Retail-Tech Landscape: Retailers' Technology Shopping List for Holiday 2021

The outlook for US retail in the 2021 holiday season looks promising despite ongoing economic and health challenges. Coresight Research estimates that retail sales during the 2020 season were up 9.1% year over year, despite the challenges from the pandemic. With our

US Consumer Tracker survey findings indicating that consumers are becoming increasingly comfortable returning to normal activities, we expect a greater degree of in-store shopping this year. Look out for our early holiday estimates and full-season coverage in upcoming reports.

The Covid-19 pandemic accelerated the shift to e-commerce, and consumers have changed how they discover, browse and buy products—and this is likely to have lasting impacts on expectations of the shopping experience moving into holiday 2021. Last year, we saw the holiday shopping season begin early in 2020 as consumers using online channels sought to avoid delivery delays and potential in-store crowds. We expect the season to be extended again this year, particularly because many consumers are still reluctant to visit stores and malls. Brands and retailers should plan early again to capture shoppers and maximize holiday sales. By embracing tech-powered initiatives and solutions, brands and retailers can offer a convenient, frictionless and omnichannel experience for consumers.

This

Retail-Tech Landscape comprises selected startups globally that can help retailers improve their digital e-commerce offerings and the overall customer experience in preparation for holiday 2021. We have identified five key technology segments that will be a core focus for driving profitability this holiday season, across which we present 17 selected startups:

- Product assortment and merchandising

- E-commerce fulfillment

- Digital commerce management

- Product discovery and personalization

- Returns and cost reduction

Five Key Trends in Retail Technology for Holiday 2021

1. AI and predictive analytics will drive increased sales and revenue

Consumer needs and expectations are ever-changing and ever-rising, and retailers that can predict and adapt to these changes will be best positioned heading into the holiday season. With access to huge volumes of consumer data, retailers should use predictive analytics to analyze shopper behavior and understand their expectations and preferences.

Brands and retailers should also leverage the power of artificial intelligence (AI) in demand forecasting and informing inventory decisions and price points ahead of the holiday season, as well as in inventory management and customer engagement during the season. AI enables retailers to offer personalized online product pages and recommendations to shoppers pre-purchase based on their clicks and then send further personalized messaging based on abandoned shopping carts: A March 2021 study by Barilliance, an e-commerce personalization platform, states that one in five shoppers who opened and clicked on a link within a cart abandonment email made a purchase.

Another use of AI that can differentiate retailers and boost sales this holiday season is

visual search. Retailers including British fashion retailer ASOS and furniture retailer IKEA have rolled out visual product search functionality, which uses AI to suggest similar products from a retailer’s own range that are similar to images of items that shoppers provide.

- Click here to read more Coresight Research coverage of AI in retail.

2. Technology-backed last-mile solutions enable retailers to meet delivery expectations

Consumers increasingly expect faster deliveries and, at the same time, are looking to be kept informed of the real-time status of their shipments. This will be particularly true in the holiday season as shoppers expect on-time delivery of their gift orders. During the 2020 holiday shopping season, Salesforce estimated that about 700 million gift orders would likely face potential shipping delays due to orders exceeding shipping capacities by 5%.

There are a several technologies that retailers can adopt to improve the efficiency and visibility of the last mile:

- RFID (radio-frequency identification) tags—to track shipments in real time

- IoT (Internet of Things)-enabled sensors—to monitor certain items’ temperature and humidity to prevent damage in transit

- AI—to plan optimal delivery routes that ensure shipments arrive at their final destination on time and undamaged

Other technology-supported e-commerce fulfillment options include BOPIS (buy online, pick up in store) and curbside pickup—both of which have seen increased adoption by retailers amid the pandemic. Through the holiday season, these services will be essential for retailers to reduce pressure on delivery capacity while fulfilling high volumes of digital orders and accommodate consumers reluctant to enter physical stores.

- For more on how US retailers can use technology to make the last mile a competitive advantage, read our separate report.

