albert Chan

Retail-Tech Landscape: DNVBs

DNVBs are brands born online, selling their own branded products and services as any other brand does. However, DNVBs control their entire customer experience, from factory to consumer, and bypass retailers to sell directly to consumers via their own websites. DNVBs position their success on their ability to directly target, interact with and understand today’s consumers’ unmet needs. Through this close relationship, DNVBs can build more authentic customer-brand relationships and take advantage of community buy in.

DNVBs are growing exponentially in terms of valuation, revenue, customers and positive consumer engagement. There has been a surge in DNVB launches in the US—we have seen over 200 set up in apparel and footwear, and around 50 in the food, beverage and food supplement category in the last decade.

However, as DNVBs grow, they tend to expand offline as well through traditional channels. The shift toward offline expansion is often driven by high online customer acquisition and digital marketing costs—with many DNVBs attracting venture capital funding to make this possible. DNVBs therefore look to physical sales and marketing such as temporary pop-up stores (offering location flexibility and short-term cost savings) or permanent brick-and-mortar stores (offering a more established presence and long-term cost savings). This is especially the case for more experiential retail categories such as apparel, furniture, personal care and cosmetics.

This Retail-Tech Landscape comprises 40 selected startups, most headquartered in the US, with a few from Europe and Asia, but all from the following retail categories:

- Apparel and footwear

- Beauty and personal care

- Food, beverage and snacks

- Home

- Luxury

Key Trends in Digitally Native Vertical Brands (DNVBs)

Below, we highlight two key DNVB industry trends.

1. DNVBs Are Investing in Physical Stores

Although the pandemic severely impacted physical retail, we expect DNVBs—particularly in apparel and footwear, beauty and personal care categories—to continue to value physical stores and adjust their strategies to better combine online and in-store retail. We expect this expansion to fuel DNVB sales toward further growth in 2022. Sales by apparel and footwear DNVBs will total $8.4 billion in the US in 2022–capturing 6% of the total apparel and footwear market, we estimate.

As the pandemic eases, we expect to see more brands expand into physical retail. DNVBs such as Untuckit and Glossier recently opened physical stores as part of their offline expansion to drive shopper engagement.

- Untuckit, a casual menswear brand, opened two new UK stores as part of a worldwide expansion program in August 2021. The physical stores will complement its UK online business by facilitating alterative fulfillment such as BOPIS, curbside pickup and ship-from-store.

- In December 2021, Glossier opened a permanent store in London. Glossier already runs two permanent stores; one in Seattle, which opened in August 2021, and one in Los Angeles, which opened in November 2021.

Glossier’s current flagship store in London

Glossier’s current flagship store in LondonSource: Glossier[/caption]

