DIpil Das

What’s the Story?

The US retail industry is in an era of unprecedented disruption and transformation. Following a large number of bankruptcy filings by traditional and iconic retailers in 2017 and 2018, retail failures continued apace in 2019 and year-to-date 2020. The combined effects of a challenging retail environment and the impact of the coronavirus pandemic are causing significant financial distress for companies in the retail industry.Why It Matters

Coresight Research estimates that the US retail industry will witness 20,000–25,000 store closures in 2020, of which 55–60% will be mall-based—up from our expectation of 8,000 at the beginning of the year. The sizable number of store closures and bankruptcy filings reflect the overbuilt retail footprint in the US, the continued growth of e-commerce and shifting consumer preferences. Based on store-closure patterns, we can see that major retailers are coming under renewed pressure in 2020. There are three primary reasons why bankruptcies have a significant bearing on the retail industry:- More bankruptcies translate to more store closures.

- Mall owners will face a challenge in finding new tenants to occupy space vacated by stores closed by bankrupt retailers.

- Mall owners may acquire some struggling and bankrupt retailers.

Reviewing America’s Retail Bankruptcies

In this section, we discuss how bankruptcies have plagued US retailers in 2020. We explore the details of some of the major bankrupt firms (those having liabilities of over $50 million) and discuss the factors behind their downfall. We present a comparable discussion of selected 2019 bankruptcies later in this report.Covid-19 Has Driven Retailers to Bankruptcy

