DIpil Das

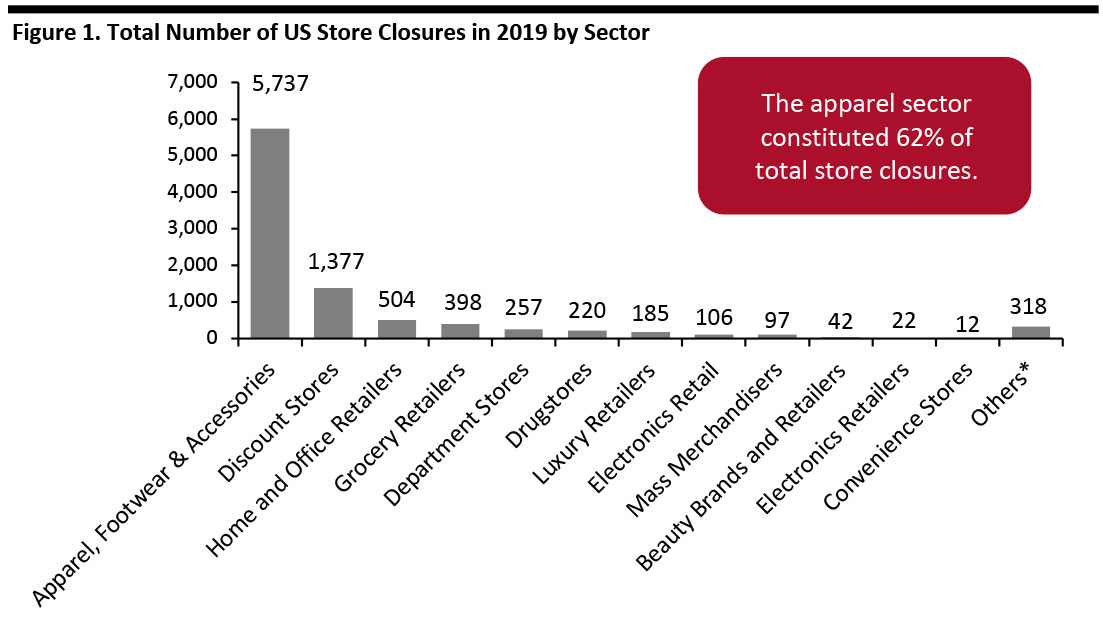

US Store Closures: Apparel Stores Led Closures

In the US, we saw 9,275 store closures by major retailers in 2019, equivalent to more than 114 million square feet (gross), according to Coresight Research estimates. This was down from more than 158 million square feet (gross) in 2018, comprising 6,897 closures. The decline in total gross square footage closed despite the higher number of closures in 2019 is explained by the fact that there were significantly more closures of department stores and other larger-format stores in 2018.

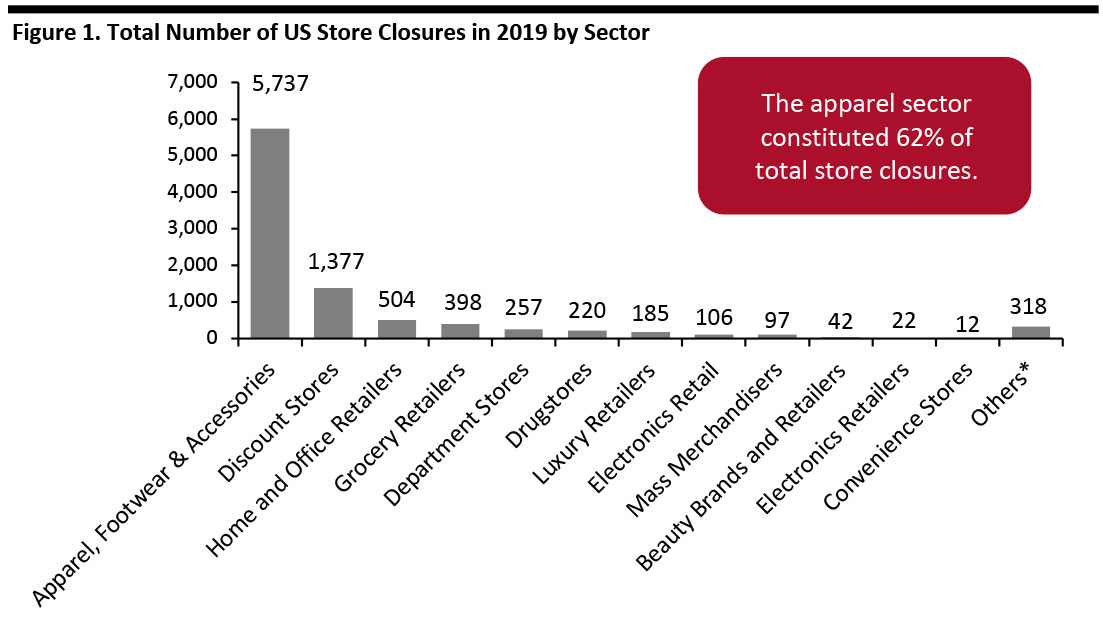

Analyzing the closures by sector, we can see that the apparel sector far outpaced other retailers over the course of 2019, with 5,737 closures in total (see Figure 1).

[caption id="attachment_102320" align="aligncenter" width="700"] *Includes retailers such as Signet Jewelers, rent-to-own company Rent-A-Center and party-supplies retailer Party City.

*Includes retailers such as Signet Jewelers, rent-to-own company Rent-A-Center and party-supplies retailer Party City.

