albert Chan

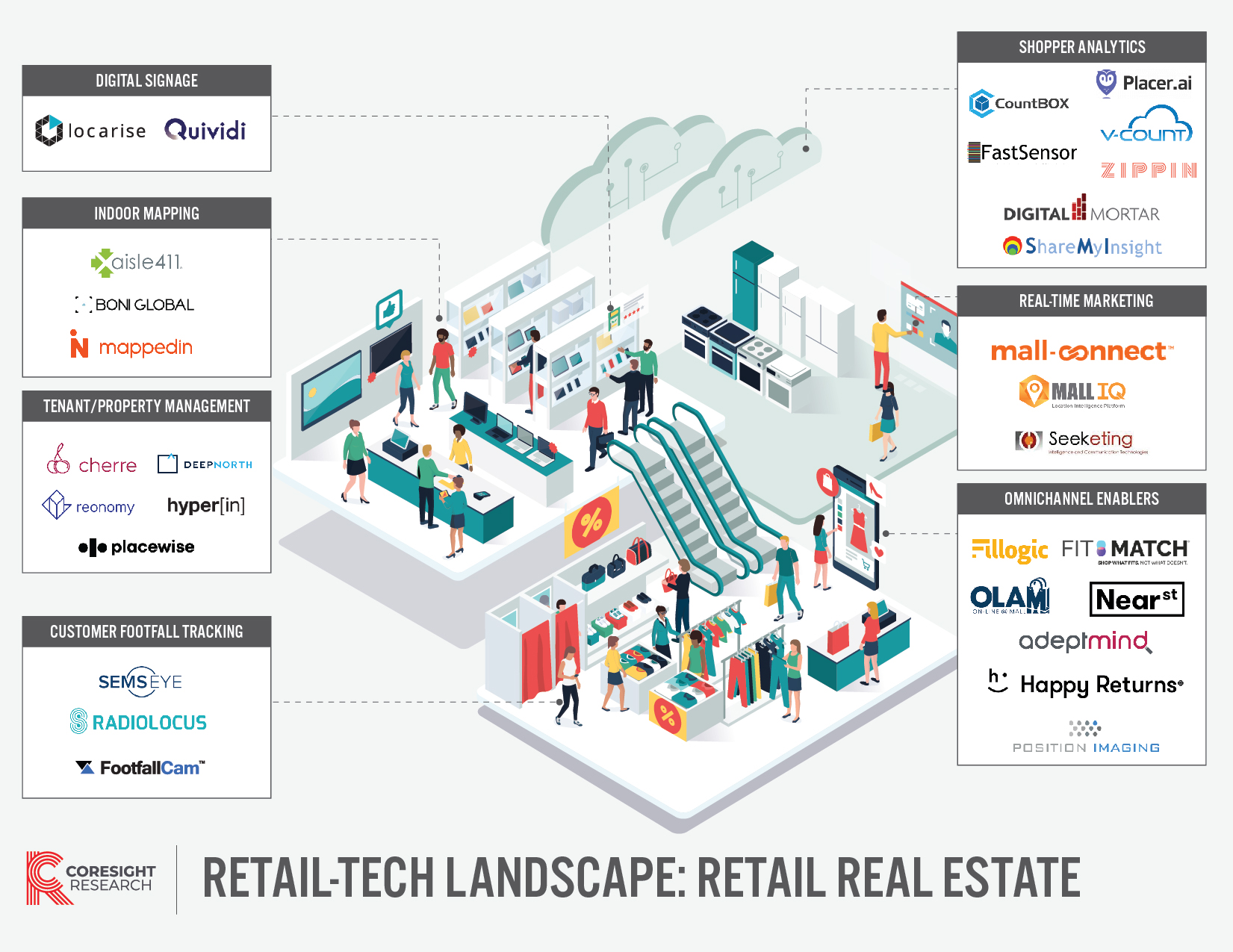

Retail-Tech Landscape: Retail Real Estate

The impact of the coronavirus pandemic on retail is evident—there has been a shift in consumer behavior, and retailers are under unprecedented pressure to stay relevant while addressing changing shopper demand. Following temporary store closures, retailers still face challenges in driving traffic to their brick-and-mortar stores as consumers continue to avoid public places due to safety concerns. Shopping centers and malls are the most-avoided public places, with over 58% of respondents currently avoiding them, according to the latest Coresight Research survey of US consumers conducted on December 8.