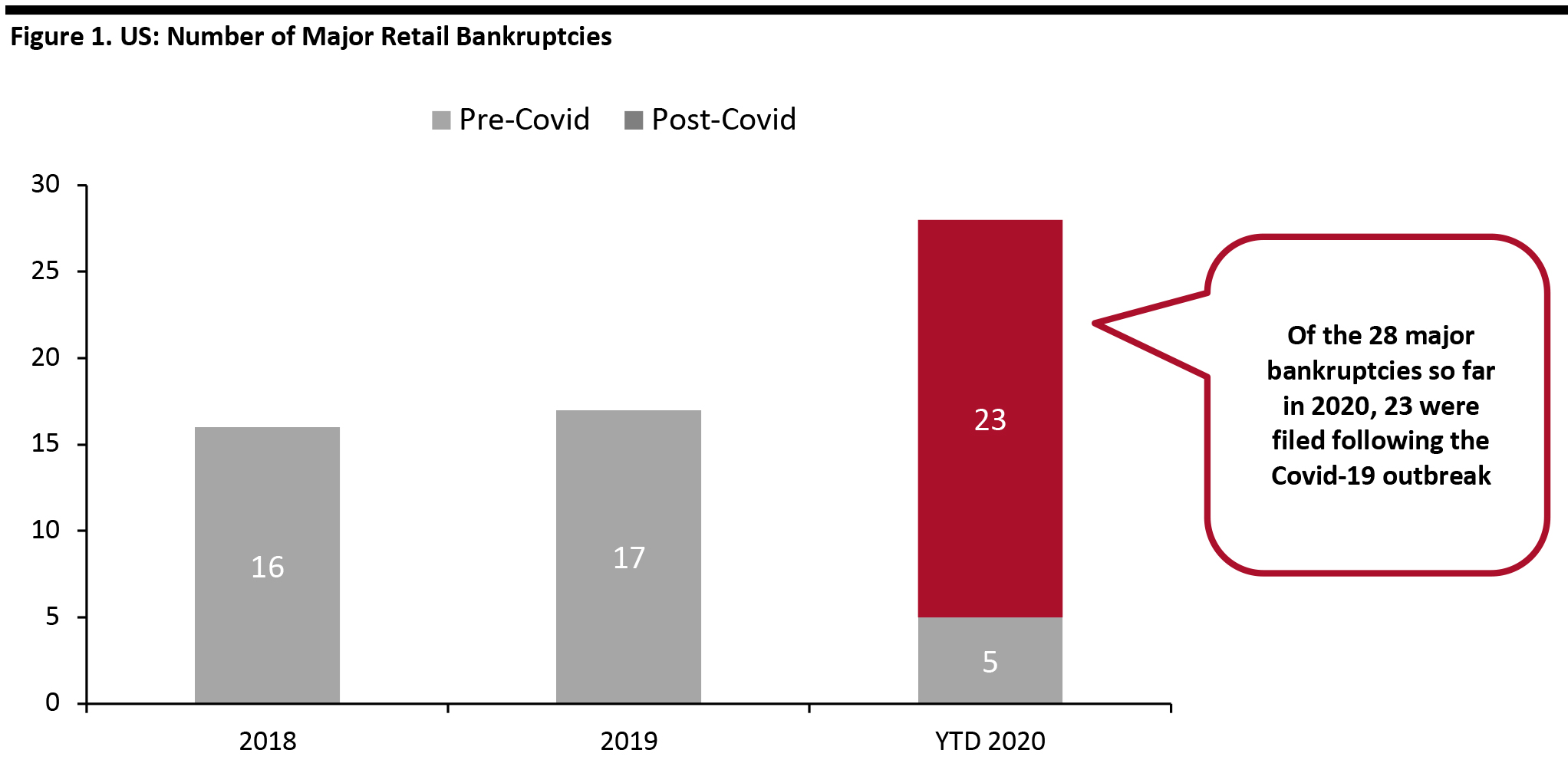

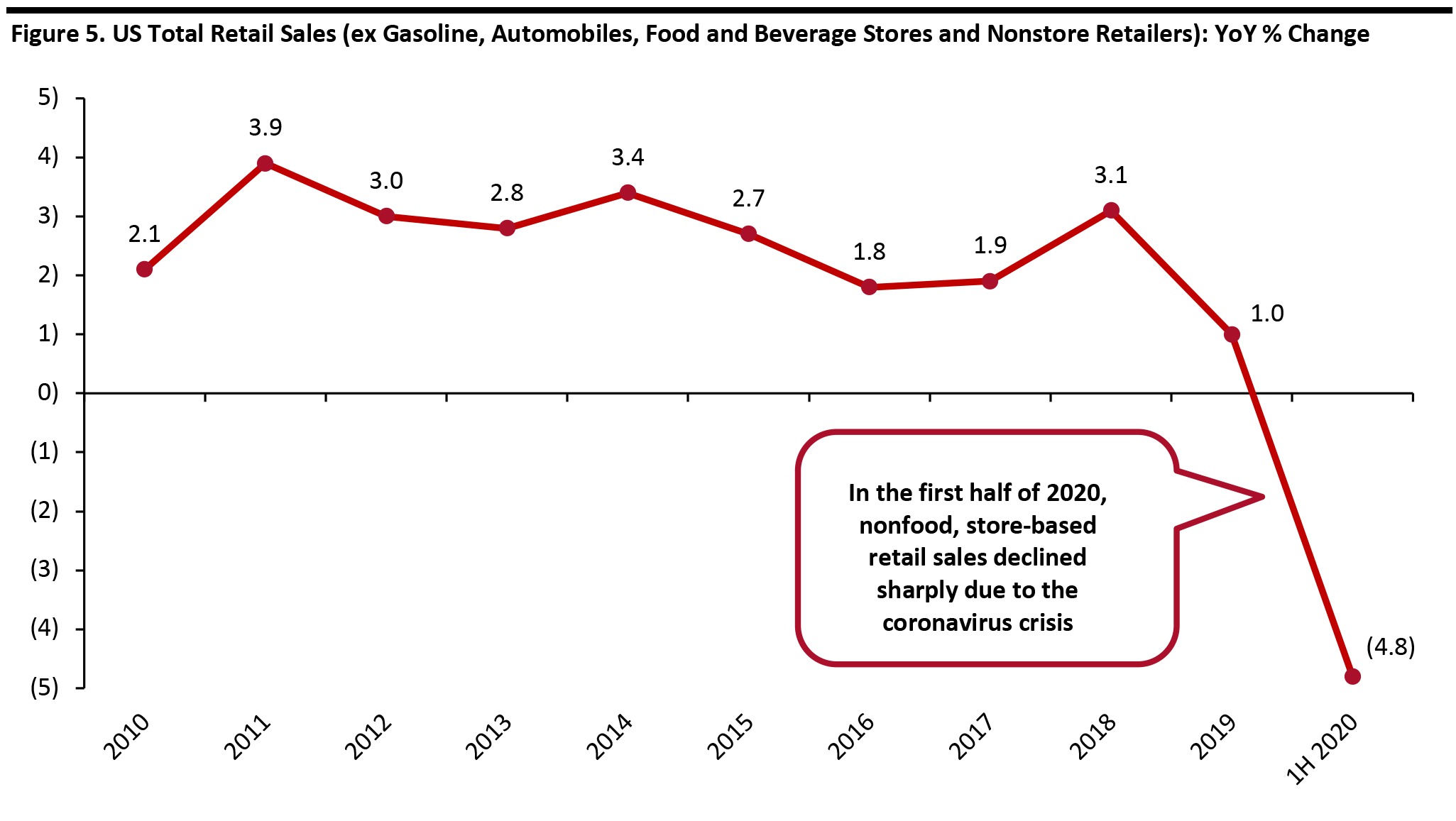

This year has been the toughest in living memory for retail. On top of the underlying factors that have forced retailers into bankruptcy in recent years has been the coronavirus outbreak, which caused unprecedented challenges in terms of supply (stores being closed) and demand (reduced consumer spending), forcing retailers to negotiate with suppliers and landlords to tackle unforeseen inventory and liquidity issues, respectively. In the second quarter of 2020, US GDP declined by 32.9% year over year, nearly four times the worst quarterly decline during the Great Recession of 2008, according to the US Bureau of Economic Analysis. At their nadir in April, retail sales slumped by as much as 87% year over year at clothing retailers, 58% at furniture retailers and 45% at department stores, according to the US Census Bureau. In 2020, retail bankruptcies have surged: 33 weeks into 2020, 28 major retailers have filed for bankruptcy in the US—already significantly more than the full-year tallies of the previous two years, as can be seen in Figure 1. Of these bankruptcies, 23—82% of the total—were filed after lockdowns began and so may be attributed to the coronavirus pandemic. [caption id="attachment_115225" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Of the 28 major bankrupt retailers in year-to-date 2020, some are closing their operations for good—including Art Van Furniture, Earth Fare, Lucky’s Market, Modell’s Sporting Goods, Papyrus, Pier 1 Imports and Stage Stores.

Source: Company reports/Coresight Research[/caption]

Of the 28 major bankrupt retailers in year-to-date 2020, some are closing their operations for good—including Art Van Furniture, Earth Fare, Lucky’s Market, Modell’s Sporting Goods, Papyrus, Pier 1 Imports and Stage Stores.

Figure 2. US: Year-to-Date 2020 Major Retail Bankruptcies [wpdatatable id=408 table_view=regular]

