Nitheesh NH

What’s the Story?

This report is part of Coresight Research’s RetailTech series, in which we discuss leading retail-technology companies and the products they offer. Retailers in the US and around the world constantly have to deal with shrink, which means loss and theft of inventory through a variety of means by different causes. The unexpected disappearance of inventory has multiple consequences for a retailer, including a reduction in profits from the missing items as well as the inability to fulfill ship-from-store orders. The incidence of shrink in US retail has increased over the past four years, both in dollar terms and as a percentage of retail sales, and new sources of loss are emerging, such as organized retail crime. In addition, new retail methods and technologies such as e-commerce, self-checkout and gift cards create further opportunities for thieves to achieve ill-gotten gains. Fortunately, as technology creates opportunities for thieves, it also creates new solutions beyond the traditional clamped-on acousto-magnetic theft-prevention devices commonly seen in department stores. Loss-prevention technologies such as RFID (radio-frequency identification) threads can be sewn into a garment so they cannot be seen or removed by a potential thief. Video cameras, which are ubiquitous inside a retail store, offer powerful capabilities when combined with AI tools. Cameras plus AI can perform facial recognition, identify suspicious behavior, track inventory and compare items to their price tags, in addition to recording customer activity for law enforcement. This report discusses shrink, its causes and the loss-prevention technologies that are available for retailers to minimize this threat to revenue.Why It Matters

