Introduction

DTC sales represent an evolutionary perfection of the e-commerce business model. DTC allows an easier entry point and therefore a more level market space, and some of today’s largest retail companies started with a DTC model. But these digitally native vertical brands are very different from their e-commerce predecessors. Born on the Internet and often focused on millennials, DTC brands are directly tapped into their audience.

The cost of selling online has dropped precipitously in recent years due to the emergence of off-the-shelf e-commerce platforms such as Shopify and Salesforce. Companies now have a much simpler, lower-cost way to communicate what they do through a myriad of online advertising channels. This makes it simpler to build a community around a brand and interact with customers. Direct channels also enable greater insight into how customers buy products and what promotions are most effective.

.

.

What Is a DTC Company?

What Is a DTC Company?

DTC brands sell products and services as any brand does, but they bypass retailers to sell directly to consumers via their own websites. These firms “own” the entire value chain – they invest in research, development and design, in some cases all the way to manufacturing the final products. DTC brands then take full responsibility for execution of marketing, ensuring the end-to-end customer experience is seamless. DTC brands typically focus on a specific product, though some have widened their offering to support growth. A number of DTC brands have also ventured into offline retail by opening physical stores.

Why Are DTC Brands so Successful?

Despite their small scale (initially) and money-losing nature, DTC product gross margins are on average around double that of traditional e-commerce, and contribution margins can be up to five times higher. The real value created by the DTC model, however, is its focus on the customer experience. As a digitally native businesses, the client relationship is everything. And through that intimacy, every transaction and interaction can be captured and is immediately accessible. All this consumer data is a treasure trove, allowing DTC brands to stay closer to their customers than their brick-and-mortar competitors. And, by creating a holistic brand experience that encompasses the actual product, the online experience and customer service, DTCs often have the upper hand over traditional e-commerce companies as well.

Nevertheless, as DTC companies grow, many expand offline as well. This is especially the case for retail categories that are more experientially oriented, including apparel, furniture and cosmetics. Physical retail extensions are usually pursued through pop-ups and showrooms, hand-picked collaborations with select partners, including installations at existing retailers, or even permanent locations. DTC offline ventures expand their ability to market the brand and further improve the customer experience.

Growth of DTC Brands

DTC brands have found success in lifestyle categories such as apparel, beauty and home furnishings. They are also impacting the consumer packaged goods category as food and beverage and personal care DTC brands emerge.

These brands are growing exponentially in terms of valuations, revenues, customers and positive sentiment. According to a report by YouGov in 2018, 40% of US Internet users expect DTC brands to account for over a third of their purchases within the next five years. In recent years, companies such as Dollar Shave Club, Warby Parker, Casper, Bonobos and Glossier have exploded onto the market.

DTC Brands that Are Disrupting the Retail Industry

In this report, we include DTC brands with physical stores (typically fewer than 20 stores), as many of these high-growth DTC brands have been establishing physical presences over the last two years. Many are introducing pop-up stores, partnering with larger retailers or even opening their own flagship stores.

