DIpil Das

This report presents Coresight Research’s updated Retail Robustness Index (RRI), which evaluates the 100 largest US retailers (by revenue) on their ability to weather the dramatic demand shifts due to the coronavirus crisis in the US.

We evaluate retailers based on financial health, sales capacity, product mix and management tenure.

Discussion

In this update, the average score across the full index increased by 0.3 points to 51.8, from 51.5 in October, owing to increases in the percentage of stores open, more favorable product mixes and longer management tenures. However, many retailers continue to experience losses from low sales volumes. The retail third-quarter reporting season is well under way, with around 75% of covered companies scheduled to release earnings later in November and in December. None of the included retailers filed for bankruptcy in October. Retailers are likely now resolved to get through the crucial holiday season; yet, given the volatility in consumer preferences and the weakened financial state of many retailers, subsequent filings are highly possible.

Monthly Changes of Overall Retail Robustness Index

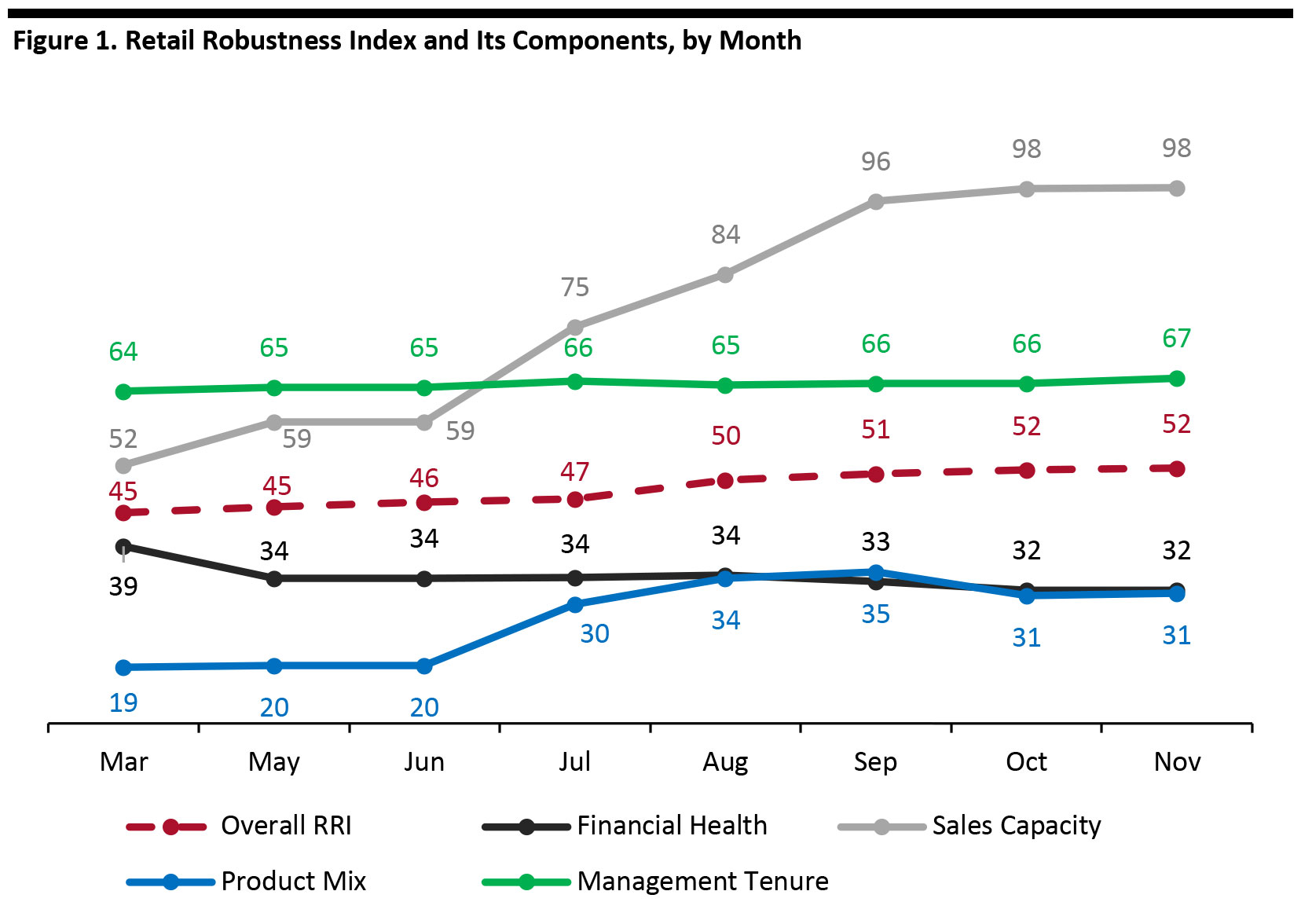

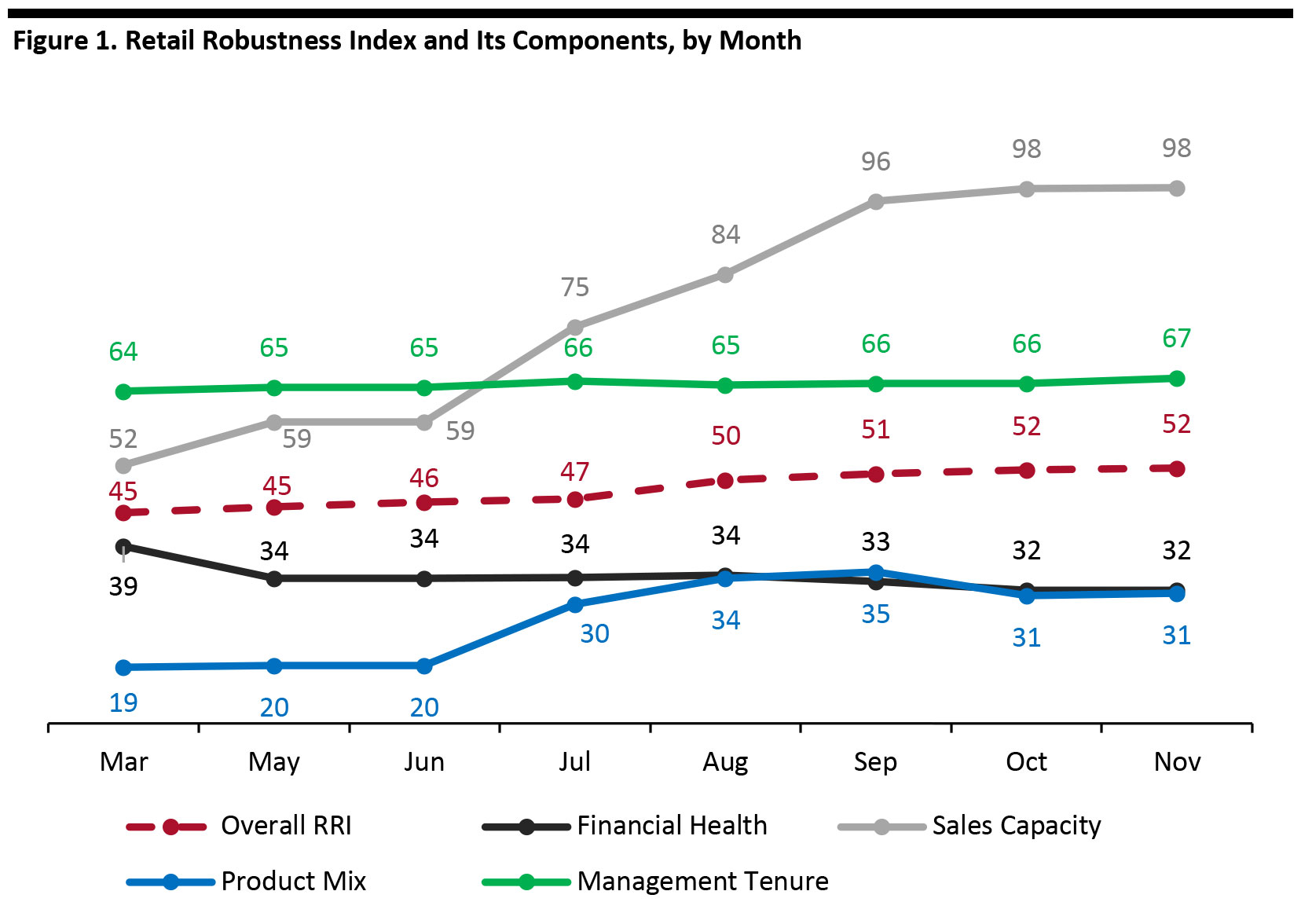

Figure 1 shows the changes in the overall RRI and its components since March 2020. We outline the components and methodology later in this report.

