Executive Summary: Pick-and-Mix Shopping

This is the second report in our

Retail Reworked series. Here, we discuss three prominent trends in shopper behavior and consider the drivers behind them:

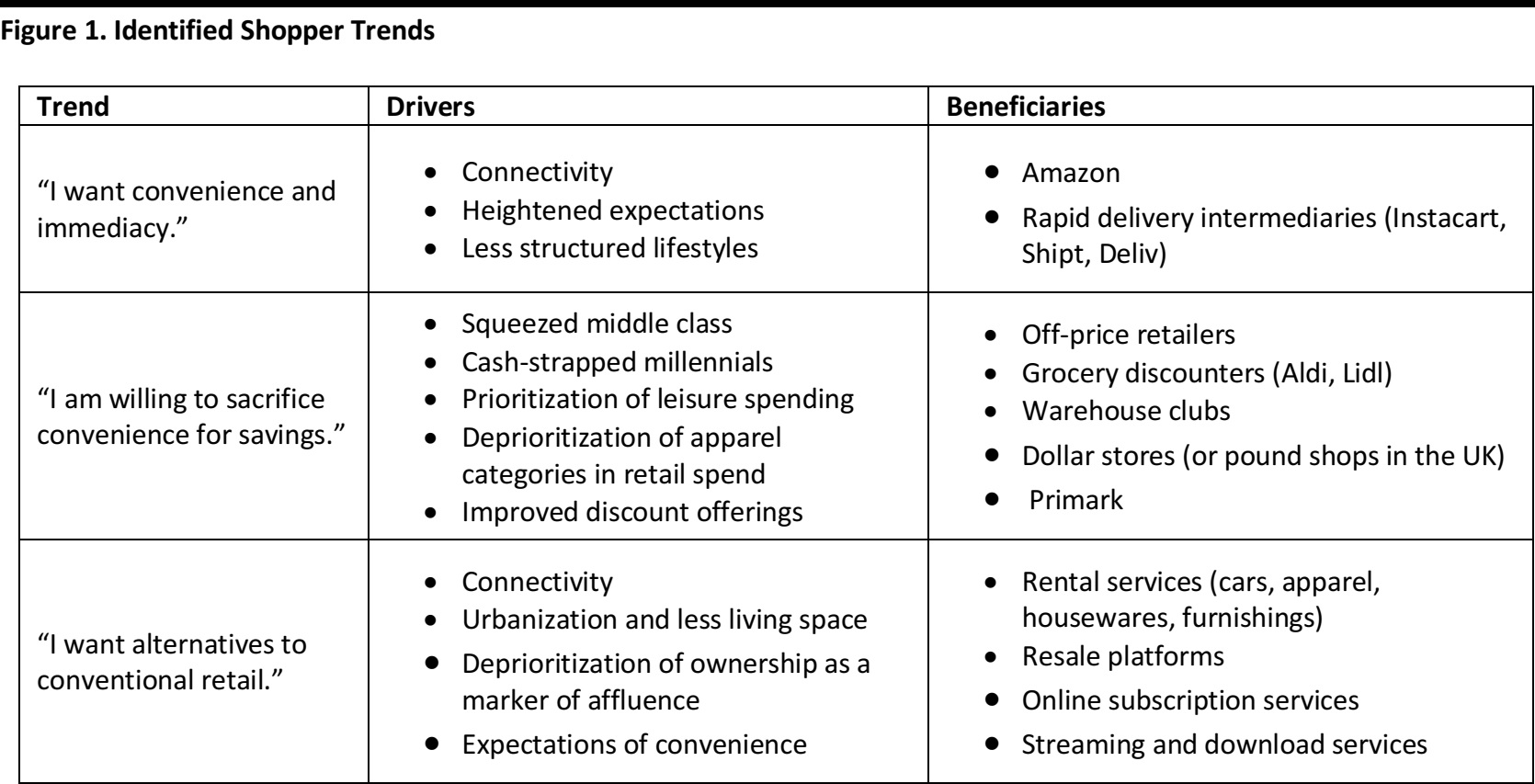

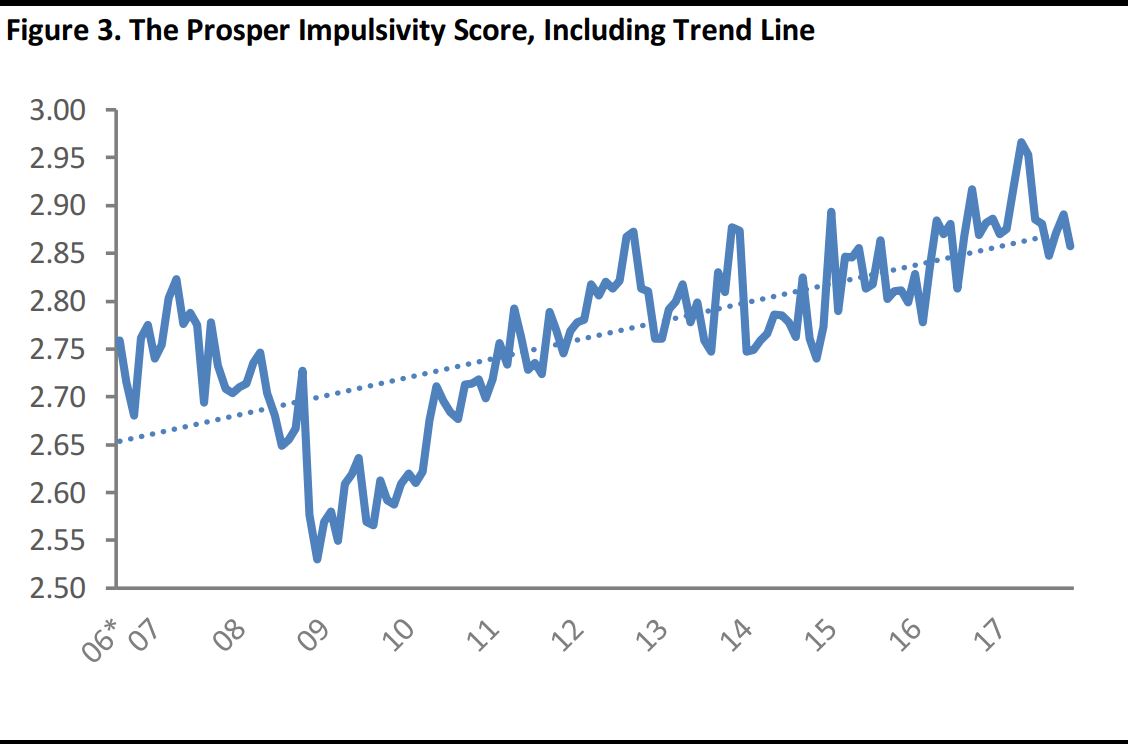

- “I want convenience and immediacy.” Today’s shoppers commonly expect retailers to deliver greater convenience and immediacy than in the past, such as through ultrafast delivery of online purchases.

- “I am willing to sacrifice convenience for savings.” Shoppers have flocked to stores that seemingly offer the antithesis of convenience, such as off-price stores, grocery discount stores, warehouse clubs and dollar stores. These types of stores typically offer no, or very limited, e-commerce options and their in-store environments and services are usually more basic than those offered by other types of retailers.

- “I want alternatives to conventional retail.” Consumers are also embracing alternatives to traditional retail. Surveys show that a significant proportion of consumers are interested in renting everything from furniture to fitness equipment and in trying services such as beauty box subscriptions.

We summarize these trends, their drivers and their likely beneficiaries in the table below.

Source: FGRT

Alternatives such as rental and subscription services are still emerging as challengers to traditional retail. We think established retail names will need to watch these segments carefully, and be ready to cater to the evident demand for services such as fashion and furniture rental and beauty box deliveries.

