What’s the Story?

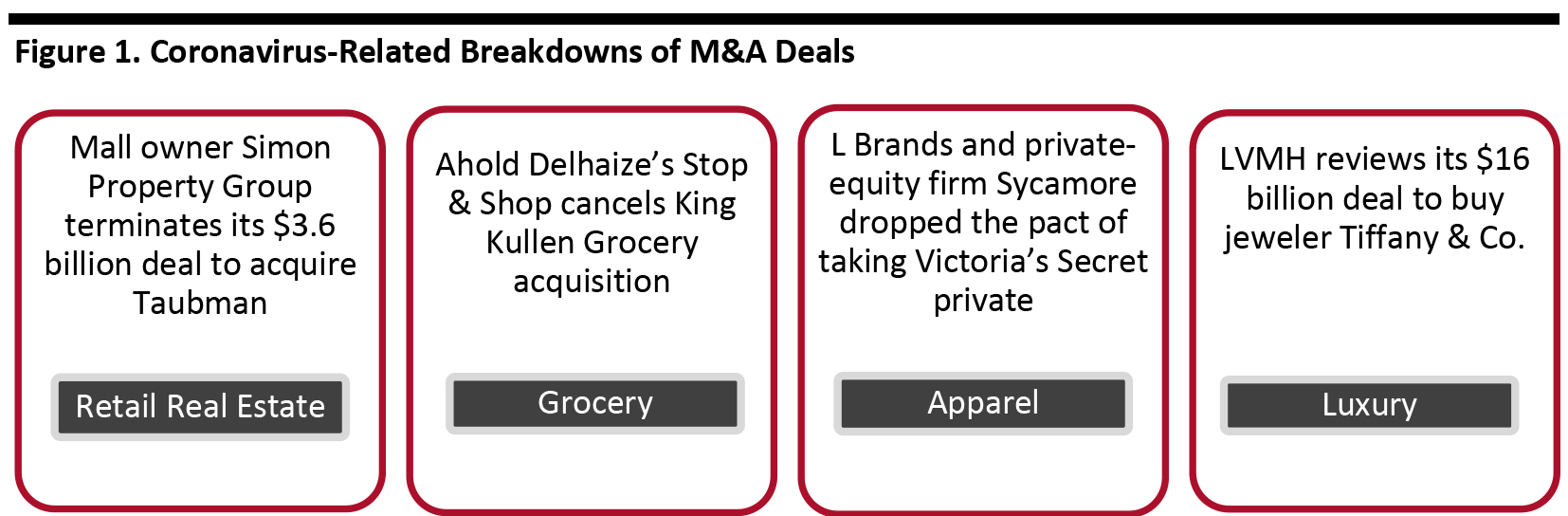

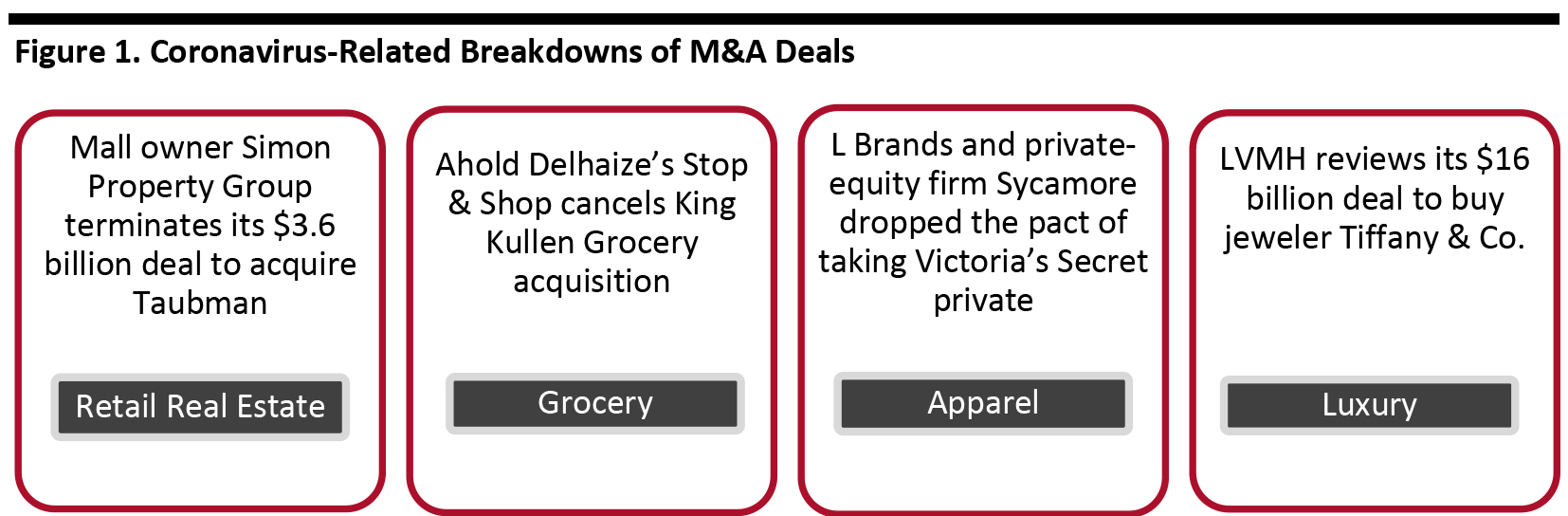

The coronavirus pandemic has caused renegotiations to take place between sellers and buyers in M&A deals—including re-pricing or outright terminations. Companies involved include mall owners, supermarket chains and luxury-goods players.

[caption id="attachment_112630" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

Why It Matters

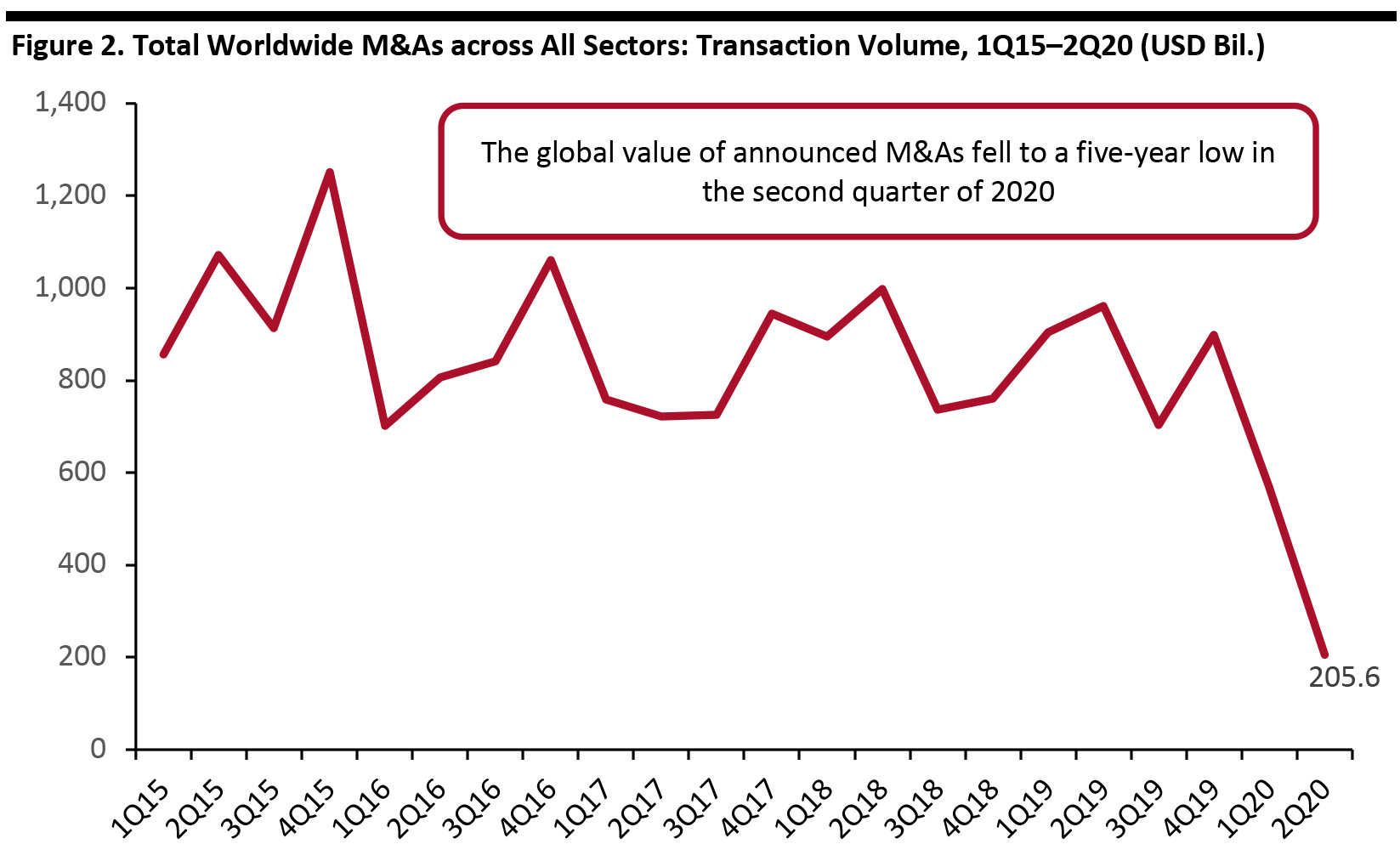

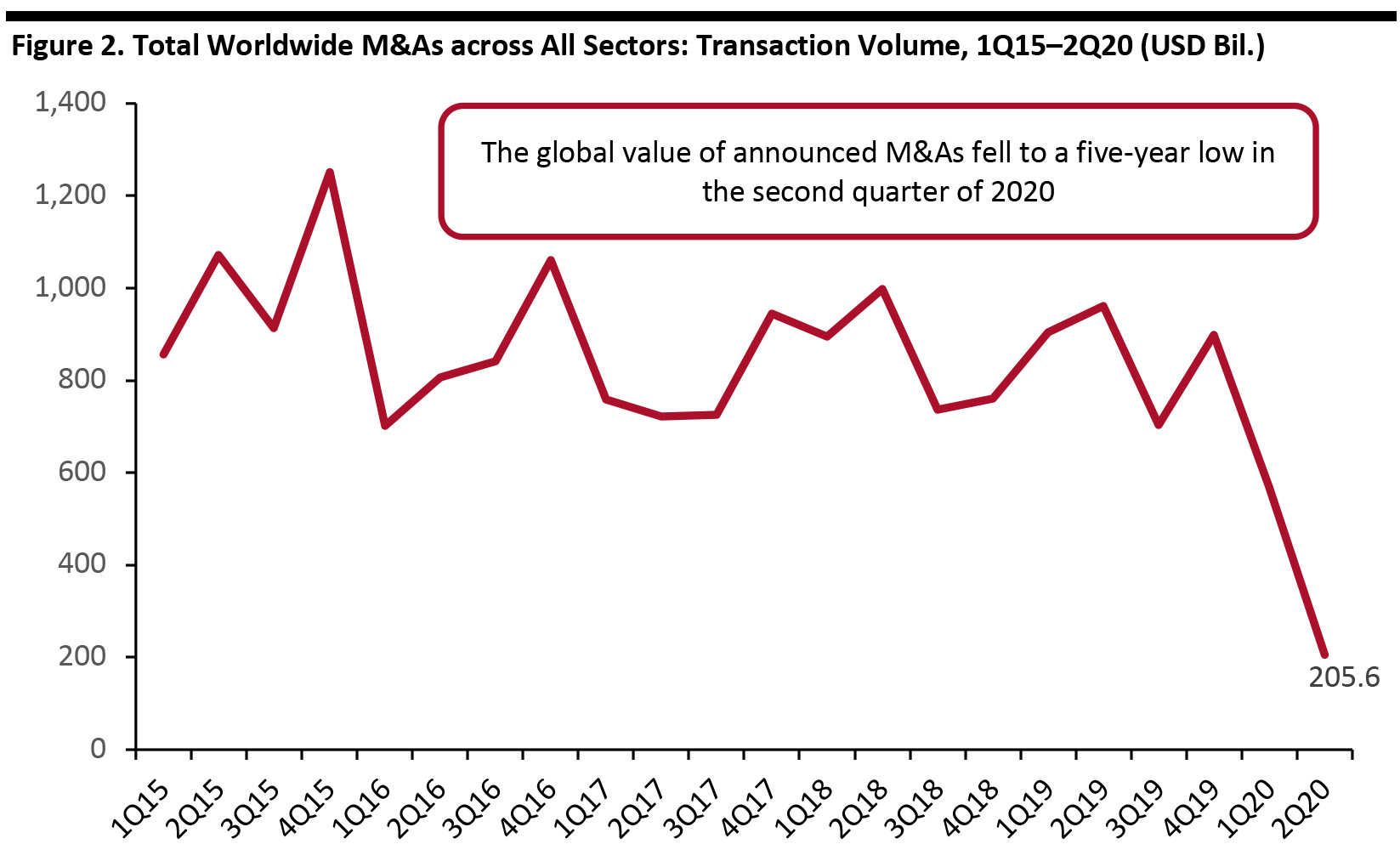

In the second quarter of 2020, the global value of announced M&As was down 78.6% compared to one year ago—representing a five-year low, according to data from S&P Capital IQ. In the US and Canada together, the decline was around 53%.

[caption id="attachment_112607" align="aligncenter" width="700"]

Source: S&P Capital IQ

Source: S&P Capital IQ[/caption]

The coronavirus has adversely impacted M&A sellers’ revenues, cash flow and liquidity. Buyers might also need to be careful about their own financial status amid the economic downturn. A trend is therefore emerging whereby M&A deals are being reconsidered.

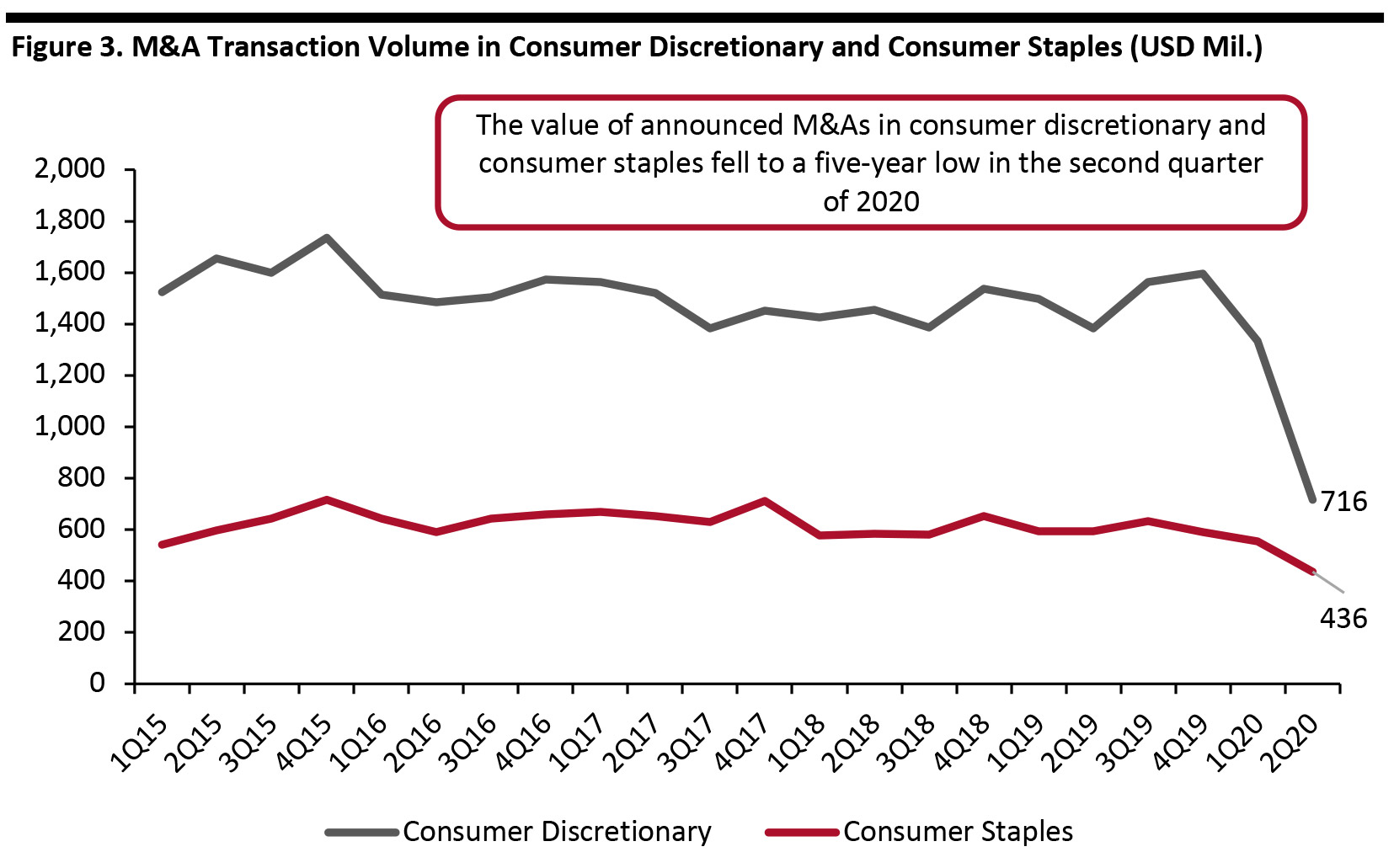

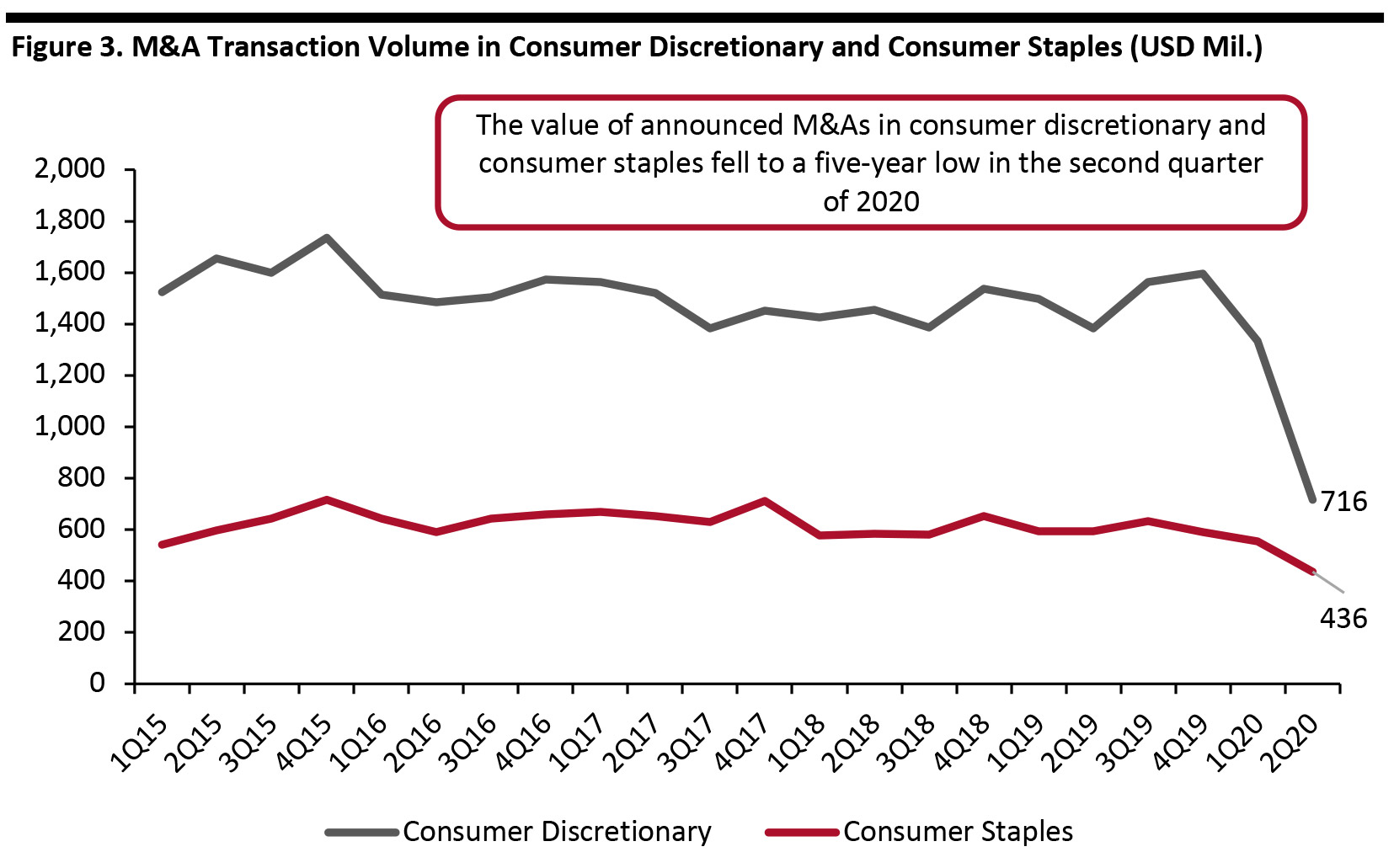

The deal volume was lower for companies that experienced major disruption during the recent stay-at-home orders. Deals related to the retail sector were hit hard, with global deal volumes in the consumer discretionary sector dropping by 46.4% year over year to $716 million in the second quarter of 2020—a five-year low, according to S&P Capital IQ. Over the same period, consumer staples (e.g., food, drug) fell by 21.3% year over year to $436 million, another five-year low, according to S&P Capital IQ.

[caption id="attachment_112608" align="aligncenter" width="700"]

Source: S&P Capital IQ

Source: S&P Capital IQ[/caption]

Coronavirus-Related Breakdowns of M&A Deals: In Detail

LVMH Reviews Its $16 Billion Deal To Buy Jeweler Tiffany & Co.

LVMH, the French luxury giant, is reportedly looking to renegotiate the price it is paying for Tiffany & Co., as the sector faces a prolonged slump due to the pandemic. The deal, which is the

largest ever in the luxury industry, was announced in November 2019.

LVMH held a board meeting on June 2, 2020 to reconsider the deal, and the company said it focused its attention on the development of the pandemic and its potential impact on the results and perspectives of Tiffany & Co. The board quashed the rumor of LVMH buying Tiffany & Co. on the open stock market, whereas Bloomberg News reported that the company raised the idea with Tiffany & Co.’s board. Making the acquisition on the open stock market rather than through the deal would possibly allow the luxury giant to pay less than the agreed purchasing price of $135 per share, which is close to Tiffany & Co.’s all-time highest value. On March 18, 2020, Tiffany’s share price fell to a four-month low ($111 per share).

The luxury-goods industry as a whole has been severely hit by the pandemic. The industry’s most lucrative customers—tourist shoppers—have been prevented from traveling, leading to a sharp contraction in luxury demand. In Coresight Research’s

April 2020 proprietary survey of Chinese tourists, around 87.2% of all respondents canceled planned vacation trips due to the Covid-19 pandemic. Furthermore, 83.4% changed their travel plans in other ways, with 36.2% of those respondents having switched their trip destinations from international to domestic—representing a meaningful shift to domestic tourism. That said, Tiffany & Co. has typically been dependent on the US market: For the fiscal year ended January 31, 2020, 65.4% of the retailer’s annual revenue come from the Americas (i.e., Brazil, Canada, Chile, Mexico and the US).

It is unclear when LVMH and Tiffany & Co. will reach a conclusion; the M&A agreement sets down a deadline of August 24, 2020 for LVMH to close the deal, although either company could apply for an extension to November 24 at the latest.

[caption id="attachment_112609" align="aligncenter" width="704"]

Source: Company website

Source: Company website[/caption]

Mall Owner Simon Property Group Terminates Its $3.6 Billion Deal To Acquire Taubman

On June 10, 2020, Simon Property Group canceled its deal to acquire rival Taubman, citing that the company breached its obligations by not taking steps to mitigate the impact of the Covid-19 pandemic. On the same day, Taubman responded to the termination notice by saying that it is “invalid and without merit, and that Simon Property Group continues to be bound to the transaction in all respects.” Taubman stated that it will hold Simon Property Group to its obligations and pursue legal remedies.

Taubman was hit heavily by Covid-19 as many of its shopping centers are located in dense metropolitan areas, and its tenants depend on high-end shoppers and tourists. The company’s portfolio includes 26 shopping centers in Asia and the US.

The short space of time between the announcement and cancellation of the deal is noteworthy; the combining of the two mall owners was first announced in February 2020, as the industry struggled with an oversupply of malls and the decline of traditional retail stores in the context of rising e-commerce. At that time, the two landlords stated that Simon Property Group would acquire 80% of the common shares of Taubman for $52.50 per share in cash.

Simon Property Group also suffered from the coronavirus crisis. A large number of requests for rent relief, retailer bankruptcies (e.g., J.Crew and Neiman Marcus) and store closures pressured the company to save cash. For instance, in early June, Simon Property Group sued its largest in-line tenant, Gap, for not paying rent worth $66 million. We estimate that at least

15,000 stores will close by the end of the year, which will affect mall owners.

L Brands and Sycamore Dropped the Pact of Taking Victoria’s Secret Private

Private equity firm Sycamore announced in February 2020 that it would pay $525 million for a 55% stake in Victoria’s Secret and PINK. Only two months later, in late April, Sycamore notified the retailer that it planned to cancel the deal due to L Brands’ failure to maintain normal business operations amid the pandemic.

[caption id="attachment_112610" align="aligncenter" width="700"]

Source: Company website

Source: Company website[/caption]

Victoria’s Secret had already been losing its popularity prior to the crisis—the brand had fallen out of touch with consumers, who were shifting away from its overtly sexy imagery. Brick-and-mortar apparel retailers were then hit hard by the pandemic due to nonessential-store shutdowns, and Victoria’s Secret saw total sales fall 46% in the first quarter ended May 2, 2020. Almost all of the brand’s stores were closed between March 17 and May 2, and it stopped selling online briefly (March 19–26) due to concerns around the coronavirus spreading in the brand’s distribution centers.

With the Sycamore deal canceled, L Brands plans to operate Bath & Body Works as a standalone public company, making Victoria’s Secret a separate entity. Bath & Body Works has been performing quite well: Same-store sales surged by 41% during the first quarter of 2020.

Ahold Delhaize’s Stop & Shop Cancels King Kullen Grocery Acquisition

On June 10, 2020, Ahold Delhaize’s US supermarket chain Stop & Shop terminated its agreement to acquire rival King Kullen Grocery. The companies cited the reason behind the decision as “significant, unforeseen changes in the marketplace that have emerged since the agreement was signed in December 2018, largely driven by the Covid-19 pandemic.”

Through the deal, Stop & Shop would have expanded its presence in Long Island, New York, where King Kullen Grocery has 37 stores, including five Wild by Nature organic supermarkets. The deal came after German discount grocery chain Lidl acquired supermarket chain Best Market in November 2018 to bring its stores to Long Island, a new market area for the chain.

[caption id="attachment_112611" align="aligncenter" width="700"]

Source: Company website

Source: Company website[/caption]

We saw a continuous delay in Stop & Shop closing the King Kullen deal. The deal was previously set to be closed in the first half of 2020, before being pushed to the second half of the year, according to an update released in early May. The Federal Trade Commission reportedly also played a role in the delay by requesting that Stop & Shop divest more stores than the retailer had planned, due to anti-competitive concerns.

Although the coronavirus negatively impacted grocers’ operations and supply chains, it resulted in boosted sales for the sector, as supermarkets in the US were deemed “essential” businesses so remained open during lockdowns. Ahold Delhaize has already moved on to another grocery acquisition: Its Food Lion chain announced plans on June 3 to acquire 62 Bi-Lo and Harvey’s Supermarket stores and a distribution center from Southeastern Grocers.

What We Think

With Covid-19 negatively impacting corporate earnings, business closures and acquisition financing, the disruption to M&A deal-making will be significant. Deal volume in the retail industry has been affected by lockdowns, as well as social distancing and travel restrictions. As we have seen, global deal volumes in the consumer discretionary sector dropped by 46.4% year over year to $716 million in the second quarter of 2020—a five-year low—according to S&P Capital IQ.

We anticipate further terminations of M&A transactions, as well as pricing renegotiations for those deals that do proceed. Recent attention has been on the coronavirus response, but once imminent risks and threats are mitigated and focus returns to pre-pandemic priorities, parties may find that they no longer have the same incentives to proceed with M&A transactions. Furthermore, companies may delay their yet-to-be-announced acquisition plans due to difficulties in attaining acquisition financing as well as the complex contract-negotiation processes created by the crisis: Each M&A agreement, including termination rights and indemnification provision, needs to be examined from a coronavirus perspective.

In retail, one implication is lower levels of consolidation versus a base case. In fragmented sectors such as US grocery, there remains much scope for consolidation, and we expect to see companies return to M&A activity to seize opportunities over the medium to long term. In the near term, particularly with the challenges facing retailers post crisis, we may see a shake-out of smaller or more vulnerable players in such markets as a consequence.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Source: S&P Capital IQ[/caption]

The coronavirus has adversely impacted M&A sellers’ revenues, cash flow and liquidity. Buyers might also need to be careful about their own financial status amid the economic downturn. A trend is therefore emerging whereby M&A deals are being reconsidered.

The deal volume was lower for companies that experienced major disruption during the recent stay-at-home orders. Deals related to the retail sector were hit hard, with global deal volumes in the consumer discretionary sector dropping by 46.4% year over year to $716 million in the second quarter of 2020—a five-year low, according to S&P Capital IQ. Over the same period, consumer staples (e.g., food, drug) fell by 21.3% year over year to $436 million, another five-year low, according to S&P Capital IQ.

[caption id="attachment_112608" align="aligncenter" width="700"]

Source: S&P Capital IQ[/caption]

The coronavirus has adversely impacted M&A sellers’ revenues, cash flow and liquidity. Buyers might also need to be careful about their own financial status amid the economic downturn. A trend is therefore emerging whereby M&A deals are being reconsidered.

The deal volume was lower for companies that experienced major disruption during the recent stay-at-home orders. Deals related to the retail sector were hit hard, with global deal volumes in the consumer discretionary sector dropping by 46.4% year over year to $716 million in the second quarter of 2020—a five-year low, according to S&P Capital IQ. Over the same period, consumer staples (e.g., food, drug) fell by 21.3% year over year to $436 million, another five-year low, according to S&P Capital IQ.

[caption id="attachment_112608" align="aligncenter" width="700"] Source: S&P Capital IQ[/caption]

Source: S&P Capital IQ[/caption]

Source: Company website[/caption]

Mall Owner Simon Property Group Terminates Its $3.6 Billion Deal To Acquire Taubman

On June 10, 2020, Simon Property Group canceled its deal to acquire rival Taubman, citing that the company breached its obligations by not taking steps to mitigate the impact of the Covid-19 pandemic. On the same day, Taubman responded to the termination notice by saying that it is “invalid and without merit, and that Simon Property Group continues to be bound to the transaction in all respects.” Taubman stated that it will hold Simon Property Group to its obligations and pursue legal remedies.

Taubman was hit heavily by Covid-19 as many of its shopping centers are located in dense metropolitan areas, and its tenants depend on high-end shoppers and tourists. The company’s portfolio includes 26 shopping centers in Asia and the US.

The short space of time between the announcement and cancellation of the deal is noteworthy; the combining of the two mall owners was first announced in February 2020, as the industry struggled with an oversupply of malls and the decline of traditional retail stores in the context of rising e-commerce. At that time, the two landlords stated that Simon Property Group would acquire 80% of the common shares of Taubman for $52.50 per share in cash.

Simon Property Group also suffered from the coronavirus crisis. A large number of requests for rent relief, retailer bankruptcies (e.g., J.Crew and Neiman Marcus) and store closures pressured the company to save cash. For instance, in early June, Simon Property Group sued its largest in-line tenant, Gap, for not paying rent worth $66 million. We estimate that at least 15,000 stores will close by the end of the year, which will affect mall owners.

L Brands and Sycamore Dropped the Pact of Taking Victoria’s Secret Private

Private equity firm Sycamore announced in February 2020 that it would pay $525 million for a 55% stake in Victoria’s Secret and PINK. Only two months later, in late April, Sycamore notified the retailer that it planned to cancel the deal due to L Brands’ failure to maintain normal business operations amid the pandemic.

[caption id="attachment_112610" align="aligncenter" width="700"]

Source: Company website[/caption]

Mall Owner Simon Property Group Terminates Its $3.6 Billion Deal To Acquire Taubman

On June 10, 2020, Simon Property Group canceled its deal to acquire rival Taubman, citing that the company breached its obligations by not taking steps to mitigate the impact of the Covid-19 pandemic. On the same day, Taubman responded to the termination notice by saying that it is “invalid and without merit, and that Simon Property Group continues to be bound to the transaction in all respects.” Taubman stated that it will hold Simon Property Group to its obligations and pursue legal remedies.

Taubman was hit heavily by Covid-19 as many of its shopping centers are located in dense metropolitan areas, and its tenants depend on high-end shoppers and tourists. The company’s portfolio includes 26 shopping centers in Asia and the US.

The short space of time between the announcement and cancellation of the deal is noteworthy; the combining of the two mall owners was first announced in February 2020, as the industry struggled with an oversupply of malls and the decline of traditional retail stores in the context of rising e-commerce. At that time, the two landlords stated that Simon Property Group would acquire 80% of the common shares of Taubman for $52.50 per share in cash.

Simon Property Group also suffered from the coronavirus crisis. A large number of requests for rent relief, retailer bankruptcies (e.g., J.Crew and Neiman Marcus) and store closures pressured the company to save cash. For instance, in early June, Simon Property Group sued its largest in-line tenant, Gap, for not paying rent worth $66 million. We estimate that at least 15,000 stores will close by the end of the year, which will affect mall owners.

L Brands and Sycamore Dropped the Pact of Taking Victoria’s Secret Private

Private equity firm Sycamore announced in February 2020 that it would pay $525 million for a 55% stake in Victoria’s Secret and PINK. Only two months later, in late April, Sycamore notified the retailer that it planned to cancel the deal due to L Brands’ failure to maintain normal business operations amid the pandemic.

[caption id="attachment_112610" align="aligncenter" width="700"] Source: Company website[/caption]

Victoria’s Secret had already been losing its popularity prior to the crisis—the brand had fallen out of touch with consumers, who were shifting away from its overtly sexy imagery. Brick-and-mortar apparel retailers were then hit hard by the pandemic due to nonessential-store shutdowns, and Victoria’s Secret saw total sales fall 46% in the first quarter ended May 2, 2020. Almost all of the brand’s stores were closed between March 17 and May 2, and it stopped selling online briefly (March 19–26) due to concerns around the coronavirus spreading in the brand’s distribution centers.

With the Sycamore deal canceled, L Brands plans to operate Bath & Body Works as a standalone public company, making Victoria’s Secret a separate entity. Bath & Body Works has been performing quite well: Same-store sales surged by 41% during the first quarter of 2020.

Ahold Delhaize’s Stop & Shop Cancels King Kullen Grocery Acquisition

On June 10, 2020, Ahold Delhaize’s US supermarket chain Stop & Shop terminated its agreement to acquire rival King Kullen Grocery. The companies cited the reason behind the decision as “significant, unforeseen changes in the marketplace that have emerged since the agreement was signed in December 2018, largely driven by the Covid-19 pandemic.”

Through the deal, Stop & Shop would have expanded its presence in Long Island, New York, where King Kullen Grocery has 37 stores, including five Wild by Nature organic supermarkets. The deal came after German discount grocery chain Lidl acquired supermarket chain Best Market in November 2018 to bring its stores to Long Island, a new market area for the chain.

[caption id="attachment_112611" align="aligncenter" width="700"]

Source: Company website[/caption]

Victoria’s Secret had already been losing its popularity prior to the crisis—the brand had fallen out of touch with consumers, who were shifting away from its overtly sexy imagery. Brick-and-mortar apparel retailers were then hit hard by the pandemic due to nonessential-store shutdowns, and Victoria’s Secret saw total sales fall 46% in the first quarter ended May 2, 2020. Almost all of the brand’s stores were closed between March 17 and May 2, and it stopped selling online briefly (March 19–26) due to concerns around the coronavirus spreading in the brand’s distribution centers.

With the Sycamore deal canceled, L Brands plans to operate Bath & Body Works as a standalone public company, making Victoria’s Secret a separate entity. Bath & Body Works has been performing quite well: Same-store sales surged by 41% during the first quarter of 2020.

Ahold Delhaize’s Stop & Shop Cancels King Kullen Grocery Acquisition

On June 10, 2020, Ahold Delhaize’s US supermarket chain Stop & Shop terminated its agreement to acquire rival King Kullen Grocery. The companies cited the reason behind the decision as “significant, unforeseen changes in the marketplace that have emerged since the agreement was signed in December 2018, largely driven by the Covid-19 pandemic.”

Through the deal, Stop & Shop would have expanded its presence in Long Island, New York, where King Kullen Grocery has 37 stores, including five Wild by Nature organic supermarkets. The deal came after German discount grocery chain Lidl acquired supermarket chain Best Market in November 2018 to bring its stores to Long Island, a new market area for the chain.

[caption id="attachment_112611" align="aligncenter" width="700"] Source: Company website[/caption]

We saw a continuous delay in Stop & Shop closing the King Kullen deal. The deal was previously set to be closed in the first half of 2020, before being pushed to the second half of the year, according to an update released in early May. The Federal Trade Commission reportedly also played a role in the delay by requesting that Stop & Shop divest more stores than the retailer had planned, due to anti-competitive concerns.

Although the coronavirus negatively impacted grocers’ operations and supply chains, it resulted in boosted sales for the sector, as supermarkets in the US were deemed “essential” businesses so remained open during lockdowns. Ahold Delhaize has already moved on to another grocery acquisition: Its Food Lion chain announced plans on June 3 to acquire 62 Bi-Lo and Harvey’s Supermarket stores and a distribution center from Southeastern Grocers.

Source: Company website[/caption]

We saw a continuous delay in Stop & Shop closing the King Kullen deal. The deal was previously set to be closed in the first half of 2020, before being pushed to the second half of the year, according to an update released in early May. The Federal Trade Commission reportedly also played a role in the delay by requesting that Stop & Shop divest more stores than the retailer had planned, due to anti-competitive concerns.

Although the coronavirus negatively impacted grocers’ operations and supply chains, it resulted in boosted sales for the sector, as supermarkets in the US were deemed “essential” businesses so remained open during lockdowns. Ahold Delhaize has already moved on to another grocery acquisition: Its Food Lion chain announced plans on June 3 to acquire 62 Bi-Lo and Harvey’s Supermarket stores and a distribution center from Southeastern Grocers.