What’s the Story?

The increased consumer shift to e-commerce has prompted many retailers to reevaluate their product mix and overall portfolio in the long term, particularly in the wake of the pandemic—driving a wave of M&A activity, especially for DNVBs. In this report, we look at DNVB M&A activity in the past 24 months and evaluate by characteristics, sectors and types to offer brands and retailers important implications.

Why It Matters

Over the past decade, many DNVBs have risen to prominence in the US, such as AdoreMe, Allbirds and Everlane—who stand out by selling products directly to consumers online. In 2020, however, DNVBs reported mixed operating results, as the US economy and the overall retail environment changed drastically due to the pandemic. Some brands such as men’s apparel company Untuckit reported challenges in growing sales, while others such as Allbirds saw a sales surge due to the casualization trend and booming e-commerce.

Currently, we are seeing many retailers and brands rebuild their portfolios by acquiring external DNVBs to stay competitive. Major companies that have recently acquired DNVBs include Edgewell Personal Care, Nestlé, and Unilever. Against this backdrop, we believe that we can provide new insights into the DNVB market and analyze how retailers and brands can best position themselves for future success.

Retailers Look to DNVB M&A for Expansion: Coresight Research Analysis

Key Trends in DNVB M&A Activity in the Past 24 Months

In the wave of DNVB M&A activity over the past 24 months, we have identified several key trends. We believe there are four key reasons retailers are acquiring DNVBs, which we detail below with an example for each.

- Grow categories and expand business reach. In August 2021, Levi’s acquired Beyond Yoga to expand its activewear offerings.

- Grow consumer base, especially younger consumers. In February 2021, Nestlé announced it would acquire SimplyCook, a subscription-based recipe box service popular among younger consumers.

- Move into the DTC business model to become more digitally adept. In January 2021, pet supplier Paws acquired Fetch, an online pet food website.

- Expand into a new market. In December 2019, Safilo, an Italian e-commerce company acquired Blenders Eyewear, aiming to its grow presence in the US.

Among DNVB M&A deals in the past 24 months, retailers prefer expanding their existing business by acquiring companies involved at the same stages in the supply chain process in the same industry, rather than at different stages of the production process or across different industries. By sector, apparel, beauty, CPG and home saw the largest number of DNVB M&A deals in the past 24 months.