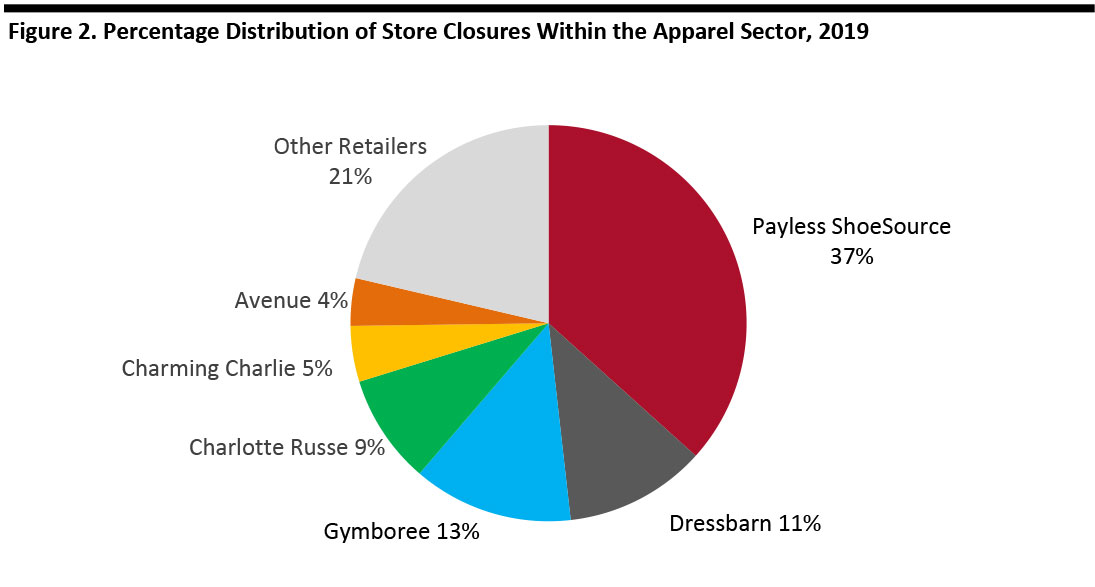

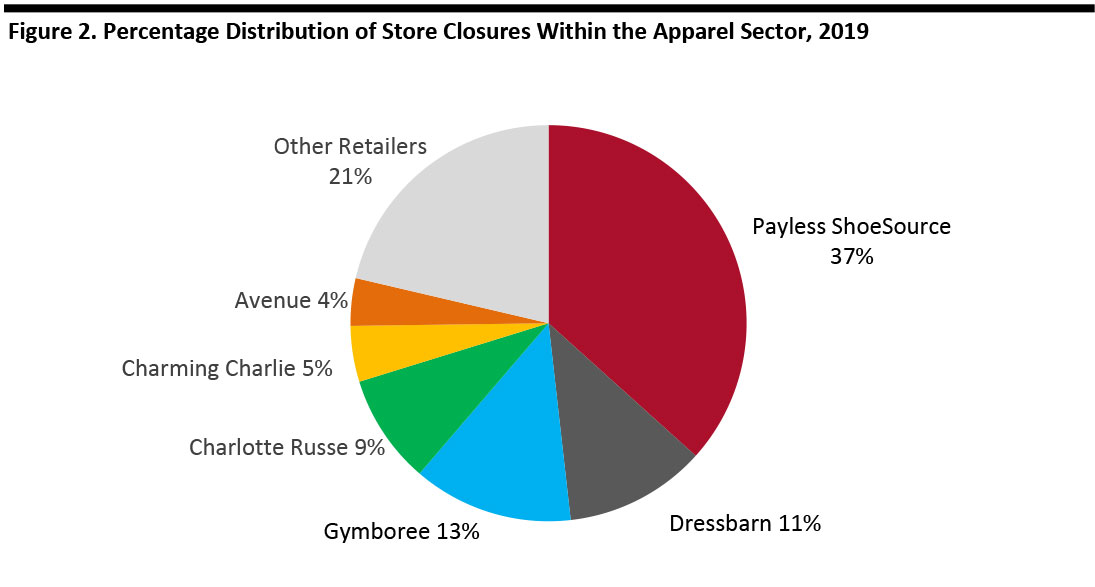

Source: Company reports/Coresight Research [/caption] Apparel, Footwear and Accessories Stores Breakdown Bankruptcies drove store closures in the apparel, footwear and accessories sector. Within this sector, footwear chain Payless ShoeSource, which shut 2,100 stores in 2019, accounted for the highest number of store closures in the year across all sectors. The company filed for bankruptcy for the second time in February 2019, having previously entered and subsequently emerged from bankruptcy in 2017. Gymboree declared bankruptcy in January and shut 749 US stores. Charlotte Russe declared bankruptcy in February and went on to shut down its entire store estate of 512 stores. Women’s fashion and accessories retailer Charming Charlie filed for bankruptcy in July and shut all 261 stores. Women’s plus-size clothing retailer Avenue filed for bankruptcy in August and went on to shut 222 stores. Following parent company Ascena Retail Group’s decision in May to wind up its Dressbarn business, all 661 Dressbarn stores closed. These six retailers accounted for 79% of total apparel-store closures recorded in 2019, as shown in Figure 2. [caption id="attachment_102321" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Store Closures across Other Sectors

Among discount stores, Shopko filed for bankruptcy in January and shut all 371 stores by June. Fred’s closed 546 stores, and Dollar Tree-owned Family Dollar closed around 359 stores.

Among home and office retailers, specialty kitchenware retailer The Kitchen Collection closed its entire fleet of 160 stores after parent company Hamilton Beach Brands announced in October 2019 its decision to wind down the business.

In the grocery retail sector, which includes health and nutrition product retailers, GNC closed an estimated 332 stores in 2019.

Other non-apparel retailers that reported major closures include Walgreens (174 estimated closures), Signet Jewelers (132) and Rent-A-Center (125).

Sears led closures in the department-store sector, with 127 closures. The company’s subsidiary Kmart closed around 83 stores, which constituted the highest number of closures in the mass-merchandiser category.

