Introduction

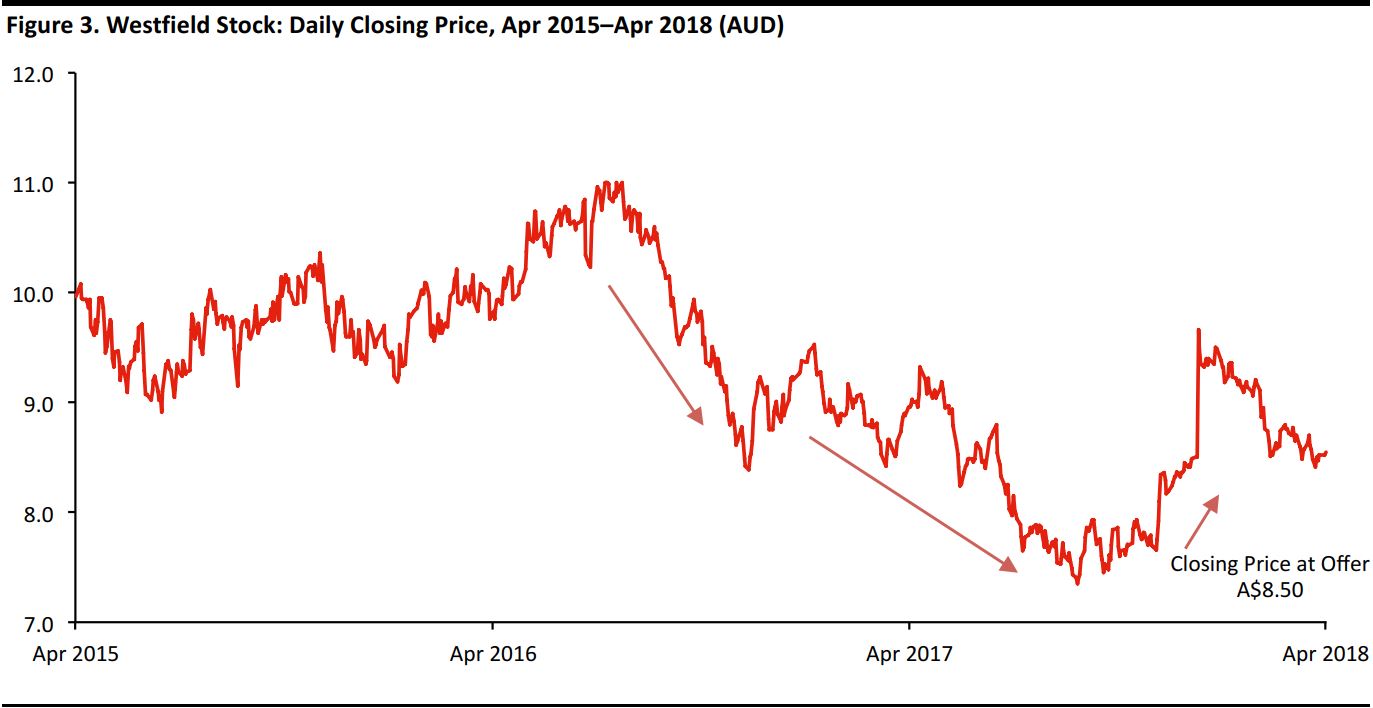

Retail real estate has seen a flurry of merger and acquisition (M&A) activity that is consolidating the sector, despite the continuing narrative about the brick-and-mortar “retail apocalypse.” In the past few months, two major operators of malls in the US—GGP and Westfield—have received acquisition offers from large commercial property firms, and we have seen M&A activity in the European sector, too. In this report, we explore this consolidation among real estate investment trusts (REITs), mall operators and commercial property firms, and offer our thoughts on the trend. We also examine an underlying trend that may have indirectly prompted this consolidation: the transformation of the shopping-center tenant mix across the US.

While there have been a number of casualties across retail categories, such as RadioShack in electronics and Toys“R”Us in toys, specialty apparel and apparel-focused department stores have accounted for the bulk of store closures in recent years.In an earlier report,

What Retail Apocalypse? Reviewing Trends in US Brick-and-Mortar Retail, we noted that regional malls, which tend to skew toward apparel, have seen a concentration of store closures. Despite this, consolidation is increasing among real estate firms, including REITs.

