Introduction

Mass store closures, soaring online sales and changing shopper expectations testify to the rapidly shifting nature of retail. Our

Retail Reworked series of reports has considered recent changes in spending trends and consumer demand, with a focus on the impact that digital channels and services are having on retail. Previous reports in the series have outlined the shift in spending from retail to alternatives such as rental, digital services and leisure categories and examined consumers’ willingness to adopt resale and subscription offerings. In this report, we conclude the series by exploring the future role of the physical store, as these changes will surely continue to impact brick-and-mortar retail in the coming years.

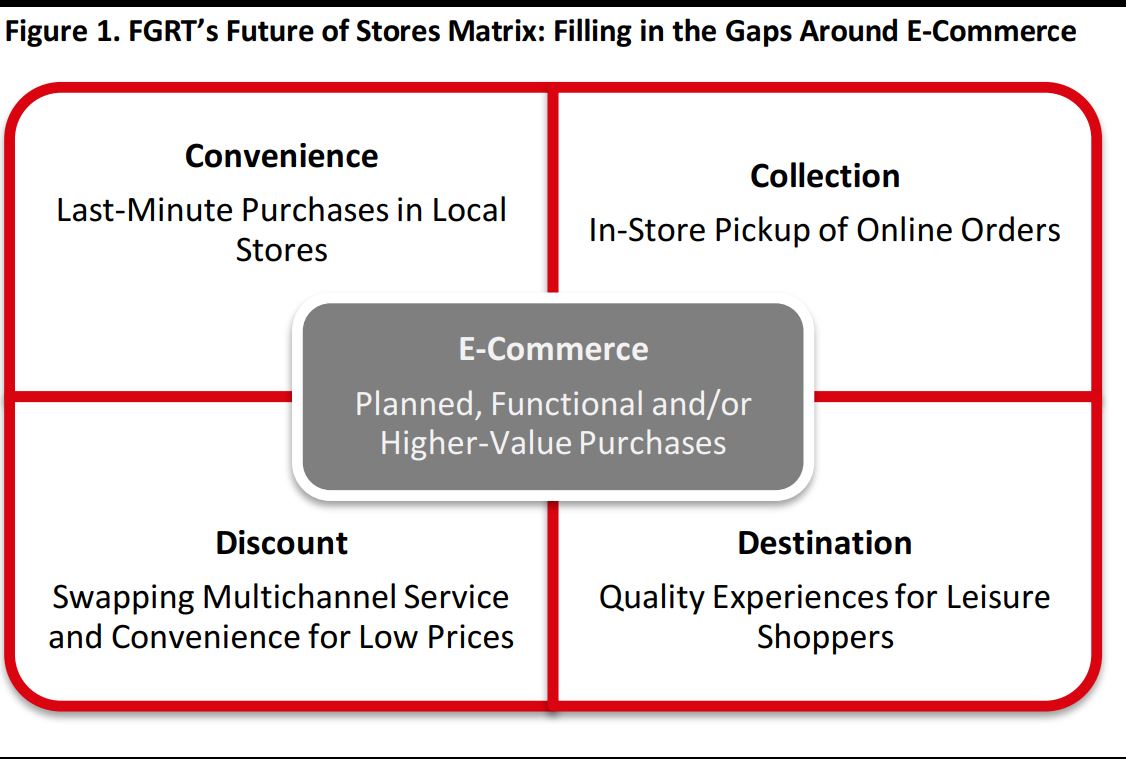

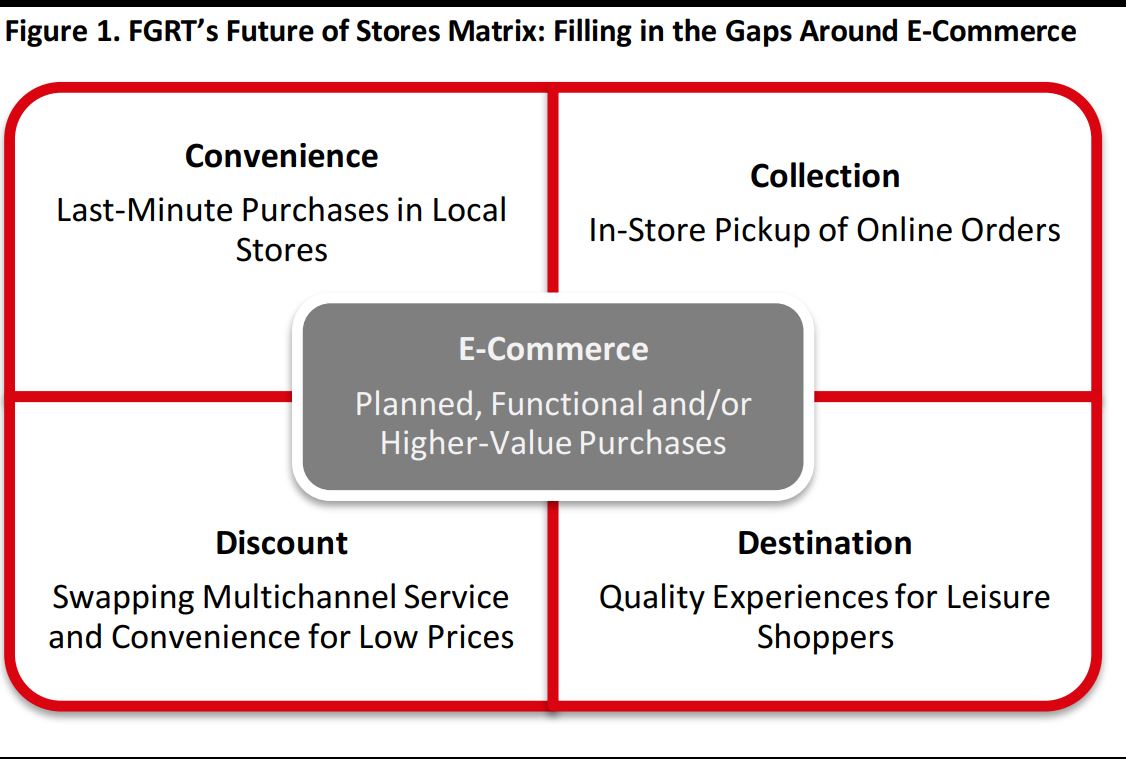

Stores Must Fill the Gaps Around E-Commerce

We expect e-commerce to continue to grow its share of retail sales in the coming years as it peels away substantial volumes from store-based retailers, mainly in nonfood categories. In the UK, the online channel is already relatively mature, and we estimate that it captures about half of all spending on consumer electronics and about a quarter of all spending on clothing and footwear. We think that e-commerce could realistically

capture 40% or more of all clothing and footwear sales in both the US and the UK in the 2030s.

Inevitably, however, e-commerce penetration will vary by type of product and type of purchase. We think that e-commerce is likely to capture the largest share among those purchases that are:

- Planned—because shoppers have to build in the delivery time when ordering items online, even if delivery is on the same day.

- Functional—repeat purchases and “chore” purchases fit well with the inherently time-efficient nature of e-commerce.

- Higher value—consumers face high cost barriers when purchasing a low-value item online for home delivery, and those barriers may increase as more retailers focus on making e-commerce profitable.

