DIpil Das

Introduction

Introduction

This report is the third installment in the Coresight Research series of deep-dive reports on retail technology, following our Introduction to Retail Tech and Supply-Chain Software reports.

Retail stores are bursting with technology: on the store floor, on the walls and shelves and ceilings, in sales associates’ hands, in the back room and in the warehouse. US retailers should spend about $100 billion in capital improvements in 2019, we estimate from US Census Bureau data

At a high level, in-store technology enables retailers to communicate with consumers, offering a quicker, smoother, more pleasant and entertaining shopping experience. At the same time, hardware in the store can gather an enormous amount of data on who enters the store, how long they stay, where they go inside the store and what promotions are effective.

Some of the most powerful in-store tech in retail is brought into the store and taken home by consumers: their smartphones. In addition to researching products and gathering information, smartphones can scan barcodes, run store apps and interact with Bluetooth beacons. Though this technology promises to offer a wealth of information and personalized offers to consumers, it has not yet made it beyond the testing stage.

Shoppers are interacting with an increasing amount of technology in stores, as they view products and computer-generated images of themselves trying on apparel. Product displays can provide information or play videos when a product is picked up, and smart displays and magic mirrors can react to data gathered from the customer, even sensing the shopper’s emotional state, and provide augmented reality images of what he or she looks like wearing a garment.

Much of the technology deployed in a physical store serves to empower the store associate and even the customer. Many sales associates are now armed with handheld tablets, enabling them to efficiently acquire customer and product information to provide richer, more informed and personalized information. Customers are now performing many of the tasks previously performed by sales associates, including obtaining product information, scanning price tags and bagging their own purchases at self-checkout stations. An array of machine-vision cameras analyzes the process to ensure accuracy.

Once confined to factory floors, advances in computer vision and artificial intelligence have brought an army of robots to retail stores. Robots greet customers, guide them within the store, fetch items, take inventory of items on the shelf and mop the floors. These machines perform repetitive, labor-intensive tasks, freeing the humans to spend more time on the store floor, building customers relationships and improving service. Additional robots are at the back of the store, helping workers unload goods and in warehouses and fulfillment centers, some completely automated and some using human-robot teams.

There is an enormous amount of technology inside and behind physical stores, some visible to the consumer, and some invisible, and the deployment of technology is likely to increase as retailers seek to improve their service and experiential offerings in a continuing effort to bring customers into the store.