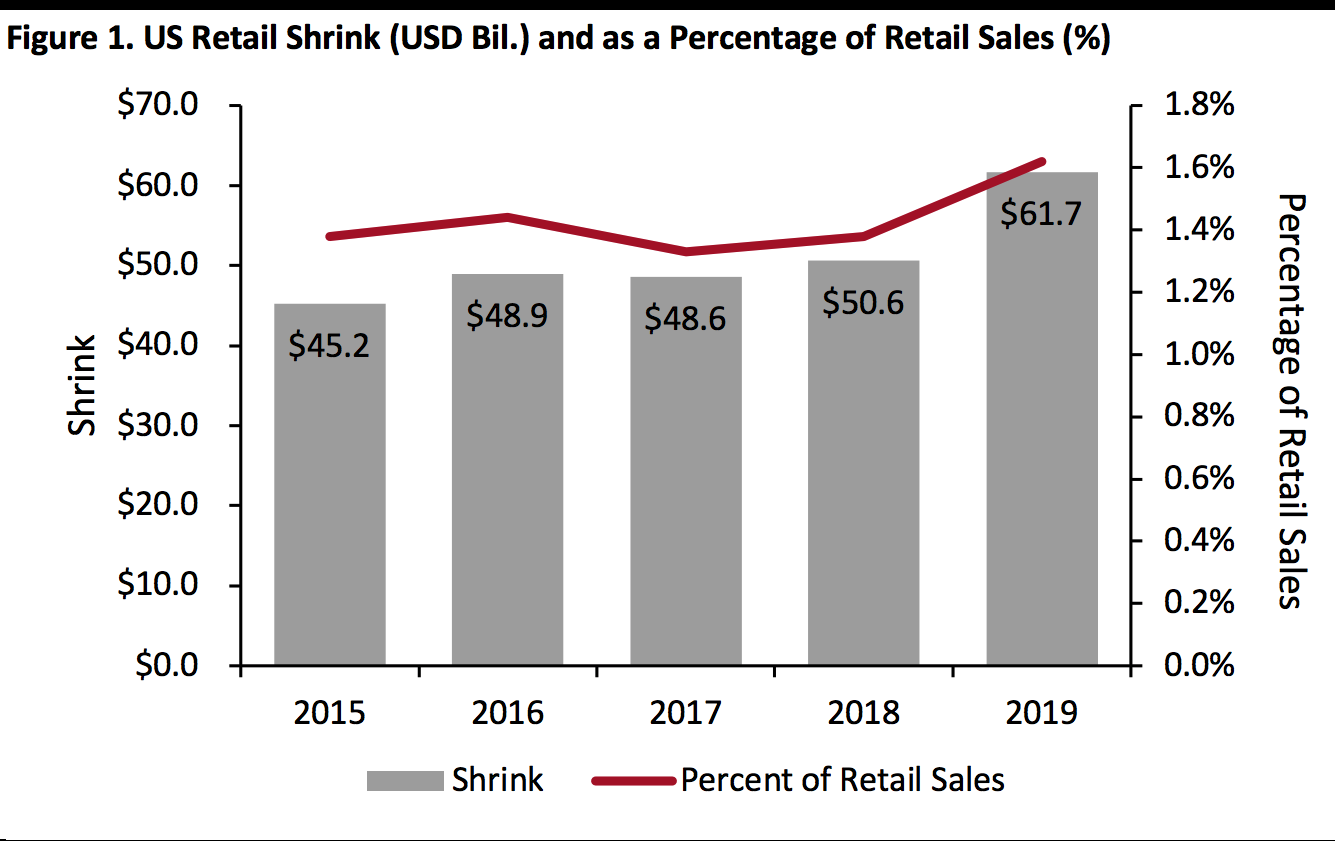

Theft, fraud and losses in the US averaged 1.62% of retail sales in 2019, amounting to $61.7 billion, according to the NRF. This represented an increase of 22% from $50.6 billion in the prior year. Retail-technology solutions provider Sensormatic pegged the global loss figure at nearly $100 billion in its 2018 Global Shrink Index. The NRF attributes the jump in shrink to an increase in the number of shoplifting, organized retail crime and employee theft incidents. The figure below shows the general trend of increasing US retail shrink in dollar terms and as a percentage of retail sales, showing a significant rise in 2019. [caption id="attachment_117147" align="aligncenter" width="580"] Source: NRF[/caption]

In addition to the loss of revenues and profits that shrink causes, loss of merchandise also plays havoc with a retailer’s ability to forecast demand, and unanticipated stock-outs could lead to declines in customer satisfaction.

Source: NRF[/caption]

In addition to the loss of revenues and profits that shrink causes, loss of merchandise also plays havoc with a retailer’s ability to forecast demand, and unanticipated stock-outs could lead to declines in customer satisfaction.

Loss Prevention: A Deep Dive

This report discusses several types of retail loss and the technologies that can be employed to minimize this risk. Causes of retail loss can be unknown or known; malicious or non-malicious; and can occur in the store, in the supply chain, in e-commerce operations or in corporate offices. The Retail Industry Leaders Association (RILA) has identified roughly 42 categories of retail loss, which are summarized in Figure 2. [caption id="attachment_117148" align="aligncenter" width="700"] Source: RILA/Coresight Research[/caption]

It is important for a retailer to understand how and where loss occurred to quantify it and take measures to prevent it from reoccurring.

One interesting element is unknown loss, where retailers are missing inventory but are unaware of how or when this “phantom inventory” came to be. Technologies such as prescriptive analytics can help answer these questions.

The expansion of e-commerce has also created new opportunities for fraud that take advantage of the channel’s unique characteristics, and customer loyalty programs also present opportunities for unscrupulous people to enrich themselves. The prevalence of gift cards offers additional opportunities for fraud.

While this report largely focuses on in-store shrink, losses can occur anywhere throughout the supply chain—such as on the way from the factory to the warehouse, on the way from the warehouse to the retail store, and during the transfers in between.

Other types of loss include of fixtures or equipment (such as PCs and tablets) within the store and at the corporate level (administrative shrink.) These assets and their movement can be tracked as well.

In-store fraud by employees can take many forms, including sweethearting (providing items at a zero or reduced cost), sliding (pretending to scan the barcode on an item), providing illegal markdowns or discounts, or manipulating cash refunds or register settings.