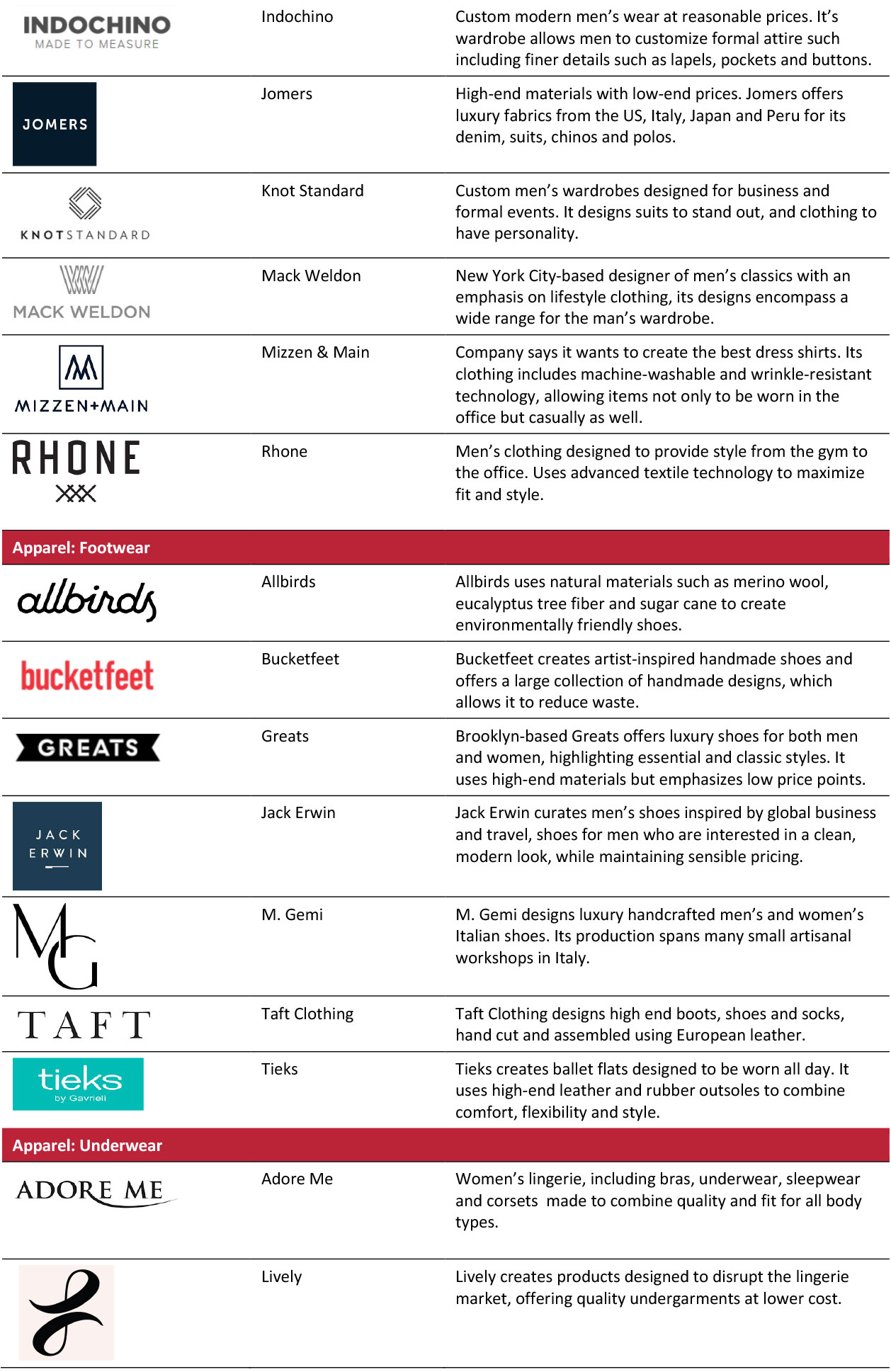

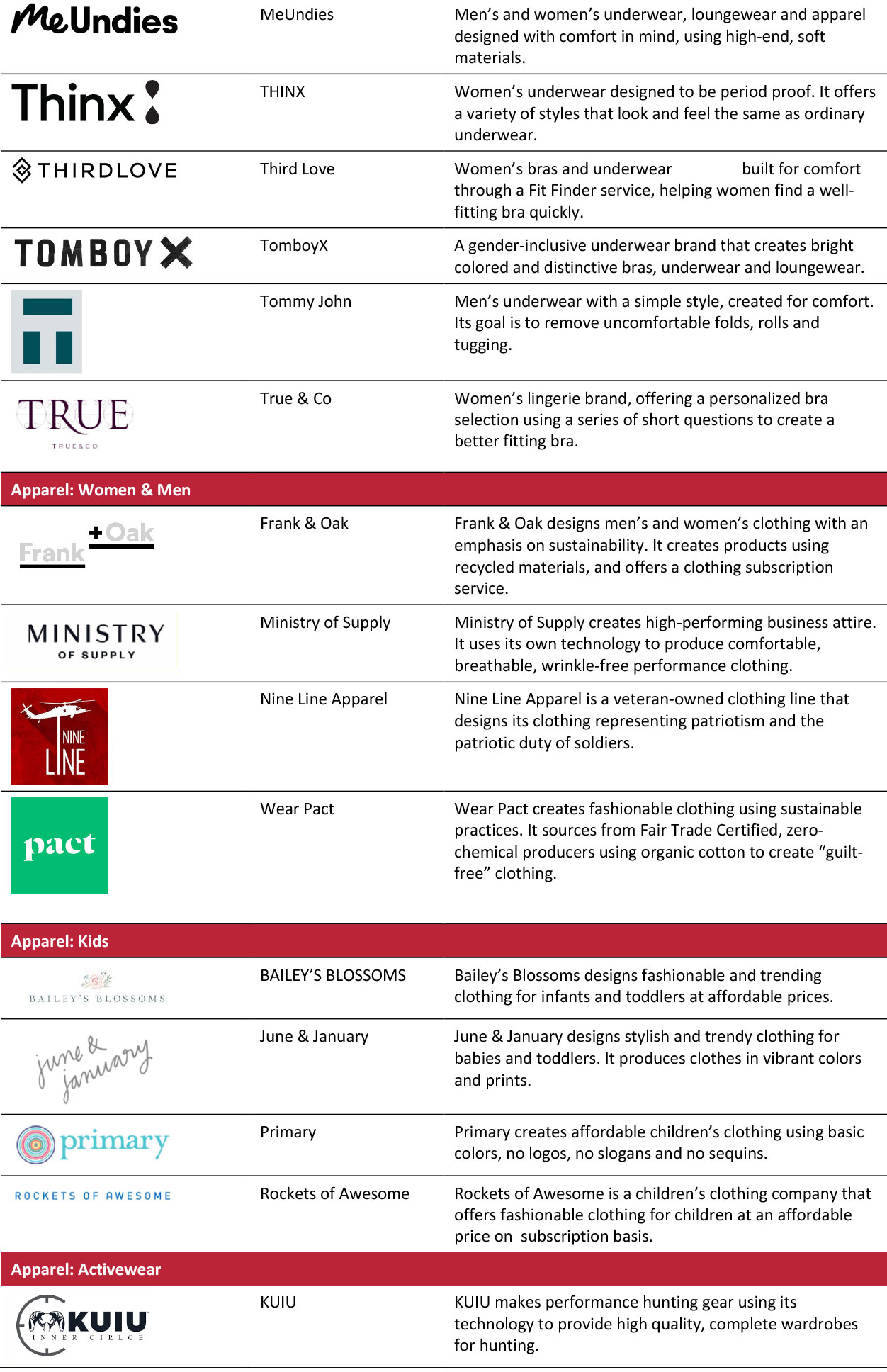

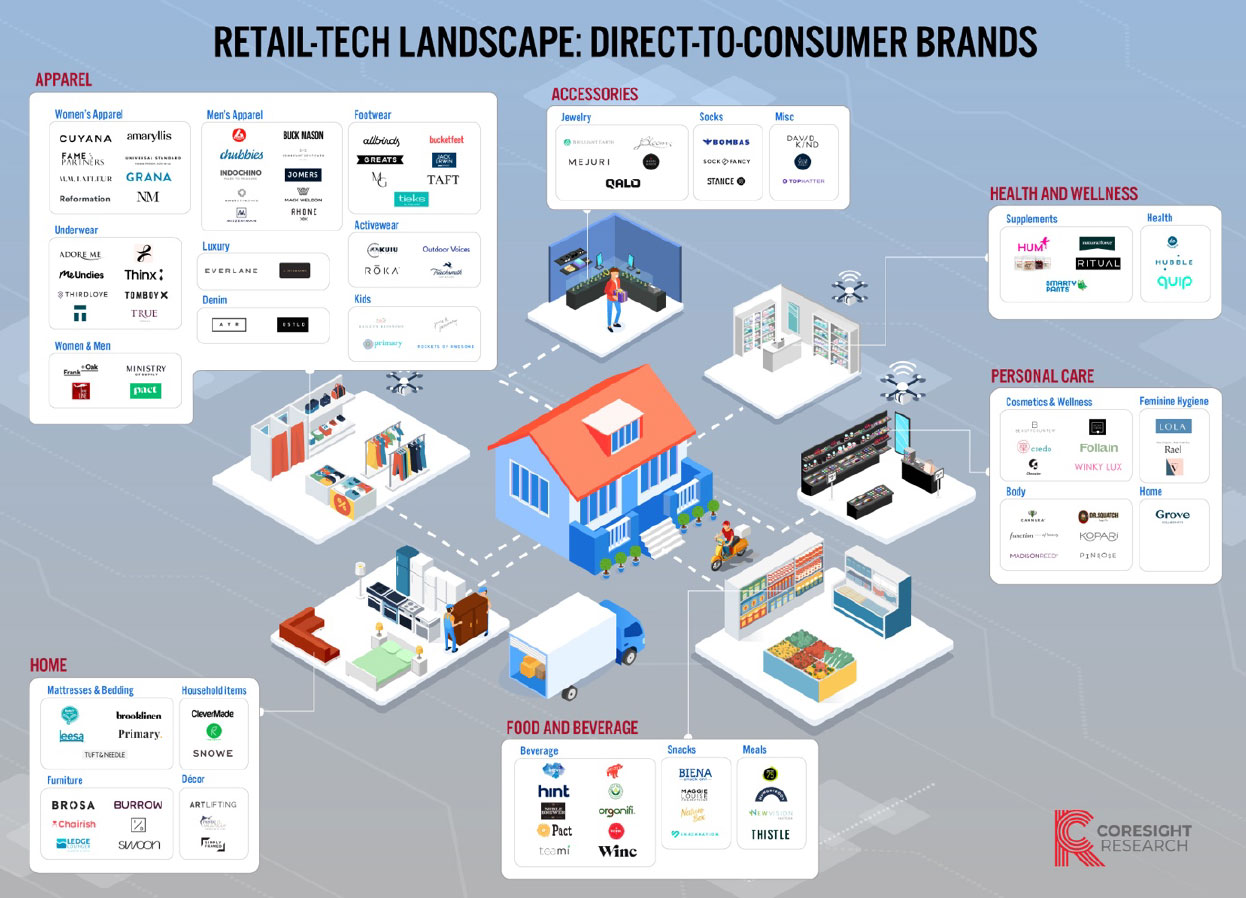

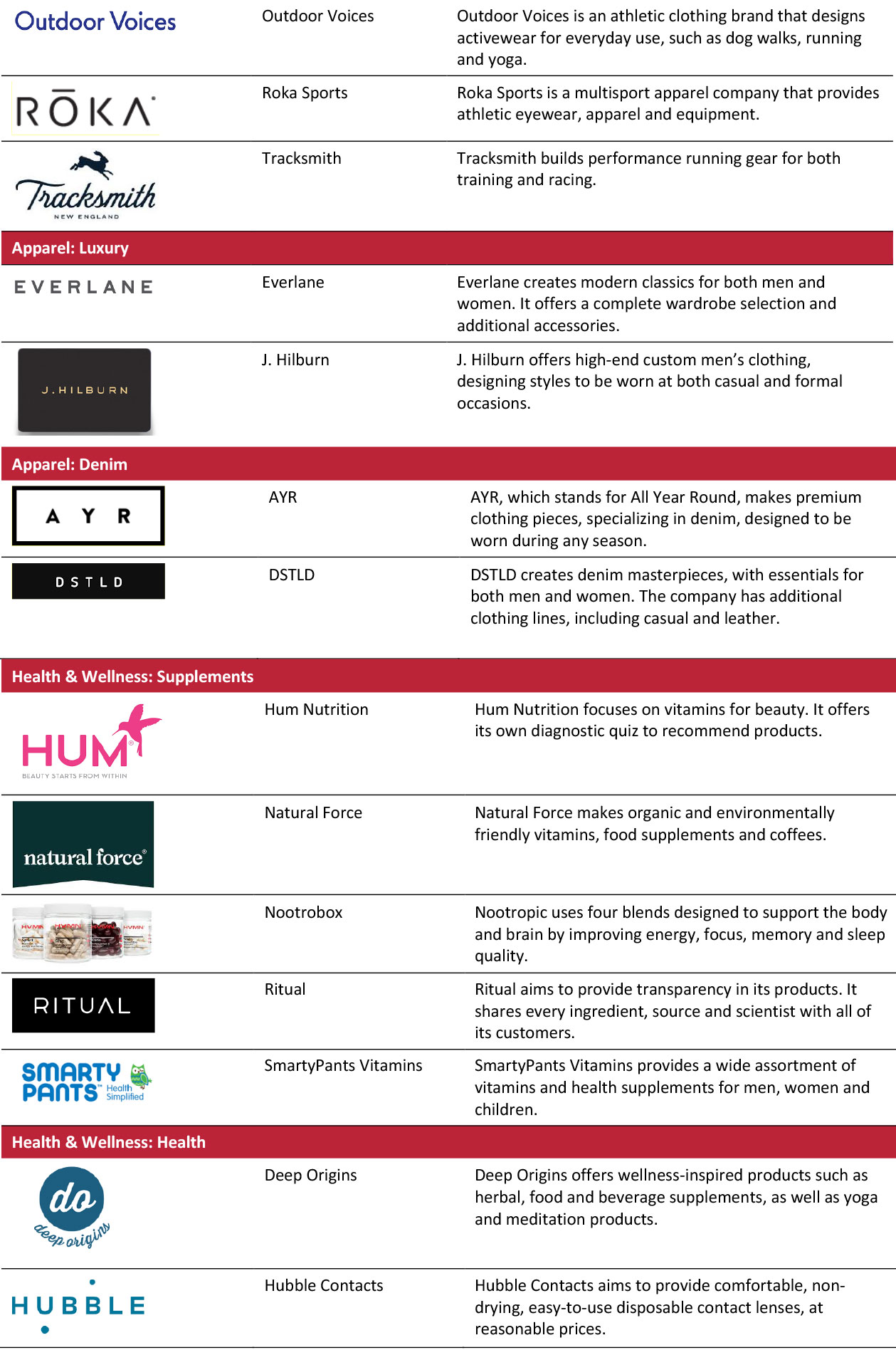

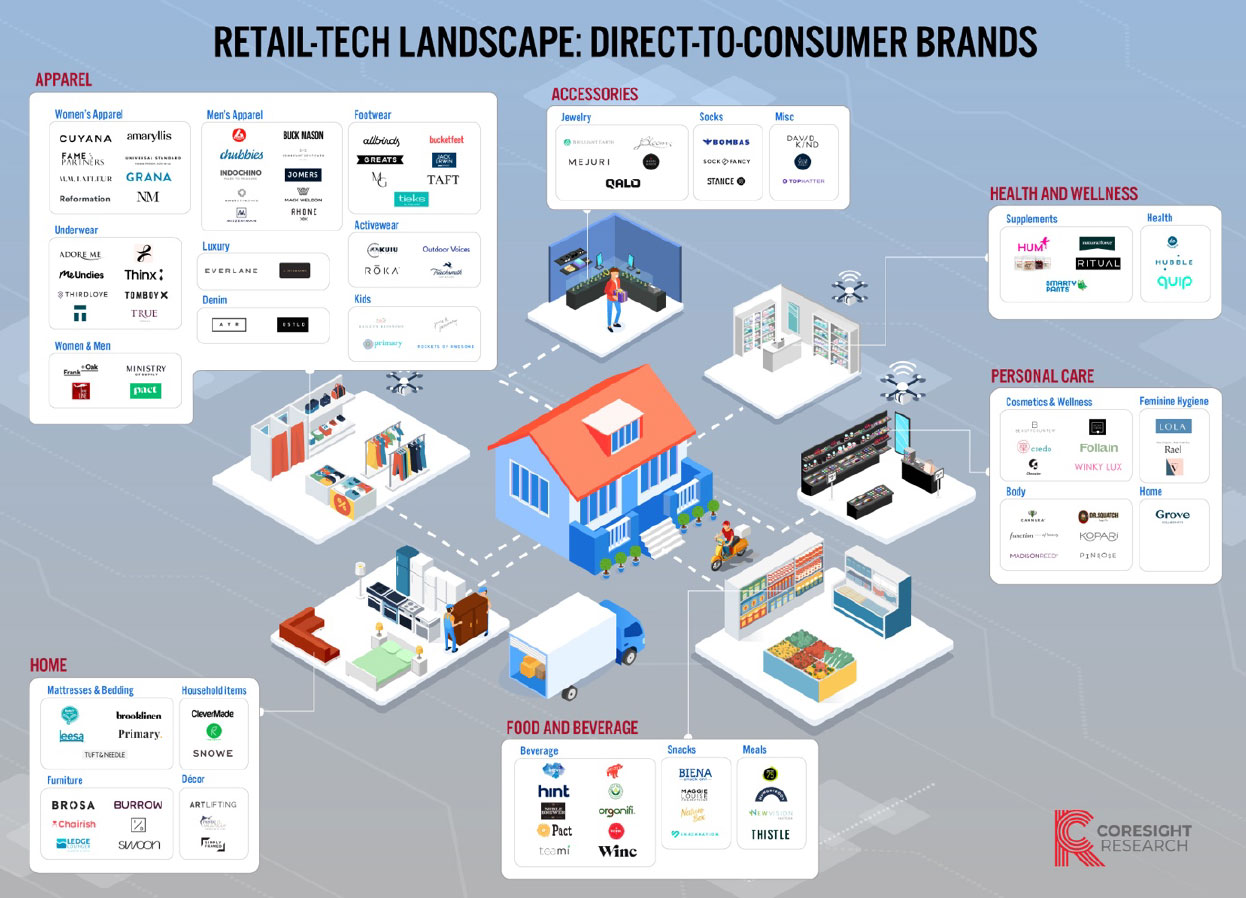

The DTC retailers included in our analysis are at the forefront of disruptive e-commerce companies; they are the ones most influencing buying behaviors and ushering in a new phase in business to consumer relationships. This Retail-Tech Landscape features 119 DTC companies, mostly headquartered in the US, with a few others in Europe and Asia-Pacific. They span six categories, each with corresponding subcategories, as follows:

