Nitheesh NH

Introduction

Sensormatic Solutions is the retail-focused division of Johnson Controls, a diversified engineering corporation focused on building and building security equipment. Founded in the 1960s, Sensormatic Solutions (Sensormatic) created and dominated the electronic article surveillance market for retailers (i.e., the familiar theft-prevention tags attached to apparel), was later acquired by Tyco International, and became part of Johnson Controls when Tyco and Johnson Controls merged in 2016. Sensormatic Solutions already has an established reputation with retailers via its loss-prevention, traffic measurement and inventory intelligence products. Retailers need insight into and control over inventory and supply chains—and need to be able to use this data to make operations more efficient and enhance the customer experience. During its journey, Sensormatic has amassed substantial intellectual property related to in-store operational performance and related technologies. The company has invested heavily in research and development of technologies and expertise, enhancing its portfolio with artificial intelligence/machine learning (AI/ML) capabilities to add predictive analytics and computer vision to future products.Company Overview

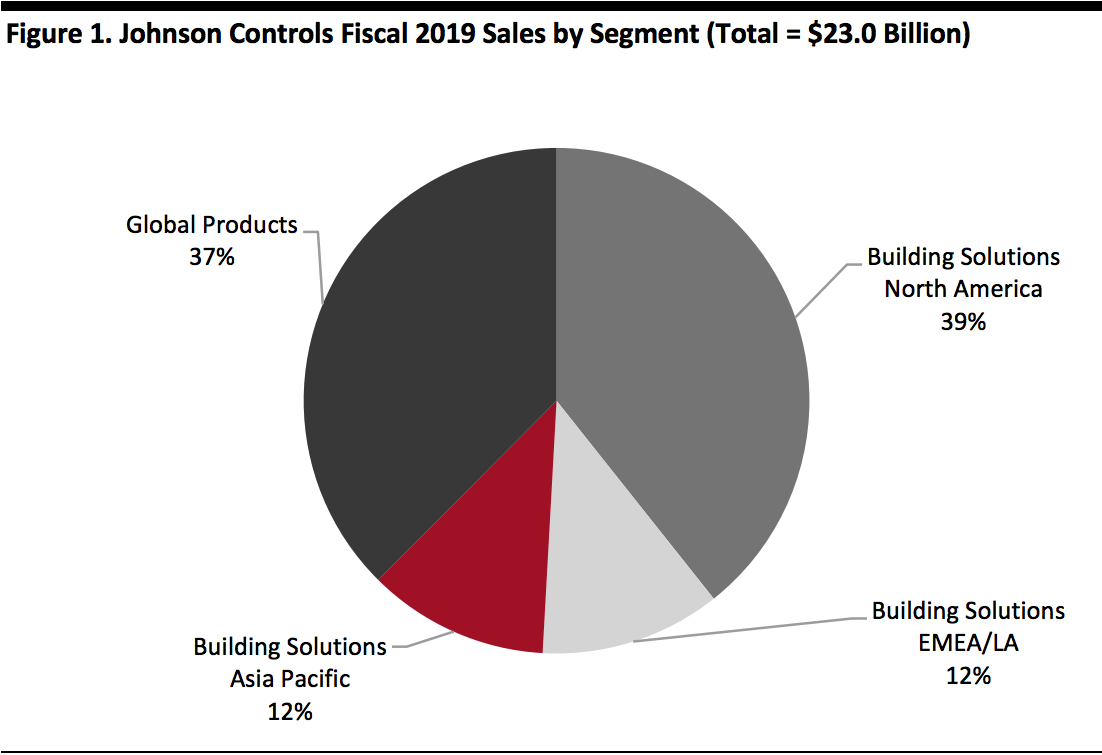

Johnson Controls Johnson Controls, headquartered in Cork, Ireland, is involved in engineering, developing, manufacturing and installing building products and systems around the world, including HVAC equipment, HVAC controls, energy-management systems, security systems, fire detection systems and fire suppression solutions. The company was originally incorporated in 1885 in Wisconsin as Johnson Electric Service Company. In 2016, the company merged with Tyco, after which it changed its name to Johnson Controls International plc and relocated its corporate headquarters to Ireland. In November 2018, the company entered into an agreement with an entity controlled by investment funds managed by Brookfield Capital Partners LLC to divest its Power Solutions business. The transaction closed on April 30, 2019, with net cash proceeds of $11.6 billion after tax and transaction-related expenses. Johnson Controls divides its business into four segments, as shown below. Sensormatic Solutions’ products are sold in all three Building Solutions segments, i.e., North America, EMEA/LA and Asia Pacific. [caption id="attachment_105583" align="aligncenter" width="580"] Source: Company reports[/caption]

