albert Chan

What’s the Story?

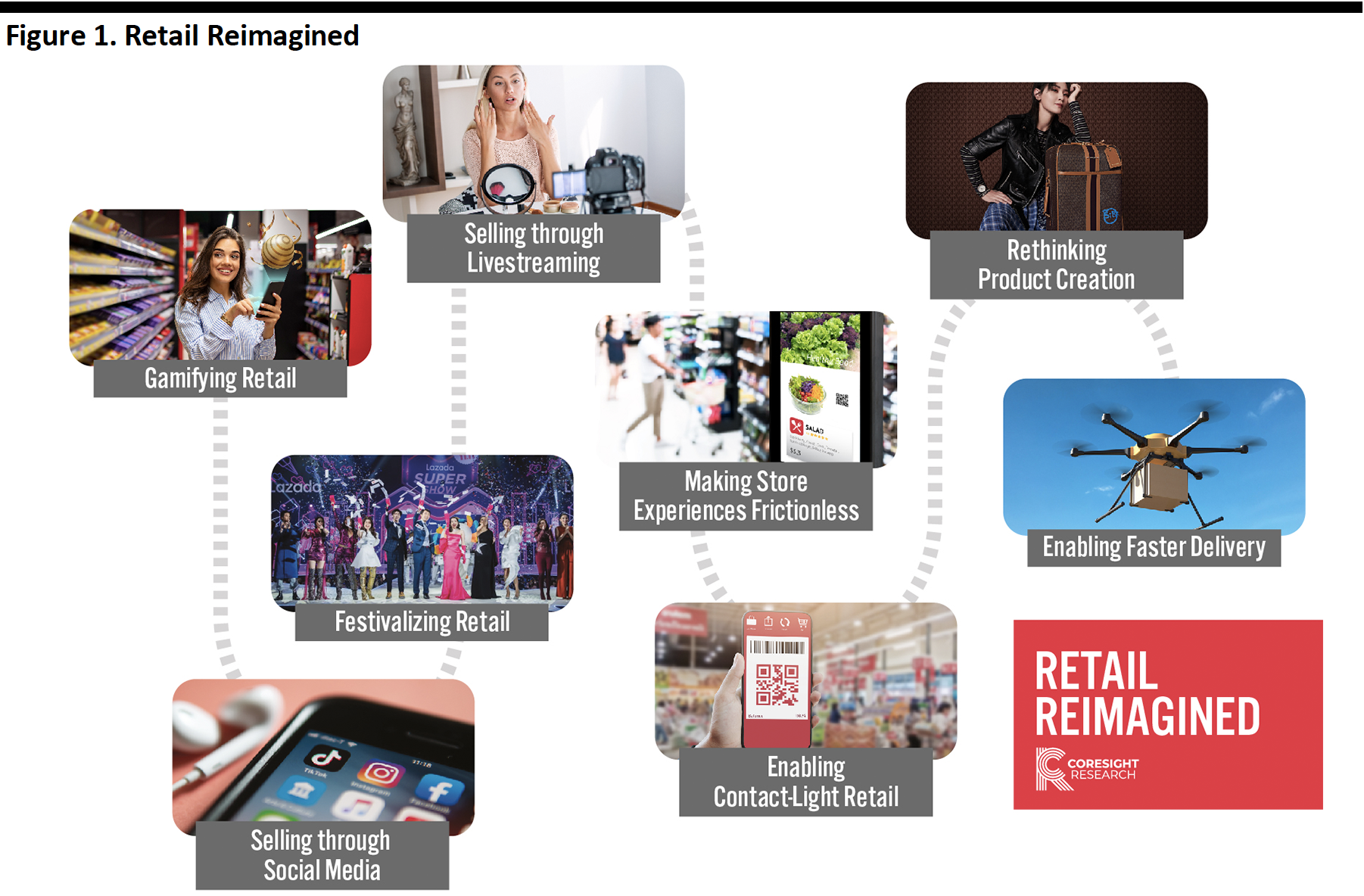

Covid-19 has changed consumer behaviors, and retailers and brands have had to actively respond to these shifts in how they operate—prompting many retail firms to adopt new and more agile channels, services and ways of selling. In our Retail Reimagined series, we offer a thematic outlook of the post-crisis world, identifying and discussing key retail trends that are likely to prevail and exploring how retail may be reimagined in response to shifts in demand and supply.