However, not all sectors of retail have been hit equally, and mall operators must focus on diversifying their tenant mix to cope up with the impacts of the pandemic and the inability of some tenants to pay rent. As we discuss in our separate report on America’s changing shopping centers, malls must look to add tenants in the grocery, health-care and CBD sectors, which are among those that have fared better in the current environment: Coresight Research data suggest that store closures in the grocery sector have accounted for 6.9% of total store closures this year as of December 2, versus 38.7% of closures in the apparel, footwear and accessories sector.

In addition to tenant diversification, mall owners must leverage advanced technologies to understand footfall and improve the overall experience of shoppers. By enhancing omnichannel offerings, mall owners can help their tenants reach a wider audience.

This Retail-Tech Landscape comprises selected startups globally that we believe have the potential to help mall operators stay relevant amid the Covid-19 crisis and reach their customers in a more efficient way. The funding raised by startups listed in this landscape ranges from seed funding to just under $130 million. All companies, except four, are under 10 years old.

In this landscape, we identify 30 startups across the following categories:

- Shopper analytics

- Omnichannel enablers

- Digital signage

- Customer footfall tracking

- Indoor mapping

- Real-time marketing

- Tenant/property management

Key Trends in Retail Real Estate Startup Ecosystem

Below, we highlight two key industry trends in the retail real estate startup ecosystem.

1. Technology startups are focusing on mallsWe have observed an increasing number of startups focus on retail real estate to forge new partnerships and help mall operators cope with the pressures caused by the Covid-19 pandemic.

- Returns solution provider Happy Returns partnered with Simon Property Group and is live at 52 Simon properties to assist mall-based retailers with returns.

- BOPIS (buy online, pick up in store) solution provider Position Imaging is working on the launch of its “iPickup”computer vision-based BOPIS solution in malls in the US.

With rising pressures from the acceleration of e-commerce and with fewer consumers visiting shopping centers, mall operators are launching their own digital programs.

- In September 2020, Centennial Realty announced a partnership with artificial intelligence (AI)-powered startup Adeptmind to launch an omnichannel shopping solution “Shop Now!,” which aggregates the inventory of all the tenants and showcases products in a shoppable format on the mall’s website.

- Tanger Outlets introduced a virtual shopping concierge app in June that connects consumers with a personal Tanger associate who recommends a selection of offerings in each store, including the hottest and best deals as well as new product launches.

- In June, Brookfield Properties partnered with Fit:Match to roll out AI-powered body-scan technology at three of its US shopping malls. Shoppers can use the Fit:Match kiosk in the mall, which takes 3D measurements of their body within two minutes.

Retail-Tech Landscape: Retail Real Estate—Infographic

Retail-Tech Landscape: Retail Real Estate, by Category

Shopper Analytics: Providing mall owners with data and analytics about shopper behavior

[wpdatatable id=625]Omnichannel Enablers: Enhancing shopper experience in malls by offering omnichannel solutions

[wpdatatable id=626]Digital Signage: Offering innovative digital display solutions to mall operators

[wpdatatable id=627]Customer Footfall Tracking: Counting the number of people visiting physical locations

[wpdatatable id=629]Indoor Mapping: Enabling mall owners to digitize their maps to better direct the shoppers who visit their locations

[wpdatatable id=630]Real-Time Marketing: Assisting mall owners in reaching shoppers with contextual and personalized messages

[wpdatatable id=631]Tenant/Property Management: Leveraging tenant and property data to provide actionable real-time insights to mall owners

[wpdatatable id=632]