albert Chan

Introduction

What’s the Story?

There are a variety of hardware and software tools and platforms, such as tablets and artificial intelligence (AI)-powered clienteling software, that enable retailers to leverage one of their most valuable assets: the store associate. Associates can use these tools to know more about the customer and make better, more personalized recommendations and upselling suggestions—mirroring the abilities of a store associate in a boutique that has served a well-known customer over years and so knows the customer’s size, likes and dislikes, and shopping history. This report is part of our ongoing RetailTech report series, which provides continued coverage of major technologies in retail.

Why It Matters

E-commerce retailers have several advantages over physical retailers. They are digital by nature and therefore well-positioned to collect a multitude of data on the consumer that is already in digital form. Lacking a physical store pushes online players to make the most out of their data by means of combining it with available software tools to generate personalized product recommendations.

In addition to relentless competition from data-driven e-commerce retailers, physical retailers face several unique challenges:

- A lack of relationship building due to high turnover rates, which results in less-experienced associates who are not familiar with the customer’s preferences and needs

- Staffing shortages that reduce the amount of time an associate has to help a given customer, thereby increasing the urgency for a meaningful conversation

- Customers come into the store already armed with research and data collected online, potentially making them more knowledgeable than a store associate

However, physical retailers have an enormous advantage versus online retailers: their associates, the humans that staff their stores with whom customers can discuss products and get recommendations. This interactive discussion, particularly when the associate is knowledgeable, exceeds the capabilities of any AI software.

Associate enablement technologies help retailers to address challenges by arming in-store staff with tools that help them know the customer. These tools enable associates to make relevant recommendations and leverage upselling opportunities, as well as access product information at their fingertips. In addition, mobile tools can help the consumer check out on the store floor, avoiding the friction and frustration from having to wait in line to pay.

Associate Enablement Technologies: Coresight Research Analysis

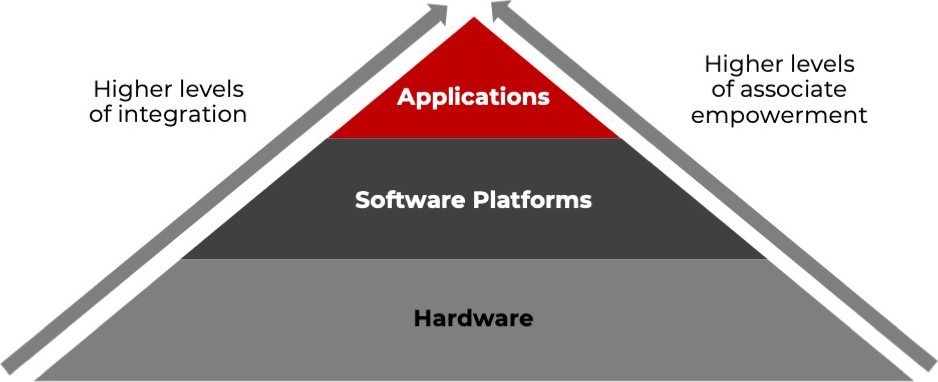

The Technology Pyramid of Associate Enablement Tools

As with other tech solutions, associate tools are the culmination of multiple technology layers, as shown in Figure 1.

Figure 1. Associate Enablement Tech Pyramid [caption id="attachment_153559" align="aligncenter" width="550"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Hardware Platforms

The underlying hardware includes cloud computing resources, in addition to physical devices such as handheld terminals. In-store hardware includes traditional desktop terminals, but mobile terminals are becoming increasingly popular due to their mobility—enabling associates to approach a customer on the store floor. Mobile terminals can leverage PC technology or Android mobile technology (the latter of which is being increasingly adopted due to its lower cost and commodity hardware).

Software Platforms

The underlying software include ERP (enterprise resource planning) and other systems that provide access to a customer’s purchase history, as well as inventory and general tools such as AI/ML (machine learning) software, which excel at finding relationships among disparate data sources to generate actionable insights.

Applications

Major enterprise software platforms with retail verticals—such as those offered by Microsoft, Oracle, Salesforce and SAP—include functionality for personalization and/or clienteling.

- Microsoft made associate empowerment (via collaboration, communication and secure devices) a key pillar of its Cloud for Retail offering.

- Oracle recently disclosed at its Cross Talk 2022 conference that it had quickly built a clienteling extension on its Platform for Modern Retail using no-code development tools.

