albert Chan

What’s the Story?

Covid-19 has changed consumer behaviors, and retailers and brands have had to actively respond to such changes—impacting how they operate and prompting retail firms to be more agile and adopt new channels, services and ways of selling.

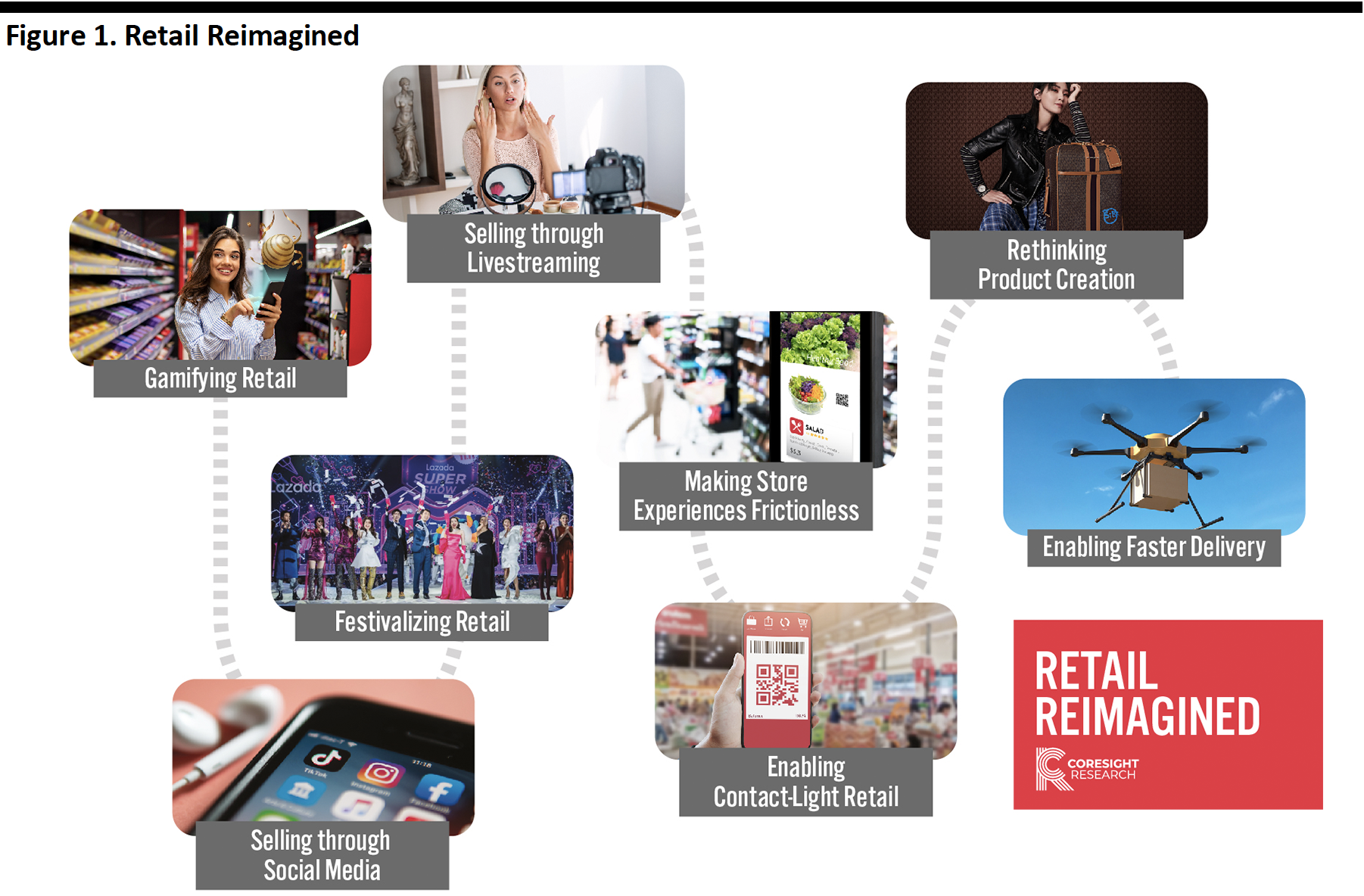

In our Retail Reimagined series, we offer a thematic outlook to the post-crisis world, identifying and discussing key retail trends that are likely to prevail and exploring how retail may be reimagined in response to shifts in demand and supply.