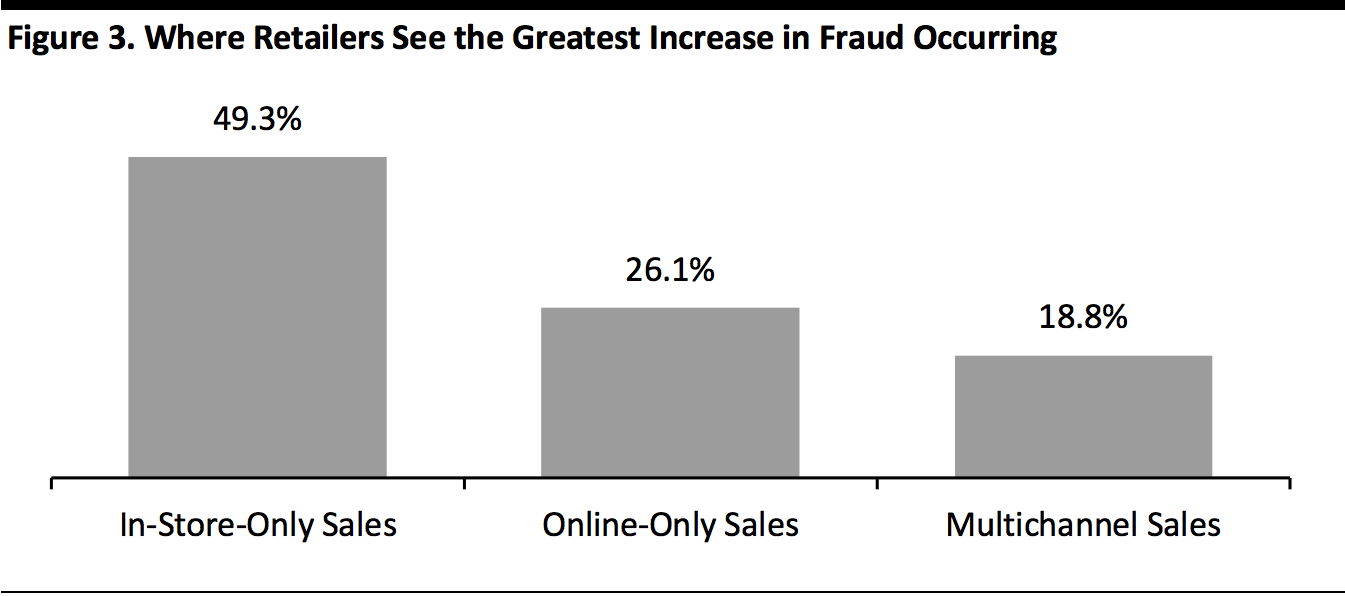

Retailers view the greatest increase in shrink as occurring in-store, as seen in Figure 3. With the advent of innovative shopping channels, types of shrink specific to those channels is becoming a concern, particularly since the penetration of e-commerce within retail sales continues to increase. Moreover, with the e-commerce penetration rate rising in 2020 amid the Covid-19 crisis, e-commerce theft is increasingly attractive to criminals.

[caption id="attachment_117149" align="aligncenter" width="580"]

Source: RILA/Coresight Research[/caption]

It is important for a retailer to understand how and where loss occurred to quantify it and take measures to prevent it from reoccurring.

One interesting element is unknown loss, where retailers are missing inventory but are unaware of how or when this “phantom inventory” came to be. Technologies such as prescriptive analytics can help answer these questions.

The expansion of e-commerce has also created new opportunities for fraud that take advantage of the channel’s unique characteristics, and customer loyalty programs also present opportunities for unscrupulous people to enrich themselves. The prevalence of gift cards offers additional opportunities for fraud.

While this report largely focuses on in-store shrink, losses can occur anywhere throughout the supply chain—such as on the way from the factory to the warehouse, on the way from the warehouse to the retail store, and during the transfers in between.

