DIpil Das

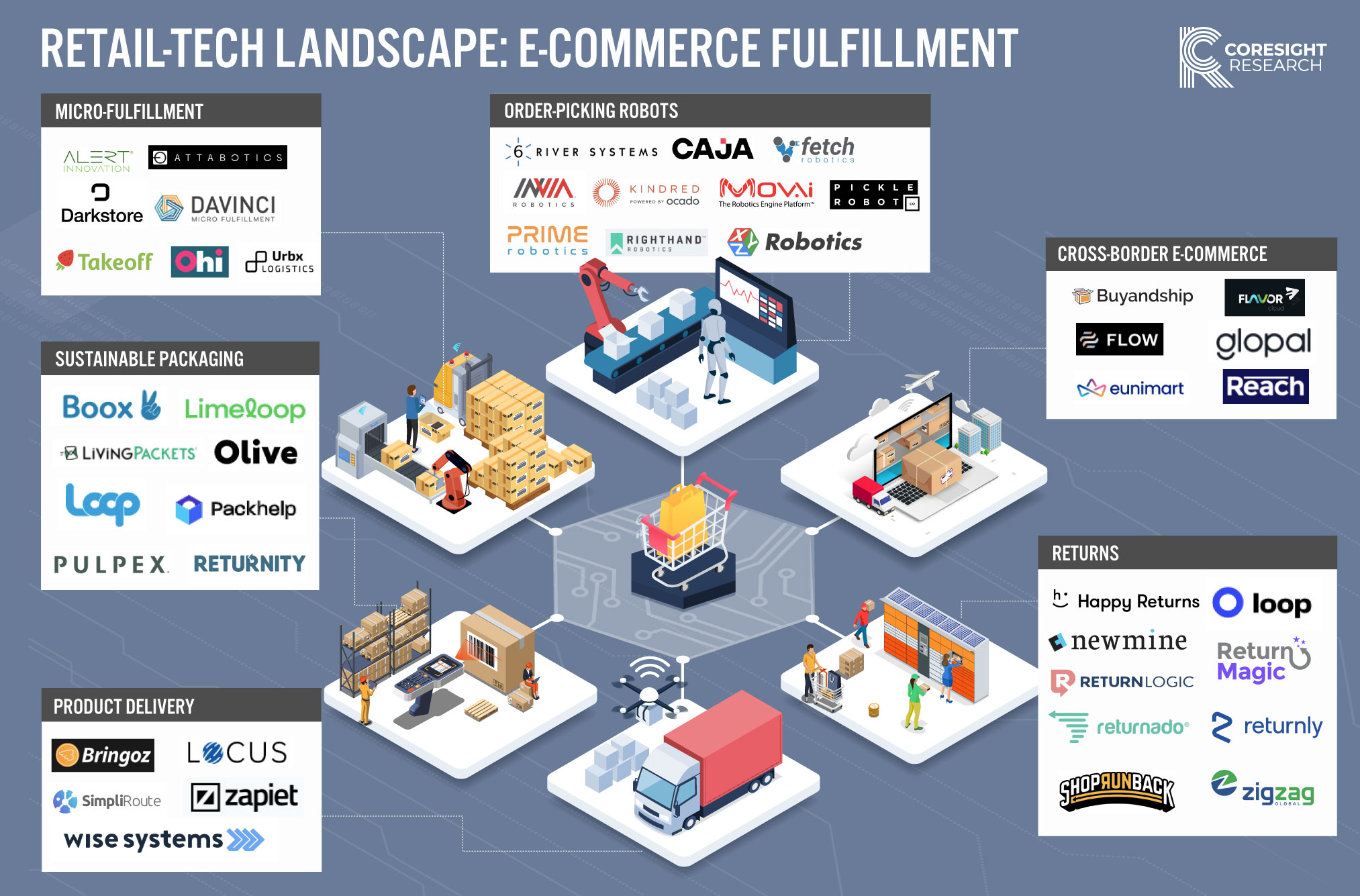

Retail-Tech Landscape: E-Commerce Fulfillment

We expect to see stickiness in pandemic-driven online shopping habits and estimate that total US online retail sales reached $805 billion in 2021 and will reach approximately $1.2 trillion in 2025, representing a CAGR of around 10%, based on our analysis of US Census Bureau data. Brands and retailers must streamline their e-commerce operations using innovative technologies to cater to demand for rapid fulfillment, real-time updates and cross-border purchasing. This will not be easy given existing challenges in inventory management, order fulfillment and returns. This Retail-Tech Landscape comprises selected startups globally that can help retailers improve their e-commerce fulfillment operations and thus enhance overall customer experiences. We have identified 45 startups across the following categories:- Micro-fulfillment

- Order-picking robots

- Product delivery

- Returns

- Sustainable packaging

- Cross-border e-commerce

- Walmart has announced plans to open a high-tech fulfillment center in Mississippi in spring 2022 to support its supply chain network and e-commerce business in the US mid-South. The new center spans over 1 million square feet and will store items to be picked, packed and shipped directly to consumers for next-day deliveries.

