albert Chan

What’s the Story?

Covid-19 has changed consumer behavior, and retailers and brands will need to actively respond to such changes. The crisis has also changed how firms operate, prompting them to be more agile and lean, as well as adopting new channels, services and ways of selling.

In our Retail Reimagined series, we offer a thematic outlook to the post-crisis world, identifying and discussing key retail trends that are likely to prevail and exploring how retail may be reimagined in response to shifts in demand and supply.

[caption id="attachment_113523" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

In this Retail Reimagined report, we explore how brands and retailers can innovate their product offerings through collaboration and customization to drive consumer interest and demand post pandemic.

Why It Matters

Economic downturns caused by the Covid-19 pandemic have hit consumer sentiment in many countries, with shoppers shifting their priorities to health-related and essential purchases over discretionary products.

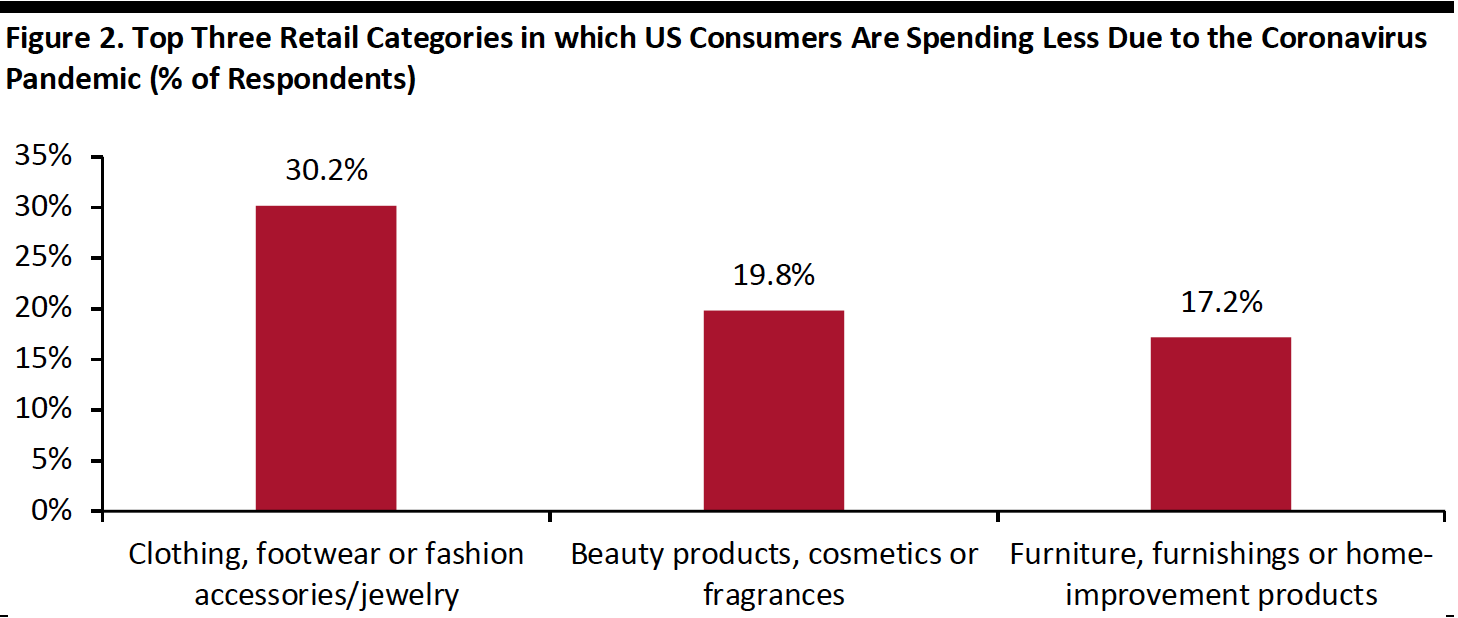

A Coresight Research US consumer survey, conducted on July 15, showed that 54.2% of respondents are currently reducing their spending due to the pandemic—discretionary categories, including clothing, footwear and accessories, saw the highest cutbacks, followed by beauty and home products.

