DIpil Das

Introduction

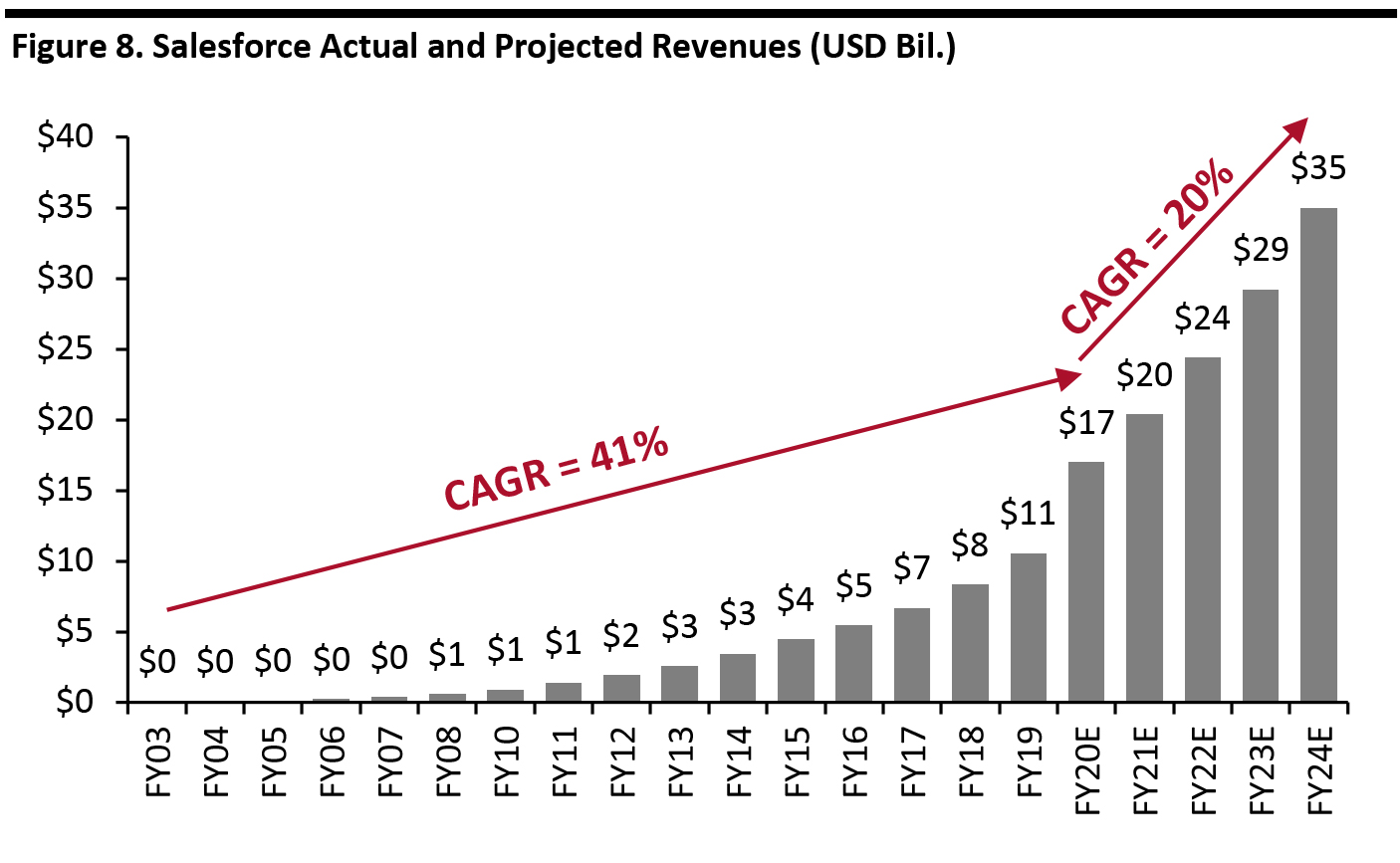

This report is the first in a new Coresight Research series of RetailTech profiles, discussing leading retail-technology companies in the Coresight 100—our coverage list of retail-related companies. In slightly more than two decades, Salesforce has pioneered the trend of cloud-based computing, offering software as a service, as well as defining and leading the customer-relationship management (CRM) software category. The company’s revenues grew at a 41% CAGR during FY03-FY20E, and the company is targeting a healthy 20% CAGR growth rate for the next four years. Salesforce maintains an intense focus on its customers’ needs, initially offered salesforce-enablement tools (i.e., business to business) and later branched out into more consumer-facing capabilities through both in-house development and also acquisition. Building on its B2B foundation in sales, service and marketing, Salesforce is building a portfolio of leading tools in marketing, e-commerce, interoperability and analytics. Looking ahead, the company is focusing its retail strategy on helping its customers use their vast amounts of data and enhance relationships with its B2B and B2C customers anywhere, anytime and on any channel.Company Overview