This leaves physical stores to fill in the gaps for consumers whose shopping mission would not be best served by e-commerce. Specifically, we see opportunities for physical stores that focus on one or more of the following propositions: convenience, collection, discount or destination.

Source: FGRT

Convenience, Collection, Discount, Destination

Convenience

Stores that cater to time-pressed shoppers looking for immediate purchases will be among the most resilient physical formats. Online delivery options will get faster, and more e-commerce operators will offer same-day, two-hour and one-hour delivery, but shoppers will still encounter barriers to buying online when they need products fast. Consumers outside dense urban areas are already much less likely to be served by rapid delivery services, and such services still tend to carry significant charges, which makes them unviable for lower-value purchases and for frugal shoppers.

The demand for convenience will be most evident in grocery retailing: shoppers will always want to be able to replenish the basics in their cupboards and choose dinner for tonight on short notice. But shoppers also often find themselves needing unexpected gifts and replacement items, and these needs, along with treats bought on impulse, will drive demand for last-minute, store-based purchases across much of nonfood retail.

Consumers’ desire for convenience implies sustained demand for local shopping centers that are home to grocery retailers and other retailers of everyday goods and lower-cost products, including dollar stores and mass merchandisers.

Collection

Brick-and-mortar retailers continue to report strong—and, in many cases, strengthening—demand for in-store collection of online orders. In the US, consumer uptake of in-store collection is already substantial, and it continues to grow apace. A JDA consumer survey published in July 2017 found that 50% of US consumers had used buy-online, collect-in-store services in the past 12 months, up from 46% in 2016 and 35% in 2015.