Overview of In-Store Tech

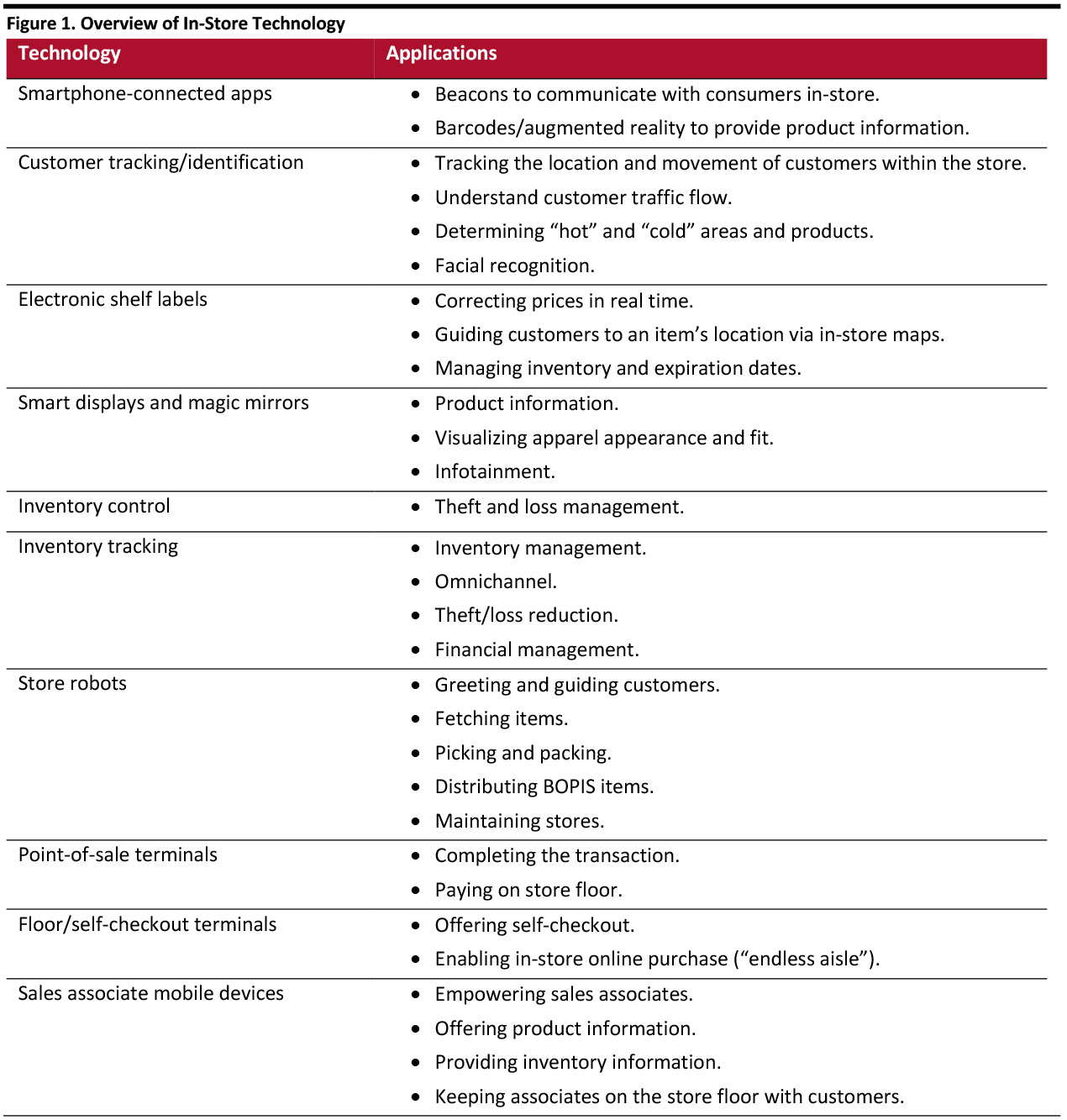

The table below illustrates major in-store technologies and key applications, which include the following:

[caption id="attachment_94554" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Retailer Capital Spending and Tech Operating Expense

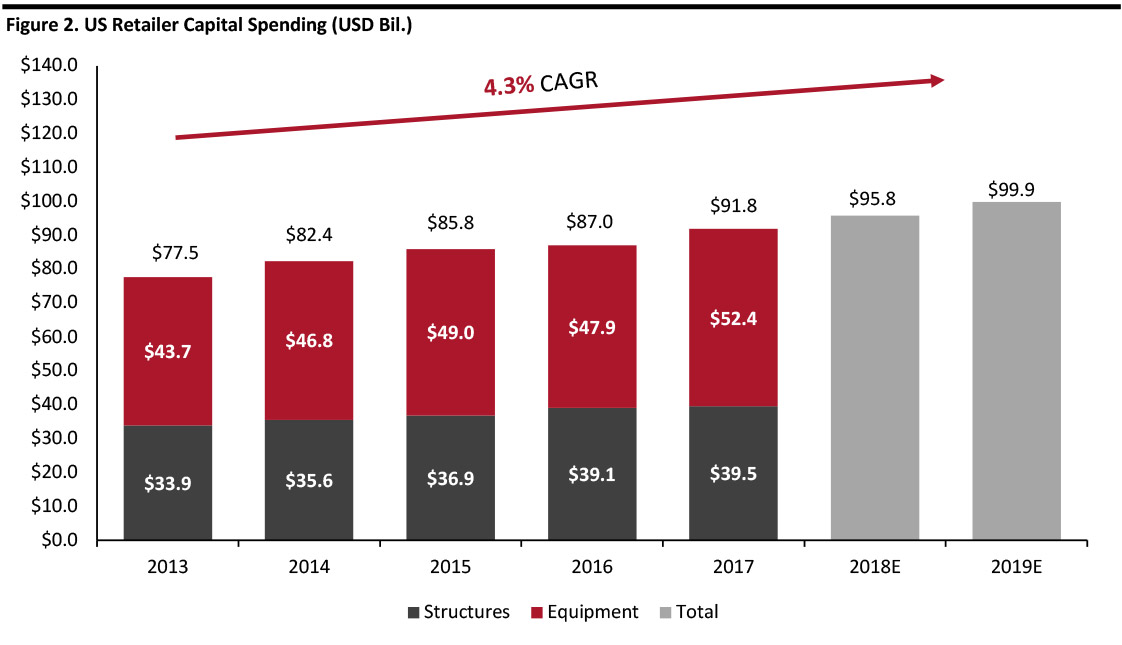

Retailers spend a great deal on technology and store improvements, some $91.8 billion in 2017, according to data from the US Census Bureau, increasing at a 4.3% CAGR during 2013-2017. Using this growth rate, US retailer capital spending should hit about $100 billion in 2019.Still, retail’s capital spending lags other industries: While the overall market average is 4.63%, retailers spend a low-single-digit percentage of revenues on capital improvements, according to data from New York University Professor of Finance Aswath Damodaran.

And of that relatively lower ratio of capital improvement spend, just 38% goes to technology (according to those retailers offering this breakdown), with the remaining 62% going to stores and store improvements.