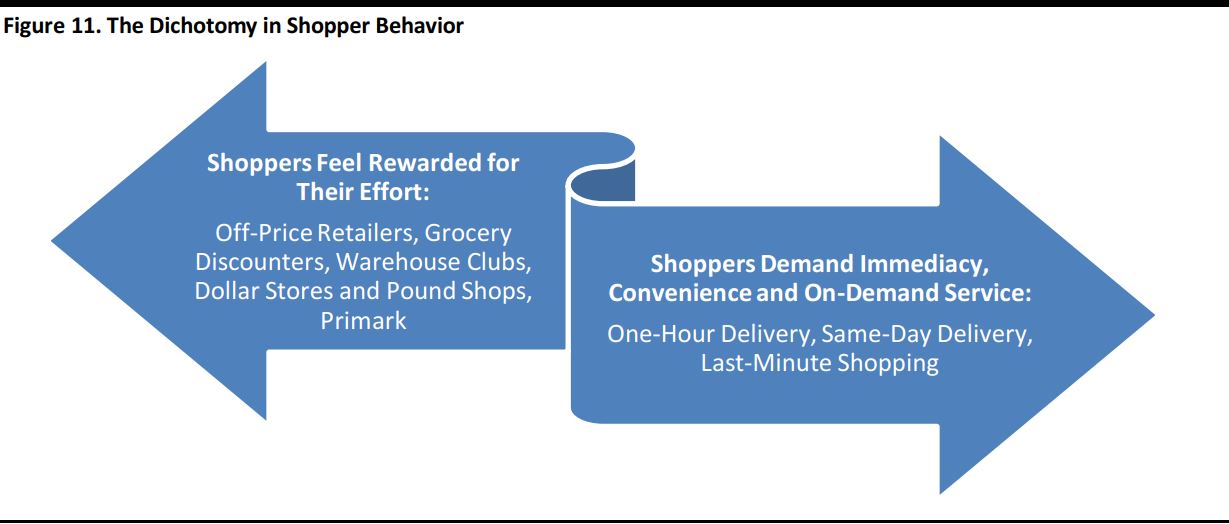

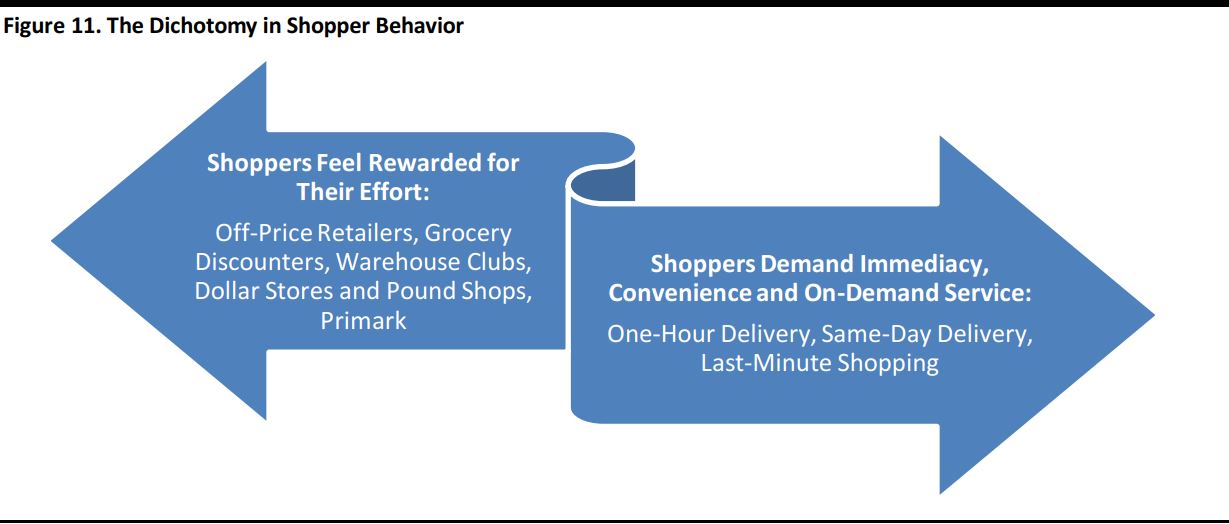

In the immediate term, we see a dichotomy in consumer behavior that will impact retailers more directly. Shoppers are demanding retailers spoil them with services such as one-hour delivery, yet they are also willing to trade such conveniences for savings

if they can do so on their own terms. Many shoppers are willing to forgo such services if they can choose when and for what categories they will make a trade-off in order to save money.

We see this as shoppers adopting a “pick-and-mix attitude” that blends demand for immediacy with a feeling that they are getting rewarded when they put effort into their shopping.

Introduction: Consumer Behavior Is the Push Factor Reworking Retail

In our three-part

Retail Reworked series, we look at changes in spending trends, consumer demands and channel adoption. Our first report quantified in dollar terms some of the competing segments that are pulling spending away from traditional retailers. In this second report, we consider how consumer behavior is changing, drawing largely on consumer survey data. In turn, we consider the underlying drivers of changes in shopper behavior.

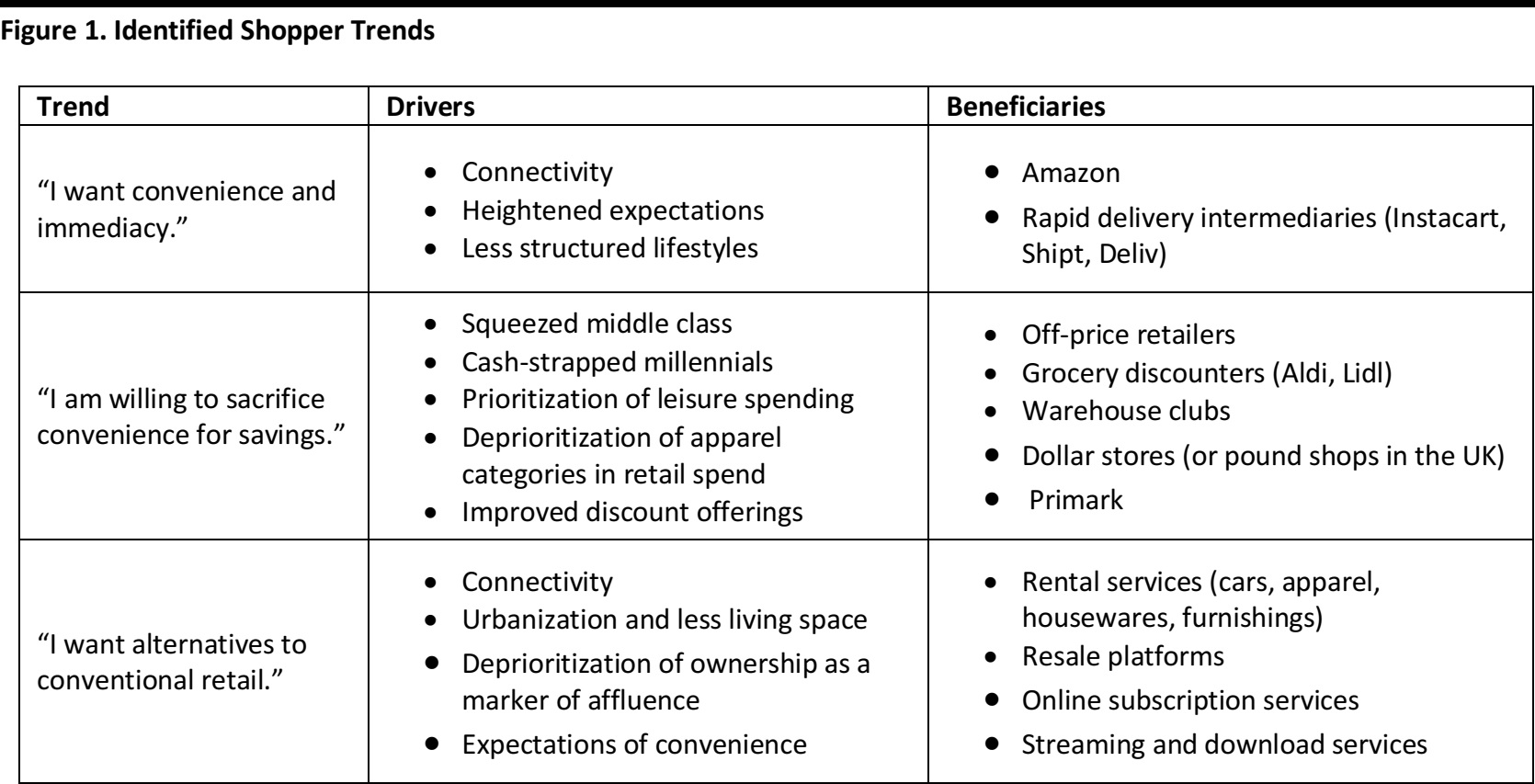

We begin by restating the fundamental truth: retail is driven directly by consumer demand. This means that changing consumer demands and behaviors comprise the “push factors” behind the rapid developments we are seeing in retail. These behaviors work in conjunction with the “pull factors” of technology and connectivity, which are driving changes that range from an explosion in rapid delivery options to consumers redirecting their spending away from purchasing goods and toward renting them.

Source: FGRT

In our first report in this series, we focused on the US market. In this report, we bring in data points from the UK market, too. The UK sees higher e-commerce penetration rates than many other markets do, and changes in consumer demand in the UK have fueled the growth of segments such as discount stores and convenience stores and driven the rise of retailers such as Primark. So, what we see in the UK may well be replicated elsewhere eventually.

The following sections focus on three aspects of the consumer mind-set that are changing shopper behavior across markets:

- “I want convenience and immediacy.”

- “I am willing to sacrifice convenience for savings.”

- “I want alternatives to conventional retail.”

“I Want Convenience and Immediacy.”

Shoppers Are Impatient and Impulsive

It is something that we all recognize: shoppers are less patient and more impulsive than ever. When they decide they want something, they want it

now. For instance, shoppers increasingly expect same-day or even one-hour delivery instead of being willing to wait for days or weeks for a delivery. In addition, in the offline world, a growing number of consumers appear to be shopping for groceries at the last minute instead of planning ahead to do a big weekly grocery shop like they used to.