Sensormatic Solutions Overview

Sensormatic Solutions’ origins began with the Sensormatic brand created from a retail manager spotting a shoplifting incident in 1965. The manager subsequently created the Sensormatic Electronics Corporation, which went public in 1969. In August 2001, Tyco announced an agreement to acquire Sensormatic Electronics for $2.2 billion in stock, placing the group under the Tyco Retail Solutions umbrella. In January 2019, Tyco Retail Solutions was rebranded as Sensormatic Solutions.

In July 2015, Tyco Retail Solutions acquired FootFall, a global retail intelligence leader, from Experian for US$60 million (£38.5 million) in cash. Prior to the acquisition, Footfall had $39 million in annual revenues and managed more than 50,000 devices in approximately 13,000 retail sites, capturing over 15 billion shopper visits across 11 markets.

In January 2016, Sensormatic (then part of Tyco) completed the acquisition of global retail analytics provider ShopperTrak for approximately $175 million in cash. Prior to the acquisition, ShopperTrak had approximately $75 million in annual revenue and provided customer traffic and related intelligence to more than 1,200 retailers in 97 countries.

Financial Overview

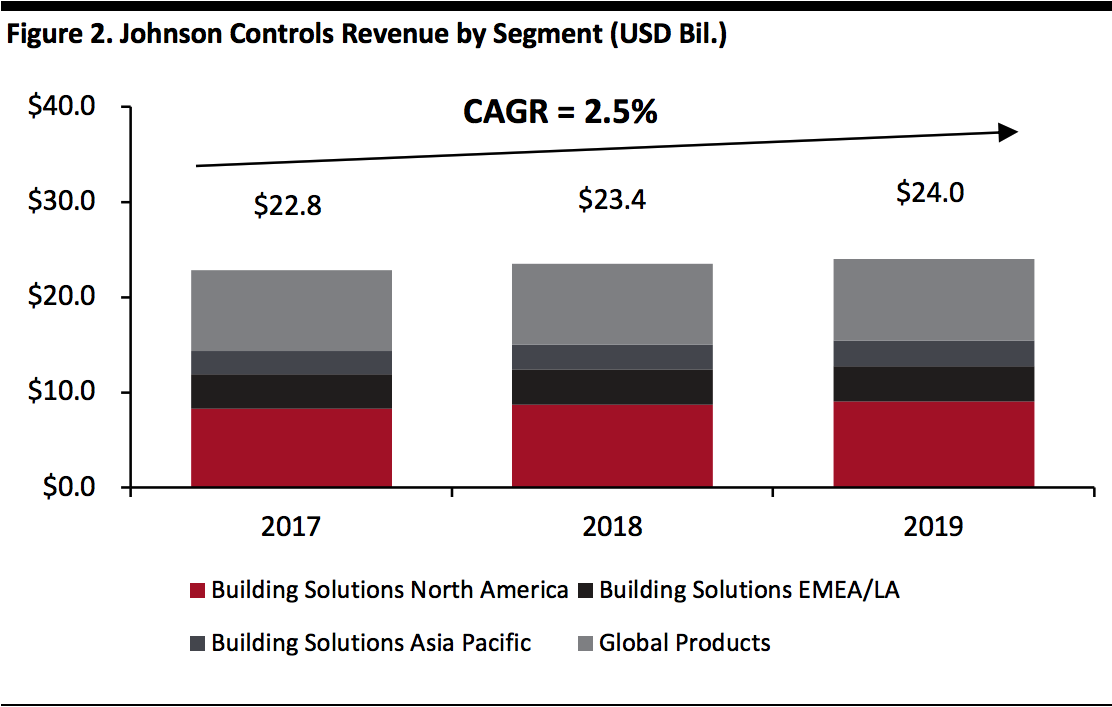

The figure below shows Johnson Controls’ revenue by segment, of which Sensormatic represents about $1 billion annually.