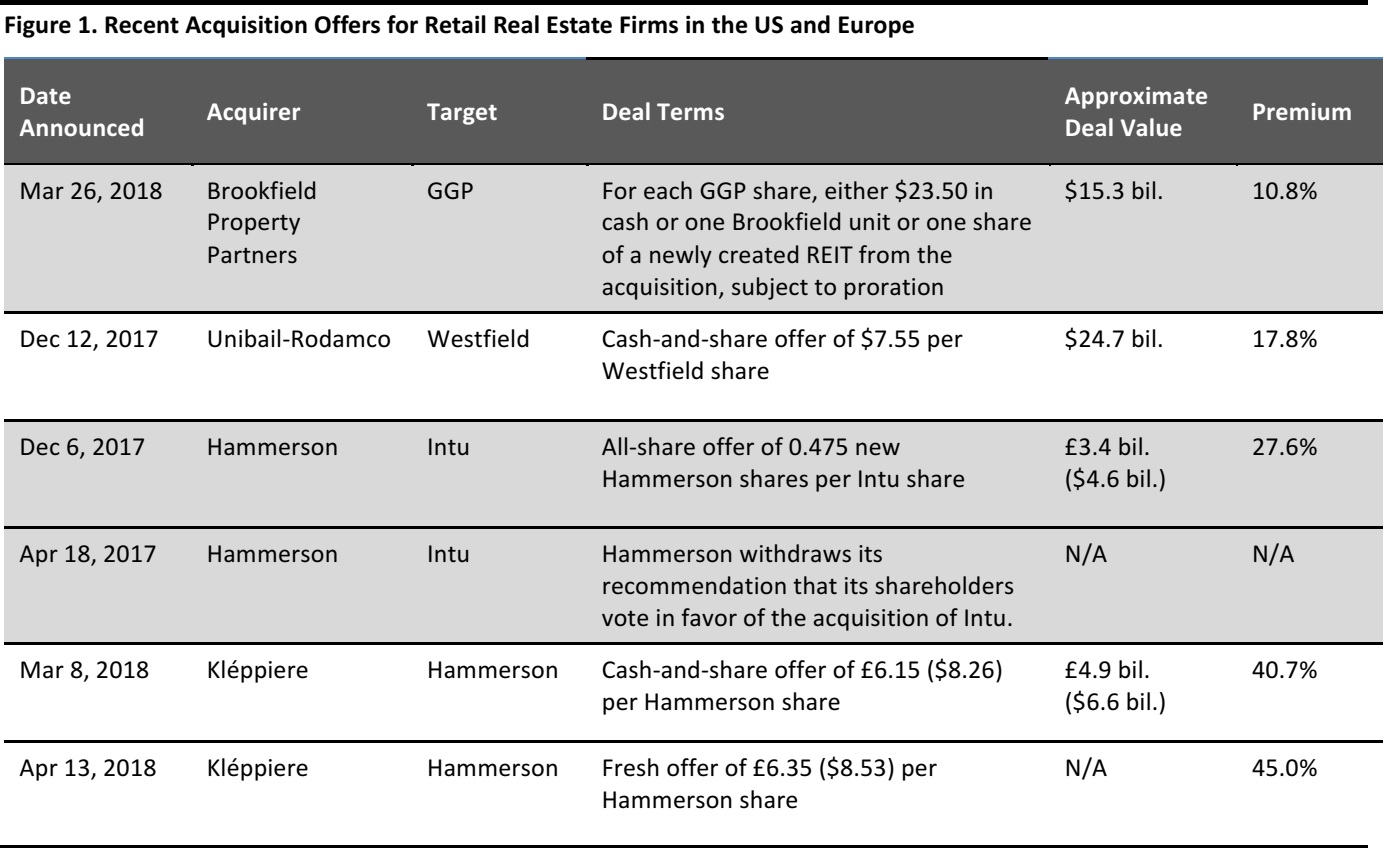

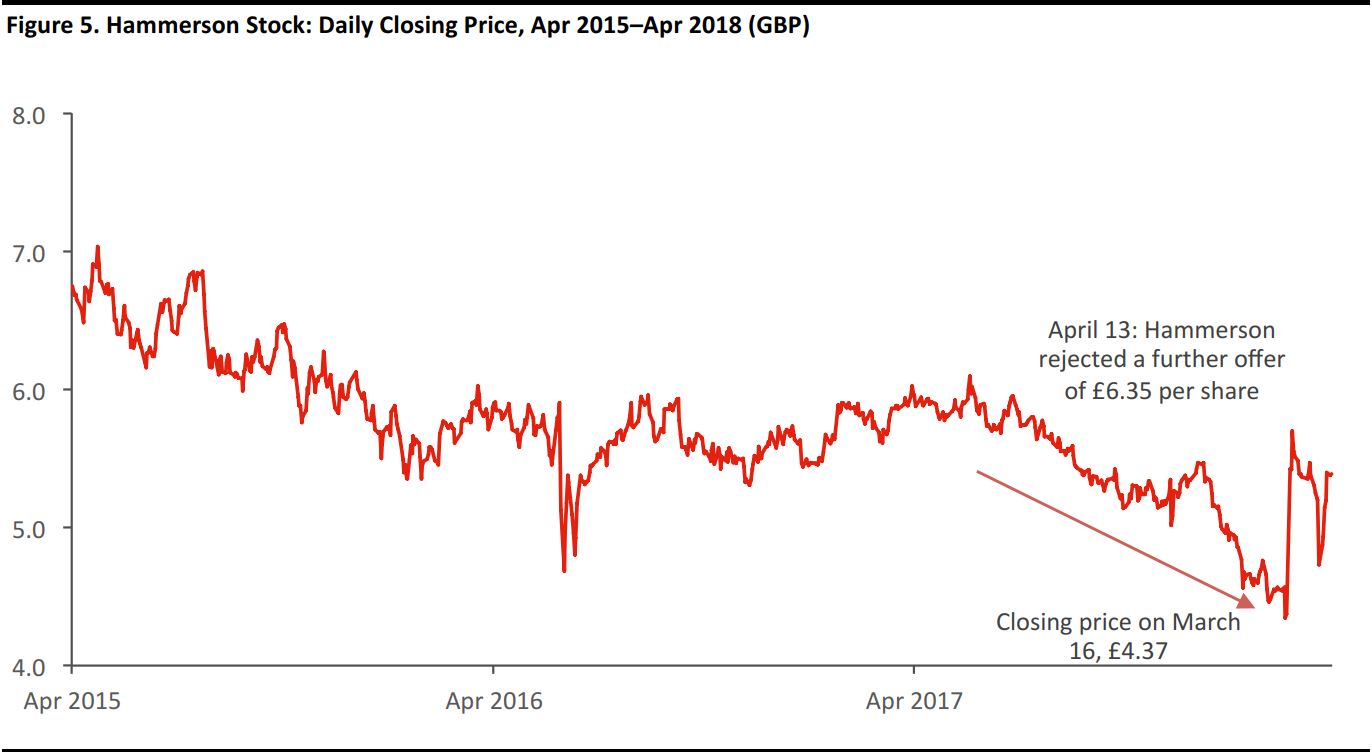

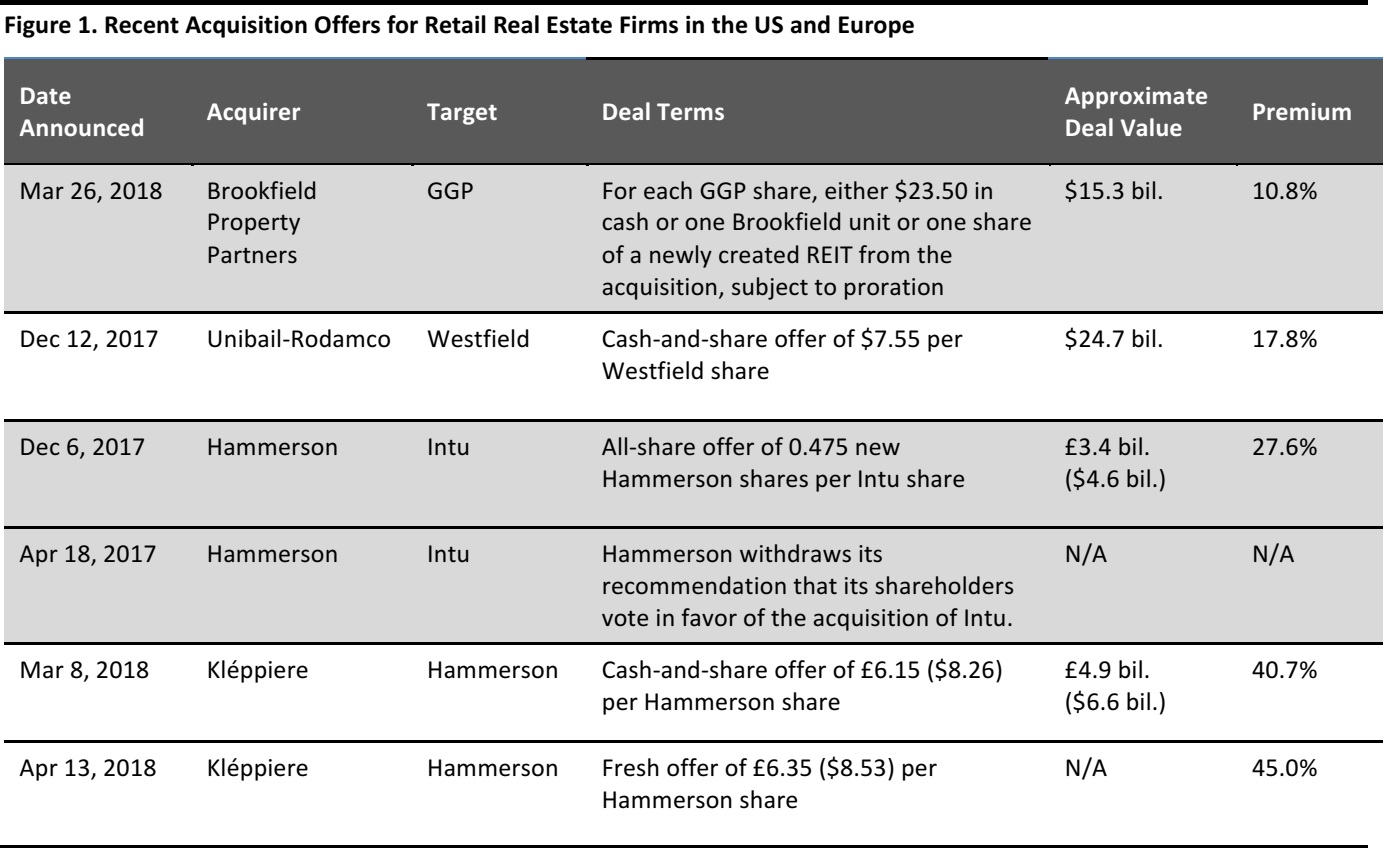

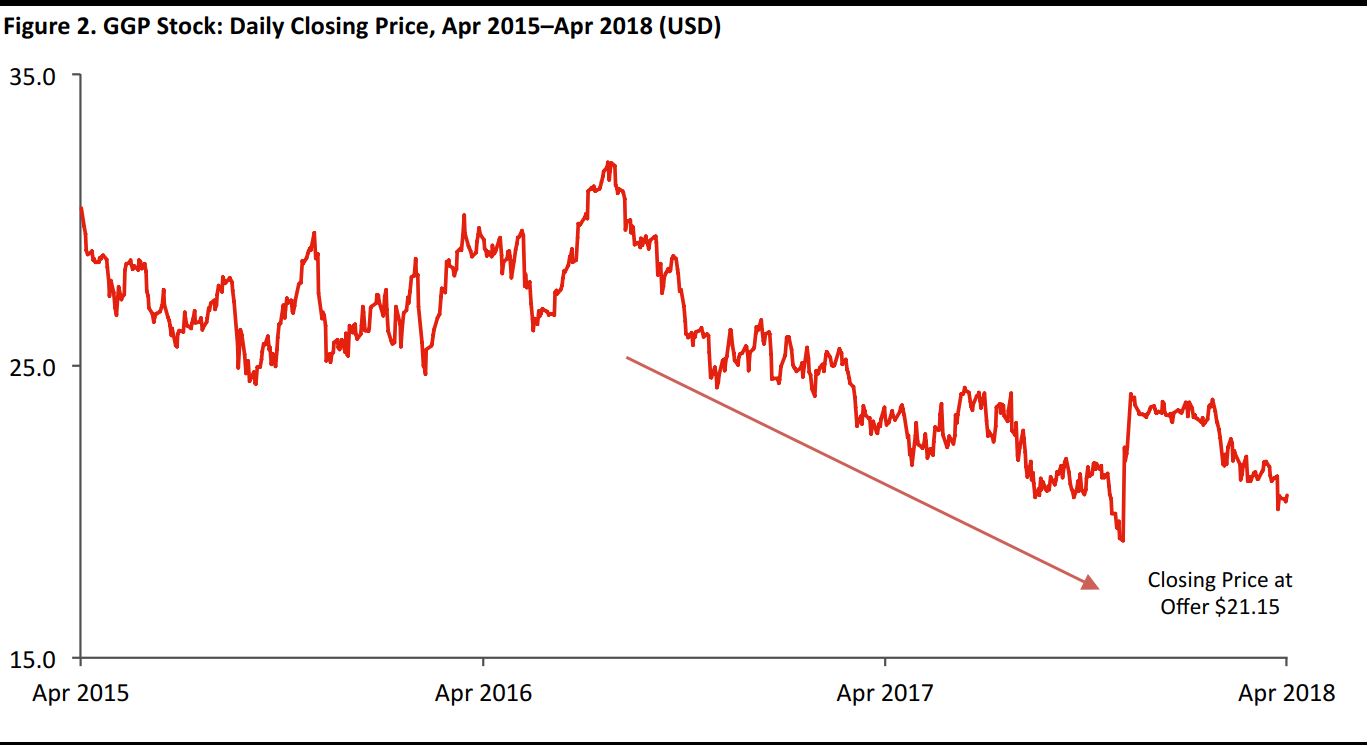

Consolidation Among Retail Property Firms

Within a matter of four months, we have seen four M&A offers involving some of the largest mall and shopping-center operators, even though their share prices have been declining over the last three years. We think that this could be the beginning of a trend that will gain momentum through the rest of the year, and that further consolidation among real estate companies is likely.Two factors underlie this trend: high-quality properties’ stocks are currently trading at a discount and shopping-center operators are transforming their tenant mix as they work to enhance the quality of their properties.

Recent offers in the retail real estate space have valued target firms at double-digit-percentage premiums.Share prices have been declining in the segment overall, possibly reflecting negative investor sentiment due to store closures and bankruptcies. Investors who believe that the mall is not dead may be buying these properties at a discount because they see future value in the assets.

Source: Company reports

We note that the targets’ share prices were either approaching a trough or were bottoming out at the time these four offers were made.

