DIpil Das

In the last 10 years, RetailROI of Retail Orphans Initiative has helped more than 250,000 children in 25 countries. The Retail Orphans Initiative is a charitable foundation under the umbrella of The Giving Back Fund. RetailROI has three primary goals: to raise awareness of the needs of the 400 million orphans around the world; to encourage retailers, manufacturers and vendors to create internal corporate programs supporting the needs of local foster children, foster parents and paths to adoption; and to raise funds that make a real difference. RetailROI is cultivating the culture of giving back across the retail ecosystem.

Below, we present key insights from this year’s event, held on January 11.

The collapse of the middle

Similar to Weinswig’s Hourglass theme, Steve Dennis, author of Remarkable Retail, spoke of the hollowing out of the middle ground of retail due to the lack of differentiation among retailers. From product to website to marketing to promotions, retailers are going to market with the same offering. With new digitally native brands being easy to launch and Amazon spawning private brands nearly daily, consumers have a plethora of options, and boring sameness is not winning.

Coresight Research CEO and Founder Deborah Weinswig articulated her Hourglass theory more than a decade ago, and we continue to see this play out. The Hourglass model points to the bifurcation of demand in the US consumer market: Retailers and brands in the middle lacking meaningful differentiators are losing share to sharper value/price offerings and so must look to provide a personalized connection to consumers.

Dennis emphasized that the choice for retailers is to either compete on value and price or choose “remarkable.” Brands and retailers should find the moments that matter in their customers’ journey and differentiate themselves from the competition: Be authentic and amplify the “wow” of the brand and its store shopping experience. When this is done well, shoppers will amplify the brand by sharing it on social media and offering personal recommendations, thus boosting brand awareness and sales potential.