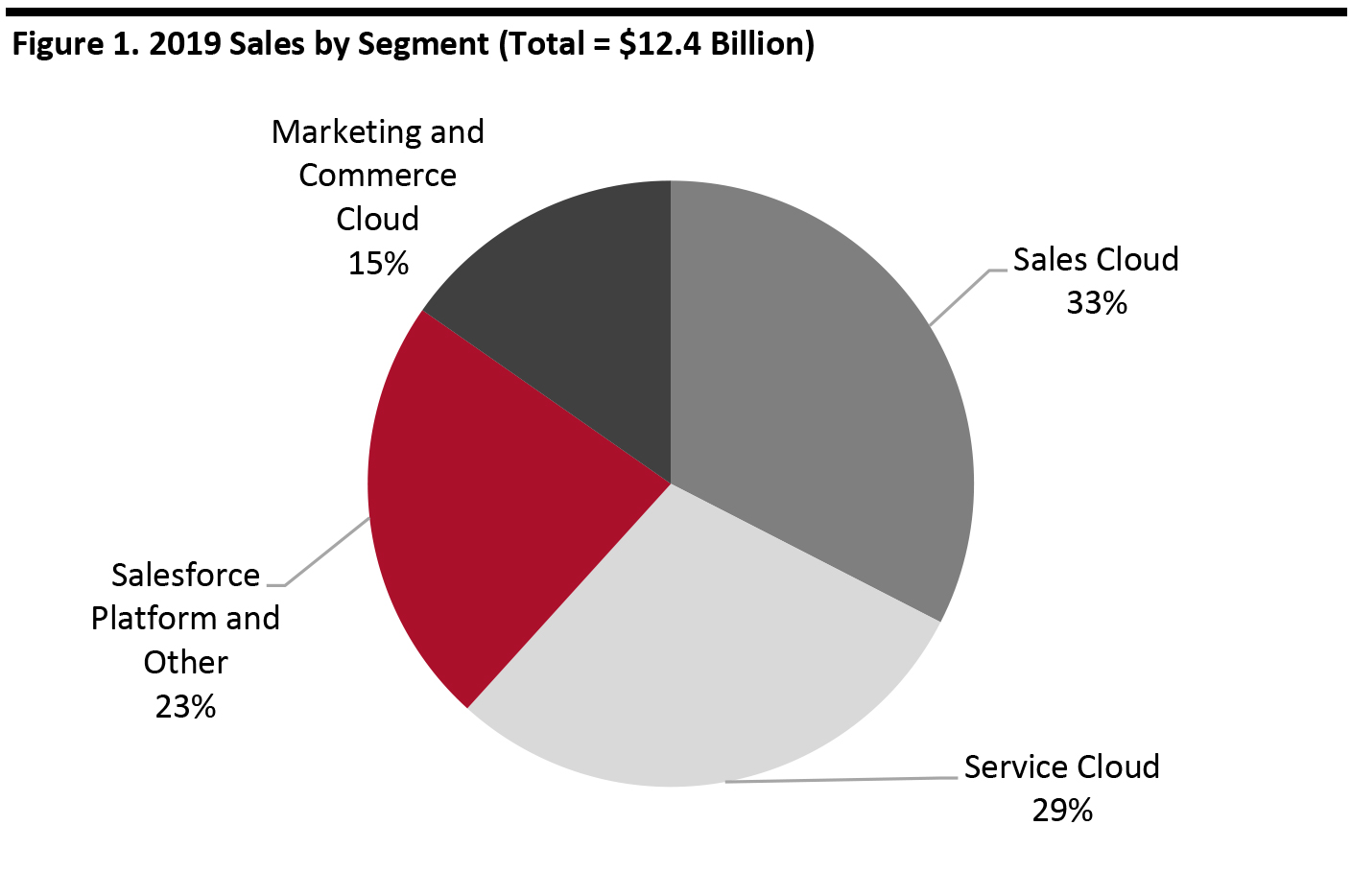

Salesforce was founded in February 1999 in Marc Benioff’s apartment in San Francisco, along with co-founders Parker Harris, Dave Moellenhoff and Frank Dominguez. Benioff, who was a rising star at Oracle, left the company to pursue a new business concept: providing software as a service (SaaS) that was hosted on the Internet. Despite Benioff leaving to form a company that would ultimately compete with the company, Oracle’s co-founder, executive chairman and CTO Larry Ellison was an early investor in the Salesforce. On June 22, 2014, Salesforce completed an initial public offering on the NYSE under the ticker symbol “CRM” offering 11.5 million shares (including the overallotment) at $11 per share. Salesforce bills itself as “the global leader in CRM,” and provides customer relationship management (CRM) technology that enables companies to improve relationships and interactions with customers. The Salesforce Customer 360 Platform delivers services such as sales, service, marketing, commerce, engagement, integration, analytics, industries, communities, enablement and collaboration, of which most operate in the cloud, are designed to be intuitive and operate on both browsers and mobile devices. Salesforce operates four main clouds—sales, service, marketing and commerce—on the trusted, smart, flexible and sustainable Customer 360 Platform, whose revenues are broken down in the figure below. [caption id="attachment_103936" align="aligncenter" width="700"] Source: Company reports[/caption]