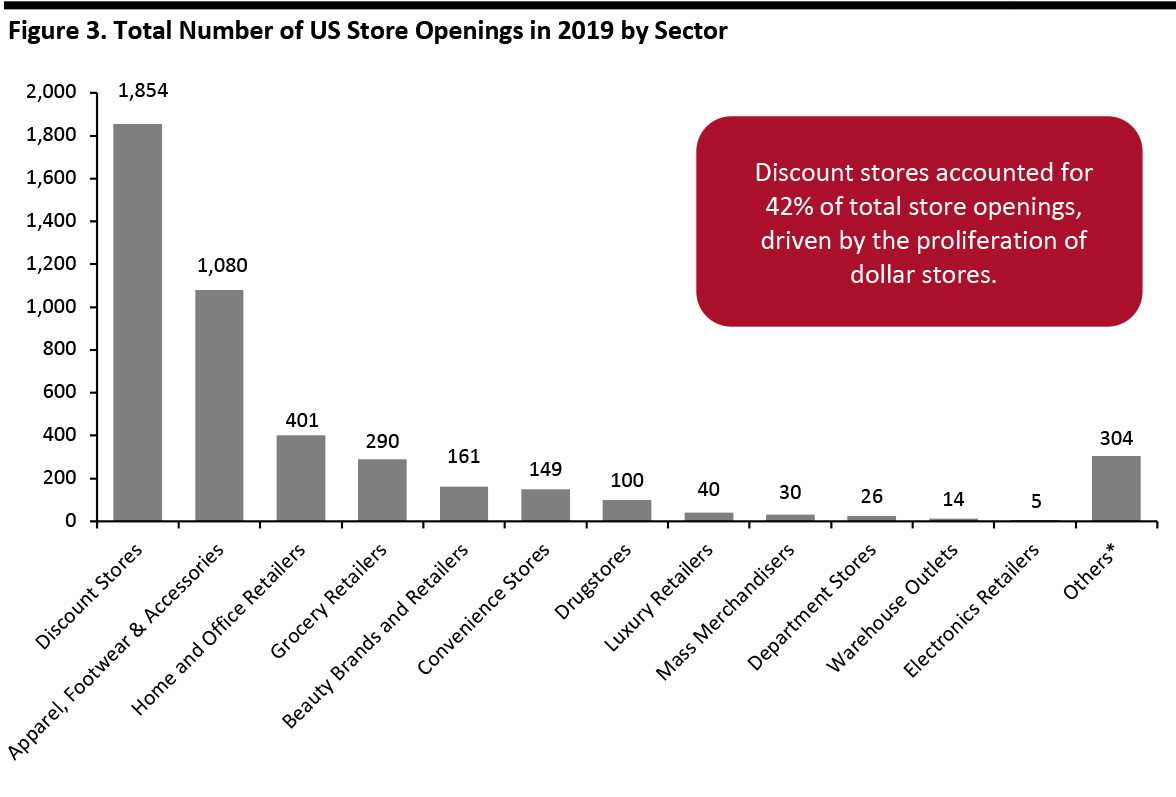

US Store Openings: Discount Stores Led Openings

Major US retailers opened 4,454 stores in 2019, spanning an area of more than 66 million square feet (gross), according to Coresight Research estimates. By comparison, 4,311 stores spanning an area of more than 72 million square feet (gross) opened in 2018.

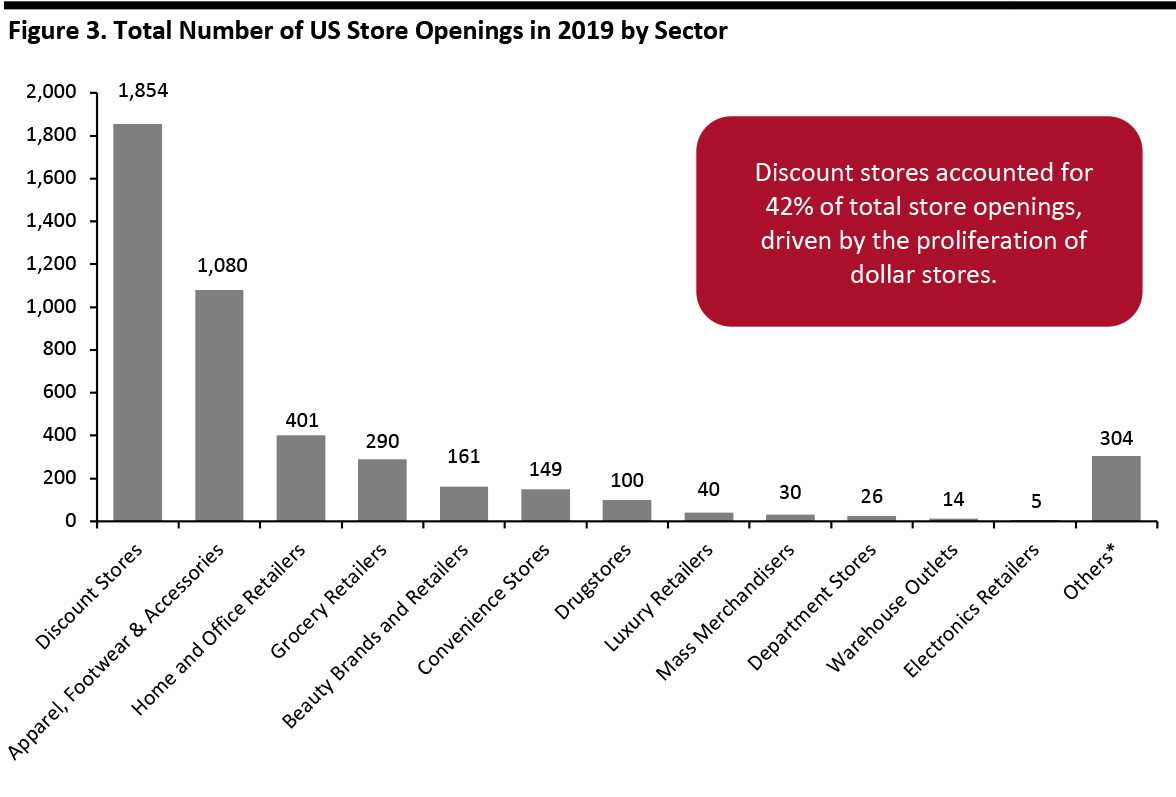

In 2019, discount stores (which include the growing dollar-store segment) constituted approximately 42% of total openings. There was also a significant number of store openings among apparel retailers.

The 1,854 store openings by discount stores outnumbered the 1,377 total closures in the sector. The apparel sector saw 911 store openings, substantially fewer than the 5,727 store closures over the course of 2019.

