 companies, including many of its largest brick-and-mortar competitors, including Sleepy’s 1,000 locations for $780 million in 2015. As its marketplace moved online, Mattress firm expanded from about 700 locations to 3,500 in five years. Then filed for bankruptcy.

The company incurred a heavy debt burden to fund these acquisitions and expansion, which led to the accumulation of $1.3 billion of debt and $2.7 billion of operating lease obligations. In 2006, Mattress Firm was acquired by South Africa-based Steinhoff International in a $3.8 billion deal. Separately, Steinhoff had $10.2 billion in debt and had been dealing with an accounting investigation and other issues since 2017.

Moreover, Mattress Firm’s poor execution of its online platform favored its online rivals, including newer competitors such as Casper, Wayfair, Leesa and Amazon. Casper sells sleep products online, provides free shipping and lets the buyer return the mattress within 100 days of purchase.

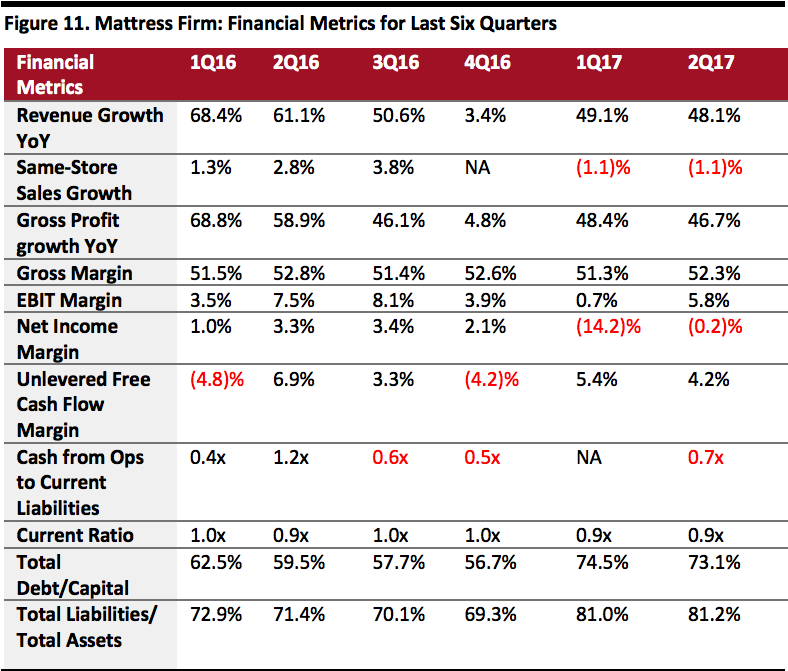

Mattress Firm has reported strong topline growth over the past couple of years but struggled to manage debt.

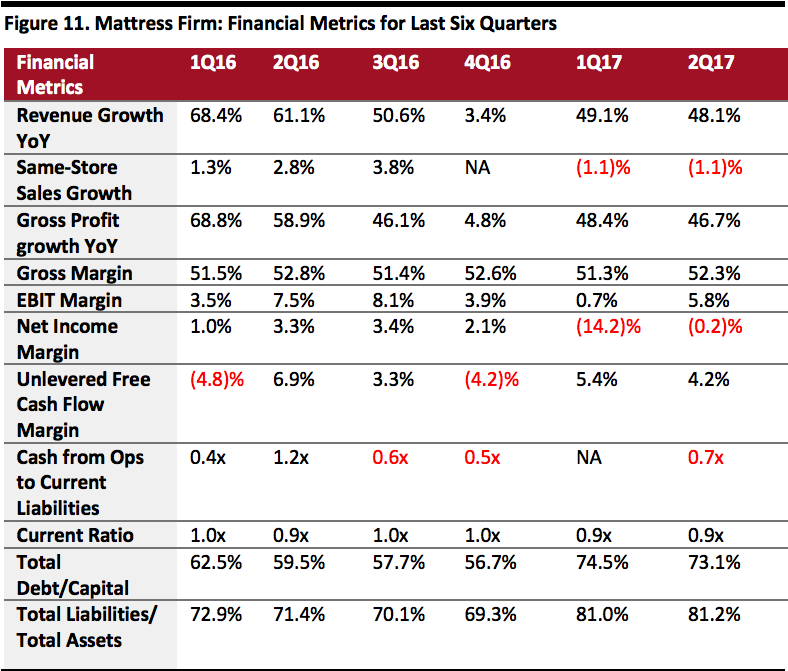

Reviewing Mattress Firm’s last six quarters prior to filing for bankruptcy protection, we observe the following:

Source: S&P Capital IQ/Coresight Research[/caption]

Mattress Firm

Established: 1986

Retail sector: Furniture and Home Furnishings

Bankruptcy filing date: October 5, 2018

Emerged date: November 11, 2018

Number of stores closed: 600

Mattress Firm emerged from bankruptcy less than two months after filing for Chapter 11 protection, albeit having closed about 600 stores. The company blamed over-expansion and above-market rents for its bankruptcy. Since 2005, Mattress Firm had acquired more than 25 companies, including many of its largest brick-and-mortar competitors, including Sleepy’s 1,000 locations for $780 million in 2015. As its marketplace moved online, Mattress firm expanded from about 700 locations to 3,500 in five years. Then filed for bankruptcy.

The company incurred a heavy debt burden to fund these acquisitions and expansion, which led to the accumulation of $1.3 billion of debt and $2.7 billion of operating lease obligations. In 2006, Mattress Firm was acquired by South Africa-based Steinhoff International in a $3.8 billion deal. Separately, Steinhoff had $10.2 billion in debt and had been dealing with an accounting investigation and other issues since 2017.

Moreover, Mattress Firm’s poor execution of its online platform favored its online rivals, including newer competitors such as Casper, Wayfair, Leesa and Amazon. Casper sells sleep products online, provides free shipping and lets the buyer return the mattress within 100 days of purchase.

Mattress Firm has reported strong topline growth over the past couple of years but struggled to manage debt.

Reviewing Mattress Firm’s last six quarters prior to filing for bankruptcy protection, we observe the following:

Source: S&P Capital IQ/Coresight Research[/caption]

Sears Holdings

Established: 2005

Retail sector: Department stores

Bankruptcy filing date: October 15, 2018

Emerge date: February 7, 2019

Number of stores closed: 212

Many factors contributed to the breakdown of Sears Holdings. Former CEO Arthur Martinez blames the company’s diversification into various businesses, including insurance, banking, investments and real estate, among others, for losing focus. Sears ventured into insurance in 1931 and moved into real estate and banking in the 1980s. Towards the end of the 20th century, Sears started losing market share to big box competitors, such as Walmart and Home Depot. Walmart offered strong competition with a wider variety of products at lower prices and invested in technology focused on improving overall customer experiences.

Similarly, more specialized rivals such as Home Depot offered competitive prices and greater variety of product in some key categories, such as appliances, tools and outdoor products. Towards the beginning of the 21st century, Sears slipped further behind as consumers went online. Instead of adapting, Sears merged with another troubled retailer, Kmart, in 2005. Since then, Sears has not reported a single year of positive comparable sales growth.

