albert Chan

What’s the Story?

Covid-19 has changed consumer behavior, and retailers and brands will need to actively respond to such changes. The crisis has also changed how firms operate, prompting them to be more agile and lean, as well as adopting new channels, services and ways of selling.

In our Retail Reimagined series, we offer a thematic outlook to the post-crisis world, identifying and discussing key retail trends that are likely to prevail and exploring how retail may be reimagined in response to shifts in demand and supply.

[caption id="attachment_113523" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

In this Retail Reimagined report, we explore the different ways in which brands and retailers can implement contact-light retail.

Why It Matters

The concept of contact-light and contactless operations in retail stores was on the rise before the coronavirus crisis, from curbside pickup to contactless payment. The emergence of these contact-light solutions was first driven by consumers’ quest for convenience. In addition, cash as a payment method was falling out of favor among shoppers prior to the pandemic, with increasing preferences toward using debit/credit cards.

However, Covid-19 has accelerated the development of contact-light shopping experiences by making such operations a necessity for safety; consumers are aiming to avoid any physical contact in stores to minimize the risk of contracting the virus. This is likely to become the new norm, with our survey of US consumers on July 15 revealing that some 28% of respondents expect to retain the behavior of having less physical interaction after the crisis ends.

Looking Beyond the Crisis

Looking ahead, we expect to retailers to leverage four opportunities to provide consumers with contact-light retail: curbside pickup, cashierless stores, contactless payment and vending machines.

[caption id="attachment_114027" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Curbside Pickup