Kohl’s and other retailers are reporting uplifts in the proportion of online orders that shoppers are choosing to collect in-store. Macy’s has noted the benefit of incremental in-store purchases by shoppers coming in to collect online orders. And in August 2017, JCPenney noted that its in-store pickup service was driving 600,000 visits to its stores each week.

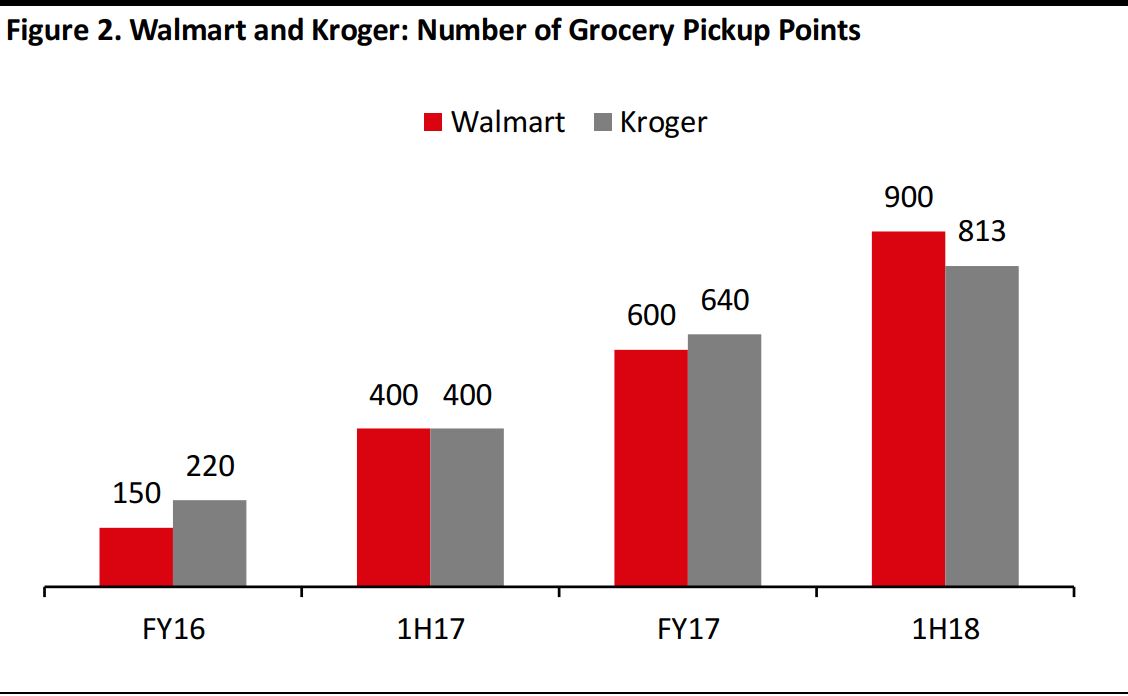

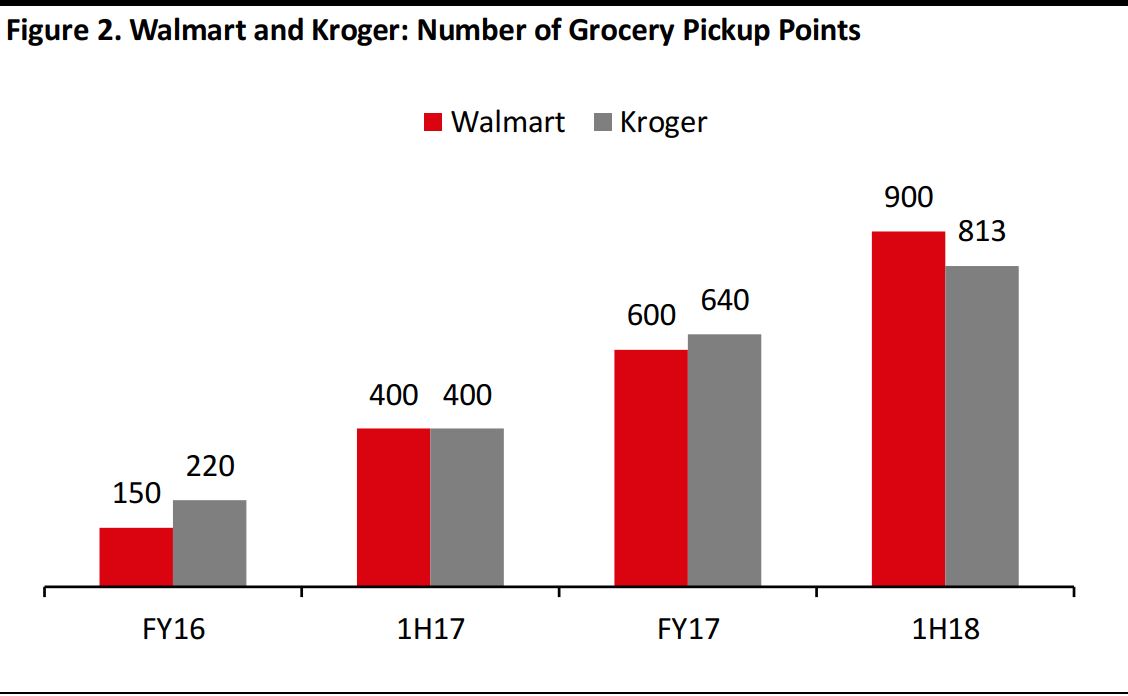

Anticipating sustained growth in demand for collection, US retailers are building capacity. For example, grocery retailers are currently racing to roll out pickup points as collection, rather than delivery, is becoming the default option in the nascent US online grocery market.

Fiscal years ended January, so FY17 was the year ended January 2017. Kroger includes Harris Teeter and Fred Meyer.

Source: Company reports

Discount

Dollar stores/pound shops, off-price retailers, grocery discounters, warehouse clubs and other low-price stores such as Primark continue to operate largely or solely offline. Even if more of these types of stores launch e-commerce operations in the coming years, we expect that their sales will still be disproportionately store-based due to customer demographics, customer resistance to delivery charges and the challenges of replicating their retail experiences on the Internet.