Crucially, Sears failed to invest sufficiently in its existing stores. Just as e-commerce skimmed off ever more “functional” purchases, store-based retailing became more about offering better experiences and services. However, Sears department stores remained underinvested and lacking in the kind of appeal that department stores must generate to survive today. Compounding these challenges, according to a CBRE report, more than 70% of the company’s locations are in class B- and C- malls, which have continued to witness declining traffic.

Lastly, Sears was effectively being operated as a company with a focus on financial engineering instead of as a retailer seeking to grow sales and sustain its appeal to consumers. Soon after Sears merged with Kmart, CEO Edward Lampert spent $6 billion on stock buybacks to reward investors and boost share price. Lampert also lent billions to Sears Kmart, increasing overall corporate debt. To service loans, he sold off major assets, such as Craftsman tools, Kenmore appliances and Land’s End outdoor equipment, among others. These years of financial engineering, spinoffs, loans and restructurings robbed Sears of assets when it needed them. While the company’s competitors were pouring money into their businesses, Sears was cutting its assets.

In February 2019, a federal bankruptcy court approved the sale of Sears to Edward Lampert after he won an auction with bid valued at $5.2 billion.

The company’s revenues declined from $53 billion in 2006 to about $17 billion in 2017. In the last 42 quarters, Sears had only one quarter of positive same store sales growth. In 2017, the company burned through $1.8 billion in cash, compared to $1.4 billion in 2016.

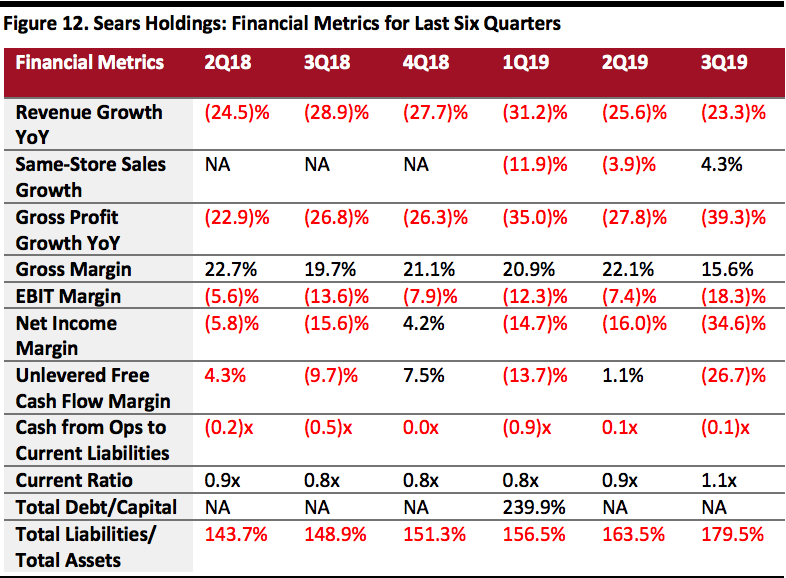

We make the following observations over the last six quarters prior to filing bankruptcy:

Source: S&P Capital IQ/Coresight Research[/caption]

Sears Holdings

Established: 2005

Retail sector: Department stores

Bankruptcy filing date: October 15, 2018

Emerge date: February 7, 2019

Number of stores closed: 212

Many factors contributed to the breakdown of Sears Holdings. Former CEO Arthur Martinez blames the company’s diversification into various businesses, including insurance, banking, investments and real estate, among others, for losing focus. Sears ventured into insurance in 1931 and moved into real estate and banking in the 1980s. Towards the end of the 20th century, Sears started losing market share to big box competitors, such as Walmart and Home Depot. Walmart offered strong competition with a wider variety of products at lower prices and invested in technology focused on improving overall customer experiences.

Similarly, more specialized rivals such as Home Depot offered competitive prices and greater variety of product in some key categories, such as appliances, tools and outdoor products. Towards the beginning of the 21st century, Sears slipped further behind as consumers went online. Instead of adapting, Sears merged with another troubled retailer, Kmart, in 2005. Since then, Sears has not reported a single year of positive comparable sales growth.

Crucially, Sears failed to invest sufficiently in its existing stores. Just as e-commerce skimmed off ever more “functional” purchases, store-based retailing became more about offering better experiences and services. However, Sears department stores remained underinvested and lacking in the kind of appeal that department stores must generate to survive today. Compounding these challenges, according to a CBRE report, more than 70% of the company’s locations are in class B- and C- malls, which have continued to witness declining traffic.

Lastly, Sears was effectively being operated as a company with a focus on financial engineering instead of as a retailer seeking to grow sales and sustain its appeal to consumers. Soon after Sears merged with Kmart, CEO Edward Lampert spent $6 billion on stock buybacks to reward investors and boost share price. Lampert also lent billions to Sears Kmart, increasing overall corporate debt. To service loans, he sold off major assets, such as Craftsman tools, Kenmore appliances and Land’s End outdoor equipment, among others. These years of financial engineering, spinoffs, loans and restructurings robbed Sears of assets when it needed them. While the company’s competitors were pouring money into their businesses, Sears was cutting its assets.

In February 2019, a federal bankruptcy court approved the sale of Sears to Edward Lampert after he won an auction with bid valued at $5.2 billion.

The company’s revenues declined from $53 billion in 2006 to about $17 billion in 2017. In the last 42 quarters, Sears had only one quarter of positive same store sales growth. In 2017, the company burned through $1.8 billion in cash, compared to $1.4 billion in 2016.

We make the following observations over the last six quarters prior to filing bankruptcy:

Source: S&P Capital IQ/Coresight Research[/caption]

Toys “R” Us

Established: 1957

Retail sector: Toy specialist stores

Bankruptcy filing date: September 18, 2017

Liquidation date: June 29, 2018

Number of stores closed: 735

The demise of Toys “R” Us can be attributed to several factors, including a failure to innovate its business model to adapt to changing customer needs and expectations. However, the most important factor was it was overburdened with the billions of dollars in debt that stopped the company from making the necessary investment in stores and digital platforms. In 2005, Toys “R” Us was taken private with over $5 billion in debt, on which the company was thereafter paying interest of $400 million every year for more than a decade. After its leveraged buyout, the company continually underinvested in its business.

The company failed to compete effectively with major rivals, such as Amazon, Walmart and Target, mainly in terms of pricing. In 2017, Toy “R” Us sold about $792 million worth of toys online – a fraction of Amazon’s $4.5 billion, according to One Click Retail.

Toys “R” Us had been struggling for more than a decade, with declining revenues and accumulated losses.