[caption id="attachment_102322" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Store Closures across Other Sectors

Among discount stores, Shopko filed for bankruptcy in January and shut all 371 stores by June. Fred’s closed 546 stores, and Dollar Tree-owned Family Dollar closed around 359 stores.

Among home and office retailers, specialty kitchenware retailer The Kitchen Collection closed its entire fleet of 160 stores after parent company Hamilton Beach Brands announced in October 2019 its decision to wind down the business.

In the grocery retail sector, which includes health and nutrition product retailers, GNC closed an estimated 332 stores in 2019.

Other non-apparel retailers that reported major closures include Walgreens (174 estimated closures), Signet Jewelers (132) and Rent-A-Center (125).

Sears led closures in the department-store sector, with 127 closures. The company’s subsidiary Kmart closed around 83 stores, which constituted the highest number of closures in the mass-merchandiser category.

US Store Openings: Discount Stores Led Openings

Major US retailers opened 4,454 stores in 2019, spanning an area of more than 66 million square feet (gross), according to Coresight Research estimates. By comparison, 4,311 stores spanning an area of more than 72 million square feet (gross) opened in 2018.

In 2019, discount stores (which include the growing dollar-store segment) constituted approximately 42% of total openings. There was also a significant number of store openings among apparel retailers.

The 1,854 store openings by discount stores outnumbered the 1,377 total closures in the sector. The apparel sector saw 911 store openings, substantially fewer than the 5,727 store closures over the course of 2019.

[caption id="attachment_102322" align="aligncenter" width="700"] *Includes retailers such as cannabis and CBD retailer Green Growth Brands and travel retailer Dufry AG.

*Includes retailers such as cannabis and CBD retailer Green Growth Brands and travel retailer Dufry AG.

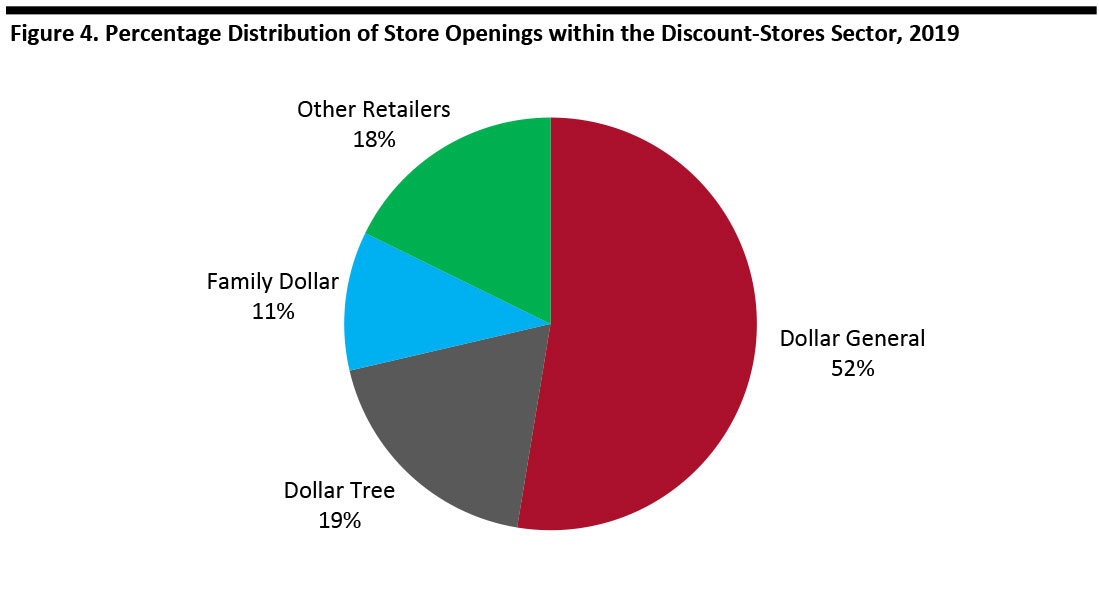

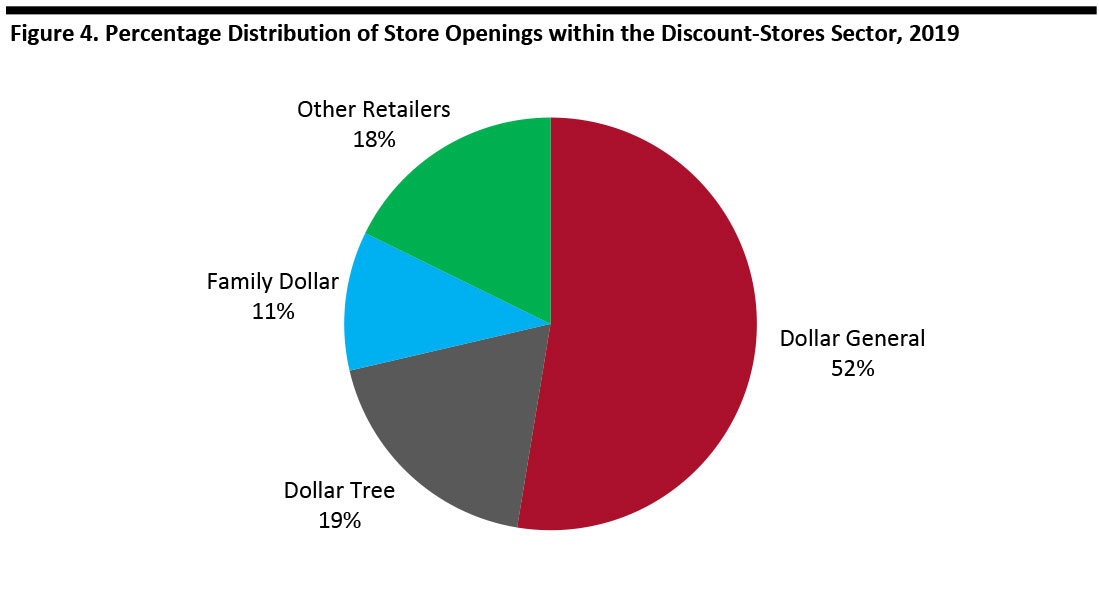

Source: Company reports/Coresight Research [/caption] Discount Stores Breakdown Dollar stores had a notable impact on the total number of openings in the discount-stores sector last year, with Dollar General opening 975 stores, Dollar Tree opening 348 and Family Dollar opening 202. Together, these three retailers accounted for 82% of sector openings in 2019, indicating the rapid expansion of discount stores in the US retail landscape. [caption id="attachment_102323" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Store Openings across Other Sectors

Among apparel stores, TJX and Charlotte Russe were the frontrunners in store openings, having opened 192 and 135 stores respectively. Following Charlotte Russe’s bankruptcy in February 2019, the new stores opened after the retailer was acquired by North American fashion company YM Inc in April.