- The move is part of Walmart’s initiative to ramp up its supply chain through high-tech local fulfillment centers. The facilities will use AI for palletizing products and employ automated bots to retrieve items from within the center for faster order fulfillment.

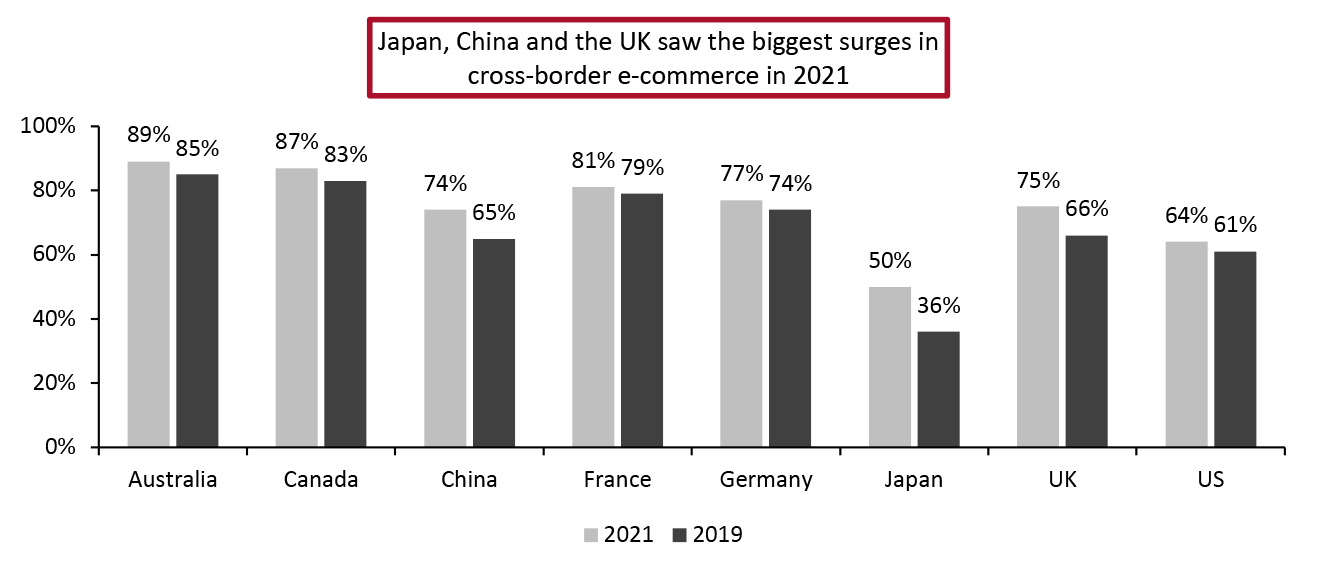

- Some 76% of shoppers made a cross-border purchase in 2021, up from 69% in 2019, according to a 2021 global survey of 2,021 respondents aged 18–54 conducted by cross-border e-commerce platform Flow Commerce.

- Apparel (57%), fashion accessories (34%), and beauty and personal care (34%) were the most popular categories for cross-border purchases, according to the survey.

Figure 1. Cross-Border E-Commerce Shopping by Country [caption id="attachment_143607" align="aligncenter" width="700"]

Base: 2,021 consumers in the 18–54 age group

Base: 2,021 consumers in the 18–54 age group Source: Flow Commerce [/caption] Pandemic-led travel restrictions and limited access to international stores have also boosted cross-border e-commerce. Legacy retailers in Western countries can take advantage of shoppers in fast-growing markets such as China and India.

- China’s State Council issued a statement in February 2022 to approve the establishment of further cross-border e-commerce pilot zones (designated areas in cities to promote cross-border online commerce). This will involve experimentation with new business models, regulatory policies and technical standards to boost foreign trade and the country’s economy. The additional zones will be set up in 27 cities across China, following a surge in cross-border e-commerce amid the pandemic.

- China’s cross-border e-commerce imports and exports saw a 15% increase year over year to ¥1.98 trillion ($312.3 billion) in 2021, with e-commerce pilot zones significantly contributing to the growth, according to official data released by China’s State Council on January 15, 2022.