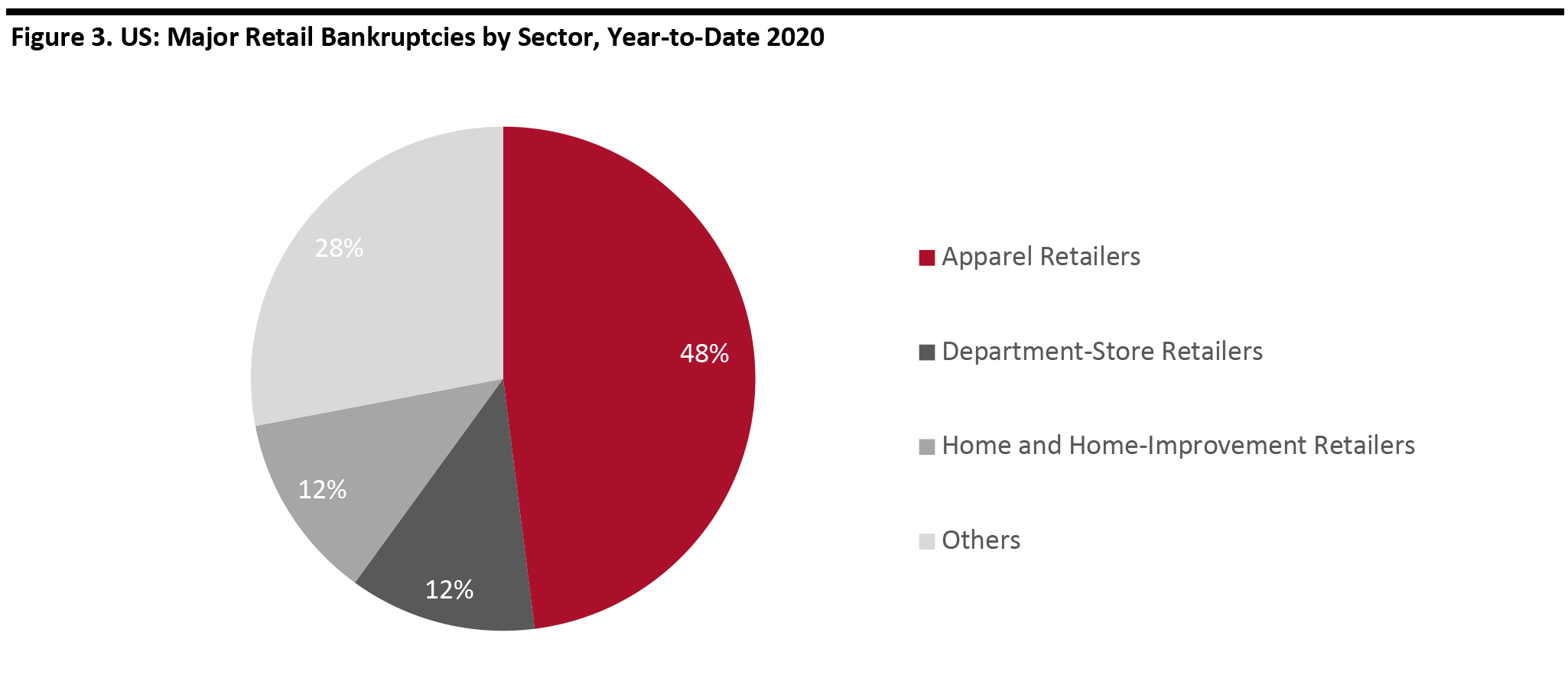

The revenue figure depicted for Centric Brands is for the nine-month period ended September 30, 2019. *Fairway Market filed for bankruptcy for the second time after entering and exiting bankruptcy in 2016; True Religion Apparel filed for bankruptcy for the second time after entering and exiting bankruptcy in 2017. ***J. Crew Group includes J.Crew and Madewell banners; Ascena Retail Group includes Justice, Catherines, Ann Taylor, LOFT, Lane Bryant and Lou & Grey banners. N/A – Not Available Source: Company reports/Coresight Research As the coronavirus pandemic wreaked havoc on retail, apparel retail and department stores have proven to be the hardest-hit sectors in terms of bankruptcies, impacted by a slump in demand and, in several cases, high levels of debt (we discuss factors in more detail later in this report). [caption id="attachment_115226" align="aligncenter" width="700"]

“Apparel” includes retailers such as Ascena Retail Group and Muji; “Others” includes drugstore GNC and grocery, gift and stationery retailers.

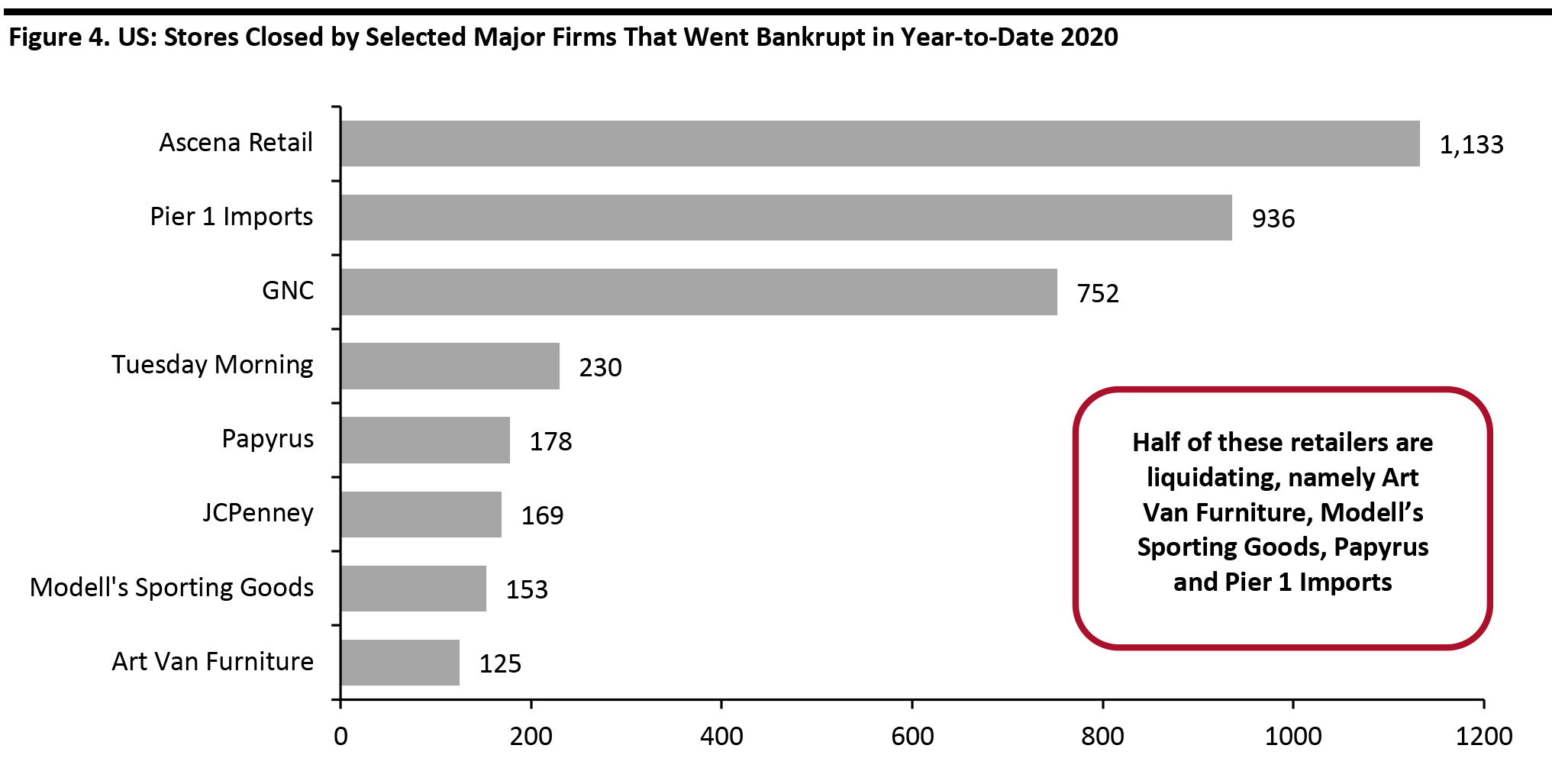

“Apparel” includes retailers such as Ascena Retail Group and Muji; “Others” includes drugstore GNC and grocery, gift and stationery retailers. Source: Coresight Research [/caption] As of August 14, US retailers have announced 6,650 store closings in 2020—this total includes many retailers that are closing stores without entering bankruptcy. Some 2,821 of these closures were announced by Ascena Retail Group, Pier 1 Imports and GNC combined. [caption id="attachment_115227" align="aligncenter" width="700"]