[caption id="attachment_94609" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

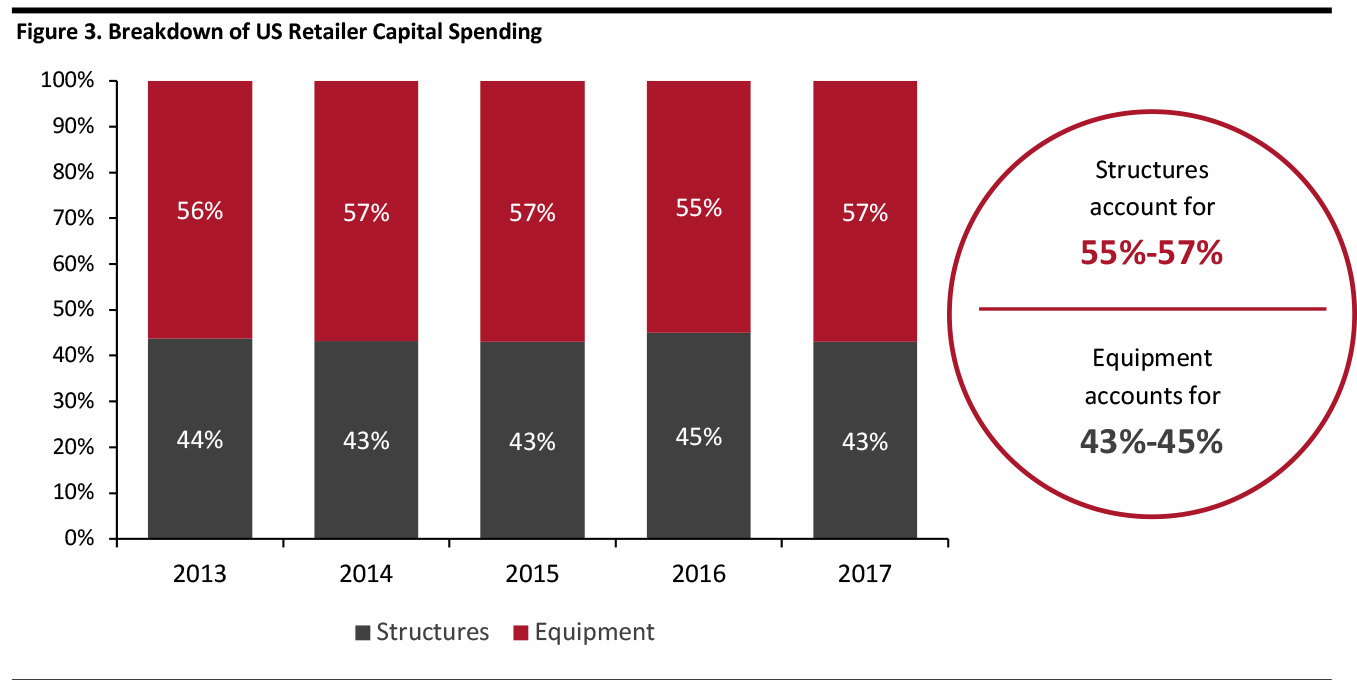

The figure below shows that the allocation of capex between structures and equipment has remained constant during 2013-2017, with structures accounting for 56%-57% of capex and equipment accounting for 43%-45%.

[caption id="attachment_94175" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

Retailer capital spending trails US companies on average in terms of their capital spending-sales ratios, and they trail technology companies by a wide margin. For example, system and application software companies spend 9.77% of revenues on capex. Capital spending is just one way retailers invest in technology: Much of the investment falls on the operating expense line of the income statement.

Capital spending is just one way retailers invest in technology: Much of the investment falls on the operating expense line of the income statement. Digital retail IT spending in North America was estimated at $47.6 billion in 2018 and growing at a 6.5% CAGR through 2026E, according to Transparency Market Research.