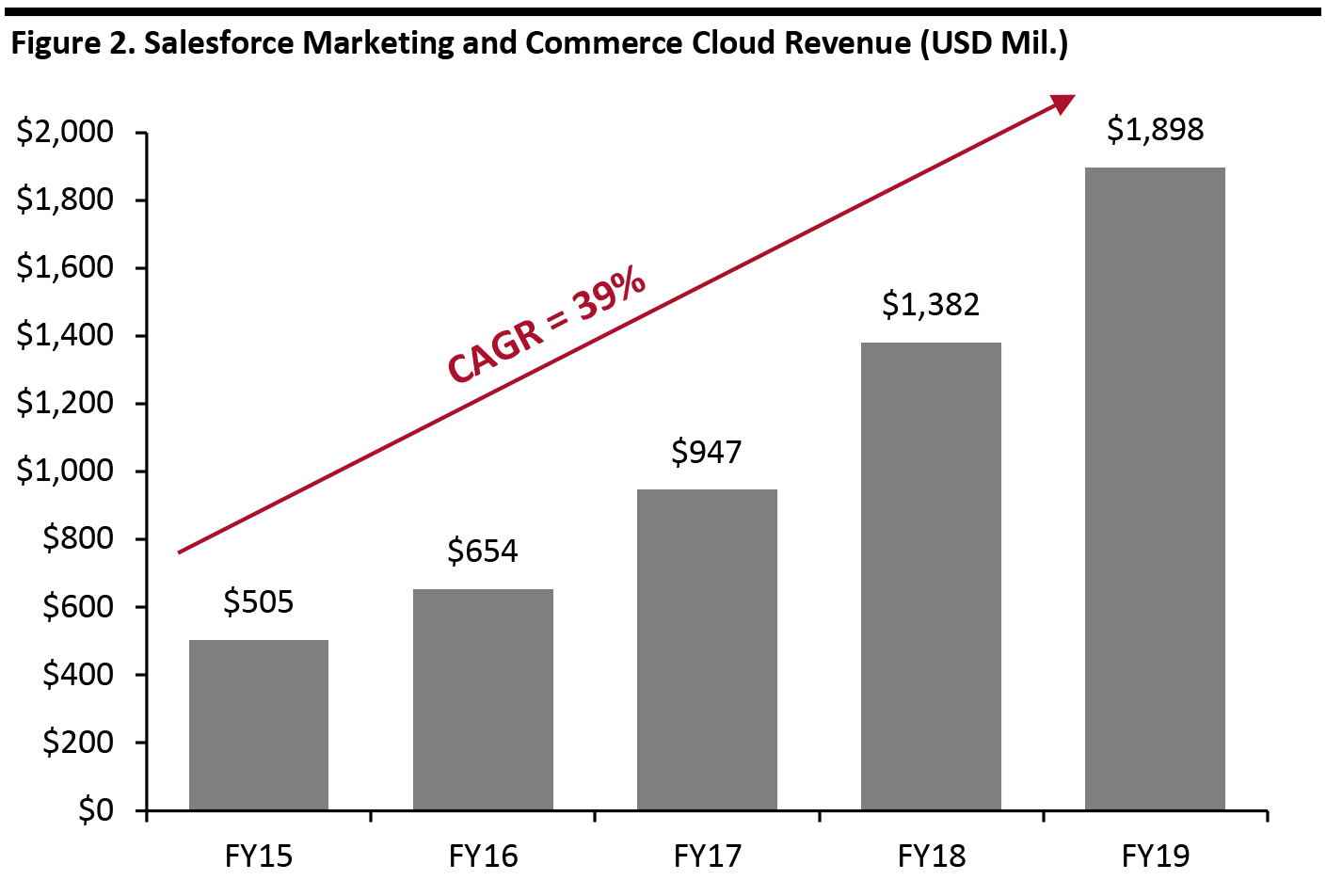

The figure below shows Salesforce’s Marketing and Commerce Cloud revenue, which grew at a 39% CAGR during FY15-FY19. This figure is not organic due to the acquisition of Demandware, which had annual revenues of $237 million in calendar 2015. The company guided that the acquisition would add $100-120 million to FY17 revenues.

[caption id="attachment_103937" align="aligncenter" width="700"]

Source: Company reports[/caption]

The figure below shows Salesforce’s Marketing and Commerce Cloud revenue, which grew at a 39% CAGR during FY15-FY19. This figure is not organic due to the acquisition of Demandware, which had annual revenues of $237 million in calendar 2015. The company guided that the acquisition would add $100-120 million to FY17 revenues.

[caption id="attachment_103937" align="aligncenter" width="700"] Source: Company reports/S&P Capital IQ[/caption]

Source: Company reports/S&P Capital IQ[/caption]

