albert Chan

U.S. Store Closures: Apparel Specialist Stores Lead Closures

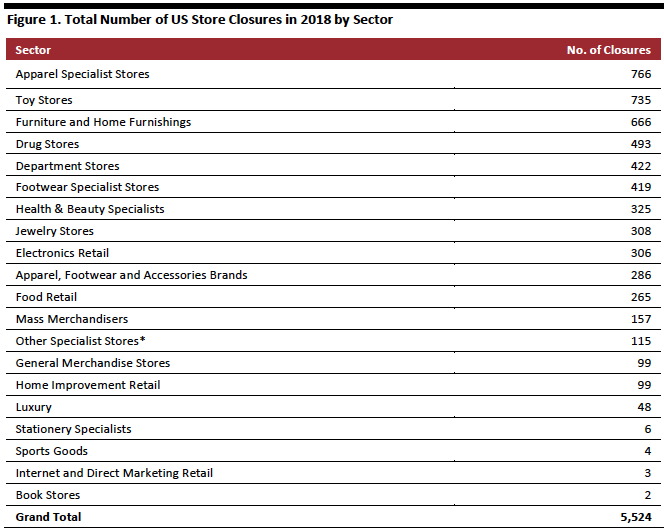

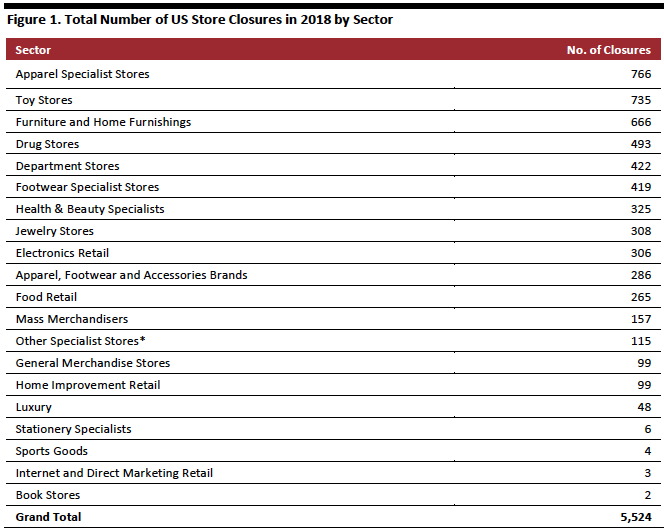

In the U.S., we saw 5,524 store closures by major retailers in 2018. This was down from 8,139 closures in 2017. Among the sectors, apparel specialist stores led the pack with 766 closures.

*Includes niche retailers such as frames seller Aaron Brothers and camping gear retailer Camping World.

*Includes niche retailers such as frames seller Aaron Brothers and camping gear retailer Camping World.

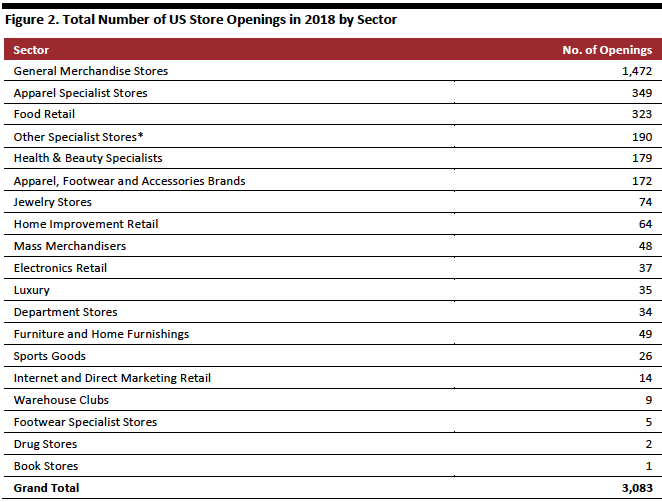

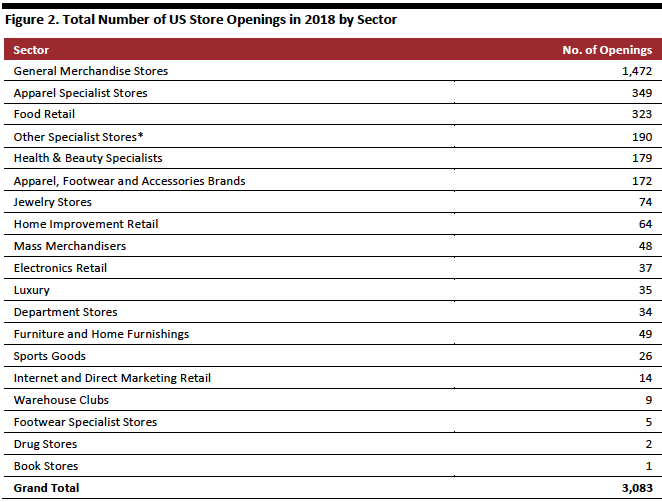

Source: Company reports/Coresight Research[/caption] U.S. Store Openings: General Merchandise Stores Lead In Openings Major U.S. retailers opened 3,083 stores in 2018 — fewer than the 4,231 stores opened in 2017. In 2018, general merchandise stores (which included the growing dollar-store segment), apparel specialist stores and food retailers led the pack. The 1,472 store openings by general merchandise retailers outnumbered the 99 closures in the sector, and the 343 store openings outnumbered the 265 closures in food retail. Apparel specialists opened 349 stores, substantially fewer than the 766 closed. *Other specialist stores include niche retailers such as outdoor activity retailer Gander Outdoors and crafts retailer

