albert Chan

Retail-Tech Landscape: Sustainability

Coresight Research has identified sustainability as one of the key trends to watch in retail, with the Covid-19 pandemic bringing a renewed focus to environmental concerns. Sustainability is now high on the list of demands among many consumers, employees and investors—moving it beyond a matter to be referenced in corporate social responsibility (CSR) policies. Coresight Research’s July 2021 survey found that around three in 10 US consumers think the Covid-19 crisis has made environmental sustainability more of a factor for them when shopping—more than double the proportion of respondents that said sustainability is now less of a factor for them. Furthermore, amid the pandemic-induced shift to e-commerce, many retailers have had to rethink their operations and supply chains, bringing environmental sustainability issues into the spotlight.

Coresight Research’s EnCORE framework helps brands and retailers frame their approach to sustainability. The framework includes the five components shown in Figure 1.

Figure 1. The EnCORE Framework [caption id="attachment_132363" align="aligncenter" width="550"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

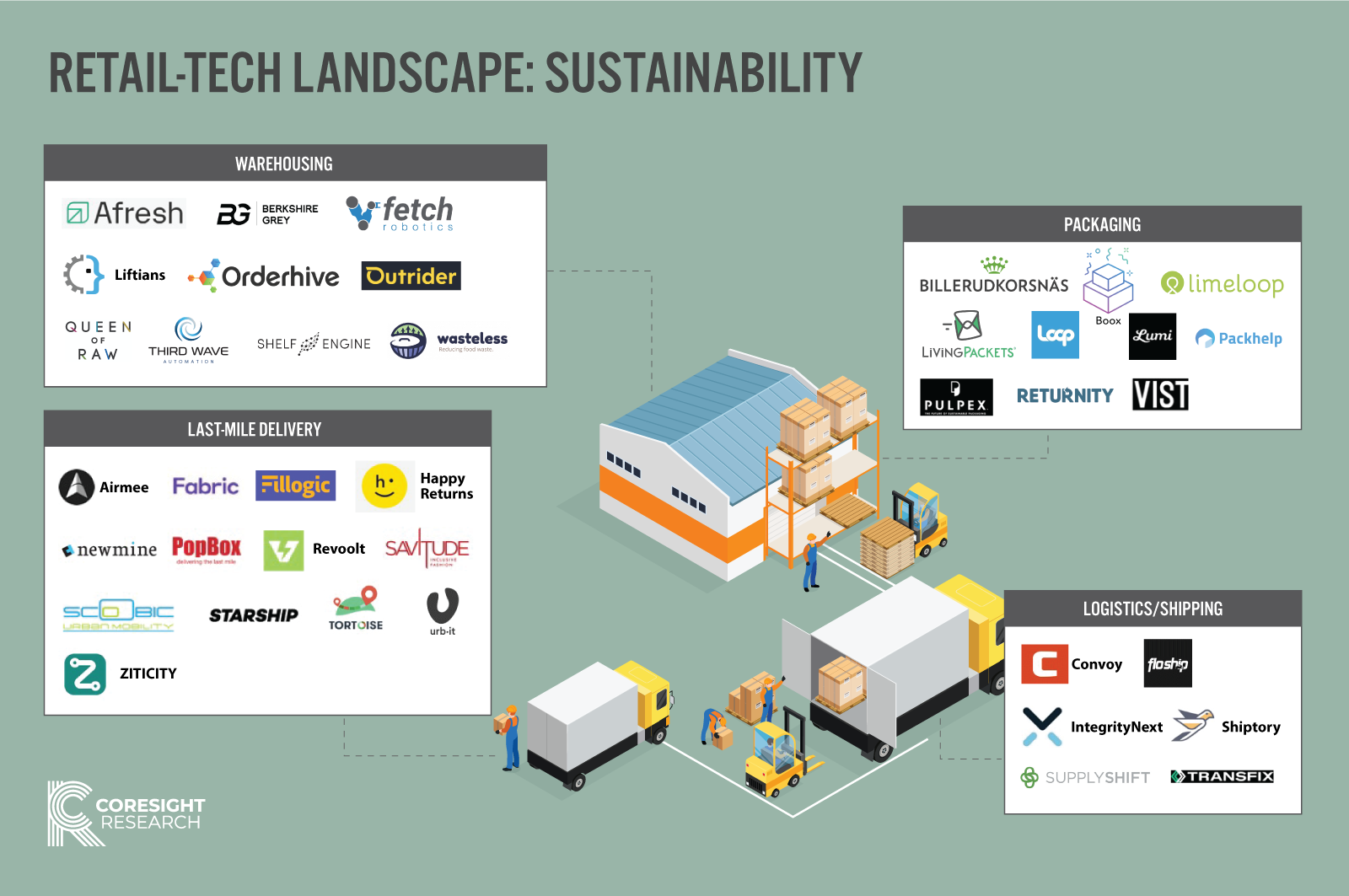

This Retail-Tech Landscape covers selected startups globally whose technology solutions support brands and retailers in developing sustainable business practices. We have identified almost 40 startups across the following categories:

- Last-mile delivery

- Logistics/shipping

- Packaging

- Warehousing

Key Trends in Retail Sustainability

Below, we highlight two key industry trends around sustainability.

Retailers are adopting refillable and reusable packaging

We are increasingly seeing brands and retailers offer packaging that is designed to have a lower environmental impact than conventional single-use and non-recyclable options. In a bid to improve its brand sustainability, beauty retailer Ulta Beauty announced a commitment in March 2021 to reduce its beauty waste, in partnership with global reuse platform Loop.

According to Loop CEO and Founder Tom Szaky, “Consumers are increasingly asking for more environmentally responsible options in this category and this collaboration provides them with a solution that is simple and convenient.” Loop’s solution enables shoppers to access reusable packaging, secured against a deposit that is fully refundable on return of the empty container. Consumers can only use the scheme by ordering collection from their homes online but the in-store option is set to be launched by the end of 2021, creating a network of drop-off locations. Expanding the scheme across more retailers will also lessen the transportation load and reduce carbon emissions.

Local delivery and logistics firms are turning to electric vehicles

Electric vehicles are emerging as a popular strategy for local delivery and logistics firms to meet their environmental sustainability goals. We are seeing firms build out electric distribution networks for short-distance delivery trips. For instance, global logistics company FM Logistic is working with Indian agri-commerce company WayCool Foods to implement hyper-local delivery from local kirana stores and supermarkets to shoppers via electric vehicles.

Coresight Research sees opportunity for brands and retailers to partner with third-party solution providers to tackle specific issues related to sustainability, with many requiring minimal set-up and infrastructure investment.

Retail-Tech Landscape: Sustainability—Infographic

Retail-Tech Landscape: Sustainability, by Category

Last-mile delivery: Ensuring responsibility in retail supply chains

[wpdatatable id=1239]Logistics/shipping: Optimizing efficiency to solve fulfillment pain points

[wpdatatable id=1240]Packaging: Working toward ciruclar models and environmental enagement

[wpdatatable id=1241]Warehousing: Using tech-enhanced solutions to mimize waste and improve automation

[wpdatatable id=1242]