Strategy

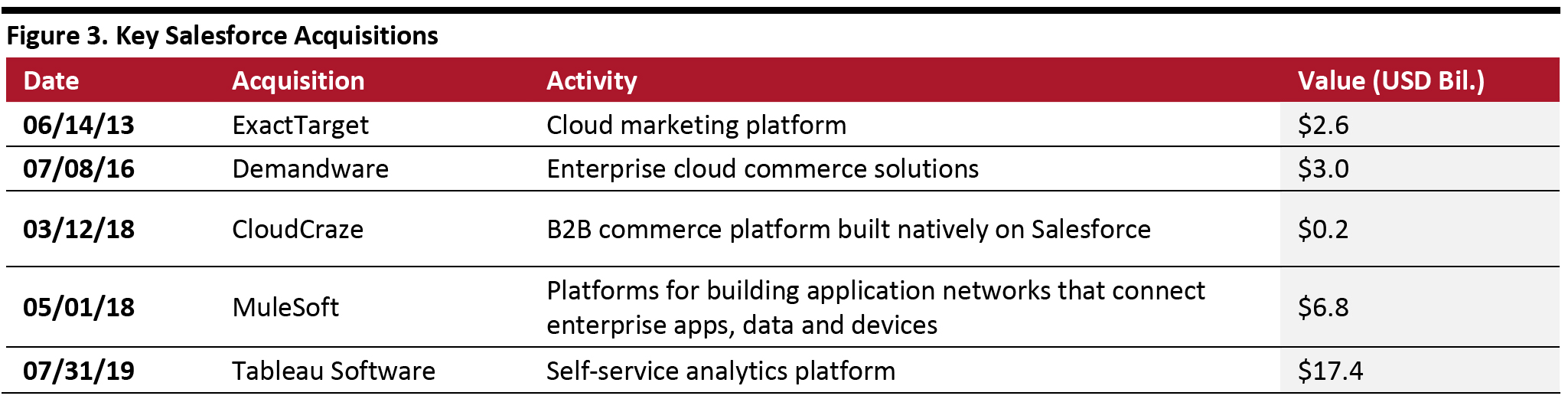

Corporate Strategy Salesforce’s corporate strategy centers on the following points: 1. Targeting vertical industries, including financial services, healthcare and government. In April 2014, the company announced a New Industries Strategy, in which a new business unit was formed to deliver solutions for six global industries: financial services, health care/life sciences, retail/consumer products, communications/media, public sector and automotive/manufacturing. Examples of new verticals include the following customized cloud offerings: Manufacturing Cloud and Consumer Goods Cloud, both of which were launched in September 2019. In September 2016, the Demandware product was rebranded as Commerce Cloud. 2. Expanding into new horizontal markets, such as analytics, commerce, IoT and integration. Examples include the acquisitions of ExactTarget (marketing), Demandware (commerce), MuleSoft (integration) and Tableau (analytics), as detailed in the table below. [caption id="attachment_103938" align="aligncenter" width="700"] Source: S&P Capital IQ[/caption]

Source: S&P Capital IQ[/caption]

Retail Strategy

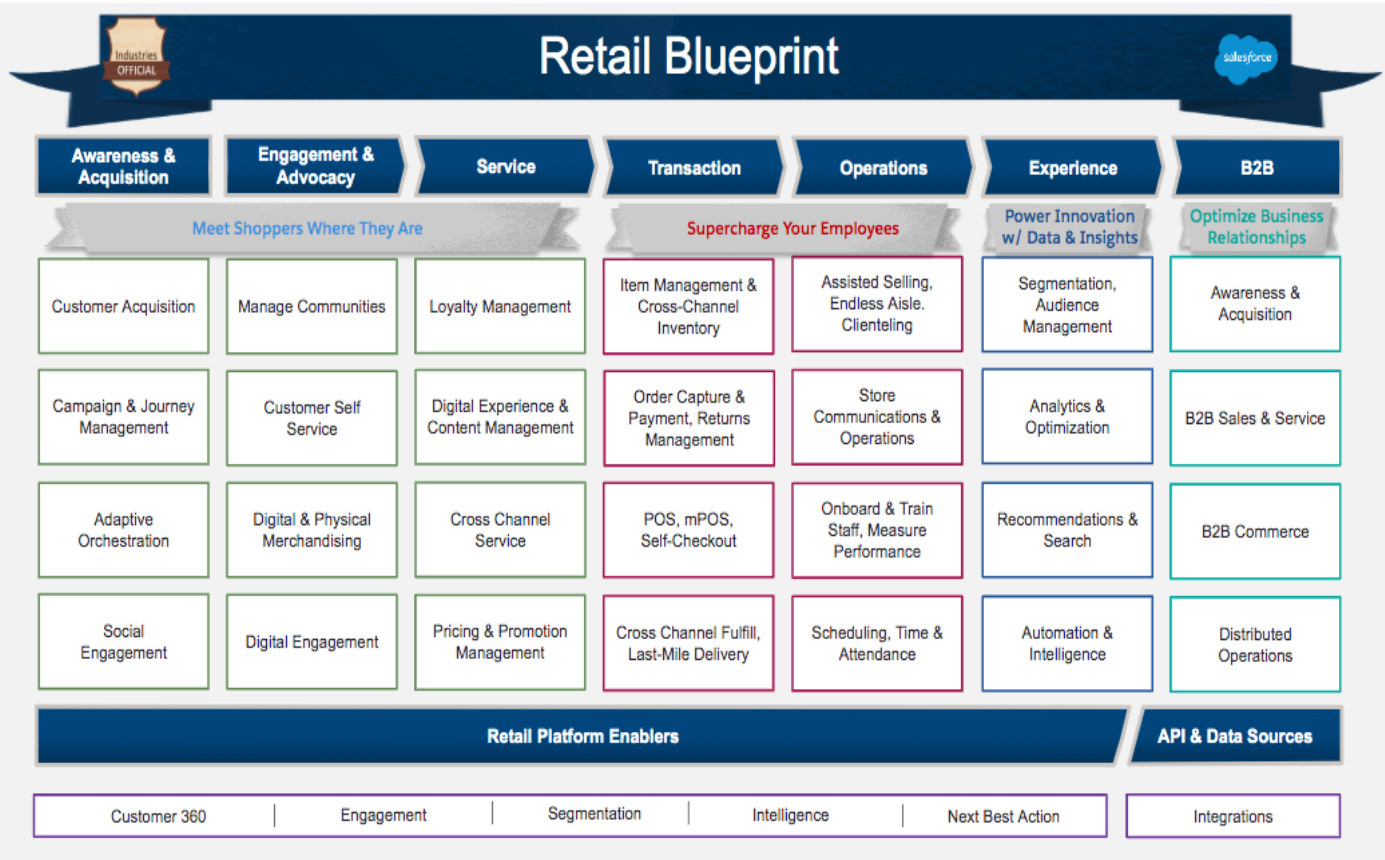

Salesforce aims to benefit from the massive digital transformation retailers and brands are currently undertaking. These retail solutions unleash and integrate data, leverage artificial intelligence and analytics and ultimately provide streamlined and personalized engagement across an exponentially growing number of channels, all on Salesforce Customer 360. The company’s retail strategy rests on four pillars: Meet shoppers where they are: No matter where a shopper is in the journey from discovery to service, brands need to know, personalize, engage and serve shoppers on every channel and device. Brands are also working to deliver the next generation of buying experiences online and in-store. Supercharge employees: Enable the workforce with digital tools and connectivity to enhance productivity, grow careers and personalize shopper experiences. Digitalize operations in-store through connected systems and collaboration. Optimize business relationships: Drive growth across the business by transforming the way of doing business, creating scale across sales, service and marketing. Create consumer-grade experiences for business partners, inside teams and vendors. Drive Innovation with data and analytics: Connect siloed data, create technical agility, and enable business intelligence to transform faster. Leverage AI-fueled insights and personalization across the enterprise to optimize investments and resources. The individual functions of Salesforce’s retail solution are illustrated in the figure below. [caption id="attachment_103939" align="aligncenter" width="700"] Salesforce Retail Solution Blueprint