1) Apparel

- Women

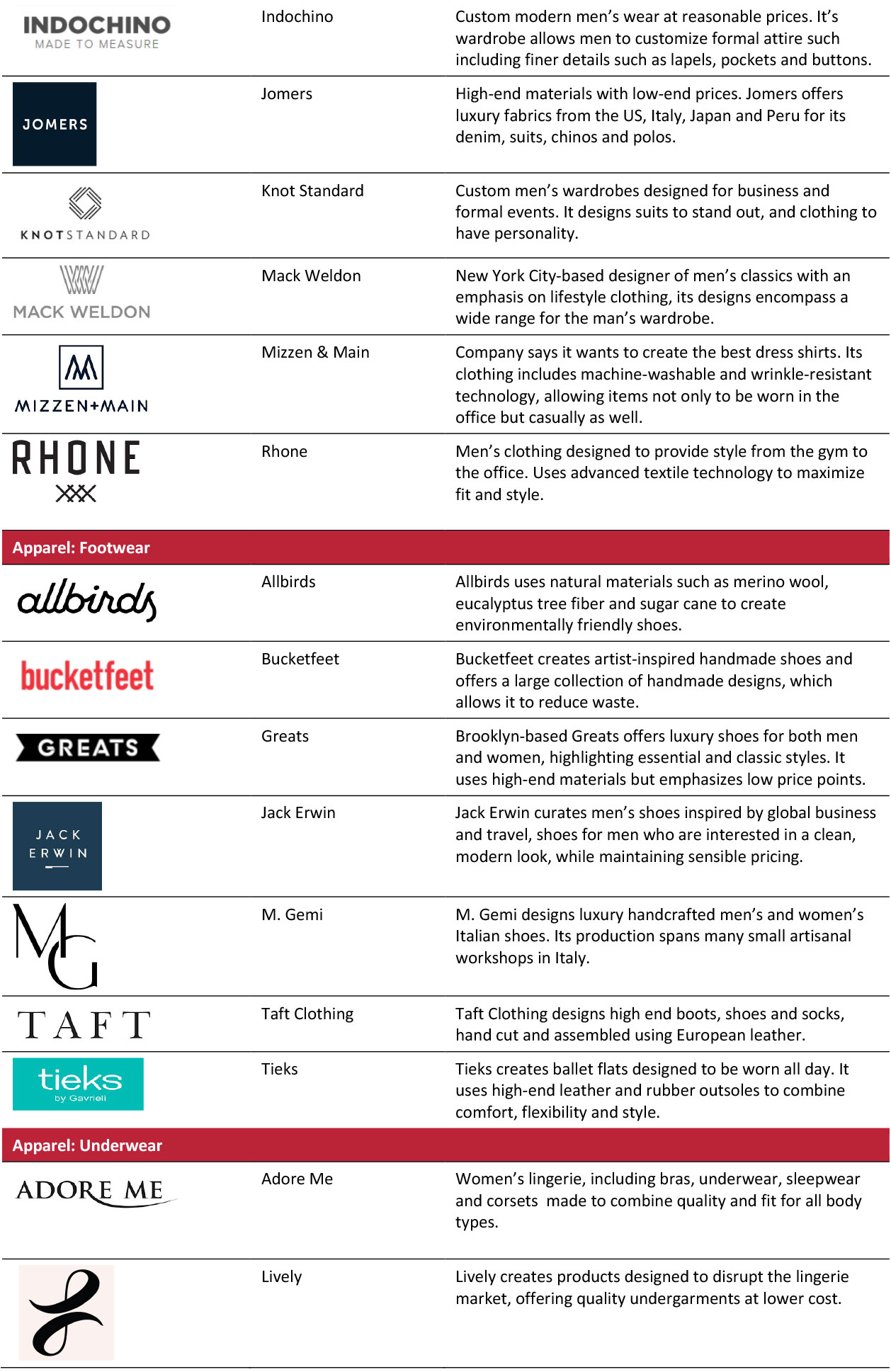

- Men

- Footwear

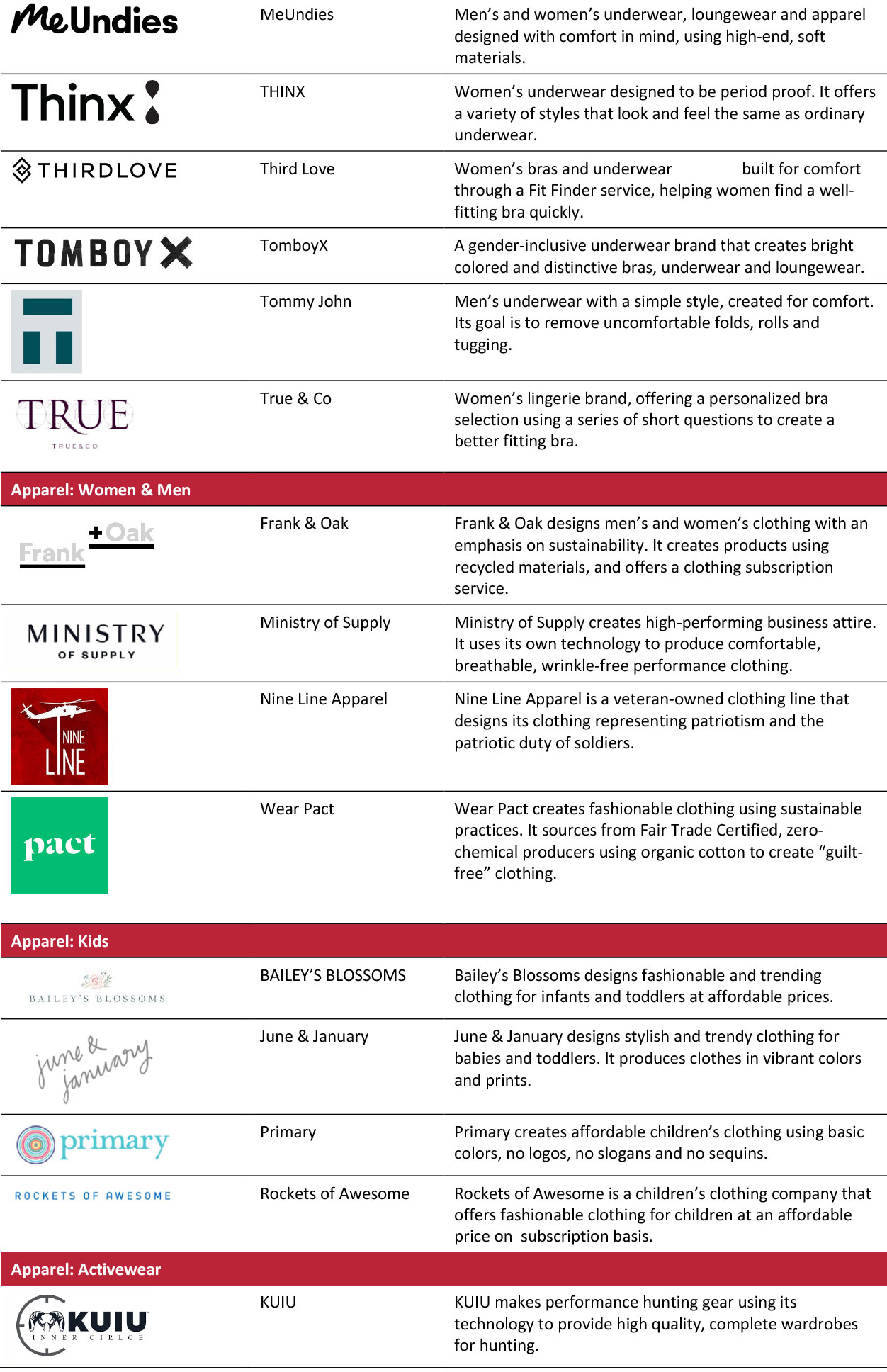

- Underwear

- Women & Men

- Kids

- Activewear

- Luxury

- Denim

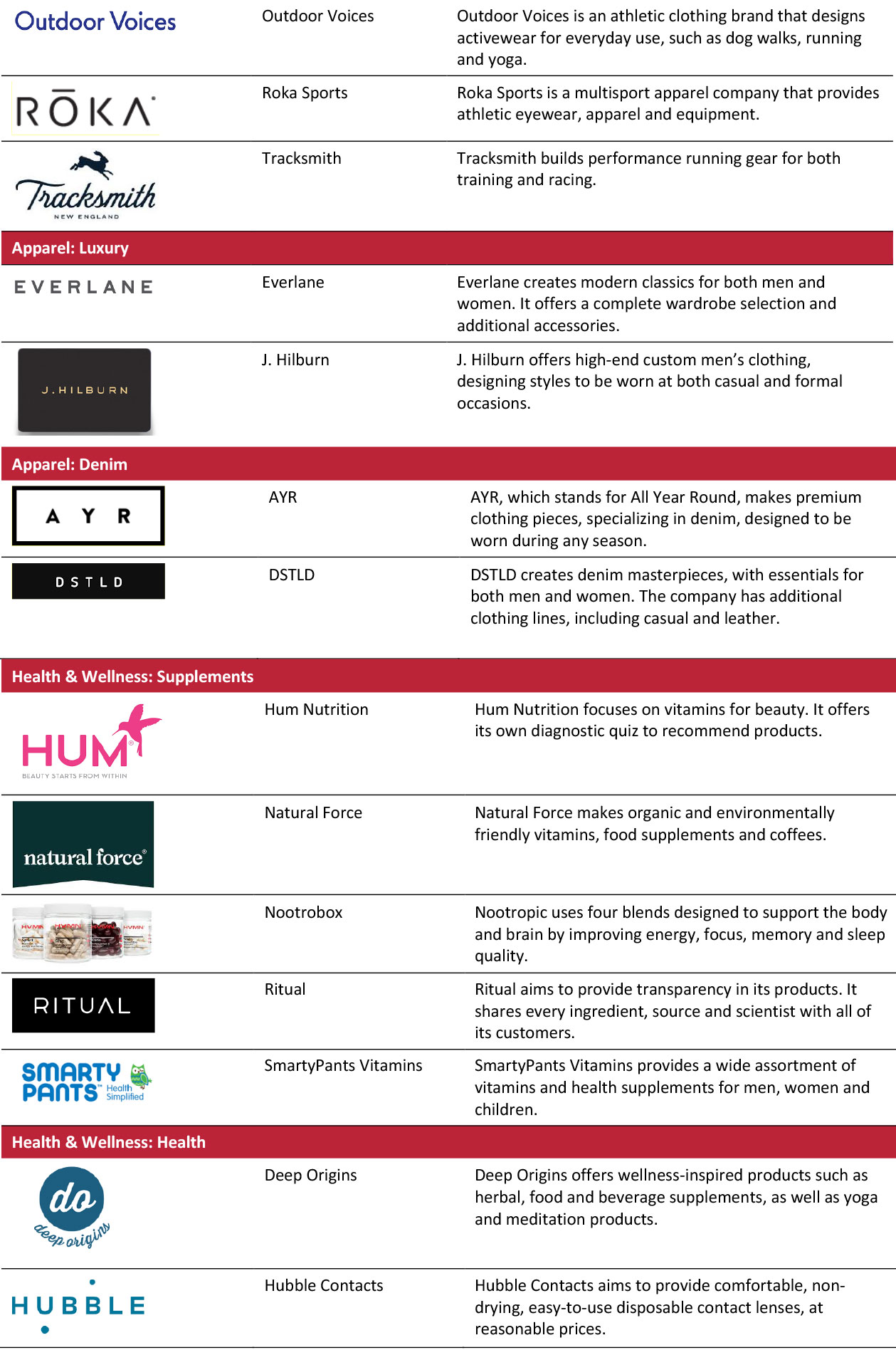