Clienteling: The Holy Grail of Retail Tech

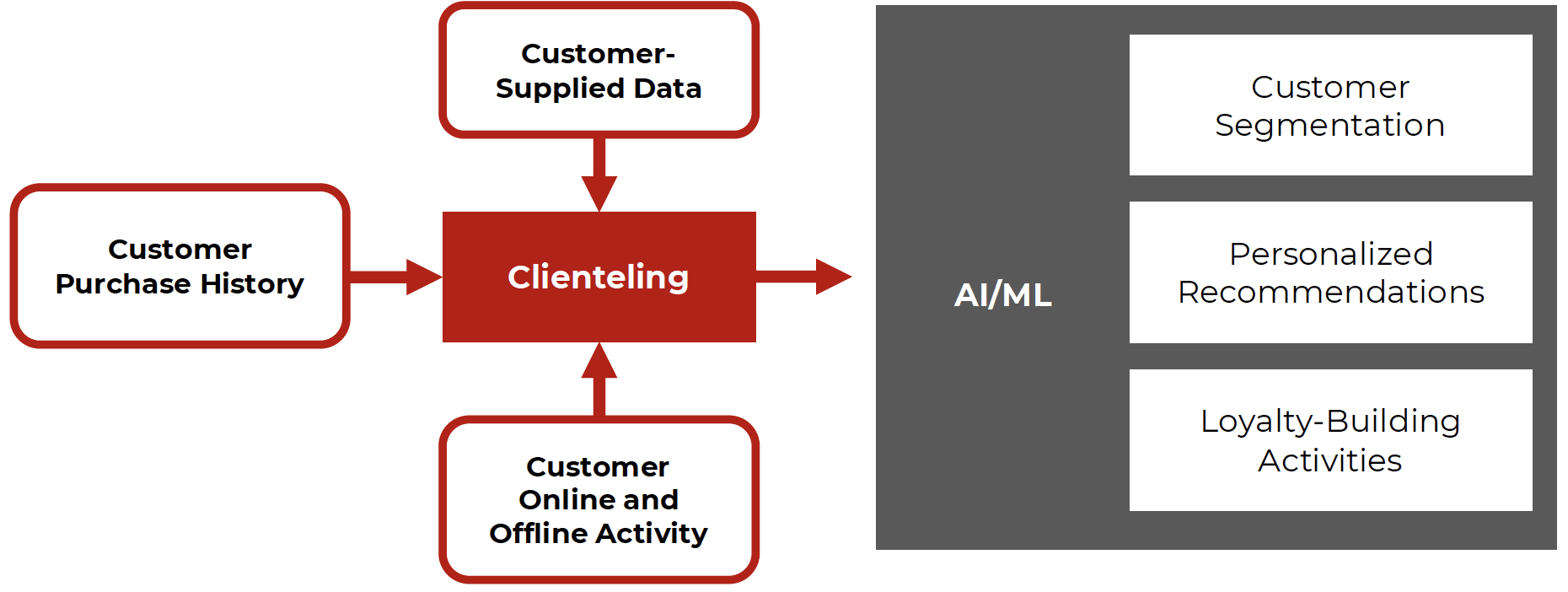

Clienteling means using technology to establish a relationship and familiarity with the customer that endures over the long term. Clienteling uses data on customer preferences, online and in-store behavior, and prior purchases to know the customer and make relevant recommendations to ensure that brand communication delights, rather than annoys, the shopper.

As a human associate would do, understanding the customer requires drawing insights from several data sources, as illustrated in Figure 2.

Figure 2. Clienteling Inputs and Outputs [caption id="attachment_153560" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

POS Systems: More than Just Cash Registers

Modern point-of-sale (POS) systems do much more than offer a view into inventory, and there has been an explosion in the development of different types of POS devices—including fixed, convertible and mobile, as well as fixed and mobile devices that use tablet or smartphone technology.

- Technology company Apple has long used mobile devices that enable associates to check out customers on the store floor.

Beyond inventory and collecting payment, modern tablets enable associates to view purchase histories, perform omnichannel functions such as ship-from-store (including accessing online inventory contained in an “endless aisle”), and access AI-based product and outfit recommendations.

[caption id="attachment_153561" align="aligncenter" width="550"] Mobile POS system used in curbside pickup

Mobile POS system used in curbside pickupSource: HP[/caption]

The Macroeconomic Context: Mitigating High Turnover and Staffing Shortages

Retailers face the double challenge of high turnover rates and difficulty in obtaining sufficient staff. The retail separation rate was 5.0% in May 2022, as compared to 3.9% for the private industry overall, according to data from the US Bureau of Labor Statistics (BLS). At the same time, retailers are facing increasing competition for employees from other sectors that are paying competitive wages, such as the restaurants, and even from fulfillment centers and delivery services.