Includes only those brand and retailers that have announced more than 100 store closures

Includes only those brand and retailers that have announced more than 100 store closures Source: Company reports/Coresight Research [/caption]

Covid-19 Drives Spike in US Retail Bankruptcies—But It’s Not the Only Factor

The well-documented impacts of the coronavirus have been the principal drivers of bankruptcies this year—although structural challenges and company-specific factors have contributed too. We will turn to those secondary, longer-term factors later in this section, after acknowledging the extraordinary impact of Covid-19.- Coronavirus crisis. The crisis is compounding structural pressures for brands and retailers. It is particularly tough for companies in discretionary sectors seeing weak demand (most notably for clothing and footwear) and that have high brick-and-mortar exposure, as well as those that are saddled with debt. Names such as JCPenney and Brooks Brothers tick all of these boxes.

The shutdown of nonessential stores cut off the cash flow of discretionary retailers, eating into those companies’ liquidity cushions. Even as lockdowns eased and stores reopened, pockets of weak consumer demand (especially for clothing and footwear) and social-distancing measures are continuing to impact retailers’ sales.

Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

- Debt overload. To grow brick-and-mortar capacity, a number of retailers racked up high debt levels. Companies are now having trouble making payments as the retail shutdown stemmed cash flows. Retailers once rolled over debt to buy time, but with rising interest rates, overleveraged companies are finding refinancing expensive. Some retailers, such as Ascena Retail and J.Crew, had weak balance sheets, with liabilities massively exceeding assets, making rolling over debt even more challenging. Huge borrowings, followed by rising repayment and refinancing deadlines, made it difficult for these retailers to invest in e-commerce capabilities and store upgrades that could have helped them compete with their peers and online-only retailers.

- Leveraged buyouts by private equity firms. Between 2012 and 2018, more than 70% of the largest retail-chain bankruptcies were at private equity-acquired chains, according to a July 2019 study by the Center for Popular Democracy and other groups, including Americans for Financial Reform Education Fund. The study suggests that about two-thirds of retailers that went bankrupt in 2016 and 2017 were backed by private equity.

The above trends highlight that some private equity owners potentially place substantial debt on the retailers. For example, the leveraged buyouts of Gymboree by private equity firm Bain Capital in 2010 saddled the retailer with $1.2 billion of debt, with interest expense increasing from $0.25 million to $91 million every year, increasing the strain on Gymboree’s resources and leaving little room for investment in stores and technology.

Figure 6. US: Private Equity-Acquired Major Retailers That Have Gone Bankrupt Since 2006 [wpdatatable id=409 table_view=regular]

Source: The Center for Popular Democracy/Debtwire/Bankruptcydata.com/Coresight Research

- Burgeoning e-commerce. E-commerce has grown at a rapid pace in retail: Coresight Research estimates that e-commerce nearly doubled its share of all US nonfood retail sales between 2012 and 2019, rising from 10.3% to 19.6%. In 2020, we expect e-commerce to capture around one-quarter of all nonfood retail sales. However, many retailers could not match this pace of change and failed to substantially transform themselves. More profoundly, the growth of e-commerce stripped many legacy retailers of their USPs—those companies, such as some department stores, were focused on the promise of choice, convenience and, in some cases, price, but found that online rivals stole those competitive advantages.

- A shrinking middle class. According to Coresight Research analysis of US Census Bureau data, the US middle class fell from 54% of the population in 1967 to just 42% in 2018, reflecting that income gains have been unevenly distributed toward wealthy households and the middle class lost spending power as costs rose. Retailers in the centerground of retail, such as department stores, are among those to have relied on spending from this segment. The shrinking of the middle class has compounded challenges across the centerground of retail, driving a fragmentation of spending, including toward value players and premium names.

Reviewing Selected 2020 Retail Bankruptcies (Post-Covid) in Detail

In this section, we review the details of selected major retailers that entered bankruptcy after the coronavirus-induced lockdowns (and so may be attributed to the crisis). Ascena Retail Group Established: 1962 Retail sector: Apparel, footwear and accessories Bankruptcy filing date: July 23, 2020 Number of stores closed: 1,133 Like a number of legacy apparel retailers with high mall exposure, Ascena Retail was dealing with declining sales long before the coronavirus pandemic. However, the crisis has caused substantial losses to the company. In a brief update related to its most recent quarter ending May 2, 2020, Ascena’s Interim Executive Chairman Carrie Teffner said, “Covid-19 has significantly disrupted our business. Despite aggressive actions to preserve liquidity, the pandemic has significantly reduced our earnings and cash flow, resulting in increased levels of debt and deferred liabilities.” Ascena Retail has reported five consecutive years of losses. As a conglomerate with a large number of retail brands, it faced difficulty in giving sufficient attention to several brands under its portfolio, resulting in the faltering of a number of brands, such as Dressbarn. The company has been facing strong competition from value apparel brands and retailers, such as Gap Inc’s Old Navy and Target, as well as online platforms, including Stitch Fix and Rent the Runway (Ascena Retail launched a rival rental subscription service in 2017). Furthermore, Ascena Retail was burdened with debt, which it took to fund expansion, such as through acquisitions of other apparel companies. As of February 1, 2020, the company had $1.2 billion of long-term debt on its books. In its bankruptcy filing, Ascena Retail said it owes many mall owners—$31.7 million to Simon Property Group, $16.6 million to Brookfield Property Partners, $8.8 million to Boston Properties and $7.2 million to Tanger Properties. In 2015, the company made one of its boldest moves since inception when it acquired Ann Inc—Anna Taylor and LOFT—for $2 billion. The acquisition deal did not turn around the company’s fortune as hoped, as losses continued to accumulate. Instead, the deal exposed Ascena Retail to heavy amounts of debt and interest payments, preventing it from making sufficient investments into store refreshes and digital capabilities. Since it acquired Ann Inc, Ascena Retail’s market capitalization has nosedived, from $2.6 billion as of September 16, 2015 to $3.9 million as of August 7, 2020, according to S&P Capital IQ. We make the following observations over the last six quarters prior to Ascena Retail filing for bankruptcy:- Revenue growth was negative for most of the quarters.