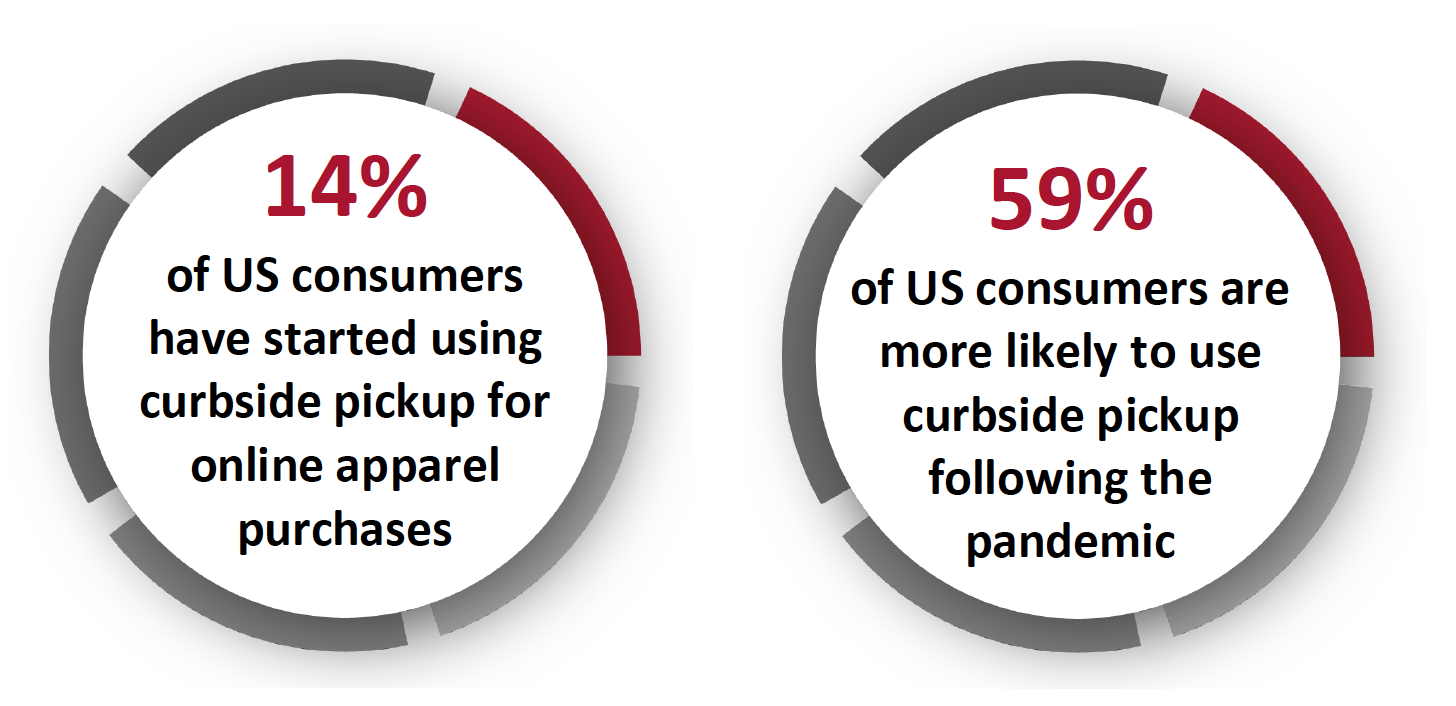

We expect curbside pickup to be embraced by more retailers in the long term, as shoppers and retailers look for contact-light fulfillment options. A Coresight Research survey found that 14% of US consumers have started using curbside pickup for online apparel purchases, and our August 2020 analysis found that 76% of the top 50 store-based retailers in the US now offer curbside pickup. We see that share creeping even higher post crisis. Retailers who rolled out curbside pickup during the pandemic also plan to extend the service to additional stores through the remainder of the year.

While there may be a slowdown in consumers’ use of such services compared to the peak of the crisis, curbside pickup could remain prevalent: Some 59% of consumers are more likely to use curbside pickup following the pandemic, according to a recent survey by tech provider CommerceHub.

[caption id="attachment_114028" align="aligncenter" width="700"] Base: US Internet users aged 18+, surveyed on July 1, 2020 (left); Over 1,500 US consumers, surveyed in April (right)

Base: US Internet users aged 18+, surveyed on July 1, 2020 (left); Over 1,500 US consumers, surveyed in April (right)Source: Coresight Research/CommerceHub[/caption]

Today, we are seeing retail players across multiple sectors adopt curbside-pickup services, including mass merchants, shopping malls, department stores, beauty and home retailers, and fashion brands such as Everlane and Old Navy.

We anticipate the further advancement of this type of fulfillment through the integration of technology such as robotics and automation—such as for inventory management—which helps make the process more efficient.

Contactless Payment

We expect contactless payment to become mainstream in the post-Covid world. Contactless payment has achieved popularity in Asia, particularly in China, and is finally gaining traction among US consumers, spurred by the pandemic. Around 24% of US consumers expect to retain heightened use of contactless payment after the crisis ends, according to the Coresight Research survey conducted on July 15, 2020.

The penetration of proximity mobile payment users in US is still low: Only 29% of US smartphone users used proximity payment in 2019, versus 81% of penetration rate in China, according to eMarketer. This represents huge potential for growth, and brands and retailers should prepare for contactless and frictionless checkout in a post-Covid environment.

QR codes, which have gained widespread acceptance in China, are gradually taking off in US retail as an appealing form of contactless payment. We are likely to see more retailers incorporate the function as a payment method, mostly within their own apps. Walmart, for example, upgraded its Walmart Pay app in late March to enable consumers to scan a QR code to pay at checkout.

Cashierless Stores

Covid-19 has prompted retailers to rethink their checkout process, and we expect to see more retailers go cashierless, eliminating in-person checkout to reduce exposure to other people. The checkout process has been one of the biggest pain points in consumers’ in-store shopping experience, and many consumers are gravitating towards automated or mobile checkout to avoid waiting in lines. Covid-19 represents a catalyst for the transition to cashierless stores.

Consumers’ mobile devices are becoming individual POS terminals for safer and faster checkout. We have seen retailers ramping up their scan-and-go solutions: Kroger is upgrading its “Scan, Bag and Go” system; and Wegmans is expediting the rollout of its “SCAN” service to more stores.

A few retailers such as Amazon have taken this concept a step further by automating the entire checkout process with a system of cameras, sensors and artificial intelligence (AI) in its Amazon Go and Amazon Go Grocery formats. Amazon recently announced the trial of its next-generation shopping cart “Dash Cart” to enable shoppers to skip checkout lines, which is built on its “Just Walk Out” technology.

At the beginning of March 2020, Amazon began selling its cashierless technology to other retailers. Retail tech company Aifi also announced in July that it will deploy 330 autonomous stores with top grocery retailers primarily in Europe and the US. We could see this type of just-walk-out shopping become a fixture of the physical retail landscape in the coming years.

Vending Machines

A wave of smart vending machines is set to become more ubiquitous post crisis. Vending machines presented an edge over other retail channels amid Covid-19 as they provide 24/7 access with no human interaction, and consumers are not going to touch the products until they have bought them.

With connected devices and Internet of Things (IoT) sensors being widely adopted in retail, there is increasing demand from consumers for more intelligent vending machines. Today’s smart vending systems are not the common snack dispensers but are incorporating high-definition displays, gesture recognition, contactless payment and mobile apps to sell a variety of products.

