DIpil Das

What’s the Story?

Product sampling, which involves customers trialing portions of food or other products for free, is a common and effective way for retailers and CPG brands to raise awareness of newly launched products. Sampling also helps to re-engage lapsed buyers, drive product trial for smaller-penetration CPG brands and increase the likelihood of browsers becoming buyers, ultimately leading to increased sales. According to an Ad Age-Harris Poll of 2,000 US shoppers in June 2021, more than two-thirds (68%) of respondents said they are more likely to buy a product after sampling it in a store, and 86% reported that they have purchased an item after sampling it in the past, demonstrating the effectiveness of product sampling. When the Covid-19 pandemic first hit the US in March 2020, retailers and CPG brands paused their product-sampling initiatives. By June 2021, Costco, Target and Walmart had announced plans of a return to in-store sampling, with an enhanced focus on safety and hygiene. Nearly half (49%) of the US consumers surveyed in the Ad Age-Harris Poll said it is “a good idea” for stores to reintroduce in-store samples, and 65% said they would partake in in-store sampling as Covid-19 restrictions are lifted. However, the US has seen a recent surge in the Covid-19 Delta variant, presenting an uncertain outlook for in-store sampling. In this report, we analyze findings from an August 2021 Coresight Research survey of 220 US retailers and CPG brands. We explore the business challenges faced by retailers and CPG brands due to the evolving nature of product sampling, the dynamics of in-store and at-home (e-commerce) sampling, and how sampling can be a competitive advantage as retailers and CPG brands navigate uncertainties with the aid of third-party solutions. This report is sponsored by next-generation digital discovery and automated sampling company Freeosk.Why It Matters

Product sampling is not a simple matter, constituting multiple elements such as packaging, labor, staff training, marketing collateral, logistical operations, the samples themselves and sometimes collaboration with marketing companies and agencies on the planning and execution of campaigns. There are therefore various costs associated with product-sampling initiatives. Such programs can cost between $25,000 and $100,000 to create from scratch, according to sampling manufacturer Arcade Beauty, becoming more expensive with increasing numbers of product samples being distributed and with a larger population being targeted. Due to cost pressures, smaller retailers and CPG brands would demand a proven ROI (return on investment) for product-sampling initiatives. Despite high costs, product sampling remains a core focus and continues to drive marketing investment among many retailers and CPG brands. Our survey found that 84% of retailers and CPG brands plan to spend some of their marketing dollars on product sampling moving forward. Furthermore, those respondents plan to spend an average of 38% of their total annual marketing expenses on product sampling, post pandemic—with CPG brands citing a higher level of intended investment (44% of total annual marketing expenses) in post-pandemic product sampling than retailers (which intend to spend 30% of total annual marketing expenses). Product-sampling approaches often lack the ability to minimize waste, minimize delivery and staff deployment costs, and provide retailers and CPG brands with actionable insights about the shoppers receiving the product samples. We think it is important for retailers and CPG brands to rethink their approach to product sampling to optimize the experience for shoppers while enhancing their bottom line.Rethinking Product Sampling: Coresight Research x Freeosk Analysis

