Nitheesh NH

Introduction: Digitally Enabled Spending Is Stealing Share from Retail

In our three-part Retail Reworked series, we look at changes in spending trends, consumer demand and channel adoption. In this first report in the series, we quantify some of the competing segments that are pulling spending away from traditional retailers. We note that digital connectivity has impacted retailing in many more ways than just through conventional e-commerce. It is not simply a matter of Amazon versus brick-and-mortar stores: connectivity has enabled new business models such as platforms where consumers can rent or resell products and specialized firms that dispatch products to shoppers’ doorsteps on a subscription basis. In this report, we focus on four challenges to retail spending:- There are new ways to buy or rent goods via digital channels—beyond conventional e-commerce.

- Consumers have been switching to digital media such as streamed music and downloaded video, leaving many retailers of hard-copy media products unable to compete.

- The macro trend of consumers prioritizing spending on leisure services and experiences over goods has been enabled and fueled by digital innovations.

- Brands selling directly to consumers represent an emerging threat to traditional retailers.

Overview: Digital Services to Peel $36.5 Billion Away from Conventional Retail This Year

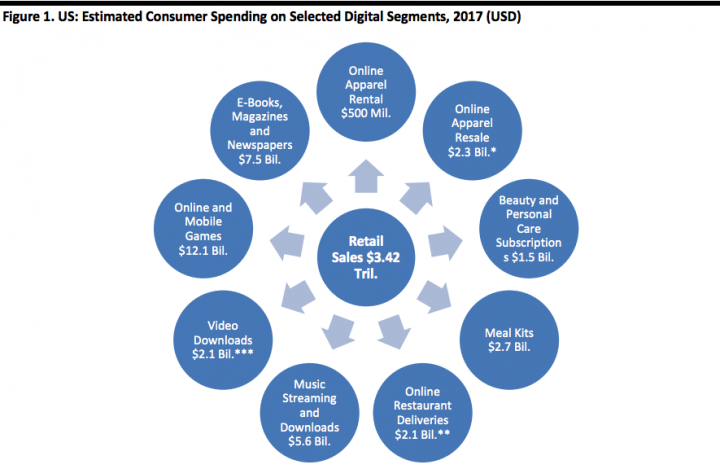

Each year, digitally enabled providers of products and services attract more and more consumer spending that would have gone to conventional retailers in the past:- In 2017, US consumers will spend a total of around $36.5 billion on the array of digitally enabled segments shown in the graphic below. Broken out by segment, this projected spending ranges from $500 million on online apparel rental to $12.1 billion on online and mobile games.

- The $36.5 billion total is equivalent to around 1% of the $3.42 trillion that we estimate Americans will spend at retail this year.

- We estimate that the digital spending total will climb to slightly more than $40 billion in 2018.

*Apparel sold through specialized resale sites; excludes secondhand sales made through generalist marketplaces such as eBay and OfferUp.

*Apparel sold through specialized resale sites; excludes secondhand sales made through generalist marketplaces such as eBay and OfferUp.**Represents only restaurants that rely on third-party service providers such as UberEats for delivery; online takeaway orders add an extra $16.2 billion.

***Excludes streaming and pay-per-view TV services, which, combined, add an extra $8.8 billion.

Source: Statista/US Census Bureau/company reports/FGRT[/caption]

- Many of these digital segments are capturing spending predominantly at the expense of conventional retailers. For example, apparel rental firms, beauty subscription services and online meal-kit providers are siphoning off spending that in the past would have gone to clothing retailers, beauty stores and grocery retailers, respectively.

- Some of the digital media segments shown—such as video downloads and music streaming—will gain some share from other legacy sectors, such as traditional broadcasters, as well as from retailers.

- We have excluded video streaming and pay-per-view TV, as these appear to mainly displace DVD-rental and pay-TV spending, respectively, rather than retail spending. Music and games are somewhat different. Prior to the digital revolution, there were no comparable, mass-market rental or on-demand services for music or video games. So, we include streaming as well as downloads for music and games, as these are retail-displacement categories.