In this Retail Reimagined report, we highlight the growing importance of festivalization for post-crisis retail and explore how brands and retailers can leverage these compelling shopping events to drive sales.

[caption id="attachment_113523" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Why It Matters

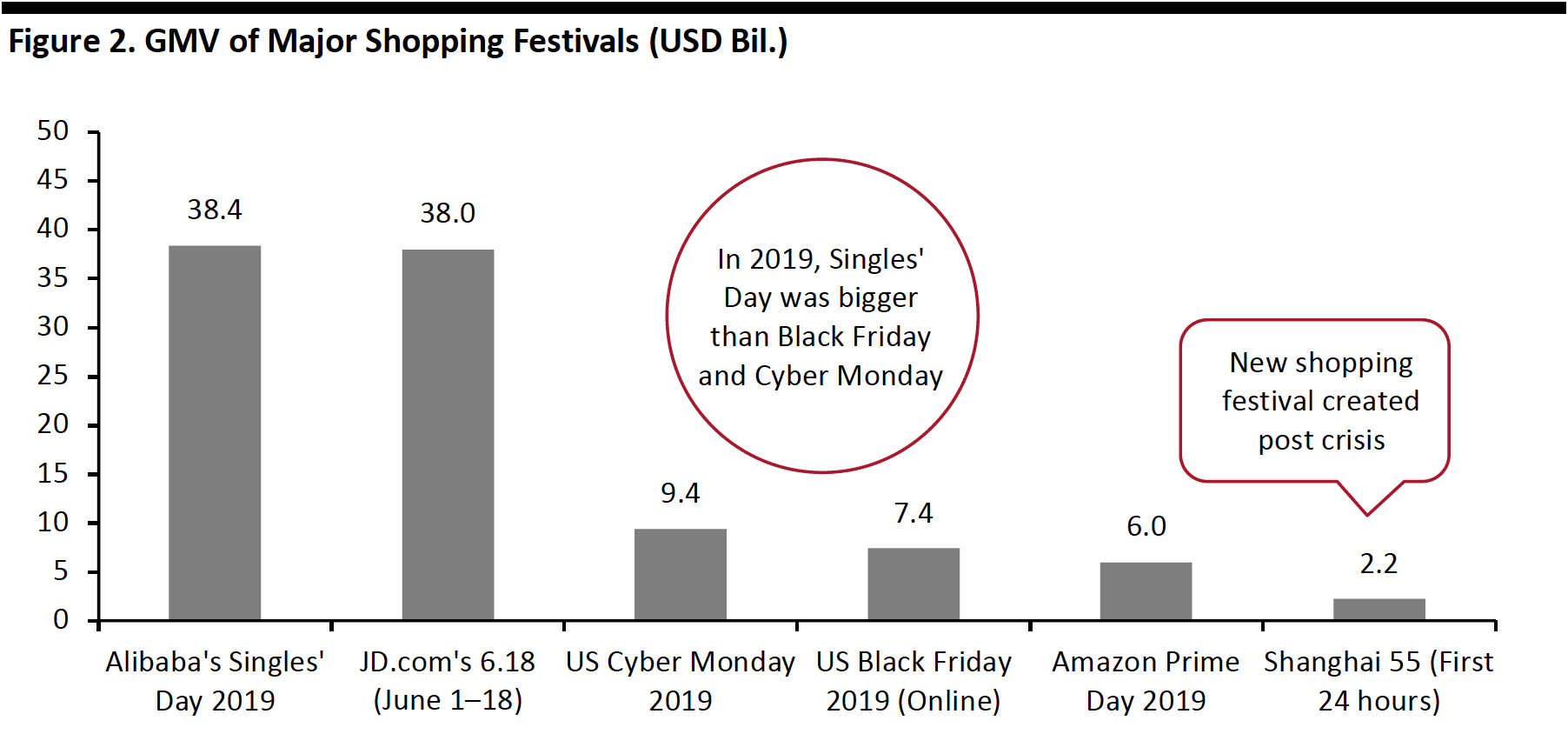

Shopping festivals have been gaining traction since before the coronavirus pandemic, especially in China. Singles’ Day, the world’s largest online shopping festival (created by e-commerce giant Alibaba) has evolved into a global event, with an expanding presence in Western countries. During Singles’ Day 2019, total gross merchandise volume (GMV) generated by Alibaba alone was more than five times that of Black Friday online sales in the US. Chinese e-commerce is at the forefront of retail festivals, showcasing opportunities for US brands and retailers.

Festivalizing retail presents massive opportunities for brands and retailers to increase brand awareness and drive sales, particularly in periods of uncertainty. As consumer sentiment has been dampened by the coronavirus pandemic, consumers are keeping a tighter grip on their spending, particularly in discretionary categories. Our weekly survey of US consumers on July 8, 2020 revealed that around 31.8% of respondents expect to continue to shop less after the crisis ends.

[caption id="attachment_113524" align="aligncenter" width="700"] Prime Day data estimated

Prime Day data estimatedSource: Coresight Research/Alibaba/Adobe/JD.com/Shanghai Municipal Commission of Commerce[/caption]

Looking Beyond the Crisis

We expect to see more retailer-created shopping festivals, as well as an increase in the scale of existing events. While most of the current shopping festivals are online-focused, their reach will extend to offline stores. Festivals will not only function as promotional events, but also destinations for consumers to discover innovative new products and brands.

Shopping Festival Expansion