[caption id="attachment_114287" align="aligncenter" width="700"] Base: US Internet users aged 18+, surveyed on July 15, 2020

Base: US Internet users aged 18+, surveyed on July 15, 2020Source: Coresight Research[/caption]

It will become increasingly important for brands and retailers to step up their product offerings to cope with softened consumer demand post crisis. Companies must cultivate demand and create a sense of urgency to drive conversion—making customized and limited-edition products more important than ever.

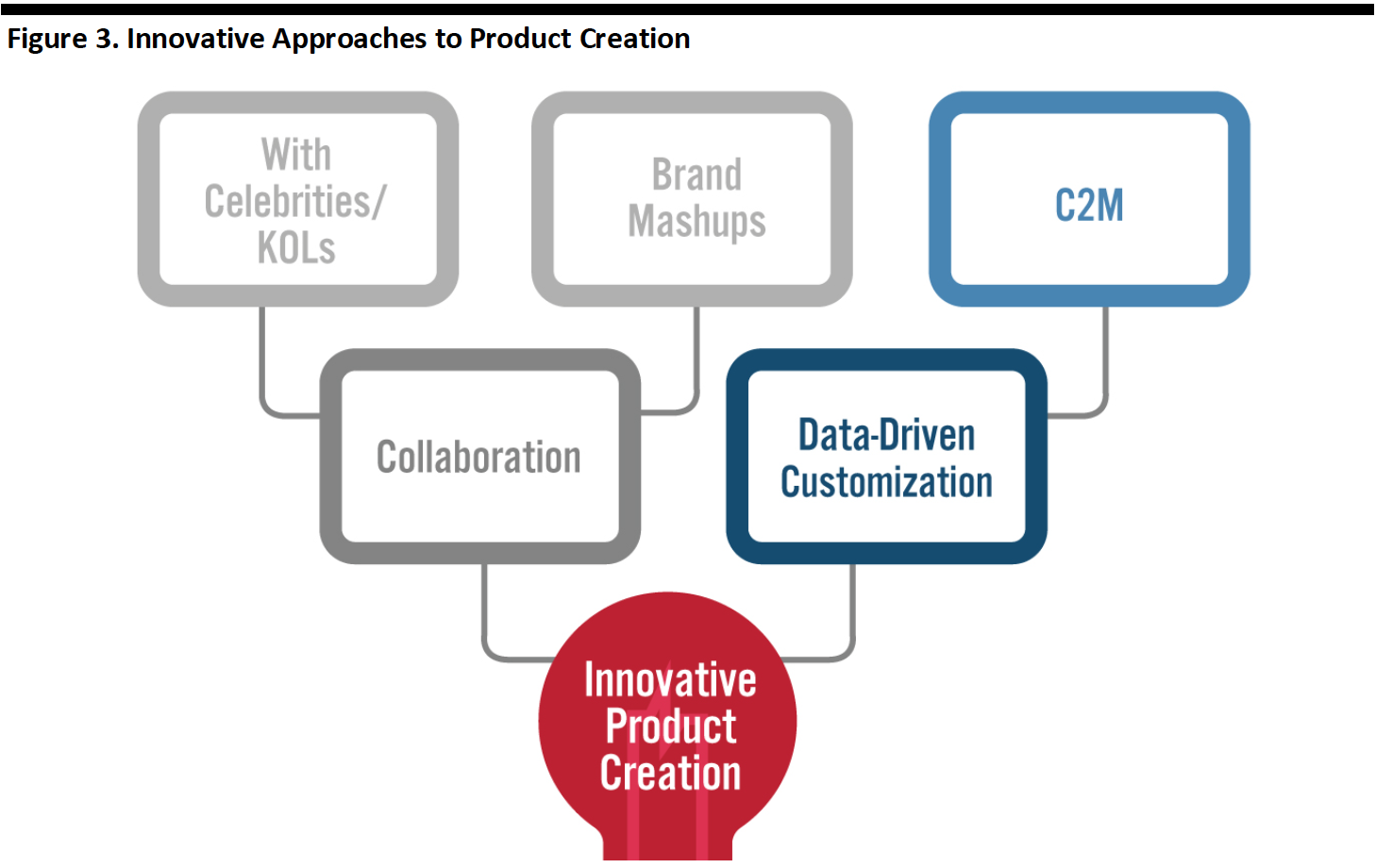

We expect to see brands and retailers take innovative approaches to product creation—by leveraging consumer data to create customized products that meet consumers’ needs and moving towards brand and celebrity collaborations as a way to launch exclusive products to drive shoppers’ excitement.

