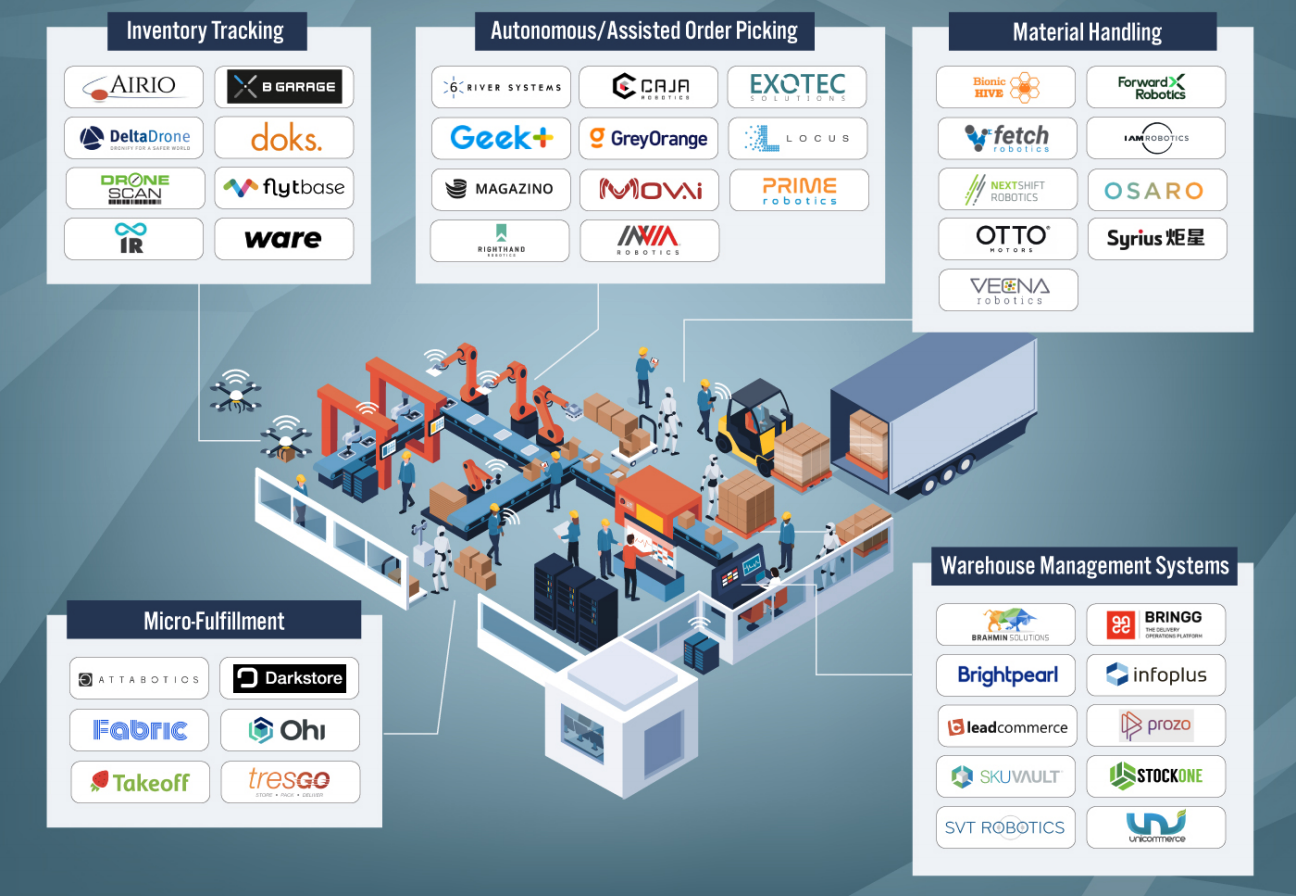

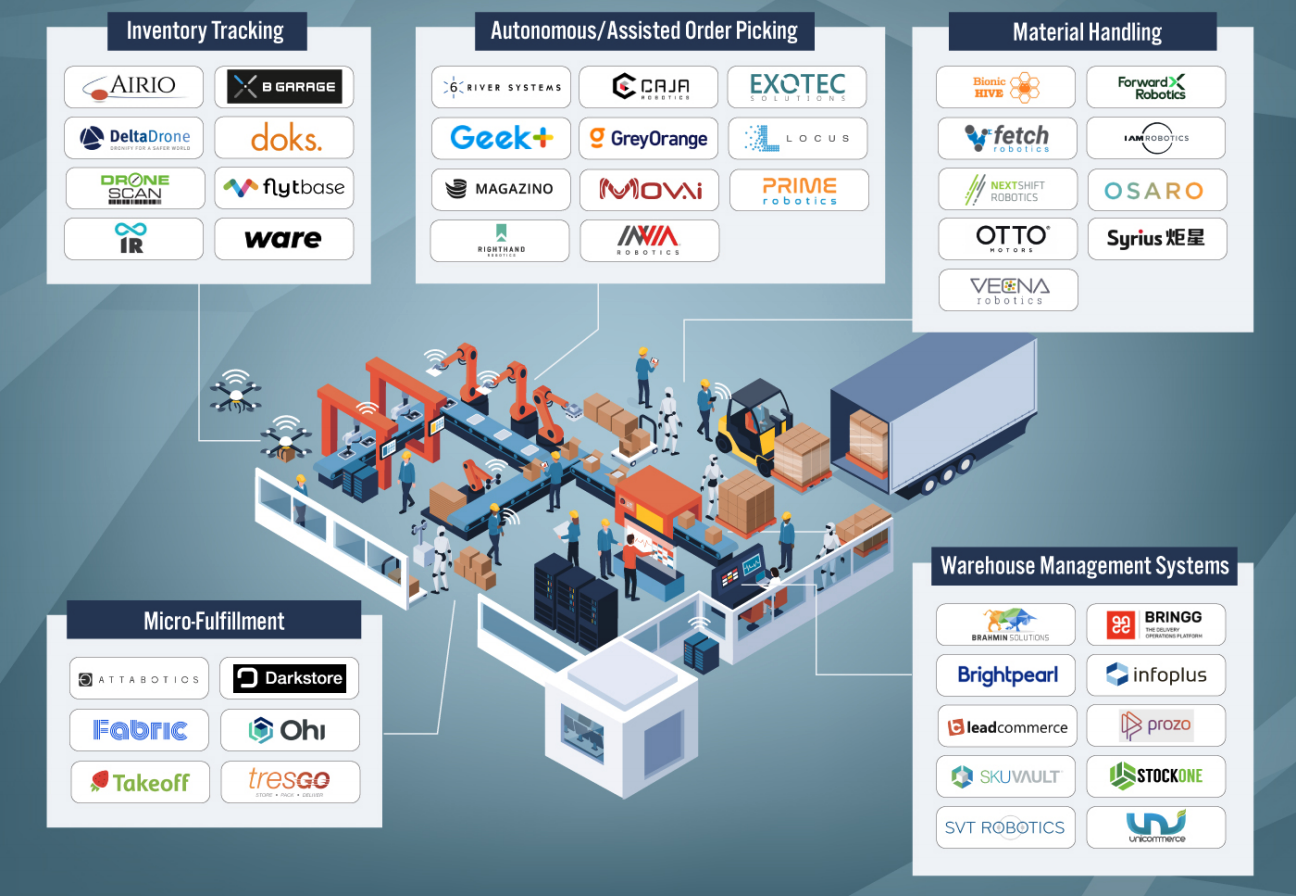

Retail-Tech Landscape: Warehouse Automation

Growth in e-commerce has been accelerated by the Covid-19 pandemic and is driving demand for warehousing space, fulfillment efficiency and storage capacity. For 2020 overall, we estimate that US e-commerce sales reached $752 billion—growth of 35% from 2019—and accounted for 19% of total retail sales. We believe that this sudden spike in online orders has implications for the warehousing sector, driving the need for increased automation:

- Order Fulfillment—Automating order picking and packing and introducing collaborative robots (also known as “cobots”) can help retailers meet increased consumer demand for fast delivery and thus retain customers.

- Inventory Management—Warehouse inventory tracking has been a long-standing problem in the retail sector, partially due to redundant and outdated processes that depend on manual labor. We believe that automating inventory management has become paramount for retailers in this new era of e-commerce. Automating inventory tracking can increase the overall accuracy and help retailers standardize the process.

This

Retail-Tech Landscape comprises selected startups globally that can help retailers automate their warehouse operations. The funding raised by startups listed in this landscape ranges from seed funded to just over $439 million. All companies, except two, are under 10 years old.

In this landscape, we have identified 44 startups across the following categories:

- Autonomous/assisted order picking

- Inventory tracking

- Material handling

- Micro-fulfillment

- Warehouse management systems (WMS)

Key Trends in the Warehouse Automation Sector

Below, we highlight two key industry trends in the warehouse automation sector.

1. Retailers are increasingly adopting warehouse robots