- Same-store sales growth turned negative in the latest quarter.

- Debt levels were on the rise.

- Operating margins were negative in three of the six quarters.

- Unlevered cash flow margins were negative for most of the quarters.

Figure 7. Ascena Retail Group: Financial Metrics for the Last Six Quarters [wpdatatable id=410 table_view=regular]

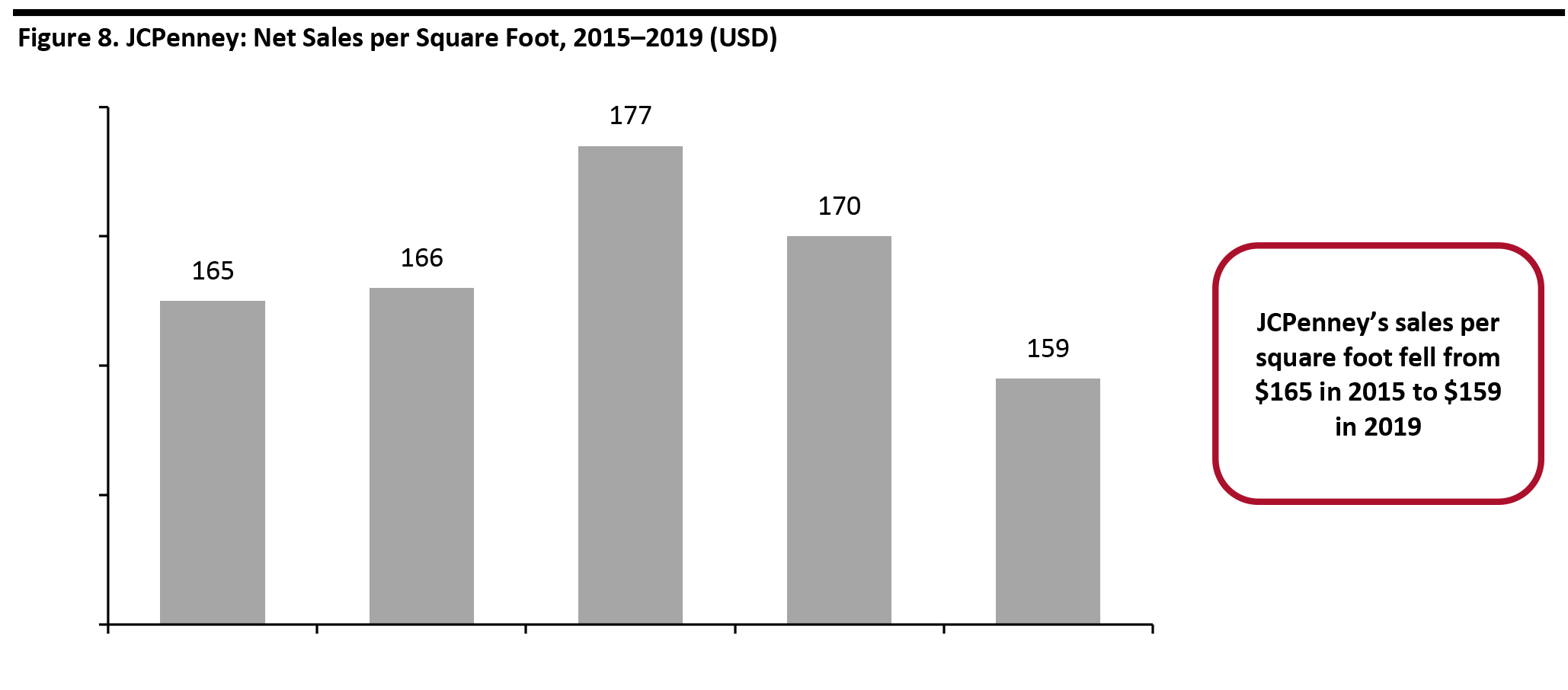

Source: Company reports/Coresight Research JCPenney Established: 1902 Retail sector: Department stores Bankruptcy filing date: May 15, 2020 Number of stores closed: 169 Although JCPenney was struggling even before the coronavirus crisis, the pandemic has severely hurt the department store. In April, when all JCPenney stores were closed due to lockdowns, the company’s sales plunged 88% year over year. The coronavirus pandemic also derailed talks with lenders, which may have helped it manage its balance sheet outside of the bankruptcy court process. JCPenney had been struggling for almost a decade, with declining revenues and accumulated losses. The department stores’ most recent profitable year was 2010, and its accumulated losses stood at $4.1 billion as of 2019. JCPenney’s sales were battered by the growth of online retailers. Furthermore, the company faced strong competition from big-box discounters such as Costco and Target, which not only provide consumers with lower prices but also with a selection of products/items not found in traditional department stores, such as groceries. JCPenney’s merchandise sales per square foot of selling space in stores fell, from $165 in 2015 to 159 in 2019 (as seen in Figure 6 below), alongside rising rents. [caption id="attachment_115229" align="aligncenter" width="700"]

Source: Company reports[/caption]

Furthermore, JCPenney has been burdened with debt, which it took to finance expansion. As of February 1, the department store chain had $3.6 billion of long-term debt on its books. The heavy amounts of debt prevented JCPenney from quickly adapting to changing digital trends that reduced footfalls in malls and department stores. Although much of the company’s debt will come due next year, JCPenney missed a $12 million debt payment on the due date of April 15. After filing for bankruptcy in May, the company borrowed an additional $450 million from lenders to pay for operations during the reorganization.