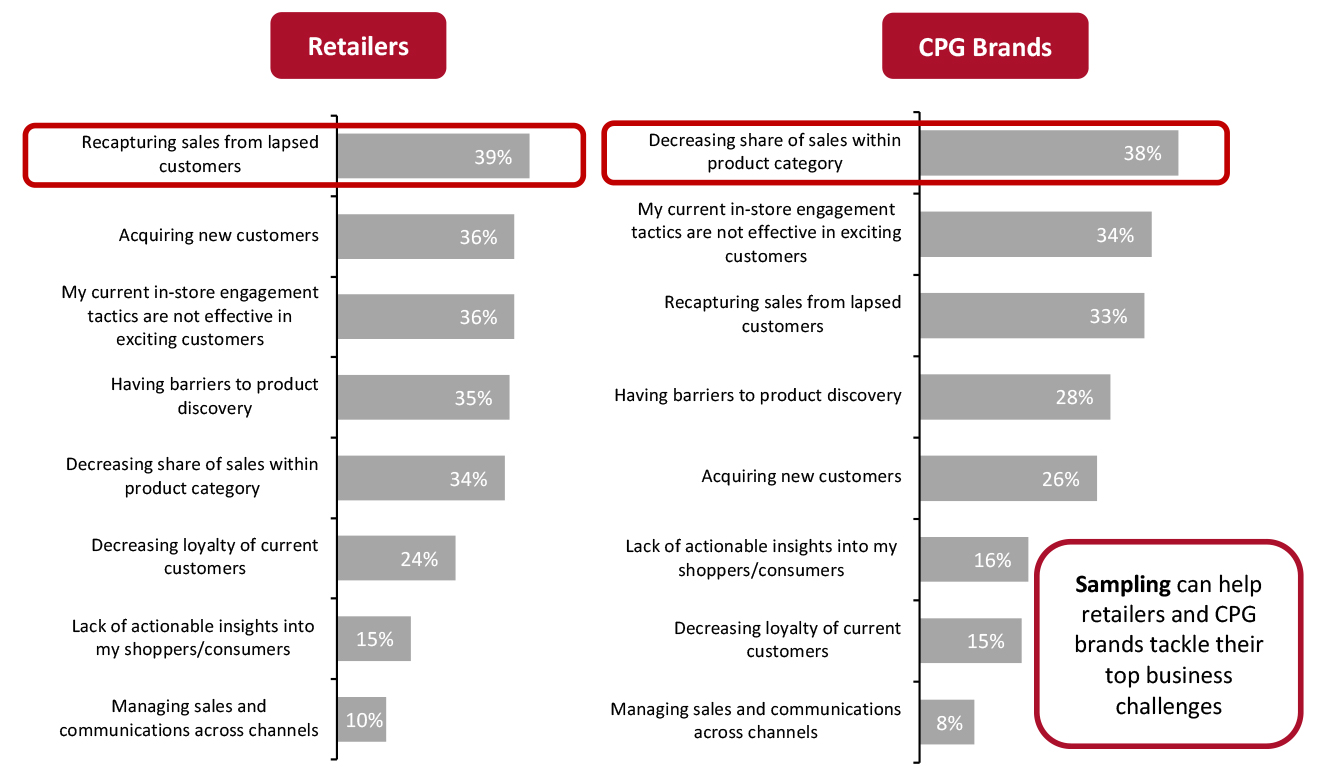

How Product Sampling Can Address Retailers and CPG Brands’ Business Challenges Retailers and CPG brands are in a constant battle for consumers’ share of wallet and shopper loyalty—and Covid-19 has increased the pressures of competition, making marketing spend even more important in the current environment. As an example, CPG giant Procter & Gamble increased its annual advertising expenses by 12% year over year to $8.2 billion in the 12 months to June 2021, in order to cope with lost sales and to maintain sales share within its different product lines during the pandemic. It is therefore not surprising that our survey found that recapturing sales from lapsed customers (cited by 39% of retailers and 33% of CPG brands) was among the top three business challenges for retailers and CPG brands. Regarding the acquisition of new customers, it is interesting to see that more retailers (36%) than CPG brands (26%) perceive this as a business challenge. Product sampling can help retailers to be more effective in acquiring new customers, and help CPG brands recapture sales and market share by increasing consumer awareness of their products. It also facilitates product discovery and creates effective in-store engagement to delight shoppers—both of which were cited among the top five business challenges for both retailers and CPG brands, as shown in Figure 1.Figure 1. Business Challenges Faced by Retailers and CPG Brands (% of Respondents) [caption id="attachment_136478" align="aligncenter" width="700"]

