Retail-Tech Landscape: Returns Management

The continuing acceleration in e-commerce seen across retail undoubtedly translates to an increase in returns. We expect e-commerce sales to account for 20.1% of overall US retail sales in 2022, up from just over 13% in 2021. Given the stickiness in pandemic-driven online shopping habits and the logistical demands of handling consumers’ unwanted purchases, we expect managing returns to become a more pressing challenge than ever for brands and retailers.

This

Retail-Tech Landscape covers selected startups globally that are helping brands and retailers solving the returns problem. We have identified 38 companies across the following categories:

- Returns reduction

- Returns experience

- Physical drop-off

- Overseas returns

- Post-return management

Returns Management Trends in Retail

Below, we highlight two key industry trends in retail returns.

1. While Returns Are Inevitable, Retailers Can Reduce Volumes

The pandemic has changed the way shoppers make purchases—with online purchases as a percentage of overall retail sales set to rise by 7.0 percentage points in 2022, we estimate. Brands and retailers should expect an increase in returns as an inevitable consequence of this shift.

Coresight Research’s March 2021 survey found that over four in 10 (42.4%) US consumers had returned unwanted products in the prior 12 months. Clothing ranked as the most returned product category (46.5%) at almost double the rate of electronics (25.9%), which came in second place.

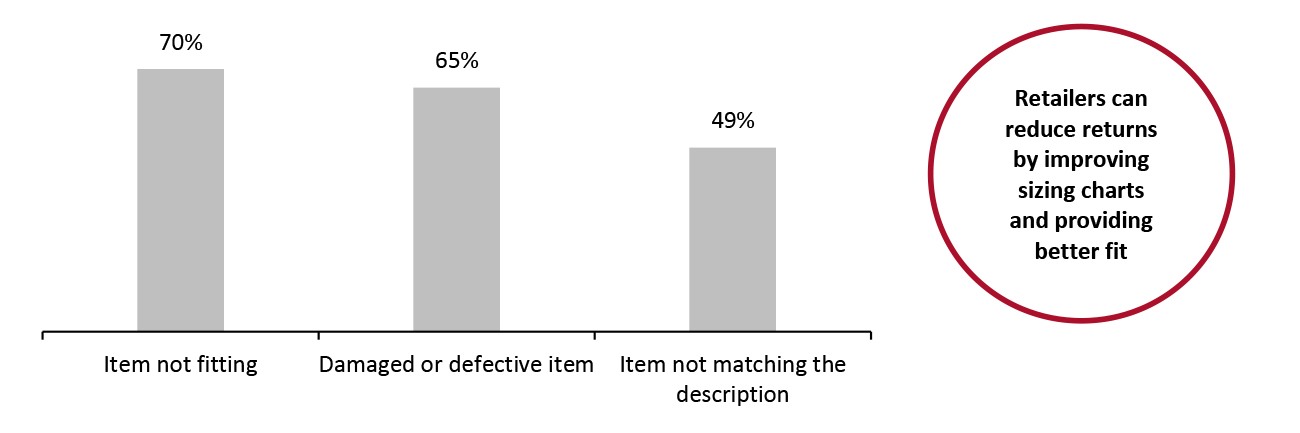

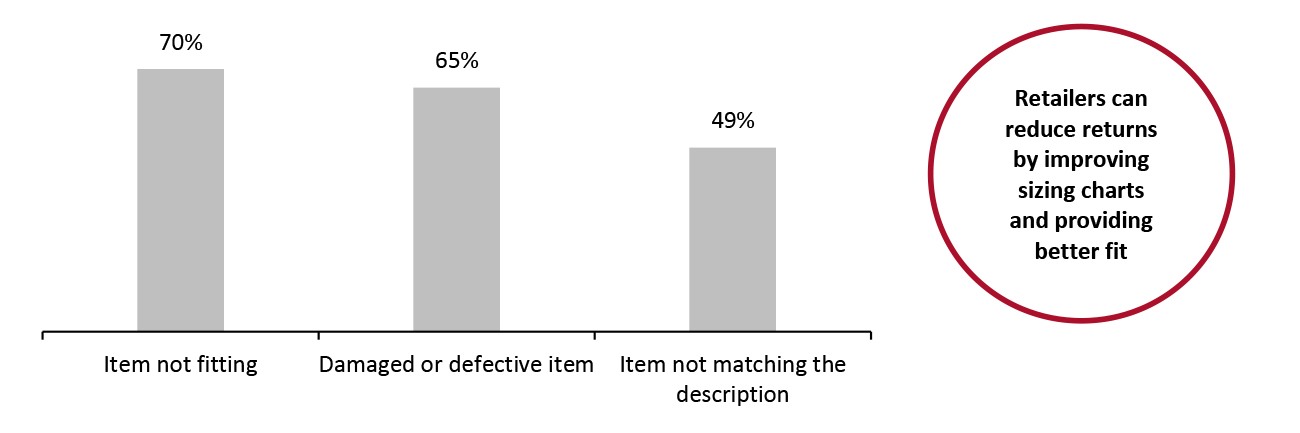

A separate survey of US shoppers conducted in June 2021 by software company Power Reviews reveals fit issues as the topmost reason for returns—aligning with apparel as the most returned category. This was followed by item damage or defects, and a mismatch in the item and its description, as shown in Figure 1. We believe that technology companies providing size and fit recommendations will be invaluable in helping brands and retailers to reduce instances of such returns. Furthermore, improving product descriptions online along with technology-augmented quality checks can help retailers ensure that defective items are removed from inventory and product descriptions better align with physical products.

Figure 1. Top Three Reasons for Returning Online Purchases (% of Respondents)

[caption id="attachment_148256" align="aligncenter" width="700"]

Base: 7,688 US shoppers surveyed in June 2021

Base: 7,688 US shoppers surveyed in June 2021

Source: PowerReviews [/caption]

2. Costly Returns Become That Bit Costlier

The National Retail Federation (NRF) estimates that retail returns surpassed $761 billion in 2021, with return rates at an estimated 16% versus 10.6% in 2020. The NRF also revealed that the average retailer incurs $166 million in merchandise returns for every $1 billion in retail sales. The onset of the pandemic has driven increased returns, with store closures preventing shoppers from physically touching, feeling or trying products before they buy them online.

Growing returns add pressure to retailers’ bottom lines, particularly when coupled with labor market constrictions and an increase in shipping costs. In September 2021, for instance, domestic carrier FedEx announced an average increase of 5.9% in shipping rates across most of its US services, starting January 2022. UPS followed suit in November 2021, announcing an average rate increase of 5.9% across its services in 2022.

Retail-Tech Landscape: Returns Management—Infographic

Retail-Tech Landscape: Returns Management, by Category

Returns Reduction: Companies offering solutions to brands and retailers to decrease returns rates

[wpdatatable id=2001 table_view=regular]

Returns Experience: Companies assisting brands and retailers to deliver optimal experiences for shoppers making returns

[wpdatatable id=2002 table_view=regular]

Physical Drop-off: Companies enabling customers to make returns via physical drop-off stations

[wpdatatable id=2003 table_view=regular]

Overseas Returns: Companies providing software suites/online portals to brands and retailers for managing their overseas returns

[wpdatatable id=2004 table_view=regular]

Post-Return Management: Companies helping to simplify the overall returns process for consumers, brands and retailers alike.

[wpdatatable id=2005 table_view=regular]

Base: 7,688 US shoppers surveyed in June 2021

Base: 7,688 US shoppers surveyed in June 2021