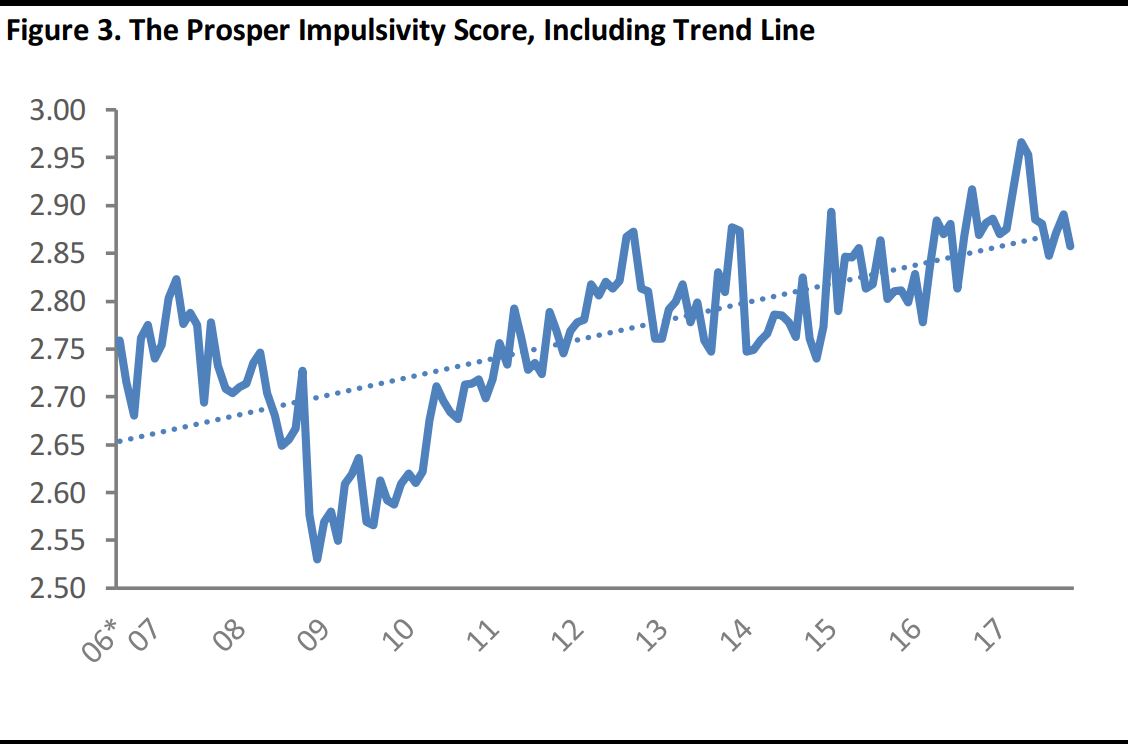

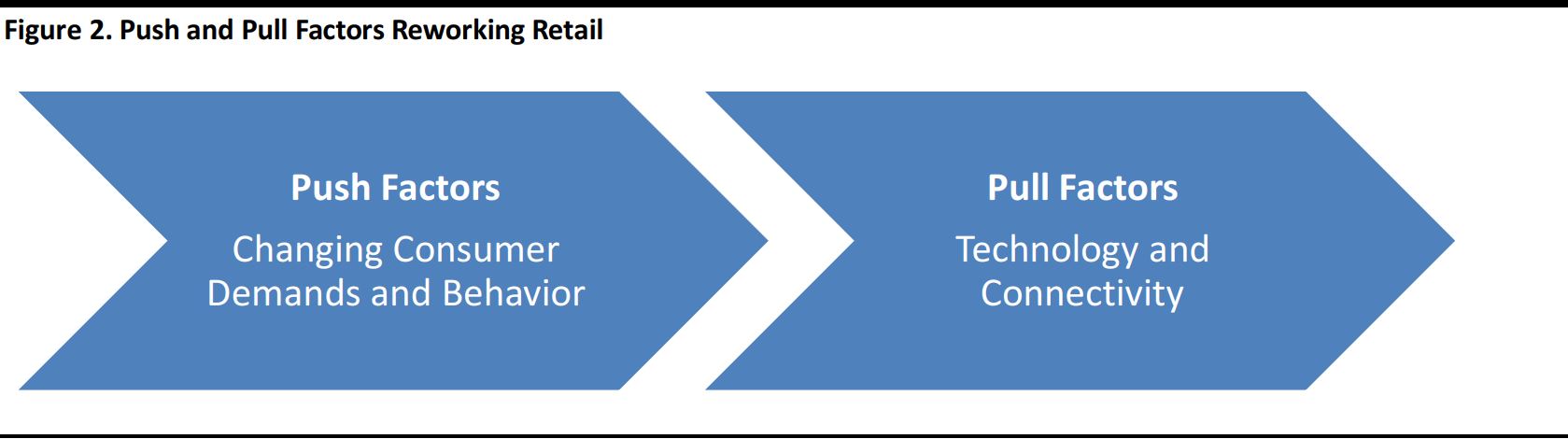

Below, we chart the Prosper Impulsivity Score from Prosper Insights & Analytics, which indicates how much, or how little, consumers are living in the moment when it comes to their spending habits. This measure of shoppers’ impulsivity is based on monthly surveys that ask consumers to what extent they agree with the statement “Live for today because tomorrow is so uncertain.”

Even if we ignore the impact of the Great Recession and look at the survey trend on either side of 2008, it is apparent that shopper impulsivity has increased. We think that this has resulted in a structural change in how people approach consumption.

The Prosper Impulsivity Score is calculated using a weighted average based on a five-point scale. The closer the score is to five, the more likely consumers are to agree with the statement “Live for today because tomorrow is so uncertain.” The closer the score is to one, the more likely they are to disagree. The trend line has been added.

*In 2006, the survey was conducted every three months beginning in April; since January 2007, the survey has been conducted monthly.

Source: Prosper Insights & Analytics/FGRT

Heightened Expectations Underpin Rapid Delivery Rollout

Impulsive and impatient consumers are the push factor driving the rollout in rapid delivery options that we are seeing. According to a survey that consulting firm BRP sent to 500 North American retailers in July 2017, some 27% of retailers offer same-day delivery and a further 35% expect to start offering the service by mid-2019.

In November, Walmart partnered with Deliv to offer same-day delivery in the San Jose, California, area. Also in November, Albertsons became the latest big US grocery name to announce a tie-up with delivery firm Instacart, and Albertsons now plans to offer one-hour delivery from 1,800 stores by mid-2018. Aldi is also among those partnering with Instacart. Whole Foods Market invested an undisclosed sum in Instacart in 2016, when the two companies signed a five-year service agreement, according to tech news website Recode.