In-Store Technologies

Smartphone-Connected Apps

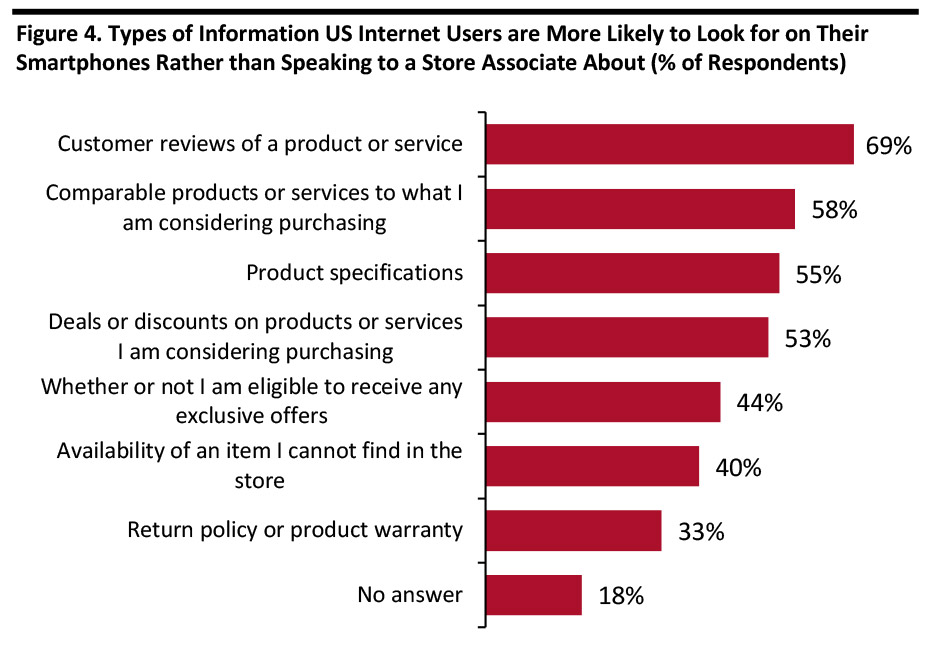

Consumers use smartphone apps to get pricing and additional product information in the store and outside the store, as well as to make purchases on the company’s e-commerce sites. The figure below shows that more than two thirds of those surveyed used their smartphones to read reviews on a product or service.

[caption id="attachment_94176" align="aligncenter" width="700"] March 2019

March 2019 Source: eMarketer [/caption]

Beacons

Beacons function like a lighthouse, transmitting their existence and signature via Bluetooth radio to shoppers in store. This signal can be picked up by the retailer’s app on the customer’s smartphone, then the app can track the shopper’s path through the store and offer coupons and personalized offers.

[caption id="attachment_94177" align="aligncenter" width="700"] Beacon Developer Kit

Beacon Developer Kit Source: Estimote [/caption]

Apple introduced iBeacon using Bluetooth low-energy (BLE) wireless technology. While retailers such as Macy’s tested the technology, beacon technology has not been deployed widely. One possible explanation is that the consumer needs to take several steps to benefit from the technology and missing any one step means that the beacon’s transmission cannot be received.

This is what the customer needs to do:

- Download the app (if in-store, Wi-Fi needs to be working, and the user needs to register on the network).

- Install the app and register with the retailer.

- Turn on Bluetooth.

- Be in proximity of the beacon.

- Have notifications turned on to see the alerts.

Barcode Scanning/Augmented Reality

The embedded cameras in smartphones can also easily scan barcodes, which can be interpreted by a browser or app, and several retailers are using barcodes and augmented reality to offer customers additional information on a product.

This technology is an enabler of numerous other retail-related functions including self-checkout (covered later in this report).

[caption id="attachment_94178" align="aligncenter" width="700"] Use of Augmented Reality in the Grocery Store

Use of Augmented Reality in the Grocery Store Source: Marxent Labs [/caption]

Customer Tracking/Identification

There are several technologies that retailers can use to track the location and movement of customers in store to understand customer traffic flow, determine “hot” and “cold” areas and products. Many of these technologies do not directly reveal the customer’s identity, but identities can be determined by combining multiple data sources or if the customer has the retailer’s app installed on his or her smartphone.

Applications include store-performance measurement, mall analytics and inventory optimization.

Retailers can use a combination of sensors, antennas and cameras to track customer movements in the store. Selected methods and technologies include the following.

- Optical/thermal imaging: Retailers can use CCTV cameras and machine vision software or infrared cameras that track customers’ body heat to count the number of visitors to a store and their journey within the store.

- Facial recognition: The technology exists to identify customers in a store, though there are privacy concerns. Other applications include detecting a customer’s mood to determine if assistance from a sales associate is appropriate.

- Wi-Fi: Each smartphone has a network controller chip with an embedded media access control (MAC) address, which can be read by an access point. There are 248 (i.e., 281,474,976,710,656) possible MAC combinations, so this address is virtually unique. The MAC address does not reveal the users’ identity or provide location – but the retailer can track repeat visits.

- GPS: Smartphones include chips that receive signals from the network of Global Positioning System (GPS) satellites, which are analyzed to determine the user’s location. This information can be used by retailers and other apps to determine when the consumer enters the store or a specific area (geofencing), and even the consumer’s journey throughout his or her day. However, in response to user concerns over privacy, smartphones now offer the option of when and where to share this information, for example in the privacy / location services menu in iOS.