Salesforce Retail Solution Blueprint Source: Company reports [/caption]

Products

Salesforce’s software operates in the cloud, hence its major product offering names: Sales Cloud: which empowers sales teams. Service Cloud: which enables personalized customer service and support. Marketing and Commerce Cloud: which originally focused on planning, personalizing and optimizing one-to-one customer marketing journeys beginning with the acquisition of ExactTarget in 2013, and subsequent acquisitions have expanded these capabilities. Salesforce accelerated into the B2C commerce space via acquisition: Demandware, which was acquired in 2016, enables B2C commerce; CloudCraze, which was acquired in 2018, enables B2B commerce. In addition, Salesforce has built products organically such as its order management system (OMS) and content management system (CMS). In commerce, Salesforce now offers the following capabilities:- B2C commerce: Grow revenue with AI-powered merchandising and shopping.

- B2B commerce: Digitalize sales using the company’s leading CRM.

- Headless platforms: Deliver commerce on any channel.

- Salesforce OMS: Simplify the post-purchase experience.

- Salesforce CMS: Deliver connected content across every channel.

- Commerce portal: Connect CRM-powered portals and apps.

- AppExchange for commerce: Extend commerce with pre-integrated apps including store, subscription, loyalty and more.

Customer 360 products, platforms and technologies

Customer 360 products, platforms and technologies Source: Company reports [/caption] Customer 360 Truth At the Dreamforce trade show in November 2019, Salesforce announced Customer 360 Truth, a new set of data and identity services that enable companies to build “a single source of truth” across all customer relationships. The new offering connects data from sales, service, marketing, commerce and other sources to create a single platform that better serves and predicts customer needs, including addressing a service problem, creating a personalized marketing journey, predicting the best sales opportunities or offering product recommendations. The MuleSoft technology, which enables connecting to and leveraging data from multiple disparate sources, is a key part of this offering.