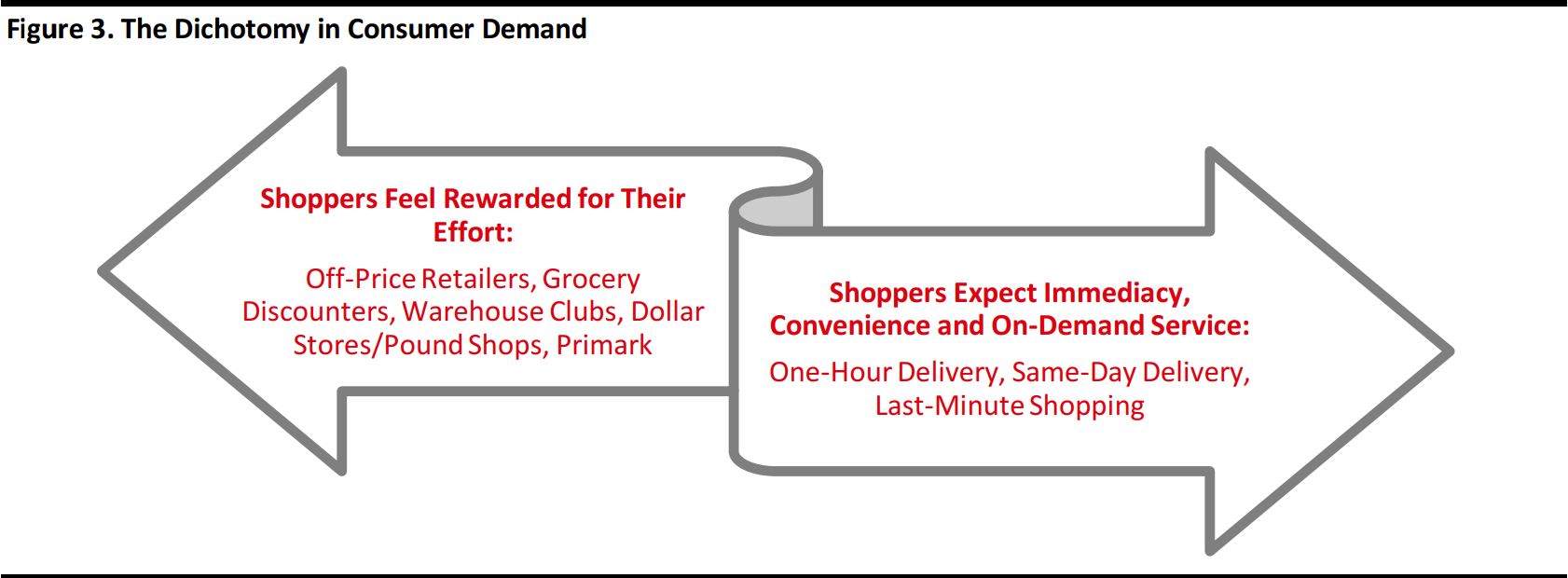

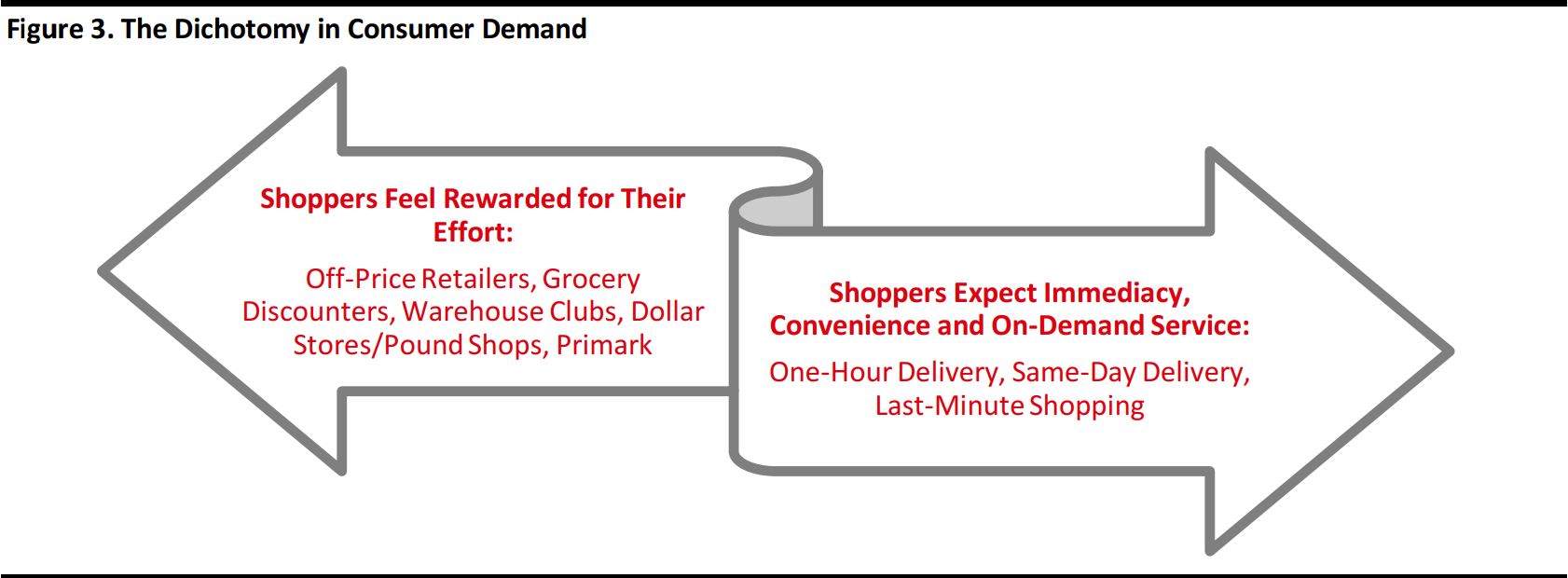

In the

second report in this series, we outlined a polarization in consumer demand: even while shoppers are demanding immediacy and convenience in the form of ultrafast delivery and other omnichannel services, they are flocking to value-positioned stores—such as off-price, grocery discount and dollar stores, as well as warehouse clubs—that seemingly offer the antithesis of convenience. These types of stores typically offer no, or only limited, e-commerce options, more basic in-store environments and more limited customer service.

Source: FGRT

Retailers that are expanding, such as Dollar General and T.J.Maxx, are apparently anticipating no letup in demand for “inconvenient” discount shopping formats. And while some of this discount hunting activity may move online eventually, the added costs of e-commerce—notably picking and delivery—are a strong mitigating force against the wholesale migration of discount shopping to the Internet.

Destination

As e-commerce continues to capture more and more functional shopping, leisure shopping remains one of the most obvious areas of opportunity for physical stores. Accordingly, many long-standing retailers and shopping center owners are now talking about investing in better experiences that cater to consumers looking for an antidote to the more pedestrian experience of online shopping.