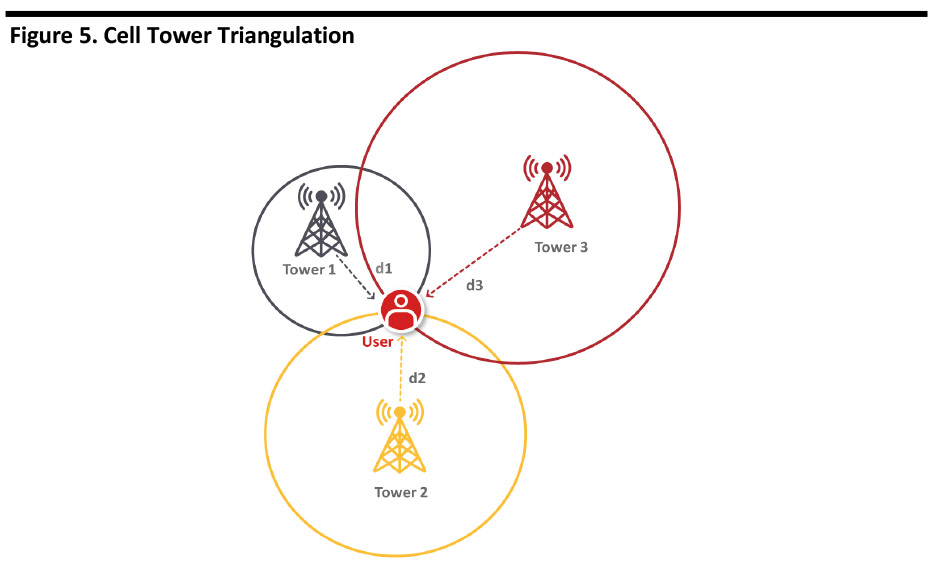

- Cell tower triangulation: Cellular technology enables the signal to hop from one cell tower to another, detecting a weakening signal as the user moves throughout the service area, and signal strength and connection data from cell towers can be used to determine a subscriber’s location.

- RFID: Tags can identify and detect items inside the store, and multiple scanners can track the location and movement of items within a store. For example, several items taken to a dressing room and left there unpurchased could indicate a problem with the fit or sizing of the item.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Other relevant technologies include using structured light, physical sensors (e.g., under the floor), and ultrawideband (i.e., radar) tracking.

Electronic Shelf Labels

Electronic shelf labels (ESLs) enable remotely controlled, frequent updates and corrections of prices depending on demand, weather and competitor prices. Benefits include the ability to correct prices in real time; less time and labor from no longer having to print out and attach price labels; the ability to guide customers to an item’s location via in-store maps; the benefits from combining pricing changes with customer-tracking data; and, the ability to manage inventory and expiration dates.

There are several technologies used for transmitting data to ESL, including:

- Radio: ESL systems can use analog or digital radio frequencies (typically using low frequencies) to transmit updated pricing information.

- Infrared: Infrared light is invisible to the human eye so prices can be changed electronically.

- Visible light: Store lighting can be imperceptibly modulated to impart pricing information on ESLs.

Display and transmission technologies have evolved over time, from LCD (pictured below) plus infrared, to e-paper plus infrared or radio, to complex solutions that combine ESL with other functions such as digital signage, loss prevention and customer tracking.

[caption id="attachment_94180" align="aligncenter" width="690"] LCD Electronic Shelf Label

LCD Electronic Shelf Label Source: Pricer [/caption]

Smart Displays and Magic Mirrors

Akin to the technology behind ESLs, smart in-store displays can connect to the store network to download and display refreshed content, and can react to physical or visual input from the consumer.

Magic mirrors are a type of smart display that changes the image based on input from a camera. For example, the image displayed can change based on a person’s movement, facial expression, emotion, or present a visualization of what a garment would look like on a customer using augmented or virtual reality.

Examples include:

- Uniqlo’s UMood kiosks use neuroscience technology to help shoppers decide what to buy based on neurological response. Inside the kiosk, customers wear a neuro-headset and watch a series of video stimuli, which are analyzed in real time by a custom algorithm that recommends the perfect t-shirt based on the customer’s current mood.

- Rebecca Minkoff’s flagship store in New York City uses magic mirrors (in partnership with eBay) to let shoppers browse through merchandise and send items to a dressing room. Inside the dressing room, another magic mirror shows them how they look, and they can request different colors, cuts, sizes, and a beverage.

Magic Mirror at Rebecca Minkoff Store

Magic Mirror at Rebecca Minkoff Store Source: eBay [/caption]

Retailers can also install interactive product displays, which showcase products with displays that change when an item is picked up and can take input from consumers in to provide additional product information. For example, Perch uses 3D sensing technology to detect when shoppers touch, pick up or put down a product, which triggers entertaining or informative experiences.

Inventory Control

Maintaining control of inventory theft (euphemistically termed “shrink”) is a high priority for retailers, who lose $46.8 annually due to crime or error, according to a 2018 survey by the National Retail Federation (NRF).

Means of reducing or preventing loss include surveillance, optimizing the store layout and the technological solutions for electronic article surveillance (EAS), which include:

- Acoustomagnetic (AM): The typical department-store apparel tag.

- Electromagnetic (typically used in library books).

- Radio-frequency (RF), such as RFID.

- Microwave: Also used in apparel but now out of favor.

The Sensormatic division of Johnson Controls generates $1 billion in annual revenue from products for loss prevention, inventory intelligence and other areas. Its EAS products include detection systems, sensors, detachers and deactivators.

[caption id="attachment_94182" align="aligncenter" width="700"] Acoustomagnetic Tag and Detection System

Acoustomagnetic Tag and Detection System Source: Johnson Controls [/caption]

Catalyst, a Li & Fung company, offers a line of RFID and electronic article surveillance products for retail for loss prevention, inventory management and customer experience.