[caption id="attachment_114288" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Innovative Approaches to Product Creation

Collaboration

Collaborating with celebrities and influencers or with other brands enables a brand to create and launch new products. Such collaborations are particularly popular in the fashion and beauty categories. One approach to leveraging celebrity influence over consumers involves limited-edition products. The implied scarcity of limited-edition collaborations can trigger a sense of urgency around purchases by prompting consumers to feel a “fear of missing out.” This can help to boost interest in a product and drive sales conversion. Limited product inventory can also reduce risk for brands and retailers.

Celebrities and influencersWe expect that celebrity and influencers will play an increasingly important role in driving consumer purchasing decisions in the future: Celebrity or influencer endorsement is one of the most coveted forms of marketing. Brands can seek out collaborations in product development and utilize existing celebrity and influencer fanbases to engage with new audiences and drive direct sales.

The rising power of social media facilitates brand engagement, with customers responding positively to the credibility of celebrity and influencer endorsements and authenticity of interactions via channels such as livestreaming. This form of consumer engagement enables brands to create hype and intrigue around a product and offer consumers direct purchasing options.

We expect to see a growing number of struggling brands and retailers impacted by the pandemic look to celebrity or influencer collaboration to refresh their brand images and attract young shoppers. For instance, fashion retailer Gap was struggling to stay relevant even before the coronavirus pandemic and has now struck a 10-year deal with celebrity Kanye West to launch a new clothing line called Yeezy Gap.

In a Coresight Research November 2019 survey, one-quarter of all US respondents said that their shopping behaviors are occasionally or often influenced by social media influencers/celebrities. Amid greater adoption of e-commerce by consumers and a push toward social media and social commerce by retailers, we see this proportion scaling to more than 35% of all US shoppers by 2023.

Brand mashupsCross-brand collaboration is an innovative approach to product creation that leverages the unique strengths of each brand—often taking advantage of surprising partnerships to generate intrigue. Collaboration between mass-market or high-street brands and luxury fashion designers is a concept that has proven successful for both parties. The strategic mix provides a novelty that often attracts younger consumers and provides shoppers with a more affordable way to access premium luxury brands, which is likely to appeal to post-pandemic consumers with a tighter budget. For smaller designer or luxury brands, there are two primary advantages: increased mainstream exposure and access to production resources.

Brand mashups—especially unlikely collaborations—are a popular phenomenon in Chinese and US markets and allow conventional products to be positioned as unique offerings. Crossovers between food and discretionary products are particularly popular, and unusual mashups can easily spike social media attention. For example, Chinese beauty brand Perfect Diary partnered with Oreo at the beginning of April to drop two limited-edition cushion compacts (a foundation makeup product), which sold out in its first day of launching on JD.com. We have also seen apparel brands launch limited-edition collections with Coca-Cola, KFC, McDonald’s and other popular food brands.

Read our separate report on brand mashups for more examples of this type of product creation.

[caption id="attachment_114289" align="aligncenter" width="480"] Perfect Diary x Oreo cushion compacts

Perfect Diary x Oreo cushion compactsSource: Perfect Diary[/caption]

Data-Driven Customization

Consumers are likely to exercise more caution in making purchases post crisis due to financial pressures, making it critical for brands and retailers to provide products that are tailored to their needs and preferences. Behind a successful, appealing product are detailed consumer data derived from multiple consumer touchpoints that offer deep consumer insights and help to optimize the product creation process.

Customization is also a key factor for brands in differentiating product offerings, which can help to drive engagement and boost sales. Increased predictability in demand can help brand and retailers to lower their production costs.

Brands and retailers are striving to keep their customers front of mind in their product development processes by integrating feedback and suggestions alongside consumer data. Personal styling company Stitch Fix uses data science to identify demand for new products to develop under exclusive brands—whilst constantly improving existing product offerings based on consumer feedback.

Positive consumer response to customization predates the coronavirus pandemic—according to a 2019 survey conducted by Deloitte, 36% of consumers expressed an interest in purchasing personalized products or services. We expect to see brands and retailers continue to become more consumer-centric and demand-driven in their product development processes by optimizing consumer data.

