Nitheesh NH

What’s the Story?

Amazon is one of the biggest e-commerce players globally. In recent years, the company has established its presence in the CPG industry with multiple private labels as the wider industry shifts to the digital channel. In this report, we discuss Amazon’s success and current focus areas in the CPG industry.Why It Matters

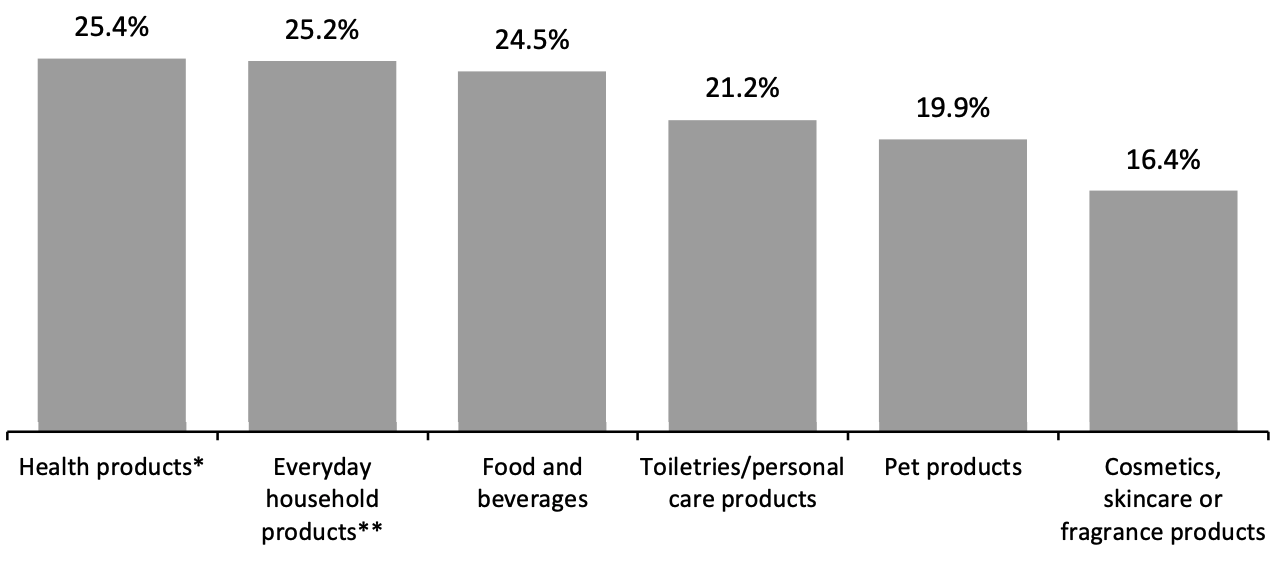

CPG has been one of the slowest categories to shift from brick-and-mortar retail to the online channel. Many companies have started selling their products online in the past couple of years, but the boost in e-commerce in 2020 changed the face of the CPG retail landscape due to widespread temporary store closures amid pandemic-led lockdowns. Many consumers turned to the online channel to buy CPG products—a trend that has not abated in 2021 so far. Survey findings from Coresight Research’s weekly US Consumer Tracker consistently show double-digit proportions of US consumers are purchasing CPG categories online—with around one-quarter buying groceries. In Figure 1, we present data from our recent survey on July 19, 2021, as an example. Amazon remains one of the leaders in CPG e-commerce, but the space may become more congested as more brands and retailers move online in the wake of the consumer shift to digital.Figure 1. US Consumers: CPG Product Categories Bought Online in Past Two Weeks in the US (% of Respondents) [caption id="attachment_132020" align="aligncenter" width="700"]

*Health products include items such as vitamins, medicines and health devices

*Health products include items such as vitamins, medicines and health devices**Everyday household products include cleaning products, paper towels, laundry products, and others

Base: 457 US respondents aged 18+, surveyed on July 19, 2021

Source: Coresight Research[/caption]