2) Health and Wellness

- Supplements

3) Accessories

- Jewellery

- Socks

- Misc

4) Food and Beverage

- Beverages

- Snacks

- Meals

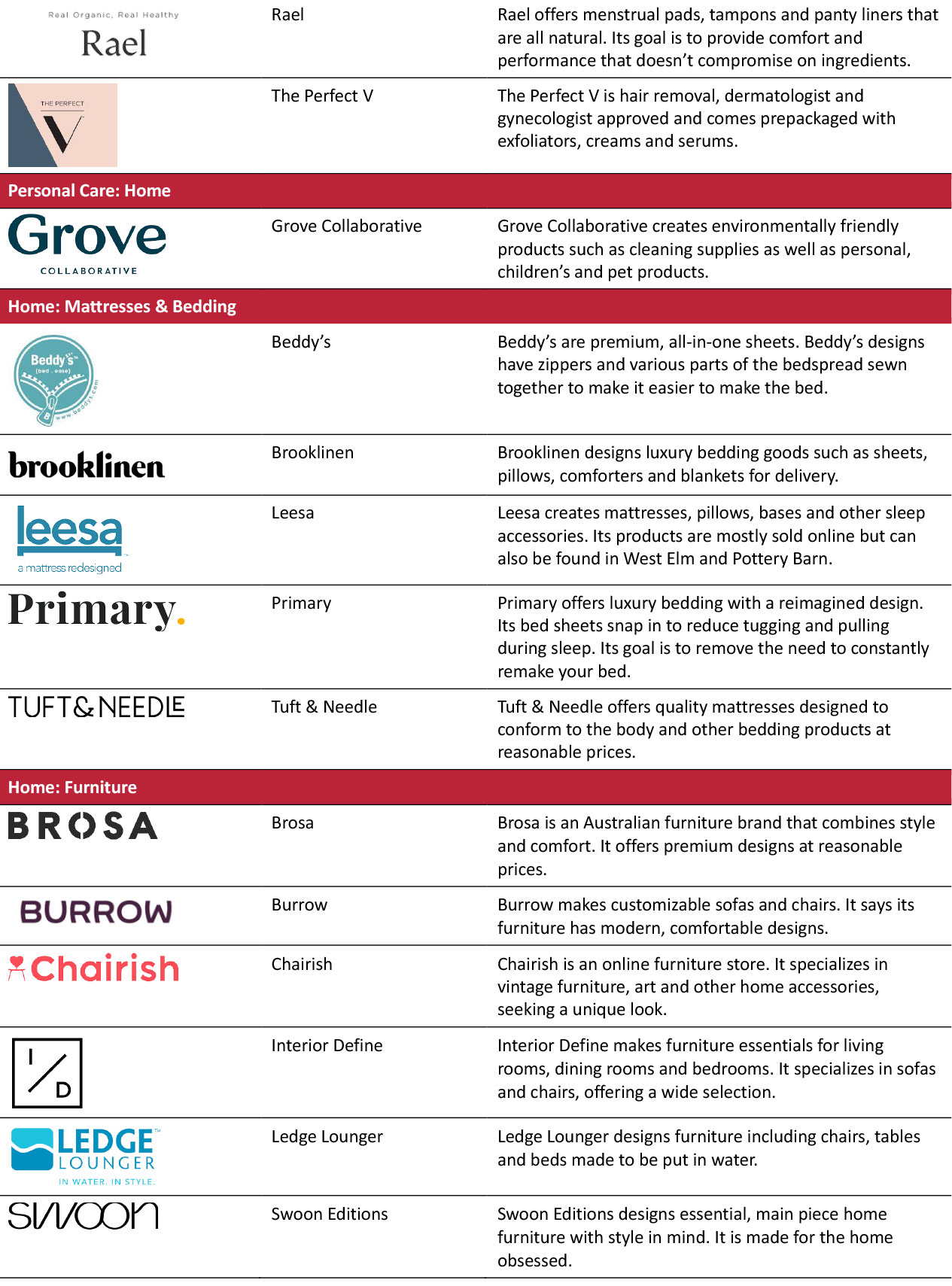

5) Personal Care

- Cosmetics/Wellness

- Body (Hair&Skin)

