Nitheesh NH

Introduction

What’s the Story? It has never been more important for retailers and brands to adapt quickly to the changing preferences and behaviors of consumers, who now shop across a variety of platforms, devices and geographies. Customers are increasingly seeking tailored experiences and expect value back for sharing their data with brands and retailers. In this report, we discuss the differences in perceptions between consumers and brands/retailers on retail personalization and data privacy. We analyze the findings of three Coresight Research surveys—two sent to consumers, and one to brands and retailers, in the US and the UK. This report is sponsored by cross-channel marketing automation solution provider Sailthru, which helps marketers build relationships with their customers through one-to-one personalization via email communication and desktop and mobile platforms. Why It Matters Brands and retailers need to be agile and recognize that value exchange is the critical component to capitalizing on consumer engagement opportunities. Personalization in marketing can bring numerous benefits to brands and retailers, including increased customer lifetime value, stronger customer loyalty and increased market share. To optimize the effectiveness of personalization strategies, brands and retailers must understand consumer preferences and behavior in order to choose the right channel. The key to building trust with consumer data is by providing next-generation marketing personalization that helps shoppers with product discovery provides a seamless experiences across channels. Consumers also place data privacy top of their agendas and pay strong attention how their data is being used. Brands and retailers must be respectful and transparent in their marketing personalization efforts when it comes to data privacy, in order to build consumer trust. New policies governing privacy—such as Google’s and Apple’s privacy updates in 2021—offer retail companies an opportunity to rethink their approach to acquiring consumer data, and to use it in a way that makes shopping feel more personal without compromising data privacy.Retail Personalization in 2022: Coresight Research x Sailthru Analysis

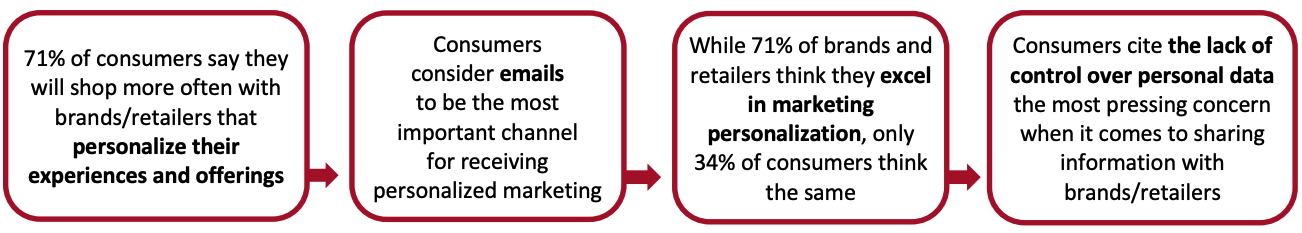

We summarize our key survey findings below, before presenting our analysis and exploring the implications of each in detail below.Figure 1. Retail Personalization in 2022: Key Survey Findings [caption id="attachment_144435" align="aligncenter" width="700"]

Base: Consumer personalization survey—5,014 US and UK consumers; Retailer personalization survey—260 US and UK brands and retailers; Consumer privacy survey—1,002 US and UK consumers

Base: Consumer personalization survey—5,014 US and UK consumers; Retailer personalization survey—260 US and UK brands and retailers; Consumer privacy survey—1,002 US and UK consumersSource: Coresight Research[/caption] The Importance of Personalization and Its Effective Execution: Perceptions of Consumers vs. Brands/Retailers Personalization can bring in extra dollars for brands and retailers, as more than two-thirds (71%) of consumers surveyed said they will shop more often with companies that personalize the experience. Brands and retailers can deliver personalization to customers in the following ways:

- Creating a consistent shopping experience across desktop, in-store and mobile sites, as well as through email

- Offering products and experiences that align with the shopper’s purchase patterns and browsing preferences

- Adopting personalized pricing and promotional strategies such as coupon codes to reward consumers’ loyalty