[caption id="attachment_119157" align="aligncenter" width="700"] Note: The index includes new weightings and methodologies for sales capacity and product mix starting in July 2020.

Note: The index includes new weightings and methodologies for sales capacity and product mix starting in July 2020.

Source: Coresight Research [/caption] The main driver of higher RRI scores has been sales capacity, which has increased over the past six months due to store reopenings, but some stores are temporarily closing again as outbreaks occur in certain areas. Financial health was flat in November. Consumer shopping preferences in October showed improvements in the “buy more/buy less ratios” of beauty, electronics and food, with a slight decline in furniture, according to our recent proprietary survey of US consumers. November RRI Outlook November RRI scores could decrease in the next month, owing to declines in financial health from upcoming earnings reports, as retailers absorb losses due to low sales volumes now that the holiday retail season is taking place in earnest. Sales capacity figures are approaching 100%, but some retailers have temporarily closed stores again in some areas of the US due to renewed coronavirus outbreaks. Shopping preferences are likely to shift toward essentials again, as consumers stock their pantries in anticipation of future outbreaks and due to anticipated unrest following the US presidential election. We are forecasting a 5% increase in holiday US retail sales, which will have an impact on retailers’ financials in the quarter ending January 2021. Top 10 Retailers by RRI Ranking Figure 2 presents the 10 retailers that rank highest in our index as of the start of November 2020. The overall changes in most of the top 10 RRI scores were modest, with nine of the companies retaining a top-10 ranking since last month, due to a lack of recent financial data and little change in the percentage of stores open.

Figure 2. Changes in Retail Robustness Index: Top 10 Retailers [wpdatatable id=551 table_view=regular]

Note: Differences in score changes are rounded. Source: Coresight Research Commentary on Score Changes Some retailers saw more pronounced score changes, which we outline below. Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Figure 4. Coresight Research Retail Robustness Index: Components and Weighting [wpdatatable id=453 table_view=regular]

Source: Coresight Research A more detailed discussion of the index methodology is included in the appendix of this report. Additional notes on the Coresight Research Retail Robustness Index:

Figure 5. Coresight Research Retail Robustness Index: Full List [wpdatatable id=552 table_view=regular]

Figures may fluctuate due to rounding; Green represents an increase from the previous update, while red represents a decrease. Source: Company reports/S&P Capital IQ/Coresight Research

Note: The index includes new weightings and methodologies for sales capacity and product mix starting in July 2020.

Note: The index includes new weightings and methodologies for sales capacity and product mix starting in July 2020. Source: Coresight Research [/caption] The main driver of higher RRI scores has been sales capacity, which has increased over the past six months due to store reopenings, but some stores are temporarily closing again as outbreaks occur in certain areas. Financial health was flat in November. Consumer shopping preferences in October showed improvements in the “buy more/buy less ratios” of beauty, electronics and food, with a slight decline in furniture, according to our recent proprietary survey of US consumers. November RRI Outlook November RRI scores could decrease in the next month, owing to declines in financial health from upcoming earnings reports, as retailers absorb losses due to low sales volumes now that the holiday retail season is taking place in earnest. Sales capacity figures are approaching 100%, but some retailers have temporarily closed stores again in some areas of the US due to renewed coronavirus outbreaks. Shopping preferences are likely to shift toward essentials again, as consumers stock their pantries in anticipation of future outbreaks and due to anticipated unrest following the US presidential election. We are forecasting a 5% increase in holiday US retail sales, which will have an impact on retailers’ financials in the quarter ending January 2021. Top 10 Retailers by RRI Ranking Figure 2 presents the 10 retailers that rank highest in our index as of the start of November 2020. The overall changes in most of the top 10 RRI scores were modest, with nine of the companies retaining a top-10 ranking since last month, due to a lack of recent financial data and little change in the percentage of stores open.

Figure 2. Changes in Retail Robustness Index: Top 10 Retailers [wpdatatable id=551 table_view=regular]

Note: Differences in score changes are rounded. Source: Coresight Research Commentary on Score Changes Some retailers saw more pronounced score changes, which we outline below.

- Gildan Activewear (decrease of 6 points): The score decreased due to a decline in financial health, more than offsetting an increase in product mix.