See also our report Revealing the Hidden Costs of Poor Inventory Management.Inventory Tracking

Retailers need accurate counts of inventory for financial reporting, but also to enable delivery methods such as BOPIS and ship-from-store. As delivery times shorten to keep pace with Amazon’s introduction of one-day shipping, having an accurate view of inventory becomes even more crucial, since canceling a customer order due to inventory inaccuracy infuriates and could lead to the loss of the customer.

The benefits of better inventory tracking include revenue by preventing stockouts and excessive discounting, margin benefits from optimized pricing and preventing sharp discounting or write-offs, as well as reducing working capital (which consumes cash) by avoiding keeping excess inventory.

Inventory-tracking technologies include:

- Radio frequency identification tags (RFID): Tags can track the location of containers, packages or individual items, and systems can scan entire shelves or track the movement of an item in the store, offering accuracy and eliminating physical inventory checks.

- Machine vision: Computer vision technology can track inventory, customer purchases in unstaffed stores and ensure accurate reporting in self-checkout terminals (i.e., reduce or eliminate theft.)

- Sensors: Sensors underneath on-shelf inventory can track when an item is removed and make the corresponding inventory adjustment.

Unstaffed stores such as Amazon Go use a combination of RFID and computer vision to track when an item is taken off the shelf and put in a shopping cart to update the inventory view and bill the customer.

Technologies such as machine and RFID can track inventory as it moves from supplier to warehouse to physical store.

Robots can also perform inventory counts. In 2017, Walmart announced plans to use robots from Bossa Nova Robotics to scan shelf inventory, initially planning deployment in 50 stores.

[caption id="attachment_94183" align="aligncenter" width="700"] A Shelf-Scanning Robot

A Shelf-Scanning Robot Source: Bossa Nova Robotics [/caption]

Store Robots

Thanks to advances in AI and machine vision technology, Robots are no longer the stuff of science-fiction. New applications for robotics in the store include the following:

- Greet customers: Pepper is manufactured by SoftBank Robotics (formerly Aldebaran Robotics) and is used in Japan to greet and chat with customers, recognize human emotions, send meeting notifications and order beverages.

- Guide customers: Lowe’s LoweBot, designed by Fellow and introduced in 2016, can help customers with simple questions and guide them through the store.

- Fetch items: In 2014, Starwood Hotels (acquired by Marriott) announced that one of its Aloft-branded hotels would start using robotic ”Botlrs,” built by Savioke, that can navigate the hotel to deliver items to rooms without bumping into guests.

- Pick and pack: Amazon sent shockwaves through the industry with its acquisition of warehouse-robot maker Kiva Systems in 2012, and there are several providers of warehouse robots, many working in human-robot teams, in addition to the automated grocery warehouse technology developed by Ocado and being implemented by Kroger. Walmart has lauded its FAST technology, a form of automated conveyor belt, which helps associates unload trucks faster and spend more time with customers on the store floor.

- Distribute BOPIS items: Walmart introduced automated towers for picking up BOPIS items, made by Cleveron, in 2017. After a consumer orders an item, he or she receives a notification and can come to the store, scan a barcode, and receive the item from the pickup tower.

- Maintain stores: The consumer robotic vacuum Roomba was introduced by iRobot in 2002, and in 2018 Walmart announced it was deploying robotic janitors — made by Brain Corp — to mop floors.

Robotic Janitor

Robotic Janitor Source: CNBC [/caption]

(Mobile) Point-of-Sale (POS) Terminals

The traditional mechanical/electronic cash register has evolved into an intelligent, mobile device. POS devices today can be mobile (on a smartphone, or on a regular or ruggedized tablet), or traditionally fixed on a countertop, and consumers can complete their purchases from the store floor.