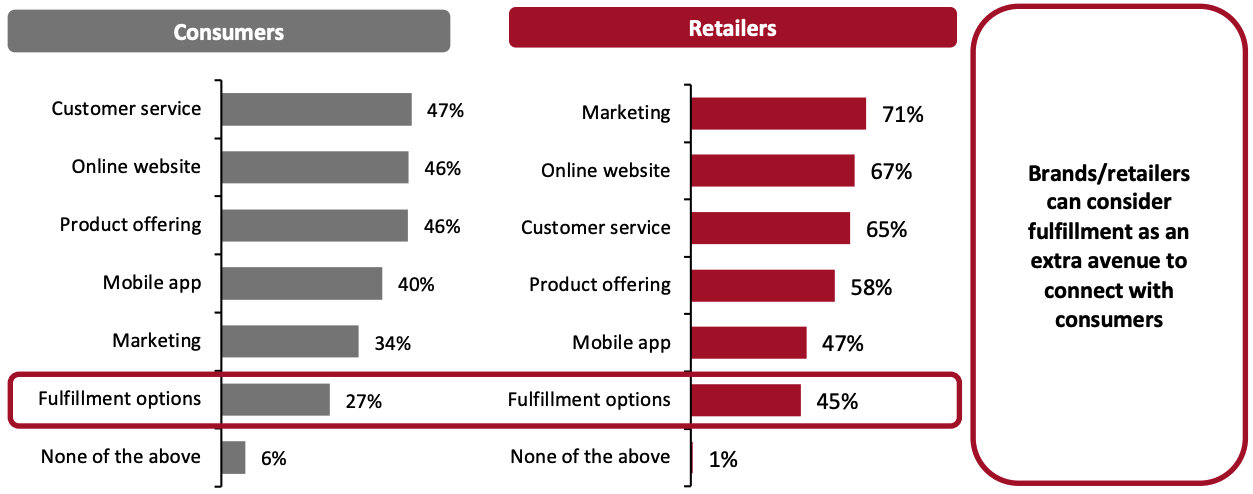

Figure 2. Areas in Which Consumers and Brands/Retailers Perceive Brands and Retailers Excel in Personalization (% of Respondents) [caption id="attachment_144436" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: Consumer personalization survey—5,014 US and UK consumers (left); Retailer personalization survey—260 US and UK brands and retailers (right)

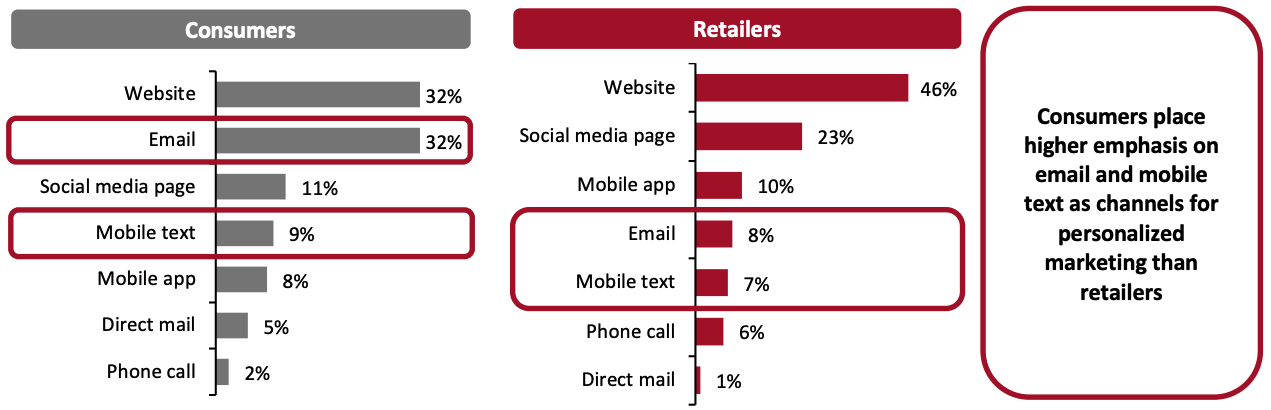

Source: Coresight Research[/caption] Key Marketing Channels: Email and Mobile Texts Present Opportunity While consumers and retailers and brands agree that websites are the most important channel for personalized marketing, they diverge when it comes to other channels. Most notably, almost one-third of consumers cited email as the most important channel—tying in top spot with websites—less than 10% of brands and retailers reported the same. Despite the penetration of social media into our daily lives (a channel that ranked in the top three for both consumers and brands and retailers), email still represent a very important marketing channel that retailers and brands must not ignore. Both consumers and retailers consider mobile texts and mobile apps among the top channels for personalized marketing. Although not a new tactic, personalized SMS marketing can provide an effective way to reach consumers while ensuring communications are relevant and timely.