- Under Armour (increase of 4 points): The score increased due to increases in sales capacity, product mix and management tenure.

- Crocs (increase of 4 points): The score increased due to increases in financial health and product mix.

- Sprouts Farmers Market (increase of 3 points): The score increased due to increases in financial health and management tenure.

- Canada Goose (increase of 3 points): The score increased due to increases in product mix and management tenure.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

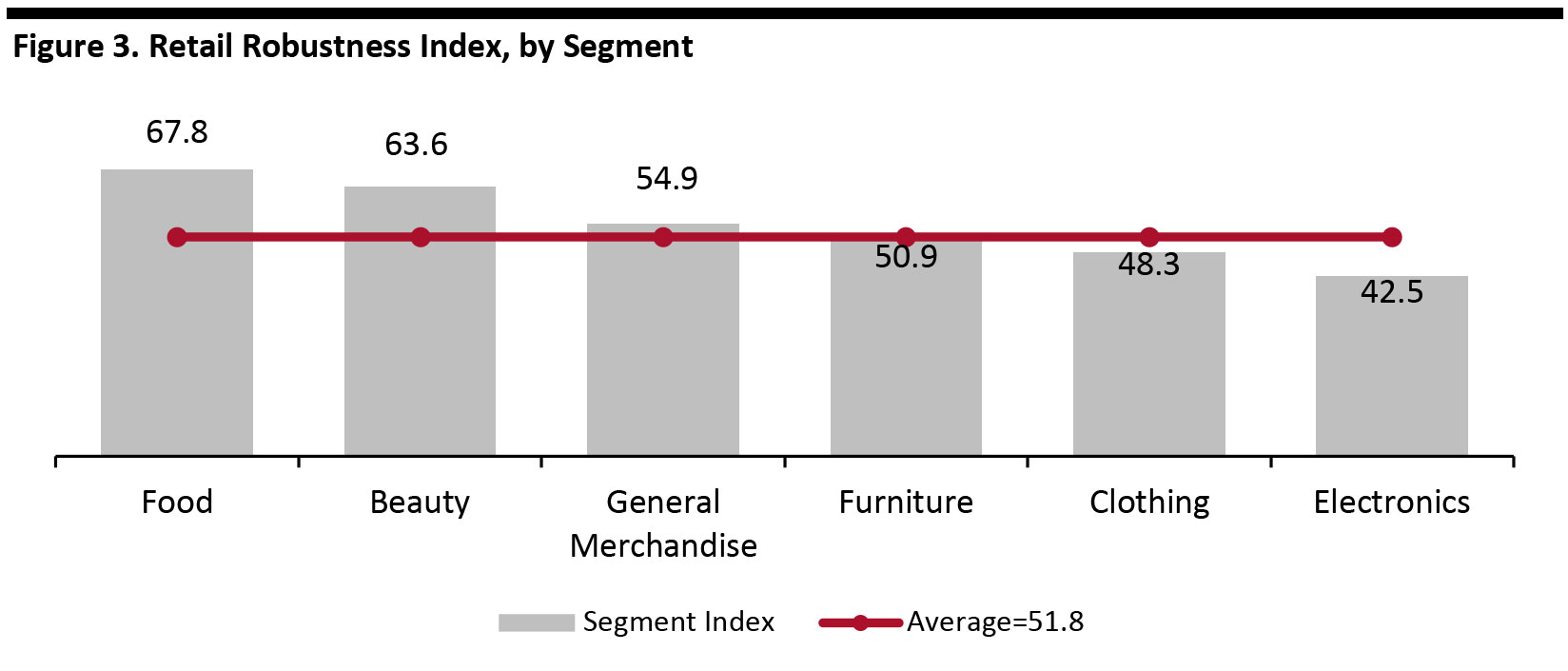

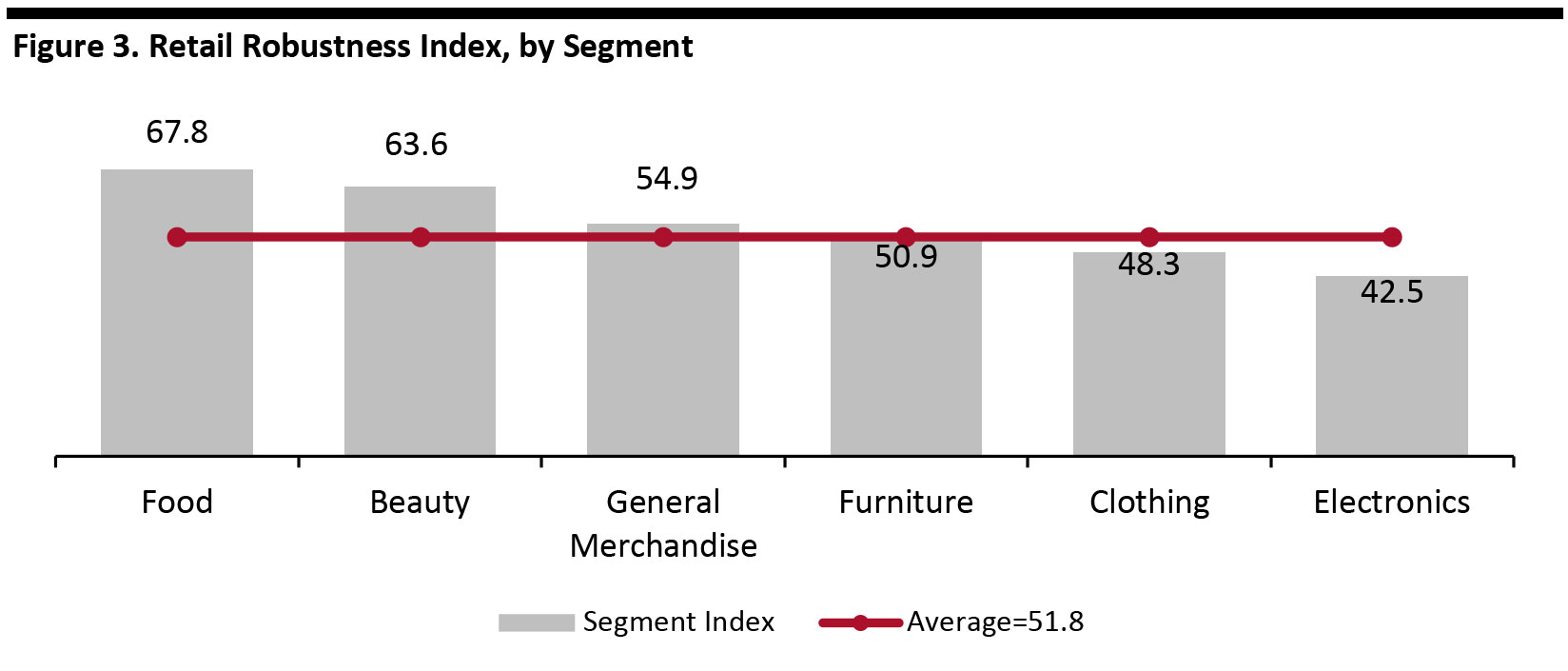

- Food ranks the highest due to its high product mix and availability since it is an essential category.

- Beauty has moved above the average, with the share of consumers buying less beauty having hit a new low.

- Electronics and clothing rank below average due to consumers currently purchasing less in these product categories compared to before the pandemic.

Figure 4. Coresight Research Retail Robustness Index: Components and Weighting [wpdatatable id=453 table_view=regular]

Source: Coresight Research A more detailed discussion of the index methodology is included in the appendix of this report. Additional notes on the Coresight Research Retail Robustness Index:

- The index is a model for retailer robustness based on selected weights and factors and relies on certain assumptions and estimates.

- The environment is evolving dramatically at a fast pace: Figures are thought to be accurate as of writing but may change as companies continue to report quarterly earnings.

- The index is not a predictor of investment performance. Retailers with higher financial-health scores are much less likely to file for bankruptcy than retailers with low scores.

Figure 5. Coresight Research Retail Robustness Index: Full List [wpdatatable id=552 table_view=regular]

Figures may fluctuate due to rounding; Green represents an increase from the previous update, while red represents a decrease. Source: Company reports/S&P Capital IQ/Coresight Research

Appendix

Retail Robustness Index Methodology The individual components are discussed further below.- Retailer financial health (40%): Represents a retailer’s financial state and ability to handle financial challenges.

- Sales capacity (20%): Represents a retailer’s ability to sell products.

- Product mix (20%): Determines the relative benefit of a retailer’s product categories.

- Management tenure (20%): Reflects the number of years that the CEO has served in the position.