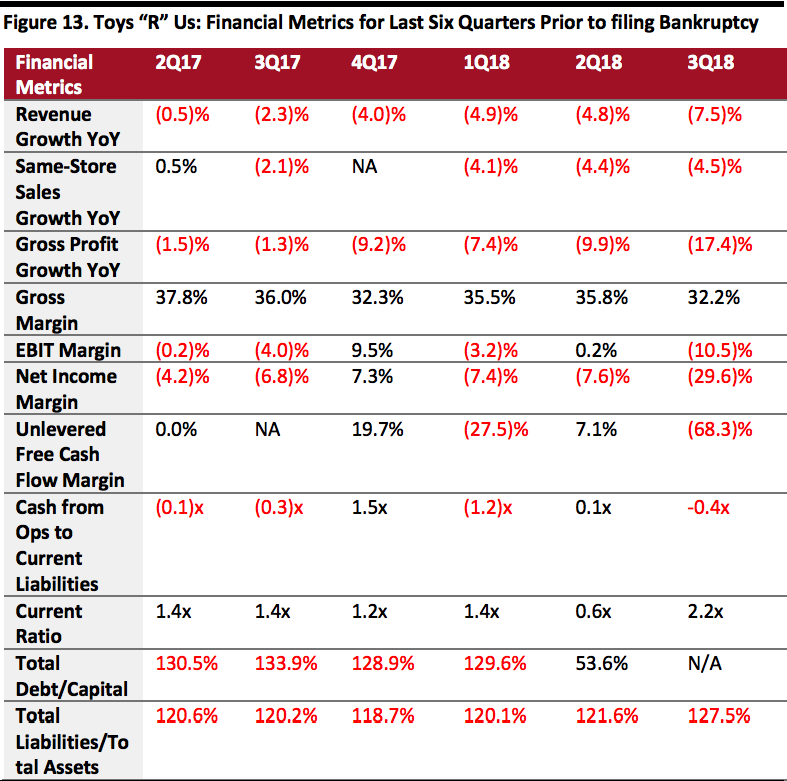

Reviewing the last six quarters prior to the company filing for bankruptcy, we observed the following at Toys “R” Us:

Source: S&P Capital IQ/Coresight Research[/caption]

Toys “R” Us

Established: 1957

Retail sector: Toy specialist stores

Bankruptcy filing date: September 18, 2017

Liquidation date: June 29, 2018

Number of stores closed: 735

The demise of Toys “R” Us can be attributed to several factors, including a failure to innovate its business model to adapt to changing customer needs and expectations. However, the most important factor was it was overburdened with the billions of dollars in debt that stopped the company from making the necessary investment in stores and digital platforms. In 2005, Toys “R” Us was taken private with over $5 billion in debt, on which the company was thereafter paying interest of $400 million every year for more than a decade. After its leveraged buyout, the company continually underinvested in its business.

The company failed to compete effectively with major rivals, such as Amazon, Walmart and Target, mainly in terms of pricing. In 2017, Toy “R” Us sold about $792 million worth of toys online – a fraction of Amazon’s $4.5 billion, according to One Click Retail.

Toys “R” Us had been struggling for more than a decade, with declining revenues and accumulated losses.

Reviewing the last six quarters prior to the company filing for bankruptcy, we observed the following at Toys “R” Us:

Source: S&P Capital IQ/Coresight Research[/caption]

The Way Ahead

We think the slew of bankruptcies in the past two years does not necessarily indicate a weak retail sector, but rather a “survival of the fittest” environment. Physical stores are still important, which can be seen in Amazon’s move into brick and mortar with the launch of Amazon Go Stores and the acquisition of Whole Foods Market. But, to stay relevant, retailers need to invest in stores and online platforms, with a focus on omnichannel retailing. Failure to invest in appealing propositions has been a hallmark of many retailers that have entered bankruptcy. Their peers must strengthen their brands, with attractive stores and engaging experiences that create positive customer interactions.

Source: S&P Capital IQ/Coresight Research[/caption]

The Way Ahead

We think the slew of bankruptcies in the past two years does not necessarily indicate a weak retail sector, but rather a “survival of the fittest” environment. Physical stores are still important, which can be seen in Amazon’s move into brick and mortar with the launch of Amazon Go Stores and the acquisition of Whole Foods Market. But, to stay relevant, retailers need to invest in stores and online platforms, with a focus on omnichannel retailing. Failure to invest in appealing propositions has been a hallmark of many retailers that have entered bankruptcy. Their peers must strengthen their brands, with attractive stores and engaging experiences that create positive customer interactions.

*Subsequently emerged from bankruptcy

*Subsequently emerged from bankruptcySource: Company reports/Coresight Research[/caption] These bankruptcies contributed to the substantial number of store closures in 2018. In total, Coresight Research recorded 5,726 store closures in the year. We show major closures in 2018 by selected bankrupt retailers below. [caption id="attachment_82515" align="aligncenter" width="640"]

Source: Company reports/Coresight Research[/caption]

Comparison of US Retail Bankruptcies: 2018 vs. 2017

In 2017, bankruptcies among US retailers hit a six-year high after more than 50 retailers sought Chapter 11 protection. Below, we note some of the key similarities and differences between 2017 and 2018 retail bankruptcies.

Source: Company reports/Coresight Research[/caption]

Comparison of US Retail Bankruptcies: 2018 vs. 2017

In 2017, bankruptcies among US retailers hit a six-year high after more than 50 retailers sought Chapter 11 protection. Below, we note some of the key similarities and differences between 2017 and 2018 retail bankruptcies.

- According to data from consulting firm AlixPartners, 26 major retail companies filed for bankruptcy in 2017, surpassing the 20 major bankruptcies in the 2008 global financial crisis. Retail bankruptcy filings and store closures slowed in 2018, with just a dozen retailers filing for Chapter 11 protection.

- In 2018, we saw bankruptcies across sectors: apparel, footwear and accessories, department stores, and furniture and furnishings retailers. However, in 2017, most were in the apparel, footwear and accessories segments as consumers switched a greater share of their spending from physical stores to e-commerce.

*Subsequently merged from bankruptcy

*Subsequently merged from bankruptcySource: Company reports/Coresight Research[/caption] Store closures slowed in 2018: After 8,139 store closure announcements in 2017, there were only 5,726 in 2018, a large number of which were due to bankruptcy. [caption id="attachment_82517" align="aligncenter" width="640"]

Source: Company reports/Coresight Research[/caption]

In summary, 2018 witnessed approximately 16 US retail bankruptcy filings, far fewer than the nearly 50 bankruptcies in 2017. Yet, measured by scale, 2018’s failures proved more painful as we saw filings by some of biggest retailers such as Sears and Mattress Firm, and the liquidation of Toys “R” Us and Bon-Ton Stores.

Retail bankruptcies in 2017 and 2018 occurred due to various reasons. We present some below.

Major Factors That Led to US Retail Bankruptcies in 2017 and 2018

Bankruptcies are being driven by a number of factors: Saturation of brick-and-mortar locations, a shrinking middle-class, competition from online platforms and rising debt, among others.

Source: Company reports/Coresight Research[/caption]

In summary, 2018 witnessed approximately 16 US retail bankruptcy filings, far fewer than the nearly 50 bankruptcies in 2017. Yet, measured by scale, 2018’s failures proved more painful as we saw filings by some of biggest retailers such as Sears and Mattress Firm, and the liquidation of Toys “R” Us and Bon-Ton Stores.

Retail bankruptcies in 2017 and 2018 occurred due to various reasons. We present some below.

Major Factors That Led to US Retail Bankruptcies in 2017 and 2018

Bankruptcies are being driven by a number of factors: Saturation of brick-and-mortar locations, a shrinking middle-class, competition from online platforms and rising debt, among others.