Markets

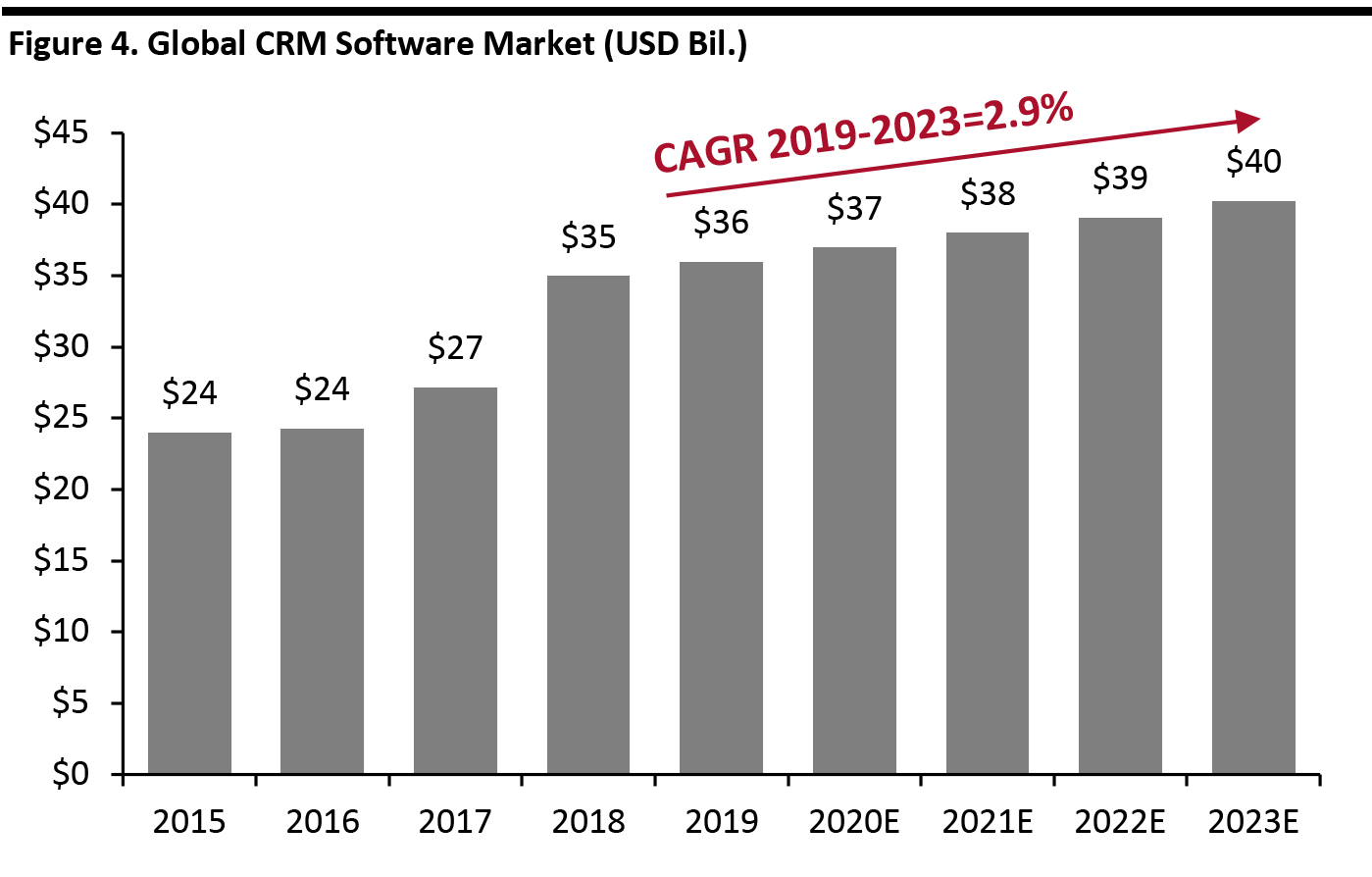

Salesforce estimates its total addressable market to be about $126 billion in 2020, growing at a 10% CAGR through 2023. The global CRM software market is estimated at $37 billion in 2020, which Statista estimates will grow at a 2.9% CAGR through 2023, as seen in the figure below. Salesforce claims to be the number one CRM software provider. Based on 2019 figures, the company’s market share is 37%. [caption id="attachment_103941" align="aligncenter" width="700"] Source: Statista[/caption]

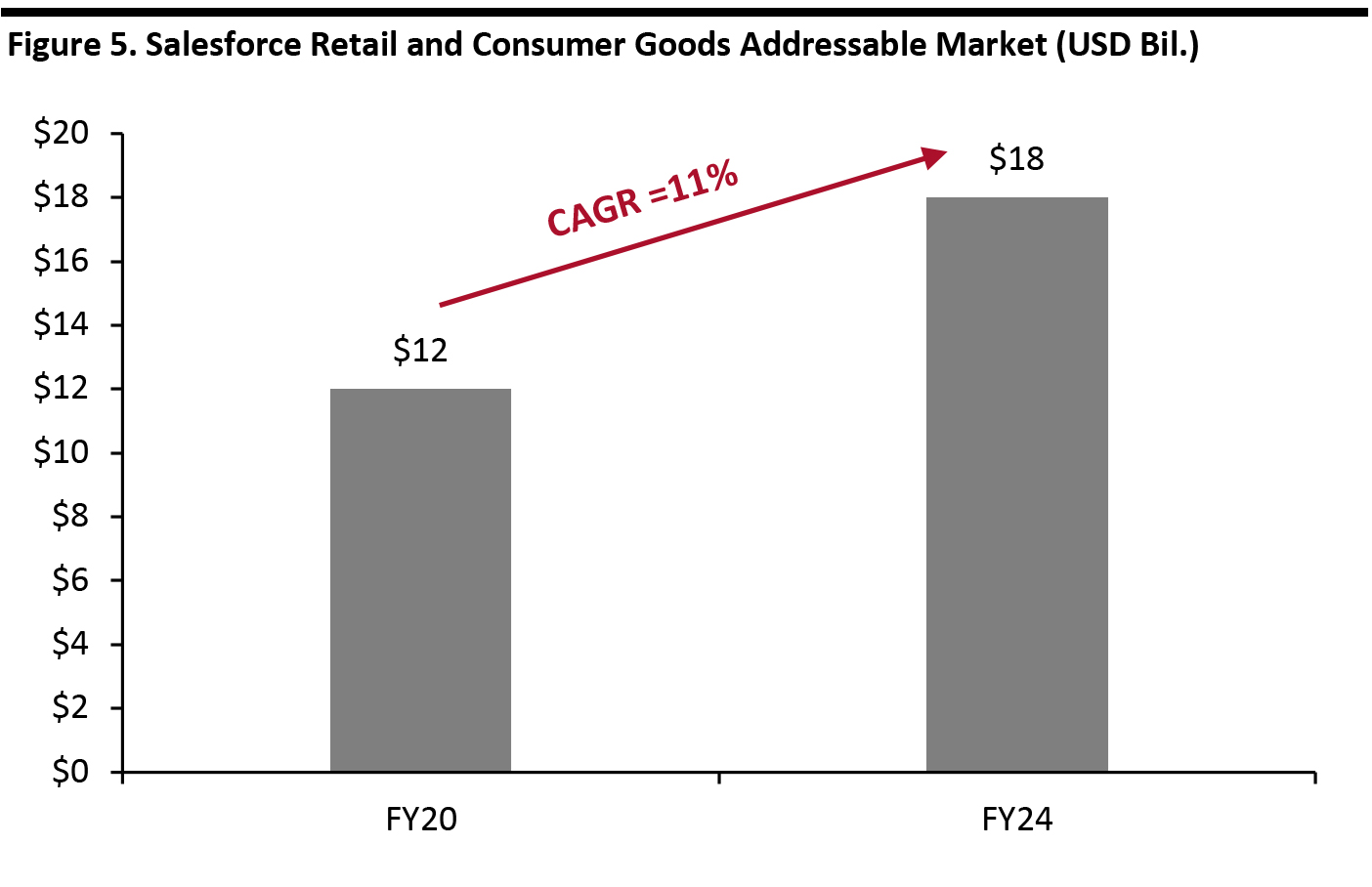

Salesforce’s retail revenues should be approximately $1.8 billion in FY2020, based on its $12 billion estimate of its retail and consumer-good addressable market and 15% market share.