Other types of loss include of fixtures or equipment (such as PCs and tablets) within the store and at the corporate level (administrative shrink.) These assets and their movement can be tracked as well.

In-store fraud by employees can take many forms, including sweethearting (providing items at a zero or reduced cost), sliding (pretending to scan the barcode on an item), providing illegal markdowns or discounts, or manipulating cash refunds or register settings.

Retailers view the greatest increase in shrink as occurring in-store, as seen in Figure 3. With the advent of innovative shopping channels, types of shrink specific to those channels is becoming a concern, particularly since the penetration of e-commerce within retail sales continues to increase. Moreover, with the e-commerce penetration rate rising in 2020 amid the Covid-19 crisis, e-commerce theft is increasingly attractive to criminals.

[caption id="attachment_117149" align="aligncenter" width="580"] Source: NRF 2020 National Retail Survey[/caption]

What Technologies Can Retailers Use?

Retailers can implement a combination of one or more of the following techniques and technologies to reduce shrink:

Track the product—via electronic article surveillance

Track the product and consumer—via video surveillance and analytics

Impair the product following theft—via tamper-proof labels or labels that identify a product as stolen or alter its appearance when removed

Track product data—to follow its journey throughout the factory warehouse to the store

Tracking the Product—Electronic Article Surveillance

EAS technologies can prevent and identify theft and fraud, and they provide key information to retailers when combined with RFID, which gives item-level detail. Such technologies are used to identify which products have left the store or warehouse, as well as by which exit and when. This information enables retailers to update their inventory count and is extremely useful in preventing shrink in the future.

There are three main EAS technologies used to protect store merchandise from theft: acousto-magnetic (AM), radio frequency (RF) and RFID. Generally, AM and RF tags are “hard tags” that are clamped onto the item, whereas RFID tags are “soft tags” that can be attached or sewn into a garment. There are also AM/RFID hard tags, which provide both item-level tracking and EAS protection. Manufacturer Avery Dennison offers dual-technology tags that combine ultra-high-frequency (UHF) RFID and EAS in an inlay optimized for retail, which provides item-level tracking and loss prevention capabilities.

There are also many types of products for attaching, deactivating and detaching tags.

Figure 4 summarizes the three main EAS technologies, their frequency bands and the type of information they provide. It is worth noting that AM and RF tags convey only binary information—i.e., their only response is to show the existence of merchandise—whereas RFID tags provide more detailed information. Each technology offers specific benefits and limitations, and they can be used individually or together.

Figure 4. Types of EAS Technologies

[wpdatatable id=487]

Source: NRF 2020 National Retail Survey[/caption]

What Technologies Can Retailers Use?

Retailers can implement a combination of one or more of the following techniques and technologies to reduce shrink:

Track the product—via electronic article surveillance

Track the product and consumer—via video surveillance and analytics

Impair the product following theft—via tamper-proof labels or labels that identify a product as stolen or alter its appearance when removed

Track product data—to follow its journey throughout the factory warehouse to the store

Tracking the Product—Electronic Article Surveillance

EAS technologies can prevent and identify theft and fraud, and they provide key information to retailers when combined with RFID, which gives item-level detail. Such technologies are used to identify which products have left the store or warehouse, as well as by which exit and when. This information enables retailers to update their inventory count and is extremely useful in preventing shrink in the future.

There are three main EAS technologies used to protect store merchandise from theft: acousto-magnetic (AM), radio frequency (RF) and RFID. Generally, AM and RF tags are “hard tags” that are clamped onto the item, whereas RFID tags are “soft tags” that can be attached or sewn into a garment. There are also AM/RFID hard tags, which provide both item-level tracking and EAS protection. Manufacturer Avery Dennison offers dual-technology tags that combine ultra-high-frequency (UHF) RFID and EAS in an inlay optimized for retail, which provides item-level tracking and loss prevention capabilities.

There are also many types of products for attaching, deactivating and detaching tags.