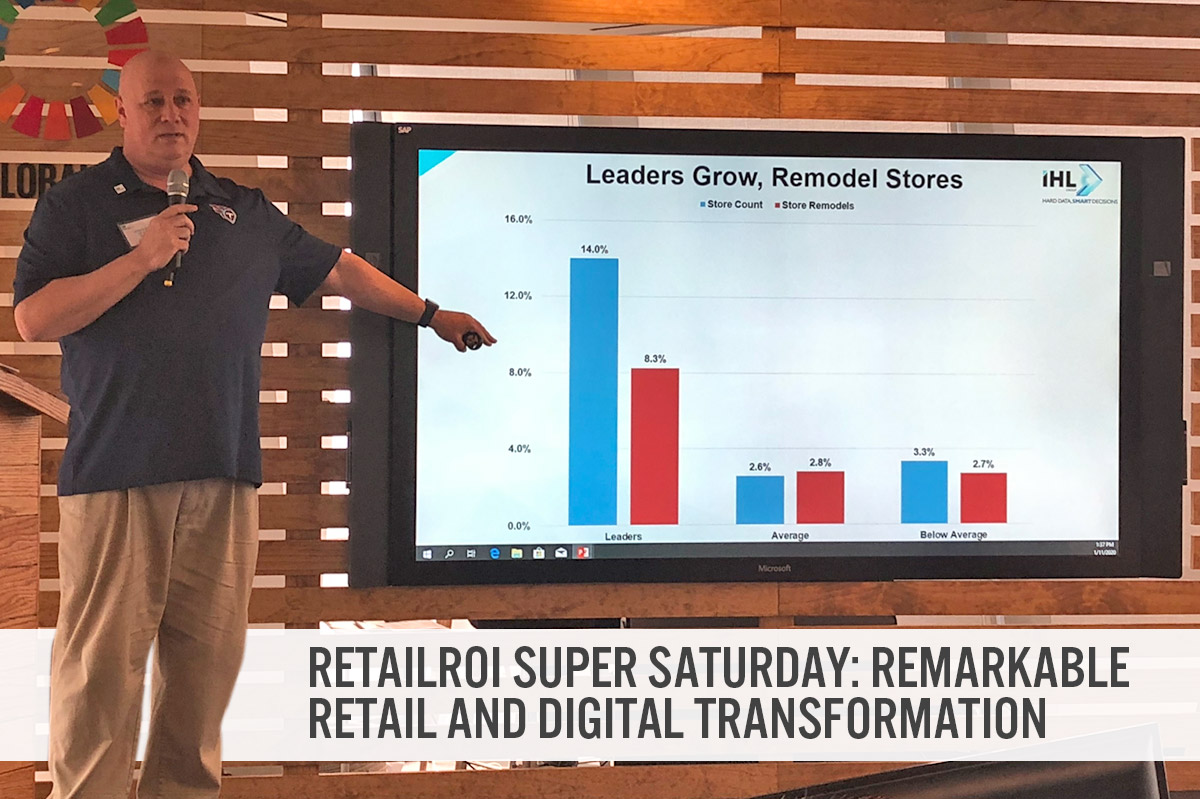

Retail leaders are growing, despite the onslaught of digital commerce, Amazon’s lead and ever-demanding consumers.

Retail leaders have decoupled technology investment with sales growth. Traditionally, spending on technology represented a steady 1.5% of a retailers’ sales: If sales rose by 4%, then tech spending also rose by 4%. However, market leaders have recognized that that is not way to win the technology arms race in retail and so are spending on technology that matters in order to grow at a more rapid rate than the industry average.