2. Apparel and Footwear DNVBs Are Focusing on Sustainable Business Practices

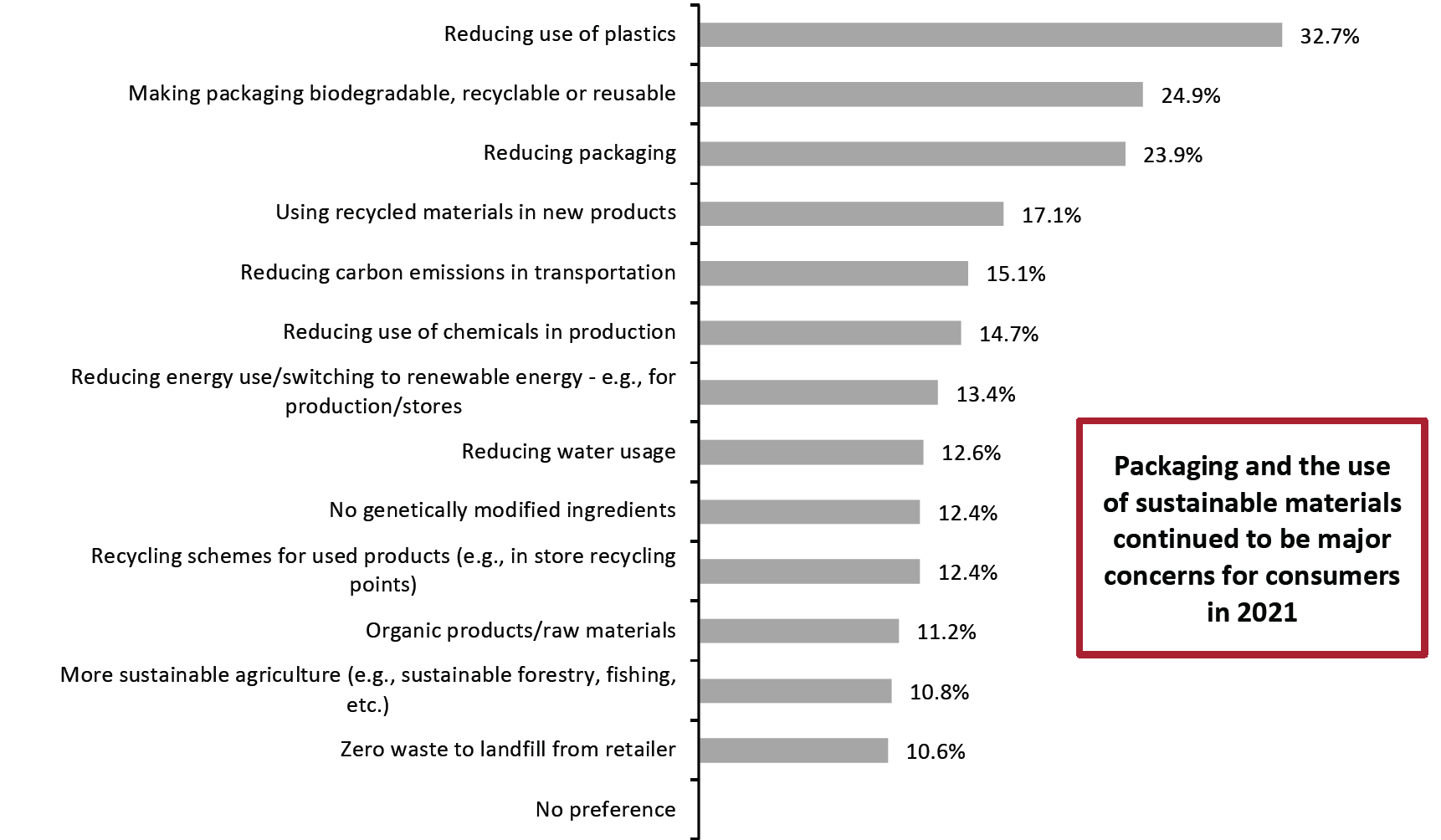

Apparel and footwear DNVBs increasingly offer options marketed as sustainable for US consumers amid an increase in awareness of the environmental impacts of their shopping decisions. Among various sustainability practices that consumers consider the most important for retailers, reducing plastics takes the lead, according to findings from a Coresight Research survey of US consumers conducted on July 26, 2021.

- California-based apparel and fashion platform for women Fame and Partners offers modern clothing for women with an emphasis on sustainability. According to the company, it takes a low-waste approach to production to minimize fashion waste.

- US-based luxury apparel brand Summersalt uses recycled materials for its fabrics and packaging materials for its range of apparel items.

Figure 1. Aspects of Sustainable/Eco-Friendly Consumption That Are Important to US Consumers

[caption id="attachment_146864" align="aligncenter" width="700"] Respondents could select up to three options or “No preference”

Respondents could select up to three options or “No preference”Base: US Internet users aged 18+, surveyed in July 2021

Source: Coresight Research[/caption]

Retail-Tech Landscape: DNVBs—Infographic

Retail-Tech Landscape: DNVBs, by Category

Apparel and Footwear: DNVBs offering apparel and footwear products for men, women, and children

[wpdatatable id=1953]Beauty and Personal Care: DNVBs offering beauty, wellness and personal care products to consumers

[wpdatatable id=1954]Food and Beverage: DNVBs selling beverages, meals and snacks

[wpdatatable id=1955]Home: DNVBs selling furniture and home décor products

[wpdatatable id=1956]Luxury: DNVBs across luxury fashion, footwear and jewelry

[wpdatatable id=1957]