When we review JCPenney’s last six quarters prior to filing for bankruptcy, we see the following:

Source: Company reports[/caption]

Furthermore, JCPenney has been burdened with debt, which it took to finance expansion. As of February 1, the department store chain had $3.6 billion of long-term debt on its books. The heavy amounts of debt prevented JCPenney from quickly adapting to changing digital trends that reduced footfalls in malls and department stores. Although much of the company’s debt will come due next year, JCPenney missed a $12 million debt payment on the due date of April 15. After filing for bankruptcy in May, the company borrowed an additional $450 million from lenders to pay for operations during the reorganization.

When we review JCPenney’s last six quarters prior to filing for bankruptcy, we see the following:

- Revenue growth was consistently negative.

- Same-store sales growth remained negative.

- Operating margins and unleveraged cash flow margins were negative for three out of the six quarters.

- Total debt levels were on rise, but the company’s ability to service its short-term debt remained intact.

Figure 9. JCPenney: Financial Metrics for the Last Six Quarters [wpdatatable id=411 table_view=regular]

Source: Company reports/Coresight Research J.Crew Established: 1947 Retail sector: Apparel, footwear and accessories Bankruptcy filing date: May 4, 2020 Number of stores closed: Eight The demise of J.Crew can be attributed to several factors, including the coronavirus pandemic, a high debt burden and a failure to innovate its business model to adapt to changing customer needs. As of February 2020, J.Crew had $1.7 billion in debt, which prevented the company from making the necessary investments into stores and digital platforms. J.Crew was taken private after being acquired by TPG Capital and Leonard Green & Partners in a leveraged buyout for $3 billion in 2011. To reduce some of its debt, J.Crew planned to capitalize a 2020 initial public offering (IPO) of its fast-growing Madewell brand. However, the coronavirus crisis derailed the IPO efforts as the company failed to reach an agreement with lenders, as cited by Bloomberg in March 2020. Furthermore, J.Crew made a misstep when it raised its prices at a time when consumers were increasingly cost-conscious, according to J.Crew’s former CEO Mickey Drexler in an interview with The Wall Street Journal in 2017. For example, J.Crew launched J.Crew Collection, a high-priced line at the time of the Great Recession in 2008. As part of the financial restructuring process, J.Crew had secured a $400 million loan from lenders. The retailer will retain its popular Madewell brand, as per its bankruptcy plan. We make the following observations over the last six quarters prior to the retailer filing for bankruptcy:

- Revenue growth was in the low, single digits for most of the quarters.

- The company’s ability to service its short-term debt declined substantially.

- Unlevered cash flow margins fluctuated between negative and positive.

Figure 10. J.Crew Group: Financial Metrics for the Last Six Quarters [wpdatatable id=412 table_view=regular]

Source: Company reports/Coresight Research Neiman Marcus Established: 1907 Retail sector: Department stores Bankruptcy filing date: May 7, 2020 Number of stores closed: 21 Several factors contributed to the breakdown of Neiman Marcus. The luxury department store chain had been slow to embrace digital and been facing strong competition from online rivals (such as Farfetch) before the pandemic. Since 2017, Neiman Marcus’s monthly online visitors have been less than half that of its main rival Nordstrom; in April 2020, NeimanMarcus.com tracked 10.2 million visits versus Nordstrom.com’s 35.7 million visits, according to data analytics service provider SimilarWeb. The coronavirus outbreak presents further challenges for Neiman Marcus, including overall weakness in the luxury market. Coresight Research estimates that the global personal luxury goods market will decline by 20–25% at constant exchange rates in 2020, largely due to the widespread global impact of the coronavirus, which has already caused disruption in travel and has halted consumer discretionary spending in those regions on lockdown. Furthermore, Neiman Marcus was burdened with billions of dollars of debt that stopped the company from making the necessary investments into stores and digital platforms—as we have seen from Nordstrom and Macy’s in recent years. At the time of its bankruptcy filing, Neiman Marcus had $5.1 billion of debt. Through financial restructuring, Neiman Marcus aims to eliminate $4.0 billion of its $5.1 billion of debt. As part of the restructuring process, Neiman Marcus secured $675 million in financing from its creditors, which own about two-thirds of its debt, to continue its operations. In the company’s press release on May 7, Neiman Marcus’s CEO Geoffroy van Raemdonck said, “The binding agreement from our creditors gives us additional liquidity to operate the business during the pandemic and the financial flexibility to accelerate our transformation. We will emerge a far stronger company.” According to the agreement, Neiman Marcus will continue to operate its luxury e-commerce platform Mytheresa independently, beyond the reach of creditors. Reviewing the last six quarters prior to the company filing for bankruptcy, we observed the following at Neiman Marcus:

- Revenue growth was negative in the last three quarters.

- Same-store sales growth continued to deteriorate and turned negative in the latest quarter.

- Unlevered free cash flow margin was negative in the last quarter.

- Debt levels had been surging.

Figure 11. Neiman Marcus: Financial Metrics for Last Six Quarters [wpdatatable id=413 table_view=regular]