Base: 220 retailers and CPG brands, surveyed in August 2021

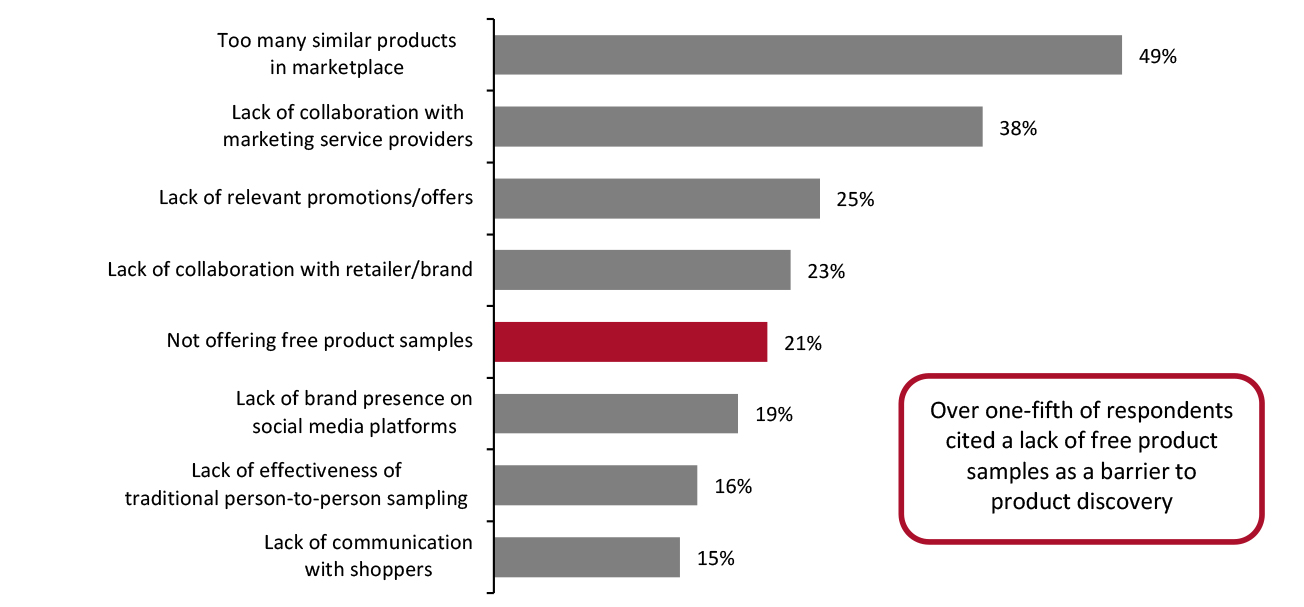

Base: 220 retailers and CPG brands, surveyed in August 2021 Source: Coresight Research [/caption] Given the nature of the CPG industry, with its steady flow of new product launches and improved formulations, retailers and CPG brands can easily lose salience and relevance among shoppers if they do not make their products easily discoverable. SKU (stock-keeping unit) proliferation—a process where retailers or CPG brands add products to their inventory in a bid to increase sales—also makes it hard for CPG brands with lower penetration to break through all of the products on the shelf. Without the expertise of marketing service providers and insights into how offers can be made relevant to shoppers, it gets even more difficult for retailers and CPG brands to enhance product discovery. Our survey respondents cited a crowded marketplace, lack of collaboration with marketing service providers and lack of relevant promotions/offers as the top three barriers to consumers discovering their products (see Figure 2). Product sampling can help CPG brands stand out through counteracting the impact of SKU proliferation, leverage cross-merchandising opportunities (as we highlight later) and provide consumers with free products alongside incentives to make a purchase, such as special offers—thus helping overcome these barriers. It is also interesting that more than one-fifth of retailers and CPG brands specified “not offering free product samples” as a barrier to product discovery, demonstrating the value that many retailers place on such strategies and indicating clear opportunity in this space.

Figure 2. Retailers and CPG Brands: Barriers to Product Discovery (% of Respondents) [caption id="attachment_136479" align="aligncenter" width="700"]