Shopping festivals are expected to become bigger and longer in order to attract more consumers to participate in the shopping frenzy. We have already seen festivals in China, such as Singles’ Day and 6.18, grow from 24-hour flash sales to almost month-long events. Amazon has also expanded the length of its Prime Day since the launch of the event. Last year, the shopping extravaganza lasted 48 hours—the longest ever Prime Day festival—which helped to lift the transaction volume.

Large US retailers can learn from Chinese e-commerce platforms to create their own shopping festivals. In addition to Singles’ Day, Alibaba has also established smaller shopping events that typically feature a new theme and occur each month. We also expect to see international retailers and e-commerce platforms collaborating on shopping festivals. For example, Amazon opened a pop-up store on Pinduoduo for cross-border shopping on last year’s Black Friday, which is still an emerging event in China.

As US consumers are expected to shop months in advance of the holiday season, we see opportunities for retailers such as Target and Walmart to develop their own signature shopping events besides traditional holiday festivals to compete with Amazon.com.

Omnichannel Approach

Online shopping festivals are expected to shift toward an omnichannel approach to bring shopping events to offline stores. As many stores that temporarily closed during the pandemic are now reopening, consumers are being encouraged to return to brick-and-mortar store shopping.

The recent Shanghai 55 Shopping Festival was a two-month-long event that was rolled out by Shanghai municipal government and both online and offline retailers. The festival was launched to drive online consumers back to offline stores by issuing digital coupons that could only be spent in physical stores. More than 100,000 offline businesses took part in the event.

[caption id="attachment_113526" align="aligncenter" width="700"] Shanghai 55 Shopping Festival

Shanghai 55 Shopping FestivalSource: Shanghai.gov.cn[/caption]

In addition to fulfilling online orders for fast delivery, physical stores will also be used to create an interactive experience and connect with consumers during shopping festivals, supplementing online marketing efforts. We expect that pop-ups will continue to be a popular shopping format among retailers and brands to entice shoppers.