Real estate owners are adding restaurants,

food halls, entertainment venues and fitness centers to their shopping centers in order to establish them as destinations for leisure visitors. In some cases, mall owners are filling anchor spaces vacated by department stores with these kinds of services and offerings.

Similarly, retailers are innovating to drive traffic by filling stores with experiential offerings and services that help build shops into destinations.

Restoration Hardware, for example, has added restaurants in selected stores and Sephora now offers beauty services in some stores.

Macy’s even launched a temporary Samsung digital experience center in its Herald Square flagship for the 2017 holiday shopping season.

It is not only US retailers that are making efforts to turn their stores into destination spots.

In Hong Kong, mall owners are using pop-up stores to add excitement and retailers are driving traffic by positioning themselves as experiential hubs for engagement and community interactions.

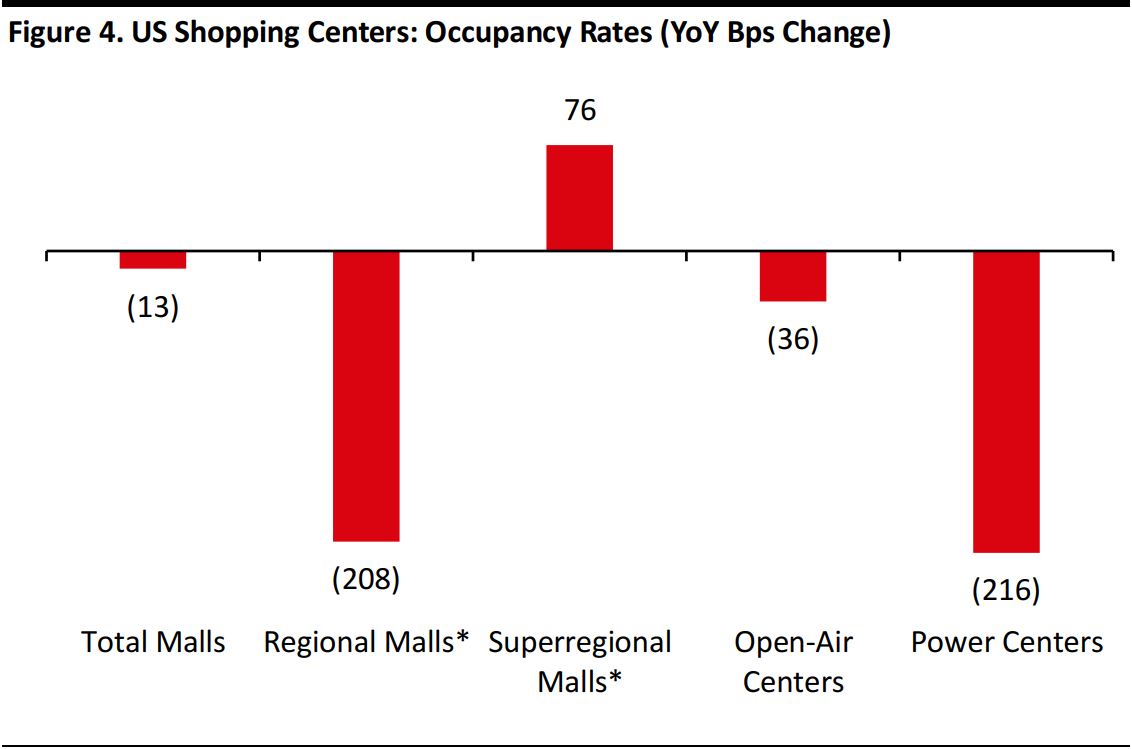

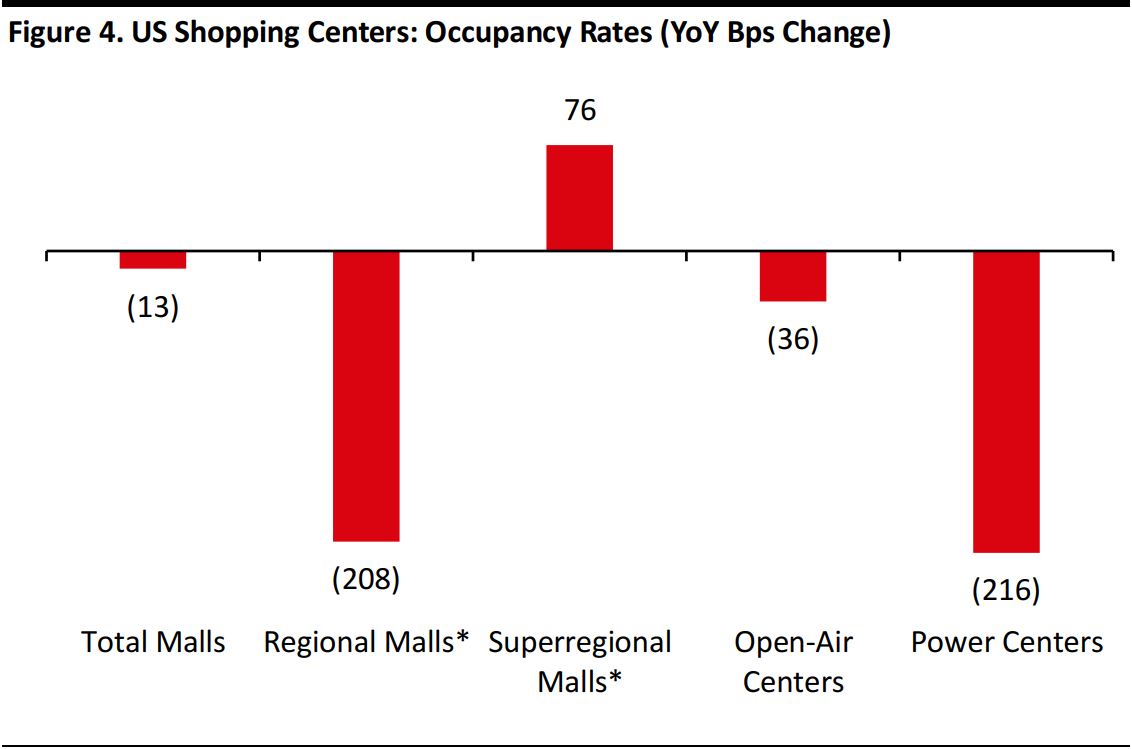

Shopping centers that offer quality experiences and incorporate a broad mix of retail and leisure offerings are being rewarded with sustained shopper traffic flows and higher occupancy rates:

On its midyear conference call, shopping-center owner GGP pointed to a 1.4% year-over-year increase in traffic at its top-tier, class A malls.

- The firm noted that its B+ malls had seen positive traffic trends and that its B malls had seen flat traffic trends, which implies a correlation between quality and shopper traffic growth.

- As we chart below, the International Council of Shopping Centers (ICSC) recorded that superregional malls—which are destination centers of 800,000 square feet or more—bucked the general trend of declining occupancy rates in 2017.

As of September 2017