In the home and office retail sector, Ace Hardware Corp opened the most stores (113), while Tractor Supply Company opened 80 stores.

The total number of store openings in the non-apparel retail category was significantly boosted by cannabis and CBD retailer Green Growth Brands, which opened 178 stores.

In the grocery retail sector, German discount grocery chain Aldi opened an estimated 159 stores in 2019. Aldi announced in June 2017 that it will open around 2,500 stores by the end of 2022—our 2019 figure is a calendarized estimate.

In summary, with the number of closures in 2019 considerably surpassing the 2018 total, the year turned out to be another tough one for brick-and-mortar retail, and we expect this theme to continue in 2020.

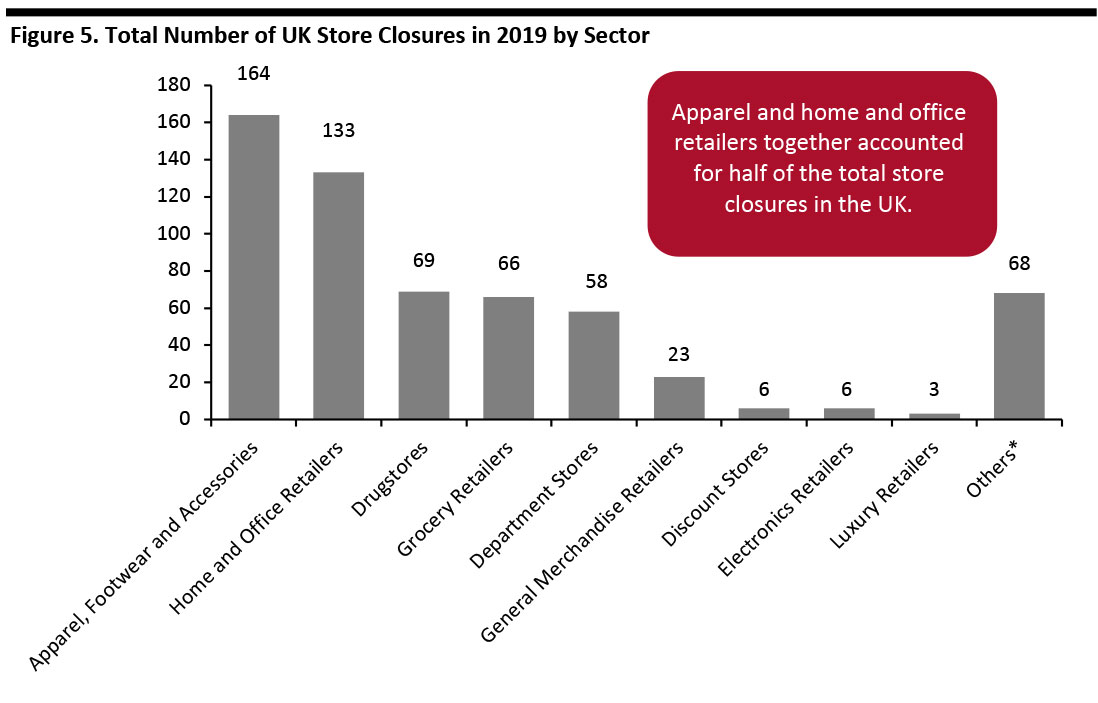

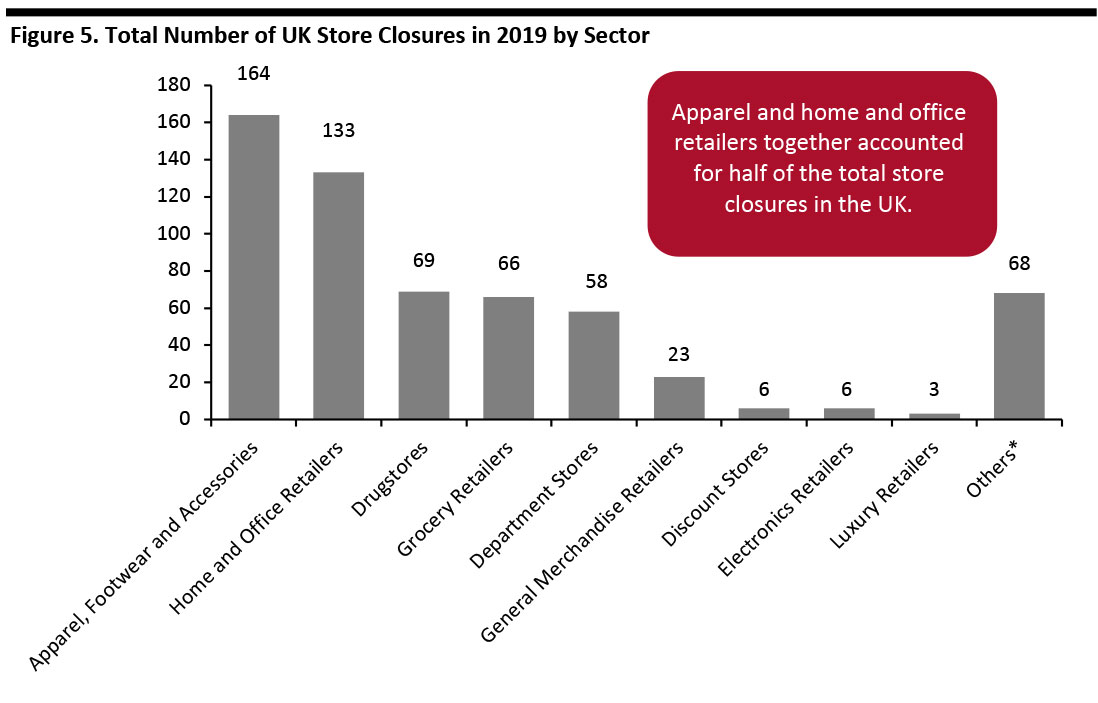

UK Store Closures: Apparel Stores and Home and Office Retailers Drove Store Closures

In the UK, we saw major retailers close 596 stores compared to the 1,502 store closures we recorded in 2018.