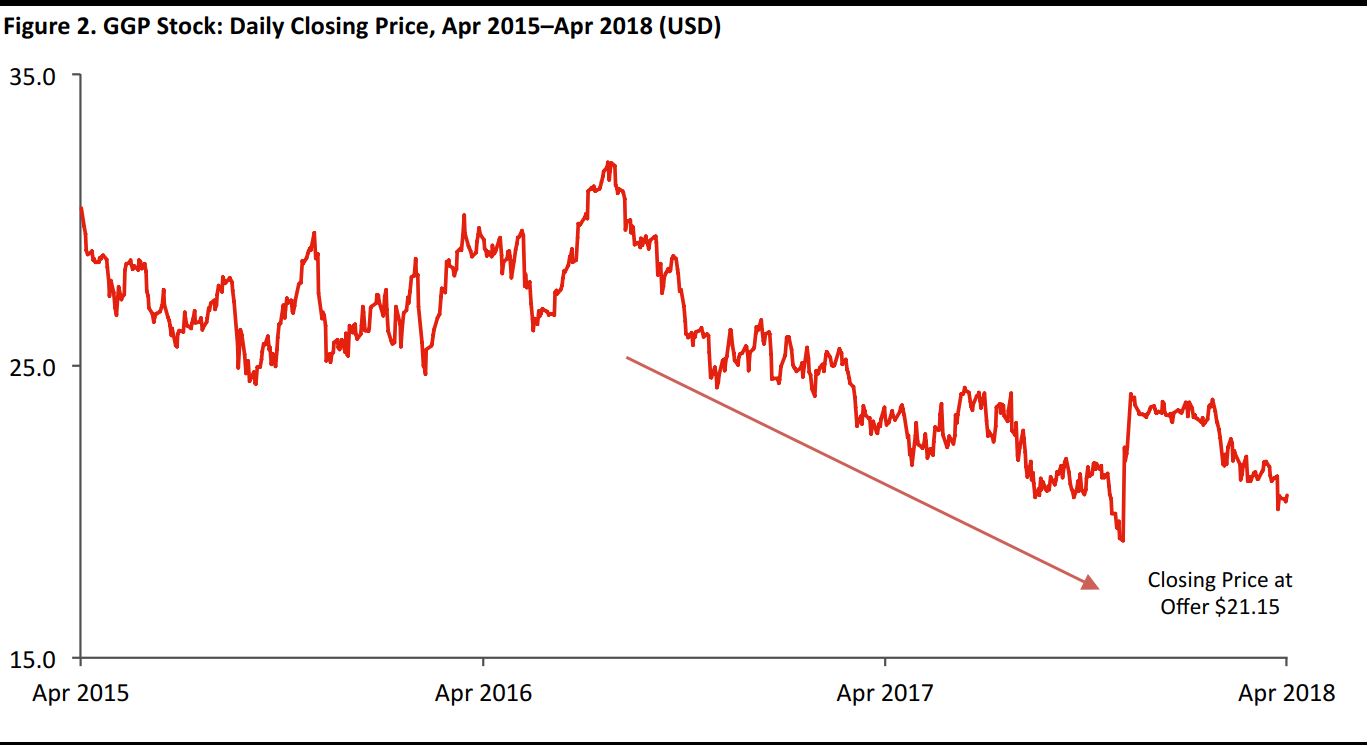

Brookfield Property Partners and GGP

On March 26, 2018, commercial real estate firm Brookfield Property Partners announced an offer to acquire the remaining 66% stake of GGP that it does not already own. GGP is a US REIT and one of the largest mall operators in the country. The deal was valued at about $15.3 billion and implied a 10.8% premium to GGP’s share closing price on the day of the announcement. GGP’s stock has been declining since April 2016, but Brookfield Property Partners sees value in the firm’s high-quality real estate assets. In a statement, Brookfield CEO Brian Kingston remarked that the deal will help Brookfield combine its “access to large-scale capital and deep operating expertise across multiple real estate sectors with GGP’s portfolio of irreplaceable retail assets.”