[caption id="attachment_103942" align="aligncenter" width="700"]

Source: Statista[/caption]

Salesforce’s retail revenues should be approximately $1.8 billion in FY2020, based on its $12 billion estimate of its retail and consumer-good addressable market and 15% market share.

[caption id="attachment_103942" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

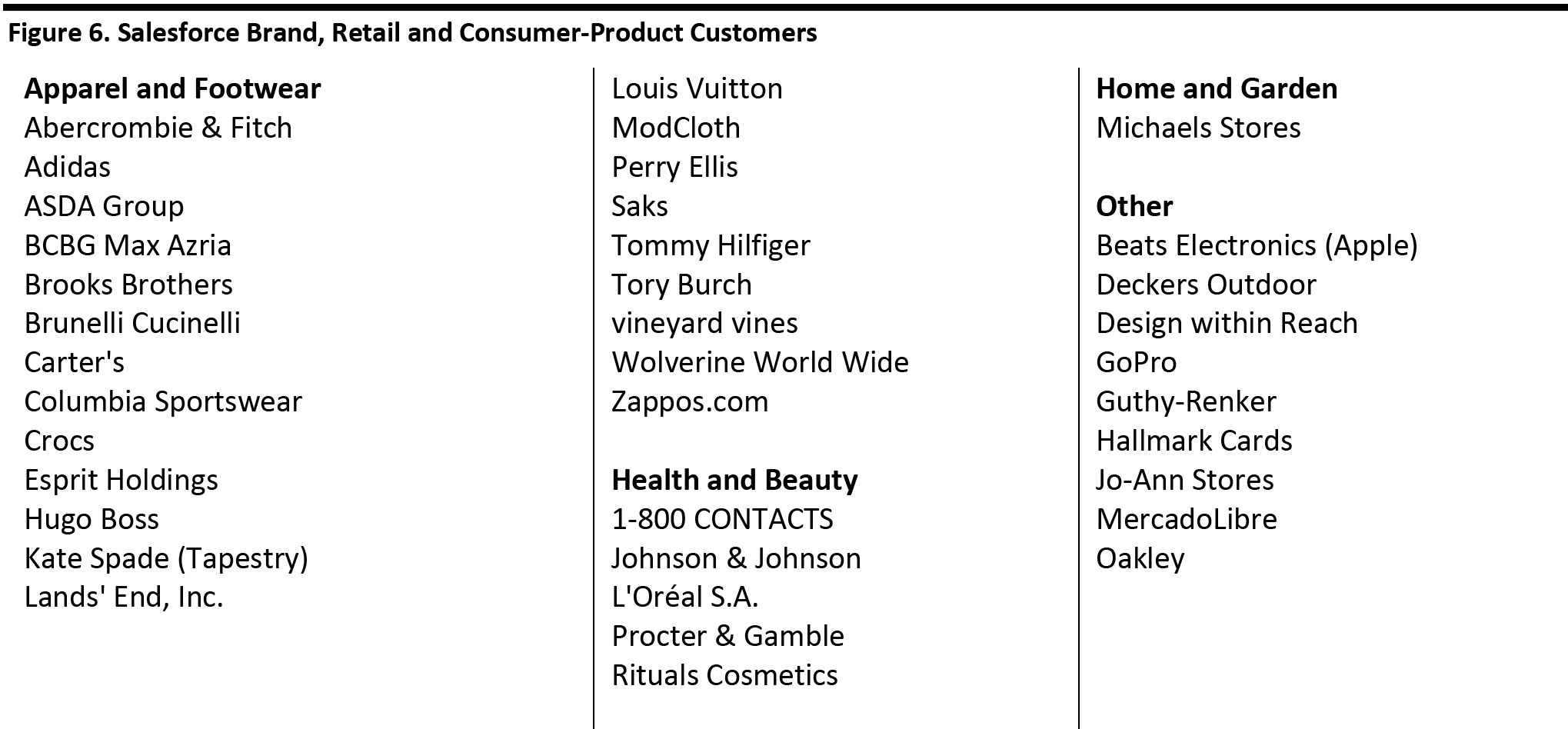

Customers

Salesforce boasts an impressive customer list of leading global companies and brands, including: [caption id="attachment_103943" align="aligncenter" width="700"] Source: Company reports/S&P Capital IQ[/caption]

Source: Company reports/S&P Capital IQ[/caption]