*Other specialist stores include niche retailers such as outdoor activity retailer Gander Outdoors and crafts retailer

Hobby Lobby.

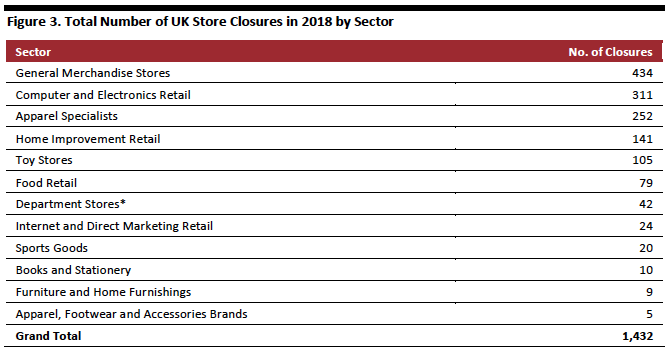

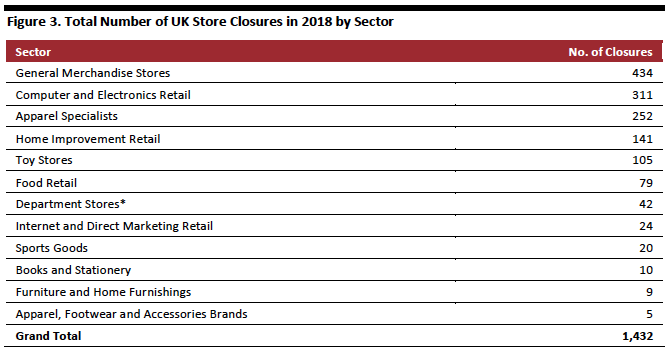

Source: Company reports/Coresight Research[/caption] U.K. Store Closures: General Merchandise Stores Lead the Rush to Close Stores In the U.K., we saw major retailers close 1,432 stores — surpassing the 1,012 store closures we recorded in 2017. Discount retailer Poundworld closed the highest number of stores in the year (335) as it fell into administration in June 2018. Poundworld alone accounted for a significant number of general merchandise store closures. Another victim of the high street was electronics retailer Maplin, which collapsed into administration in February - followed by 219 store closures. Other notable retailers that contributed to the total number of closures in 2018 were: *Includes Marks & Spencer clothing and home stores.

*Includes Marks & Spencer clothing and home stores.

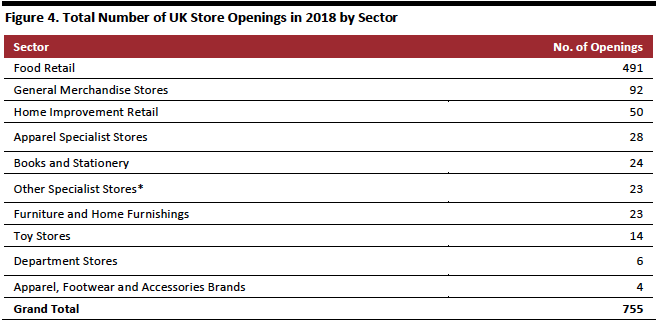

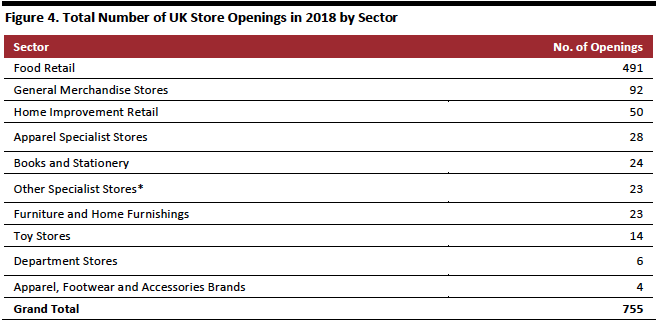

Source: Company reports/Coresight Research[/caption] U.K. Store Openings: Food Retailers Register the Most Openings In 2018, major U.K. retailers opened a total of 755 stores, fewer than the 952 store openings we recorded in 2017. Food retailers led the way with 491 openings, helped by growth in discounter formats and convenience stores. *Other specialist stores include niche retailers such as hearing aids and optics retailer Acuitis and pet supplies retailer

*Other specialist stores include niche retailers such as hearing aids and optics retailer Acuitis and pet supplies retailer

Pets at Home.