Figure 4 summarizes the three main EAS technologies, their frequency bands and the type of information they provide. It is worth noting that AM and RF tags convey only binary information—i.e., their only response is to show the existence of merchandise—whereas RFID tags provide more detailed information. Each technology offers specific benefits and limitations, and they can be used individually or together.

Figure 4. Types of EAS Technologies

[wpdatatable id=487]

Source: Sensormatic

Major vendors of EAS products include Century Europe, Checkpoint Systems, EAS Systems, Nedap, Sensormatic and WG Security Products. Vendors of RFID chips, inlays, labels and hardware include Avery Dennison, Impinj, NXP Semiconductors, Sensormatic, SML and Zebra Technologies. Acousto-magnetic Tags AM tags use low-frequency electromagnetic waves to communicate with scanners. They have the following characteristics:- Electrical noise immunity

- Able to penetrate moisture

- Can be detected by simple receivers

- Difficult to block

An acousto-magnetic tag and a combination AM/RFID tag

An acousto-magnetic tag and a combination AM/RFID tagSource: Sensormatic[/caption] Radio-Frequency Tags RF and RFID tags use high-frequency electromagnetic waves to communicate with antennas/detection systems. They have the following characteristics:

- Low penetration over a short range

- Susceptible to moisture and other barriers—i.e., easier to block

- RFID does not require “line of sight” to work (but it is still easier to block)

- Can carry more information over UHF frequencies (i.e., RFID)

A radio-frequency tag for frozen food

A radio-frequency tag for frozen foodSource: Alibaba[/caption] RFID Tags RFID tags play an essential role in retail inventory management due to their ability to transmit stored data as well as their location, and this data can be read by handheld or fixed RFID readers. RFID technology can be combined with other technologies such as AM/RF to set off alarms when an item leaves the store, but the information that the item is no longer in inventory itself offers high value to retailers. One of RFID’s advantages is the small size of the tags, which means they can be easily included in an apparel label. RFID tags can be preprinted, or printed inside the warehouse or store using an RFID printer. [caption id="attachment_117153" align="aligncenter" width="580"]

RFID printer

RFID printerSource: Avery Dennison[/caption] RFID Readers RFID tags communicate with antennas or readers, which can be handheld or mounted in a fixed location. They can be positioned inside the store (in order to track inventory and the movement of goods inside the store), both on the store floor and in the storeroom, and at the entry and exit points of the store or warehouse—to track whether goods leave the premises via the front or back door. [caption id="attachment_117154" align="aligncenter" width="580"]

SmartLens sensing reader (left—for in-store) and transition reader (right—for use at entrances and exits)

SmartLens sensing reader (left—for in-store) and transition reader (right—for use at entrances and exits)Source: Zebra Technologies[/caption] RFID Chips with Protected Mode RFID technology provider Impinj launched two new chips at the 2020 NRF Big Show. These chips feature a “protected mode” that means they cannot be tracked by RFID readers—and the chips can become “visible” again with a secure PIN number. This mode makes the chips useful for retail. When a consumer purchases an item, its RFID can be made invisible, and the buyer can leave the store without triggering loss-prevention systems. If the product is returned, the RFID chip can be reactivated to signify that the item is again available for sale. RFID Yarn In an emerging, pre-commercial application, RFID antennas and chips can also be embedded in thread or yarn and woven into garments, providing an invisible loss-prevention technology. Companies offering this product include EON.ID, Primo1D (which weaves an Impinj RAIN-based RFID chip into the thread) and Swicofil. [caption id="attachment_117155" align="aligncenter" width="380"]

RFID yarn

RFID yarnSource: Primo1D[/caption] Benefits of Multiple Technologies The benefits of using several technologies are multiplicative when data from multiple sources are combined—such as sales data, product identification data, location data, and date and time. Examples include the following:

- Bypassing the point-of-sale (POS) terminal—when POS data is compared with RFID location data

- Returns fraud—by analyzing location data to determine if the item was actually purchased in the store