Amazon’s Success in CPG: In Detail

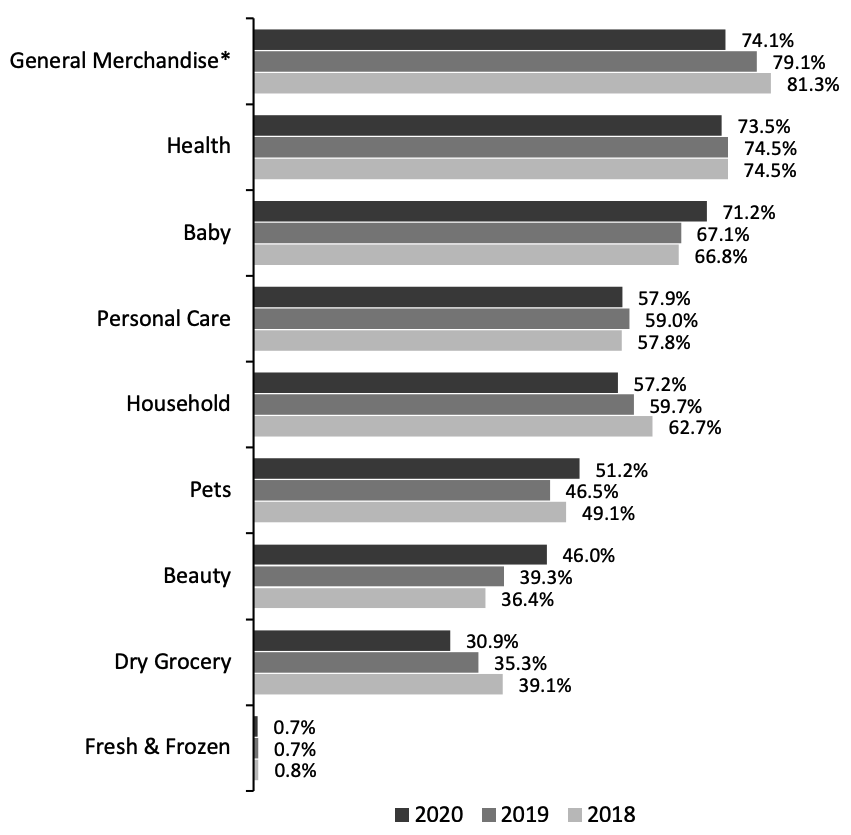

Amazon’s Growth in the US CPG E-Commerce Industry Amazon was the market leader in US CPG e-commerce in 2020, with a 46.1% share of online CPG sales, according to IRI. However, this share has been declining since past two years, down from 48.2% in 2018 and 46.6% in 2019, in the context of rising competition from traditional retailers that are establishing an online presence. Figure 2 shows a breakdown of Amazon’s share in selected CPG e-commerce categories in the US since 2018. While Amazon enjoys a dominant online share in a number of nonfood CPG categories, it tends to have a much lower share in online sales of food categories. Its share of dry grocery has been declining, presumably due in part to competition from multichannel grocery rivals. Amazon’s share in online fresh and frozen food sales is tiny, reflecting that its core website is not set up to serve the unique demands of multiple-item grocery baskets with fresh and frozen goods. Demand for regular grocery baskets must be channeled through Amazon Fresh and Prime Now, both of which require a Prime membership and are not available to all addresses.Figure 2: Amazon’s Share in Selected CPG E-Commerce Categories in the US (%) [caption id="attachment_132021" align="aligncenter" width="700"]

*Includes batteries, kitchen storage units, foils and wraps, paper towels and other products