Source: S&P Capital IQ

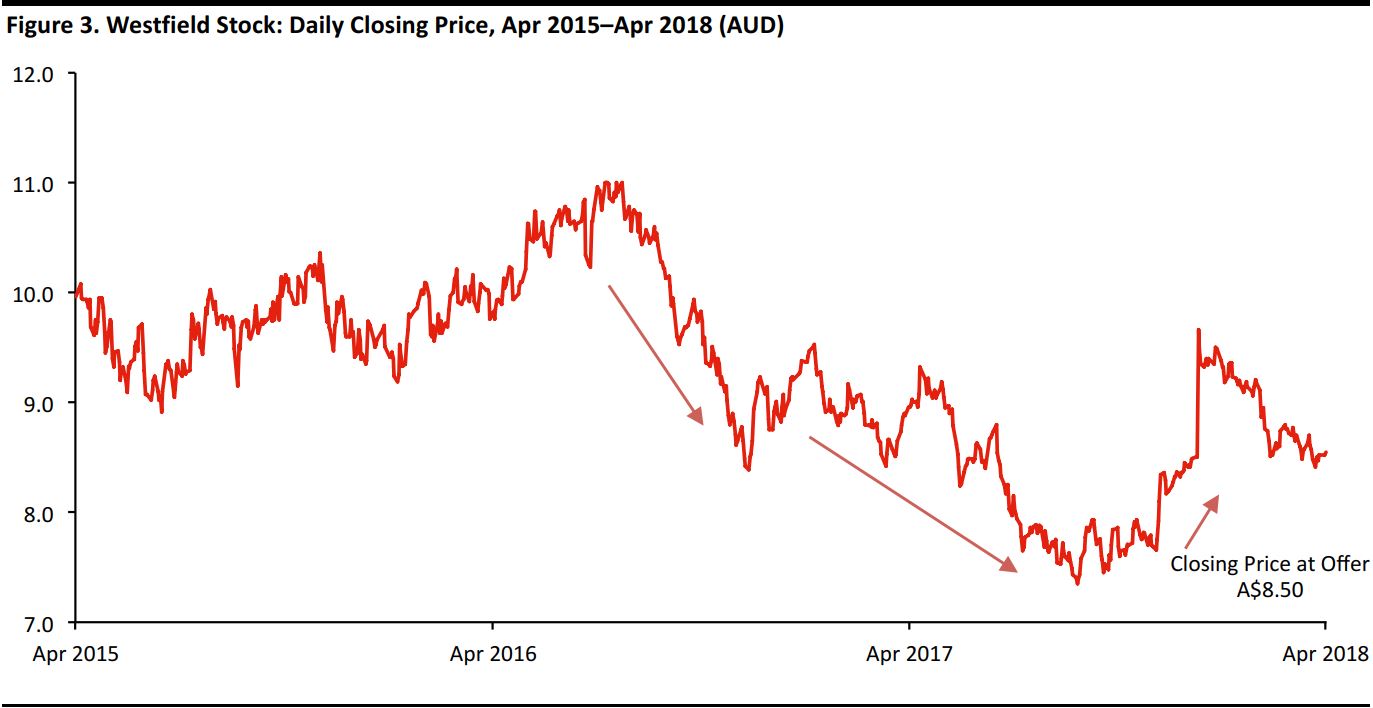

Unibail-Rodamco and Westfield

In December 2017, French commercial real estate firm Unibail-Rodamco announced an offer to acquire Australia-based Westfield, which runs 33 malls in the US and two in the UK. Unibail-Rodamco’s offer valued each Westfield share at A$10.01 (US$7.55), or a premium of 17.8%, and valued Westfield in its entirety at about A$32.8 billion (US$24.7 billion). Unibail-Rodamco managed to push its offer to Westfield before the stock bottomed out.