Base: 220 retailers and CPG brands, surveyed in August 2021

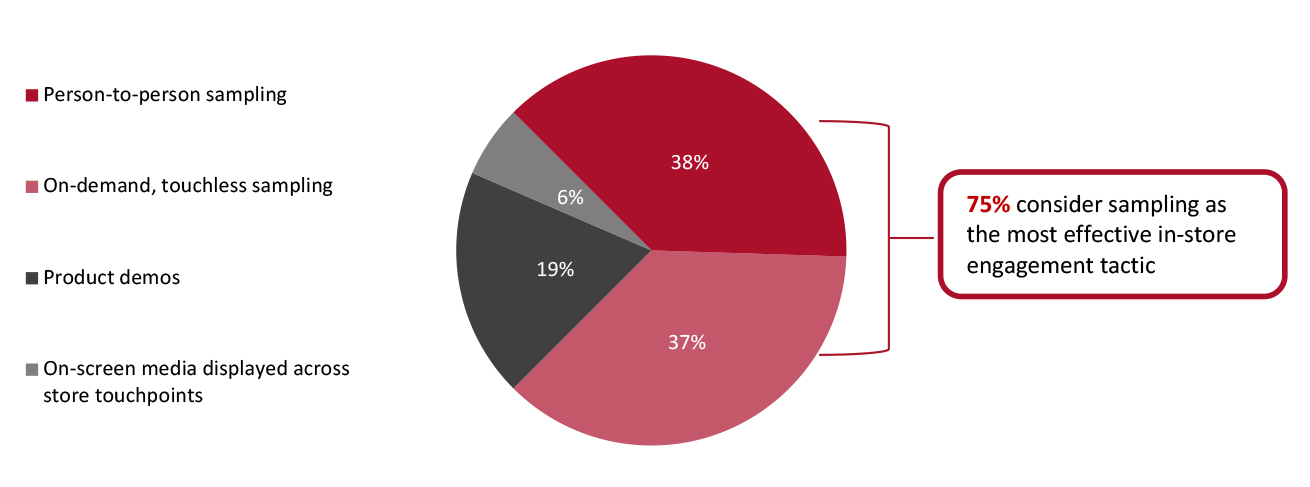

Base: 220 retailers and CPG brands, surveyed in August 2021 Source: Coresight Research [/caption] Product sampling is a method that not only helps retailers and CPG brands to increase sales and awareness, but also makes in-store engagement more effective and product discovery more seamless, as we discuss below. Benefits of Product Sampling: Effective In-Store Engagement and Enhanced Product Discovery Product sampling provides an opportunity for retailers and CPG brands to interact with shoppers and enable them to experience newly launched products. Our survey found that 75% of retailers and CPG brands feel that product sampling is the most effective tactic in generating consumer excitement in-store, when compared with product demos and on-screen media alone. This can be explained by the fact that free samples can reduce shoppers’ risk aversion to trialing new products, and that they help to create a tactile experience with shoppers, where demonstrations and on-screen media alone could not. That said, it does not mean that retailers and CPG brands should completely ignore the importance of on-screen media—43% of US shoppers said they have been influenced by in-store digital screens, according to a 2019 study of Mood Media, an in-store sensory marketing solutions provider. When visual information presented to shoppers is contextually relevant or sensory-elevating, it can be compelling to shoppers and drive their purchase intent. Free samples provide shoppers with surprise and delight as elements of a product discovery experience, according to a study conducted by research firm Sprout Insights in February 2021, while helping to build reliability and confidence in a product and brand, eventually leading to sales conversion for retailers and CPG brands.

Figure 3. Most Effective In-Store Engagement Tactics in Generating Consumer Excitement (% of Respondents) [caption id="attachment_136480" align="aligncenter" width="700"]

Base: 220 retailers and CPG brands, surveyed in August 2021

Base: 220 retailers and CPG brands, surveyed in August 2021 Source: Coresight Research [/caption] Our survey also found that retailers and CPG brands perceived on-demand, touchless sampling as almost as effective as person-to-person sampling (38%) in generating consumer excitement. While person-to-person interactions offer opportunities for social engagement between shoppers and retailers/CPG brands, such tactics are not measurable and often lack the opportunity for retargeting and creating a connection with the shopper in other channels. On-demand, touchless sampling is an effective alternative to delight shoppers in the current retail climate—where shoppers have hygiene concerns and want to limit human contact as much as possible due to the pandemic. Some CPG brands have recently adopted such initiatives:

- In July 2021, global beauty company Coty announced plans to roll out a touchless fragrance tester to beauty retailers globally within the next 12 months, to minimize consumers’ hygiene concerns in stores.