Source: Company reports/Coresight Research

Comparison of US Retail Bankruptcies: 2020 Versus 2019

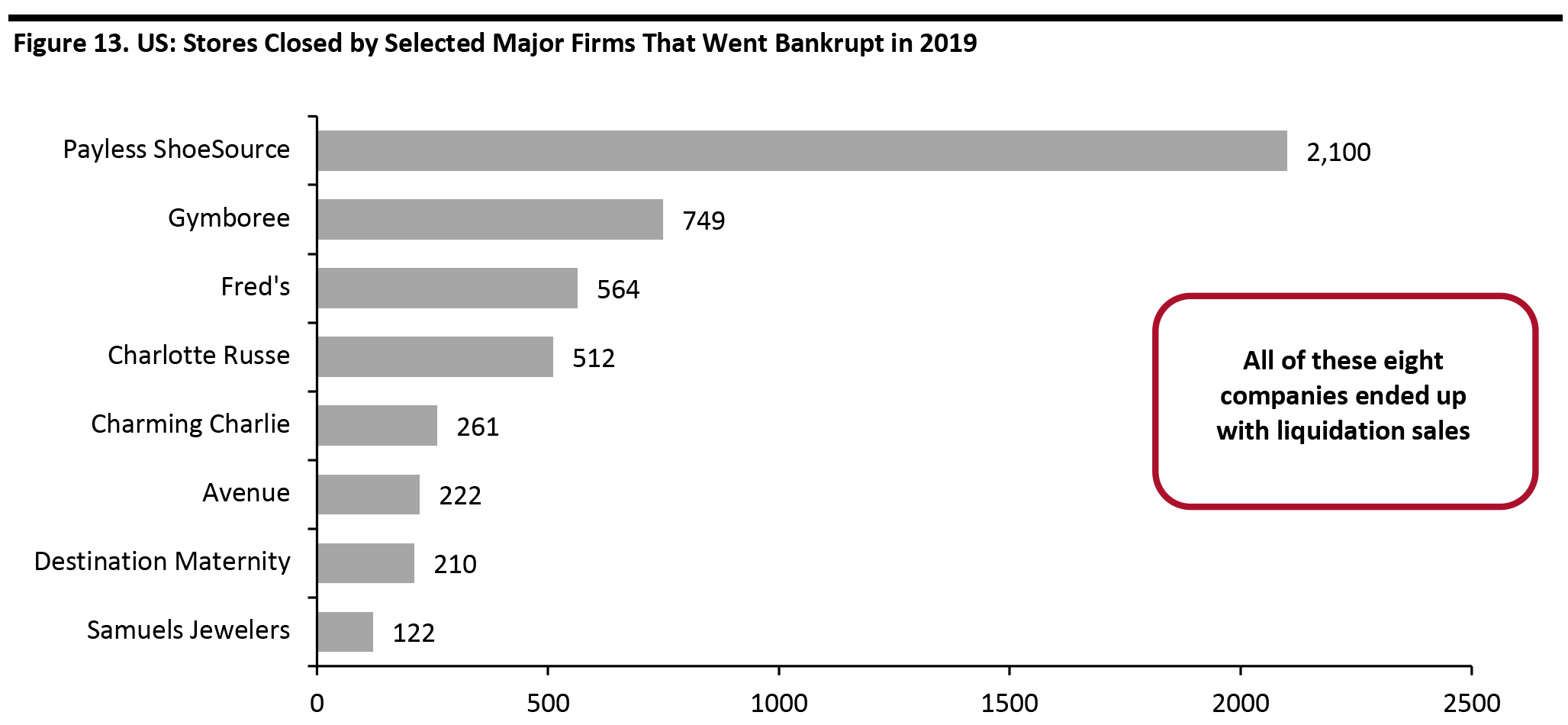

In 2019, we tracked a total of 17 major retailers filing for bankruptcy protection, versus the 28 major retail bankruptcies in year-to-date 2020. In both years, most bankruptcies were in the apparel, footwear and accessories segment, as consumers switched a greater share of their spending from physical stores to e-commerce. In 2019, a few retailers managed to emerge from bankruptcy proceedings; clothing retailer Fullbeauty Brands exited court protection in less than 24 hours, for example. However, some retail companies closed their doors for good—including Avenue, Barneys New York, Charlotte Russe, Charming Charlie, Destination Maternity, Fred’s, Gymboree, Payless ShoeSource, Shopko and Samuel Jewelers.Figure 12. US: Major Bankruptcy Filings in 2019 [wpdatatable id=414 table_view=regular]

The revenue figure depicted for Gymboree is for the nine-month period ended November 3, 2018. *A’gaci filed for bankruptcy for the second time after entering and exiting bankruptcy in 2018. N/A – Not Available Source: Company reports/Coresight Research These bankruptcies contributed to the substantial number of store closures in 2019. In total, Coresight Research recorded 9,832 store closures in the year, which includes many retailers that are closing stores without entering bankruptcy. We show major closures in 2019 by selected bankrupt retailers below. [caption id="attachment_115230" align="aligncenter" width="700"]

Includes only those brands and retailers that have announced more than 100 store closures

Includes only those brands and retailers that have announced more than 100 store closures Source: Company reports/Coresight Research [/caption]

Reviewing Selected 2019 Retail Bankruptcies (Pre-Covid) in Detail

In this section, we review the details of selected major retailers that entered bankruptcy in 2019 (before the coronavirus pandemic). Destination Maternity Established: 1982 Retail sector: Apparel, footwear and accessories Bankruptcy filing date: October 21, 2019 Liquidation date: December 16, 2019 Number of stores closed: 210 In recent years, maternity-apparel retailer Destination Maternity had struggled financially due to various factors, such as declining national birth rates, dwindling foot traffic, the rise of e-commerce players and internal leadership shifts. Destination Maternity’s revenues declined by about one-third between 2013 and 2018, and in the fiscal year ending February 2, 2019, the company reported a net loss of $14.3 million. The retailer attributed unfavorable demographic changes as one of the factors for declining traffic—the US birth rate dropped to a 32-year low in 2018 at 11.6 per 1,000 of the population, according to the US Department of Health and Human Services. This shift in demographics has come about as millennials are having children later in life than previous generations, or not at all. Furthermore, Destination Maternity’s sales were impacted by a shift in general retail trends toward a looser fit in women’s clothing, such as elastic waistbands and maxi dresses—non-specialized apparel that could be worn further into pregnancy. In addition, the company has been facing stronger competition from a range of apparel retailers, such as Gap Inc, H&M, Target and Walmart, which have been investing in innovating their stores and digital platforms. Destination Maternity faced immense pressure from online-only retailers such as Hatch, Pink Blush and Zulily, and subscription retailers such as Rent the Runway and Le Tote. Destination Maternity’s leadership has been in turmoil for some time. In the last five years, the company has burned through many CEOs, each with a very different vision for success. In 2018, the leadership turmoil was met with another problem when investors launched a proxy fight over the Board. In June 2019, CEO Marla Ryan resigned within one year of appointment. At the time of filing for bankruptcy, the company carried $244 million in debt. In December 2019, Destination Maternity announced plans to sell its e-commerce sites, leased departments across third-party retailers and intellectual property to brand management company Marquee Brands for $50 million. Marquee Brands intends to transform Destination Maternity’s business model to better compete in the digital landscape; it is also looking to build an engaged online community of new and expecting mothers and to develop relevant content that would support their motherhood journeys. When we review Destination Maternity’s last six quarters prior to filing for bankruptcy, we see the following:- Revenue growth was negative consistently, hit by declining store traffic and growing competition.

- Same-store sales growth was negative in most of the quarters.