- Feminine Hygiene

- Home

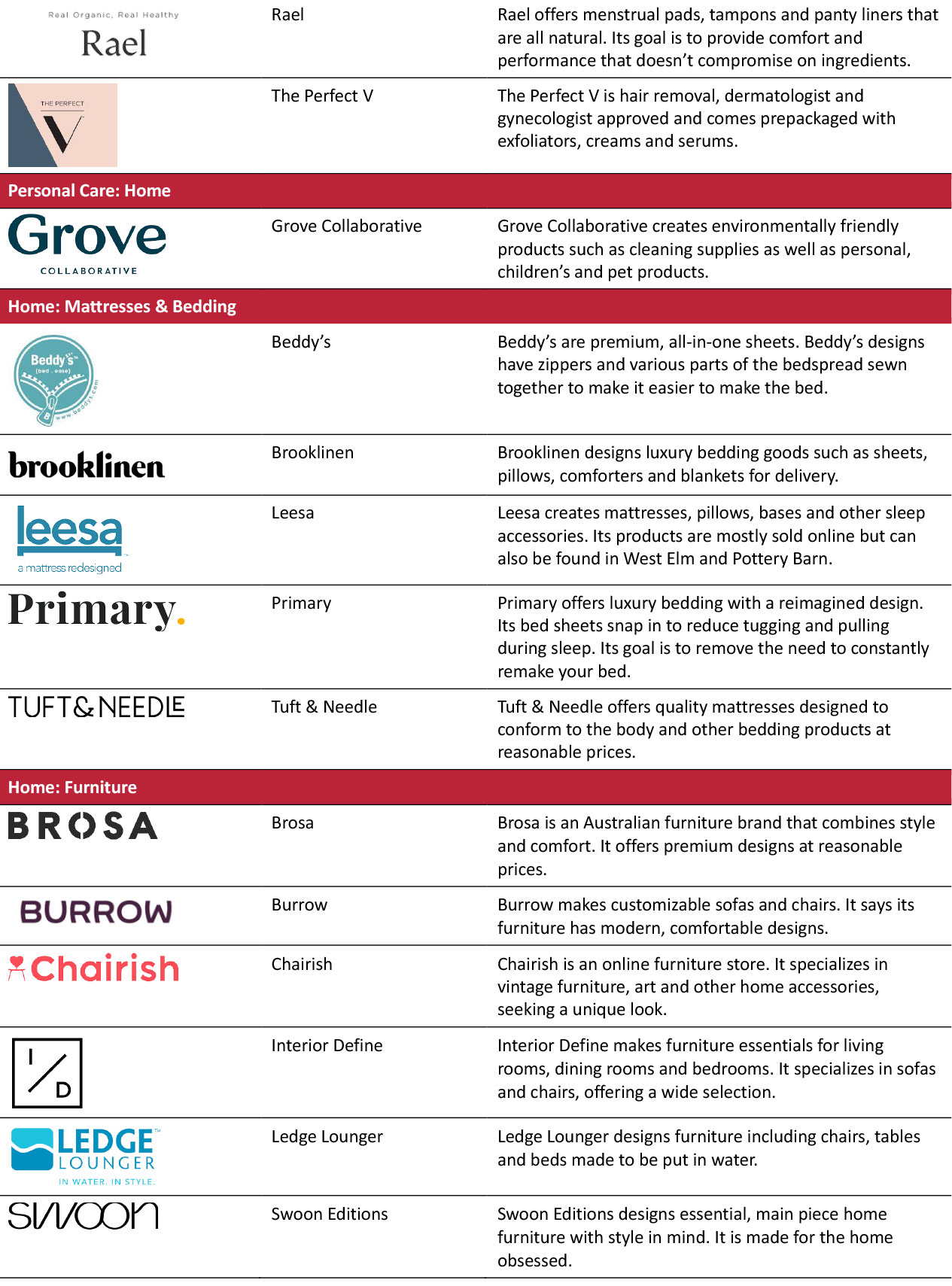

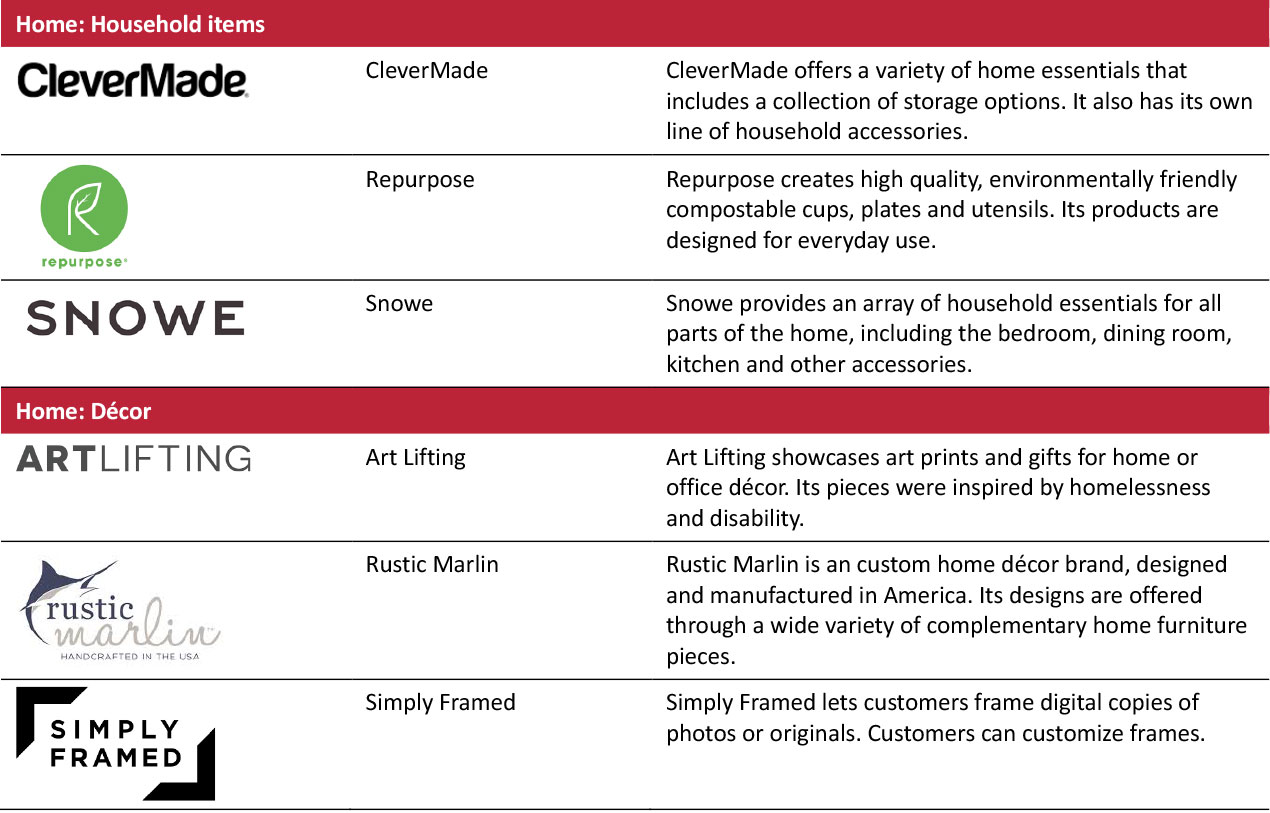

6) Home

- Mattresses & Bedding

- Furniture

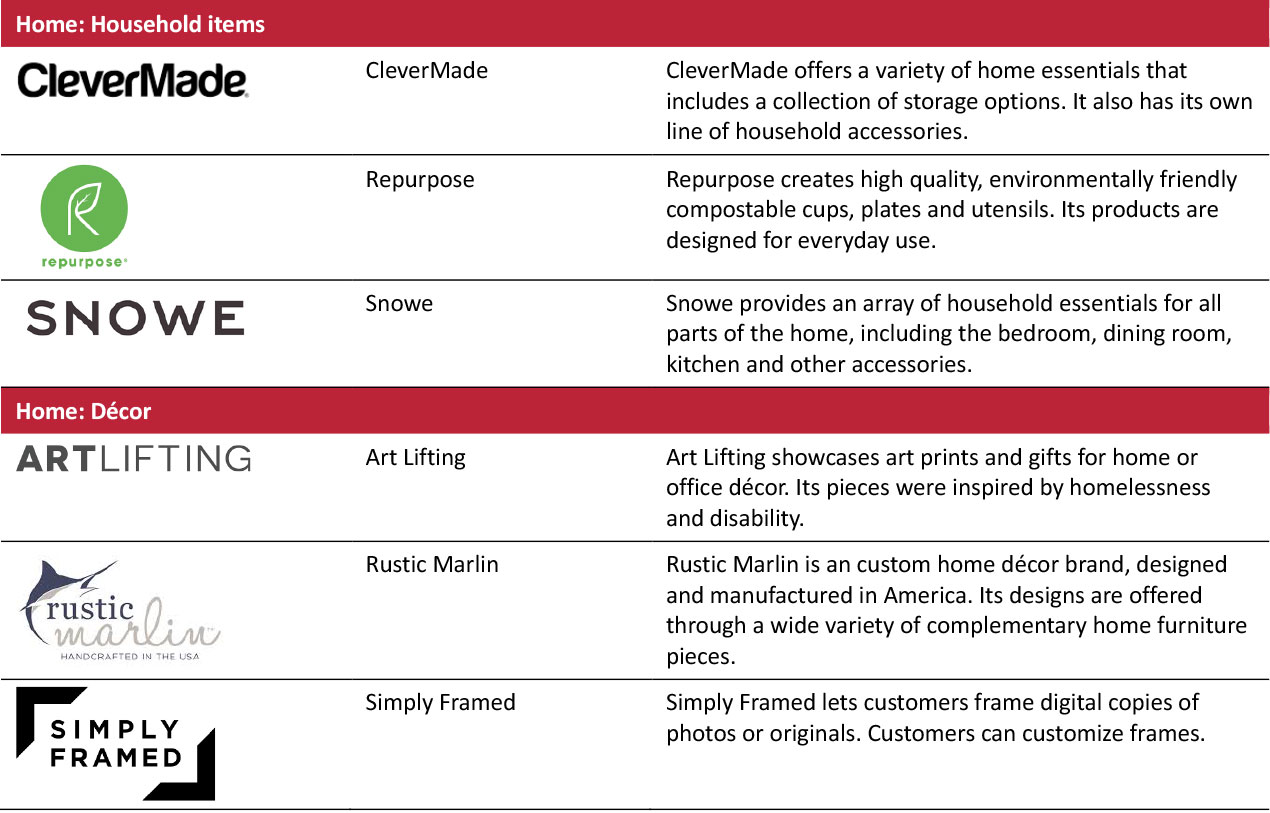

- Household Items

- Décor

What Is a DTC Company?

DTC brands sell products and services as any brand does, but they bypass retailers to sell directly to consumers via their own websites. These firms “own” the entire value chain – they invest in research, development and design, in some cases all the way to manufacturing the final products. DTC brands then take full responsibility for execution of marketing, ensuring the end-to-end customer experience is seamless. DTC brands typically focus on a specific product, though some have widened their offering to support growth. A number of DTC brands have also ventured into offline retail by opening physical stores.

Why Are DTC Brands so Successful?

Despite their small scale (initially) and money-losing nature, DTC product gross margins are on average around double that of traditional e-commerce, and contribution margins can be up to five times higher. The real value created by the DTC model, however, is its focus on the customer experience. As a digitally native businesses, the client relationship is everything. And through that intimacy, every transaction and interaction can be captured and is immediately accessible. All this consumer data is a treasure trove, allowing DTC brands to stay closer to their customers than their brick-and-mortar competitors. And, by creating a holistic brand experience that encompasses the actual product, the online experience and customer service, DTCs often have the upper hand over traditional e-commerce companies as well.

Nevertheless, as DTC companies grow, many expand offline as well. This is especially the case for retail categories that are more experientially oriented, including apparel, furniture and cosmetics. Physical retail extensions are usually pursued through pop-ups and showrooms, hand-picked collaborations with select partners, including installations at existing retailers, or even permanent locations. DTC offline ventures expand their ability to market the brand and further improve the customer experience.

Growth of DTC Brands

DTC brands have found success in lifestyle categories such as apparel, beauty and home furnishings. They are also impacting the consumer packaged goods category as food and beverage and personal care DTC brands emerge.

These brands are growing exponentially in terms of valuations, revenues, customers and positive sentiment. According to a report by YouGov in 2018, 40% of US Internet users expect DTC brands to account for over a third of their purchases within the next five years. In recent years, companies such as Dollar Shave Club, Warby Parker, Casper, Bonobos and Glossier have exploded onto the market.