- In June 2021, Sam’s Club relaunched its sampling and demo program “Taste & Tips” in 600 US locations—but in sealed samples in limited quantities and available only on weekends.

- Fragrance brand Hermès launched a touchless fragrance sampler across a few retailers in France in February 2021.

Coty’s touchless fragrance tester for its Chloé brand

Coty’s touchless fragrance tester for its Chloé brand Source: Company website [/caption] In addition to creating effective in-store engagement, product sampling is instrumental in enhancing product discovery: It provides an opportunity for shoppers to experience newly launched products. Retailers and CPG brands recognize the importance of sampling in product discovery, with our survey finding that 60% of respondents believe that sampling is very important to product discovery. We present two notable examples of product sampling in effective product discovery below:

- Elly Truesdell, former Global Director of Local Brands and Product Innovation at Whole Foods, stated that some brands would be in Whole Foods three or four times per week pushing their products because sampling is important for their growth, as reported by Food Dive in August 2021.

- Rodrigo Salas, President of sauce manufacturer Molli Sauces, said that samples are critical to differentiating the brand’s products from thousands of competitors on the shelf and for educating people and store employees, as reported by Eater, a food news website of Vox Media, in August 2020.

- Traditional person-to-person sampling—A product demonstrator hands out free product samples to shoppers in storefronts, on streets or at shopping malls.

- At-home (grocery pickup, delivery/e-commerce) sampling—Retailers and CPG brands attach free samples as part of shoppers’ online orders or mail free samples to shoppers’ homes.

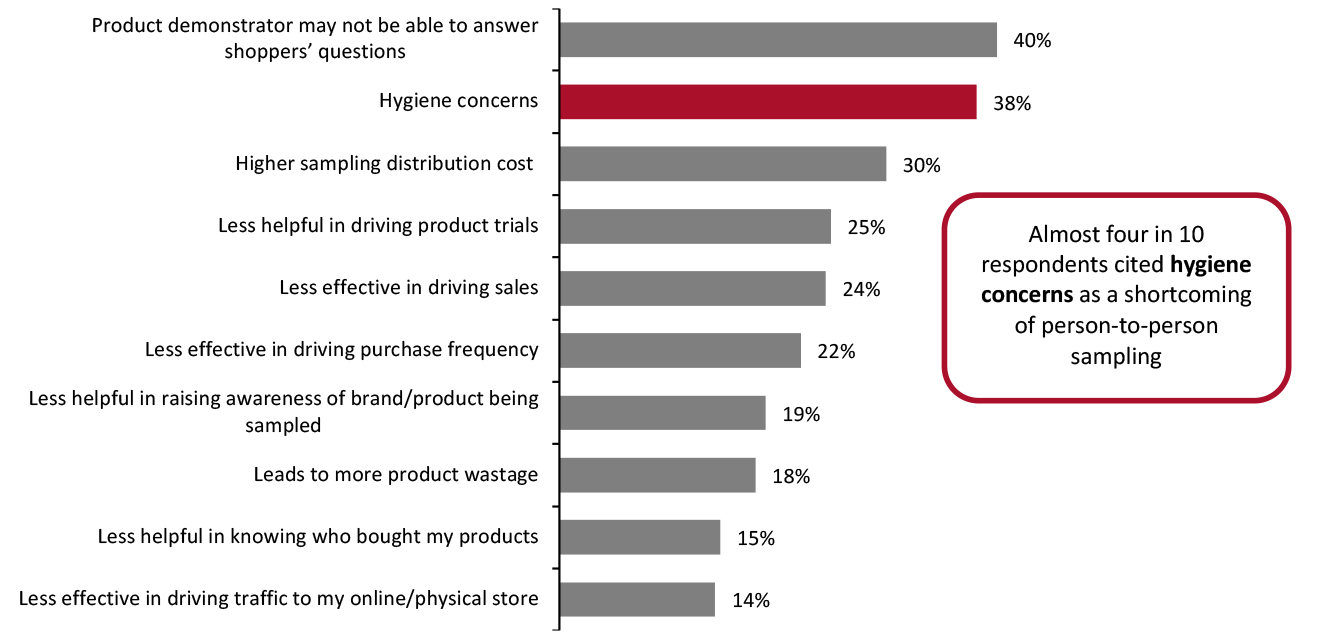

Figure 4. Shortcomings of Traditional Person-to-Person Sampling Relative to At-Home (Grocery Pickup, Delivery/E-Commerce) Sampling (% of Respondents) [caption id="attachment_136482" align="aligncenter" width="700"]