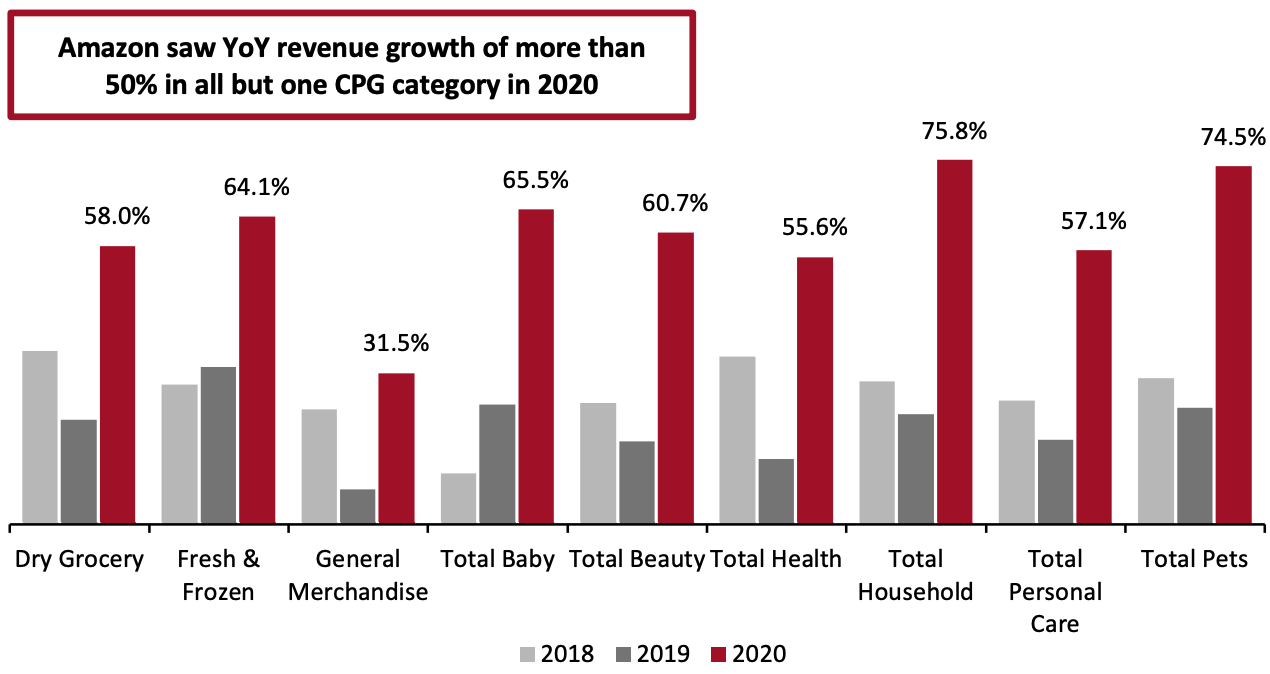

*Includes batteries, kitchen storage units, foils and wraps, paper towels and other products Source: IRI[/caption] Even though Amazon’s overall market share has declined, the company has seen its revenue from the sale of CPG products increase significantly in the same period—with the consumer shift to e-commerce amid the Covid-19 pandemic likely having supported this trend, as well Amazon’s continued expansion of CPG product offerings on its platform. Figure 3 highlights overall recorded revenue growth across Amazon’s multiple CPG categories.

Figure 3. Amazon’s Revenue Growth Across CPG Categories in the US (YoY %) [caption id="attachment_132022" align="aligncenter" width="700"]

Source: IRI[/caption]