[caption id="attachment_113523" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

In this Retail Reimagined report, we highlight two emerging sales channels that originated in China: livestreaming and community group buying. We outline how we expect these methods to help brands and retailers drive traffic as well as facilitating sales. While livestreaming is expanding outside of China and finding applicability worldwide, community group buying looks to be more closely tied to the characteristics of China’s domestic consumer market.

Why It Matters

Livestreaming

According to estimates by Chinese financial services firm Everbright Securities, livestreaming e-commerce reached an estimated value of $63 billion across major platforms in China in 2019—equivalent to just over 5% of all online sales of goods, as reported by the National Bureau of Statistics of China—and it appears that this channel will continue to gain traction. The Covid-19 pandemic has intensified the popularity of livestreaming e-commerce among merchants. According to Alibaba, the number of new merchants utilizing Taobao Live for the first time increased by 719% in February 2020, compared to January 2020.

Beyond China, livestreaming has begun to be globally recognized as an effective marketing tool. In the US, it is just taking off—we estimate a potential market size for US livestreaming e-commerce of around $25 billion by 2023. This is based on the assumption that livestreaming can capture 2.5% of online retail sales by 2023—half of the proportion that it captures in China.

Community Group Buying

According to Kantar China, community group buying—a buying format that can be used by a group of residents living in the same housing development—will reach $12.72 billion ($89 billion) in China in 2020. The lockdown jump-started the popularity of this means of shopping. Community group-buying platforms often manage their customers by using WeChat groups to assign a community group leader. WeChat groups usually enjoy high user stickiness, partly due to the social media platform’s ubiquitous status with around 1.2 billion monthly active users as of the first quarter of 2020. Community group buying arose in the midst of quarantine restrictions in China, owing to its efficient delivery model that takes orders from a community and delivers them in bulk to one location (e.g., a community center).