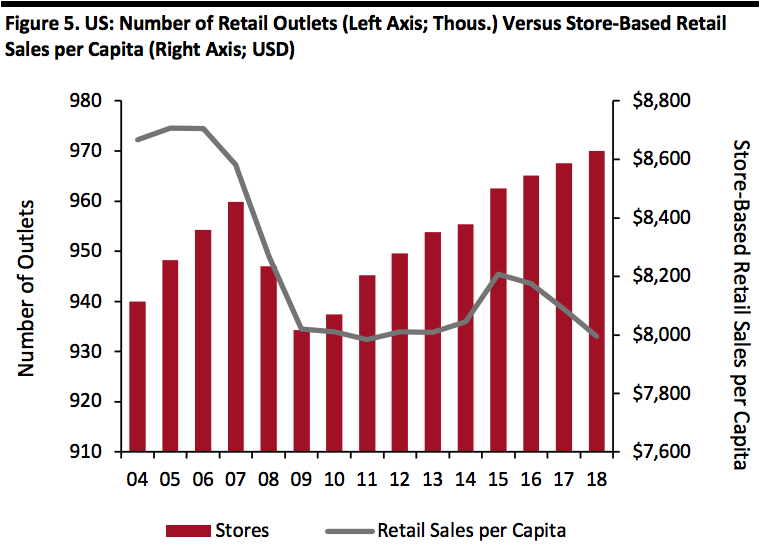

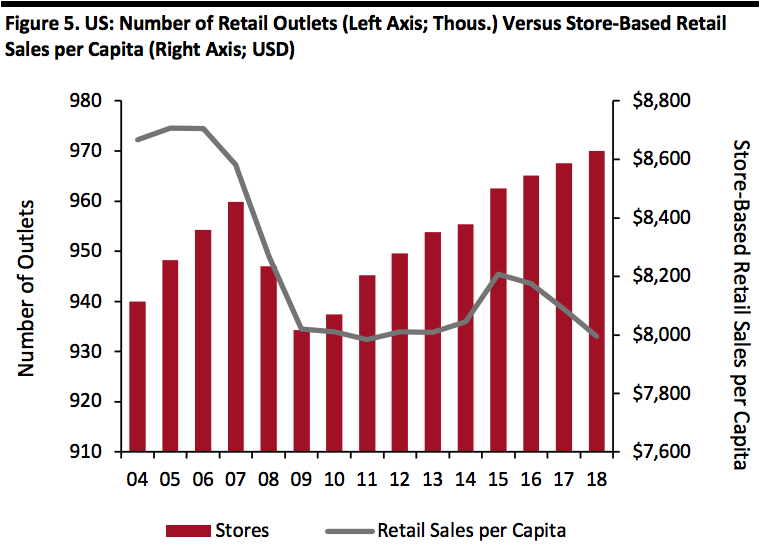

- Saturation of US physical retail space and changing consumer trends. According to a 2016 Morningstar report, the US has significantly more retail space per person than other countries: 23.5 square feet per capita versus 16.4 square feet in Canada and just 11.1 in Australia. Between 1970 and 2015, the growth rate of malls in the US was more than double the growth rate of the population. All of this retail space became a burden as consumers moved online. The figure below shows a dramatic increase in US retail outlets during 2004–2017, which retreated during the Global Financial Crisis, before increasing again and setting new records starting in 2015. At the same time, in-store retail sales per capita declined sharply through 2009 and have been flattish, though with some ups and downs, with declines during 2016-2018.

Note: Figures in fixed 2018 dollars

Note: Figures in fixed 2018 dollarsSource: Euromonitor International/Coresight Research[/caption]

- Shrinking middle class. According to Pew Research Center analysis of the US Census Bureau data, the US middle class fell from 61% of the population in 1971 to just 50% in 2015. This demographic was hard hit by the Global Financial Crisis, and have never recovered. In the decade since the crisis, consumers have experienced a decline in disposable income, while costs for education and healthcare surged. Traditional retailers such as Macy’s and Sears relied on spending from this segment, and their shrinking numbers and spending power drove severe sales declines.

- Burgeoning e-commerce. Online platforms brought massive disruption to the US retail industry. The rise of the online retailers hammered major brick and mortar retailers, such as Gymboree and Payless, who were not able to transform themselves in the digital era. In 2018, online giant Amazon further penetrated brick and mortar space, launching Amazon Go stores, its cashierless convenience stores focused on food-and-beverage. Amazon also expanded its physical bookstores and introduced Amazon 4-Star, which features only those products rated four stars on its website. To keep up, retailers such as Walmart and Target have been investing heavily in store upgrades and e-commerce capabilities of their own, including the expansion of curbside pickup, personalized shopper services, new areas in stores for online orders and dedicated parking spaces devoted to picking up products bought online.

- Debt overload. To grow brick and mortar capacities, retailers went into debt. That debt is coming due, but now companies are having trouble making payments as they come under increasing competitive pressure from online. Retailers once rolled over debt to buy time, but with rising interest rates, overleveraged companies are finding refinancing expensive. Big retailers such as Toys “R” Us, Sears Holdings and Bon-Ton Stores had weak balance sheets, with liabilities massively exceeding assets, making rolling over debt even more challenging. Huge borrowings, followed by rising repayment and refinancing deadlines, made it difficult for traditional retailers to invest in e-commerce capabilities that could have helped them compete with online.