Amazon’s Share of the US Online Grocery Space

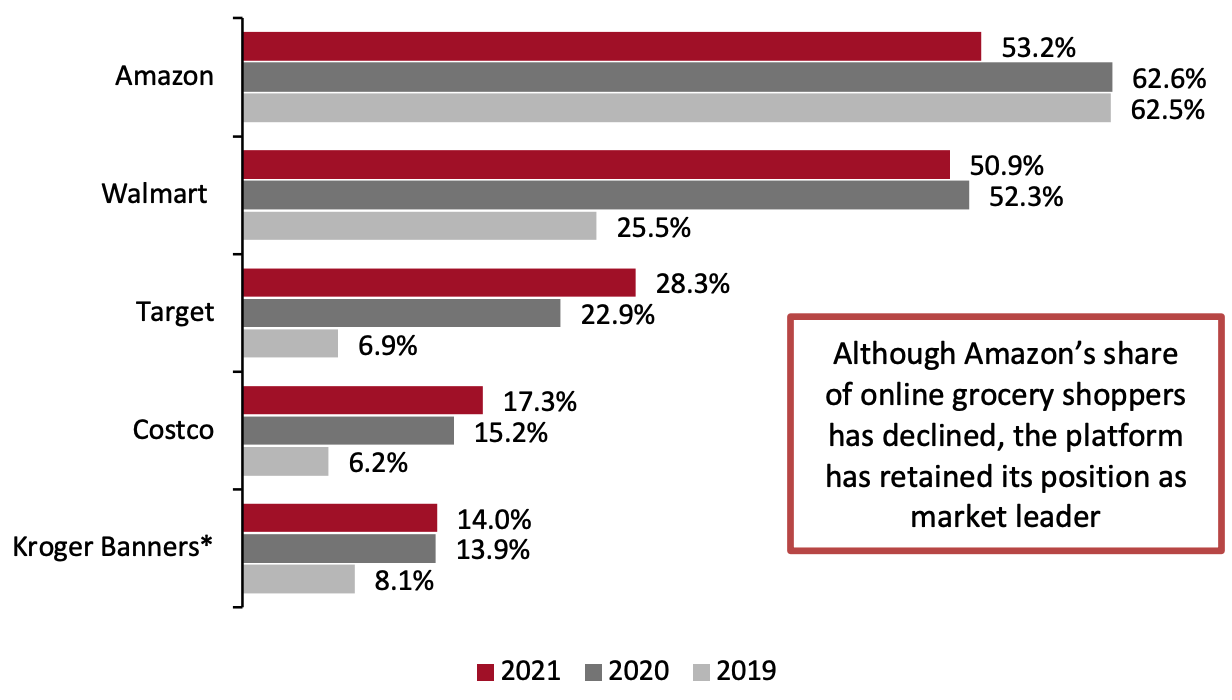

Amazon is the top destination for online grocery shopping, according to Coresight Research’s US online grocery survey conducted in March/April 2021. Among US online grocery shoppers, 53.2% had bought groceries from Amazon in the past 12 months, with the e-commerce giant leading its closest competitor Walmart by only 2.3 percentage points.

The proportion of online grocery shoppers buying on Amazon saw a year-over-year decline of 9.4 percentage points (although this was on an online shopper base that increased). This was in the context of the Covid-19 pandemic prompting many shoppers to turn to e-commerce for regular, large-basket grocery shops, which (as we noted earlier) Amazon’s main website cannot fully serve—these full-basket shoppers accounted for a greater proportion of online consumers in 2020/21, boosting Amazon’s grocery-store rivals.

Source: IRI[/caption]

Amazon’s Share of the US Online Grocery Space

Amazon is the top destination for online grocery shopping, according to Coresight Research’s US online grocery survey conducted in March/April 2021. Among US online grocery shoppers, 53.2% had bought groceries from Amazon in the past 12 months, with the e-commerce giant leading its closest competitor Walmart by only 2.3 percentage points.

The proportion of online grocery shoppers buying on Amazon saw a year-over-year decline of 9.4 percentage points (although this was on an online shopper base that increased). This was in the context of the Covid-19 pandemic prompting many shoppers to turn to e-commerce for regular, large-basket grocery shops, which (as we noted earlier) Amazon’s main website cannot fully serve—these full-basket shoppers accounted for a greater proportion of online consumers in 2020/21, boosting Amazon’s grocery-store rivals.

Figure 4. Retailers from Which US Online Grocery Shoppers Have Purchased Groceries in the Past 12 Months (% of Respondents) [caption id="attachment_132023" align="aligncenter" width="700"]

*Kroger banners include City Market, Fred Meyer, Harris Teeter, King Soopers, Kroger, Ralphs and Smith’s Food & Drug

*Kroger banners include City Market, Fred Meyer, Harris Teeter, King Soopers, Kroger, Ralphs and Smith’s Food & DrugBase: US respondents aged 18+ who had purchased groceries online in the past 12 months, surveyed in March/April each year (695 in 2019, 599 in 2020 and 975 in 2021)