Base: 220 retailers and CPG brands, surveyed in August 2021

Base: 220 retailers and CPG brands, surveyed in August 2021 Source: Coresight Research [/caption] Retailers are adopting various measures to deal with hygiene concerns:

- Walmart and its wholesale club division Sam’s Club are serving only pre-sealed food samples and limiting sampling on weekends only.

- Target has been allowing self-service sampling of individually wrapped items.

- Costco stated in May 2021 that it plans to introduce sampling stations, where items are prepared behind plexiglass barriers in small batches and served to customers individually.

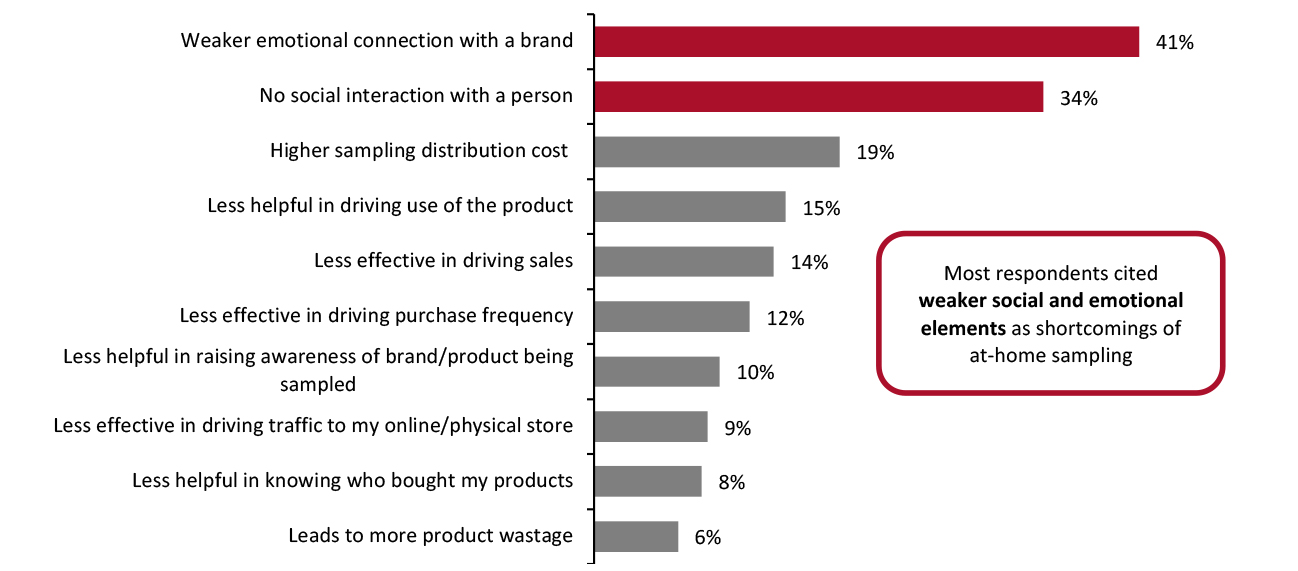

Figure 5. Shortcomings of At-Home Sampling Relative to Traditional Person-to-Person Sampling (% of Respondents) [caption id="attachment_136483" align="aligncenter" width="700"]