Livestreaming amid the Crisis

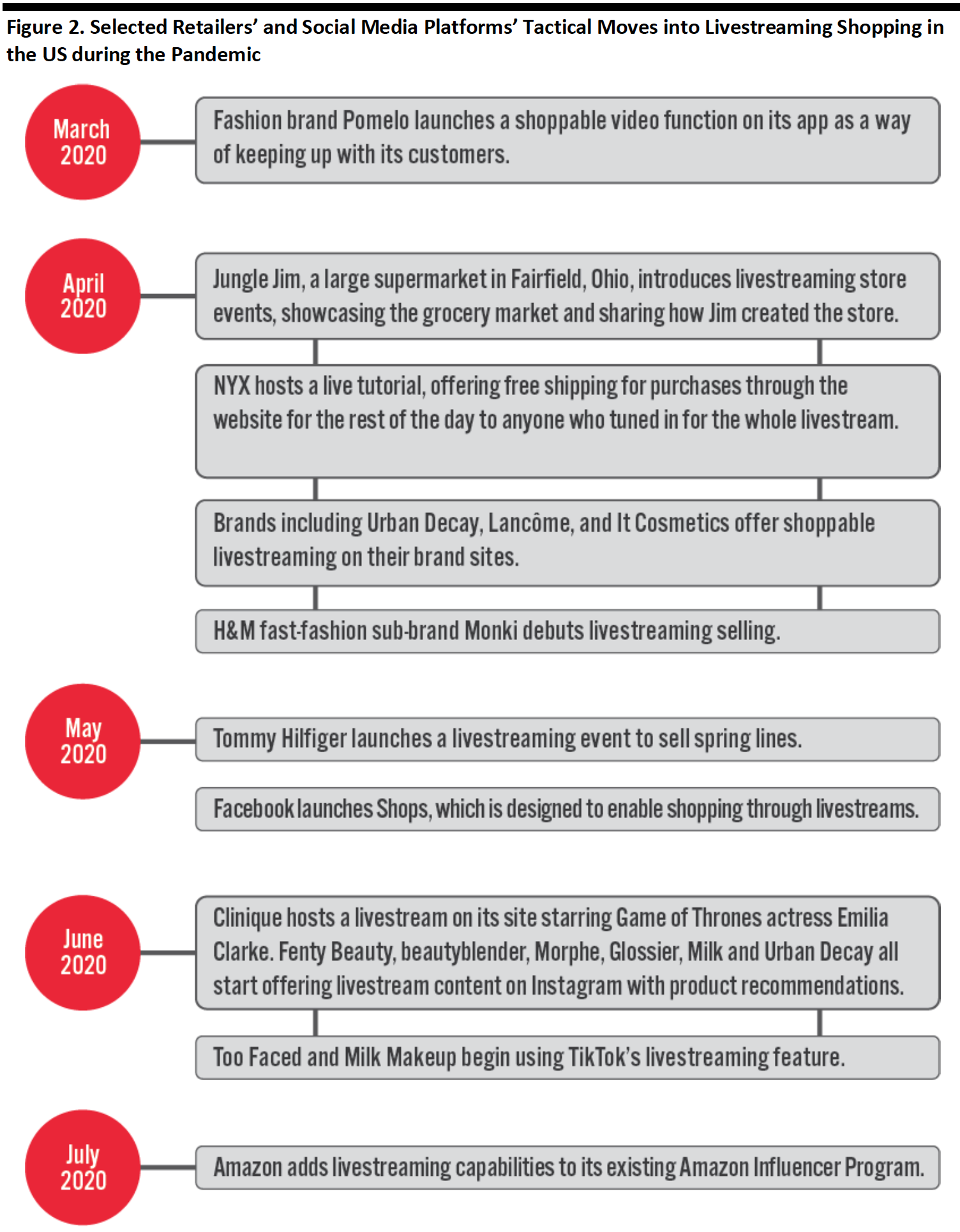

The pandemic saw many merchants in China take advantage of livestreaming to engage and sell products to consumers from afar. Livestreaming e-commerce also began to take-off in the US, with retailers and social media platforms making tactical moves in this space, including by launching livestreaming sales events on companies’ own websites.

Livestreaming Takes Off in US Retail

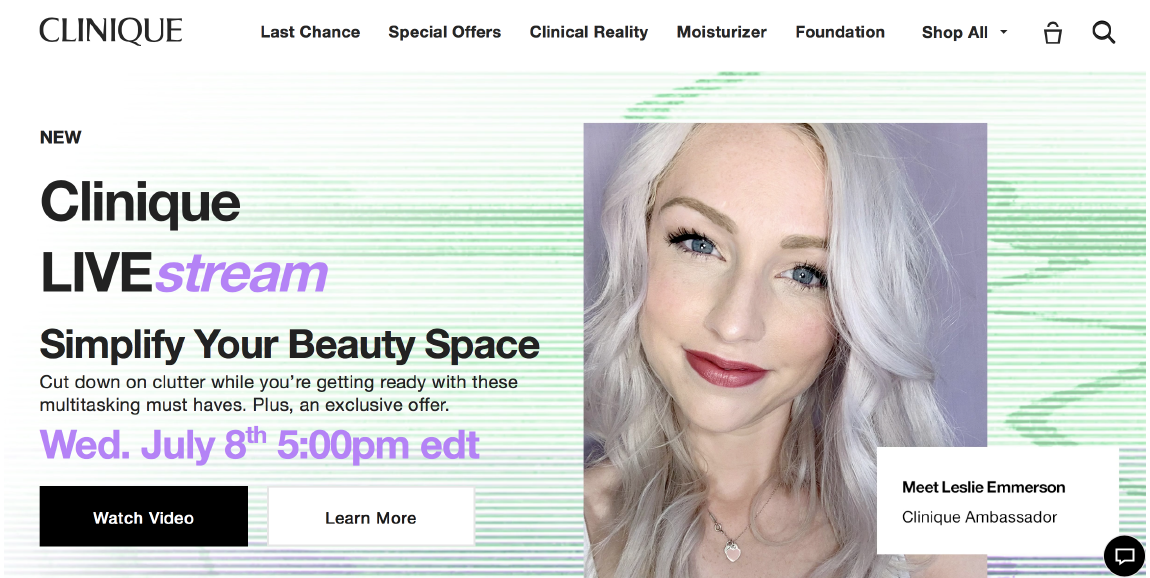

US brands and retailers, including the beauty and fashion sector, actively used livestreaming to sell their products during the crisis. NYX hosted a live tutorial on its own website, offering free shipping for purchases through the website for the rest of the day to anyone who tuned in to the whole livestream. Brands including Clinique, It Cosmetics, Lancôme and Urban Decay also offered livestreams with built-in shopping functionality on their sites.