Consumer-to-manufacturer (C2M)Reiterating the importance of consumer input, C2M has been widely adopted by Chinese e-commerce giants as a data-driven business model, and we expect this model to continue gaining traction: We are likely to see the C2M model moving from East to West. Under this model, e-commerce platforms use artificial intelligence (AI), big data and cloud technologies to enable brands and manufacturers to leverage real-time analytics to better understand consumer needs. Brands can then launch customized products at attractive price points in a much shorter time frame.

C2M products are gaining huge popularity among Chinese consumers, especially those in lower-tier cities. During the 6.18 shopping festival from June 1 to 14, 2020, sales of C2M products on JD.com spiked 622% year over year. We expect to see more brands join up with e-commerce platforms to develop C2M products. Recently, luxury footwear brand Sergio Rossi co-designed a new ankle boot based on JD.com’s big data analysis of customer preferences.

Innovative Product Launches amid the Crisis

We have seen a recent surge in brands and retailers redeveloping their product offerings to generate consumer interest and drive sales. We discuss two notable examples below.

IKEA x Pizza Hut Collaboration

In early March, IKEA and Pizza Hut partnered to create a new pizza in Hong Kong that features IKEA’s famous Swedish meatballs as a topping. To add a second layer of intrigue, IKEA launched a life-size version of the small plastic table, known as a pizza saver, that sits in the middle of a pizza in its takeaway box. The all-white table has three legs and a circular top inscribed with Pizza Hut’s logo. Each table also comes in a package that resembles a regular pizza box.

The two brands kicked off a joint marketing campaign by posting a picture on their social media accounts featuring a Pizza Hut delivery person sleeping on a sofa in an IKEA store. This caught consumers’ attention and sparked huge exposure ahead of the product launches. According to Pizza Hut’s marketing agency Ogilvy, the projected unit sales amount was exceeded by 67% over the first three days.

[caption id="attachment_114290" align="aligncenter" width="450"] IKEA x Pizza Hut collaboration

IKEA x Pizza Hut collaborationSource: Dezeen[/caption]

C2M Products: Alibaba Customization

In late January, as consumers in China were focusing more on hygiene during the coronavirus outbreak, Alibaba’s C2M unit witnessed a surge in online searches for alcohol-based car cleaning supplies. One of the unit’s specialists reported that working directly with a manufacturer was the only way to meet this spike in demand. Alibaba reached out to Chinese car products manufacturer Odis with this insight, allowing it to adapt its existing offering to meet consumer demand for car cleaning products.

Alibaba was able to provide real-time analytics—enabling Odis to respond quickly to customer feedback on the product. For example, one of the sanitizing sprays was designed as an aluminum can. Based on consumer preference data, Odis customized their product offering and changed the container to a plastic bottle. When the product launched on Tmall, more than 200,000 bottles were sold within 24 hours.

What We Think

In a coronavirus-impacted retail market, it is critical that brands and retailers innovate their product offerings to stimulate consumer spending for discretionary products.

Implications for Brands and Retailers

- A successful collaboration between two brands can help both brands to expand their reach, acquire new customers and refresh their image.

- Brands and retailers that have been severely impacted by the pandemic can leverage celebrity or influencer visibility and pre-existing audience bases to launch new products. Amid greater adoption of e-commerce by consumers and a push toward social media and social commerce by retailers, we expect the proportion of US consumers whose shopping behaviors are occasionally or often influenced by social media influencers/celebrities to scale from one-quarter in 2019 to more than 35% of all US shoppers by 2023.

- Brand mashups is another form of collaboration that brands and retailers can consider to create excitement around a product. “Unlikely” partnerships between dissimilar brands often draw consumers’ attention and create valuable social media buzz.

- Leveraging consumer data will become even more important post crisis. Brands and retailers that provide tailored products to satisfy the needs and preferences of consumers can differentiate their product offerings and increase customer loyalty and retention.

- Data-driven C2M models can help to optimize product creation processes and meet specific consumer demands. In China, brands and retailers could consider working with e-commerce giants to better address consumer needs and improve supply-chain efficiency.

Implications for Technology Vendors

- Technology vendors can provide necessary technologies for brands and retailers to create more personalized products based on consumer demand. This could include technologies that better capture consumer data across touchpoints, as well as big data, machine learning and AI-driven real-time analytics that generate consumer insights.