[caption id="attachment_105584" align="aligncenter" width="520"]

Source: Company reports[/caption]

Sensormatic Solutions Overview

Sensormatic Solutions’ origins began with the Sensormatic brand created from a retail manager spotting a shoplifting incident in 1965. The manager subsequently created the Sensormatic Electronics Corporation, which went public in 1969. In August 2001, Tyco announced an agreement to acquire Sensormatic Electronics for $2.2 billion in stock, placing the group under the Tyco Retail Solutions umbrella. In January 2019, Tyco Retail Solutions was rebranded as Sensormatic Solutions.

In July 2015, Tyco Retail Solutions acquired FootFall, a global retail intelligence leader, from Experian for US$60 million (£38.5 million) in cash. Prior to the acquisition, Footfall had $39 million in annual revenues and managed more than 50,000 devices in approximately 13,000 retail sites, capturing over 15 billion shopper visits across 11 markets.

In January 2016, Sensormatic (then part of Tyco) completed the acquisition of global retail analytics provider ShopperTrak for approximately $175 million in cash. Prior to the acquisition, ShopperTrak had approximately $75 million in annual revenue and provided customer traffic and related intelligence to more than 1,200 retailers in 97 countries.

Financial Overview

The figure below shows Johnson Controls’ revenue by segment, of which Sensormatic represents about $1 billion annually.

[caption id="attachment_105584" align="aligncenter" width="520"] Source: Company reports[/caption]

Source: Company reports[/caption]

Strategy

Johnson Controls’ Corporate Strategy Corporate initiatives include the following:- Transform the company into a pure-play buildings company.

- Strengthen the core, increase profitability and accelerate growth in digital solutions across all aspects of the company.

- Deploy smart EDGE devices, connected equipment, systems and cloud-based applications; and, data analytics capabilities to help customers achieve outcome-based solutions.

- Inventory journey: through a dynamic supply chain.

- Associate journey: making associates informed, equipped and focused on the shopper by automating nonessential tasks.

- Customer journey: enabling shopping anytime, anywhere on any device.

- Store environment: offering connected fixtures, displays, safety and security products, energy management and other smart-building technologies.

- In-store insights: helping associates engage with shoppers, enhancing the customer experience.

Products and Solutions

Sensormatic Solutions offers solutions in three main categories: loss prevention, inventory intelligence, traffic insights and analytics. These are offered via three main brands: Sensormatic, TrueVUE and ShopperTrak. The solutions cover a range of components, including transponders (sensors and tags), readers and edge devices, on-premise and cloud-based software and analytics, supported by global services and field analytics. The figure below illustrates the integrated parts of Sensormatic Solutions’ operating platform for retailers. [caption id="attachment_105585" align="aligncenter" width="580"] Sensormatic Solutions Retailer Operating Platform

Sensormatic Solutions Retailer Operating PlatformSource: Johnson Controls[/caption] The division is developing advanced technology, including AI, to provide predictive in-store insights. Loss Prevention Maintaining control of theft (euphemistically termed “shrink”) is a high priority for retailers: Global retailers lost nearly $100 billion in 2017 to theft, according to the Sensormatic Global Shrink Index. Sensormatic is an industry standard in the retail vertical, providing electronic article surveillance (EAS) systems that protect a wide range of product categories to minimize shrink and maximize profitability, shown below. [caption id="attachment_105586" align="aligncenter" width="580"]

Infuzion SuperTag (left) and Synergy entrance

Infuzion SuperTag (left) and Synergy entranceSource: Johnson Controls[/caption] The company’s solutions protect products in the following categories, in addition to custom solutions:

- Apparel and fashion.

- Electronics, grocery and liquor.

- Hardware.

- Health and beauty.

- Jewelry and accessories.

- Luxury.

- Office supplies.

- Optical.

- Sporting goods.

- On-floor visibility.

- Fitting room recommendations.

- Covering the store perimeter.

- People counting and conversion: Total traffic, busiest hours, conversion and movement patterns.

- Shopper experience: Abandonment, zone performance, dwell time and optimal layout.

- Market benchmarks: Store performance, performance comparisons and geo-based traffic trends to determine new store locations or expansion.

- Inventory tracking using machine vision shelf monitoring.

- Customer tracking using machine vision to track dwell time.

- Unstaffed checkout using RFID and security gates.