We see opportunities for vending machines to further integrate seamless shopping with inventory management, loyalty programs, analytics and content marketing—to improve the overall customer experience. For example, retailers can receive real-time information on inventory stock levels to ensure immediate replenishment of products.

The potential of this channel should not be overstated: Vending remains a niche channel, which we estimate accounts for less than 0.5% of all US retail sales—but from this tiny base, there are opportunities to grow share.

The increased presence of vending machines in locations such as office buildings, public transportation, college campuses, airports and residential communities also helps brands and retailers to reach consumers outside of malls and retail stores. They can leverage vending machines as unstaffed pop-ups to raise brand awareness.

Contact-Light Retail amid the Crisis

Below, we take a look at the innovative contact-light approaches that brick-and-mortar brands and retailers have recently adopted to make consumers feel more comfortable when shopping.

Emergence of Fresh-Produce Vending Machines in China

Demand for grocery surged in the beginning of the pandemic. Chinese consumers would need to arrive at supermarkets early in the morning before stocks depleted or reserve delivery time slots in advance for online grocery. Vending machines that were installed in residential communities provided a convenient and safe channel to purchase fresh produce 24/7.

E-commerce giant JD.com rolled out its AI vending machines in several cities in China, to offer residents access to fresh produce sourced from JD.com’s 7Fresh supermarket nearby. Consumers can use their mobile phones to scan a QR code to open the door of the machine, and payment will be automatically processed after they take out the products.

Employees from 7Fresh regularly disinfect the machine and ensure the produce is sufficient and fresh. JD.com also leverages big data to analyze what produces are more favored than others by nearby residents and frequently changes the assortment to meet localized demand.

[caption id="attachment_114029" align="aligncenter" width="700"] Fresh produce vending machines in a community area in China

Fresh produce vending machines in a community area in ChinaSource: Coresight Research[/caption]

Department Store Develops a Mobile App for a Contactless Shopping Experience

Showfield, an experiential department store that combines retail with art exhibitions in New York launched a new mobile app called Magic Wand to lure consumers back to its store when it reopened. The app allows consumers to take an interactive tour in the store using their mobile device. They can point their phones at the displays to learn exclusive information about each brand. Shoppers can then select products to save to a virtual shopping cart and pay for these on the app. The store associates makes the items available at pickup points throughout the store. The retailer also offers curbside pickup for online orders.

What We Think

Offering a contact-light shopping experience is becoming a “must-have” for brands and retailers to meet consumers’ demand for safety and convenience. It is important for them to adapt quickly to the new reality.

Implications for Brands and Retailers

- Curbside pickup provides a safer way to serve consumers, and brands and retailers that adopt the service should ensure a frictionless process by having good control over inventory levels and the fulfillment process. The service might seem counterintuitive for retailers—as it prevents potential impulse purchases and upsell opportunities with consumers not entering the stores—but brands and retailers can still leverage their online platforms to drive more sales. For example, they can integrate AI and machine learning to deliver highly personalized product recommendations.

- Brands and retailers can choose different types of contactless payments—including NFC-enabled POS and QR codes—to be implemented in stores. Bigger retailers can develop their own app, not just to serve as a payment method but also to provide added services such as loyalty program and BOPIS (buy online, pick up in store) functions to elevate the overall shopping experience.

- To further improve the checkout process, brands and retailers can adopt scan-and-go technology. With Amazon and other retail tech companies offering just-walk-out services, it makes sense for retailers such as convenience stores and smaller grocers—where consumers prefer to buy things quickly and long lines are common—to adopt such technology.

- Brands and retailers can use vending machines to acquire consumers outside of shopping malls or retail stores, as well as increase brand awareness with engaging elements. For example, they can add gamification or personalization features to interact with consumers.

Implications for Technology Vendors

Technology is more crucial than ever in a contact-light retail world. Technology vendors can continue to provide innovative tools for retailers and brands to make consumers feel comfortable and safe to shop. We expect to see strengthened post-crisis demand from retailers for the following:

- Technologies that enable efficient curbside pickup—including AI-enabled inventory management through AI, real-time product location tracking, automation and robotics.

- Contactless payment that is relatively simple to adopt for retailers, with mainstream technologies such as NFC chips and QR codes.

- Cashierless stores that utilize a combination of cameras, sensors, computer vision systems, IoT devices, radio-frequency identification, and voice and facial recognition.

- Technologies equipped in intelligent vending machines, which can include IoT systems, cashless technologies, analytics, cloud, and gesture and image recognition.