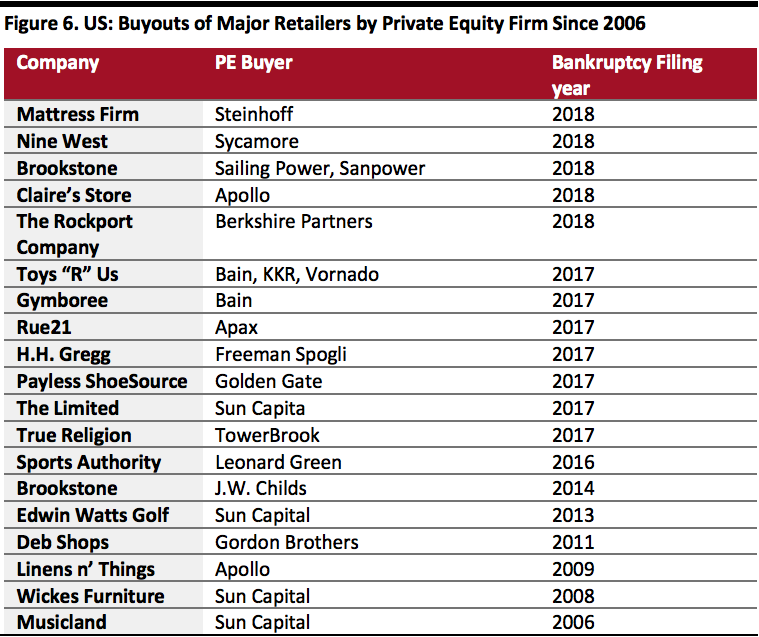

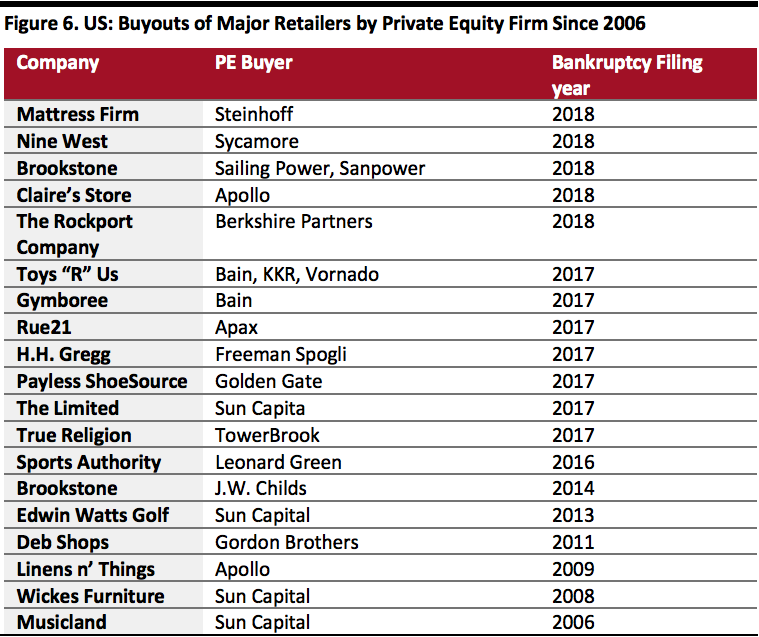

- Leveraged buyouts by private equity firms. A significant number of the retailers that filed for bankruptcy in the last two years were also carrying debt from leveraged buyouts by private equity firms. After buying companies with massive debt, the private equity firms used corporate cash reserves to pay themselves back. Since 2002, more than 15% of retailers acquired by private equity firms have filed for Chapter 11 bankruptcy protection:

Source: Debtwire/Bankruptcydata.com/Coresight Research[/caption]

While companies such as Sears Holding and Mattress Firm managed to survive bankruptcy, Toys “R” Us and Bon-Ton did not. In the following segment, we highlight retailers’ struggles after they emerged from the bankruptcy process and how amendments to the bankruptcy laws in 2005 favor liquidation over restructuring.

Despite Emerging from Bankruptcy, Many Retailers Continue to Struggle

Historically, US retailers have used the bankruptcy process to reorganize by reducing the debt significantly and closing most of their stores. Before the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) 2005 law, retailers often spent years in bankruptcy while deciding which leases to keep and which to abandon and which business models to follow. However, the BAPCPA 2005 law gives bankrupt retailers just 210 days to act on store leases. Since it can take up to 90 days to hold a going-out-of-business (GOB) sale, retailers often have just 120 days to propose a reorganization plan and provide disclosure statements to creditors, who then evaluate the plan and decide whether to approve or reject it. Owing to this reduced time frame, bankrupt firms are finding it more difficult to restructure debt and emerge from bankruptcies.

While some retailers manage to emerge strong from bankruptcies, many end up back in bankruptcy or in liquidation, such as The Walking Company and Brookstone, both of which filed for bankruptcies in 2018, the second time in recent years. The main problems are a weak business model, declining topline growth and increasing debt. Also, the bankruptcy process can prove distracting, impacting management’s ability to focus on running the business.

Gymboree and Payless ShoeSource both exited, then subsequently re-entered, bankruptcy. During its first bankruptcy reorganization, Gymboree eliminated $900 million in debt and closed 300 stores, but the company continued to lose market share, from about 27.4% to 15.8%, according to data compiled by Earnest Research and cited by Retail Dive.

In its first bankruptcy, Payless ShoeSource closed 900 stores, leaving it with a substantial footprint of 3,000 outlets, most of which were located in Class-B malls. Payless eliminated $435 million in debt, but continued to carry a substantial burden. In its second bankruptcy, the company said it would close all its remaining 2,100 stores in the US and Puerto Rico.

Both Gymboree and Payless are again on the brink due to their high debt loads and the increasingly competitive retail environment.

Sears Holdings emerged from bankruptcy in February, with 425 fewer stores. The company plans to downsize its full line operation and open smaller stores, each of which will be about one-third the size of its previous stores. Sear’s business restructuring plan relies on deep cuts to overheads, which means the company will have virtually no marketing budget.

Distressed retailers may survive bankruptcy, but we believe many may be short-term revivals that merely delay the inevitable – unless they create a sound long-term restructuring plan.

Continuation of Bankruptcies in 2019

In 2019, bankruptcies are continuing at a rapid pace. Twelve weeks into 2019, seven major retailers have already filed for bankruptcy in the US. Discount store Shopko announced it will liquidate its assets and close all its stores by June 2019, as the company failed to find a buyer for its business.

[caption id="attachment_82524" align="aligncenter" width="640"]

Source: Debtwire/Bankruptcydata.com/Coresight Research[/caption]

While companies such as Sears Holding and Mattress Firm managed to survive bankruptcy, Toys “R” Us and Bon-Ton did not. In the following segment, we highlight retailers’ struggles after they emerged from the bankruptcy process and how amendments to the bankruptcy laws in 2005 favor liquidation over restructuring.

Despite Emerging from Bankruptcy, Many Retailers Continue to Struggle

Historically, US retailers have used the bankruptcy process to reorganize by reducing the debt significantly and closing most of their stores. Before the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) 2005 law, retailers often spent years in bankruptcy while deciding which leases to keep and which to abandon and which business models to follow. However, the BAPCPA 2005 law gives bankrupt retailers just 210 days to act on store leases. Since it can take up to 90 days to hold a going-out-of-business (GOB) sale, retailers often have just 120 days to propose a reorganization plan and provide disclosure statements to creditors, who then evaluate the plan and decide whether to approve or reject it. Owing to this reduced time frame, bankrupt firms are finding it more difficult to restructure debt and emerge from bankruptcies.

While some retailers manage to emerge strong from bankruptcies, many end up back in bankruptcy or in liquidation, such as The Walking Company and Brookstone, both of which filed for bankruptcies in 2018, the second time in recent years. The main problems are a weak business model, declining topline growth and increasing debt. Also, the bankruptcy process can prove distracting, impacting management’s ability to focus on running the business.

Gymboree and Payless ShoeSource both exited, then subsequently re-entered, bankruptcy. During its first bankruptcy reorganization, Gymboree eliminated $900 million in debt and closed 300 stores, but the company continued to lose market share, from about 27.4% to 15.8%, according to data compiled by Earnest Research and cited by Retail Dive.

In its first bankruptcy, Payless ShoeSource closed 900 stores, leaving it with a substantial footprint of 3,000 outlets, most of which were located in Class-B malls. Payless eliminated $435 million in debt, but continued to carry a substantial burden. In its second bankruptcy, the company said it would close all its remaining 2,100 stores in the US and Puerto Rico.

Both Gymboree and Payless are again on the brink due to their high debt loads and the increasingly competitive retail environment.