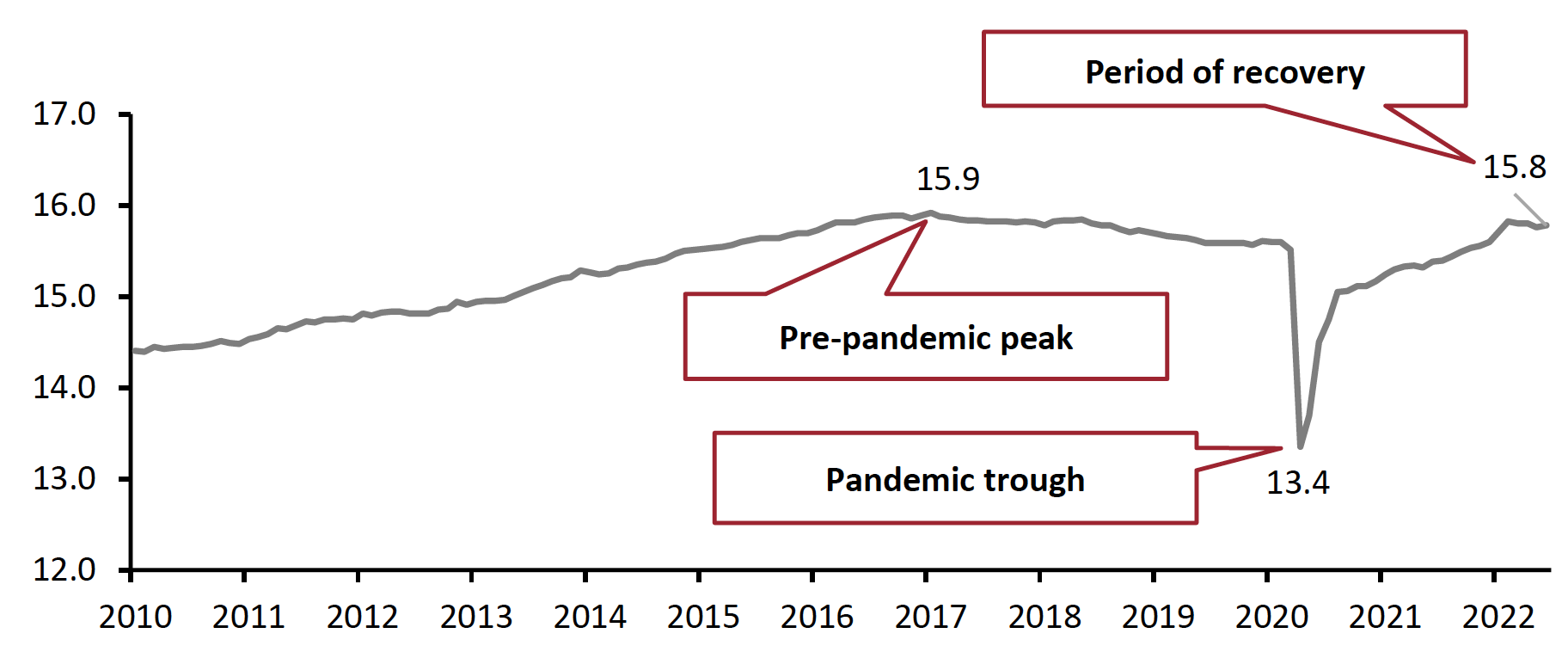

In Figure 3, we show US retail sector employment, including the pandemic-caused trough and recovery, based on data from the BLS. We see that retail employment has not reached the peak set in early 2017 despite growth in retail sales in the intervening period.

Figure 3. US Retail Trade Employees (Mil.) [caption id="attachment_153562" align="aligncenter" width="550"]

Source: US BLS[/caption]

Source: US BLS[/caption]

Keeping stores staffed is essential for physical retailers, since staff shortages could lead to truncated store hours, and a lack of knowledgeable staff could cause customers to leave the store without making a purchase, never to return.