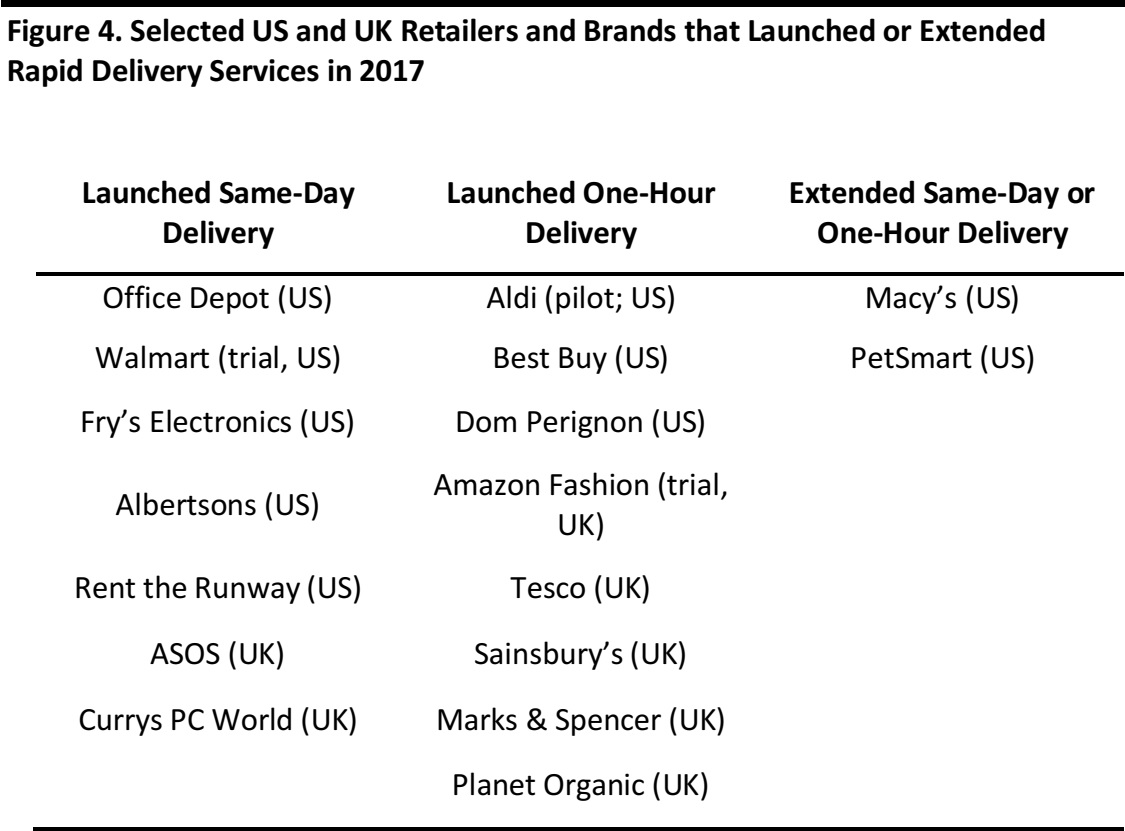

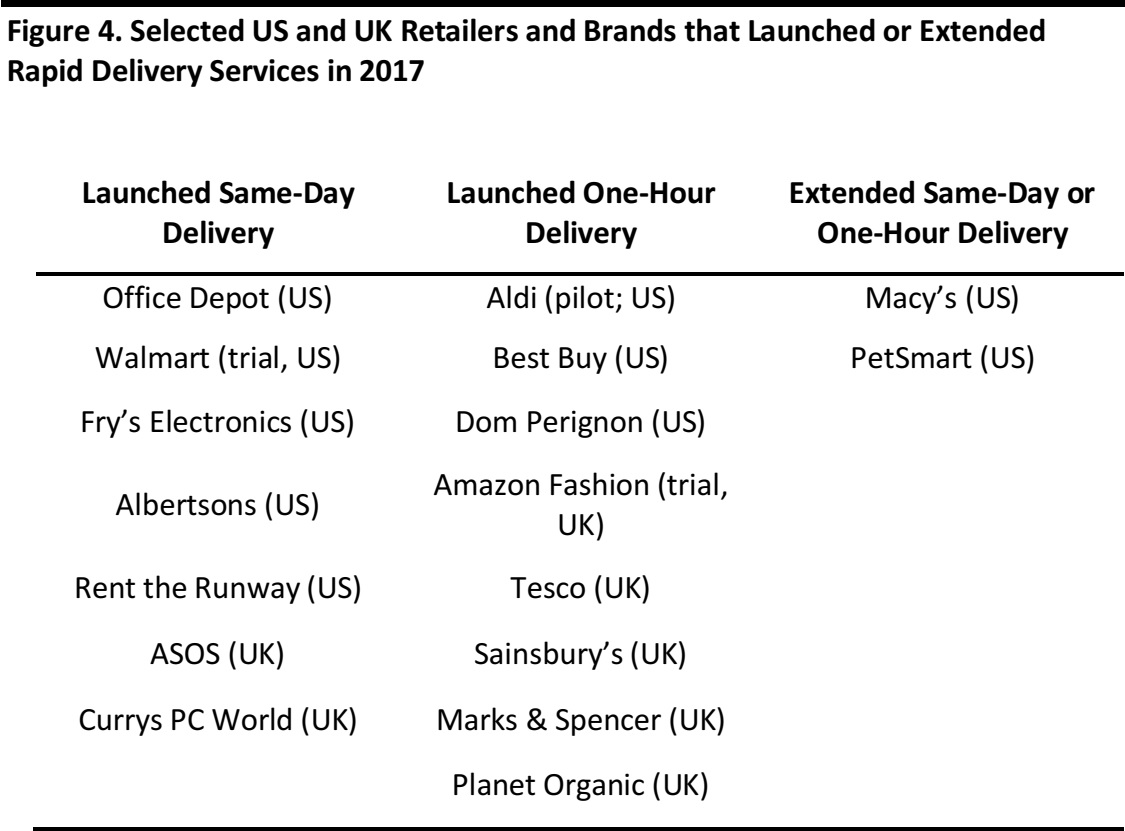

The table below lists major US and UK retailers and brands that have launched or extended rapid delivery services in 2017.

Source: Company reports

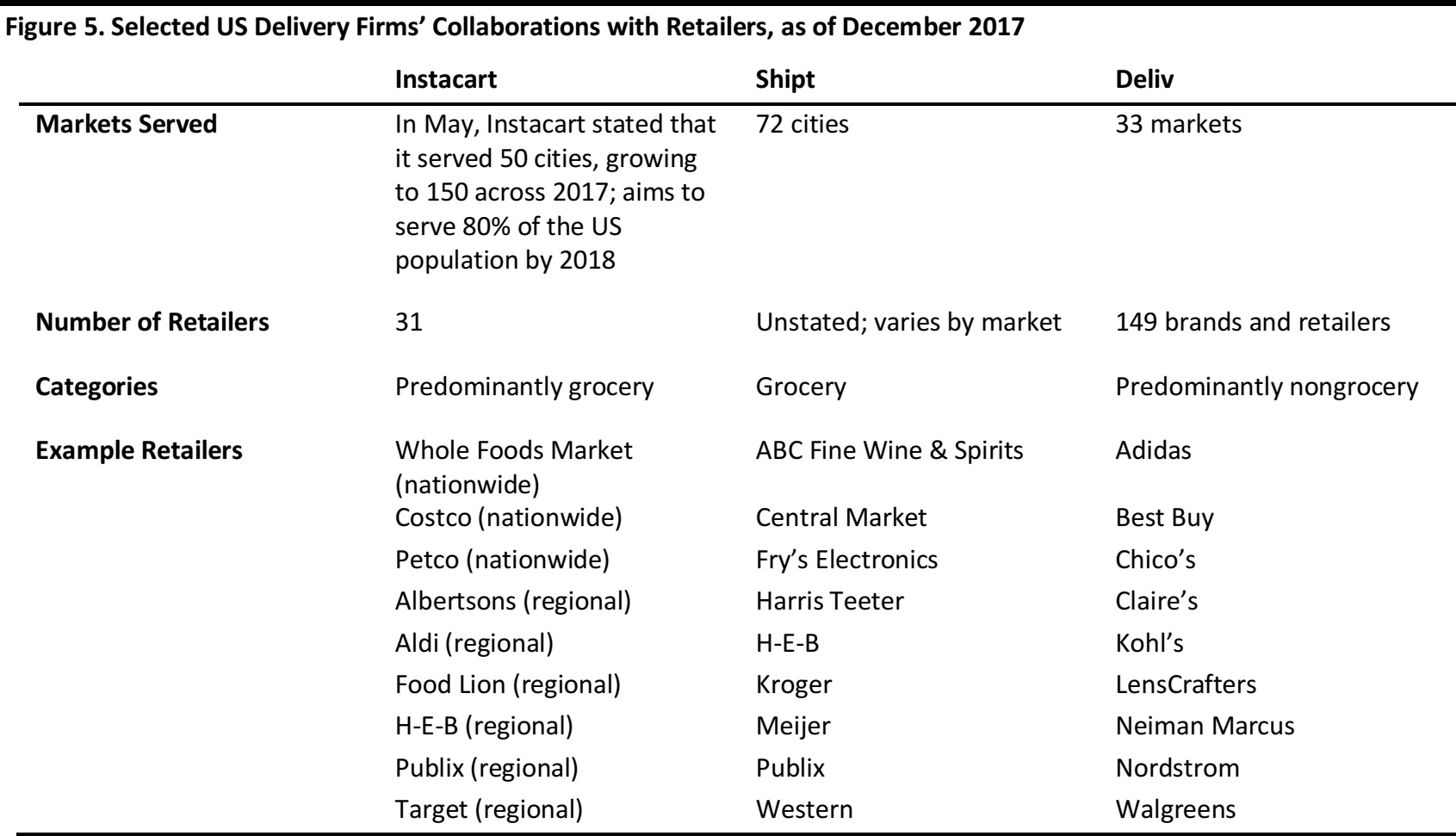

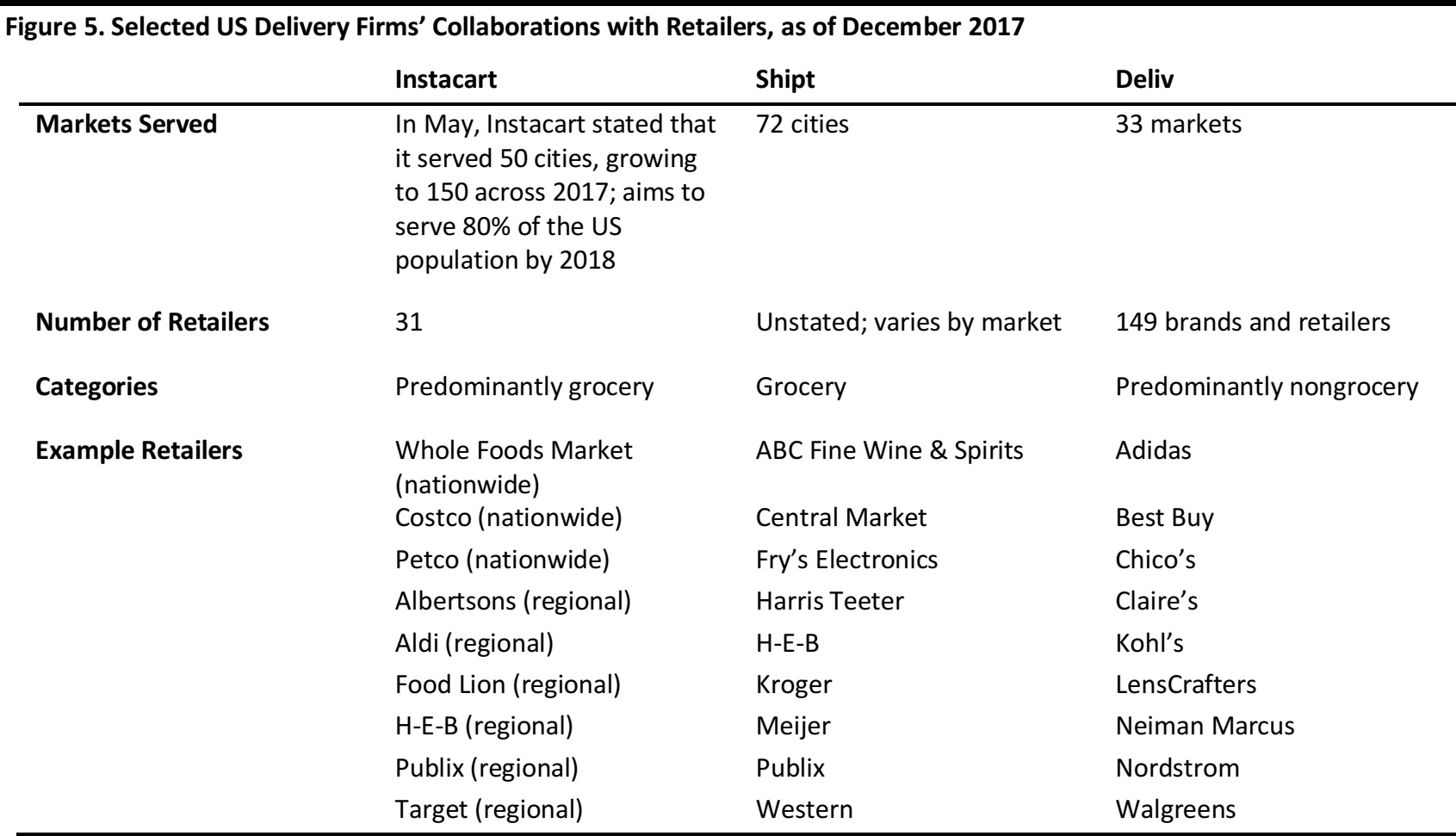

The table below provides key metrics on three firms that specialize in rapid delivery for retailers: Instacart, Shipt and Deliv.