Source: Company reports/Coresight Research[/caption] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. For a minority of retailers, store opening and closure numbers are estimated, including from part-year data or global figures. Figures for openings and closures are gross.

- Toys “R” Us, which shut 735 stores in 2018, was by far the single-biggest contributor to store closures in the year. The company filed for bankruptcy in September 2017 and entered insolvency in March 2018.

- In furniture and home furnishings, Mattress Firm closed 600 stores.

- Other nonapparel retailers that reported major closures included Walgreens Boots Alliance, with 458 closures, and Best Buy, with 275 closures.

- Among apparel and footwear specialist retailers, Payless ShoeSource led closures, with 408 stores shuttered; National Stores filed for Chapter 11 bankruptcy protection in August and closed 258 stores during the year.

- Bon-Ton led closures in the department store sector, with 256 closures.

- Kmart contributed to the closure number for mass merchandisers.

*Includes niche retailers such as frames seller Aaron Brothers and camping gear retailer Camping World.

*Includes niche retailers such as frames seller Aaron Brothers and camping gear retailer Camping World.Source: Company reports/Coresight Research[/caption] U.S. Store Openings: General Merchandise Stores Lead In Openings Major U.S. retailers opened 3,083 stores in 2018 — fewer than the 4,231 stores opened in 2017. In 2018, general merchandise stores (which included the growing dollar-store segment), apparel specialist stores and food retailers led the pack. The 1,472 store openings by general merchandise retailers outnumbered the 99 closures in the sector, and the 343 store openings outnumbered the 265 closures in food retail. Apparel specialists opened 349 stores, substantially fewer than the 766 closed.

- The general merchandise sector was supported by Dollar General, which opened the most stores in 2018: 860.

- Among apparel specialist stores, Old Navy and Burlington Stores were the frontrunners, having opened 60 and 57 stores respectively.

- Food retail was significantly boosted by Aldi, which opened 113 stores.

*Other specialist stores include niche retailers such as outdoor activity retailer Gander Outdoors and crafts retailer

*Other specialist stores include niche retailers such as outdoor activity retailer Gander Outdoors and crafts retailerHobby Lobby.

Source: Company reports/Coresight Research[/caption] U.K. Store Closures: General Merchandise Stores Lead the Rush to Close Stores In the U.K., we saw major retailers close 1,432 stores — surpassing the 1,012 store closures we recorded in 2017. Discount retailer Poundworld closed the highest number of stores in the year (335) as it fell into administration in June 2018. Poundworld alone accounted for a significant number of general merchandise store closures. Another victim of the high street was electronics retailer Maplin, which collapsed into administration in February - followed by 219 store closures. Other notable retailers that contributed to the total number of closures in 2018 were:

- Toys “R” Us: The U.K. store estate of Toys “R” Us closed 105 stores during the year.

- Dixons Carphone: Electronics retailer Dixons Carphone announced the closure of 92 stores in May amid falling demand for mobile contracts and computers.

- Carpetright and Homebase: Carpetright closed 76 stores amid weak trading and recurring losses while Homebase entered into a company voluntary agreement, leading the company to close an estimated 65 stores.

- House of Fraser: Sports Direct bought House of Fraser on August 10. At the time, Sports Direct owner Mike Ashley pledged to keep 47 of 59 existing stores open, implying that 12 were at risk of closure. However, in 2018, House of Fraser appeared to close just one store.

- Greggs contributed 50 closures to the total for food retail.

*Includes Marks & Spencer clothing and home stores.

*Includes Marks & Spencer clothing and home stores.Source: Company reports/Coresight Research[/caption] U.K. Store Openings: Food Retailers Register the Most Openings In 2018, major U.K. retailers opened a total of 755 stores, fewer than the 952 store openings we recorded in 2017. Food retailers led the way with 491 openings, helped by growth in discounter formats and convenience stores.

- Bakery chain Greggs recorded the highest number of store openings, with 149 new stores, accounting for a significant component of openings recorded in food retail.

- The Co-op opened 100 stores.

- Aldi and Lidl contributed significantly to the food retail total: Aldi opened 70 stores and Lidl opened 55.

- The discount grocery retail sector also saw a new entrant in 2018 as Tesco launched a chain called Jack’s, named after its founder Jack Cohen; eight Jack’s stores have opened so far.

*Other specialist stores include niche retailers such as hearing aids and optics retailer Acuitis and pet supplies retailer

*Other specialist stores include niche retailers such as hearing aids and optics retailer Acuitis and pet supplies retailerPets at Home.

Source: Company reports/Coresight Research[/caption] Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur. For a minority of retailers, store opening and closure numbers are estimated, including from part-year data or global figures. Figures for openings and closures are gross.