In June 2020, specialty retailer Gap Inc. announced that it purchased 73 SORT robots from third-party logistics company Kindred to install in its US distribution centers, taking its total fleet of robots to 106 units. Between January 1 and April 30, 2020, Gap used SORT robotics systems to sort more than 13 million units of merchandise. During that time frame, the systems facilitated an average sorting speed of 335 units per hour and maintained uptime at 99.8%, according to the company.

In June 2019, during the Machine Learning, Automation, Robotics and Space (MARS) conference, Amazon unveiled its new Pegasus sorting system. Amazon claims that Pegasus can reduce misplaced goods by 50% and minimize workplace injuries. Amazon also uses robots from Kiva, which it acquired in 2012, to support picking and packing.

2. Piece-picking robots are becoming more prevalent as e-commerce surges

The global market for piece-picking (process of picking individual items) robots was worth $95.3 million in 2019 and will grow at a CAGR of 62.5% to reach $1.7 billion in 2025, according to research company Research and Markets. The market will primarily be driven by the surge in e-commerce and consumer expectations around faster delivery. Retailers are increasingly turning to automation technologies to increase the speed of order fulfillment. This has led to the growth of micro-fulfillment centers, which focus on automating the order picking and packing process.

Retail-Tech Landscape: Warehouse Automation—Infographic

Retail-Tech Landscape: Warehouse Automation, by Category

Autonomous/Assisted Order Picking: Autonomous robots assisting warehouse staff in picking online orders

[wpdatatable id=694]

Inventory Tracking: Autonomous robots tracking warehouse inventory through sensors and cameras

[wpdatatable id=695]

Material Handling: Autonomous and semi-autonomous mobile robots and vehicles helping in movement of goods inside the warehouse

[wpdatatable id=696]

Micro-Fulfillment: Micro-fulfillment solutions for e-commerce retailers

[wpdatatable id=697]

Warehouse Management Systems: Software and services that help retailers streamline warehouse operations

[wpdatatable id=698]