Competitive Landscape

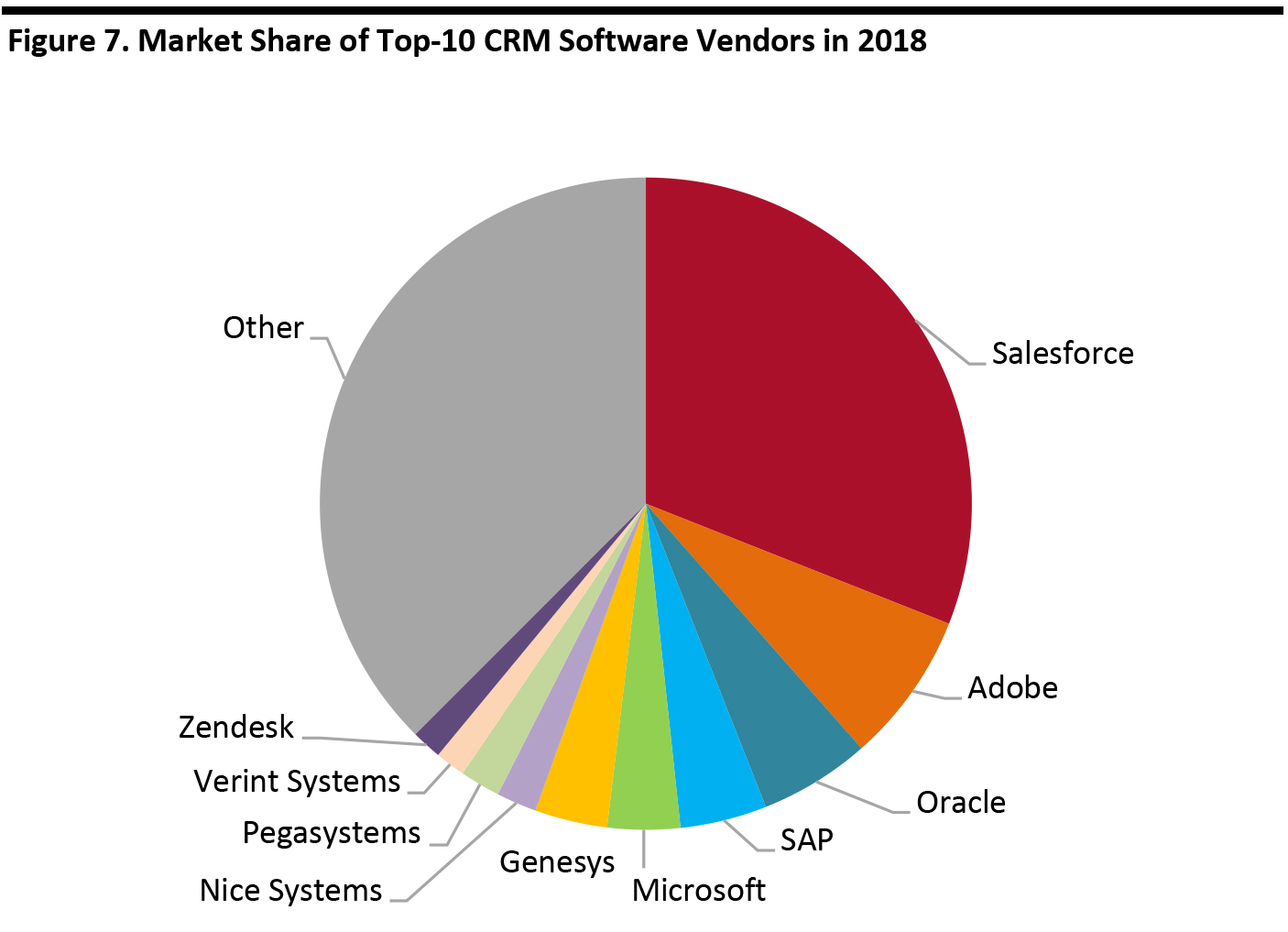

Salesforce competes against the large global providers of enterprise and ERP software, such as Microsoft, Oracle and SAP, as well as against vendors of software for e-commerce, IoT and AI. The figure below shows market shares for the top-10 global CRM vendors: Salesforce has more than three times the share of its nearest competitor. [caption id="attachment_103944" align="aligncenter" width="700"] Source: appsruntheworld.com[/caption]

Source: appsruntheworld.com[/caption]

Competitive Advantages

Salesforce’s competitive advantages include the following: Cloud-based service: Salesforce was an early adopter of cloud-based software as a service, unlocking the many benefits of working in the cloud. Its cloud-based platform is written in a modular fashion with microservices and provides multiple updates throughout the year, as opposed to a large, monolithic update that requires significant effort to install, test and update. Given its cloud-based architecture—which is uniquely multi-tenant—customers enjoy the benefit of a global scalable platform, which runs on multiple servers, and additional computing power can easily be added from other servers for one-time, computing-intensive tasks. Customers benefit by avoiding the expense and effort of owning their own infrastructure, taking advantage of Salesforce’s constant innovation and its pool of complementary capabilities. Focus on CRM: Salesforce’s primary focus has been on CRM since its founding, compared to ERP companies which have subsequently launched their own ERP platforms. Ease of integration: Salesforce offers and publishes a set of application program interfaces (APIs) that other platforms can access to accelerate integration. The MuleSoft platform enables data to be requested, translated and exchanged with systems and platforms from a diverse group of vendors. Analytics and artificial intelligence: With Einstein Analytics and the newly acquired Tableau, Salesforce now has the ability to create complete visualizations, predictions and insights for all of a customer’s ecosystem, via Salesforce tools and third parties. Intense customer focus: Salesforce maintains an intense focus on its customers, rather than developing technology for its own sake, and constantly updates its software to offer new features to strengthen its relationship with its customers. With the always-on resource of online-learning platform Trailhead, Salesforce empowers users to become knowledgeable in areas of interest through modules and hands-on learning activities. Units can be completed at the user’s own pace. Growing portfolio of leading companies: Through acquisition, Salesforce has secured leading solutions in its various sectors, including marketing and e-commerce. With AppExchange, customers can use an enterprise marketplace to extend and complement the company’s products and services. This enables small businesses to build on or contribute to the Salesforce economy for mutual benefit.Financial Results

Salesforce revenues have grown at a meteoric rate, from $43 million in FY03 to $17 billion in FY20E, a 41% CAGR. During the company’s 2019 investor meeting, Salesforce introduced a FY24 revenue target of $35 billion, which represents a 20% CAGR from FY17 revenues, a healthy growth rate for a company of Salesforce’s size. [caption id="attachment_103945" align="aligncenter" width="700"] Source: S&P Capital IQ/company reports[/caption]

Source: S&P Capital IQ/company reports[/caption]