Figure 3. Top Channels Through Which Consumers Want To Receive Personalized Marketing vs. Channels Through Which Brands/Retailers Will Consider Delivering Personalized Marketing (% of Respondents) [caption id="attachment_144437" align="aligncenter" width="700"]

Respondents were asked to select up to three answers

Respondents were asked to select up to three answersBase: Consumer personalization survey—5,014 US and UK consumers (left); Retailer personalization survey—260 US and UK brands and retailers (right)

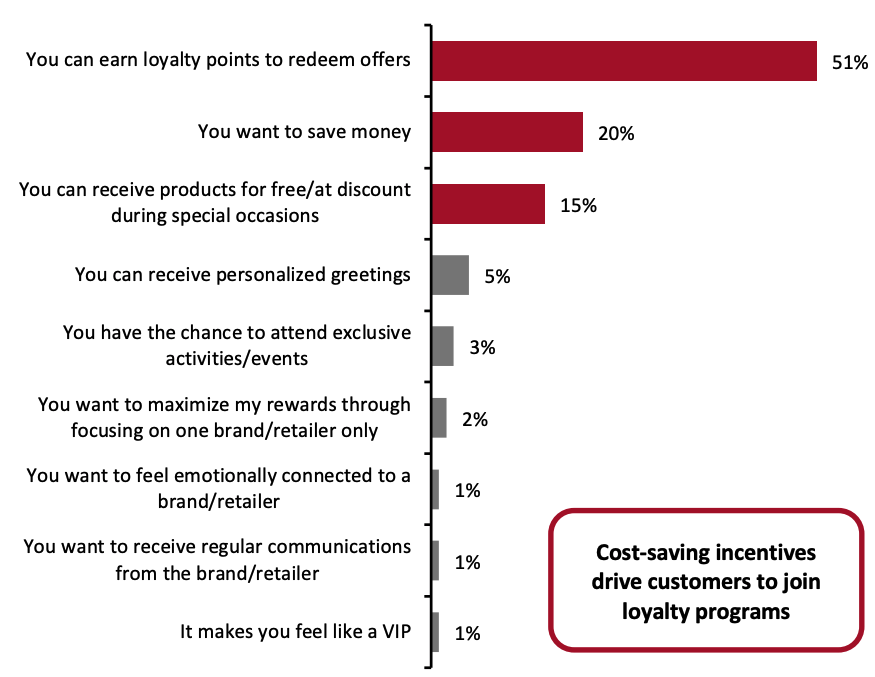

Source: Coresight Research[/caption] Loyalty Programs: Providing Data for Brands and Value for Consumers Loyalty programs remain a popular choice for many consumers: 53% of consumers from our consumer personalization survey said that they had joined a loyalty program of at least one or more brand/retailer. However, consumers need to be offered value in exchange for sharing their data to brands and retailers—and cost-saving incentives such as offers and discounts proved to be key reasons for joining a loyalty program among consumers in our survey (see Figure 4). If done well, loyalty programs can be instrumental in helping brands and retailers drive customer lifetime value and ultimately increase overall company performance.

Figure 4. Reasons Why Customers Want To Join a Loyalty Program (% of Respondents) [caption id="attachment_144438" align="aligncenter" width="700"]