The apparel and home-and-office retail sectors together accounted for half of the total store closures in the UK.

Boots led the casualty list among UK retailers, having closed an estimated 67 stores. Laura Ashley closed an estimated 40 stores over the course of the year.

Other notable retailers that contributed to high-street closures in 2019 include:

Source: Company reports/Coresight Research[/caption]

Store Openings across Other Sectors

Among apparel stores, TJX and Charlotte Russe were the frontrunners in store openings, having opened 192 and 135 stores respectively. Following Charlotte Russe’s bankruptcy in February 2019, the new stores opened after the retailer was acquired by North American fashion company YM Inc in April.

In the home and office retail sector, Ace Hardware Corp opened the most stores (113), while Tractor Supply Company opened 80 stores.

The total number of store openings in the non-apparel retail category was significantly boosted by cannabis and CBD retailer Green Growth Brands, which opened 178 stores.

In the grocery retail sector, German discount grocery chain Aldi opened an estimated 159 stores in 2019. Aldi announced in June 2017 that it will open around 2,500 stores by the end of 2022—our 2019 figure is a calendarized estimate.

In summary, with the number of closures in 2019 considerably surpassing the 2018 total, the year turned out to be another tough one for brick-and-mortar retail, and we expect this theme to continue in 2020.

UK Store Closures: Apparel Stores and Home and Office Retailers Drove Store Closures

In the UK, we saw major retailers close 596 stores compared to the 1,502 store closures we recorded in 2018.

The apparel and home-and-office retail sectors together accounted for half of the total store closures in the UK.

Boots led the casualty list among UK retailers, having closed an estimated 67 stores. Laura Ashley closed an estimated 40 stores over the course of the year.

Other notable retailers that contributed to high-street closures in 2019 include:

*Includes cycle retailer Evans Cycles and music and film retailer HMV.

*Includes cycle retailer Evans Cycles and music and film retailer HMV.