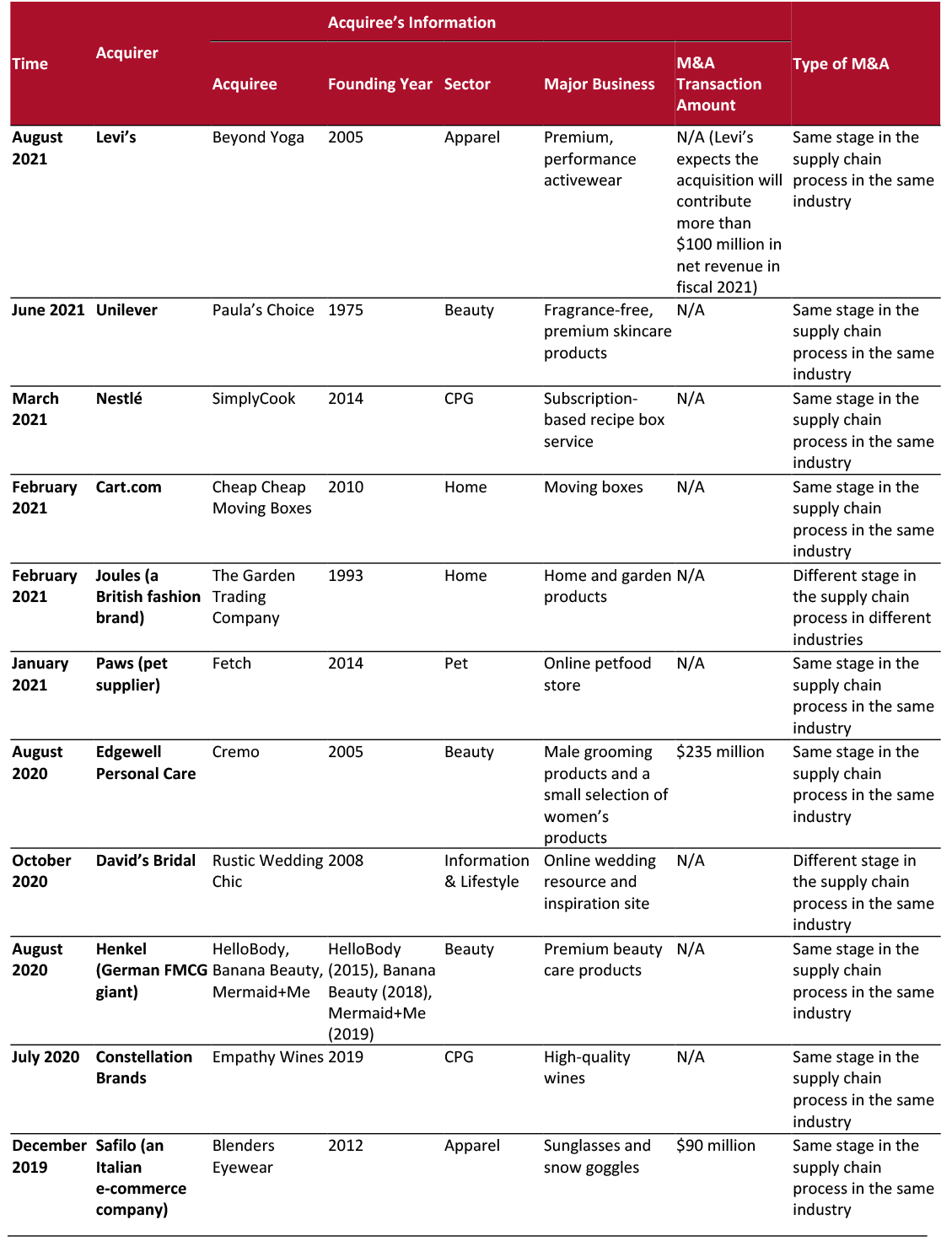

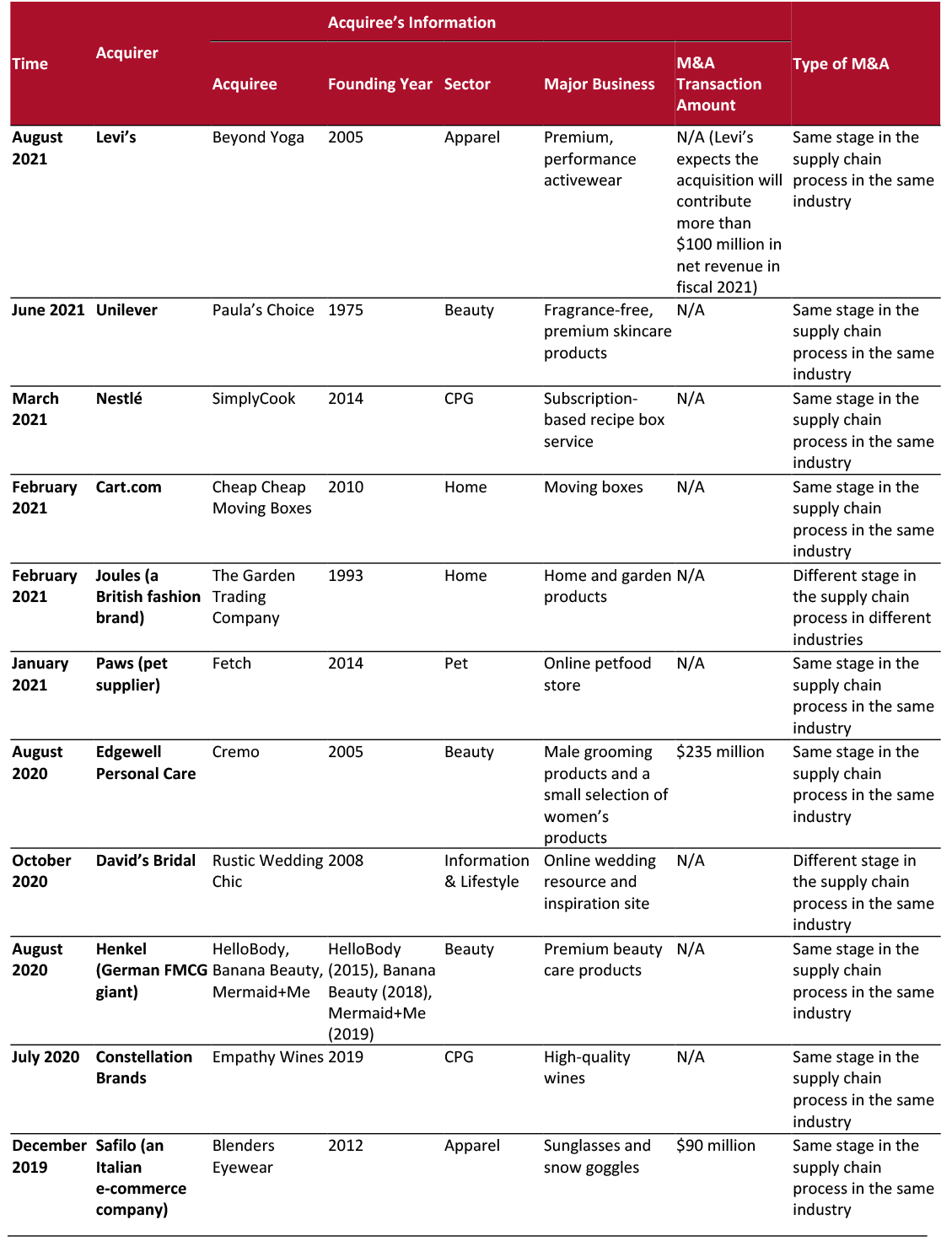

In Figure 1, we present a timeline of selected DNVB M&A activity.