Base: Consumer personalization survey—5,014 US and UK consumers

Base: Consumer personalization survey—5,014 US and UK consumersSource: Coresight Research[/caption] Not surprisingly, shoppers’ age plays a role in determining motivators to join a rewards program. While younger shoppers cited insider offers and VIP discounts as their motivators to join a loyalty program, older shoppers are more value-conscious, reporting that price breaks and discounts are the primary reason for joining a loyalty program. Younger shoppers are also more likely to value exclusivity and access to events than other age cohorts. Retailers and brands should therefore tailor loyalty perks according to age demographics. Some retailers and brands offer shoppers a full range of advantages to all loyalty members but showcase certain benefits to specific shoppers. For instance, Sephora’s membership program, Beauty Insider, offers consumers points based on purchase levels, as well as tier-based savings and lower shipping costs, which appeal to more mature shoppers. On the other hand, perks such as access to events and product samples are promoted to younger customers, personalizing sample recommendations based on each shopper’s purchasing history. Adidas’ Creators Club membership, which includes a tiered loyalty program, has perks that not only include discounts but also rewards such as free premium access to the Adidas training and running apps when consumers reach a certain loyalty tier. Personalization Tactics: Lower-Revenue Retailers and Brands Lag Behind Nearly all retailers and brands (98%) are using personalization tactics of some sort, with the three most prevalent being the following:

- Predictive personalization (cited by 50% of brands and retailers in our survey)—the ability to predict preferences and actions of users based on their past online behaviors and then customize current and future communications via the right channel at the right time

- Email send-time optimization (47%)—a feature that enables marketers to send emails at the most optimal time to each recipient, based on when they are most likely to engage

- Buyer journey-based personalization (44%)—a tactic that caters to individual buyers’ entire shopping journey, from discovery to point of purchase

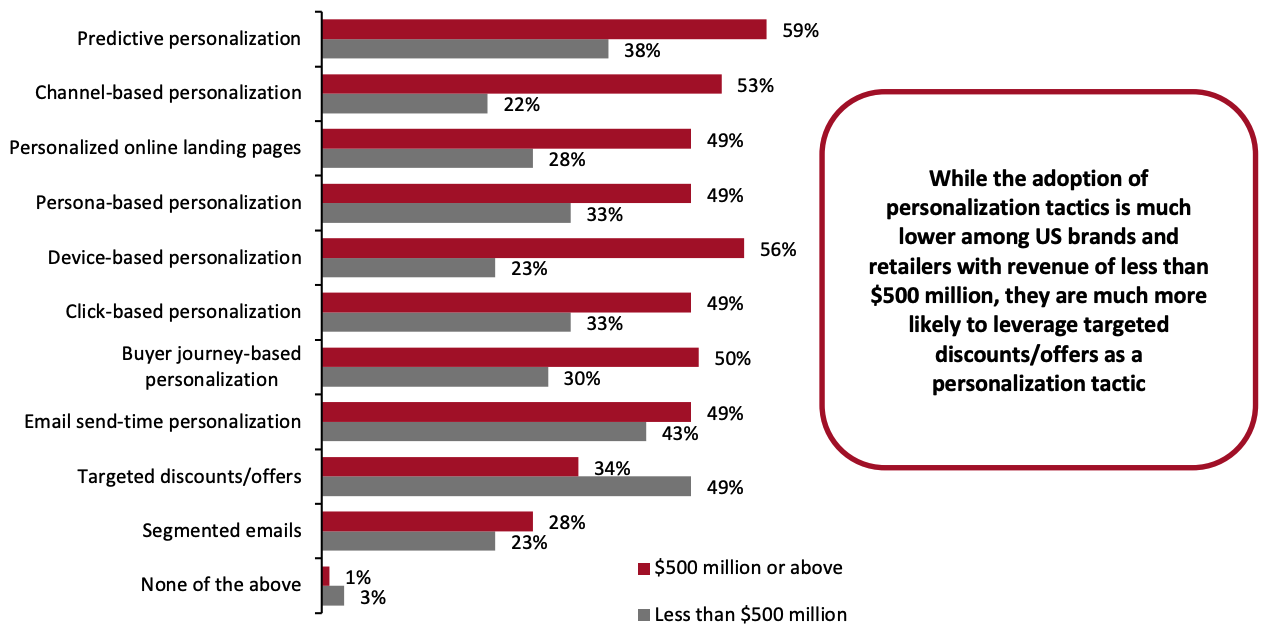

Figure 5. US Brands and Retailers: Current Adoption of Personalization Tactics, by Company Revenue (% of Respondents) [caption id="attachment_144439" align="aligncenter" width="700"]