[caption id="attachment_113698" align="aligncenter" width="550"] Livestreaming events have been launched on Clinique’s website

Livestreaming events have been launched on Clinique’s websiteSource: Company website[/caption]

Below, we list examples of retailers and social media platforms that made tactical moves into livestreaming shopping in the US during the pandemic.

[caption id="attachment_113696" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Leveraging Livestreaming in China

In China, department store Intime Mall also capitalized on livestreaming during the pandemic. The company trained its sales assistants to become livestreaming hosts on Taobao, enabling the retailer to continue operations during Covid-19. According to Estée Lauder, the sales of one livestream session via Intime Mall’s livestreaming platform was equivalent to one week of offline performance.

[caption id="attachment_113697" align="aligncenter" width="350"] Intime Mall’s sales assistants sell beauty products via livestreaming

Intime Mall’s sales assistants sell beauty products via livestreamingSource: Taobao Live[/caption]

Community Buying amid the Crisis

Consumers flocked to community group-buying platforms during lockdown restrictions. The platforms gather orders from a community group and efficiently deliver them in bulk to the same destination—enabling residents from the same housing development to receive their orders without the delays caused by limited delivery capacity during the pandemic.

The working model of a community group-buying platform involves recruitment of a community leader from a housing community, who then creates a WeChat group with residents from the same community and regularly posts product links in the WeChat group. Consumers click the links to be directed to the platform’s WeChat mini program, where they place orders. The platform delivers the orders to the designated collection point, often the following day.

Alibaba’s Freshippo Community Group-Buying Model

In mid-February 2020, Alibaba’s supermarket chain Freshippo began to sell its products via a community group-buying model to reduce delivery wait times as hordes of customers turned to online grocery shopping. Residents from the same WeChat community group would communicate to decide what they wanted to buy from the Freshippo store near their home and Freshippo staff would deliver the orders to the designated collection point the following day. This community group-buying model helped to reduce the number of deliveries made to the same area.

Other retailers in China also implemented their own community group-buying model—for instance, multicategory retailer BBK launched its community group-buying unit Xiaobu Youxian on February 27, 2020.

Looking Beyond the Crisis

Livestreaming E-Commerce Developments

We expect experiential e-commerce techniques such as livestreaming to continue to help brands and retailers offset the decline in offline business and connect with consumers from afar. As there continue to be additional Covid-19 outbreaks and shutdowns, plus possible future waves of the virus, we anticipate that brands and retailers will continue to leverage livestreaming to engage with consumers and promote products.

In-Video Checkout

In-video checkout during livestreaming will enable frictionless purchasing and drive conversion. We foresee the widespread adoption of technologies such as AI, especially facial recognition, which will enable livestreaming platforms to identify products being promoted by livestream hosts and display associated embedded links that viewers can click to make purchases.

Most livestreaming videos, visual posts or advertisements on social media platforms only have tags or links to third-party websites, rather than providing a direct means of purchasing—thus preventing a fully seamless shopping experience. Without a checkout option, consumers are more likely to give up on their purchase. According to a 2019 Coresight Research survey of US consumers on their use of social commerce, 78% of respondents who use social media for product discovery said they would “occasionally” or “often” abandon a purchase after discovering a product on social media if there is no built-in purchasing function.

We also expect the higher bandwidth of 5G technology to enhance viewing quality for consumers during livestreaming sessions and allow platforms to broadcast more interactive content.

Community Group-Buying Platforms

In China, we expect the community group-buying model to drive higher user stickiness as users live in close proximity to their group leader, which helps to build trust between the platform and consumers. This model is expected to continue to thrive post crisis, as it not only employs an effective distribution channel, but also enables shoppers to enjoy a community and trust-based shopping experience.

The community-based model has captured consumers’ attention because it quickly establishes trust in the platform via the community leader, who takes responsibility for maintaining relationships among the residents in the WeChat Group. The community leader often receives commission based on how many orders they generate, which may motivate them to build positive relationships with residents in the WeChat group. Furthermore, residents usually know the community leader on a personal level, so feel that they can communicate easily with them. The effective distribution channel of community group buying enables such platforms to gather orders from the same housing development and deliver products in bulk at one time.