- EBIT margin and unlevered free cash flow margin remained negative for most of the last six quarters.

- The company’s ability to service its short-term debt declined in the last two quarters.

- Total debt as a percentage of equity worsened in the last three quarters.

Figure 14. Destination Maternity: Financial Metrics for the Last Six Quarters [wpdatatable id=415 table_view=regular]

Source: Company reports/Coresight Research Fred’s Inc Established: 1947 Retail sector: General merchandise stores and pharmacies Bankruptcy filing date: September 9, 2019 Liquidation date: November 9, 2019 Number of stores closed: 564 The discount general-merchandise and pharmacy chain Fred’s had been reporting yearly losses since 2015. In the general-merchandise business, Fred’s had been facing strong competition from rival discount stores—such as Dollar General—and mass merchandisers such as Target and Walmart. In the pharmacy business, Fred’s faced challenges from CVS and Walgreens Boots Alliance. In recent years, Fred’s had been incorporating cost-cutting measures, such as inventory clearance sales and the shuttering of hundreds of unprofitable stores. However, these did not help the retailer to avoid bankruptcy and liquidation. In September 2018, Fred’s sold its patient prescription files and related pharmacy inventory from its 185 stores to Walgreens for $165 million. In May 2018, Fred’s had sold its specialty pharmacy business to CVS Health for $40 million. Reviewing Fred’s last six quarters prior to filing for bankruptcy protection, we observe the following:

- Revenue growth was negative for most of the quarters.

- Same-store sales growth was negative consistently.

- EBIT margins remained negative.

- The company’s ability to service its short-term debt remained intact.

- Unlevered cash flow margins fluctuated between negative and low-single-digit positive.

- Total debt as a percentage of equity surged in the last quarter.

Figure 15. Fred’s Inc: Financial Metrics for Last Six Quarters [wpdatatable id=416 table_view=regular]

Source: Company reports/Coresight Research

Despite Emerging from Bankruptcy, Many Retailers Continue To Struggle

Historically, US retailers have used the bankruptcy process to reorganize by reducing debt significantly and closing most of their stores. Before the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) 2005, retailers often spent years in bankruptcy while deciding which leases to keep, which to abandon and which business models to follow. However, BAPCPA 2005 gives bankrupt retailers just 210 days to act on store leases. Since it can take up to 90 days to hold a going-out-of-business sale, retailers often have just 120 days to propose a reorganization plan and provide disclosure statements to creditors, which then evaluate the plan and decide whether to approve or reject it. Owing to this reduced timeframe, bankrupt firms are finding it more difficult to restructure debt and emerge from bankruptcies. From 2016 to 2019, there were about 40 liquidations in the US retail industry versus roughly 30 reorganizations, according to Debtwire data. During the coronavirus pandemic, bankruptcy filings are increasingly spelling death for retailers due to very low financing availability as banks tighten their purse strings. Some distressed retailers may survive bankruptcy, but we believe that many may be short-term revivals that merely delay the inevitable—unless they create a sound long-term restructuring plan.Mall Owners Are Looking To Acquire Bankrupt Retailers amid the Coronavirus Pandemic

The recent wave of retailer bankruptcies, along with the ominous signs for an acceleration of such filings for the future, will further complicate the challenges that mall owners continue to face. Department stores such as JCPenney and other large-format retailers have traditionally played the role of anchor tenants in malls, generating strong foot traffic that attracts other retailers to set up shop in the malls. When anchor tenants shutter their stores in the mall, other tenants are likely to follow suit. Some of these tenants often enter into co-tenancy clauses that enable them to pay lower rent or break their leases when an anchor tenant leaves. It is in this context that some leading mall owners are considering acquiring bankrupt and struggling retailers. Sparc Group, Simon Property Group’s 50-50 joint venture with brand management company Authentic Brands (primarily known for acquiring brands with licensing potential), has submitted stalking-horse bids to buy Brooks Brothers and Lucky Brand Jeans out of bankruptcy. Simon Property Group sees three benefits from these acquisitions:- Acquiring below-cost inventory

- Reducing overheads

- Increasing cash flow

What We Think

Many of the US retailers we have discussed in this report were already facing major challenges prior to Covid-19, and the crisis then proved disastrous for the most challenged and especially the most debt-laden. Even post-lockdown reopenings did not provide much support to the most troubled names: Store rents and employees’ salaries became due, while sales remained stagnant due to low traffic levels and depressed spending in some categories. We believe the coronavirus pandemic will create a surge of bankruptcy filings in late 2020; the longer the coronavirus crisis goes on, the greater chance that more retailers will falter. The survival of brands and retailers depends on a mix of factors, such as how much cash they have and when their major loans will mature, meaning full payment is due. The near-term maturities made things difficult for some retailers this year: Neiman Marcus has a substantial loan to repay this year; and J.Crew’s sizable loan is maturing next year, and the retailer’s plan to generate money through the IPO of its fast-growing brand Madewell was put on hold. Implications for Brands/Retailers- The coronavirus crisis will primarily hit retailers that were already in financial trouble but stayed afloat by using low-interest funds prior to the crisis. Some of the leading examples are J.Crew, JCPenney and Neiman Marcus.

- Brick-and-mortar retailers will likely be worse-off. Although online retailers might look comparatively safe, they might face financial struggle due to interrupted supply chains, lowered credit ratings and depressed demand due to higher unemployment.

- More retailers filing for bankruptcy imply more store closures. It would also put pressure on many of the remaining retailers: With malls losing their anchor stores, traffic will decline as shoppers will have less reason to visit—in contrast to the expectations of remaining stores benefiting from reduced competition.

- Brands and retailers could buy valuable time to negotiate rent payments with landlords and production costs under other business contracts.

- Retailers may look at their sales differently and conduct a thorough financial assessment to determine if they are financially stable and have enough cash on hand to survive in this troubled economy.

- There is opportunity for stronger retailers to gain market share.

- A rise in the number of retail bankruptcies will create significant challenges for malls to find new occupants for vacant spaces on account of store closures.

- In particular, department store chains and other large-format-store retailer bankruptcies will impact malls significantly, given that they operate as anchors. Mall landlords may also lose other remaining retailers and stores due to co-tenancy clauses.

- Mall owners may consider acquiring struggling and bankrupt retailers, particularly anchor retailers, that have the potential to survive.