- We have excluded online restaurant takeaway orders, as they most likely primarily displace telephone orders. However, they may be taking a little share from in-store food purchases, too, given the convenience of ordering online. We include online restaurant orders for delivery by third-party courier firms, as this is an entirely new segment that is likely gaining some sales at the expense of in-store food purchases simply because of the convenience the service offers.

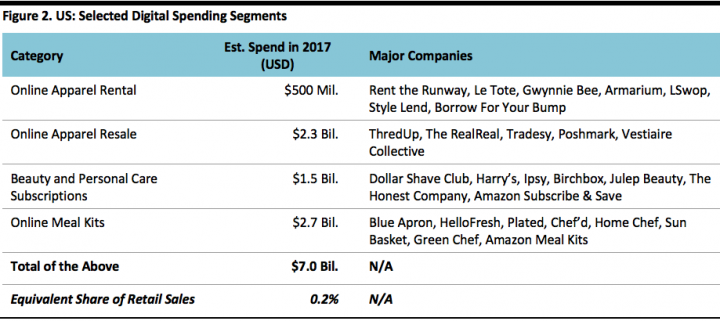

1. Beyond Conventional E-Commerce, Digital Opens Up New Ways to Buy or Rent Physical Goods

From rental to resale to subscriptions, digital channels bring new ways to consume physical goods. We estimate that new methods of buying or renting physical products, as listed in the table below, will capture around $7 billion of US consumer spending in 2017. Those billions will come almost entirely at the expense of conventional retail as shoppers switch from buying to renting fashions or decide to swap a trip to the drugstore for a monthly personal care product subscription.- This $7 billion equates to a very modest 0.2% of estimated total 2017 retail sales.

- However, the impact is greater in categories such as apparel, where conventional retailers face competition from both rental and resale sites. We estimate that online rental and resale will capture the equivalent of almost 1% of total US clothing and footwear spending in 2017, based on data from the US Bureau of Economic Analysis.

- The $1.5 billion that we estimate will flow to beauty and personal care subscription services is equivalent to almost 2% of the total US beauty and personal care market as recorded by Euromonitor International.

Source: Company reports/FGRT[/caption]

Source: Company reports/FGRT[/caption]

1. Digital Media Leaves Established Retailers Out in the Cold

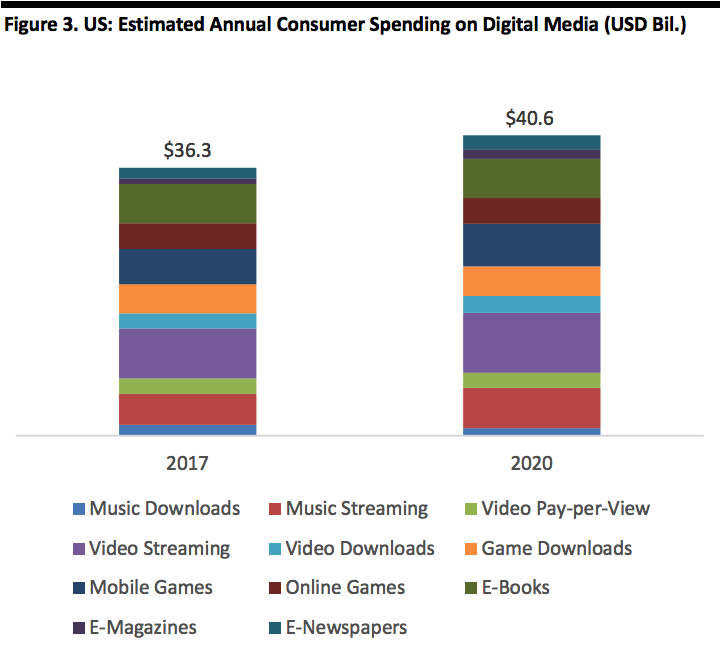

The switch to digital media, such as downloaded video, music, games and books, has hit established retailers hard, as many of them are not set up to compete with music downloads from Apple, video downloads from Amazon or video streaming from Netflix. Meanwhile, new digital categories such as games for mobile phones are competing for shoppers’ discretionary dollars. While these digital media segments are sizable, they are not expected to grow very rapidly in the coming years, according to Statista estimates. The firm projects that total US spending on digital media will grow by 12%, to $40.6 billion, between 2017 and 2020; this represents an average annual rate of 3.9%. [caption id="attachment_87313" align="aligncenter" width="720"] Includes some segments not included in Figure 1.