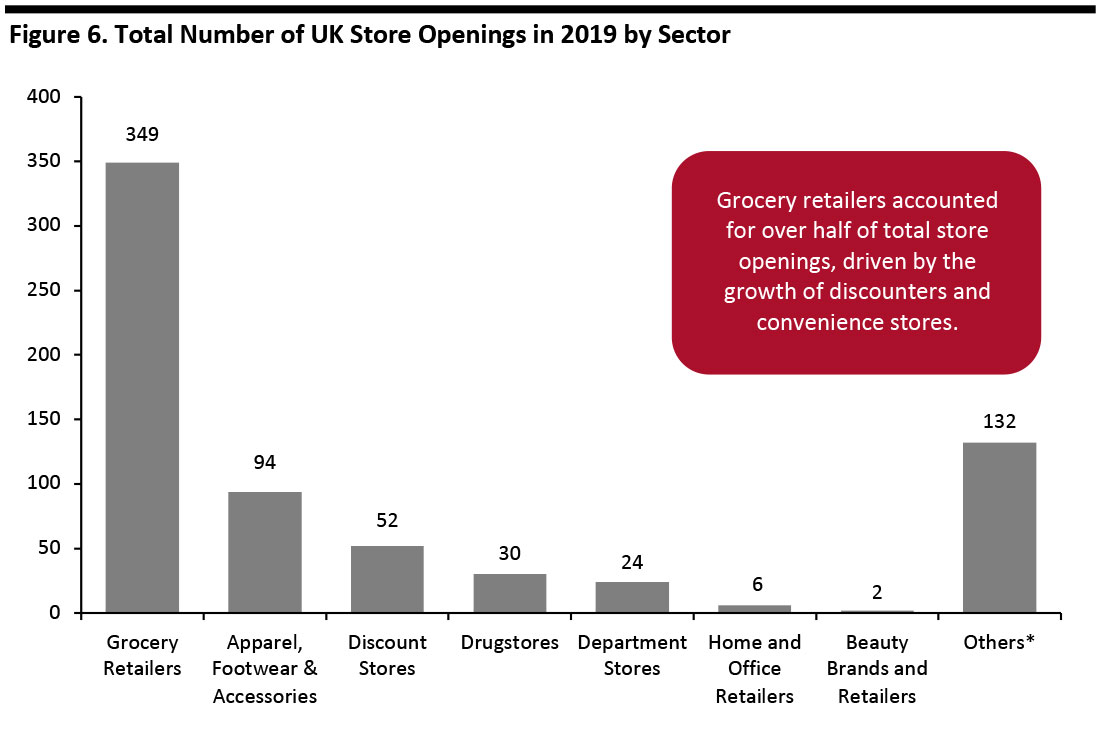

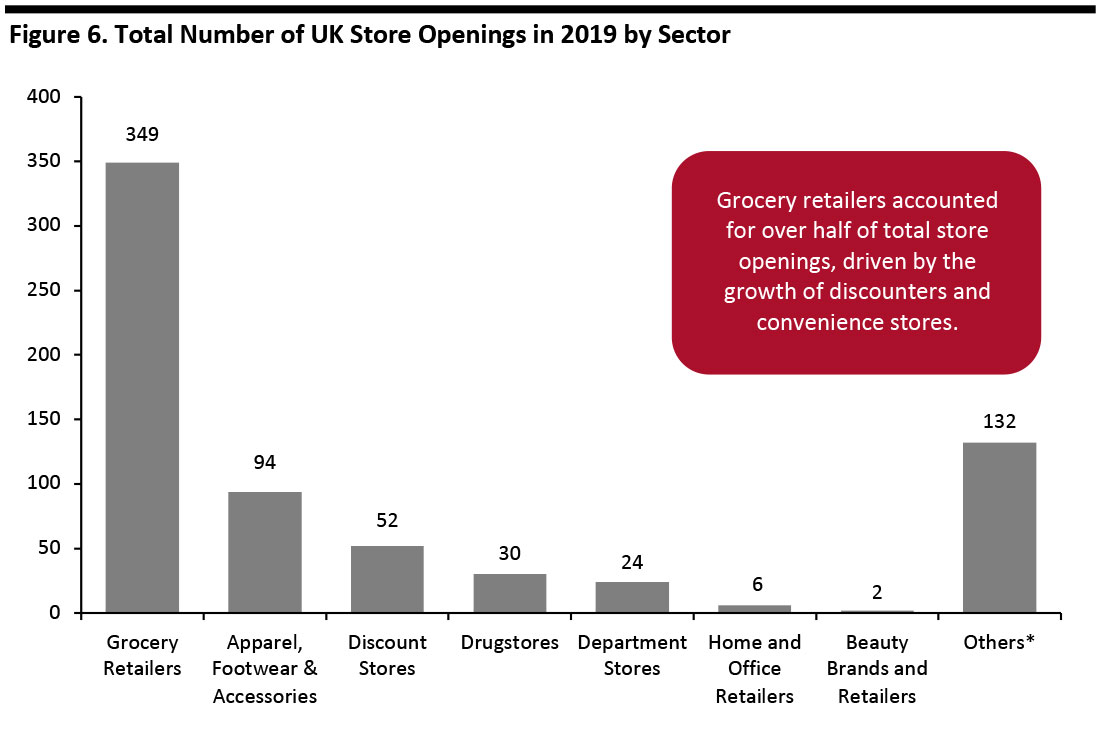

Source: Company reports/Coresight Research[/caption] UK Store Openings: Grocery Retailers Recorded the Most Openings In 2019, major UK retailers opened a total of 689 stores, fewer than the 909 store openings we recorded in 2018. The grocery retail sector was the biggest contributor with 349 openings, spurred by robust growth of discounter formats and convenience stores. *Includes retailers such as Card Factory, toy retailer The Entertainer and vape retailer VPZ

*Includes retailers such as Card Factory, toy retailer The Entertainer and vape retailer VPZ

Source: Company reports/Coresight Research [/caption] Note on Methodology Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. For some retailers, store opening and closure numbers are estimated, including from part-year data or global figures. 2019 figures for some retailers will be updated as companies provide store counts with their quarterly results and trading updates. Figures for openings and closures are gross.

*Includes retailers such as Signet Jewelers, rent-to-own company Rent-A-Center and party-supplies retailer Party City.

*Includes retailers such as Signet Jewelers, rent-to-own company Rent-A-Center and party-supplies retailer Party City. Source: Company reports/Coresight Research [/caption] Apparel, Footwear and Accessories Stores Breakdown Bankruptcies drove store closures in the apparel, footwear and accessories sector. Within this sector, footwear chain Payless ShoeSource, which shut 2,100 stores in 2019, accounted for the highest number of store closures in the year across all sectors. The company filed for bankruptcy for the second time in February 2019, having previously entered and subsequently emerged from bankruptcy in 2017. Gymboree declared bankruptcy in January and shut 749 US stores. Charlotte Russe declared bankruptcy in February and went on to shut down its entire store estate of 512 stores. Women’s fashion and accessories retailer Charming Charlie filed for bankruptcy in July and shut all 261 stores. Women’s plus-size clothing retailer Avenue filed for bankruptcy in August and went on to shut 222 stores. Following parent company Ascena Retail Group’s decision in May to wind up its Dressbarn business, all 661 Dressbarn stores closed. These six retailers accounted for 79% of total apparel-store closures recorded in 2019, as shown in Figure 2. [caption id="attachment_102321" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Store Closures across Other Sectors

Among discount stores, Shopko filed for bankruptcy in January and shut all 371 stores by June. Fred’s closed 546 stores, and Dollar Tree-owned Family Dollar closed around 359 stores.

Among home and office retailers, specialty kitchenware retailer The Kitchen Collection closed its entire fleet of 160 stores after parent company Hamilton Beach Brands announced in October 2019 its decision to wind down the business.

In the grocery retail sector, which includes health and nutrition product retailers, GNC closed an estimated 332 stores in 2019.

Other non-apparel retailers that reported major closures include Walgreens (174 estimated closures), Signet Jewelers (132) and Rent-A-Center (125).

Sears led closures in the department-store sector, with 127 closures. The company’s subsidiary Kmart closed around 83 stores, which constituted the highest number of closures in the mass-merchandiser category.

US Store Openings: Discount Stores Led Openings

Major US retailers opened 4,454 stores in 2019, spanning an area of more than 66 million square feet (gross), according to Coresight Research estimates. By comparison, 4,311 stores spanning an area of more than 72 million square feet (gross) opened in 2018.

In 2019, discount stores (which include the growing dollar-store segment) constituted approximately 42% of total openings. There was also a significant number of store openings among apparel retailers.

The 1,854 store openings by discount stores outnumbered the 1,377 total closures in the sector. The apparel sector saw 911 store openings, substantially fewer than the 5,727 store closures over the course of 2019.

[caption id="attachment_102322" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Store Closures across Other Sectors

Among discount stores, Shopko filed for bankruptcy in January and shut all 371 stores by June. Fred’s closed 546 stores, and Dollar Tree-owned Family Dollar closed around 359 stores.

Among home and office retailers, specialty kitchenware retailer The Kitchen Collection closed its entire fleet of 160 stores after parent company Hamilton Beach Brands announced in October 2019 its decision to wind down the business.

In the grocery retail sector, which includes health and nutrition product retailers, GNC closed an estimated 332 stores in 2019.