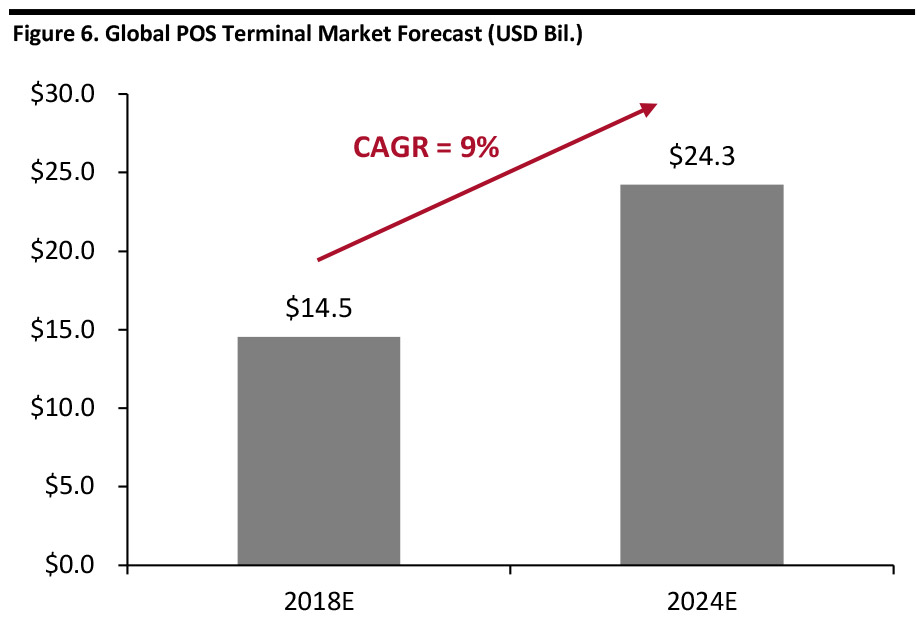

The POS market is forecast at more than $14.5 billion this year, growing at a 9% CAGR through 2024E, according to Grandview Market Research, driven by increasing use of credit cards adhering to EMV (Eurocard, Mastercard, Visa) standards. The adoptions of contactless payments in smartphones and other wearables is another market driver.

[caption id="attachment_94185" align="aligncenter" width="700"] Source: Grandview Research[/caption]

Source: Grandview Research[/caption]

POS vendors include Cisco, Diebold, HP Inc, NCR, Panasonic, Toshiba (which acquired IBM’s business), Verifone, Zebra and many others.

Within this market, wireless terminals are expected to account for about $7.5 billion, growing at an 11.2% CAGR during 2019-2024E, according to a forecast from Research and Markets.

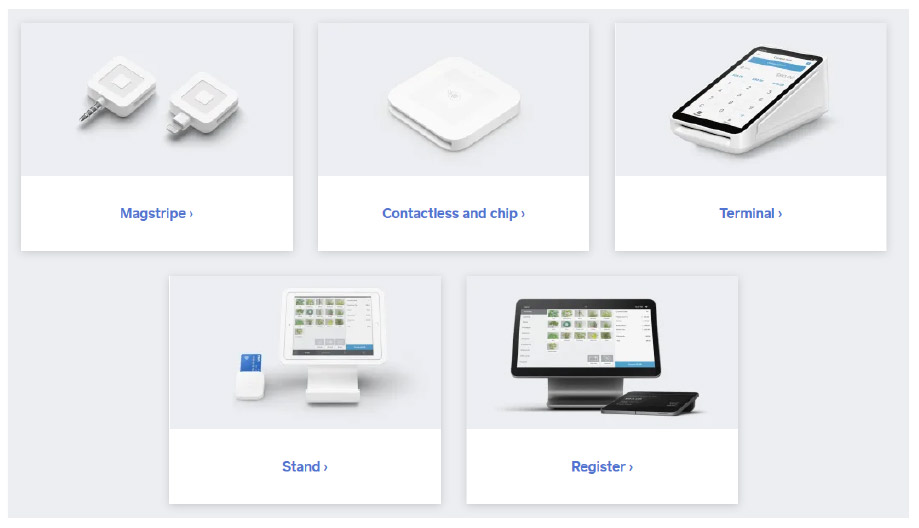

The advent of the smartphone has created diversity in the form factors of payment terminals, enabling small merchants to accept contactless and credit-card payments. Companies such as Square offer a broad line of hardware, peripherals and software that transform off-the-shelf tablets into POS terminals.

[caption id="attachment_94186" align="aligncenter" width="700"] Sample Tablet Add-on Payment Hardware

Sample Tablet Add-on Payment Hardware Source: Square [/caption]

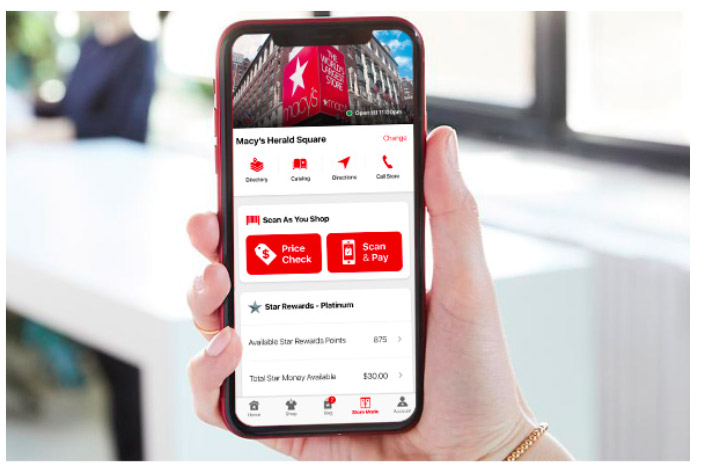

Apple, with its revolutionary Apple Store, introduced in-store checkout, eliminating the need to stand in line. Since then, other retailers have tested the ability to check out on the store floor, including Macy’s, Target and Walmart.