Sears Holdings emerged from bankruptcy in February, with 425 fewer stores. The company plans to downsize its full line operation and open smaller stores, each of which will be about one-third the size of its previous stores. Sear’s business restructuring plan relies on deep cuts to overheads, which means the company will have virtually no marketing budget.

Distressed retailers may survive bankruptcy, but we believe many may be short-term revivals that merely delay the inevitable – unless they create a sound long-term restructuring plan.

Continuation of Bankruptcies in 2019

In 2019, bankruptcies are continuing at a rapid pace. Twelve weeks into 2019, seven major retailers have already filed for bankruptcy in the US. Discount store Shopko announced it will liquidate its assets and close all its stores by June 2019, as the company failed to find a buyer for its business.

[caption id="attachment_82524" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

In terms of store closures, year-to-date 2019, retailers have announced 5,399 store closings, up 71% year over year; some 2,100 of these closures were announced by Payless ShoeSource alone. If we annualize 2019 store closures from the latest part-year data, it would be more than double the store closures reported in 2018.

[caption id="attachment_82526" align="aligncenter" width="640"]

Source: Company reports/Coresight Research[/caption]

In terms of store closures, year-to-date 2019, retailers have announced 5,399 store closings, up 71% year over year; some 2,100 of these closures were announced by Payless ShoeSource alone. If we annualize 2019 store closures from the latest part-year data, it would be more than double the store closures reported in 2018.

[caption id="attachment_82526" align="aligncenter" width="640"] Refers to the period from January 1, 2019 to March 22, 2019

Refers to the period from January 1, 2019 to March 22, 2019 Source: Company reports/Coresight Research[/caption] Over the next 12 to 18 months, the US retail sector seems positioned for further, significant transition – on top of concerns over the ongoing trade war with China and the looming possibility of recession. Retail Industry Outlook According to our analysis of data from the US Census Bureau, retail sales excluding automobiles and gasoline grew 4.3% year over year in 2018. For 2019, the NRF expects US retail sales to grow at 3.8-4.4%, at the midpoint slower than 2018, due to the ongoing US-China trade war and possible economic slowdown. According to a recent survey from the National Association of Business Economics (NABE), about 75% of business economists expect a recession to hit the US by 2021, though only 10% expect a recession in 2019. In retail, some big mall owners have cautioned more bankruptcies are on the way. David Simon, CEO of Simon Property Group, the largest mall owner in the US in terms of total measured area in square feet, said during the 4Q18 earnings conference call that his company is nervous about a few store chains and expects more bankruptcies for retailers with high debt levels. Retail Executives’ Expectations for 2019 According to a 2019 BDO survey of 300 US retail executives, 52% believe retail bankruptcies will rise in 2019 and nearly 51% of are actively preparing for an economic downturn. [caption id="attachment_82527" align="aligncenter" width="640"]

Source: BDO/Coresight Research[/caption]

Reviewing Selected Retail Bankruptcies

In the following sections, we review the details of selected major retailers that entered bankruptcy or liquidated in 2018.

Bon-Ton

Established: 1898

Retail sector: Department stores

Bankruptcy filing date: February 4, 2018

Liquidation date: April 17, 2018

Number of stores closed: 256

Bon-Ton was burdened with debt, which it took to finance expansion, including acquisitions of other regional department stores. In 2005, the company made the boldest move in its 107-year history, when it acquired Saks’ Northern Department Store Group for $1.1 billion. The deal exposed Bon-Ton to heavy amounts of debt and stopped Bon-Ton from quickly adapting to changing digital trends that reduced footfall in malls and department stores. At the time of bankruptcy filing, the company carried hundreds of millions of dollars in debt.

Bon-Ton’s financial performance deteriorated in the couple of years prior to its bankruptcy: The company had struggled to generate cash flow from its retail business and even had to borrow funds to meet day-to-day obligations. Bon-Ton reported negative same-store sales growth for 13 of its last 16 quarters.

When we review Bon-Ton’s last six quarters prior to filing bankruptcy, we see the following:

Source: BDO/Coresight Research[/caption]

Reviewing Selected Retail Bankruptcies

In the following sections, we review the details of selected major retailers that entered bankruptcy or liquidated in 2018.

Bon-Ton

Established: 1898

Retail sector: Department stores

Bankruptcy filing date: February 4, 2018

Liquidation date: April 17, 2018

Number of stores closed: 256

Bon-Ton was burdened with debt, which it took to finance expansion, including acquisitions of other regional department stores. In 2005, the company made the boldest move in its 107-year history, when it acquired Saks’ Northern Department Store Group for $1.1 billion. The deal exposed Bon-Ton to heavy amounts of debt and stopped Bon-Ton from quickly adapting to changing digital trends that reduced footfall in malls and department stores. At the time of bankruptcy filing, the company carried hundreds of millions of dollars in debt.

Bon-Ton’s financial performance deteriorated in the couple of years prior to its bankruptcy: The company had struggled to generate cash flow from its retail business and even had to borrow funds to meet day-to-day obligations. Bon-Ton reported negative same-store sales growth for 13 of its last 16 quarters.

When we review Bon-Ton’s last six quarters prior to filing bankruptcy, we see the following:

- Revenues and gross profit growth were negative, hit by declining store traffic and growing competition.

- Same-store sales growth remained negative. EBIT margins were negative.

- Its ability to service its short-term debt declined.

- Its debt levels had been on the rise.

- Its unlevered free cash flow margin remained negative for most of the last six quarters.

Source: S&P Capital IQ/Coresight Research[/caption]

Mattress Firm

Established: 1986

Retail sector: Furniture and Home Furnishings

Bankruptcy filing date: October 5, 2018

Emerged date: November 11, 2018

Number of stores closed: 600

Mattress Firm emerged from bankruptcy less than two months after filing for Chapter 11 protection, albeit having closed about 600 stores. The company blamed over-expansion and above-market rents for its bankruptcy. Since 2005, Mattress Firm had acquired more than 25 companies, including many of its largest brick-and-mortar competitors, including Sleepy’s 1,000 locations for $780 million in 2015. As its marketplace moved online, Mattress firm expanded from about 700 locations to 3,500 in five years. Then filed for bankruptcy.

The company incurred a heavy debt burden to fund these acquisitions and expansion, which led to the accumulation of $1.3 billion of debt and $2.7 billion of operating lease obligations. In 2006, Mattress Firm was acquired by South Africa-based Steinhoff International in a $3.8 billion deal. Separately, Steinhoff had $10.2 billion in debt and had been dealing with an accounting investigation and other issues since 2017.

Moreover, Mattress Firm’s poor execution of its online platform favored its online rivals, including newer competitors such as Casper, Wayfair, Leesa and Amazon. Casper sells sleep products online, provides free shipping and lets the buyer return the mattress within 100 days of purchase.

Mattress Firm has reported strong topline growth over the past couple of years but struggled to manage debt.