3. The online channel will continue to account for a high share of sales; SEO optimization will be critical to success

Brands and retailers with an online presence should integrate search engine optimization (SEO) capabilities into their strategy. SEO integration enables their product pages to get crawled, rendered and indexed, thereby driving organic traffic to these pages as consumers search for desired products when holiday shopping. According to a multicountry study by marketing firm Wolfgang Digital, around 35% of online retail sales are generated from organic search.

Retailers should also look at personalizing their homepage and navigation based on whether consumers navigate through google search or in response to a personalized e-mail, thereby tailoring their offerings and increasing conversion.

4. Hyper-personalization will be important in meeting customer expectations

Despite having a wealth of data about consumers, it can be difficult for retailers to predict what they will buy next, especially over the holiday season when many consumers purchase gifts for others who have entirely different preferences and interests. Capturing consumer intent in each purchasing journey is therefore critical, and retailers should equip their websites to adapt to real-time buying behavior. Retailers need to leverage AI and real-time data to achieve hyper-personalization during the upcoming holiday shopping season—delivering more relevant content, recommending the right products and discounts for consumers, and upselling and cross-selling opportunities.

- US-based online retailer Stitch Fix uses AI and personal stylists to offer clients products that match their individual preferences. In the company’s subscription service, customers answer a series of questions about their fashion choices, based on which Stitch Fix recommends and ships five fashion items to them. Customers can keep what they like and return the rest. Stitch Fix improves its recommendations by combining past consumer data (including returns) with real-time data (such as consumers updating their preferences).

- Starbucks uses data from its loyalty program to understand each customer and send personalized emails and app notifications with deals and updates relevant to them.

5. Returns will be a key consideration; retailers can better manage returns by adopting an omnichannel approach

Returns are an ongoing retail challenge, and with the spike in e-commerce in 2020, managing reverse logistics is putting increasing pressure on brands and retailers: Coresight Research survey findings from March 2021 reveal that 42.4% of US consumers returned unwanted products in the prior 12 months. According to the NRF (National Retail Federation), the US returns rate for online purchases was 18.1% in 2020—much higher than the overall retail industry rate of 10.6% (totaling $428 billion). In addition, returns equated to a high proportion of total US retail sales during the holidays, at 13.3%, according to the NRF.

To minimize the impact of returns—both on the customer experience and a retailer’s logistics processes—retailers can work with third-party logistics solutions and returns portals to offer home-pickup options, as well as providing alternative contact points for returns, such as in-store and self-service options, micro-fulfillment centers and designated drop-off points to increase convenience for customers and reduce shipping costs.

- After the 2020 holiday shopping season, Amazon enabled the return of its packages at Kohl’s, Whole Foods and UPS stores to cut down shipping costs and allowing its shoppers to get refunds more quickly.

- Nordstrom has dedicated Nordstrom Local stores that do not house any inventory but offer services such as alterations and handle online returns.

- Third-party returns platforms such as Narvar are increasingly joining hands with brands to accept returns at pop-up kiosks in malls.