Base: Retailer personalization survey—205 US brands and retailers

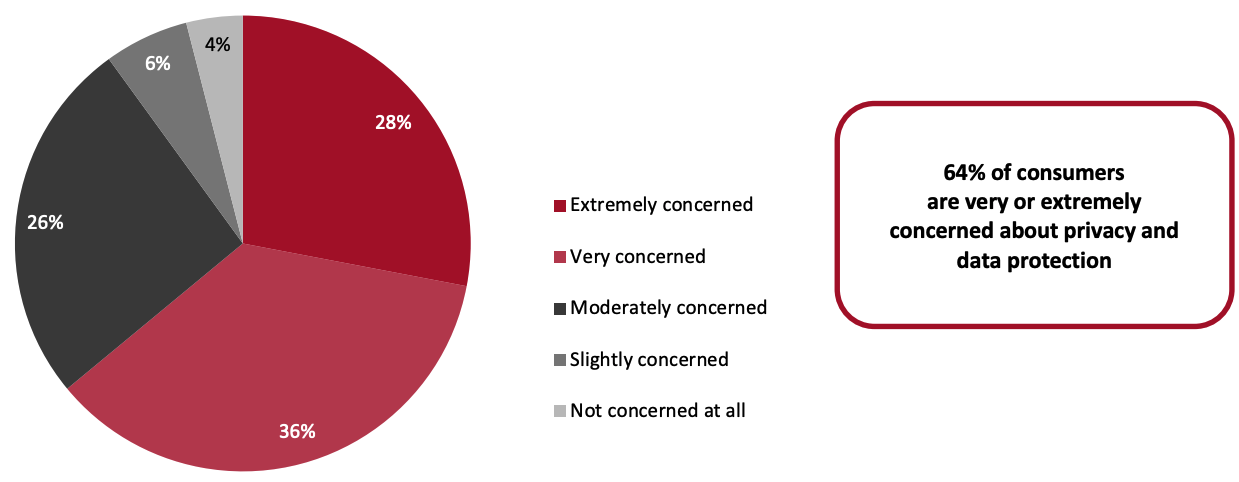

Base: Retailer personalization survey—205 US brands and retailersSource: Coresight Research[/caption] We found a similar pattern among UK brands and retailers: Those with revenue of less than £600 million (around $800 million) in revenue demonstrated a considerably lower usage of personalization tactics compared to those with higher revenues, and at the same time are demonstrating a reliance on targeted discounts/offers as a personalization tactic. Apart from leveraging personalization tactics, most brands and retailers are also tailoring communications to customers according to their local region or recent behaviors. From our survey, 79% of retailers and brands say they tailor communication to customers’ online web visits, followed by 78% that tailor to local region and 70% that tailor to social media behaviors. Consumer Concerns Around Data Privacy The majority of consumers (96%) are at least slightly concerned about data protection, according to our surveys (see Figure 6).

Figure 6. Level of Concern Related to Privacy and Data Protection (% of Respondents) [caption id="attachment_144440" align="aligncenter" width="700"]