- Good—leaves a residue when removed

- Better—tamper-resistant film labels that chip away when removal is attempted

- Best—tamper-evident films that are extremely difficult to tamper with and also chip away

Tamper-evident label

Tamper-evident labelSource: Avery Dennison[/caption] Video Analytics Given that retail stores are replete with video cameras—for recording activity in the store, tracking customer traffic, monitoring inventory and other operational functions—it is logical that the output from those same cameras is processed for loss-prevention purposes, leveraging AI and machine learning. Video loss-prevention technologies include public-view monitors (PVMs), facial recognition, product identification and behavior identification. PVMs let would-be shoplifters know that someone may be watching, which helps deter theft. Facial-recognition technology is powerful and ubiquitous. Although privacy concerns have limited its use in the US, it is more widely used in other countries. The technology is even more powerful in concert with video surveillance footage and other platforms as a means of building a case against shoplifters. Video plus AI can be used to analyze customer behavior. Sensormatic develops video-based solutions for use cases including sweethearting, shelf sweep and more. At the NRF Big Show 2020, the company demonstrated a platform that can identify customers loitering inside the store without making a purchase or repeatedly visiting a store without making a purchase. Supermarket checkout scanners can contain embedded cameras that do more than just scan barcodes. Current-generation products can recognize loyalty cards, identify produce and determine whether the scanned price tag matches the store price, thus identifying price-tag switching. For example, Zebra Technologies’ MP7000 Scanner Scale includes a high-resolution camera that can capture high-quality still images and video of every action at cashier-operated and unstaffed checkout registers. [caption id="attachment_117157" align="aligncenter" width="580"]

MP7000 Scanner Scale with color camera

MP7000 Scanner Scale with color cameraSource: Zebra Technologies[/caption] Prescriptive Analytics Prescriptive analytics uses insights from a retailer’s data to identify issues and revenue opportunities, for which recommended, concrete, corrective actions can be taken. Employing machine learning, prescriptive analytics is centered around five core capabilities that can help reduce loss:

- Anomaly detection—A platform can compare actual performance to baseline figures to identify labor inefficiencies, fraud, inventory inaccuracies, logistics issues, noncompliance and promotion execution issues.

- Hidden demand identification—This type of demand represents what the retailer could have sold but did not, typically due to lack of inventory on the shelf or product appearance.

- Sentiment analysis—Such analysis mines data from text to create a score to rate pricing, quality or store performance.

- Clustering—Profiles are aggregated for customers, employees, stores or regions to determine baseline averages and thus identify inconsistent behavior.

- Shrink prediction—Historical data is analyzed to predict where shrink is likely to occur (often concentrated to a couple of products) and determine corrective actions.

Bingobox theft detection

Bingobox theft detectionSource: YouTube[/caption] Still, unstaffed convenience stores are on the rise around the world. In the past few years, Alibaba has demonstrated an experimental unstaffed store called Tao Café, and JD.com has launched a smart-shelf business. Now, convenience store chain 7-Eleven is operating unstaffed stores in Taiwan, and Circle K is testing an unstaffed store in the US (in Phoenix, Arizona) with technology from Standard Cognition. Leading Loss-Prevention Technology Providers There are several companies that provide a diverse group of products for loss-prevention applicatins, from EAS (tags, deactivators, detectors and detachers) to RFID chips, inlays, tags and readers. The segment is generally dominated by larger, often multi-segment businesses. Despite the technology being over 70 years old, there has been much innovation in the RFID space. In particular, the range and accuracy of RFID tags has improved, and microwaveable tags have been developed for convenience stores, grocery retailers and hypermarkets. Given the ubiquity of cameras for various functions—including inventory tracking and security/safety—and the proliferation and increased power of computer-vision systems, this segment is likely to see heightened startups wielding AI and computer-vision technology. Figure 5. Selected Loss-Prevention Companies and Products [wpdatatable id=489]