Source: S&P Capital IQ

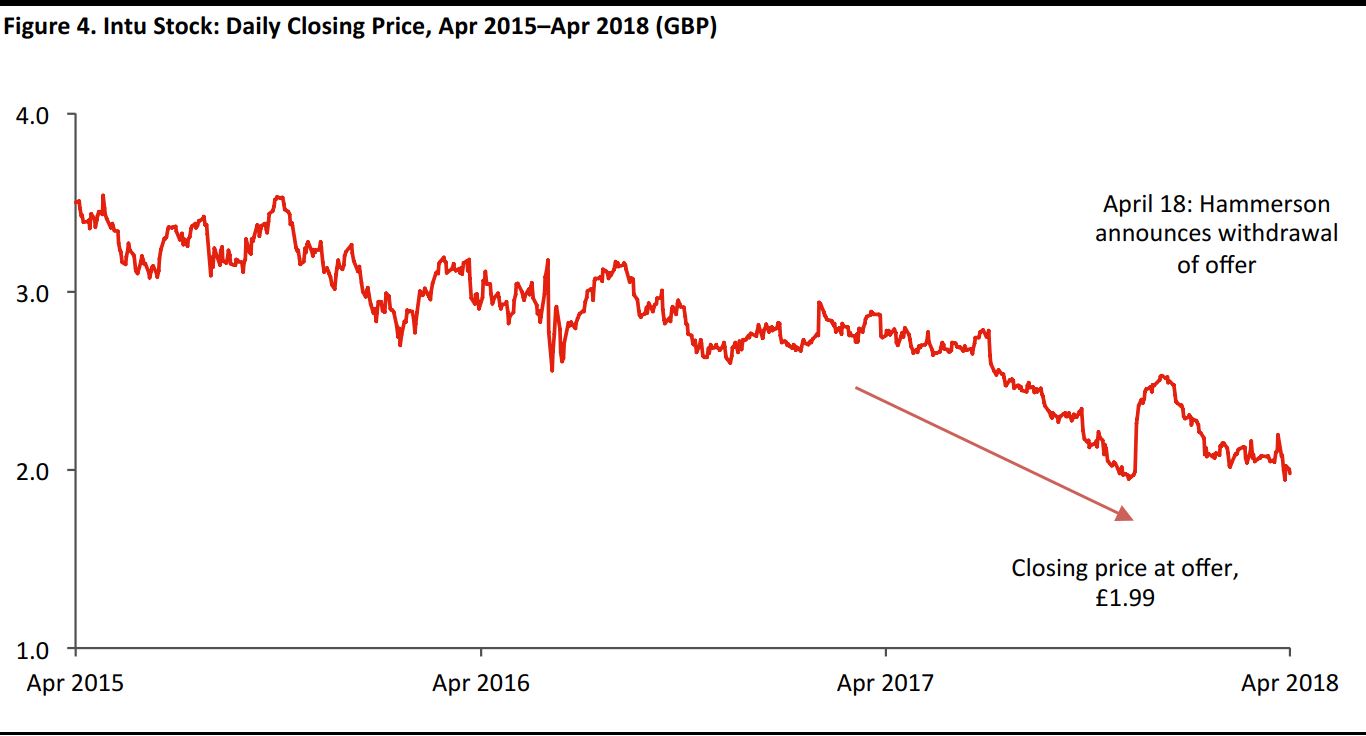

Hammerson and Intu

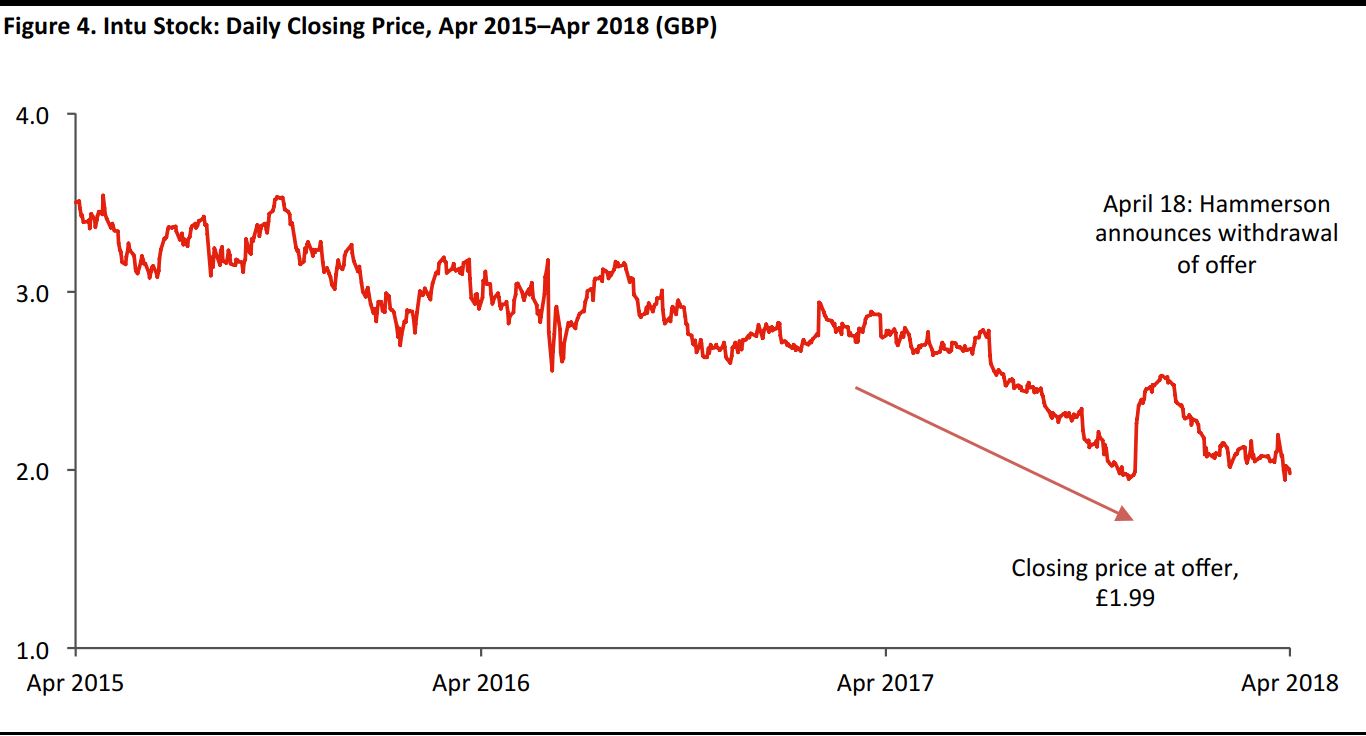

The retail landscape in Europe is also beginning to see signs of consolidation. In December 2017, British firm Hammerson, which runs shopping centers and premium outlets in the UK, Ireland and France, announced an all-share offer to buy UK rival and shopping-center operator Intu for £3.4 billion ($4.6 billion), which was a 28% premium to its share closing price on the business day before the announcement. In the first half of 2017, Intu’s stock price was mostly stable. But between July and the date when Hammerson announced its offer to buy it, Intu’s stock price fell by as much as 27%.

On April 18, Hammerson effectively pulled its offer to buy Intu, by withdrawing its recommendation that its shareholders vote in favor of the acquisition. Hammerson management cited a deterioration in the UK retail property market since the start of the year.