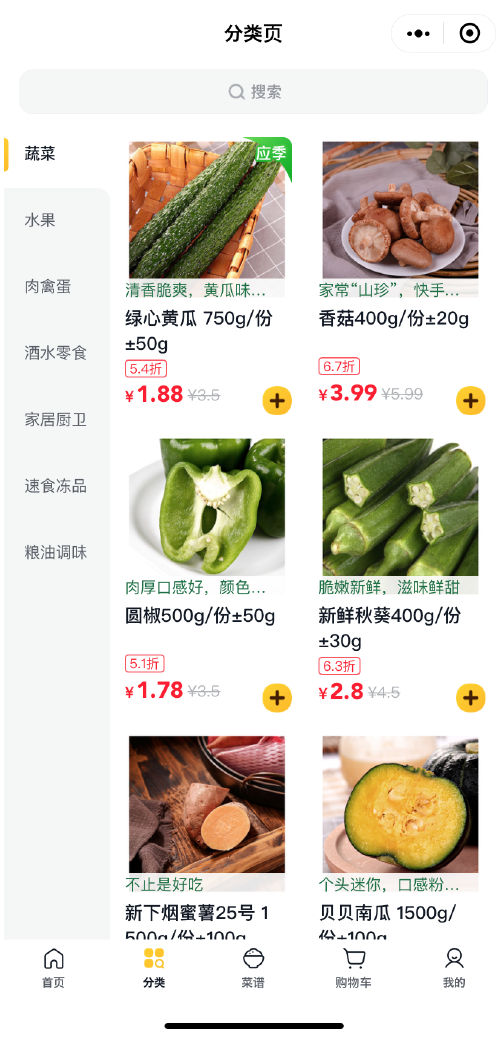

Companies are continuing to launch community group-buying platforms in China post crisis, demonstrating the popularity of this purchasing model. On July 7, 2020, Chinese food-delivery platform Meituan launched a community group-buying platform called Youxuan, which literally translates to “best pick.” Youxuan sells fresh food including fruit and vegetables, as well as alcohol and other beverages. Shoppers can purchase products at discounts as high as 46. As of July 15, Youxuan has launched its service in Beijing, Dongguan, Guangzhou, Jinan, Shanghai, Shenzhen and Wuhan.

[caption id="attachment_113699" align="aligncenter" width="350"] Youxuan WeChat mini program

Youxuan WeChat mini programSource: WeChat[/caption]

What We Think

The pandemic has seen livestreaming soar in popularity in China. Although livestreaming e-commerce is just taking off in the US, we have seen retailers and social media platforms make tactical moves to develop in this space, especially during the coronavirus crisis. We expect to see more retailers and brands leverage experiential e-commerce approaches such as livestreaming to stay competitive and attract more customers.

We expect community group buying to continue to thrive in China, although it is less directly transferable to global markets than livestreaming, given its reliance on community and residential arrangements and types of mobile apps. The community group-buying model leverages users who live in the same neighborhood to improve delivery efficiency. This model also makes it easier for the platform to engage with consumers, often through a WeChat group that is managed by a community leader who was recruited by the platform.

Implications for Brands and Retailers

There are multiple ways that brands and retailers can leverage livestreaming and community group buying, such as:

- Working with livestreaming platforms that have in-app checkouts on their livestreaming videos. This drives conversion by creating a seamless transition from the consumer’s buying intentions to making a purchase.

- Developing partnerships with community group-buying platforms to promote products and build stronger relationships with consumers.

Implications for Technology Vendors

There are multiple opportunities for technology vendors to facilitate frictionless and personalized shopping processes for consumers via social media, such as:

- Developing technology for livestreaming platforms to ensure smooth viewing and an interactive experience for consumers, particularly technologies that will reduce network latency and improve real-time interactions.

- Integrating livestreaming seamlessly into existing social media platforms.

- Providing technology for livestreaming platforms to enable in-app checkout.

- Providing support on how to smoothly integrate AI into livestreaming platforms to identify products being promoted by livestream hosts and display associated embedded links that viewers can click to make purchases.