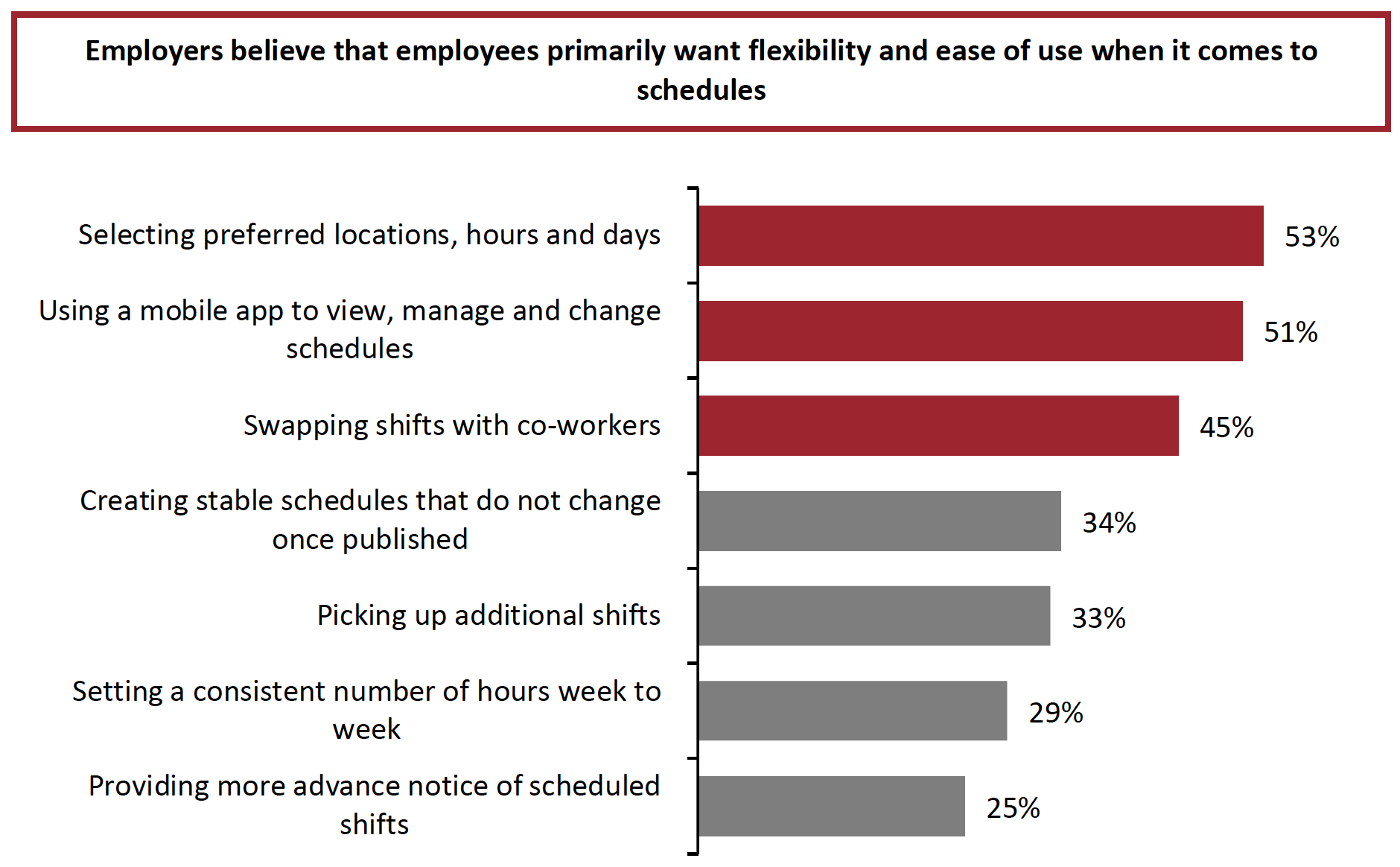

Enabling workers with the tools to select the shifts that best fit their outside lives makes happy workers, and this happiness is passed on to customers in the form of good service. This is especially true in the current competitive employment environment, and employers believe that workers largely want flexibility in setting schedules and the ability to use mobile apps, according to a Coresight Research survey (see Figure 4).

There are software platforms that can be used to address the specific challenges in staffing frontline workers in retail and hospitality.

Figure 4. Scheduling Capabilities That Would Most Contribute to Better Recruitment, Higher Retention and Higher Employee Satisfaction (% of Respondents) [caption id="attachment_153563" align="aligncenter" width="550"]

Base: 216 mid-sized to large enterprises, surveyed in September 2021

Base: 216 mid-sized to large enterprises, surveyed in September 2021Source: Coresight Research[/caption]

What We Think

Store associates are valuable assets for retailers, and retailers need to arm them with tools that highlight their unique strength of being able to hold knowledgeable, interactive conversations with customers in physical stores. While it is nearly impossible for an hourly associate in a large chain to know an individual customer’s purchase history and preferences unaided, mobile tools can put this information in the associate’s hands, with the quality of recommendations and insights amplified by AI/ML. The need to do this is exacerbated by current employment trends such as high turnover and competition for talent.

Implications for Brands/Retailers

- Retailers can use technology to help mitigate disruption from high turnover rates and the resulting harm it causes in the customer relationship.

- Technology such as AI/ML can turn disparate data into clienteling, which cements the customer relationship and builds loyalty.

- AI/ML can also turn data into upselling opportunities and make recommendations for outfits and combinations.

Implications for Technology Vendors

- There are opportunities along the technology chain—from hardware platforms to software platforms to applications.

- The retail payment landscape is fast-moving, with new innovations such as self-checkout and the ability to accept payment via tapping a smartphone.

- There continue to be opportunities to develop innovative solutions that leverage AI/ML to generate ever-more accurate customer insights.