Includes some segments not included in Figure 1.Source: Statista[/caption]

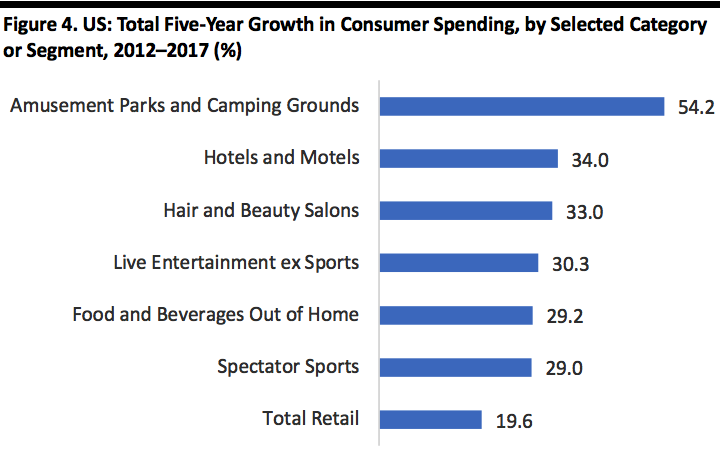

1. Leisure Spending Is Growing Fast, Enabled by Digital Tools

Each year, American consumers are directing more of their spending toward leisure services and experiences. In this section, we quantify the changes we have seen in leisure spending beyond the confines of digital channels.- We estimate that in 2017, US consumers will spend fully $327 billion more on recreational services, dining out, hotels and personal care services than they did back in 2012.

- That is a total increase of 28% over 2012 spending on these categories, we estimate, based on data from the US Bureau of Economic Analysis.

- This total increase includes some $39 billion more in personal care services spending in 2017 than in 2012 and $160 billion in additional spending on dining and drinking away from home.

- This year, we expect US consumers to spend $1.5 trillion on recreational services, dining out, hotels and personal care services, versus $3.4 trillion on retail purchases.

Source: US Bureau of Economic Analysis/US Census Bureau/FGRT[/caption]

We note that digital innovations have helped underpin the solid growth we have seen in leisure spending, in two ways:

Source: US Bureau of Economic Analysis/US Census Bureau/FGRT[/caption]

We note that digital innovations have helped underpin the solid growth we have seen in leisure spending, in two ways:

- First, digital platforms have served to consolidate the often-fragmented services landscape, making it easier for consumers to find and book anything from a meal at a restaurant to a treatment at a beauty salon.

- Second, social media has nudged consumers toward spending on experiences that they can showcase online—this is what we call the Instagram effect on consumer spending.

1. The Next Challenge to Retail: Direct-to-Consumer, from Fashion to FMCGs

The shifts to digital channels may already be well under way, but the waves of change facing retailers are not subsiding. Disintermediation of the supply chain is the next great threat to retailers. More and more brands, from apparel to beauty brands, are going directly to the consumer. This is a trend that we have discussed in detail previously, and it shows no sign of abating.- Nike’s direct-to-consumer business contributed 24% of the company’s revenue in 2016, up from 17% in 2013. Nike plans to grow its direct-to-consumer business by 250% in the next five years. In mid-2017, the company announced the creation of a new Nike Direct division that focuses on building the company’s direct-to-consumer business through com, direct retail and Nike+ digital products.

- Adidas is following suit. At its 2017 Investor Day, company management discussed plans to generate 60% of revenue from controlled retail locations and to quadruple revenue from e-commerce by 2020.