Beyond Discounts and Deals

We expect shopping festivals to evolve, eventually becoming experiences for consumers to discover new and exclusive products, rather than solely focusing on discounts. Although in the short term we are likely to see a lot of discounting as a reaction to Covid-19, consumers’ pursuit of high-quality products will likely hold steady.

In China, shopping festivals are becoming the preferred avenue for product launches, in order to stoke consumers’ excitement. E-commerce platforms have increasingly been used to debut C2M (consumer-to-manufacturer) products, thanks to their big-data capabilities that improve understanding of consumer preferences. During the Shanghai 55 Shopping Festival, approximately 40 luxury companies, including Kering and LVMH, staged new product launches.

New products are also a key driver for luxury purchases in the US, according to our luxury shoppers survey conducted in June 2020. Some 41% of US luxury shoppers stated that new products determine their luxury spending.

Moreover, brands and retailers can unveil limited-edition and exclusive products for shopping festivals, which generates consumers’ interest and creates a sense that shoppers may miss out if they do not make impulse purchases. Several top luxury brands, including Delvaux and Prada, focused on limited-edition products rather than discounts for JD.com’s 6.18 festival.

Festivalizing Retail amid the Crisis

Below, we take a look at examples of innovative approaches to shopping festivals adopted by brands and retailers in the midst of the coronavirus pandemic in China.

Valentine’s Day

Valentine’s Day is a critical shopping holiday for e-commerce platforms and is typically celebrated by promoting female-focused fashion and beauty products. However, the event took place during the lockdown period, and many brands were hesitant to heavily promote their products in such a challenging time.

For example, instead of launching a huge marketing campaign, Perfect Diary created an interactive game to connect with Chinese consumers at home, offering perfume gift sets and face masks for winners.

International Women’s Day

International Women’s Day was the first big shopping event to occur in China after stores began to reopen in March. Many brands offered zero-interest installment plans to encourage consumers to shop after the pandemic.

Beauty brand L’Oréal offered multiple limited-edition product sets at a discounted price point to urge consumers to purchase quickly to avoid missing out. This bundle strategy can also help brands to deplete excess inventory,

[caption id="attachment_113527" align="aligncenter" width="700"] L’Oréal Paris’ promotional bundle

L’Oréal Paris’ promotional bundleSource: Tmall[/caption]

What We Think

Shopping festivals provide enticing opportunities for brands and retailers to improve brand awareness, attract new consumers and drive sales. The role of shopping events has become more significant in the current context of the post-coronavirus global retail industry, as consumer spending has dropped, and brands and retailers are looking to clear inventory and make up for the losses caused by the pandemic.

Implications for Brands and Retailers

- Brands and retailers must select the most relevant shopping festivals to participate in and adapt their strategies accordingly. For example, fashion brands can sign up for big overall shopping festivals as well as smaller, fashion-focused events.

- The US retail calendar has may be redefined: Although brands can look to participate in established festivals such as Prime Day, larger US retailers could consider developing their own kind of signature shopping events throughout the calendar year to compete with Amazon.com and spur consumer spending outside of traditional holidays.

- Online shopping festivals are also taking place offline. Brands and retailers should leverage their brick-and-mortar stores or launch pop-ups to maximize their brand visibility and better engage with consumers.

- Brands and retailers in the US can learn from shopping festivals in China that go beyond just offering discounts. Introducing limited-edition or exclusive products during shopping festivals can create consumer excitement and boost sales.

Implications for Technology Vendors

Technology plays a huge part in retail festivalization in terms of streamlining and improving the shopping experience. Technology vendors can provide tools to support retailers and brands during busy shopping periods.

- Retailers should prepare to handle higher-than-usual traffic during shopping festivals with scalable infrastructure.

- Livestreaming has become an effective sales tool, especially in China. Technology vendors can offer tools that ensure smooth viewing and an interactive experience.

- Technology vendors can develop AI-powered chatbots as customer-service assistants to support retailers and brands in responding to huge volumes of inquiries during shopping events.