What Is a DTC Company?

DTC brands sell products and services as any brand does, but they bypass retailers to sell directly to consumers via their own websites. These firms “own” the entire value chain – they invest in research, development and design, in some cases all the way to manufacturing the final products. DTC brands then take full responsibility for execution of marketing, ensuring the end-to-end customer experience is seamless. DTC brands typically focus on a specific product, though some have widened their offering to support growth. A number of DTC brands have also ventured into offline retail by opening physical stores.

Why Are DTC Brands so Successful?

Despite their small scale (initially) and money-losing nature, DTC product gross margins are on average around double that of traditional e-commerce, and contribution margins can be up to five times higher. The real value created by the DTC model, however, is its focus on the customer experience. As a digitally native businesses, the client relationship is everything. And through that intimacy, every transaction and interaction can be captured and is immediately accessible. All this consumer data is a treasure trove, allowing DTC brands to stay closer to their customers than their brick-and-mortar competitors. And, by creating a holistic brand experience that encompasses the actual product, the online experience and customer service, DTCs often have the upper hand over traditional e-commerce companies as well.

Nevertheless, as DTC companies grow, many expand offline as well. This is especially the case for retail categories that are more experientially oriented, including apparel, furniture and cosmetics. Physical retail extensions are usually pursued through pop-ups and showrooms, hand-picked collaborations with select partners, including installations at existing retailers, or even permanent locations. DTC offline ventures expand their ability to market the brand and further improve the customer experience.

Growth of DTC Brands

DTC brands have found success in lifestyle categories such as apparel, beauty and home furnishings. They are also impacting the consumer packaged goods category as food and beverage and personal care DTC brands emerge.

These brands are growing exponentially in terms of valuations, revenues, customers and positive sentiment. According to a report by YouGov in 2018, 40% of US Internet users expect DTC brands to account for over a third of their purchases within the next five years. In recent years, companies such as Dollar Shave Club, Warby Parker, Casper, Bonobos and Glossier have exploded onto the market.