Base: Consumer privacy survey—1,002 US and UK consumers

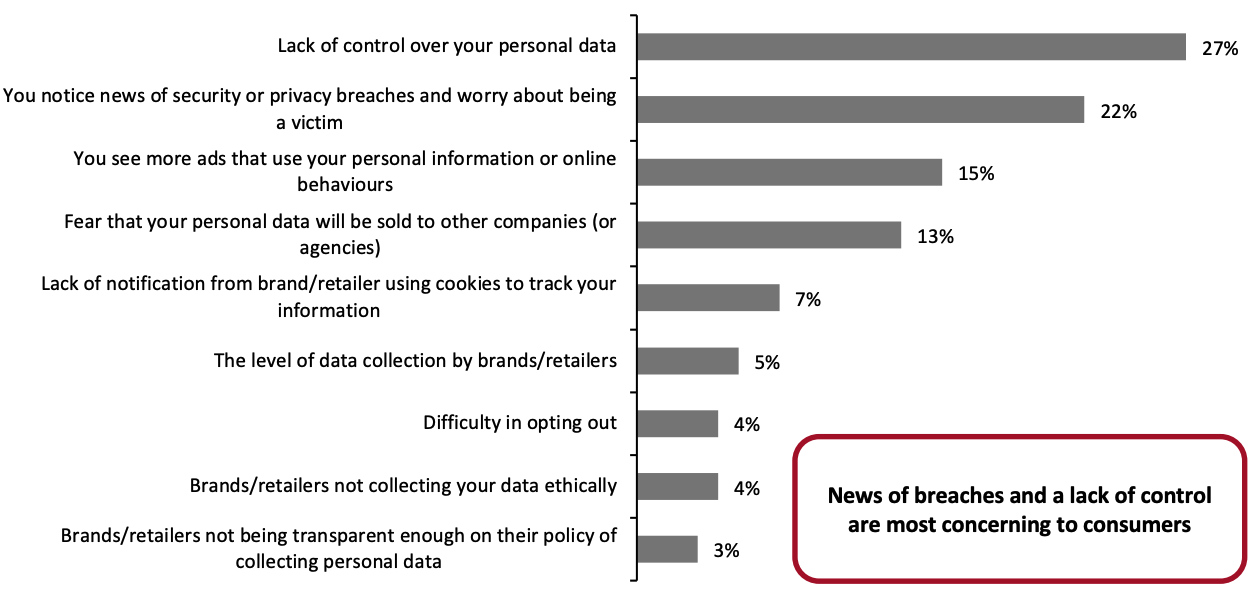

Base: Consumer privacy survey—1,002 US and UK consumersSource: Coresight Research[/caption] The primary reasons for this concern include a lack of control over personal data, news of security/privacy breaches and seeing more ads that pertain to customers’ personal behaviors (see Figure 7). While our consumer privacy survey found that 36% of consumers feel positive about sharing personal data to brands and retailers to receive better personalized experiences, consumers remain concerned about companies giving their data to third parties—cited by 13% of our survey respondents as a top concern. Brands and retailers therefore need to assure they are putting consumers’ data to legitimate use. At the same time, this reinforces the importance of value exchange: Consumers are willing to share personal data to brands and retailers if they perceive value in doing so.

Figure 7. Top Concerns Regarding Privacy/Data Protection Among Consumers (% of Respondents) [caption id="attachment_144441" align="aligncenter" width="700"]