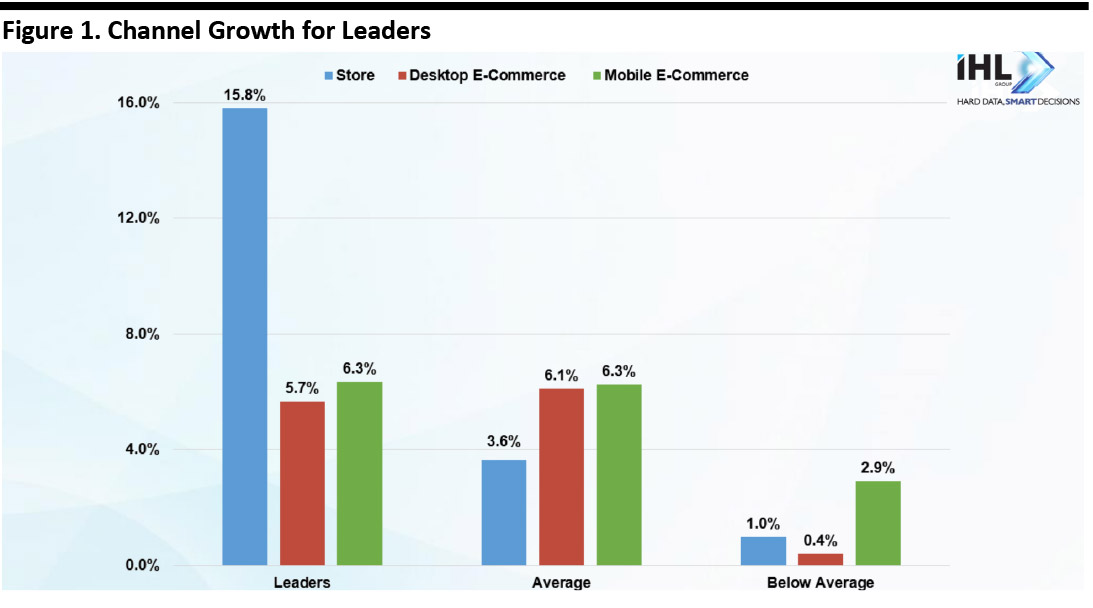

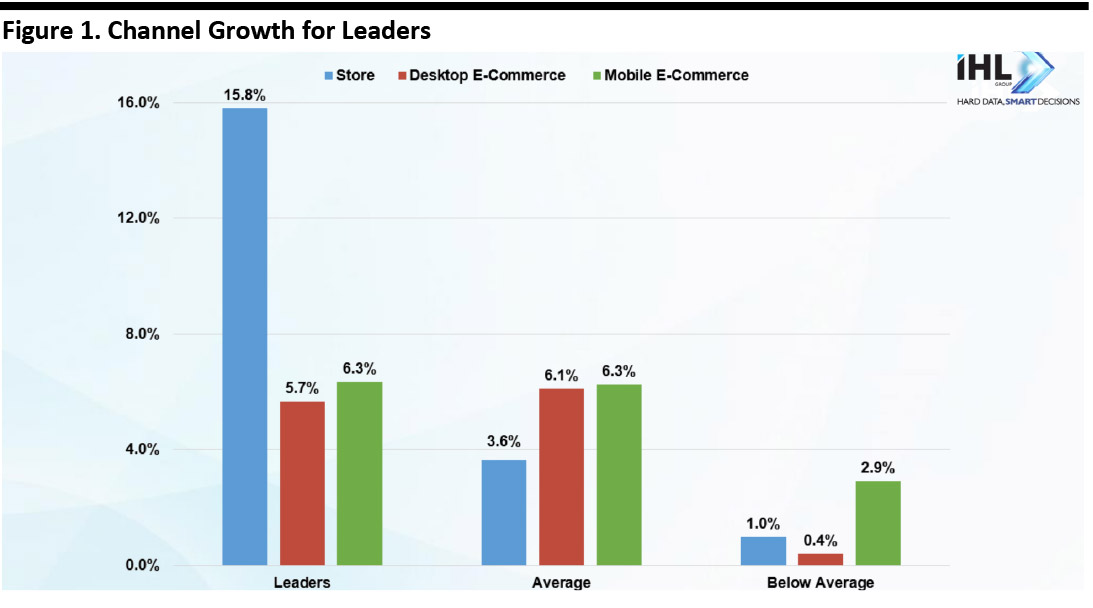

Retail leaders lead on IT spending, which drives channel growth. In October 2019, IHL Group surveyed 300 North American-based retail brands that had annual sales of $1 billion or more, and found that retail leaders that invested in IT enterprise grew by 10.1% versus an average of 4.2%. Concurrently, retail leaders achieved 15.8% growth in their store channel, versus 3.6% for average retailers (see Figure 1).

[caption id="attachment_102250" align="aligncenter" width="700"] Source: IHL Group[/caption]

The number-one in-store technology is proximity or location-based marketing.

Today, 25% of retailers have proximity marketing strategies in place, and a further 34% will implement it within two years. For many retailers, this is therefore a major current focus and a transformational store strategy. Across the retail industry, there are three primary transformational priorities for 2020: personalizing the customer experience inventory visibility, and empowering store associates with mobile devices and apps that enable productivity and efficiency.

Source: IHL Group[/caption]

The number-one in-store technology is proximity or location-based marketing.

Today, 25% of retailers have proximity marketing strategies in place, and a further 34% will implement it within two years. For many retailers, this is therefore a major current focus and a transformational store strategy. Across the retail industry, there are three primary transformational priorities for 2020: personalizing the customer experience inventory visibility, and empowering store associates with mobile devices and apps that enable productivity and efficiency.

Source: IHL Group[/caption]

The number-one in-store technology is proximity or location-based marketing.

Today, 25% of retailers have proximity marketing strategies in place, and a further 34% will implement it within two years. For many retailers, this is therefore a major current focus and a transformational store strategy. Across the retail industry, there are three primary transformational priorities for 2020: personalizing the customer experience inventory visibility, and empowering store associates with mobile devices and apps that enable productivity and efficiency.

Source: IHL Group[/caption]

The number-one in-store technology is proximity or location-based marketing.

Today, 25% of retailers have proximity marketing strategies in place, and a further 34% will implement it within two years. For many retailers, this is therefore a major current focus and a transformational store strategy. Across the retail industry, there are three primary transformational priorities for 2020: personalizing the customer experience inventory visibility, and empowering store associates with mobile devices and apps that enable productivity and efficiency.