Source: S&P Capital IQ

Kléppiere and Hammerson

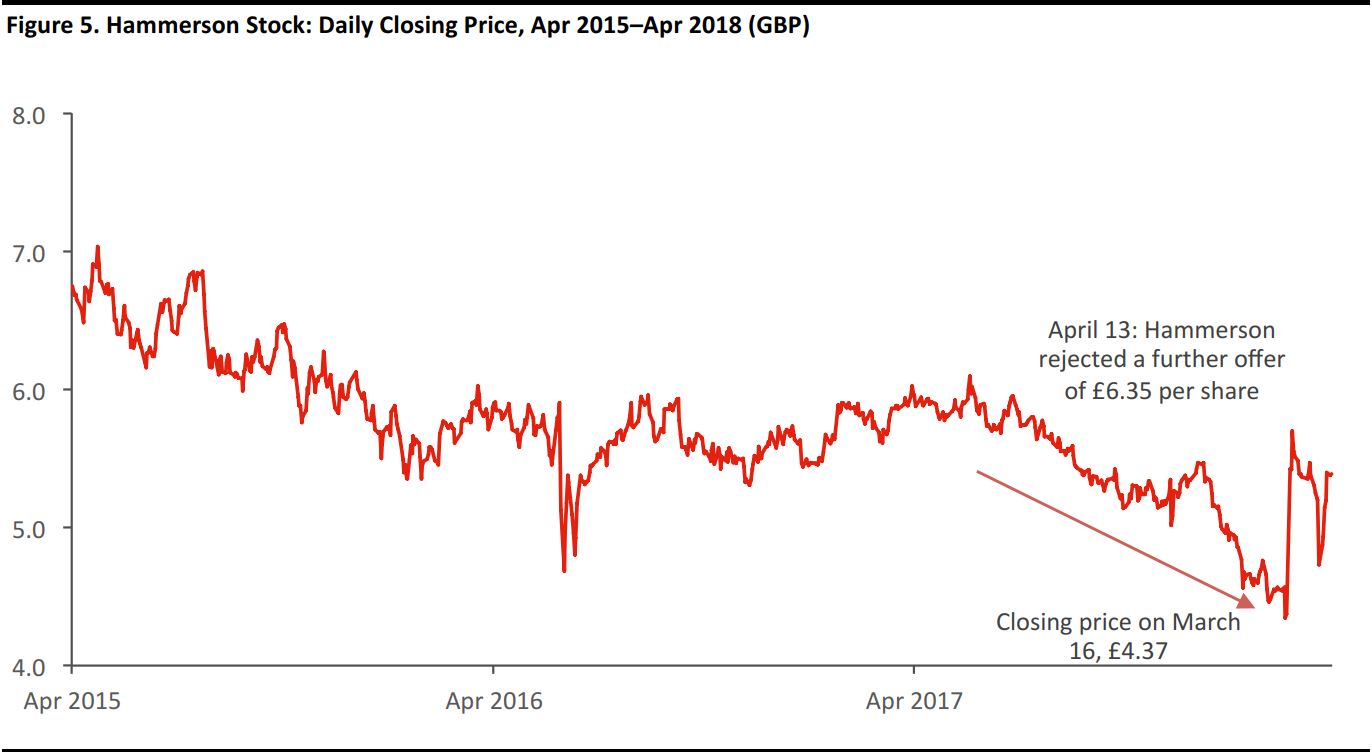

On March 8, 2018, Hammerson was again in the news, as French retail property firm Kléppiere bid to acquire it in a cash-and-share offer worth £4.9 billion ($6.6 billion) or £6.15 ($8.26) per share. However, the two companies did not make public announcements of the offer until March 19, and the stock market’s reaction was seen only in the three days before the announcements.

Hammerson rejected the bid on March 9, stating that it was “opportunistic,” as the offer valued Hammerson at a steep discount to its book value, according to Hammerson Chairman David Tyler. The company’s stock had been on the decline over the previous three years.

Kléppiere said that its offer was at a premium of 40.7% to Hammerson’s share closing price of £4.37 ($5.87) on March 16, 2018, which was a little over a week after the offer was made and around the time that Hammerson’s stock began to rise, possibly due to speculation regarding the deal, as it had not yet been officially announced. In April, Hammerson rejected a further offer of £6.35 ($8.53) per share.

Source: S&P Capital IQ

We think that the shift that retail real estate is undergoing is one structural reason behind the recent acquisition offers.Shopping centers that have adapted to changing consumer demands have continued to see success, as measured by shopper traffic and occupancy rates.

Consolidation means that companies that transform their portfolios will benefit from access to a greater pool of capital, broader industry expertise and additional resources. The need to invest in better shopping centers may therefore be one reason that REITs view M&As as worthwhile. Commercial property firms with investments beyond retail may be attracted by retail real estate firms’ discounted shares and by the fundamental changes that some of these firms are undertaking.

In the following section, we summarize some of the ways that shopping centers are diversifying their tenant mixes and offerings, in order to illustrate what the transformation of physical retail entails.

Transforming the Shopping-Center Offering

Shopping-center operators are overhauling their offering in a number of ways, including by:

- Introducing a wider mix of nonretail services, such as leisure and food services: Shopping centers increasingly house tenants that offer nonretail services.These include fitness centers, entertainment concepts, spas, medical and dental clinics, financial and insurance services,and concept dining spaces. This tenant shift is partially in response to consumers moving spending away from products and toward experiences, and it allows operators to insulate themselves somewhat, as services are more “e-commerce-proof” than traditional retail offerings are.

- Accommodating new types of retail tenants, including digital-first retailers and pop-up shops: Owners are shaking up their retail offerings by bringing in new and limited-time formats, such as pop-up shops and physical shops from digital retailers and brands that are expanding operations from online to offline.

- Reducing the number of apparel store tenants, in response to weaker clothing and footwear demand: Over the last several years, many US consumers have prioritized spending on discretionary categories such as dining out and technology over spending on apparel. Malls and shopping centers, whose biggest occupants traditionally have been apparel retailers, are now dedicating a greater proportion of space to retailers in other categories and to service providers.

- Incorporating a wider range of uses, outside retail and leisure: Property firms are repurposing redundant spaces and parking lots for uses beyond retail and leisure. Mall operators such as GGP and Simon Property Group have built homes and hotels alongside their properties, and have also signed coworking space providers as tenants on less-productive floors of shopping malls.

- Incorporating more premium malls in their portfolios: Data from mall operators indicate that shopper traffic is increasing at premium malls,reflecting a flight to quality among shoppers. For instance, GGP noted a 1.4% year-over-year increase in traffic at its premium, class A malls in 2017, while its B+ malls saw positive traffic trends and its B malls saw flat trends. Due to this and other factors, mall operators such as GGP and Simon Property Group have been expanding the proportion of premium malls in their portfolios.

What We Think

As US shopping centers continue to redefine their offering, they stand to benefit from the additional capital and industry expertise that diversified commercial real estate firms can provide. Since retail real estate firms continue to be valued at a discount, we think the category will see renewed investor confidence in coming months. As this interest peaks and investors pour greater funds into building more malls that are led by experiential and entertainment offerings, the narrative about the brick-and-mortar retail apocalypse could reverse.