*Retail segment **Industrial and IoT segment ***Sensormatic division only Source: Company reports/Owler/Xe.com/Zoominfo/Coresight Research

There are several companies that offer computer-vision systems, particularly leveraging AI technology, that could also be applied to loss prevention. For example, Trax Retail provides computer-vision solutions for consumer packaged goods and retail, and offer in-store execution tools and market-measurement services. Technology used for unstaffed checkout, which also updates inventory, could be repurposed for loss prevention, such as offerings from Everseen, Grabango, Mashgin and Standard Cognition, whose platform is currently being tested in Circle K convenience stores.Outlook

Although the dramatic increase in shrink in 2019 is likely to take a pause in 2020, with consumers largely sheltering at home, it is a clear trend that shrink is increasing, and new technologies and the greater penetration of e commerce are likely to create new opportunities for crime. Retailers in particular have seen increasing threats from organized retail crime, cyber-related incidents (such as data breaches) and other sources. We summarize such threats in Figure 6. Figure 6. Have the Following Risks and Threats Become More or Less of a Priority over the Last Five Years? [wpdatatable id=490]Source: NRF 2020 National Retail Survey

Two of the major threats are related to new technologies—e commerce and cybercrime. Another, organized retail crime, is one to which the NRF attributed the jump in shrink in 2019. The 2020 NRF survey identified several new threats and areas of concern among retailers:- Increasing boldness by shoplifters due to bail and criminal-justice reforms

- Gift-card scams, including telephone scams involving activation of gift cards

- Self-checkout and mobile checkout

- Opioid addiction, mental health challenges and economic conditions

- Investing in tools—remote monitoring technology, upgraded POS systems and programs to track refund history

- Updating plans—enterprise risk management, risk/vulnerability assessments and physical security upgrades

- Training—workplace violence awareness and training, and active-shooter programs

- Fighting fraud—organized retail-crime identification, e-commerce fraud and returns/refund fraud

Source: NRF 2020 National Retail Survey[/caption]

Source: NRF 2020 National Retail Survey[/caption]

What We Think

Shrink poses an additional burden on retailers in 2020 when year-over-year retail sales could be down and many are struggling to pay rent and remain afloat. Although in-store theft is potentially lower due to consumers staying home amid the Covid-19 crisis, this will likely have been offset by higher e-commerce fraud. Organized crime is a serious issue that is raising concern in retail, as this type of theft is planned in advance and is different in nature than ordinary pilferage. The spread of this type of crime likely requires new, innovative prevention and tracking methods. Despite the new opportunities for malfeasance created by new technologies, we think that would-be thieves are likely underestimating the power of retailers leveraging multiple cameras and AI in stores. The combination of the two technologies enables retailers to analyze customers’ movements and behavior, recognize their faces and track the movement of inventory throughout the store. One major advantage of AI-based systems is that they run continuously, improving their capabilities over time. Other technologies such as prescriptive analytics enable retailers to identify multiple sources of fraud and execute solutions in short order. There are other key implications of loss for retailers beyond just the inability to sell missing goods. Shrink interferes with a retailer’s ability to maintain an accurate view of inventory and sell down to the last item. The retailer will therefore have to retain buffer inventory and engage in discounting to clear it at the end of the season. In addition, unknown shrink creates an invisible drag on margins. Implications for Brands/Retailers- With the rising incidence of shrink and its growth as a percentage of retail sales, retailers have a financial interest in learning about old and new loss-prevention technologies and implementing one or more that are suitable for their needs.

- Increases in technology-fueled crime bring advances in technology-based solutions, such as video combined with AI.

- Organized retail crime is a growing concern and could require a mix of technology and non-technology-based countermeasures.

- Mall owners need to be aware of loss-prevention technologies, as they also have a financial interest in reducing shrink, and thieves will pursue the store representing the weakest link in a mall.

- There are many market opportunities in developing products for loss prevention, combating cybercrime and in AI-based video analytics.