Base: Consumer privacy survey—1,002 US and UK consumers

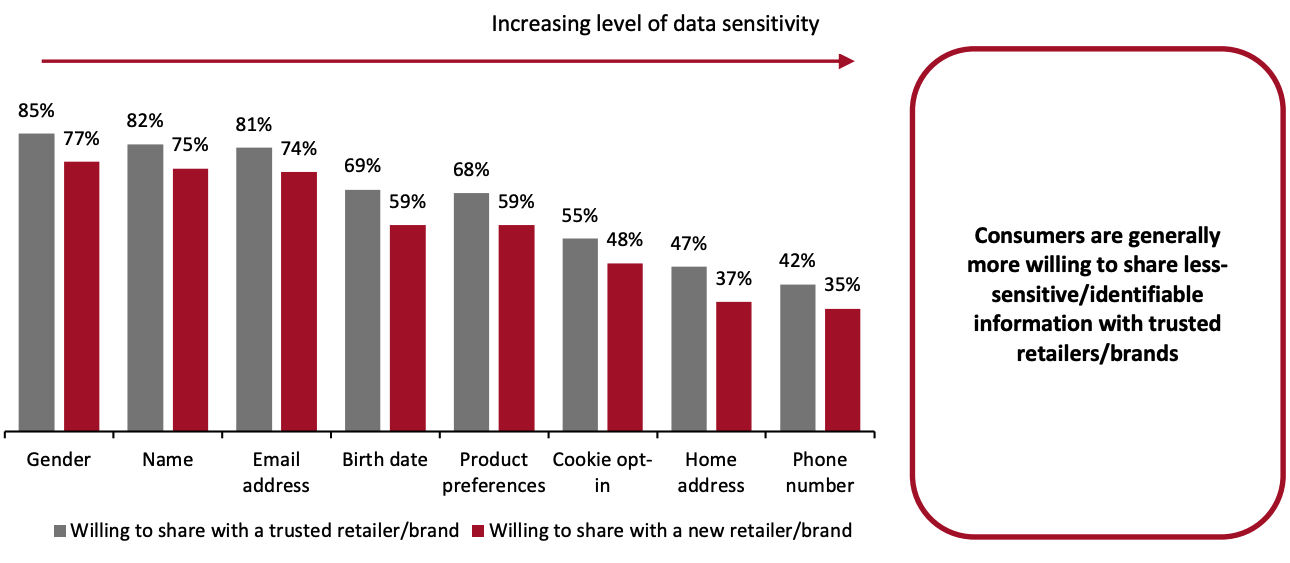

Base: Consumer privacy survey—1,002 US and UK consumersSource: Coresight Research[/caption] Despite the concerns that consumers have around privacy and data protection, they are still willing to share their personal information with retailers and brands for value in return. For example, from our consumer privacy survey, 69% of consumers said they would be willing to share their birthday with retailers and brands they trust. Brands and retailers should collect this data and build it into their personalization efforts. Our survey found the following two trends:

- Higher proportions of consumers report willingness to share generic, less-sensitive personal information with retailers and brands (new or trusted)—such as their name, gender and email address—than the proportions willing to share sensitive data such as their home address and phone number.

- There was a 7%–10% difference in consumer willingness to share personal data with a trusted retailer/brand compared to a new retailer/brand, across all types of data.

Figure 8. Data that Customers Feel Willing To Share with Trusted vs. New Retailers/Brands (% Respondents) [caption id="attachment_144442" align="aligncenter" width="700"]

Base: Consumer privacy survey—1,002 US and UK consumers

Base: Consumer privacy survey—1,002 US and UK consumersSource: Coresight Research[/caption] The reasons behind consumer willingness to share personal data relate to cost incentives: 81% of consumers in our consumer privacy survey cited willingness to share personal data to earn loyalty program benefits to a trusted retailer/brand and 70% are willing to share their data to receive special discounts and offers to a trusted brand/retailer. In fact, we see Gen Z consumers are more attracted toward cost incentives than overall, with 84% citing loyalty program benefits as a reason and 78% citing special discounts and offers as reason for sharing personal data to a trusted brand/retailer. This should serve as a wake-up call for retailers and brands to build marketing and data collection strategies that rely on information customers voluntarily provide. With new policies such as Google and Apple privacy updates limiting current data collection methods, now is the time for retailers and brands to pivot to machine learning, data collection and predictive analysis. Interestingly from our retailer personalization survey, 69% of retailers and brands think user privacy updates from Google brought them positive impact on personalization marketing strategies, where 65% thought the same for user privacy updates from Apple.

Sailthru

Sailthru, a CM Group brand, helps modern marketers drive higher revenue, improve customer lifetime value and reduce churn through a suite of connected capabilities. Sailthru’s email and website personalization, mobile marketing automation, and unique integrations power new customer acquisition by leveraging machine learning and first-party data to easily deliver relevant, personalized engagement across all channels. Sailthru’s clients include fast-growing e-commerce companies, including Everlane, MZ Wallace and NASCAR. For more information, please visit www.sailthru.com.What We Think

Personalized marketing uses data to create customized experiences for shoppers which can lead to better engagement, increased conversions and higher sales. This can only be done if retailers and brands elevate their efforts to meet consumers’ expectations for custom content and experiences, and treat personalization as a strategic priority. The ways retailers and brands can do so include leveraging loyalty programs, advanced personalization tactics and making the best use of personal data in order to create value exchange with consumers. Implications for Brands and Retailers:- Brands and retailers need to leverage personalization tactics to curate better offers for shoppers.

- Retailers and brands should re-examine where their personalization efforts are placed to more closely align with shoppers' platform and communication preferences.

- Shoppers are willing to share personal information in exchange for value, such as tailored offerings and purchasing incentives (including discounts).

- Promotions should not be the only tool for cultivating loyalty. Brands and retailers should place more focus on delivering customers the right content through the right channel at the right time.

- Data privacy is important to consumers but is not an obstacle to knowing a shopper’s preferences. Consumers in fact are willing to share personal data which retailers and brands need to make best use of.