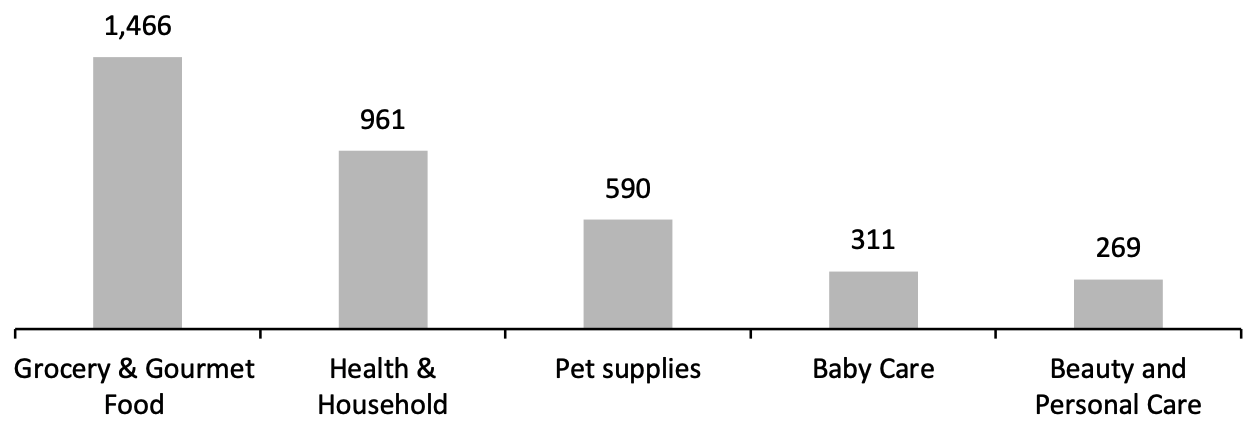

Source: Coresight Research[/caption] Amazon’s Private-Label CPG Offerings Over the last decade, e-commerce players including Amazon have increasingly launched private-label brands. The majority of Amazon’s private labels are in the clothing category, but the platform is expanding aggressively in the CPG space—by acquiring Whole Foods in 2017, launching Amazon Go Stores and Amazon Fresh in 2020 and launching Aplenty in 2021. Aplenty is a line of private-label food products, covering crackers, condiments, cookies and pita chips. In 2022, the brand will expand its collection to confections, frozen foods, baking mixes, and pantry staples to the line. Amazon now offers more than 3,500 products under its private labels in the CPG space (see Figure 5) and is selling these both online and offline.

Figure 5. Amazon CPG Private Labels: Number of Products Under Each Category* [caption id="attachment_132024" align="aligncenter" width="700"]

*Estimated as of May 2021

*Estimated as of May 2021Source: Coresight Research[/caption] Access to consumer insights through product reviews makes it easier for Amazon to compete with other established CPG brands. The Covid-19 crisis also helped Amazon’s private labels as consumers turned to them when national brands were sold out on Amazon and elsewhere due to hoarding of certain essential CPG products. US CPG sales totaled $933 billion in 2020; according to IRI, name brands collectively lost $12.1 billion in sales to private-label brands due to channel shifts, supply constraints and category shifts last year.

What We Think

Amazon is one of the pioneers in the e-commerce industry and has set various benchmarks for the rest of the industry—not least in the customer experience, with the platform leveraging access to consumer insights, artificial intelligence-driven search engines and recommendations, and an integrated distribution network to enhance the shopping journey. Amazon is now focusing on enhancing its private labels and physical retailing. Grocery shopping remains uniquely cross-channel, and an offline presence is essential to capture a meaningful share of the overall food retail market. Amazon’s growing ventures in physical retail should therefore help offset its relative weakness in food online, as reflected in its much lower share of online sales compared to nonfood CPGs.IRI DISCLAIMER: The information contained herein is based in part on data reported by IRI through its Market Advantage service, as interpreted solely by Coresight Research, Inc. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinions expressed herein reflect the judgment of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.