- Customer service enhancement using machine vision to track parking-lot activity.

Markets

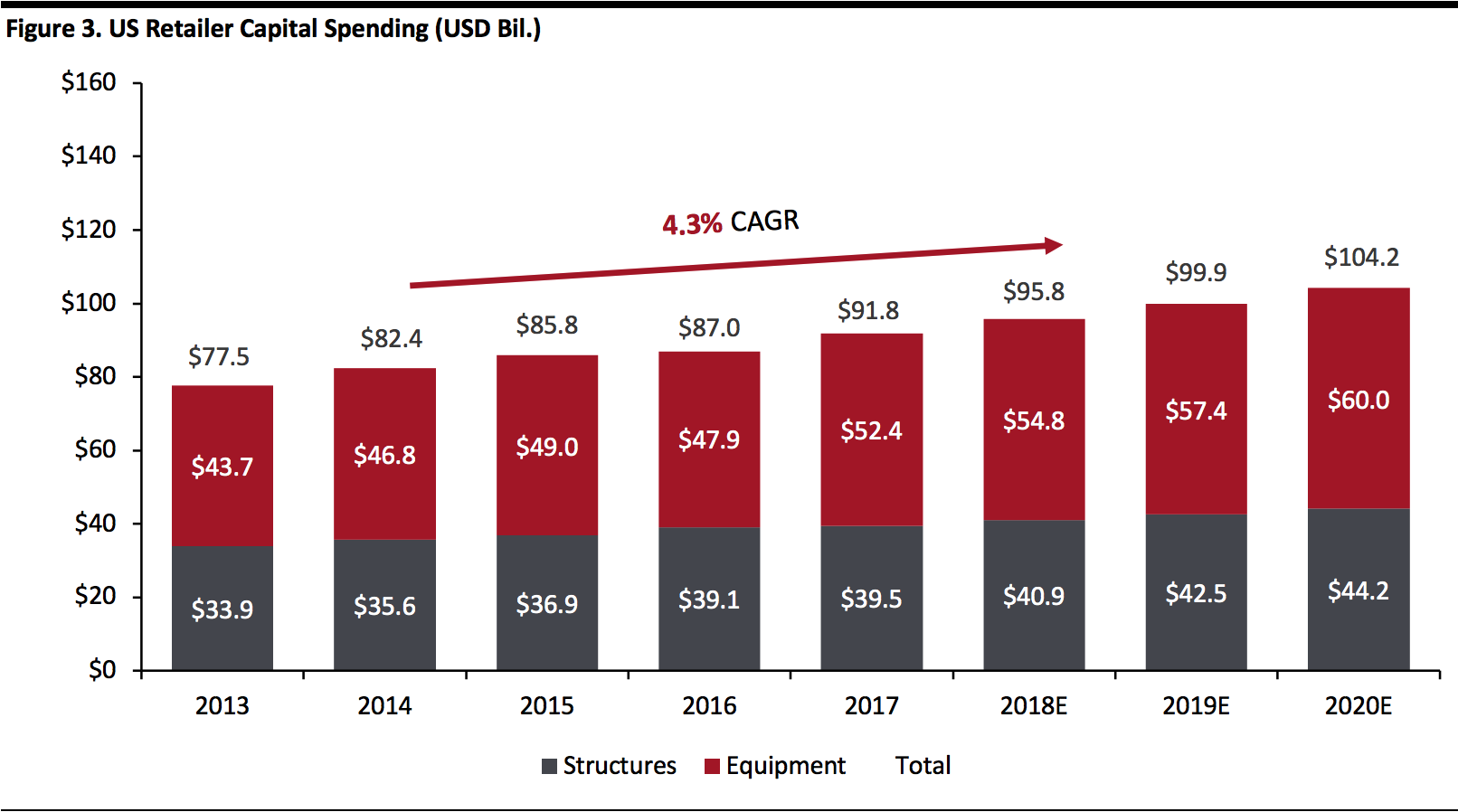

Sensormatic Solutions’ products fall within retailer equipment capital spending, which we estimate at $60 billion in 2020. [caption id="attachment_105587" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

Sensormatic dominates the retail loss-prevention market, with a market share exceeding 70%.

Source: US Census Bureau/Coresight Research[/caption]

Sensormatic dominates the retail loss-prevention market, with a market share exceeding 70%.