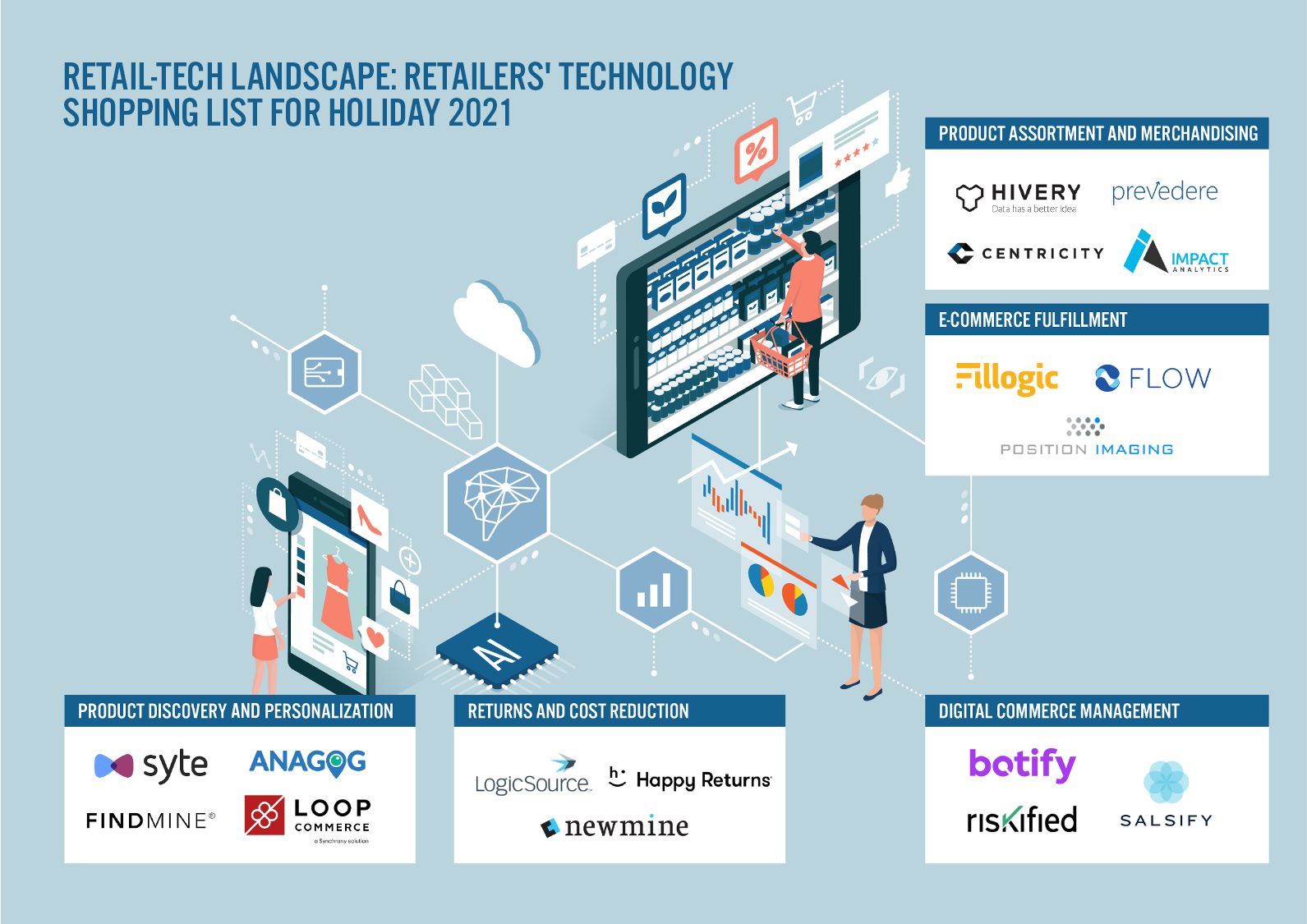

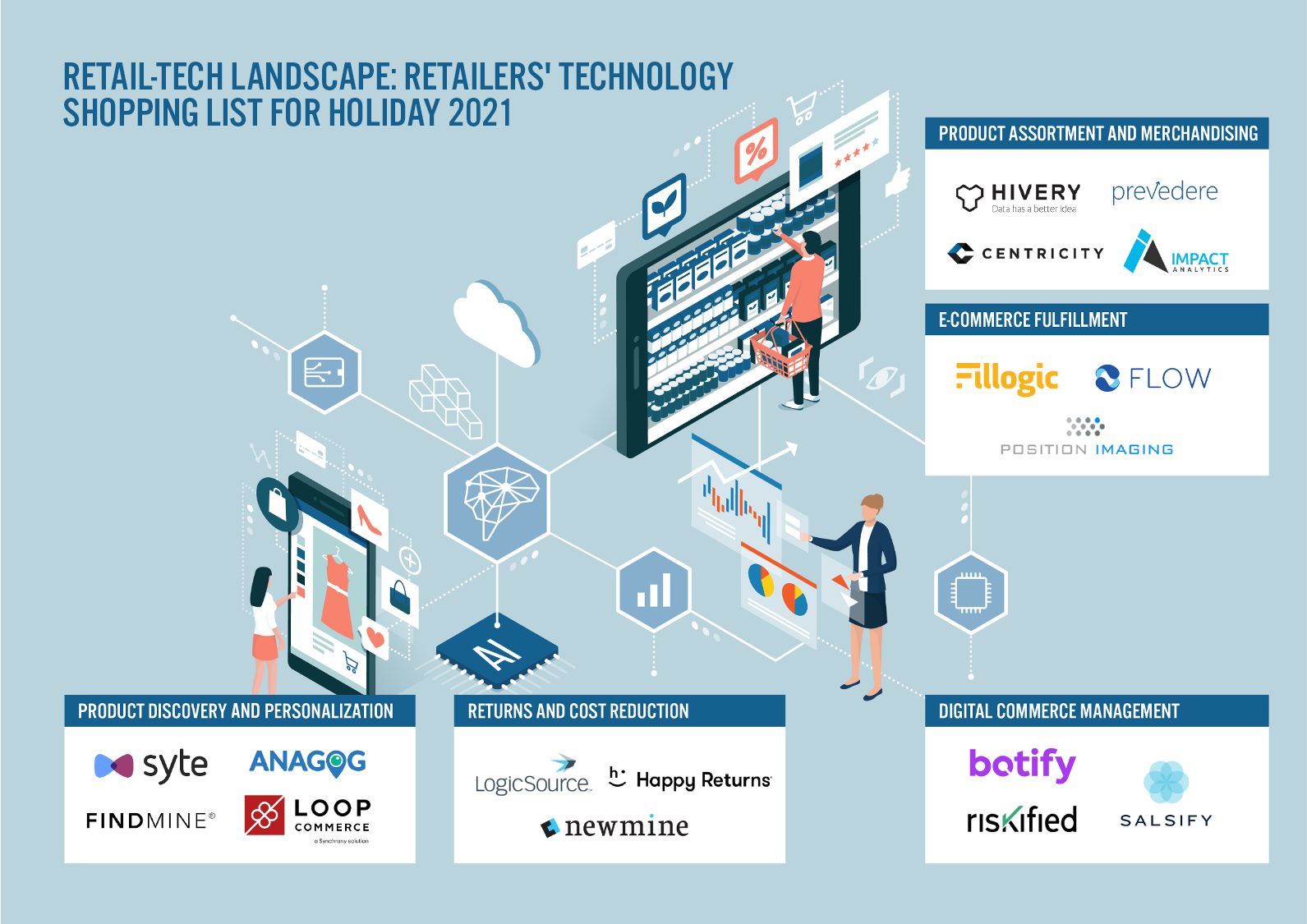

Retail-Tech Landscape: Retailers' Technology Shopping List for Holiday 2021—Infographic

Retail-Tech Landscape: Retailers' Technology Shopping List for Holiday 2021, by Category

Product Assortment and Merchandising: Companies enabling retailers to leverage AI and predictive analytics for business forecasting

[wpdatatable id=1142 table_view=regular]

E-Commerce Fulfillment: Companies offering technology-based solutions for e-commerce fulfillment

[wpdatatable id=1143 table_view=regular]

Digital Commerce Management: Companies that help retailers build a robust online presence and offer seamless online user experiences

[wpdatatable id=1144 table_view=regular]

Product Discovery & Personalization: Software providers helping retailers offer a personalized shopping experience

[wpdatatable id=1145 table_view=regular]

Returns and Cost Reduction: Companies that offer comprehensive returns solutions and cost-reduction opportunities

[wpdatatable id=1146 table_view=regular]