Open-air centers are general purpose centers and include strip malls, neighborhood centers and community centers. Power centers have category-dominant anchors and only a few small tenants; they are not included within the open-air centers category.

*Regional malls and superregional malls are subsets of total malls.

Source: ICSC/FGRT

As of September 2017

Open-air centers are general purpose centers and include strip malls, neighborhood centers and community centers. Power centers have category-dominant anchors and only a few small tenants; they are not included within the open-air centers category.

*Regional malls and superregional malls are subsets of total malls.

Source: ICSC/FGRT

Further Reading

FGRT publishes frequently on the shifts in brick-and-mortar retail, and readers may be interested in these previously published reports:

What Retail Apocalypse? Reviewing Trends in US Brick-and-Mortar Retail

Deep Dive: The Mall Is Not Dead, Part 1 and

Part 2

The Tenant of the Future: Insights from the Hong Kong Market

Takeaways from the ICSC New York Deal Making Conference: Day One,

Day Two and

Day Three

Macy’s Flagship Creates a New Retail Experience with Samsung Smart Store

Weekly Store Openings and Closures Tracker 2018 #6

As of September 2017

Open-air centers are general purpose centers and include strip malls, neighborhood centers and community centers. Power centers have category-dominant anchors and only a few small tenants; they are not included within the open-air centers category.

*Regional malls and superregional malls are subsets of total malls.

Source: ICSC/FGRT

As of September 2017

Open-air centers are general purpose centers and include strip malls, neighborhood centers and community centers. Power centers have category-dominant anchors and only a few small tenants; they are not included within the open-air centers category.

*Regional malls and superregional malls are subsets of total malls.

Source: ICSC/FGRT