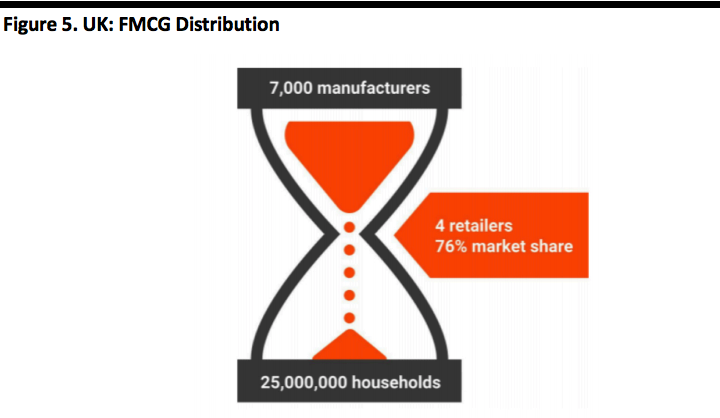

Source: Consumers International/INS[/caption]

FMCG firms will be able to market their products directly to consumers, instead of through the traditional intermediaries of wholesalers and retailers. Consumers will enjoy savings of up to 30% by buying direct, INS says.

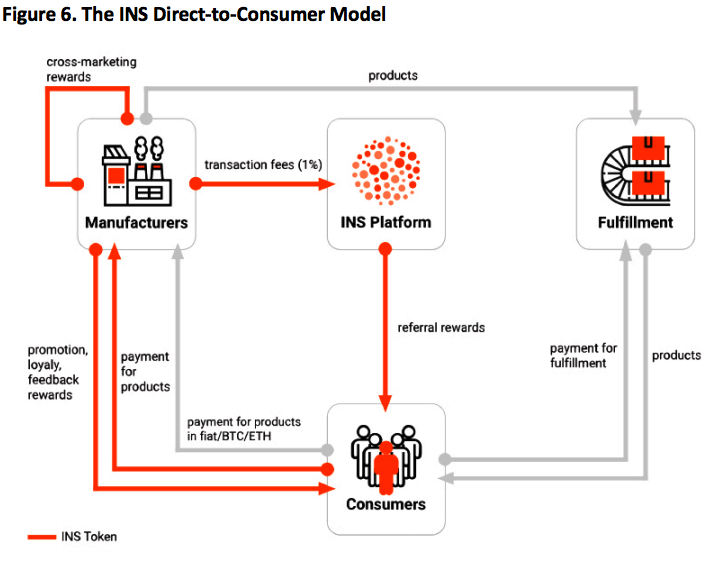

[caption id="attachment_87316" align="aligncenter" width="720"]

Source: Consumers International/INS[/caption]

FMCG firms will be able to market their products directly to consumers, instead of through the traditional intermediaries of wholesalers and retailers. Consumers will enjoy savings of up to 30% by buying direct, INS says.

[caption id="attachment_87316" align="aligncenter" width="720"] Source: INS.world[/caption]

The company already has memoranda of understanding with major firms such as Mars (Russia), Reckitt Benckiser (Russia) and Unilever Food Solutions (UK). INS will launch an initial coin offering on November 27, 2017, and will reportedly trial its platform in 2018. The widespread success of such projects would be catastrophic to the volume-sensitive grocery retail sector.

Source: INS.world[/caption]

The company already has memoranda of understanding with major firms such as Mars (Russia), Reckitt Benckiser (Russia) and Unilever Food Solutions (UK). INS will launch an initial coin offering on November 27, 2017, and will reportedly trial its platform in 2018. The widespread success of such projects would be catastrophic to the volume-sensitive grocery retail sector.

Key Takeaways

- Continued growth in new forms of spending—enabled by digital platforms, retailers and service providers—threatens to siphon off the dollars that traditionally flowed to conventional retail. The trend is about more than just e-commerce versus brick-and-mortar stores.

- In 2017, US consumers will spend a total of about $36.5 billion on an array of digitally enabled offerings that traditionally would have been provided by conventional retailers. These range from apparel rental to music downloads.

- This year, we expect US consumers to spend $1.5 trillion on recreational services, dining out, hotels and personal care services, versus $3.4 trillion on retail purchases.

- A future threat is brands bypassing retailers and selling directly to consumers. The grocery space could be shaken up by digital platforms that enable shoppers to buy directly from brand owners.