As we finalized this report, Target announced that it is to acquire Shipt for $550 million in cash. The retailer said the acquisition will bring same-day delivery services for groceries, essentials, home goods and electronics to around half of Target stores by early 2018. Target will offer this service from the majority of its stores before the 2018 holiday season.

Source: Company reports

Demand for Convenience Changes Offline Shopping, Too

A number of delivery providers, such as Instacart and Shipt, have focused on the grocery category, which has seen particular consumer demand for greater convenience. This demand extends beyond shoppers’ desire for rapid delivery of their online orders, as we have seen consumers in various countries migrate gradually away from undertaking large, preplanned grocery shops and toward buying food at the last minute.

- This trend toward last-minute purchasing has been particularly prominent in the UK. British supermarket chain Waitrose recently surveyed consumers to gauge when they decide what they will have for dinner. Fully one-third of Brits surveyed said that they typically make this decision only after 4 p.m., and well over half said that they decide only at lunchtime or later.

- Waitrose also found that fully 65% of Brits regularly or occasionally visit a supermarket more than once per day. Survey respondents cited the fact that they think ahead less than they used to as one of the top reasons for these frequent grocery visits.

- According to grocery industry body IGD, Brits make, on average, 26 grocery shopping trips per month, split among formats such as superstores, convenience stores and grocery discounters.

As more consumers worldwide migrate to buying on demand, rather than planning their shopping trips in advance, we expect other markets to see similar patterns of usage in retail channels.

Drivers of Demand for Immediacy

So, if consumer demands comprise the push factor for changes in retail, what are the drivers behind it? We see three overriding factors underpinning shoppers’ demands for convenience and immediacy:

Greater connectivity: Connectivity has brought shoppers nearly unlimited product choice and access to on-demand services, often from Internet-only retailers for whom turning a profit is secondary to growing market share.

Higher expectations: The abundance of choice delivered by e-commerce and the emergence of higher-quality brick-and-mortar retailers have raised shoppers’ expectations. Amazon, with its continually growing service offering that now includes Prime, Prime Now and Dash buttons, is one example of a retailer continually innovating in order to meet shoppers’ increased expectations.

Less structured lifestyles: Consumers’ lifestyles are more diverse than in the past. For example, more people are choosing to remain single and there is now greater workforce participation among traditionally underrepresented groups. These changes have inevitably impacted consumers’ shopping habits, and a perceived paucity of time and a faster pace of life overall have fueled the demand for immediacy and last-minute shopping.

“I Am Willing to Sacrifice Convenience for Savings.”

Consumers Flock to “Inconvenient” Retailers

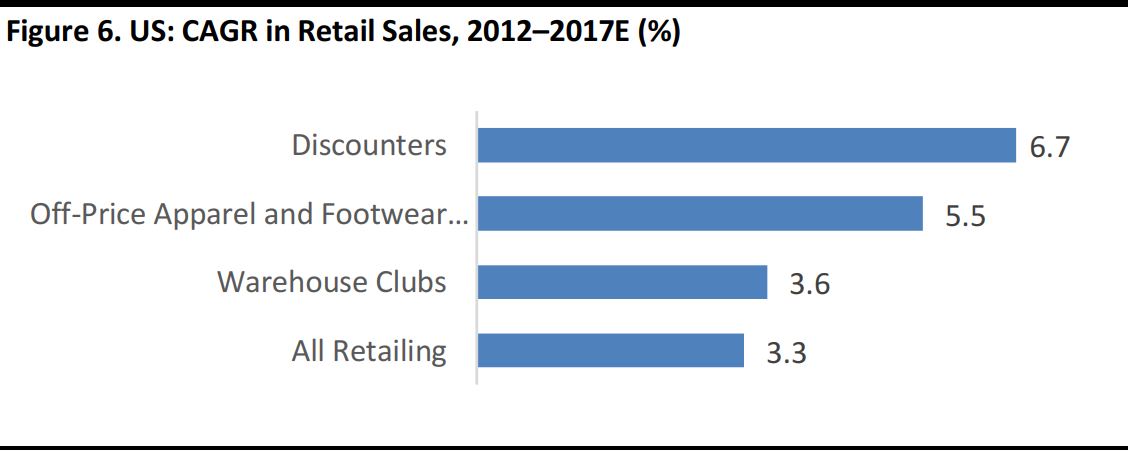

In direct contradiction to their demand for greater convenience and improved service offerings, shoppers have flocked to the types of retailers where service is minimal and where the shopper—not the retailer—is required to put in the legwork. In the US and a number of European markets, off-price retailers, grocery discounters, dollar stores and warehouse clubs have tended to grow much faster than major rivals in other retail segments. These retailers typically offer no e-commerce options, or only very limited ones, as well as no-frills stores with limited service propositions. In the case of the off-pricers, shoppers even have to search for the products they want. Despite the effort required at these “inconvenient” retailers, shoppers have embraced them due to the savings they offer.

Budget apparel specialist Primark is one example of a limited-service, offline-only retailer that has flourished in this consumer environment.

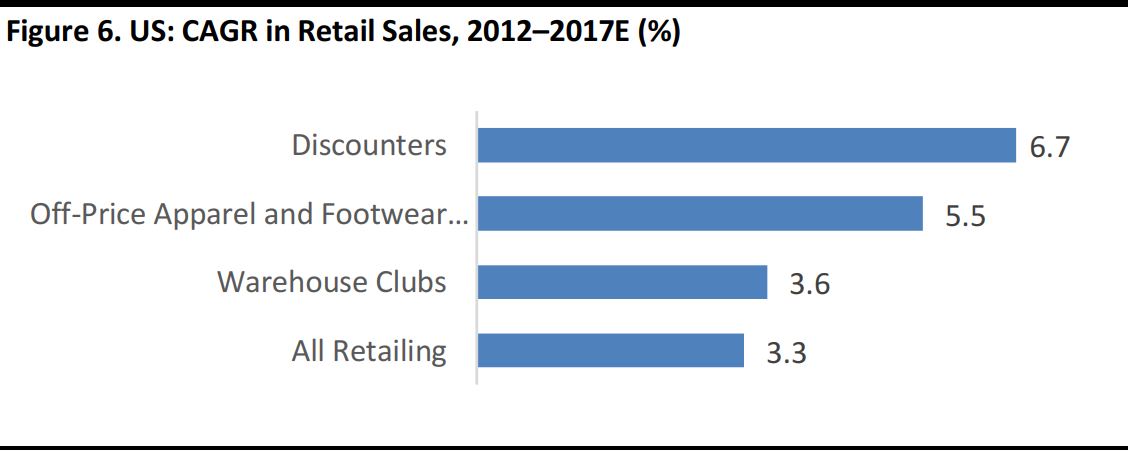

Source: Euromonitor International/FGRT

Higher-Income Consumers Contribute to This Trend

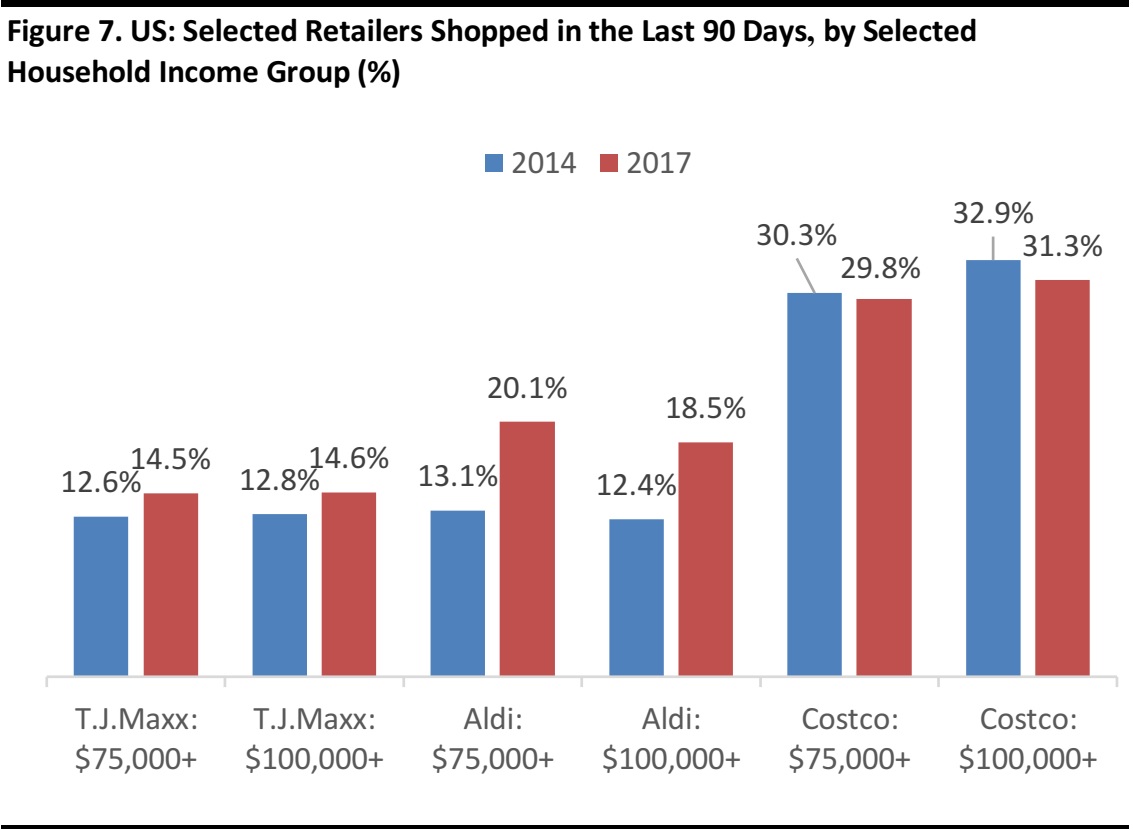

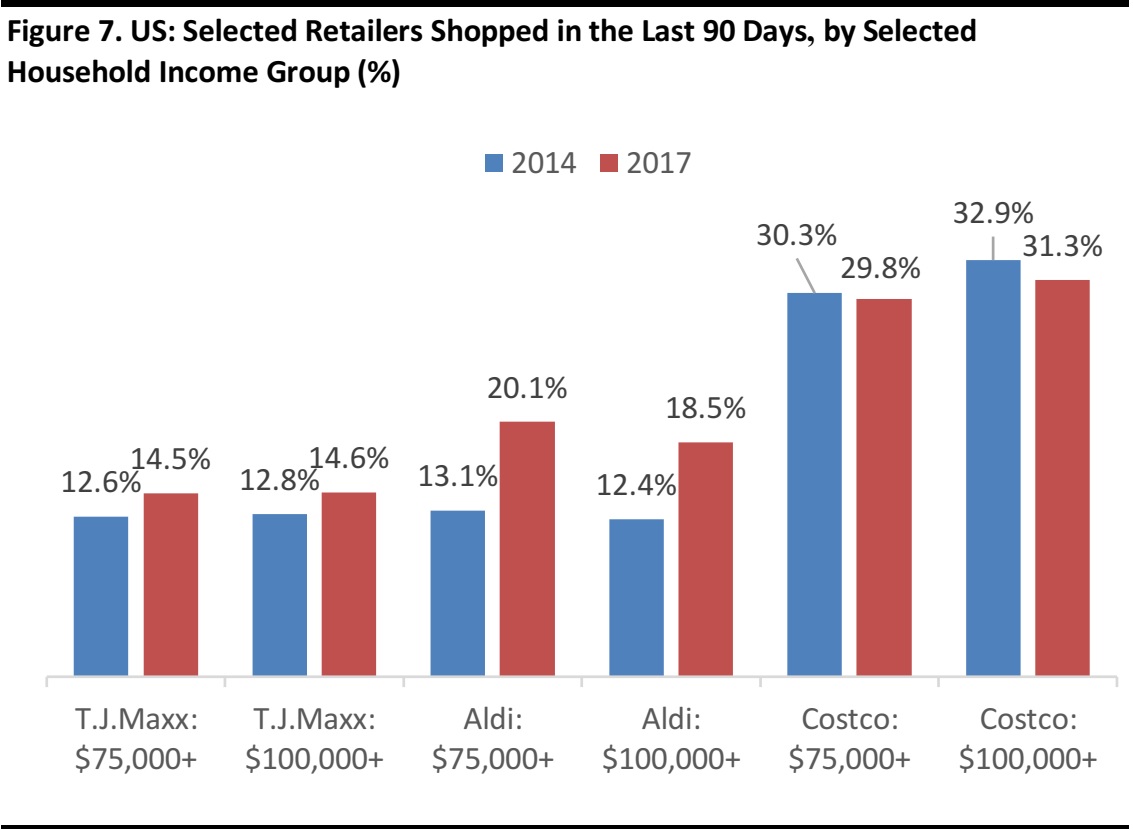

It is not only lower-income shoppers who are swapping convenience for savings by shopping at no-frills budget stores; higher-income shoppers are contributing to this trend, too. Our research partner, Prosper Insights & Analytics, conducted surveys of US consumers that revealed that the number of affluent customers who shopped at Aldi for groceries and at T.J.Maxx for women’s clothing grew more quickly between 2014 and 2017 than did the number of less-affluent customers. Over the period:

- Prosper recorded a seven-percentage-point increase among US households with incomes of $75,000 or more that said they shopped at Aldi versus a 5.2-percentage-point increase among those with household incomes of $35,000 or less.

- Prosper recorded a 1.8-percentage-point increase among US households with incomes of $75,000 or more that said they shopped at T.J.Maxx versus a 0.2-percentage-point increase among households with an income of $35,000 or less.

- Costco did not see a similar increase in shoppers who belonged to these higher-income groups, according to Prosper’s data. Shopper participation at Costco fell by half a percentage point among households with incomes of $75,000 or more between 2014 and 2017, while it rose by the same degree among households with incomes of $35,000 or less.

Below, we chart these changes in shopping rates among higher-income households.

Data for T.J.Maxx are for those who shopped the retailer for women’s clothing in the last 90 days; data for Aldi and Costco are for those who shopped the retailers for groceries in the last 90 days.

Source: Prosper Insights & Analytics

Meanwhile, data from market researchers at The NPD Group underline how enthusiastically consumers from all income brackets have accepted off-price stores. The firm found that two-thirds of all US shoppers are off-price shoppers and that they account for fully 75% of all apparel purchases.

In the UK, discount grocers Aldi and Lidl have successfully attracted more affluent consumers, too. Indeed, those in higher income brackets are slightly

more likely to be Aldi and Lidl shoppers than are consumers in the lowest-income group, according to 2017 research from Mintel.

Drivers of Willingness to Put in Shopping Effort

So, why have shoppers flocked to retailers that often provide only minimal service and more basic stores, even while their expectations of service have risen elsewhere? We see several factors underpinning consumers’ willingness to trade convenience for lower prices:

The squeezing of the middle classes: The stagnation of US middle-class incomes is well documented, and we see this prompting some trading down among consumers who traditionally would not have been core discount shoppers. According to the Pew Research Center, the US wealth (net assets) gap between upper-income and middle-income families is now the widest it has been since 1983, at 6.6 times, reflecting no wealth growth for middle- and lower-income families. We discuss this trend in more detail in

the second report in our Warehouse Clubs series.

The growing importance of cash-strapped millennials as consumers: Similarly, younger consumers tend to be more financially squeezed than older generations are. Millennials, in particular, have been impacted by higher student debt and a degradation of employment conditions. This is not unique to the US: younger consumers in countries such as the UK face similar challenges. We define millennials as those born between 1980 and 2000, which means they are becoming a core consumer group for retailers as they set up households and establish families. We discuss the shopping behaviors of this demographic in more detail in reports such as

How Millennials Disrupt Industries: Millennials and Grocery and

The Millennials Series: Millennials and Beauty.

Prioritization of leisure spending: Driven by younger age groups, consumers in multiple countries increasingly prefer to spend their discretionary income on leisure services, such as trips and dining out, rather than on retail purchases. Channels such as off-price and grocery discount allow shoppers to “fund” that increased leisure spending by making sacrifices in their retail spending. We cover the shifts to leisure spending in our reports

Deep Dive: Millennials and Leisure and

Deep Dive: The Silver Series V—Leisure Services for Seniors.

Deprioritization of apparel as a retail category: Within retail, apparel appears to be less of a spending priority for many consumers than it used to be. This is partly due to competition from newer retail categories such as consumer technology. An unwillingness to spend big on fashion has prompted some shoppers to turn to off-pricers such as T.J.Maxx, nontraditional retailers such as Costco and value stores such as Primark

Higher standards in discount: Despite being offline-only retailers, Primark, T.J.Maxx, Five Below and others like them have driven up the quality of product offering and store standards in discount retailing, drawing more shoppers to the channel.

“I Want Alternatives to Conventional Retail.”

Surveys Find Consumers Are Happy to Rent and Subscribe

In our previous report in this series, we outlined the scale of consumer spending on nonretail alternatives such as apparel rental and beauty product subscriptions. Here, we showcase selected consumer survey data to illustrate consumers’ willingness to consider such alternatives.

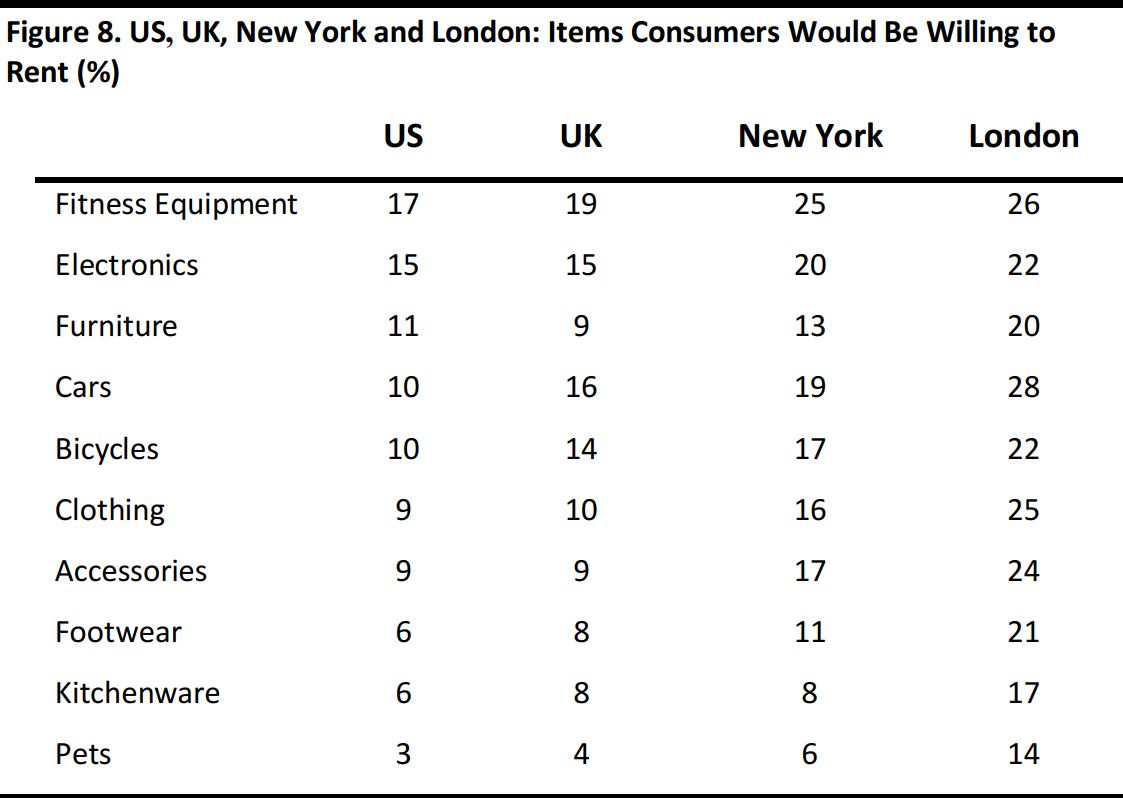

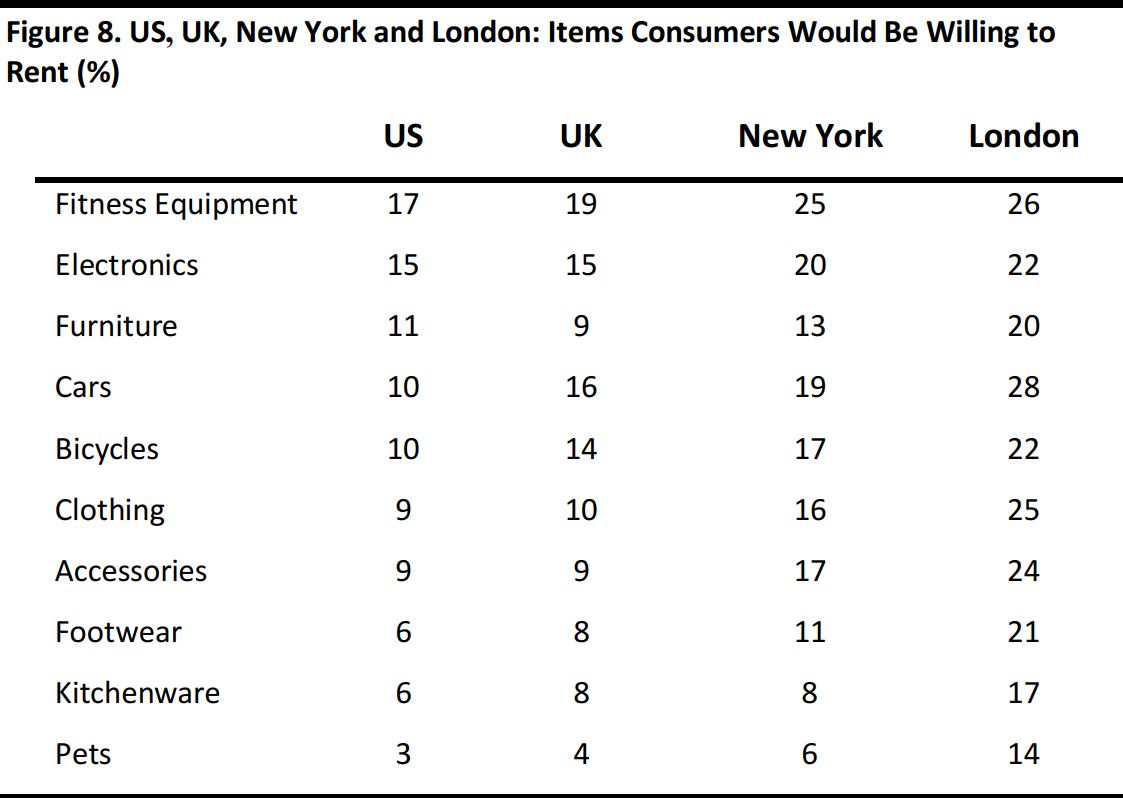

Willingness to rent is about more than apparel: Fashion rental may be a hot trend, but consumers show a willingness to rent goods in other categories, too, such as fitness equipment, electronics and furniture, according to a 2016 survey by commercial real estate firm Westfield. The survey found that inhabitants of New York and London tend to be more interested in renting products than are average consumers in the US and the UK, respectively.

Base: 13,114 respondents ages 18+ across the US and the UK surveyed October–November 2016

Source: Westfield

Base: 13,114 respondents ages 18+ across the US and the UK surveyed October–November 2016

Source: Westfield

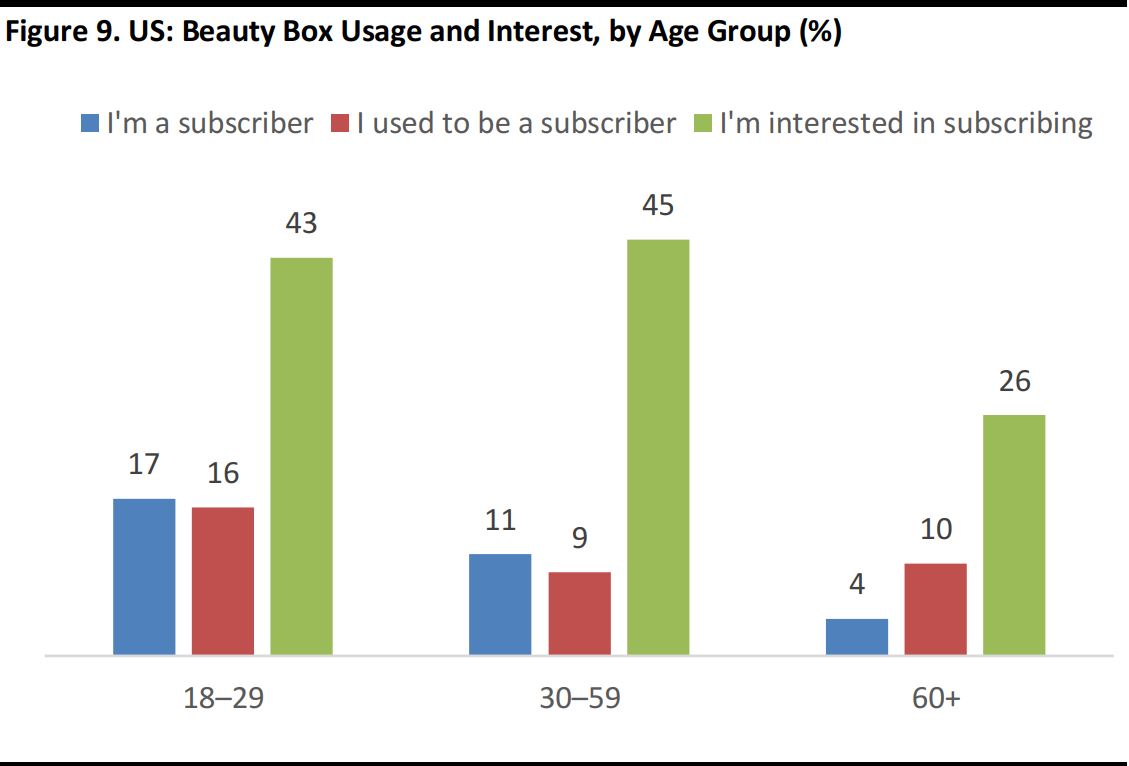

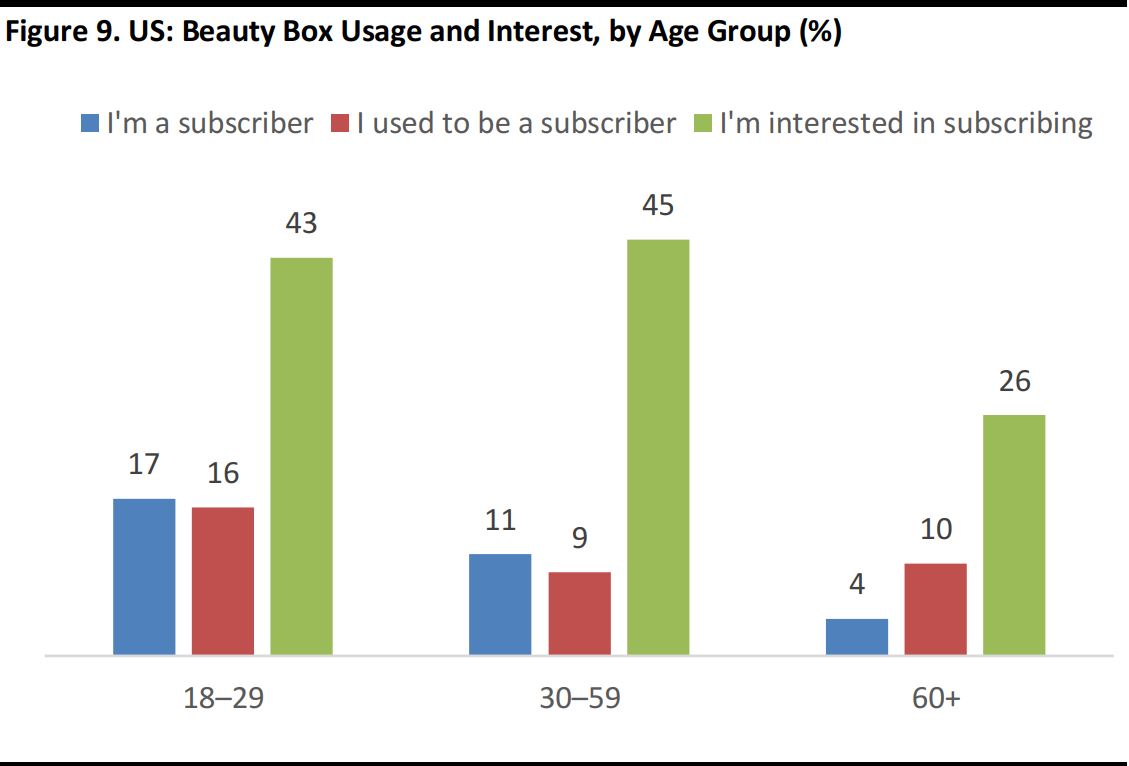

Shoppers are happy to try subscriptions: According to a 2017 survey by Statista, a large proportion of female beauty consumers are interested in trying beauty subscription boxes. Interest is highest among those in the 30–59 age bracket, but more than a quarter of older female beauty consumers are willing to try such services, the survey found.

Base: 1,006 US female consumers ages 18+ who are interested in beauty or cosmetics surveyed in May 2017

Source: Statista

Base: 1,006 US female consumers ages 18+ who are interested in beauty or cosmetics surveyed in May 2017

Source: Statista

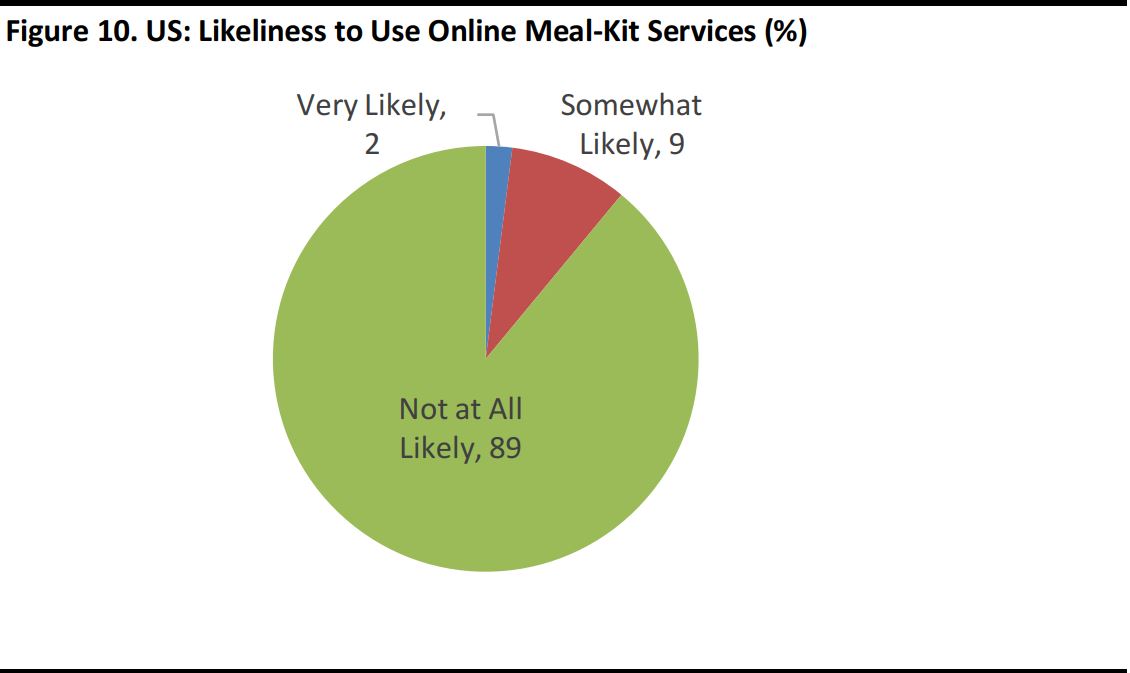

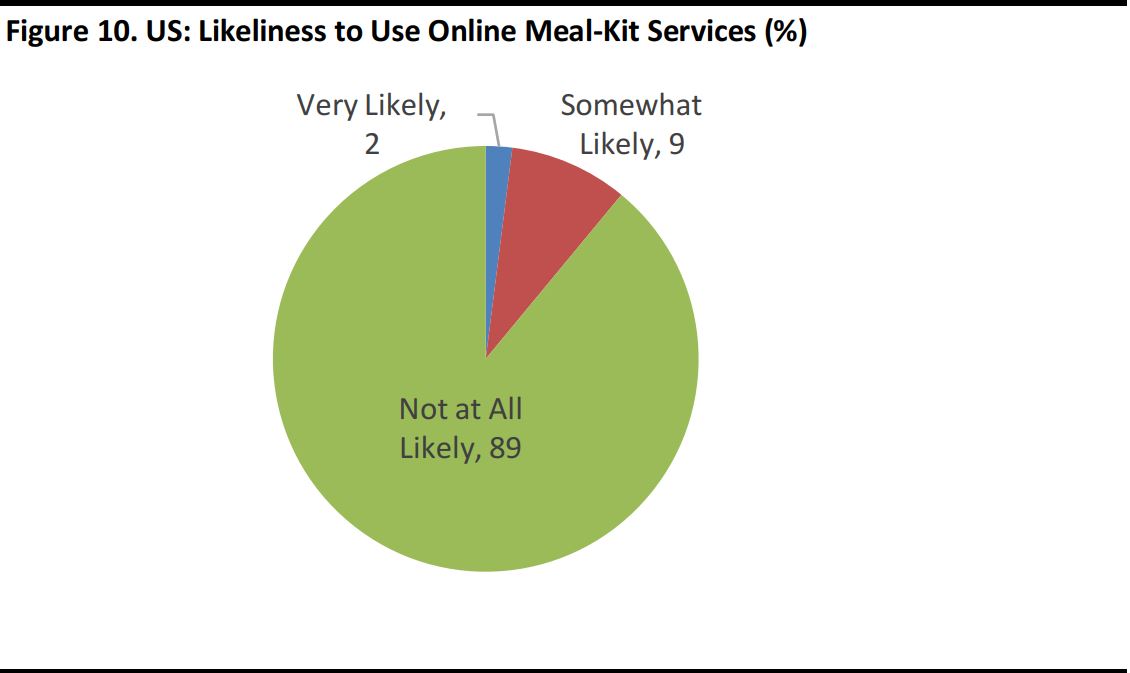

Shoppers are less interested in meal kits: Relative to product rentals and beauty box subscriptions, online meal-kit services such as Blue Apron generate low interest among US consumers, according to a 2016 poll by survey firm CivicScience. This indicates that consumers are discriminating in terms of which retail alternatives they are choosing, and that they are adopting only those services they perceive offer tangible benefits.

Base: 4,701 US consumers ages 18+ surveyed in July 2016

Source: CivicScience

Drivers of Demand for Alternatives

We see a significant number of factors conspiring to drive demand for alternatives to conventional retail:

Greater connectivity: This is a fundamental enabler of options such as resale platforms and online subscription services.

Smaller, more urban homes: More consumers are living in urban areas, more people are opting to live in single-person households and, in countries such as the US and the UK, more households are renting their homes than buying them. Each of these factors is tending to have a depressing effect on the personal space that consumers enjoy. It also impacts specific categories: for example, greater urban living drives down the need for consumers to own cars. These lifestyle trends are, in turn, prompting some consumers not to accumulate ever more possessions, and many are choosing to rent products when they need them rather than buy them. As we showed earlier, there is a higher interest in renting products in New York and London than in the US and the UK, respectively, overall. This suggests a correlation between urban living and a willingness to use alternatives to traditional retail.

We explore these themes in more depth in our reports on the impacts of

urban living and

home rental.

Material possessions are less important for an aspirational lifestyle: We perceive that ownership of products is less of a wealth signifier than it used to be. Among those seeking an aspirational lifestyle today, conspicuous consumption of products has, to an extent, been replaced by spending on leisure experiences and a focus on

wellness as a “luxury.”

Expectations of convenience: Heightened expectations of tech-enabled convenience support demand for a range of nonconventional services that make everyday life a little easier—for example, subscription services that deliver basic products such as razor blades.

Younger consumers demand more for less: Accustomed to the near-endless choice provided through e-commerce, younger shoppers demand access to a wide choice of products, including aspirational products, even though they may not be able to spend large sums of money on those items. As we note in our report on apparel rental, some millennials

want social-media-ready rotating collections of fashions, but cannot afford to buy an endless stream of designer garments. Alternative models such fashion rentals and subscription services put such goods within the reach of many millennials.

Key Takeaways

Alternatives such as rental and subscription services are still emerging as challengers to conventional retail. We think established retail names will need to watch these segments carefully, and be ready to cater to the evident demand for services such as fashion and furniture rental and beauty box deliveries.

In the immediate term, however, we see a dichotomy in consumer behavior having a more direct impact on retailers. Shoppers are demanding retailers spoil them with services such as one-hour delivery. Yet they are also willing to trade such convenience for savings—if it is on their own terms. Shoppers want to choose when, and for which categories, they will make a convenience trade-off.

We think that this has less to do with the much-documented polarization of demand between budget and premium offerings and more to do with shoppers adopting a pick-and-mix attitude that blends demand for immediacy with a feeling that they are getting rewarded for their efforts.

Source: FGRT

Base: 13,114 respondents ages 18+ across the US and the UK surveyed October–November 2016

Source: Westfield

Base: 13,114 respondents ages 18+ across the US and the UK surveyed October–November 2016

Source: Westfield Base: 1,006 US female consumers ages 18+ who are interested in beauty or cosmetics surveyed in May 2017

Source: Statista

Base: 1,006 US female consumers ages 18+ who are interested in beauty or cosmetics surveyed in May 2017

Source: Statista