Reviewing Mattress Firm’s last six quarters prior to filing for bankruptcy protection, we observe the following:

Source: S&P Capital IQ/Coresight Research[/caption]

Mattress Firm

Established: 1986

Retail sector: Furniture and Home Furnishings

Bankruptcy filing date: October 5, 2018

Emerged date: November 11, 2018

Number of stores closed: 600

Mattress Firm emerged from bankruptcy less than two months after filing for Chapter 11 protection, albeit having closed about 600 stores. The company blamed over-expansion and above-market rents for its bankruptcy. Since 2005, Mattress Firm had acquired more than 25 companies, including many of its largest brick-and-mortar competitors, including Sleepy’s 1,000 locations for $780 million in 2015. As its marketplace moved online, Mattress firm expanded from about 700 locations to 3,500 in five years. Then filed for bankruptcy.

The company incurred a heavy debt burden to fund these acquisitions and expansion, which led to the accumulation of $1.3 billion of debt and $2.7 billion of operating lease obligations. In 2006, Mattress Firm was acquired by South Africa-based Steinhoff International in a $3.8 billion deal. Separately, Steinhoff had $10.2 billion in debt and had been dealing with an accounting investigation and other issues since 2017.

Moreover, Mattress Firm’s poor execution of its online platform favored its online rivals, including newer competitors such as Casper, Wayfair, Leesa and Amazon. Casper sells sleep products online, provides free shipping and lets the buyer return the mattress within 100 days of purchase.

Mattress Firm has reported strong topline growth over the past couple of years but struggled to manage debt.

Reviewing Mattress Firm’s last six quarters prior to filing for bankruptcy protection, we observe the following:

- Revenues and gross profits grew in strong double digits for most of the quarters.

- Same-store sales growth turned negative in last two quarters.

- EBIT margins remained in low to high single digits, in line with industry peers.

- Debt levels were on the rise.

- The company’s ability to service its short-term debt remained intact.

- Unlevered cash flow margins fluctuated between negative and low-single-digit positive.

Source: S&P Capital IQ/Coresight Research[/caption]

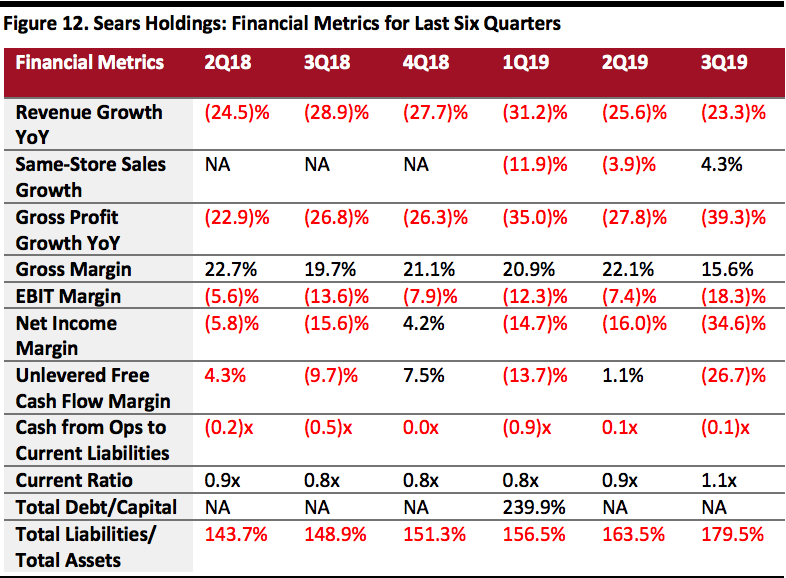

Sears Holdings

Established: 2005

Retail sector: Department stores

Bankruptcy filing date: October 15, 2018

Emerge date: February 7, 2019

Number of stores closed: 212

Many factors contributed to the breakdown of Sears Holdings. Former CEO Arthur Martinez blames the company’s diversification into various businesses, including insurance, banking, investments and real estate, among others, for losing focus. Sears ventured into insurance in 1931 and moved into real estate and banking in the 1980s. Towards the end of the 20th century, Sears started losing market share to big box competitors, such as Walmart and Home Depot. Walmart offered strong competition with a wider variety of products at lower prices and invested in technology focused on improving overall customer experiences.

Similarly, more specialized rivals such as Home Depot offered competitive prices and greater variety of product in some key categories, such as appliances, tools and outdoor products. Towards the beginning of the 21st century, Sears slipped further behind as consumers went online. Instead of adapting, Sears merged with another troubled retailer, Kmart, in 2005. Since then, Sears has not reported a single year of positive comparable sales growth.

Crucially, Sears failed to invest sufficiently in its existing stores. Just as e-commerce skimmed off ever more “functional” purchases, store-based retailing became more about offering better experiences and services. However, Sears department stores remained underinvested and lacking in the kind of appeal that department stores must generate to survive today. Compounding these challenges, according to a CBRE report, more than 70% of the company’s locations are in class B- and C- malls, which have continued to witness declining traffic.

Lastly, Sears was effectively being operated as a company with a focus on financial engineering instead of as a retailer seeking to grow sales and sustain its appeal to consumers. Soon after Sears merged with Kmart, CEO Edward Lampert spent $6 billion on stock buybacks to reward investors and boost share price. Lampert also lent billions to Sears Kmart, increasing overall corporate debt. To service loans, he sold off major assets, such as Craftsman tools, Kenmore appliances and Land’s End outdoor equipment, among others. These years of financial engineering, spinoffs, loans and restructurings robbed Sears of assets when it needed them. While the company’s competitors were pouring money into their businesses, Sears was cutting its assets.

In February 2019, a federal bankruptcy court approved the sale of Sears to Edward Lampert after he won an auction with bid valued at $5.2 billion.

The company’s revenues declined from $53 billion in 2006 to about $17 billion in 2017. In the last 42 quarters, Sears had only one quarter of positive same store sales growth. In 2017, the company burned through $1.8 billion in cash, compared to $1.4 billion in 2016.

We make the following observations over the last six quarters prior to filing bankruptcy:

Source: S&P Capital IQ/Coresight Research[/caption]

Sears Holdings

Established: 2005

Retail sector: Department stores

Bankruptcy filing date: October 15, 2018

Emerge date: February 7, 2019

Number of stores closed: 212

Many factors contributed to the breakdown of Sears Holdings. Former CEO Arthur Martinez blames the company’s diversification into various businesses, including insurance, banking, investments and real estate, among others, for losing focus. Sears ventured into insurance in 1931 and moved into real estate and banking in the 1980s. Towards the end of the 20th century, Sears started losing market share to big box competitors, such as Walmart and Home Depot. Walmart offered strong competition with a wider variety of products at lower prices and invested in technology focused on improving overall customer experiences.

Similarly, more specialized rivals such as Home Depot offered competitive prices and greater variety of product in some key categories, such as appliances, tools and outdoor products. Towards the beginning of the 21st century, Sears slipped further behind as consumers went online. Instead of adapting, Sears merged with another troubled retailer, Kmart, in 2005. Since then, Sears has not reported a single year of positive comparable sales growth.

Crucially, Sears failed to invest sufficiently in its existing stores. Just as e-commerce skimmed off ever more “functional” purchases, store-based retailing became more about offering better experiences and services. However, Sears department stores remained underinvested and lacking in the kind of appeal that department stores must generate to survive today. Compounding these challenges, according to a CBRE report, more than 70% of the company’s locations are in class B- and C- malls, which have continued to witness declining traffic.