[caption id="attachment_94187" align="aligncenter" width="705"] Scan and Pay App

Scan and Pay App Source: Macy’s [/caption]

Floor/Self-Checkout Terminals

Along with on-floor checkout, self-checkout terminals are seeing increasing deployment at retailers, offering consumers a modicum of control over the speed and flow of the checkout process. Retailers offering self-checkout include BJ’s, Home Depot, Kroger, Rite Aid, Target and Walmart, in addition to restaurants such as Burger King, Lowe’s, McDonald’s, Panera, Shake Shack and Starbucks, and many others, which offer mobile ordering.

The self-service checkout market is estimated at more than $27.5 billion this year and growing at a 15.3% CAGR during 2016-2024E, according to a forecast from Profshare Market Research. Leading equipment vendors include Fujitsu, IBM and NCR.

[caption id="attachment_94188" align="aligncenter" width="630"] Self-checkout Terminal

Self-checkout Terminal Source: NCR [/caption]

One of the biggest challenges around self-checkout technology has been theft. Walmart stopped using its Mobile Express Scan & Go, which enabled shoppers to scan their own items using smartphones, though Walmart retained the technology at Sam’s Club stores, citing the difficulty of scanning a large number of items in the typical shopping cart. Current self-checkout systems use AI-driven machine-vision systems to verify agreement between purchased and bagged items.

Retailers can also use small or large tablets to facilitate in-store pickup or online orders, enabling an “endless aisle” of items that can be purchased inside the physical store but fulfilled by the retailer’s e-commerce operation.

See also our report Grocery Tech Innovations from Walmart and Kroger.

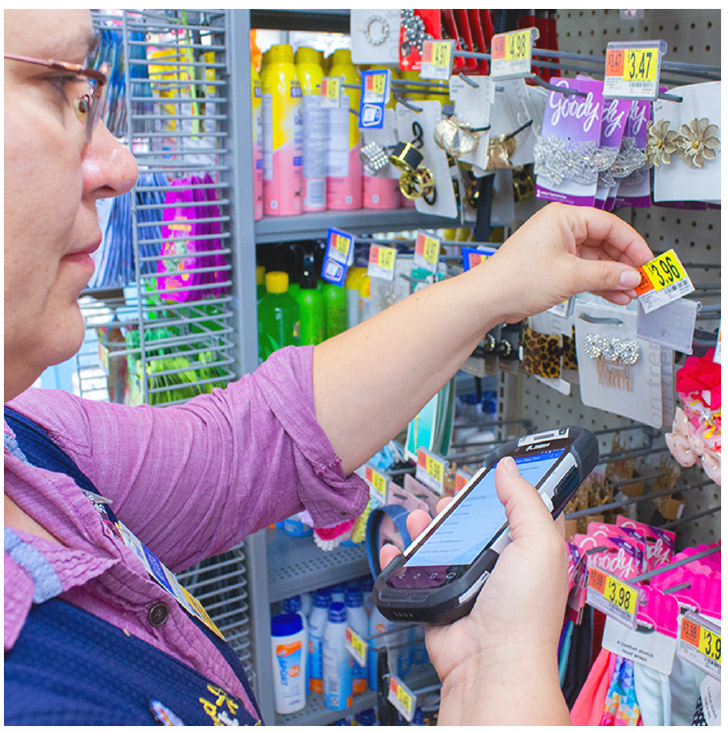

Sales Associate Mobile Devices

The advent of the tablet puts a powerful miniature mobile computer in the hands of store associates, with communication capabilities and access to the retailer’s wealth of product information. This technology, in concert with other labor-saving technologies such as robotics, has enabled store associates to spend less time in the back room and more time on the store floor with customers, improving customer service.

Tablets occupy less space than a POS or desktop PC, can accelerate the checkout process, enable graphical display of a product from different angles, can collect customer information and enable online transactions.

Sales-associate tablet vendors include traditional PC suppliers such as ASUS, Dell, Fujitsu, HP Inc and Lenovo, in addition to Apple and Android developers such as Samsung and many others.

[caption id="attachment_94189" align="aligncenter" width="700"] Store-Associate Tablet

Store-Associate Tablet Source: Walmart [/caption]

Key Insights

There is an enormous amount of technology inside and behind physical stores, some visible to the consumer, and some invisible, and the deployment of technology is likely to increase as retailers seek to improve service and experiential offerings to bring customers into the store. US retailers spend about $300 billion annually on store improvement, hardware and IT services.

Some of the most powerful in-store tech in retail is brought into the store and taken home by consumers: their smartphones. Shoppers are interacting with an increasing amount of technology in stores, as they view products and computer-generated images of themselves trying on apparel. Once confined to factory floors, advances in computer vision and artificial intelligence have brought an army of robots into retail stores. Robots greet customers, guide them within the store, fetch items, take inventory of items on the shelf and mop floors.

For Additional Information

Deep dive reports in Coresight Research’s RetailTech series include: