Introduction

India’s retail sector is largely dominated by home-grown companies, as protectionist measures make it difficult for foreign retailers to enter the market. As India has continued to open its economy to foreign investment, more international retailers are seeking to get into one of the fastest growing markets in the world.

China and India each began their economic reform drives around the same time: China in 1986, and India in 1992. Since then, we’ve seen very different patterns of growth, economic development and consumer spending. Chinese consumers now have much more discretionary spending ability compared to their Indian counterparts and per capita GPD is higher in China. These differences are due largely to factors such as culture, political structure and government planning.

We examine some key factors to compare how the Indian economy stacks up against China.

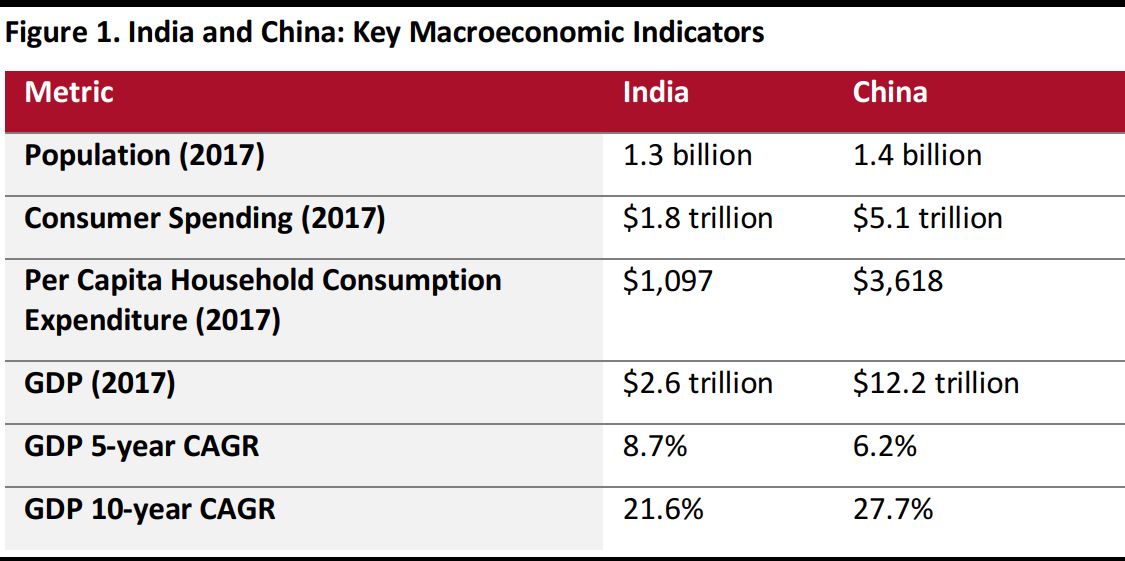

Scale: China’s Consumption Expenditure is Triple of India’s

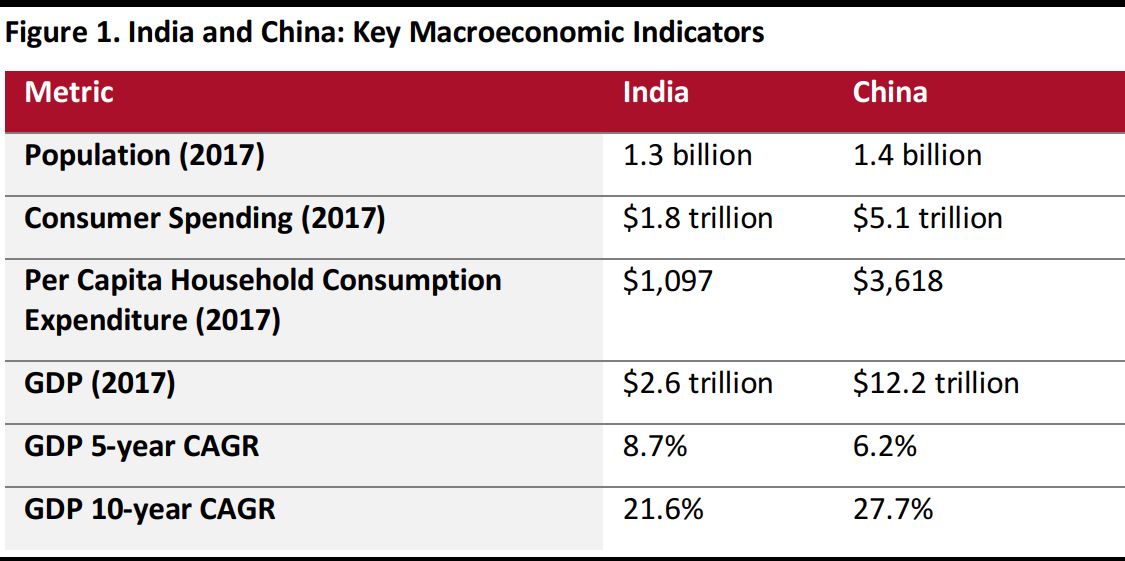

China’s scale makes it an attractive market for international brands and retailers: In 2017, the country’s population reached 1.4 billion and consumer spending totaled $5.1 trillion, according to the World Bank.India’s consumers spent just $1.8 trillion in 2017, when the country’s population reached 1.3 billion. In 2017, China’s per capita household consumption expenditure was $3,618, while India’s was just $1,097.

China’s GDP was $12.2 trillion in 2017, nearly five times that of India’s GDP at $2.6 trillion.China’s GDP has been growing at a CAGR of 27.7% over the last decade while India’s grew at 21.6%. Over the last five years, the rate of India’s GDP growth outpaced that of China’s, at a CAGR of 8.7% while China’s GDP grew at 6.2%—but the country still has a long way to go to catch up with China.

Source: World Bank

Despite being on par with China in terms of population size, several factors still deter India in being able to compete with China.

What’s Working Against India

- Consumption expenditure in India is still heavily directed toward staple sectors.

- India is less urbanized than China.

- China’s retail market size dwarfs India’s retail market size.

- Infrastructure and regulatory restrictions: India ranks lower on the World Bank’s ease of doing business index compared to China.

- Differences in culture, politics and government structure also contribute heavily to the discrepancies in growth.

India’s Consumption Expenditure is Still Heavily Directed Toward Staples

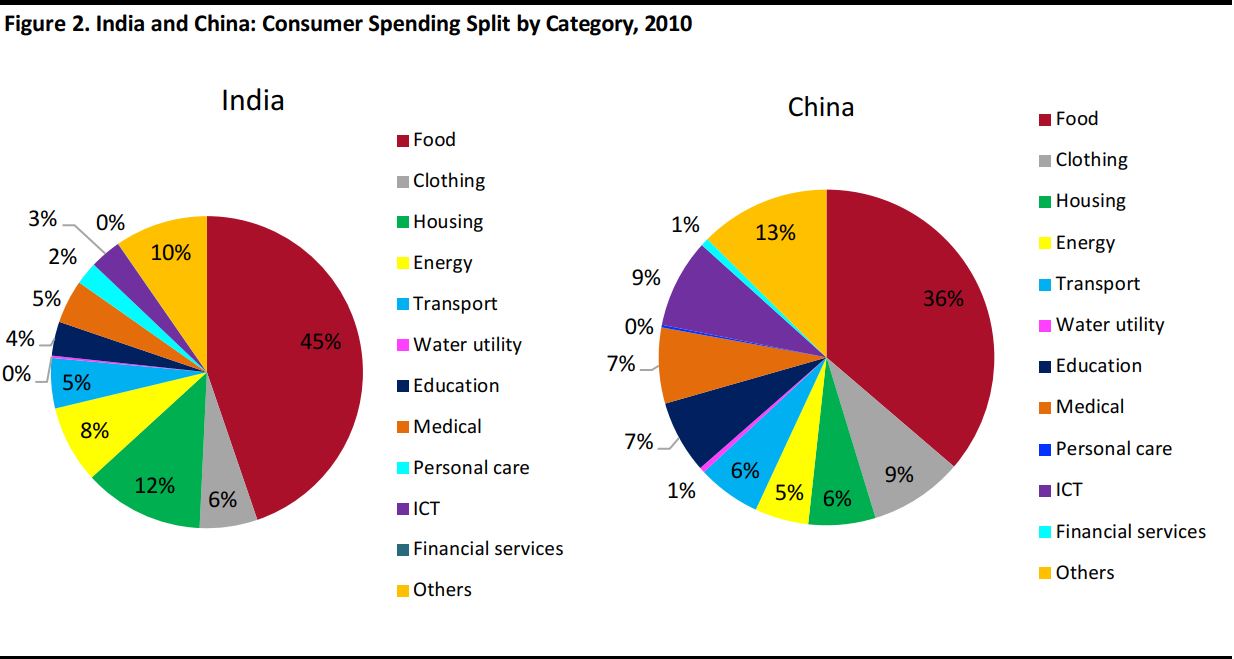

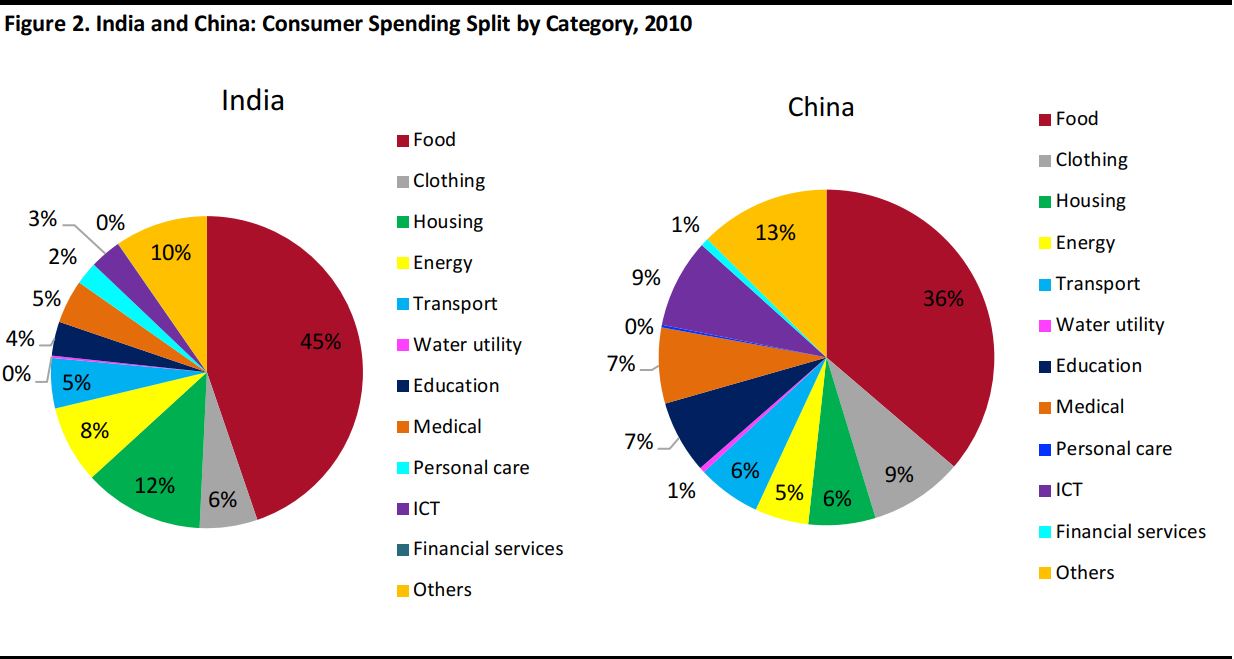

In 2010, the latest year for which comparable data are available,Indians spent 45% of their consumption expenditure on food,while consumers in China spent just 36%.In India, consumers allocate almost twice the proportion of their expenditure toward housing compared to Chinese consumers.Indians spent 6% of total consumption expenditure on clothing while Chinese spent about 9% of their total expenditure.

The bottom line: Consumers in India have less disposable income to spend on non-discretionary items.

Source: World Bank/McKinsey

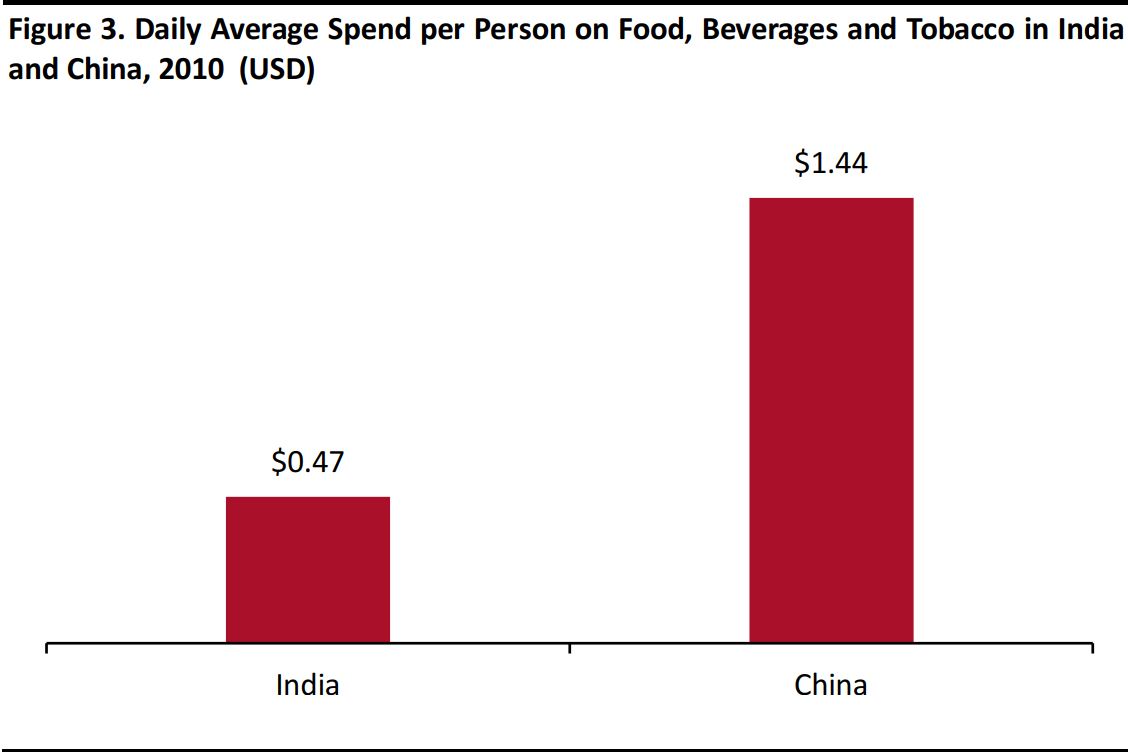

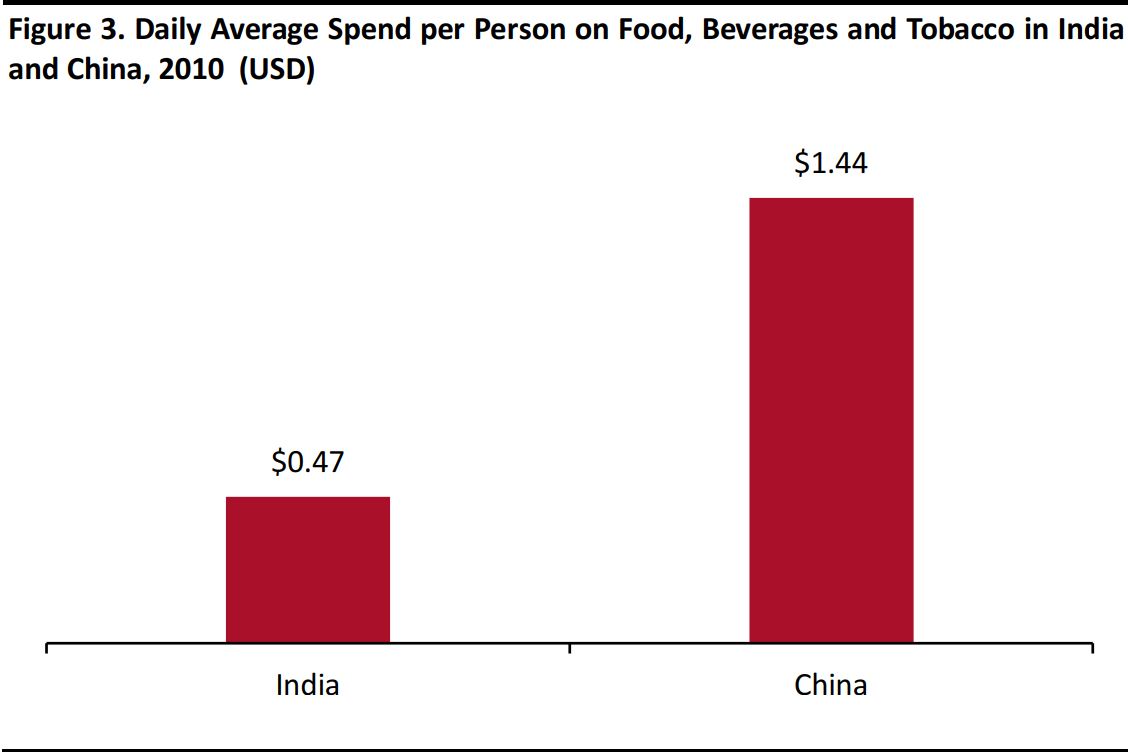

Despite India’s high growth trajectory and size, its consumers are less affluent than their peers in many other large economies and in the other BRIC nations. The average Indian grocery basket size is less than INR 1,000 ($16), according to the Business Standard, an Indian newspaper. World Bank data indicates that the daily average Indian spend per person on food, beverages and tobacco was a fraction of that seen in China.

Source: World Bank/Coresight Research

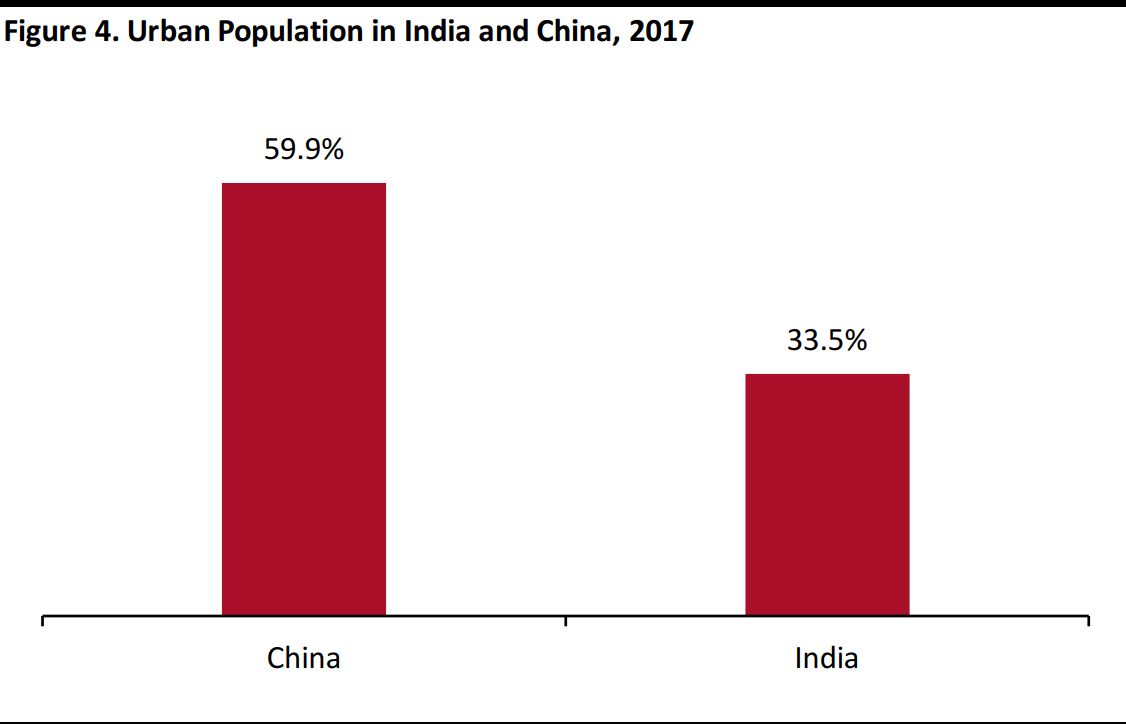

India is Less Urbanized Compared to China

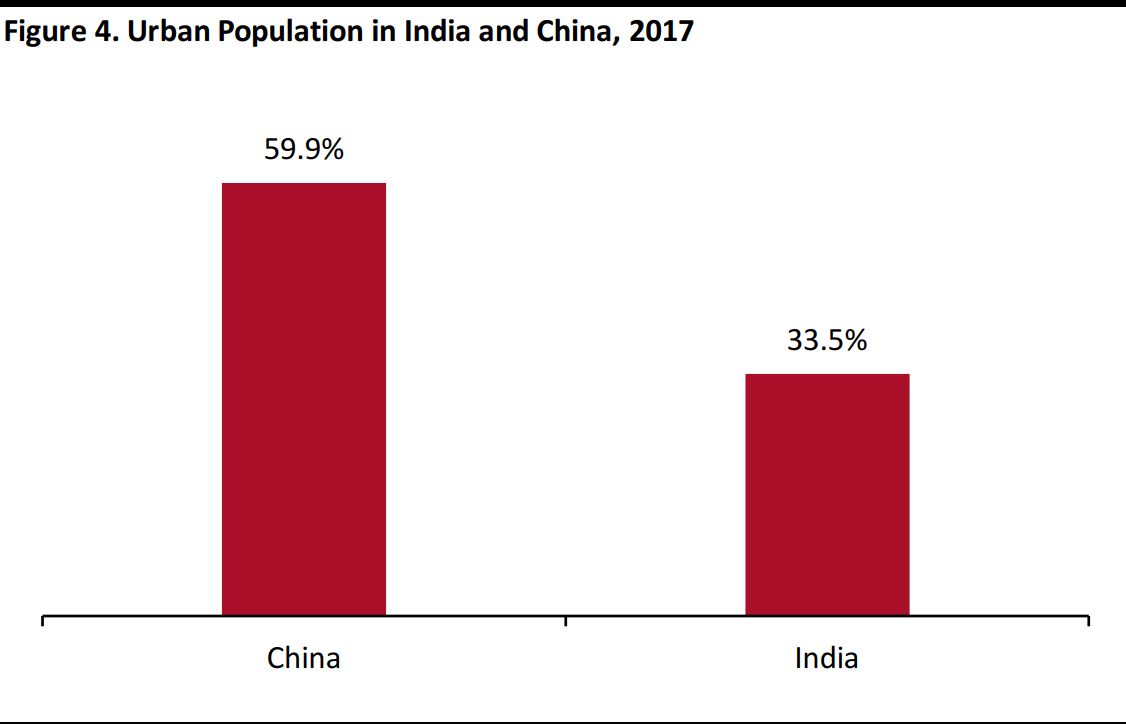

In 2017, nearly 34% of India’s population was urban compared to 60% of China’s population. As a greater proportion live in rural areas in India than in China, it complements the data on spending – that a higher share of consumer spending is directed toward staple items.

Source: World Bank

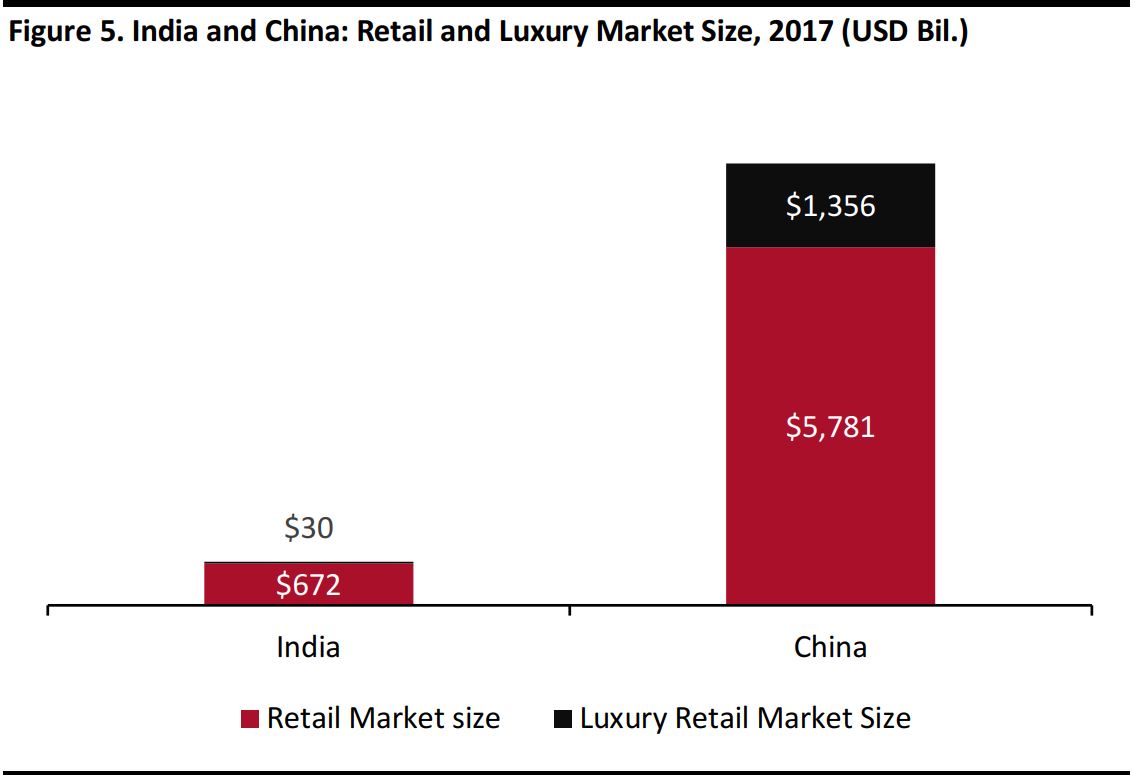

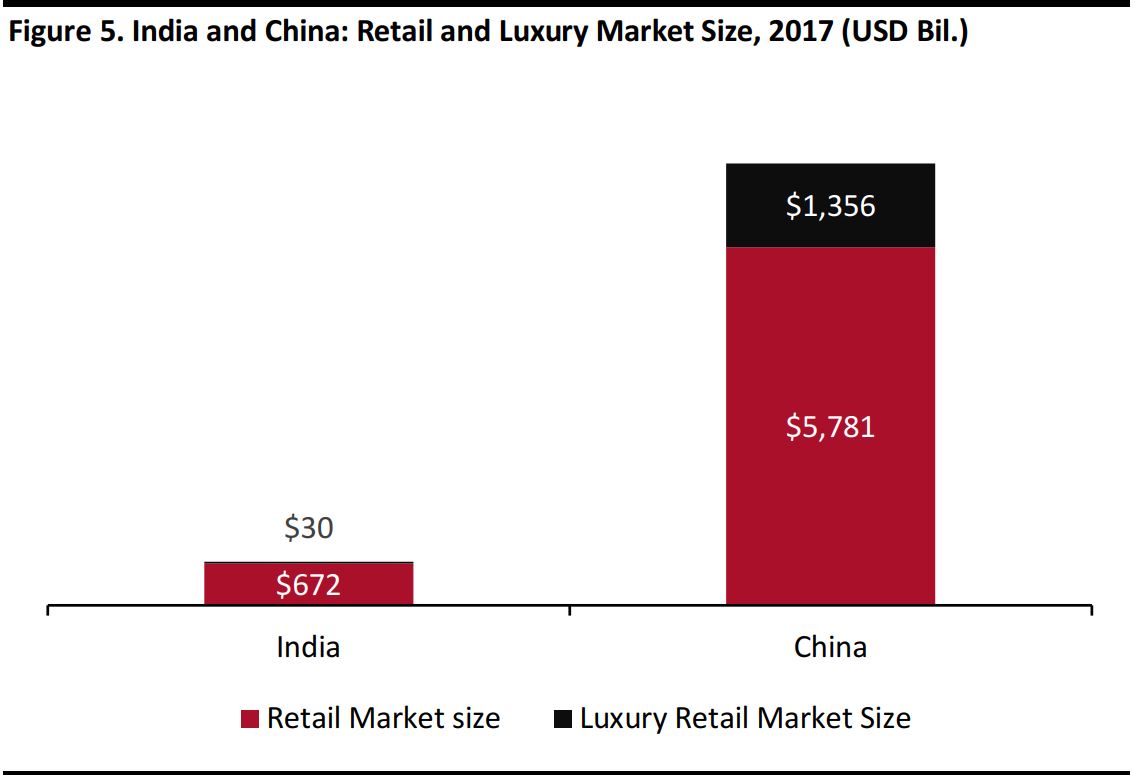

China’s Retail Market Size Dwarfs India’s Retail Market Size

In 2017, India’s retail sector was worth $672 billion while China’s was over eight times bigger, at $5.8 trillion. India’s luxury market was $30 billion, or 4% of India’s total retail market, while China’s was $1.4 trillion, or 23% of the total market, during the same period.

Source: ASSOCHAM/China Internet Watch/Bain Luxury Study

India’s apparel market is fragmented, with few large, prominent names and numerous smaller, independent retailers. Organized,modern retail accounts for only 6%–8% of India’s total retail market,according to industry estimates. However, organized retail’s share in the clothing sector is higher, at approximately 30%, we estimate,based on company data from S&P Capital IQ. In China, organized retail constituted 20% of the total market.

According to brokerage firm Edelweiss Securities, branded apparel constituted some 35% of the total ready-made garments segment in India in 2014. Branded clothing sales totaled about $45 billion that year, the firm estimates, and it expects branded apparel to account for 46%–48% of the total ready-made garments segment by 2019.

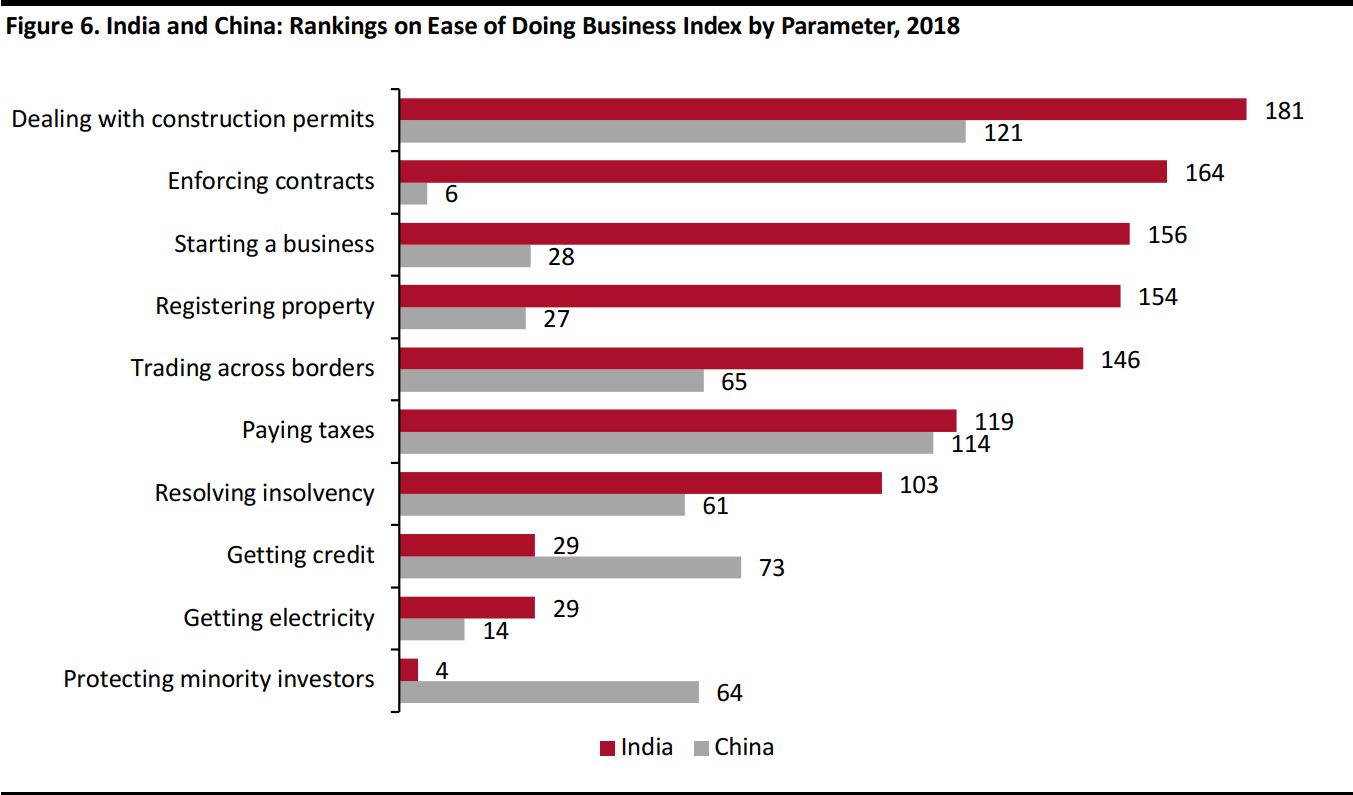

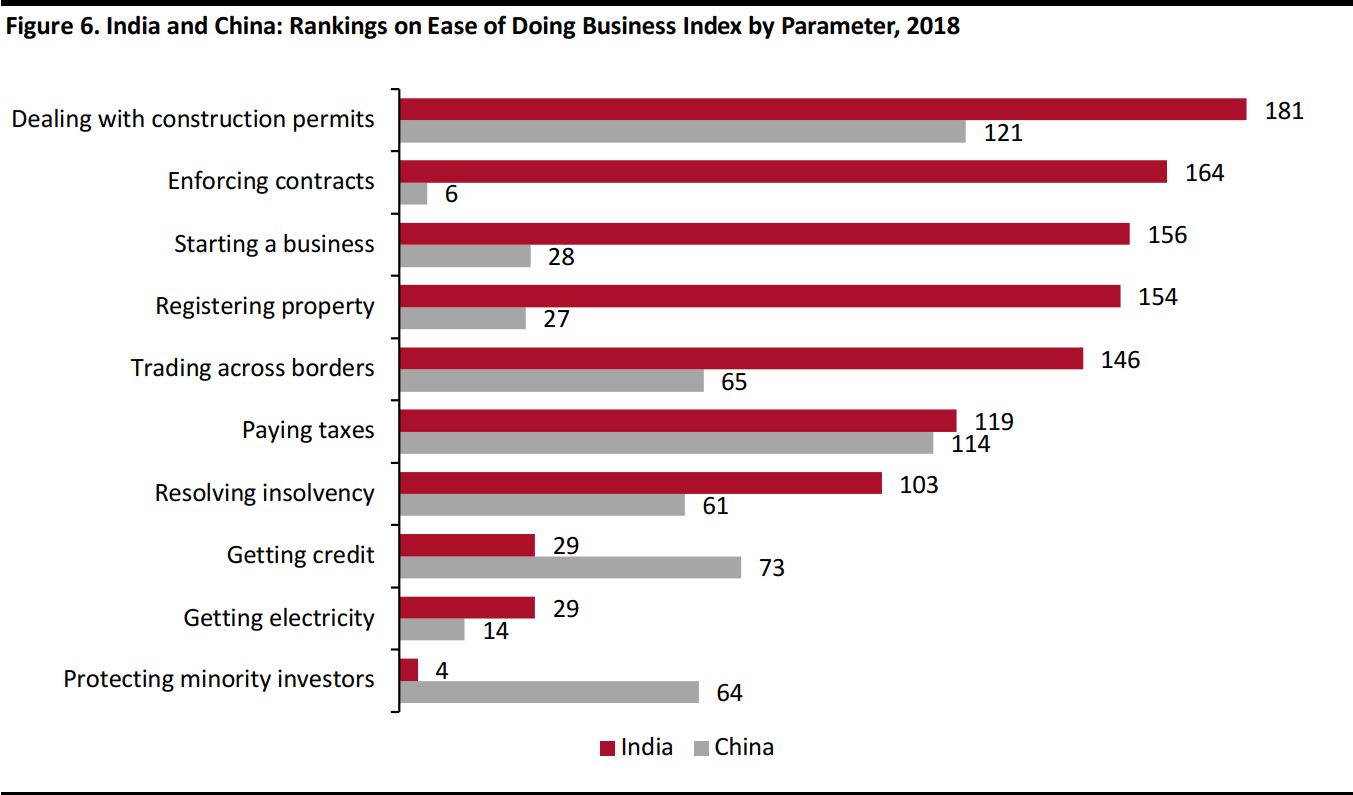

Infrastructure and regulatory restrictions: India ranks lower on the World Bank’s ease of doing business index compared to China

In the World Bank’s 2018 ranking of 190 countries for ease of doing business, India comes in at a disappointing 100 while China ranks 78.Although India’s ranking jumped 10 places since 2017, there are several specific pain-points for businesses to set up in India, the key ones being: dealing with construction permits, enforcing contracts and the actual process of registering and starting a business in the country. However, India ranks better than China on two aspects: getting credit and protecting minority investors.

Source: World Bank

Apart from the above issues, Internet penetration in India is also low despite there being a large user base. India has one of the largest Internet user bases in the world:according to brand agency We Are Social, some 462.1 million Indians accessed the Internet in January 2017. But in terms of Internet penetration, this base constitutes only about 25% of India’s 2016 population.

Low income levels have made high-tech, expensive gadgets that provide access to the Internet unaffordable in India. This has led to the majority of the user base accessing the Internet through smartphones. Mobile Internet users represent fully 96% of total Internet users in the country.

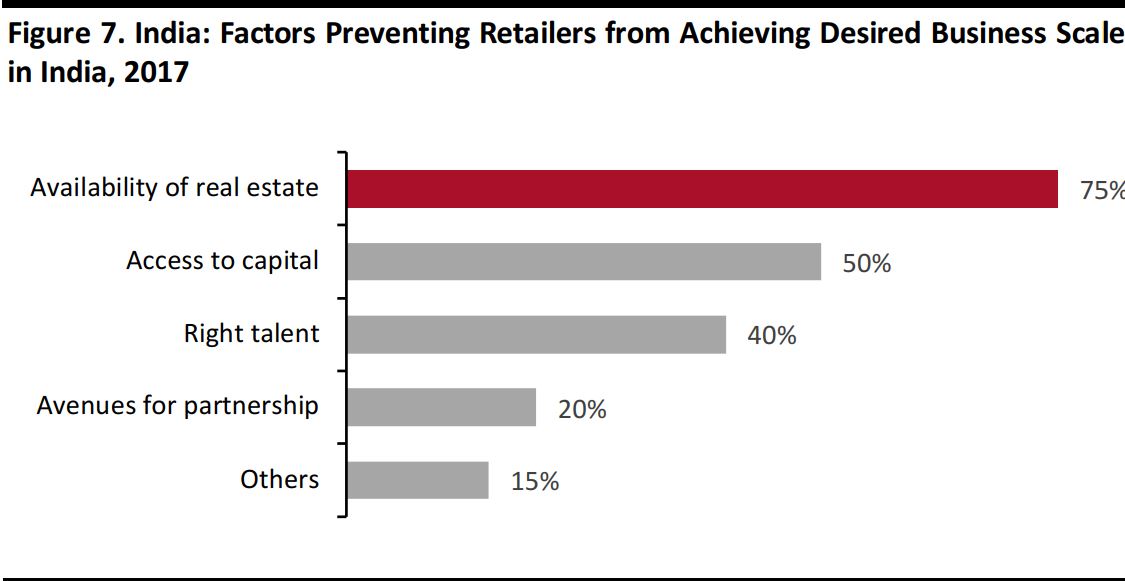

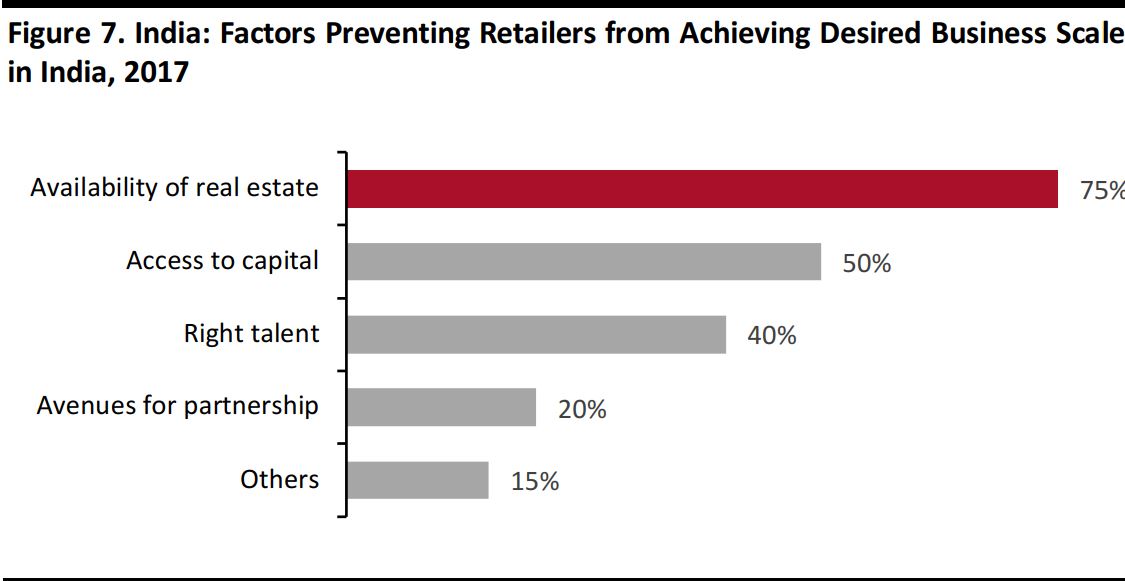

India also lacks quality retail spaces: some 75% of retailers believe that the availability of real estate is a key factor preventing retailers from achieving a desired business scale in India.

Source: PwC

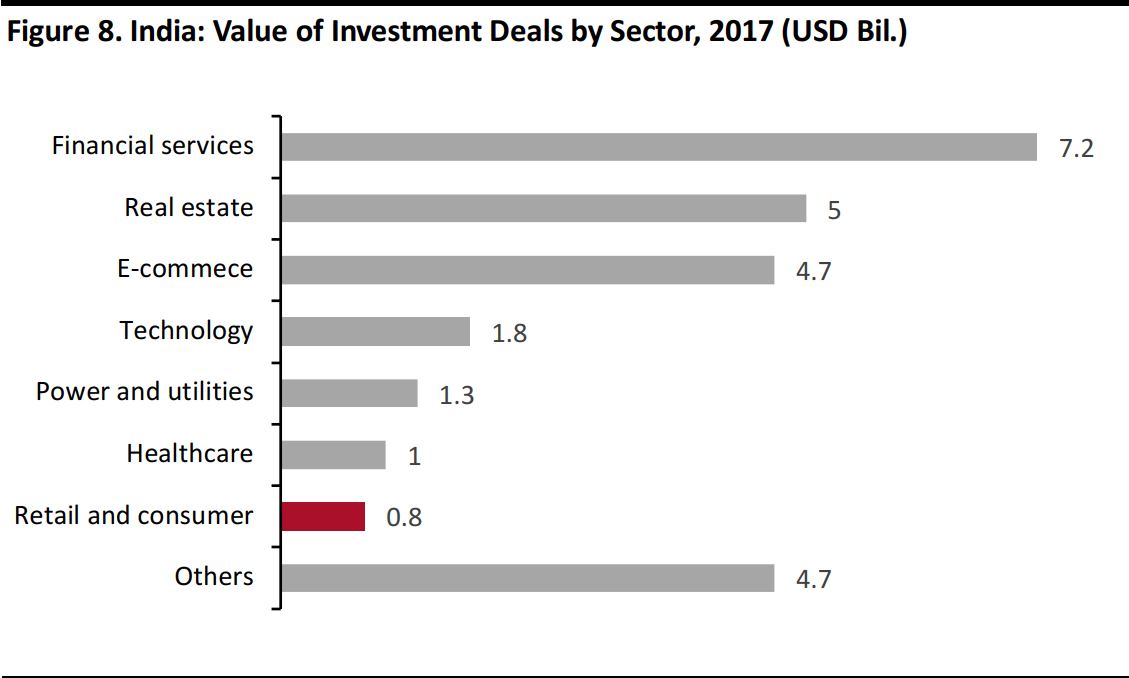

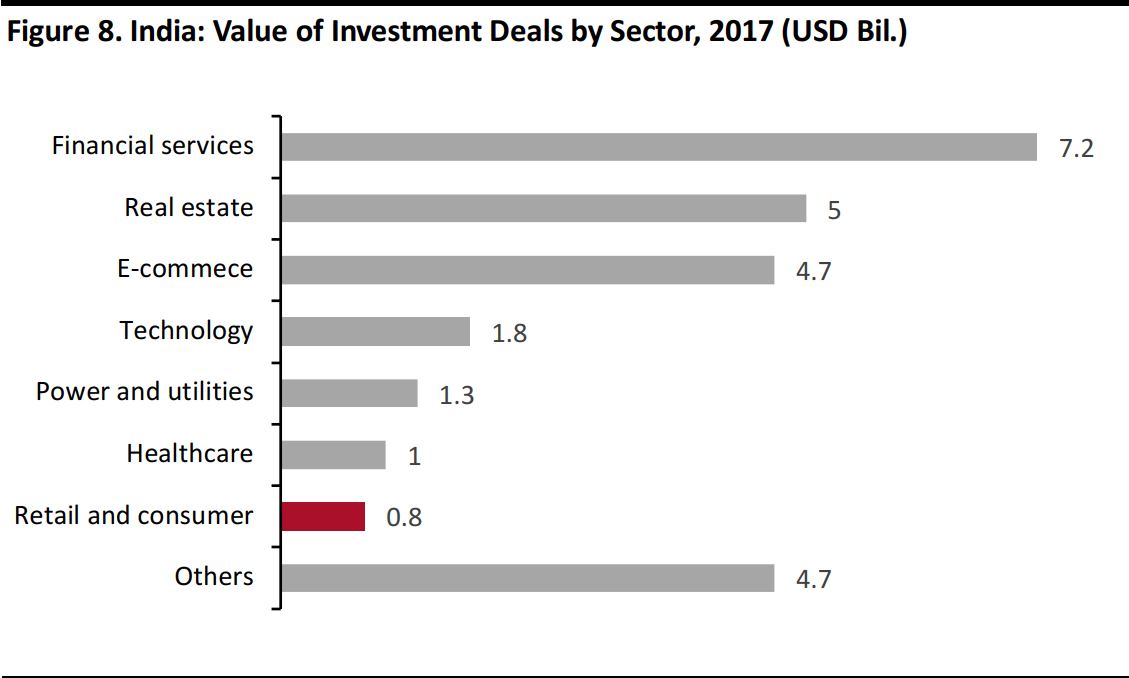

Investment in the sector’s infrastructure has been low, too. In 2017, the retail and consumer sectors have seen the lowest investment in India compared to other major sectors.

Source: EY

Culture, politics and government structure

There are also significant differences in culture, politics and government structure that give China many advantages over India in pursuing economic development.

Culture

India has a long history of political activism, most notably the use of widespread protests and civil disobedience that secured the country’s independence from English rule. This characteristic has continued and influences the government’s ability to implement policies or even approve projects that could be in the national interest, but would harm certain sectors of the population.

In China, political activism has rarely delivered desired results, and culturally there is no strong traditional of being politically active, which makes it much easier for the government to implement policies that may be in line with national policies, even if they do negatively impact a minority of people.

Politics

India is a democracy, which makes the market far more unpredictable for foreign investors, which can hamper the economic development that would bring more people to cities from the countryside and put more disposable income into the pockets of consumers.

It is not uncommon that a state or local government in India may approve a project that would deliver economic benefits, only for the opposition party to use it as a tool to criticize the incumbent party, generally asserting the incumbent government gave too favourable terms or that somehow it will negatively impact certain people. If the opposition wins in the following election term, they will likely seek to scrap or renegotiate the deal. This puts off foreign investors and even makes it more difficult for domestic players to expand operations, which could create jobs and boost economic growth.

Central planning

In China, economic development is carefully planned and largely followed through the country’s five-year plans. These plans are made public so anyone can read them and understand the economic development policies for the coming years. Provinces and local governments are expected to follow these plans, and largely do.

India does not have that level of central planning, the states and local governments have much more autonomy and do operate far more independently from the national government in Delhi.

Despite several factors that inhibit international retailers from entering India, others work in the country’s favour, such as a high proportion of young people in the population and the government’s steps to open the economy for foreign investment.

What is Working for India

Despite several factors that inhibit international retailers from entering India, others work in the country’s favour, such as a high proportion of young people in the population and the government’s steps to open the economy for foreign investment.

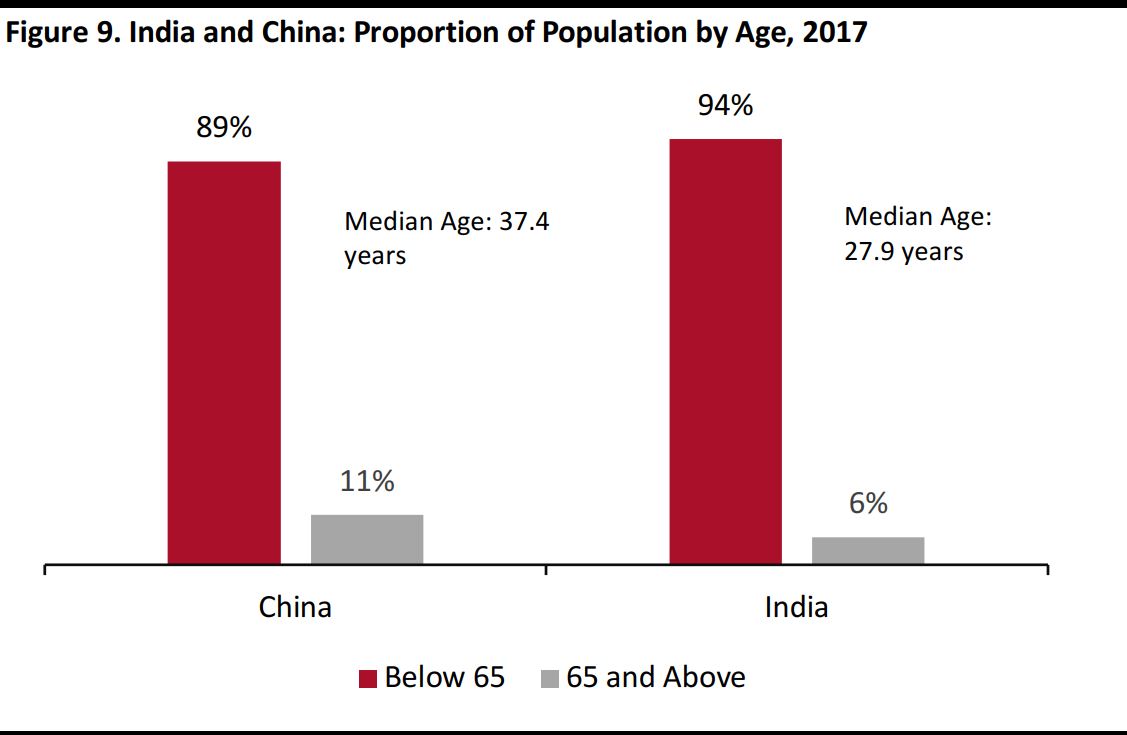

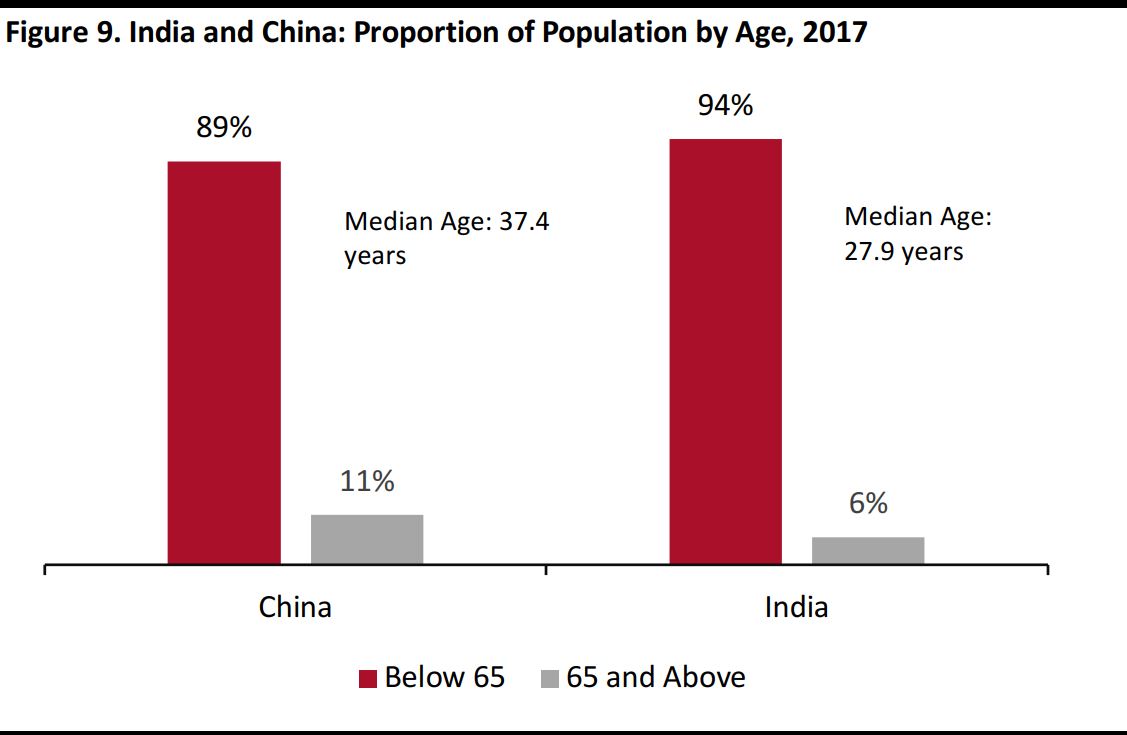

India Has a Higher Proportion of a Younger Population

In 2017, 6% of India’s population was 65 years or older compared to 11% of China’s population. The median age in India was 28 while the median age in China was 37.

Source: CIA Factbook

The Government Has Opened the Economy Further to Foreign Investment

India has been relaxing FDI rules in retail, first in 2012 when foreign entities were allowed to own up to 51% in Indian entities. The rules were further relaxed in April 2016 when the government announced it would allow foreign companies to own 100% in e-commerce ventures.That said, new reforms may restrict e-commerce. The draft policy proposes a ban on: bulk buying, group companies of online marketplaces influencing prices and offering short-lived deep discounts. If the policy is finalized with these proposals, e-commerce companies may find it more challenging to compete and maintain market share in India.

Other Hurdles to Cross in India

Apart from macroeconomic factors, regulatory hurdles and infrastructure issues, foreign retailers have cultural challenges to address if they want to capture share in the Indian retail sector. These challenges stem from a culture deeply rooted in tradition. International retailers will also need to go up against homegrown players that have an established presence in the market.

Indian consumers are loyal to traditional dress

India has 29states and seven union territories, almost all of which have a distinct identity with different languages, different spiritual beliefs and traditional dress. Some 42% of the Indian clothing market consists of traditional styles, with the remaining distributed among non-traditional tops, bottoms, apparel sets and dresses, according to market research firm Intelligence Node. Research from Indian newspaper

The Hindustan Times and MaRS Monitoring and Research Systems found that 72% of India’s urban adult population likes Indian variations on products from international brands.

The Indian clothing market focuses on women’s apparel

Intelligence Node also said womenswear accounts for some 69%of the total apparel offering in India, while menswear represents 21%and children’s wear represents 9%. The remaining 1% comprises aunisex mix. In China and in Western markets such as the US and the UK, roughly half of all clothing sales are in the womenswear segment.

Many of the larger players are owned by conglomerates

Most of the large homegrown retailers in India belong to conglomerates. One exception is Future Lifestyle Fashions, which began as a retail pure play.

Despite these hurdles, two factors indicate prospects for further growth in retail and particularly the luxury sector: untapped consumer segments in non-Tier 1 cities in India and a large youthful population that is earning more and is increasingly interested in luxury.

Opportunities for Growth and Interest in Luxury

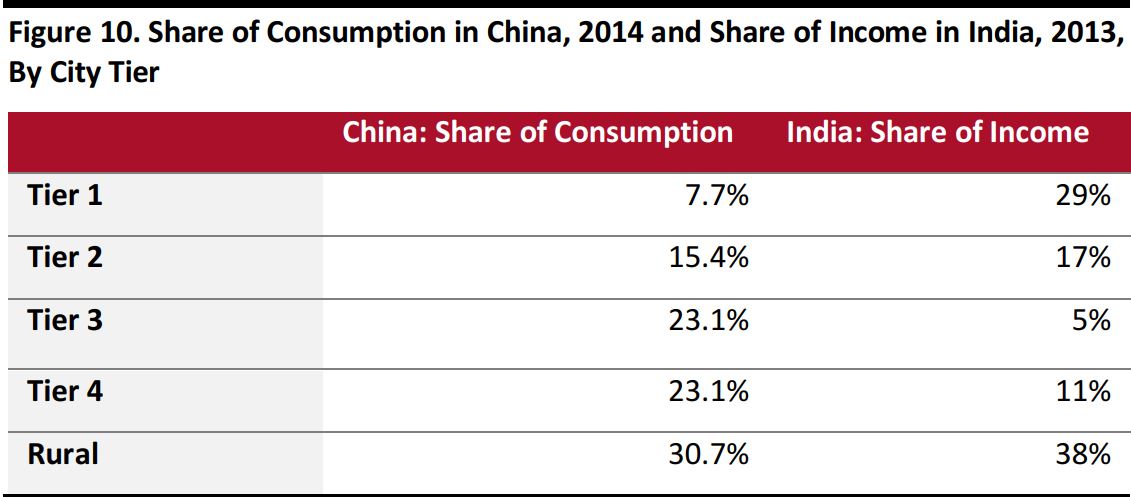

Untapped Consumer Segments in Tier 2, 3 and 4 Cities

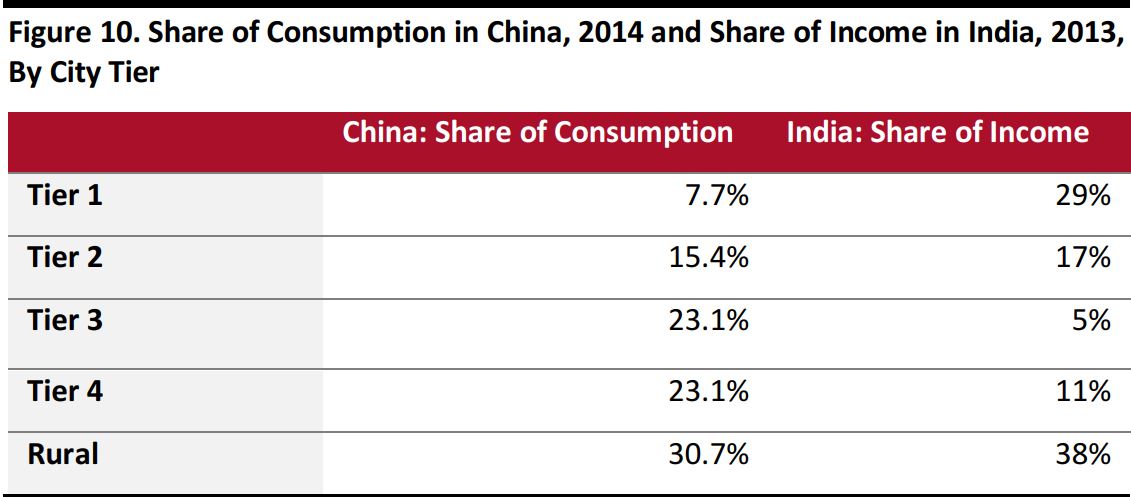

With a large, youthful population and a high economic growth rate, India is primed to advance further. Spending on consumption in China is almost evenly distributed among non-Tier 1 cities (Tier 1 cities are roughly defined as metropolises or those are most developed in terms of society, economy and infrastructure). In India, share of income (share of consumption data was not available) is skewed toward Tier 1 and rural areas.

Source: Nielsen/Indicus Analytics Market Skyline of India 2013

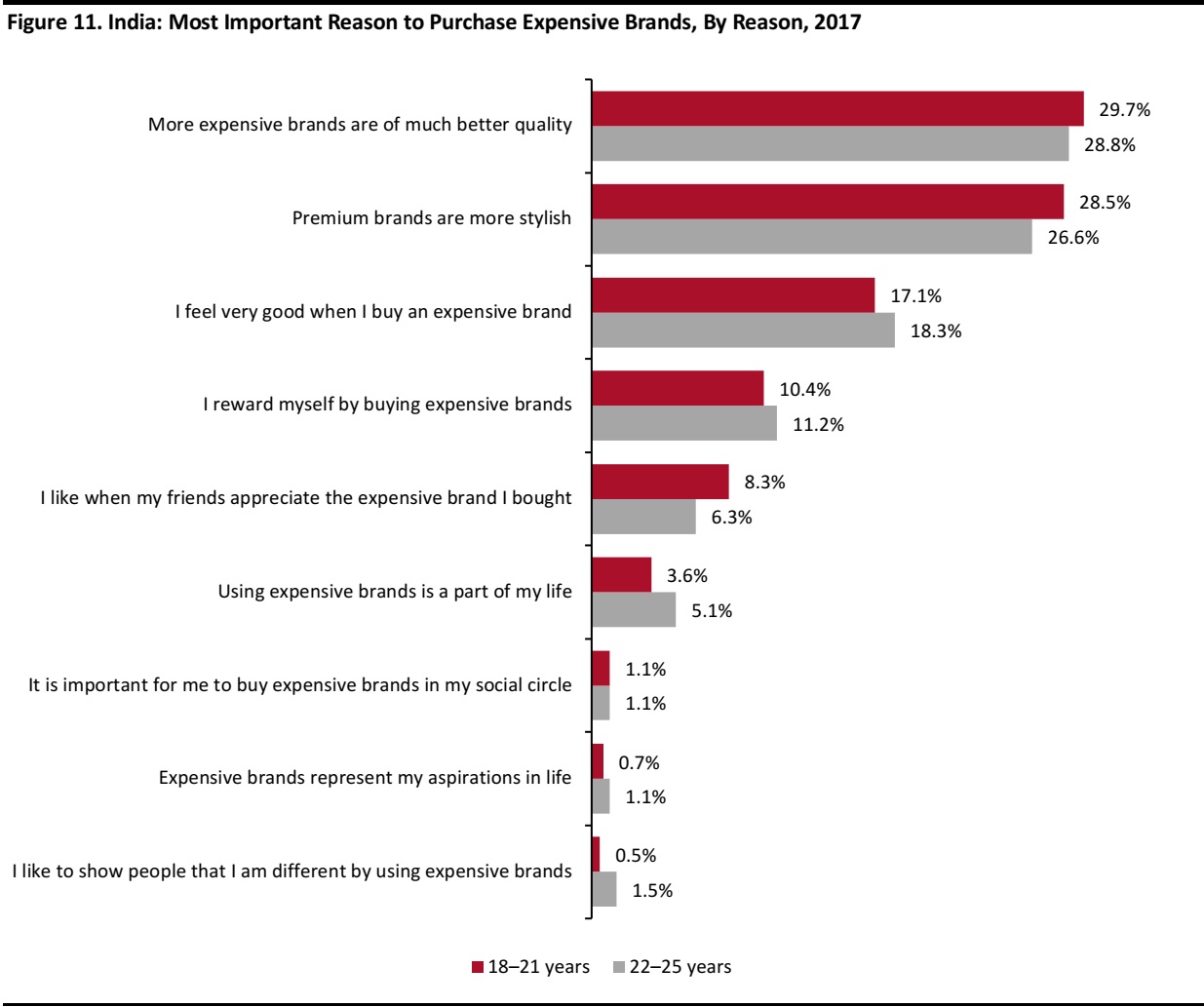

Indians Associate Quality with Expensive Brands

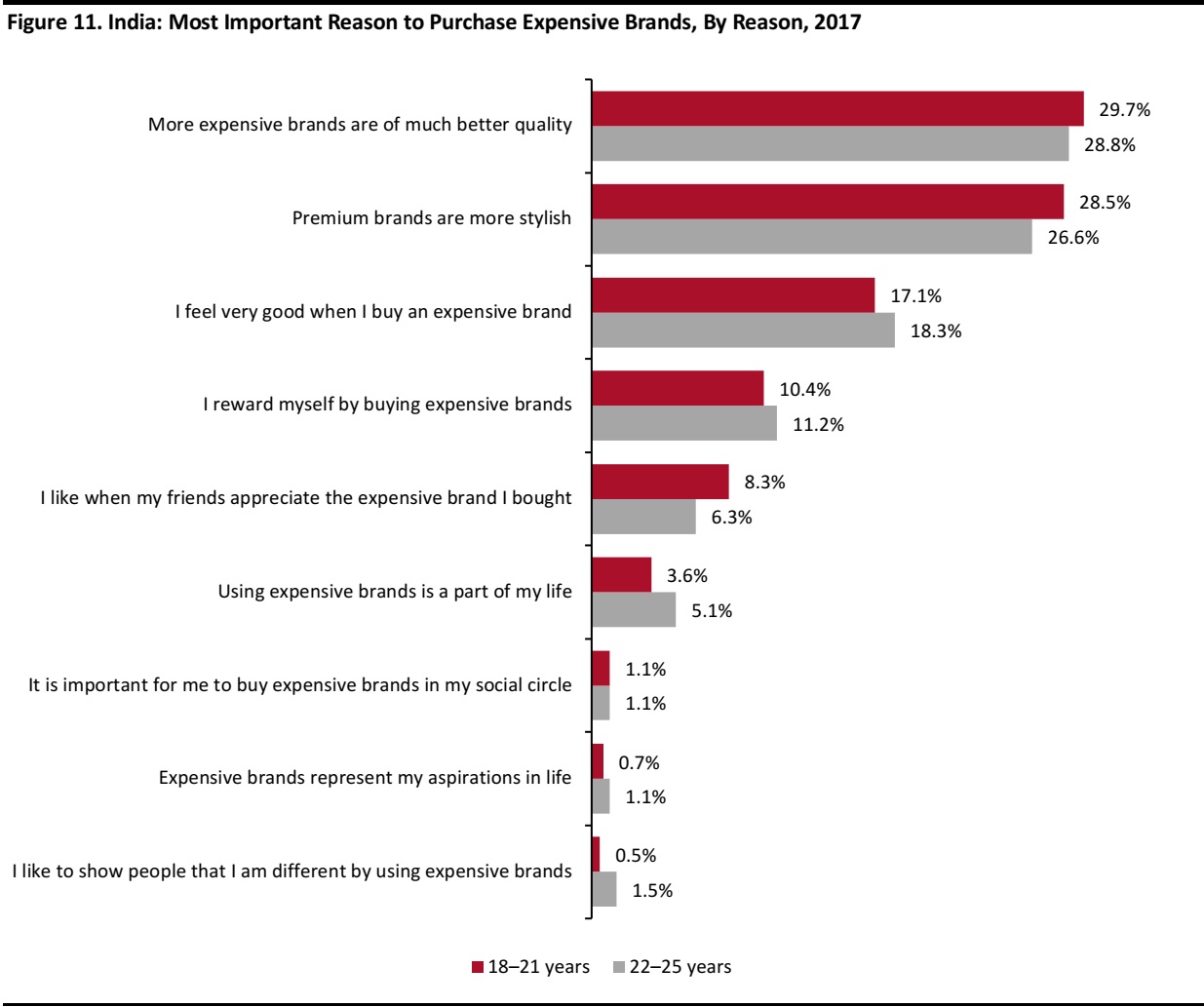

A key factor driving Indian consumers’ purchase of expensive brands is the perception of quality. Nearly 30% of young Indians say they believe expensive brands are of much better quality and that they are more stylish.

Source: Hindustan Times/MaRS Monitoring and Research Systems

The Way Ahead

Despite the many economic, social and infrastructural issues in India, there are opportunities for international brands, particularly in the luxury category, to grow in India. A significant youthful population signals expectation for rising income levels and affordability of discretionary goods. Untapped segments in smaller cities suggest there is room for further retail penetration and growth. Indian consumers have affirmed that they are interested in luxury brands as they denote quality, while also asserting their preference for and loyalty to traditional dress or “Indian varieties” in retailers’ assortments.

Retailers should tailor their assortments to cater to Indian tastes and preferences. Issues with infrastructure and red tape are things that the country will need to work on collectively, but in recent years, the government has shown openness to foreign investment in the retail sector by relaxing policies and regulations. With India’s economy growing at faster pace in recent years than previously and with Indian discretionary spending on the rise, it looks likely consumer tastes and preferences will evolve faster than before and shoppers will be quick to adopt new brands and products.