Lastly, Sears was effectively being operated as a company with a focus on financial engineering instead of as a retailer seeking to grow sales and sustain its appeal to consumers. Soon after Sears merged with Kmart, CEO Edward Lampert spent $6 billion on stock buybacks to reward investors and boost share price. Lampert also lent billions to Sears Kmart, increasing overall corporate debt. To service loans, he sold off major assets, such as Craftsman tools, Kenmore appliances and Land’s End outdoor equipment, among others. These years of financial engineering, spinoffs, loans and restructurings robbed Sears of assets when it needed them. While the company’s competitors were pouring money into their businesses, Sears was cutting its assets.

In February 2019, a federal bankruptcy court approved the sale of Sears to Edward Lampert after he won an auction with bid valued at $5.2 billion.

The company’s revenues declined from $53 billion in 2006 to about $17 billion in 2017. In the last 42 quarters, Sears had only one quarter of positive same store sales growth. In 2017, the company burned through $1.8 billion in cash, compared to $1.4 billion in 2016.

We make the following observations over the last six quarters prior to filing bankruptcy:

- Revenue growth and gross profit growth were consistently negative.

- Same-store sales were disappointing for most quarters.

- EBIT margins were negative.

- Debt levels were on the rise.

- Its ability to service its short-term debt declined.

- Unleveraged cash flow margins were negative for most quarters.

Source: S&P Capital IQ/Coresight Research[/caption]

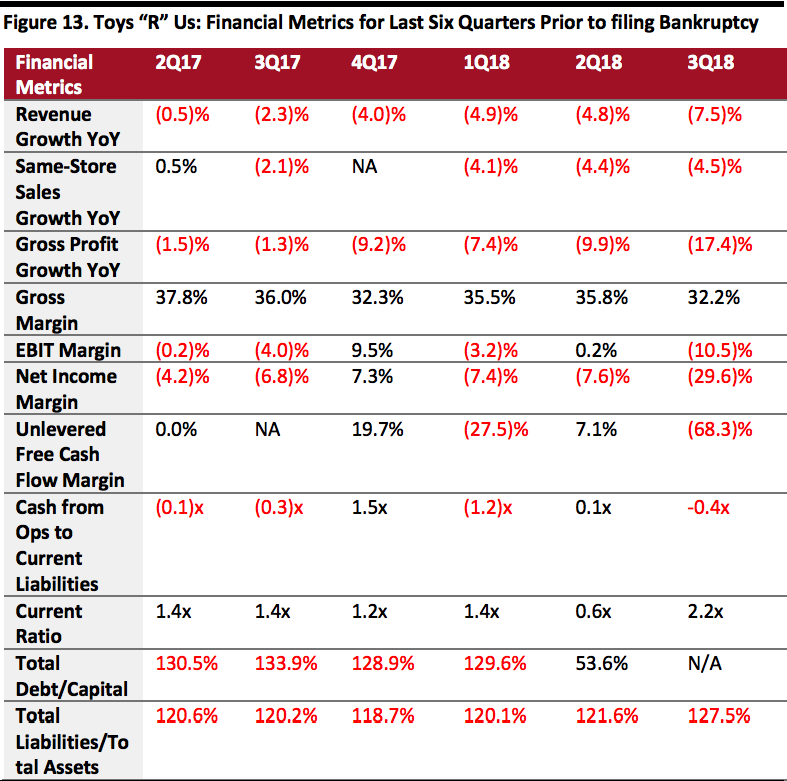

Toys “R” Us

Established: 1957

Retail sector: Toy specialist stores

Bankruptcy filing date: September 18, 2017

Liquidation date: June 29, 2018

Number of stores closed: 735

The demise of Toys “R” Us can be attributed to several factors, including a failure to innovate its business model to adapt to changing customer needs and expectations. However, the most important factor was it was overburdened with the billions of dollars in debt that stopped the company from making the necessary investment in stores and digital platforms. In 2005, Toys “R” Us was taken private with over $5 billion in debt, on which the company was thereafter paying interest of $400 million every year for more than a decade. After its leveraged buyout, the company continually underinvested in its business.

The company failed to compete effectively with major rivals, such as Amazon, Walmart and Target, mainly in terms of pricing. In 2017, Toy “R” Us sold about $792 million worth of toys online – a fraction of Amazon’s $4.5 billion, according to One Click Retail.

Toys “R” Us had been struggling for more than a decade, with declining revenues and accumulated losses.

Reviewing the last six quarters prior to the company filing for bankruptcy, we observed the following at Toys “R” Us:

Source: S&P Capital IQ/Coresight Research[/caption]

Toys “R” Us

Established: 1957

Retail sector: Toy specialist stores

Bankruptcy filing date: September 18, 2017

Liquidation date: June 29, 2018

Number of stores closed: 735

The demise of Toys “R” Us can be attributed to several factors, including a failure to innovate its business model to adapt to changing customer needs and expectations. However, the most important factor was it was overburdened with the billions of dollars in debt that stopped the company from making the necessary investment in stores and digital platforms. In 2005, Toys “R” Us was taken private with over $5 billion in debt, on which the company was thereafter paying interest of $400 million every year for more than a decade. After its leveraged buyout, the company continually underinvested in its business.

The company failed to compete effectively with major rivals, such as Amazon, Walmart and Target, mainly in terms of pricing. In 2017, Toy “R” Us sold about $792 million worth of toys online – a fraction of Amazon’s $4.5 billion, according to One Click Retail.

Toys “R” Us had been struggling for more than a decade, with declining revenues and accumulated losses.

Reviewing the last six quarters prior to the company filing for bankruptcy, we observed the following at Toys “R” Us:

- Revenues and gross profit growth were negative.

- Same-store sales continued to deteriorate.

- EBIT margins remained negative for most quarters.

- Debt levels had been on the rise.

- Unlevered free cash flow margins were poor.

Source: S&P Capital IQ/Coresight Research[/caption]

The Way Ahead

We think the slew of bankruptcies in the past two years does not necessarily indicate a weak retail sector, but rather a “survival of the fittest” environment. Physical stores are still important, which can be seen in Amazon’s move into brick and mortar with the launch of Amazon Go Stores and the acquisition of Whole Foods Market. But, to stay relevant, retailers need to invest in stores and online platforms, with a focus on omnichannel retailing. Failure to invest in appealing propositions has been a hallmark of many retailers that have entered bankruptcy. Their peers must strengthen their brands, with attractive stores and engaging experiences that create positive customer interactions.

Source: S&P Capital IQ/Coresight Research[/caption]

The Way Ahead

We think the slew of bankruptcies in the past two years does not necessarily indicate a weak retail sector, but rather a “survival of the fittest” environment. Physical stores are still important, which can be seen in Amazon’s move into brick and mortar with the launch of Amazon Go Stores and the acquisition of Whole Foods Market. But, to stay relevant, retailers need to invest in stores and online platforms, with a focus on omnichannel retailing. Failure to invest in appealing propositions has been a hallmark of many retailers that have entered bankruptcy. Their peers must strengthen their brands, with attractive stores and engaging experiences that create positive customer interactions.