Figure 1. Selected DNVB M&A Activity in the Past 24 Months

[caption id="attachment_135882" align="aligncenter" width="725"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Characteristics of DNVB M&A Targets

We have identified three typical characteristics of DNVB M&A targets, as shown in Figure 2.

Figure 2. Characteristics of DNVB Targets

[wpdatatable id=1431 table_view=regular]

Source: Coresight Research

1. Strong Business Differentiator

Acquired DNVBs typically have strong business differentiators that separate them from key competitors and may to add core competitiveness to the acquirer’s businesses.

- DNVBs that feature exclusive products, styles and collaborations

Example: Beyond Yoga

Rationale: Beyond Yoga offers premium, performance activewear in high-quality soft fabrics and apparel items with a wide range of sizes and strong positioning on inclusiveness and body positivity. The brand’s sales more than doubled over the past three years and it expects to reach more than $100 million in sales in fiscal 2022. It has also launched collaborations with other brands such as Kate Spade, celebrities and influencers such as American dancer Amanda Kloots, and lifestyle inspiration websites such as How You Glow.

- DNVBs that feature powerful methods of communicating and engaging with consumers

Example: Paula’s Choice

Rationale: Unlike other digitally native skincare brands, Paula’s Choice offers powerful content to communicate with consumers about its science-backed skincare products. The brand includes an extensive “Ingredient Dictionary” on its website, which breaks down research behind nearly 4,000 ingredients, and “Expert Advice,” a curated online hub of skincare and ingredient knowledge.

2. Potential To Achieve Robust Revenue Streams

Acquired DNVBs need to have potential to achieve robust revenues streams. Among our compiled DNVB M&A targets, there are various kinds of business models that we believe are likely to achieve robust revenues streams in the next few years.

- DNVBs with a subscription-based business model

Examples: SimplyCook

Rationale: We see the subscription-based business model as an important model in the next few years. We believe consumers will retain a portion of the pandemic-driven shift to online spending and recurring sales models can lead to higher revenues and stronger customer relationships. We expect that the

US e-commerce subscription market will grow at a high-teens rate in 2021 and believe the momentum also applies globally. SimplyCook, purchased by Nestlé, currently offers subscription boxes that cost £9.99 ($13.71) each and contain four meal kits. We anticipate that subscription-based DNVBs will continue to attract M&A activity going forward.

- DNVBs using an environmentally conscious selling model

Example: HelloBody, Banana Beauty, Mermaid+Me

Rationale: The Covid-19 pandemic has contributed significantly to the recent shift in consumer preferences surrounding the importance of sustainability, making it increasingly necessary for retailers and brands to go green. In a Coresight Research

US Consumer Tracker survey on August 26, 2020, 29% of respondents stated that the crisis has made sustainability more of a factor to consider when shopping, compared to just 16% that stated it had become less of a concern. In the middle of this trend, sustainable DNVBs look appealing for acquiring companies—and brands such as HelloBody (which offers cosmetic s based on natural ingredients), Banana Beauty (offers vegan beauty products), and Mermaid+Me (offers vegan hair care products) are likely beneficiaries.

3. Resilient Supply Chains

Acquired DNVBs frequently have resilient supply chains that could help them survive disruptions.

- Agile Inventory Management in Warehouses

Example: Blenders Eyewear

Rationale: Blenders Eyewear equips each product with specific barcodes and places them on well-designed mobile carts in its warehouses for increased efficiency and order accuracy. This also helps streamline operations for Blenders’ Blendo Boxes—special sets of sunglasses in neoprene pouches—according to its third-party logistics supplier Saddle Creek.

In our

Reshaping Supply Chains for the 2020s e-book,

we identified seven major supply chain components that are integral to a retailer or a brand’s business model—and which can represent key sources of competitive advantage and differentiation. Companies that get their products to market faster and more efficiently than their competitors are better able to make a positive impact in the market. Component processes’ execution is supported by various technologies throughout the supply chain—from product design to end-consumer.

Source: Company reports/Coresight Research[/caption]

Characteristics of DNVB M&A Targets

We have identified three typical characteristics of DNVB M&A targets, as shown in Figure 2.

Source: Company reports/Coresight Research[/caption]

Characteristics of DNVB M&A Targets

We have identified three typical characteristics of DNVB M&A targets, as shown in Figure 2.