Base: 220 retailers and CPG brands, surveyed in August 2021

Base: 220 retailers and CPG brands, surveyed in August 2021 Source: Coresight Research [/caption] The Future of Product Sampling: Next-Generation Digital Sampling Solutions While the Covid-19 pandemic put a pause to in-store sampling due to shoppers’ heightened hygiene concerns, retailer giants Costco, Target and Walmart had announced plans of a return to in-store sampling by June 2021, with an enhanced focus on safety and hygiene. US shoppers still like visiting physical stores in order to see and touch merchandise, discover and try new products as well as to enjoy the in-store experience, which the online channel simply cannot replicate. Given that shoppers go to physical stores generally because of the opportunity to try and touch products, CPG brands should not ignore the physical store channel. An interesting finding from our survey is that automated kiosks (which are vending machines for product samples) appeal to retailers as a future channel for dispensing samples, with 47% of retailers reporting as such. In a nutshell, retailers and CPG brands need a sampling strategy that is store-based—so as to avoid the pain points of at-home sampling—but does not incur the pain points posed by traditional person-to-person sampling. During the Covid-19 pandemic, as retailers and CPG brands look for ways to provide the service customers expect in a socially distanced, low-touch environment, the popularity of automated product-sampling kiosks has skyrocketed. Having an automated solution that dispenses samples also provides retailers and CPG brands with a low-cost and straightforward method of raising product awareness. At the same time, easily accessible machines meet consumers’ desire for immediate gratification. We have seen retailers and CPG brands starting to implement such next-generation digital sampling solutions:

- The Vitamin Shoppe plans to install interactive digital kiosks in at least 11 stores by the end of 2021 in order to engage consumers and drive trial of new products, according to Retail Info Systems.

- US retail giants such as Albertsons and Walmart are installing in-store automated kiosks in thousands of their stores to offer free product samples to shoppers, further widening the competitive edge over their peers.

Examples of automated product sampling kiosks

Examples of automated product sampling kiosks Source: Freeosk (left)/Vengo Labs (right) [/caption] Benefits of Next-Generation Digital Sampling Solutions

- The Importance of Consumer Research in Understanding Post-Pandemic Mindset Shifts

- Collaboration Opportunities with Marketing Service Providers

- Addressing the Challenge of Decreasing Sales Share

- Cost

- Focusing on Center-Store SKUs Instead of Perimeter SKUs

- Measurability

Freeosk’s Omnichannel Marketing Solutions

Freeosk’s Omnichannel Marketing Solutions Source: Freeosk [/caption] Below, we present two case studies from Freeosk that showcase how retailers and CPG brands can improve category sales and increase brand awareness through the use of in-store automated kiosks.

- A Global Cookie Brand

- A Moist-Tissue Brand

What We Think

Retailers and CPG brands realize the benefits of product sampling, including the ability to improve product discovery and create in-store engagement opportunities that delight shoppers. They are also realizing the importance of sampling in maintaining sales share within a product category and to have a foothold in the market. However, due to its costly nature, retailers and CPG brands need to formulate a winning product-sampling strategy in order to ensure good ROI. Next-generation digital sampling solutions (in-store automated kiosks) are attractive solutions for retailers and CPG brands amid the pandemic-impacted environment. Contactless solutions mitigate consumers’ hygiene concerns while providing better consumer insights and cross-merchandising opportunities for the retailer, as well as saving on the labor and delivery costs associated with traditional person-to-person sampling and at-home sampling, respectively. Implications for Retailers and CPG Brands- Retailers and CPG brands should leverage product sampling in order to provide delight to shoppers and navigate a crowded marketplace.

- Product sampling initiatives are often costly; it is important that retailers and CPG brands think of ways to maximize their ROI.

- A product-sampling strategy with elements from both traditional person-to-person and at-home product samplings will benefit retailers and CPG brands. They cannot rely on these strategies in silo due to their respective shortcomings.

- In-store automated kiosks, coupled with the offering of consumer insights and retargeting capabilities, pose a viable solution for retailers and CPG brands when they are considering third-party product-sampling solutions.

Survey Methodology

The study is based on the analysis of data from an online survey of 100 grocery/convenience/supermarket retailers and 120 CPG brands conducted by Coresight Research in August 2021. We selected respondents based on the following criteria:- Based in the US only

- Holding senior positions (C-suite, presidents, directors, department heads)

- Responsible for sales, e-commerce, digital, brand marketing, media, shopper marketing and consumer engagement.