Other non-apparel retailers that reported major closures include Walgreens (174 estimated closures), Signet Jewelers (132) and Rent-A-Center (125).

Sears led closures in the department-store sector, with 127 closures. The company’s subsidiary Kmart closed around 83 stores, which constituted the highest number of closures in the mass-merchandiser category.

US Store Openings: Discount Stores Led Openings

Major US retailers opened 4,454 stores in 2019, spanning an area of more than 66 million square feet (gross), according to Coresight Research estimates. By comparison, 4,311 stores spanning an area of more than 72 million square feet (gross) opened in 2018.

In 2019, discount stores (which include the growing dollar-store segment) constituted approximately 42% of total openings. There was also a significant number of store openings among apparel retailers.

The 1,854 store openings by discount stores outnumbered the 1,377 total closures in the sector. The apparel sector saw 911 store openings, substantially fewer than the 5,727 store closures over the course of 2019.

[caption id="attachment_102322" align="aligncenter" width="700"] *Includes retailers such as cannabis and CBD retailer Green Growth Brands and travel retailer Dufry AG.

*Includes retailers such as cannabis and CBD retailer Green Growth Brands and travel retailer Dufry AG. Source: Company reports/Coresight Research [/caption] Discount Stores Breakdown Dollar stores had a notable impact on the total number of openings in the discount-stores sector last year, with Dollar General opening 975 stores, Dollar Tree opening 348 and Family Dollar opening 202. Together, these three retailers accounted for 82% of sector openings in 2019, indicating the rapid expansion of discount stores in the US retail landscape. [caption id="attachment_102323" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Store Openings across Other Sectors

Among apparel stores, TJX and Charlotte Russe were the frontrunners in store openings, having opened 192 and 135 stores respectively. Following Charlotte Russe’s bankruptcy in February 2019, the new stores opened after the retailer was acquired by North American fashion company YM Inc in April.

In the home and office retail sector, Ace Hardware Corp opened the most stores (113), while Tractor Supply Company opened 80 stores.

The total number of store openings in the non-apparel retail category was significantly boosted by cannabis and CBD retailer Green Growth Brands, which opened 178 stores.

In the grocery retail sector, German discount grocery chain Aldi opened an estimated 159 stores in 2019. Aldi announced in June 2017 that it will open around 2,500 stores by the end of 2022—our 2019 figure is a calendarized estimate.

In summary, with the number of closures in 2019 considerably surpassing the 2018 total, the year turned out to be another tough one for brick-and-mortar retail, and we expect this theme to continue in 2020.

UK Store Closures: Apparel Stores and Home and Office Retailers Drove Store Closures

In the UK, we saw major retailers close 596 stores compared to the 1,502 store closures we recorded in 2018.

The apparel and home-and-office retail sectors together accounted for half of the total store closures in the UK.

Boots led the casualty list among UK retailers, having closed an estimated 67 stores. Laura Ashley closed an estimated 40 stores over the course of the year.

Other notable retailers that contributed to high-street closures in 2019 include:

Source: Company reports/Coresight Research[/caption]

Store Openings across Other Sectors

Among apparel stores, TJX and Charlotte Russe were the frontrunners in store openings, having opened 192 and 135 stores respectively. Following Charlotte Russe’s bankruptcy in February 2019, the new stores opened after the retailer was acquired by North American fashion company YM Inc in April.

In the home and office retail sector, Ace Hardware Corp opened the most stores (113), while Tractor Supply Company opened 80 stores.

The total number of store openings in the non-apparel retail category was significantly boosted by cannabis and CBD retailer Green Growth Brands, which opened 178 stores.

In the grocery retail sector, German discount grocery chain Aldi opened an estimated 159 stores in 2019. Aldi announced in June 2017 that it will open around 2,500 stores by the end of 2022—our 2019 figure is a calendarized estimate.

In summary, with the number of closures in 2019 considerably surpassing the 2018 total, the year turned out to be another tough one for brick-and-mortar retail, and we expect this theme to continue in 2020.

UK Store Closures: Apparel Stores and Home and Office Retailers Drove Store Closures

In the UK, we saw major retailers close 596 stores compared to the 1,502 store closures we recorded in 2018.

The apparel and home-and-office retail sectors together accounted for half of the total store closures in the UK.

Boots led the casualty list among UK retailers, having closed an estimated 67 stores. Laura Ashley closed an estimated 40 stores over the course of the year.

Other notable retailers that contributed to high-street closures in 2019 include:

- Mothercare: The UK store estate of the parent-and-baby products retailer shrunk by an estimated 36 in 2019.

- Marks & Spencer: The department-store retailer closed an estimated 36 stores in 2019.

- Carpetright: Carpetright shuttered an estimated 36 stores amid a difficult retail environment, despite making some progress in its turnaround.

- Tesco: The multinational grocery and general-merchandise retailer closed an estimated 32 stores in 2019.

*Includes cycle retailer Evans Cycles and music and film retailer HMV.

*Includes cycle retailer Evans Cycles and music and film retailer HMV. Source: Company reports/Coresight Research[/caption] UK Store Openings: Grocery Retailers Recorded the Most Openings In 2019, major UK retailers opened a total of 689 stores, fewer than the 909 store openings we recorded in 2018. The grocery retail sector was the biggest contributor with 349 openings, spurred by robust growth of discounter formats and convenience stores.

- The Co-operative Group opened a total of 100 stores during the year.

- German discount retailers Aldi and Lidl contributed significantly to the grocery retail sector’s total openings count, having opened 65 and 50 stores respectively.

- Supermarket chain Iceland opened 48 stores in 2019.

*Includes retailers such as Card Factory, toy retailer The Entertainer and vape retailer VPZ

*Includes retailers such as Card Factory, toy retailer The Entertainer and vape retailer VPZ Source: Company reports/Coresight Research [/caption] Note on Methodology Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. For some retailers, store opening and closure numbers are estimated, including from part-year data or global figures. 2019 figures for some retailers will be updated as companies provide store counts with their quarterly results and trading updates. Figures for openings and closures are gross.